Online banking has shifted from a simple convenience to a primary financial tool for Americans seeking higher interest rates, minimal fees, and a better user experience. With a market full of options, however, selecting the right institution can feel like a complex task. This guide is designed to eliminate the guesswork and provide a clear, actionable comparison of the best online banks USA has to offer.

We move beyond surface-level details to deliver a comprehensive analysis of what truly matters for your money. You'll find in-depth evaluations of key features like Annual Percentage Yields (APY) on savings, checking account fee structures, mobile app functionality, nationwide ATM network access, and innovative financial management tools. Our goal is to equip you with the specific information needed to make a confident decision.

This curated list breaks down top contenders, including direct banks like Ally and SoFi, as well as editorial comparison hubs such as NerdWallet and Bankrate, which provide a broader market overview. For each option, we provide screenshots for a visual preview, direct links to get you started faster, and practical scenarios illustrating who stands to benefit most. Whether you are a high-yield saver aiming to maximize returns, a tech-savvy individual looking for seamless digital integration, or someone just beginning to build their financial foundation, this roundup will serve as your definitive resource for finding the ideal online banking partner to help you achieve your financial goals.

In This Guide

- 1 1. Ally Bank

- 2 2. Capital One 360 (Capital One Bank)

- 3 3. Discover Bank (Cashback Debit + Online Savings)

- 4 4. SoFi Bank (Checking & Savings)

- 5 5. Axos Bank

- 6 6. NerdWallet – Best Online Banks (editorial comparison hub)

- 7 7. Bankrate – Best Online Banks (editorial comparison hub)

- 8 Top U.S. Online Banks: Feature Comparison

- 9 Making the Right Choice for Your Financial Future

- 10 Frequently Asked Questions (FAQ)

- 10.1 1. Are online banks safe and FDIC insured?

- 10.2 2. What is the main advantage of an online bank over a traditional bank?

- 10.3 3. How do I deposit cash into an online bank account?

- 10.4 4. Can I still get checks and a debit card with an online bank?

- 10.5 5. What happens if I need to use an ATM that isn't in my online bank's network?

- 10.6 6. Is it difficult to switch to an online bank?

- 10.7 7. Which online bank is the best for high-yield savings?

- 10.8 8. Are there online banks that offer rewards for checking accounts?

- 10.9 9. Can I open a joint account with an online bank?

- 10.10 10. What should I look for in a mobile banking app?

1. Ally Bank

Best For: Individuals seeking a full-service digital bank with powerful, automated savings tools and a user-friendly experience.

Ally Bank stands out as one of the original and most reputable players in the digital banking space, making it a top contender among the best online banks in the USA. It excels by pairing a competitive high-yield savings account with a feature-rich checking account, all managed through a sleek and intuitive digital platform. What truly sets Ally apart is its commitment to helping users automate their financial goals without the burden of common bank fees.

Key Features and Offerings

Ally's ecosystem is designed to be your primary financial hub. The Spending Account (checking) and Online Savings Account work together seamlessly. A standout feature is the savings automation suite, which includes "buckets" and "boosters."

- Savings Buckets: You can partition your savings into up to 30 digital envelopes, each for a specific goal like "Emergency Fund," "Vacation," or "New Car." This visual organization helps you track progress without needing multiple accounts.

- Boosters: These are automated rules that accelerate your savings. You can set up recurring transfers, round up debit card purchases to the nearest dollar (Surprise Savings), or have Ally analyze your linked checking accounts to find and transfer "safe-to-save" money.

Ally Bank at a Glance

| Feature | Details |

|---|---|

| APY (Savings) | Highly competitive, often among the top rates available. |

| Monthly Fees | $0 for both checking and savings accounts. |

| Overdraft Fees | $0. CoverDraft℠ offers a fee-free safety net up to $250. |

| ATM Network | 43,000+ fee-free Allpoint® & MoneyPass® ATMs. |

| ATM Reimbursement | Up to $10 per statement cycle for out-of-network fees. |

| Standout Feature | Automated savings tools (Buckets and Boosters). |

Real-Life Example: The Goal-Oriented Saver

Meet Sarah, a 28-year-old freelance designer. She needs to save for three big goals: a down payment on a house, a new laptop, and her quarterly tax payments. With Ally, she creates three "Buckets" in her savings account. She sets up a recurring transfer to fund them weekly. She also activates "Surprise Savings," which intelligently moves small, safe-to-save amounts from her checking, accelerating her progress without her having to think about it. The visual separation helps her stay motivated and avoid accidentally spending her tax money.

