Most people think passive income requires leaving their job — that’s wrong. Truly wrong. The myth is dramatic (quit, pivot, become your best self overnight) — and wildly unhelpful.

At Top Wealth Guide, we’ve seen thousands of people build real wealth while keeping their paychecks. Dividend stocks, rental properties, digital products — these aren’t magic; they’re systems. Set them up properly and they generate money with minimal daily effort…which is the whole point.

In This Guide

Three Income Streams That Actually Work While Employed

Dividend Stocks: The Hands-Off Starting Point

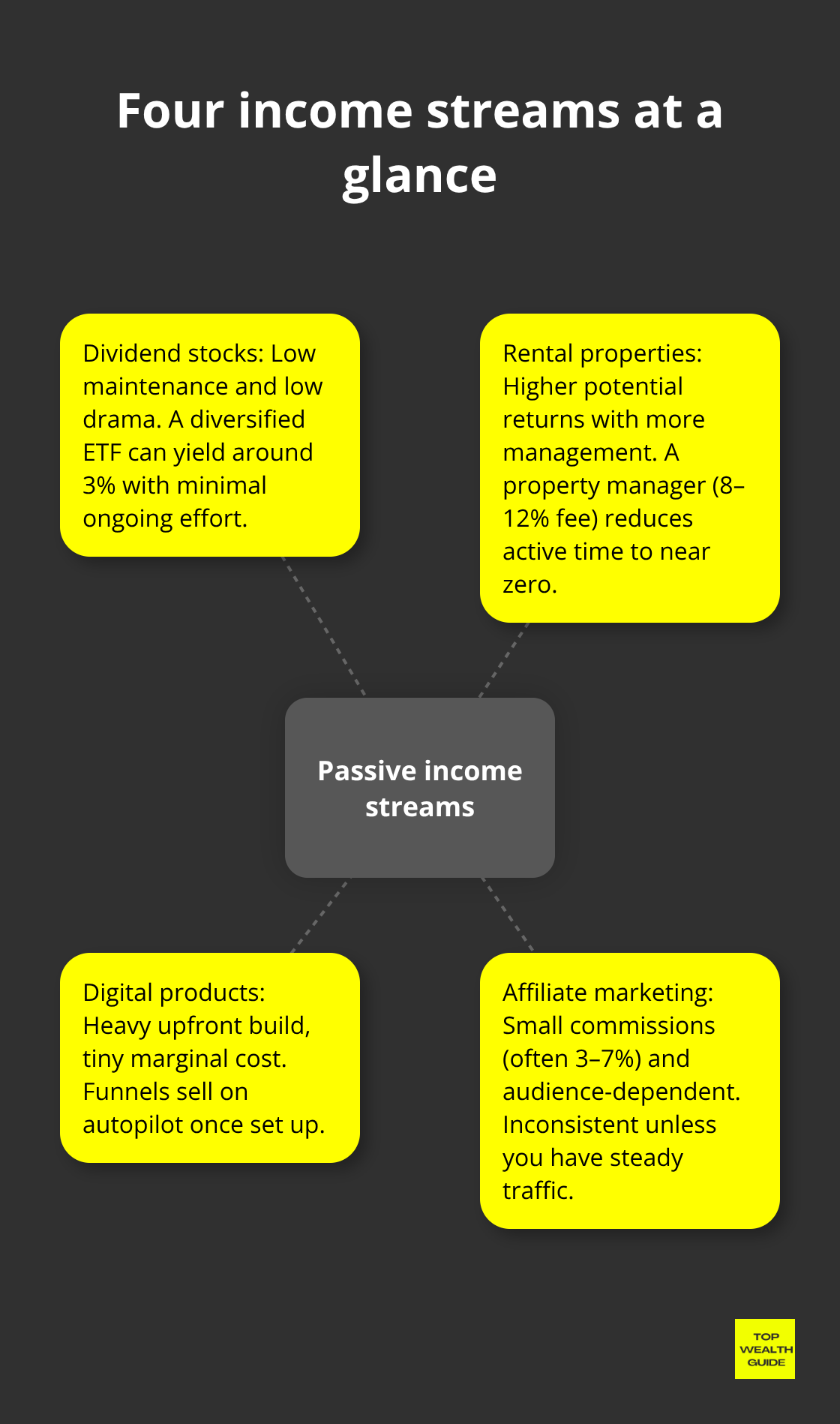

Dividend-paying stocks are the financial equivalent of autopay – you do the upfront work (buy), then money arrives on a schedule. Low maintenance. Low drama. Buy a diversified dividend ETF (think SCHD or VYM) and you’ve made one decision that compounds for decades.