Practical Tips for Maximizing Ally Bank

To get the most out of Ally, lean into its automation. Upon opening your account, immediately set up several savings buckets for your primary goals. Then, activate at least one "booster" to start building your savings habit effortlessly. Also, take advantage of the early direct deposit feature, which can make your paycheck available up to two days sooner, improving your cash flow management. For those interested in maximizing their returns, Ally's high-yield savings account is a powerful tool; you can find more information about its competitive rates in this guide on the best high-yield savings accounts.

Expert Insight: The primary drawback of Ally is the lack of physical branches, which makes depositing cash challenging. The most common workaround is using a third-party service like Walmart's MoneyCenter or buying a money order to deposit via the mobile app, though these methods may involve small fees.

Pros:

- Robust and intuitive savings automation tools (buckets and boosters).

- No monthly maintenance fees or standard overdraft fees.

- Large fee-free ATM network plus reimbursements for out-of-network fees.

Cons:

- No physical branches for in-person service.

- Depositing cash requires inconvenient and potentially costly workarounds.

- CoverDraft℠ has eligibility requirements and is not a guaranteed line of credit.

Learn more by visiting Ally Bank's official website.

2. Capital One 360 (Capital One Bank)

Best For: Individuals who want a top-tier mobile banking experience from a major national bank, combined with an enormous fee-free ATM network and no overdraft fees.

Capital One 360 fuses the convenience of a digital-first platform with the robust infrastructure of a well-established financial institution, securing its place among the best online banks in the USA. It excels by offering a genuinely fee-free 360 Checking account that eliminates the most common banking frustrations, such as monthly charges and overdraft penalties. For users who value widespread, easy access to their cash without fees, Capital One 360's extensive ATM network is a significant advantage.

Key Features and Offerings

The Capital One 360 ecosystem is built for seamless digital management, with the 360 Checking and 360 Performance Savings accounts at its core. It's designed to provide a straightforward, powerful banking experience without the complex rules or hidden costs often found elsewhere. The platform is praised for its highly-rated mobile app, which makes everyday banking tasks simple and fast.

- Fee-Free 360 Checking: This account comes with no monthly maintenance fees and no minimum balance requirements. It's a truly free account for day-to-day spending.

- Massive ATM Network: Gain access to over 70,000 fee-free ATMs through the Capital One, MoneyPass®, and Allpoint® networks, making it one of the largest access points for cash in the country.

- Early Paycheck: Like many leading online banks, Capital One 360 offers the ability to receive your direct deposit paycheck up to two days earlier than the scheduled payday.

Capital One 360 at a Glance

| Feature | Details |

|---|---|

| APY (Savings) | Competitive, though sometimes slightly lower than top online-only peers. |

| Monthly Fees | $0 for both 360 Checking and 360 Performance Savings. |

| Overdraft Fees | $0. All overdraft fees have been eliminated. |

| ATM Network | 70,000+ fee-free Capital One, MoneyPass® & Allpoint® ATMs. |

| ATM Reimbursement | None. Fees charged by out-of-network ATMs are not reimbursed. |

| Standout Feature | Massive fee-free ATM network and access to physical locations. |

Real-Life Example: The Hybrid Banker

Consider Mark, a consultant who travels frequently for work. He primarily manages his finances via his phone but occasionally needs in-person service or has to deposit a check that's over the mobile deposit limit. For him, Capital One 360 is perfect. He can find a fee-free ATM in almost any U.S. city he visits. And when he's home, he can stop by a Capital One Café for face-to-face help with a complex question, giving him the best of both digital convenience and physical access.

Practical Tips for Maximizing Capital One 360

To get the most value from a Capital One 360 account, set up direct deposit immediately to unlock the early paycheck feature, which helps with budgeting and cash flow. Familiarize yourself with the ATM locator in the mobile app to ensure you're always near a fee-free machine. While the 360 Checking account is excellent for daily use, pairing it with the 360 Performance Savings account can help you build your savings faster. For those working on their financial security, this savings account is a great place to start; you can learn more about how to build an emergency fund to prepare for unexpected expenses.

Expert Insight: The primary benefit of Capital One 360 is its hybrid model. You get the superior digital experience of an online bank but still have access to physical Capital One Cafés and branches in select locations for face-to-face assistance or more complex transactions, bridging a common gap left by purely online competitors.

Pros:

- Extensive fee-free ATM network with over 70,000 locations.

- No monthly fees, minimum balances, or overdraft fees.

- Access to some physical branches and Capital One Cafés for in-person support.

Cons:

- Does not reimburse out-of-network ATM fees charged by other banks.

- Interest paid on the 360 Checking account is typically lower than some specialized high-yield checking options.

- Some less common services, like sending an outbound wire transfer, still incur fees.

Learn more by visiting Capital One 360's official website.

3. Discover Bank (Cashback Debit + Online Savings)

Best For: Individuals who primarily use their debit card for daily spending and want to earn cash back rewards without paying typical bank fees.

Discover Bank has carved out a unique space among the best online banks in the USA by offering a checking account that actually pays you to use it. While most banks reserve rewards for credit cards, Discover’s Cashback Debit account provides an uncommon perk: 1% cash back on debit card purchases. This, combined with a no-fee structure and a solid digital banking platform, makes it a powerful choice for savvy spenders.

Key Features and Offerings

Discover's main appeal is its Cashback Debit checking account, which functions as both a spending and a savings tool. The cash back is automatically deposited into your account monthly, creating a simple way to build savings. This account pairs seamlessly with their high-yield Online Savings and CDs for a more complete financial picture.

- Cashback Debit: Earn 1% cash back on up to $3,000 in eligible debit card purchases each month. This includes online shopping, bill payments, and in-store purchases, potentially earning you up to $36 per month or $432 per year.

- Early Pay: Get access to your direct deposit funds up to two days earlier than your scheduled payday, improving your cash flow management.

- Fee-Free Cash Deposits: A major advantage over other online banks, you can deposit cash for free at any Walmart location.

Discover Bank at a Glance

| Feature | Details |

|---|---|

| Checking Reward | 1% cash back on up to $3,000 in monthly debit card purchases. |

| Monthly Fees | $0. Discover prides itself on a "no fees" structure. |

| Overdraft Fees | $0. Options include fee-free transfers or no-fee overdraft. |

| ATM Network | 60,000+ fee-free Allpoint® & MoneyPass® ATMs. |

| ATM Reimbursement | None for out-of-network fees. |

| Standout Feature | Debit card cash back and free cash deposits at Walmart. |

Real-Life Example: The Savvy Spender

Take Maria, a college student who uses her debit card for everything—groceries, textbooks, coffee, and online subscriptions. She spends about $1,200 a month on her card. With Discover's Cashback Debit, she earns $12 back every month ($144 a year) just for her normal spending. This "found money" goes directly into her Discover Online Savings account, helping her build a small emergency fund effortlessly. The ability to deposit cash from her part-time waitressing job at a local Walmart for free is also a huge plus.

Practical Tips for Maximizing Discover Bank

To make the most of your Discover account, shift your everyday spending to your Cashback Debit card. Use it for groceries, gas, and online subscriptions to maximize your 1% cash back each month. If you are eligible, set up the Early Pay feature to better manage your budget. This reward-based spending can be a great way to generate effortless extra cash, which mirrors the strategies discussed in guides about the best passive income apps.

Expert Insight: The primary limitation of Discover is the lack of physical branches. While cash deposits at Walmart are a convenient and free workaround, tasks like obtaining a large cashier's check or handling complex account issues in person are not possible. Always plan ahead for transactions that might require in-person banking services.

Pros:

- Unique 1% cash back program on debit card purchases.

- Completely fee-free structure, including no monthly, overdraft, or insufficient funds fees.

- Large fee-free ATM network and free cash deposits at Walmart.

Cons:

- No physical branch locations for face-to-face service.

- Cash back is capped at $3,000 in spending per month.

- Does not reimburse out-of-network ATM fees charged by other banks.

Learn more by visiting Discover Bank's official website.

4. SoFi Bank (Checking & Savings)

Best For: All-in-one users who want to integrate high-yield banking with a broad suite of financial products like investing, loans, and financial planning tools.

SoFi has rapidly evolved from a student loan refinance company into a comprehensive digital finance powerhouse, making it a strong contender for one of the best online banks in the USA. It offers a unified checking and savings account that incentivizes direct deposit with a top-tier APY and a host of modern features. SoFi's strength lies in its ability to offer a seamless, single-app experience for managing nearly every aspect of your financial life.

Key Features and Offerings

SoFi combines its checking and savings into one streamlined product, encouraging users to automate their finances through its digital tools. The platform’s key value is connecting your daily banking with longer-term financial goals.

- Savings Vaults: Similar to buckets at other banks, you can create up to 20 "Vaults" within your savings account. This allows you to set aside money for specific goals like "Down Payment" or "Travel Fund" while still earning a high interest rate on the entire balance.

- Roundups: Activate this feature to have SoFi automatically round up your debit card purchases to the nearest dollar and transfer the difference into a savings Vault of your choice, making saving effortless.

- Integrated Financial Ecosystem: Beyond banking, the SoFi app provides access to stock and crypto investing, personal and student loans, and complimentary financial planning advice, creating a true all-in-one financial hub.