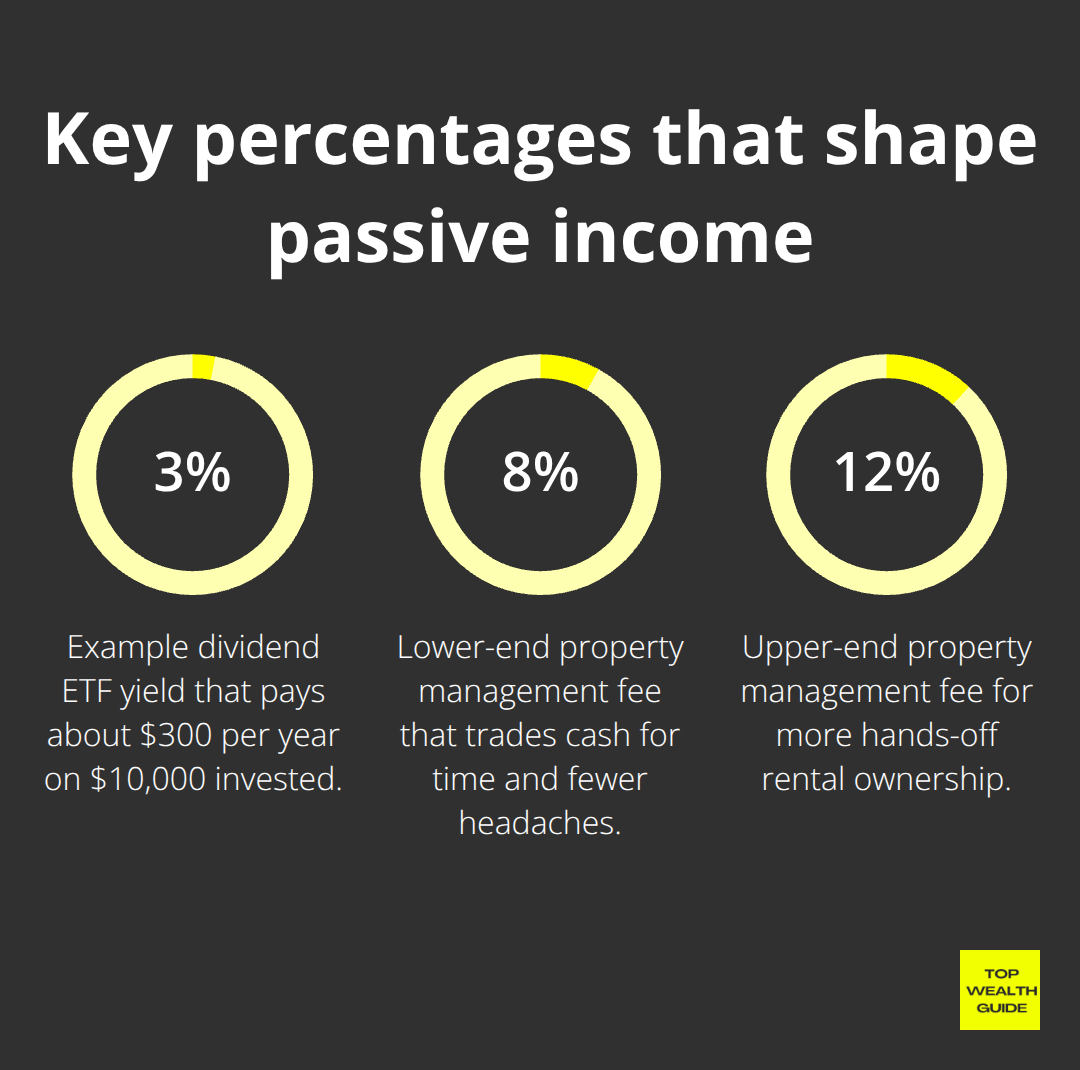

An ETF buys a basket of dividend payers for you, so you get instant diversification and low costs – which, spoiler, is the secret sauce for most long-term returns. The math is boring and beautiful: $10,000 into a 3% yield ETF nets about $300 a year with essentially zero ongoing effort. That’s not sexy – it’s effective.