SoFi Bank at a Glance

| Feature | Details |

|---|---|

| APY (Savings) | Top-tier rates, but requires qualifying direct deposit. |

| Monthly Fees | $0. |

| Overdraft Fees | $0. Coverage up to $50 for eligible members. |

| ATM Network | 55,000+ fee-free Allpoint® Network ATMs. |

| ATM Reimbursement | None. |

| Standout Feature | High APY with direct deposit and integrated financial ecosystem. |

Real-Life Example: The Financial Optimizer

Alex is a young professional who wants to streamline his financial life. He's tired of using one app for banking, another for investing, and a third to track his student loan. With SoFi, he sets up direct deposit from his employer. This unlocks the high-yield APY on his savings, where he uses "Vaults" to save for a wedding. He also automates a weekly transfer into his SoFi Invest account to buy ETFs. When he needs financial advice, he schedules a complimentary call with a financial planner through the app. Everything is managed in one place.

Practical Tips for Maximizing SoFi Bank

To unlock SoFi's full potential, set up a qualifying direct deposit as soon as you open your account. This action immediately grants you the highest APY, activates no-fee overdraft coverage, and makes you eligible for other member benefits. Next, create several Vaults for your top savings priorities and turn on Roundups to automate your progress. Explore the broader SoFi ecosystem; connecting your banking with its investment and planning tools can provide a more holistic view of your financial health, a key advantage highlighted in many guides to the best fintech apps.

Expert Insight: The primary condition for maximizing SoFi is the direct deposit requirement. Without it, the APY on savings is significantly lower and key features like overdraft coverage are unavailable. Cash deposits can also be a hurdle; you must use a third-party retail location like Walmart or Walgreens via Green Dot, which often involves a fee of up to $4.95 per deposit.

Pros:

- High-yield savings APY for customers with direct deposit.

- Seamless integration with SoFi’s investing, loan, and financial planning services.

- Simple, no-fee structure with a modern and intuitive app experience.

Cons:

- Best features (high APY, overdraft coverage) are gated behind direct deposit requirements.

- Depositing cash is inconvenient and incurs third-party fees.

- Some users report mobile check deposit can be less reliable than competitors.

Learn more by visiting SoFi Bank's official website.

5. Axos Bank

Best For: Customers who frequently use ATMs and want to choose from multiple specialized checking accounts to fit their financial style.

Axos Bank, one of the earliest digital banks, has cemented its place among the best online banks in the USA by offering an impressive degree of choice and flexibility. It moves beyond a one-size-fits-all approach, providing a diverse lineup of checking accounts tailored to different needs, from simple and fee-free to high-yield and cashback-focused. Its standout feature, particularly with its Essential Checking account, is the unlimited reimbursement of domestic ATM fees, making it a top pick for those who value unrestricted access to their cash.

Key Features and Offerings

Axos Bank’s strength lies in its specialized account options, allowing users to select an account that aligns with their financial habits. The Essential Checking account is a popular choice for its simplicity and powerful perks.

- Multiple Checking Options: Axos offers a suite of accounts, including Rewards Checking for earning a high APY, CashBack Checking for getting money back on purchases, and the straightforward Essential Checking.

- Unlimited ATM Fee Reimbursements: This is the flagship feature of the Essential Checking account. Axos will reimburse all fees charged by other domestic ATM owners, giving you the freedom to use any ATM in the country without penalty.

- Early Direct Deposit: Like many top online banks, Axos allows you to receive your paycheck up to two days earlier, which can significantly help with budgeting and cash flow management.

Axos Bank at a Glance

| Feature | Details |

|---|---|

| Checking Options | Multiple accounts (Rewards, Cashback, Essential) available. |

| Monthly Fees | $0 for most consumer checking accounts. |

| Overdraft Fees | Varies by account; $0 for Essential Checking. |

| ATM Network | Use any ATM nationwide. |

| ATM Reimbursement | Unlimited domestic ATM fee reimbursements (Essential Checking). |

| Standout Feature | Unrestricted ATM access with full fee reimbursement. |

Real-Life Example: The ATM Power User

David works in a cash-heavy industry and often needs to withdraw money from the closest ATM, regardless of the bank. His old bank charged him $3 per withdrawal plus the other bank's fee, costing him over $20 a month. He switched to Axos Essential Checking. Now, he can use the ATM at the airport, the convenience store, or a concert venue without a second thought. At the end of the month, Axos automatically credits his account for all the fees charged by those ATM operators, saving him hundreds of dollars a year.

Practical Tips for Maximizing Axos Bank

To get the most value from Axos, carefully review its different checking accounts before opening one. If you frequently use out-of-network ATMs, the Essential Checking account is likely your best bet due to its unlimited reimbursements. If you maintain a higher balance and use your debit card often, compare the earning potential of the Rewards Checking APY against the CashBack Checking to see which one would provide a greater return based on your spending patterns. Setting up direct deposit is also crucial to unlock key benefits like early paycheck access.

Expert Insight: The main challenge with Axos is navigating its product ecosystem. While having choices is a benefit, the eligibility requirements and reward structures for its interest-bearing and cashback accounts can be complex. Carefully read the terms to ensure you can meet the criteria, such as minimum direct deposit amounts or a certain number of monthly debit card transactions, to earn the advertised perks.

Pros:

- Unlimited domestic ATM fee reimbursements on its Essential Checking account.

- Wide variety of checking accounts to suit different financial goals (yield, cashback, simplicity).

- No monthly maintenance or overdraft fees on its core checking product.

Cons:

- No physical branches for in-person banking services.

- The best rates and rewards on some accounts have specific qualification requirements.

- Depositing cash can be a challenge, similar to other online-only banks.

Learn more by visiting Axos Bank's official website.

6. NerdWallet – Best Online Banks (editorial comparison hub)

Best For: Consumers who want to efficiently research and compare a wide range of top-rated online banks before making a decision.

NerdWallet is not a bank but an indispensable editorial comparison hub, earning its spot on our list of the best online banks in the USA by empowering consumers to make informed choices. It functions as a powerful research tool, aggregating data, expert reviews, and user ratings to rank and explain the top digital banking options available. For anyone feeling overwhelmed by choice, NerdWallet provides a clear, structured starting point to identify which banks align with their specific financial needs.

Key Features and Offerings

NerdWallet’s value lies in its comprehensive analysis and transparent methodology. It distills information from over 100 financial institutions, presenting it in easy-to-digest formats. Its core function is to help you compare the most critical aspects of online banking.

- Category Winners: The platform highlights banks that excel in specific areas, such as "Best for High-Yield Savings," "Best for ATM Access," or "Best for 24/7 Customer Support," allowing you to quickly find a match for your top priority.

- Transparent Methodology: NerdWallet clearly outlines the criteria used for its rankings, which typically include APYs, fee structures, minimum deposit requirements, and the quality of the digital experience. This transparency helps build trust in their recommendations.

- Direct Provider Links: Once you’ve narrowed down your options, you can click through directly to the bank's official website to verify information and begin the application process, streamlining your journey from research to action.

Pricing and Accessibility

As an editorial resource, NerdWallet is completely free for users. Its business model relies on compensation from its partners when users click through and open accounts, but its editorial recommendations remain independent.

| Feature | Details |

|---|---|

| Access Cost | $0. The platform is free to use for all research. |

| Account Requirements | None needed to access reviews and "best of" lists. |

| Information Scope | Over 100 U.S. financial institutions are considered. |

| Update Frequency | Content and rates are refreshed frequently. |

Practical Tips for Maximizing NerdWallet

To use NerdWallet effectively, start by identifying your primary banking need. Are you chasing the highest possible APY, or do you need a checking account with no fees and a massive ATM network? Use the category-specific "best of" lists to create a shortlist. Always remember that APYs and promotional offers can change quickly; use NerdWallet's links to visit the bank's official site and confirm the most current terms before applying. For a deeper dive into maximizing returns, you can learn more about how different providers structure their online savings products to better inform your comparison.

Expert Insight: NerdWallet's greatest strength is its breadth of coverage, but its "best overall" pick may not be the best for you. Pay close attention to the specific pros and cons listed for each bank to see how they align with your personal habits, like whether you need to deposit cash or require robust mobile check deposit limits.

Pros:

- Provides a fast, efficient way to scan and compare top-rated online banks.

- Wide-ranging analysis considers over 100 different institutions.

- Transparent rating methodology helps users understand the recommendations.

Cons:

- Editorial picks may not align with every individual’s unique financial priorities.

- Users must verify current APYs and terms on the bank’s website, as rates change frequently.

- It's a research tool, not a bank, so you cannot open an account directly on the site.

Learn more by visiting NerdWallet's Best Online Banks hub.