Rental Properties: Higher Returns, More Management

Real estate behaves like a different animal – messier, but with the potential for higher returns. A single rental property that cash-flows after mortgage, taxes, insurance and repairs can produce meaningful income. The barriers are capital and headaches (tenants… maintenance… the joys). The trick most people miss: pay for management. Hire a property manager and your active time drops to near zero – yes, it costs 8–12% of rent, but for many that fee is worth the sleep. Building wealth with real estate is less about romanticizing rental ownership and more about the cold numbers – can you afford the property, the vacancy periods, the repairs?

Short-term rentals (Airbnb-style) pay more per night – often $100–300 depending on location – but they require more hands-on work: turnovers, complaints, local regs. Not passive unless everything’s outsourced (cleaning, concierge, guest messaging), and outsourcing slices margins. So yes – higher yield, higher hassle.

Digital Products: Scalable Without Capital

Digital products sit in the middle ground: big upfront hustle, tiny marginal cost per sale. Creating an online course takes work – scripting, recording, marketing – but once it’s live, it sells on autopilot if you’ve built decent funnels (email, landing pages). Price points commonly land at $97–$297; sell 20 a month and you’re looking at $1,940–$5,940 recurring. E-books? Cheap to produce ($9–$19) and crowded, so don’t expect miracles. Better play: package expertise as a course and use an e-book as the lead magnet – cheaper acquisition and higher lifetime value.

Affiliate marketing pays small commissions (3–7% per sale, per Bankrate) and depends entirely on audience – no traffic, no income. Brutal truth: affiliate revenue is inconsistent and beholden to your audience’s behavior and platform algorithms.

Matching Your Resources to the Right Stream

Match the stream to your starting point. Got $5,000–$10,000? Buy dividend stocks or seed a down payment. Got specialized knowledge? Build a course. Got neither? Start creating content and pursue affiliate marketing – it costs little but demands time and relentless consistency.

The goal isn’t to pick one and stop – it’s to build multiple income streams and systems that turn those efforts into something… passive. Start smart, scale selectively, and automate or outsource the parts that steal your time. The rest is boring compounding – and that’s where real wealth lives.

Building Your First Passive Income Stream

Assess What You Have Right Now

The single biggest mistake? Waiting for perfect conditions-more cash, more time, more certainty. That’s not prudence; that’s paralysis with nicer packaging. Start by taking inventory of what you actually own right now: savings, skills, hours in your week, and how much risk you can stomach. Then pick one income stream that fits those constraints.

Have $3,000 saved? Dividend stocks are your lane. Have deep know-how in health coaching or marketing? A digital product is the fast path. No capital and no niche-but you can write or produce video? Affiliate marketing or a YouTube channel will work-just know patience is the currency here.

The IRS calls passive income earnings where you don’t “actively participate”-but most people read that and then ghost the effort. You’ll grind up front; the “passive” part arrives later, after the systems are built.

Identify Your Starting Point

Be brutally honest. What’s your monthly surplus after bills? $500? $5,000? That number dictates where you begin. What skills do you really have-not the ones you wish you had, but the ones strangers will pay for? List ten. Then go research demand.

Luisa Zhou (yes, the one featured in Forbes, Business Insider, Bloomberg) suggests finding a profitable niche by matching your skills to gaps in the market. Pick the stream, then build the automation and systems.

Automate From Day One

Automation is the difference between “passive” and “busy work dressed up as passive.” For dividend stocks-set dividends to reinvest and schedule monthly buys via your brokerage. Two clicks. Then forget about it for years.

Rentals? Hire a property manager right away-yes, they charge 8–12% of rental income, but they flip active headaches into passive checks. Without that, you’re on-call for thermostat meltdowns, tenant dramas, and surprise plumbing bills. That’s not passive-that’s a second job.

Digital products? Build an email funnel that sells without your daily attention. Tools like ConvertKit or ActiveCampaign do the heavy lifting: deliver the course, send follow-ups, process refunds. The build is heavy-recording, scripting, landing pages-but once it runs, you’re checking in monthly, not hourly.

Track What Actually Works

Obsession time-track three metrics: revenue, profit margin, and time invested. If you’re spending ten hours a week and getting $200 a month-that’s $5 an hour. Worse than minimum wage. Automate it, outsource it, or kill it. The aim: have each stream demand less than two hours of your attention per month.

Know When to Expand

People try to breed income streams like rabbits-too many, too fast, burnout guaranteed. Better play: run your first stream for three to six months, get it stable, then evaluate. Does it make at least $200 a month with minimal upkeep? Good-add a second. If not, fix the first before you multiply problems.

Choose a second stream that complements, not cannibalizes, your first. If your first is dividend stocks (capital-heavy, very passive), your second could be a digital product (time-heavy up front, then passive) or affiliate marketing (ongoing time, low capital). Don’t stack two high-maintenance bets-like traditional rentals plus short-term rentals-unless you have real capital and systems.

When you add a second stream, don’t start from zero. Reuse the tools, the platforms, the calendar blocks. People who actually win at multiple streams assign days or hours to each-no constant context-switching. Tuesday and Thursday for content; Monday to rebalance investments. That structure kills chaos and protects you from the real threat: burning out before the income compounds.

Scaling Multiple Income Streams Without Burnout

Most people don’t fail because their ideas suck – they fail because they treat each new income stream like another full-time gig. Classic mistake. You don’t need more hustle; you need a system. The fix is ruthless systematization-automate what you can, consolidate the junk, and guard your calendar like it’s a Swiss bank account. Do that and the noise dies down. Don’t – and you get three income streams and one nervous breakdown.

Automate Everything From the Start

Dividend stocks reinvest on autopilot if you flick the right switch at your brokerage. Rent checks? Route them through a property manager who answers tenant calls and fixes the leaky sink. Digital courses? Set the funnel once, let the email sequences run, and go read a book. The gap between someone managing three streams and someone drowning in three streams is often 90 minutes of setup spread over a month. That’s it.

Zapier connects your course platform to your email service so new enrollments fire off welcome sequences without you lifting a finger. Stripe or PayPal handles payments and deposits-no drama. One shared Google Sheet gives you revenue and profit by stream in real time-you glance at it weekly, not hourly. The psychological win is underrated: watching money show up without active babysitting kills the burnout feeling before it starts.