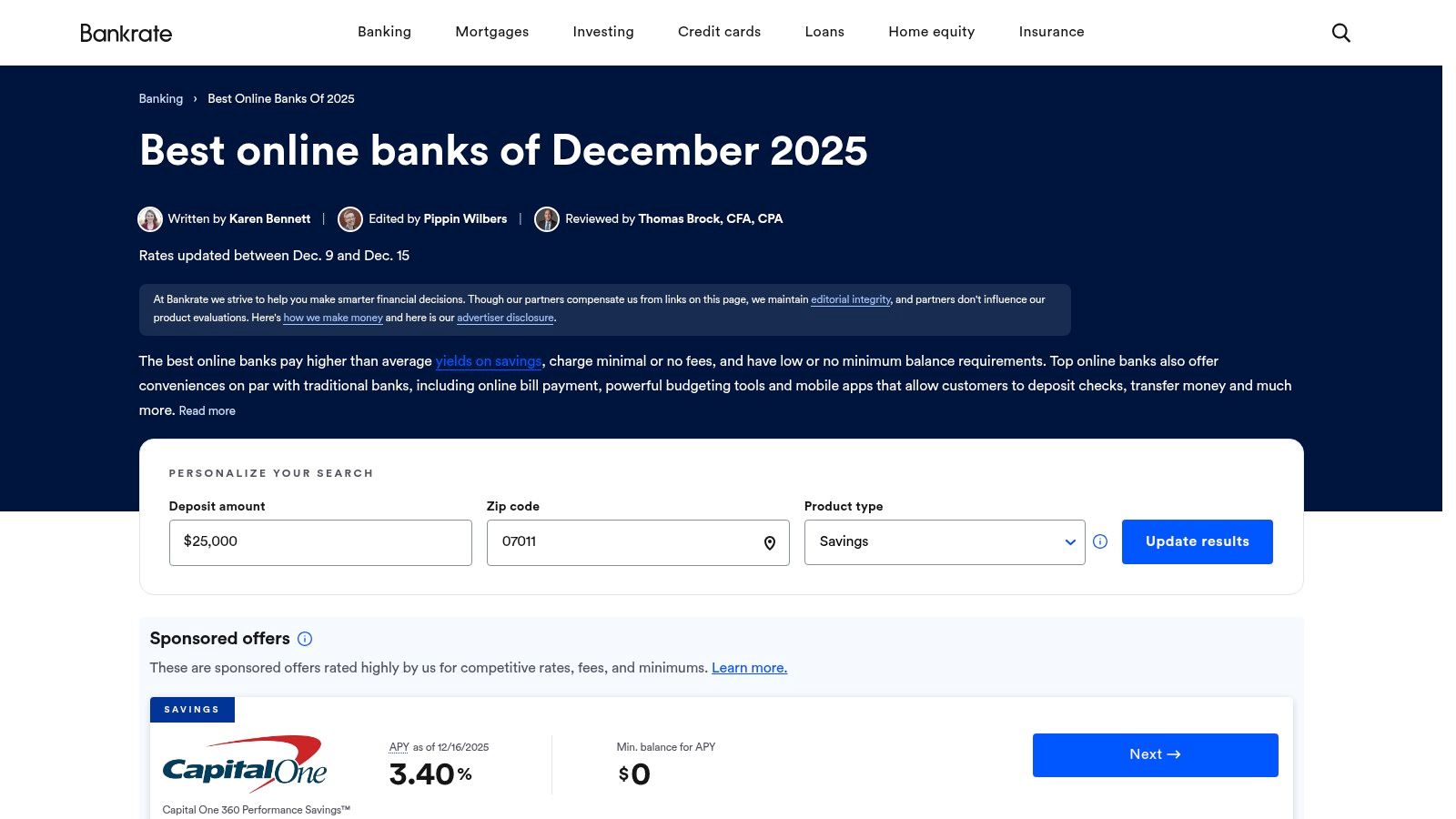

7. Bankrate – Best Online Banks (editorial comparison hub)

Best For: Consumers who want to efficiently compare top-rated online banks side-by-side to find the best fit for their specific financial needs.

Rather than being a bank itself, Bankrate is an indispensable resource in the search for the best online banks in the USA. It functions as a comprehensive editorial comparison hub, gathering data on leading financial institutions and presenting it in a clear, digestible format. Bankrate excels at cutting through the marketing noise to help you quickly identify which bank offers the best features, highest yields, or lowest fees for your unique situation.

Key Features and Offerings

Bankrate's platform is designed for quick, informed decision-making. Its "Best Online Banks" page provides concise summaries, highlights key strengths, and allows for at-a-glance comparisons of the most critical banking features.

- Curated "Best For" Categories: Bankrate doesn't just list banks; it categorizes them by their primary strengths, such as "Best for High-Yield Savings," "Best for ATM Access," or "Best for Checking." This helps you immediately narrow your focus to the banks that align with your top priorities.

- Concise Pros and Cons: Each bank profile includes a bulleted list of pros and cons, offering a balanced and rapid overview of its advantages and potential drawbacks.

- Direct Application Links: Once you identify a bank that meets your criteria, Bankrate provides direct links to the bank's official website, streamlining the process of opening an account.

Pricing and Accessibility

As a free-to-use informational resource, Bankrate's value lies in its transparency and ease of access.

| Feature | Details |

|---|---|

| Access Cost | $0. The platform is completely free for consumers. |

| Information Scope | U.S.-focused, providing details on nationally available online banks. |

| Data Updates | Rates and offers are updated regularly, but always verify on the bank's site. |

| User Account | Not required to access comparison guides and editorial content. |

Practical Tips for Maximizing Bankrate

To get the most out of Bankrate, use it as your starting point, not your final destination. Begin by identifying your primary banking need (e.g., maximizing savings interest, avoiding fees, or finding the best mobile app). Use Bankrate's "Best For" categories to create a shortlist of two or three potential banks. From there, click through to each bank's official website to confirm the latest rates, bonus offers, and read the fine print on account terms before making a final decision.

Expert Insight: Bankrate's greatest strength is its ability to aggregate and simplify complex information. However, because the financial landscape changes rapidly, promotional APYs or sign-up bonuses can become outdated. Always treat the information as a high-quality guide and perform final verification directly with the financial institution.

Pros:

- Excellent at-a-glance comparison of top online banks' key strengths.

- Clear, well-structured layout makes it easy to find relevant information quickly.

- U.S.-focused content is highly relevant for consumers searching for the best online banks in the USA.

Cons:

- Rates and promotional offers can change frequently; information may not always be real-time.

- Summaries may omit niche details that could be important for an individual's specific circumstances.

- It's a referral-based site, so be mindful that its purpose is to guide you to open an account.

Learn more by visiting Bankrate's Best Online Banks guide.

Top U.S. Online Banks: Feature Comparison

This table provides a side-by-side look at the key features of the top online banks to help you make a quick, informed decision.

| Bank | Best For | Monthly Fee | Top Feature | ATM Network |

|---|---|---|---|---|

| Ally Bank | Automated saving | $0 | Savings Buckets & Boosters | 43,000+ fee-free, plus $10/mo reimbursement |

| Capital One 360 | ATM access + physical presence | $0 | 70,000+ fee-free ATMs | 70,000+ fee-free, no reimbursement |

| Discover Bank | Debit card rewards | $0 | 1% cash back on debit purchases | 60,000+ fee-free, no reimbursement |

| SoFi Bank | All-in-one finance | $0 | High APY with direct deposit | 55,000+ fee-free, no reimbursement |

| Axos Bank | Unlimited ATM use | $0 | Unlimited domestic ATM fee reimbursement | Use any ATM; all fees reimbursed |

Making the Right Choice for Your Financial Future

The digital banking landscape has fundamentally transformed how we manage our money, moving it from brick-and-mortar lobbies to the palms of our hands. As we've explored the features of leading contenders like Ally, SoFi, and Discover, a clear theme emerges: the best online bank is not a one-size-fits-all solution. Your ideal financial partner depends entirely on your personal goals, spending habits, and long-term aspirations.

Choosing from the best online banks USA has to offer is a significant decision that directly impacts your financial efficiency. The right choice can accelerate your savings through high-yield APYs, eliminate frustrating fees that erode your balance, and simplify your daily transactions with powerful mobile tools. The wrong choice, however, can lead to missed savings opportunities, inconvenient access to cash, or a user experience that adds friction to your financial life.

Key Takeaways: From APYs to User Experience

Let’s distill our comprehensive review into actionable insights. We saw how Ally Bank excels as an all-around performer with competitive rates and top-tier customer service, making it a safe bet for many. SoFi stands out for its integrated ecosystem, appealing to those who want to bank, invest, and borrow under a single, modern digital roof. Meanwhile, Discover Bank’s Cashback Debit program offers a unique value proposition for consistent spenders, turning everyday purchases into tangible rewards.

The core lesson is to look beyond the headline APY. While a high interest rate is attractive, factors like ATM network size, mobile app usability, overdraft protection policies, and the availability of specialized accounts (like those at Axos Bank) are equally critical. Your final decision should be a balanced equation of returns, convenience, and features that align with your specific financial profile.

Your Action Plan: A Step-by-Step Guide to Choosing

Instead of feeling overwhelmed by the options, approach the decision methodically. This framework will help you transition from analysis to action with confidence.

-

Define Your Primary Banking Need: Start by identifying your main goal. Are you looking to maximize interest on a large emergency fund? Do you need a seamless checking account for daily bills and direct deposits? Or are you a frequent traveler needing fee-free ATM access everywhere? Your primary use case is the most important filter.