Protect Your Time Budget Ruthlessly

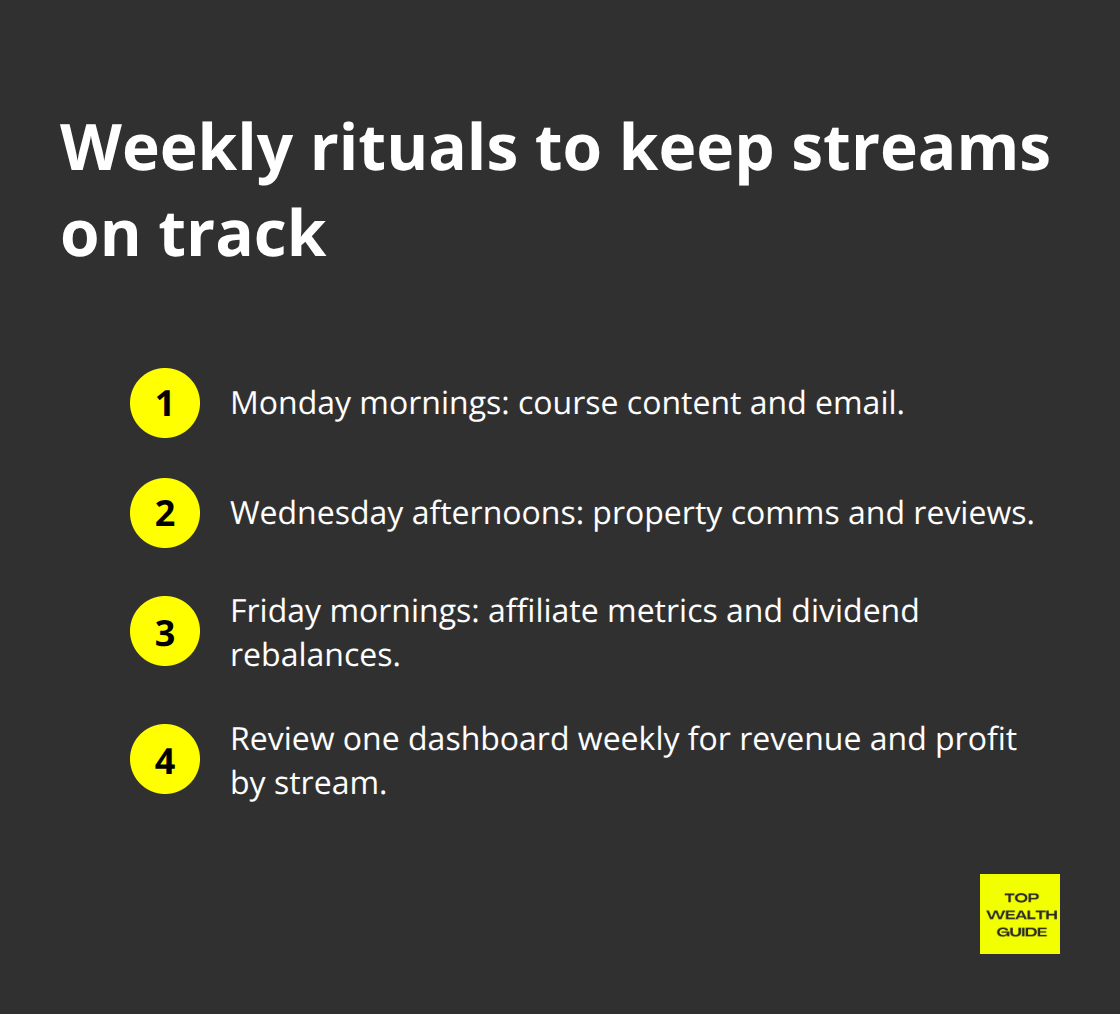

Time – not money – is the scarce resource. If you work full-time, you probably have five to ten spare hours a week (about 300 a year). Treat that as your capital and allocate it like a CFO. Block days by stream: Mondays for course work and email campaigns, Wednesdays for property reviews and vendor calls, Friday mornings for affiliate checks and dividend rebalances. Put those blocks on your calendar and defend them like meetings with your boss-because they are meetings with your future self.

Multitasking is a momentum killer. One focused hour on course content beats three scattered hours flipping between platforms. Adding a new stream shouldn’t mean adding hours; it should mean automating or delegating something from an existing stream. If your course pulls in $800 a month with four hours a week of upkeep, hire a $200-a-month VA to handle emails and minor updates. You free two hours and only shave 25 percent of profit-math that scales.

Consolidate Your Tools and Platforms

Consolidation beats proliferation every time. Use one email platform for everything-ConvertKit, ActiveCampaign, or Flodesk-don’t scatter lists across five services. Tag subscribers by interest so your course buyers aren’t getting property affiliate spam and vice versa. One payment processor. One accounting view.

Spreadsheets are fine for the first six months; when your streams collectively clear $5,000 a month, move to Wave or QuickBooks. The objective is simplicity: fewer logins, fewer dashboards, fewer places where things unexpectedly explode. Most people burn out because they’re juggling eight platforms-each with a different password and a different panic. Cut that to three or four core tools and your cognitive load drops dramatically. Your time opens up. Your stress drops. The income actually becomes predictable.

Assign Weekly Rituals to Each Stream

Rituals kill chaos. Block consistent calendar time for each stream and stick to it. Monday mornings: course content and email. Wednesday afternoons: property comms and reviews. Friday mornings: affiliate metrics and dividend rebalances. Rhythm prevents context-switching and preserves momentum. Do the ritual long enough and the streams run on autopilot (or at least on reliable semi-autopilot).

Disclaimer: Not the exact voice of a living public figure – the following is a stylized piece capturing similar high-level characteristics (pithy, conversational, liberal use of em dashes and ellipses).

Final Thoughts

Three income streams-dividend stocks, rental properties, and digital products-stacked together create real passive income without torching your day job. Put $10,000 into dividend stocks and, at a 3% yield, you’re getting roughly $300 a year. A rental that throws off $500 a month? That’s about $6,000 annually. A digital course that moves 15 units a month at $197 nets roughly $2,955 a year. Add them up and you’ve got $9,255 coming in year after year with minimal daily effort – not magic, math.

Diversification is boring but brutal in its effectiveness. One stream sputters (rental market softens, course sales dip, dividend yields wobble) – the others keep the faucets open and your benefits-stuffed day job stays intact. Over a decade, that risk-mitigated flow compounds into meaningful wealth while you avoid the all-or-nothing hustle.

Start with a realistic inventory – capital, skills, time. Pick the one stream that fits those constraints and obsess over automating it (ruthlessly). Run it for three to six months until it demands minimal attention. The team at Top Wealth Guide has built frameworks to help map this path – from picking your first stream to scaling multiple income sources without burning out.