- Scenario: A recent graduate wants to aggressively build an emergency fund. Their priority should be the highest, most consistent APY on a savings account, making a bank like Ally or a high-yield SoFi Savings account a top contender. Fees on a checking account are a secondary concern.

-

Audit Your Current Banking Habits: Track your financial behavior for one month. How many times do you visit an ATM? Do you ever deposit cash? How often do you need to speak with customer service? Answering these questions will reveal non-negotiable features.

- Example: If you frequently travel and withdraw cash, the unlimited reimbursement from Axos Bank becomes a major selling point. If you primarily use debit cards for spending, the 1% cash back from Discover Bank could be more valuable.

-

Conduct a Final Feature-to-Feature Comparison: Create a shortlist of two or three banks from our list. Use the comparison tables and our analysis to place them side-by-side. Compare their mobile app ratings in the app store, read recent customer reviews, and double-check their current sign-up bonus offers. A small bonus can be a great tie-breaker between two otherwise equal options.

By following this structured approach, you ensure your choice is based on data and personal relevance, not just marketing claims. The goal is to select a bank that feels like a natural extension of your financial life, one that empowers you to save more, spend smarter, and worry less. The transition to one of the best online banks USA offers is a powerful step toward a more optimized and rewarding financial future.

Ready to take the next step beyond just saving and managing your money? Choosing the right bank is the foundation, but building true wealth requires a comprehensive strategy. At Top Wealth Guide, we provide expert insights and actionable guides on investing, wealth generation, and financial planning to help you grow your net worth. Explore our resources at Top Wealth Guide to learn how to make your money work harder for you.

Frequently Asked Questions (FAQ)

1. Are online banks safe and FDIC insured?

Yes, reputable online banks are just as safe as traditional banks. As long as the bank is a member of the Federal Deposit Insurance Corporation (FDIC), your deposits are insured up to $250,000 per depositor, per insured bank, for each account ownership category. All banks listed in this guide are FDIC members.

2. What is the main advantage of an online bank over a traditional bank?

The primary advantages are typically higher interest rates (APYs) on savings accounts and lower fees. Because they don't have the overhead costs of maintaining physical branches, online banks can pass those savings on to customers in the form of better rates and fewer charges for things like monthly maintenance or overdrafts.

3. How do I deposit cash into an online bank account?

This is a common concern. Methods vary by bank. Some, like Discover, partner with retailers like Walmart for free cash deposits. Others may require you to use a third-party service like Green Dot, which often charges a fee. Another workaround is to deposit cash into a traditional bank account and then transfer it electronically to your online bank.

4. Can I still get checks and a debit card with an online bank?

Absolutely. Online banks provide all the essential tools of a traditional bank, including a debit card for purchases and ATM withdrawals. Most also offer free checkbooks or the ability to send checks directly from their online platform or mobile app.

5. What happens if I need to use an ATM that isn't in my online bank's network?

This depends on the bank's policy. Many online banks, like Ally and Axos, offer reimbursements for out-of-network ATM fees charged by other banks, either up to a monthly limit or unlimited. Others, like Capital One 360, have such a large fee-free network that you are rarely far from an in-network ATM.

6. Is it difficult to switch to an online bank?

It's easier than ever. Most online banks have a streamlined digital application process that takes only a few minutes. The most time-consuming part is updating your direct deposits and automatic bill payments. Many banks now offer automated tools to help you find and switch these recurring transactions.

7. Which online bank is the best for high-yield savings?

Rates change frequently, but banks like Ally, SoFi (with direct deposit), and Capital One 360 are consistently among the top performers for high-yield savings accounts. It's always best to check the current APYs directly on the banks' websites before making a decision.

8. Are there online banks that offer rewards for checking accounts?

Yes. The most notable is Discover Bank, which offers 1% cash back on debit card purchases. Some other online banks, like Axos Bank's Rewards Checking, offer a high APY on your checking balance if you meet certain requirements, which functions as a different kind of reward.

9. Can I open a joint account with an online bank?

Yes, nearly all online banks offer the option to open joint checking and savings accounts for spouses, partners, or family members, providing the same features and benefits as individual accounts.

10. What should I look for in a mobile banking app?

A great mobile banking app should be user-friendly, secure, and feature-rich. Key features to look for include mobile check deposit, easy fund transfers, bill pay, ATM locators, real-time transaction alerts, and the ability to temporarily lock or unlock your debit card. Reading user reviews in the app store can provide valuable insight.

This article is for educational purposes only and is not financial or investment advice. Consult a professional before making financial decisions.