Navigating the world of investing can feel overwhelming, but the right mobile app can simplify the process significantly. This guide is designed to help you cut through the noise and find the best investment apps for beginners, regardless of your starting capital or experience level. Whether you're looking to buy your first stock, start a retirement account, or simply grow your savings, the platform you choose is a critical first step.

We have analyzed the top platforms, focusing on the features that matter most to new investors: user-friendly interfaces, low or no fees, educational resources, and account minimums. Instead of providing generic summaries, this article offers a detailed breakdown of each app's unique strengths and potential drawbacks. You will find in-depth profiles on options like Fidelity, SoFi, Acorns, and more, helping you understand their specific use cases.

Each review includes practical insights, screenshots to guide you, and direct links to get started. Our goal is to provide a comprehensive resource that empowers you to compare your options effectively and select an app that aligns perfectly with your financial goals and learning style. By the end of this list, you'll have the clarity needed to begin your investment journey with confidence.

In This Guide

- 1 1. Robinhood

- 2 2. Fidelity Investments

- 3 3. Charles Schwab

- 4 4. E*TRADE from Morgan Stanley

- 5 5. SoFi Invest

- 6 6. Acorns

- 7 7. Stash

- 8 8. M1 Finance

- 9 9. Public

- 10 10. Webull

- 11 11. NerdWallet (Best Investment Apps roundup)

- 12 12. Investopedia (Best Investing Apps/Guides)

- 13 Investment Apps for Beginners: At a Glance

- 14 Final Thoughts

- 15 Frequently Asked Questions (FAQ)

- 15.1 1. Which investment app is truly the best for a complete beginner?

- 15.2 2. Can I actually make money with just a small initial investment?

- 15.3 3. Are my investments safe in these apps?

- 15.4 4. What is the difference between a stock and an ETF?

- 15.5 5. Do I have to pay taxes on my investment gains?

- 15.6 6. What are fractional shares and why are they important for beginners?

- 15.7 7. What's the difference between an active investing app and a robo-advisor?

- 15.8 8. Are there any hidden fees I should watch out for?

- 15.9 9. Should I use a paper trading feature before investing real money?

- 15.10 10. How many investment apps should I use?

1. Robinhood

Robinhood stands out as one of the best investment apps for beginners primarily due to its exceptionally user-friendly interface and no-frills onboarding process. The platform pioneered commission-free trading for stocks and ETFs, effectively removing a major cost barrier for new investors. Its core strength lies in making the stock market accessible and less intimidating.

Key Features & User Experience

The mobile-first design is clean and intuitive, allowing users to buy and sell assets with just a few taps. A key feature is fractional shares, which lets you invest with as little as $1 in major companies like Apple or Amazon, rather than needing hundreds or thousands of dollars for a single share. This is ideal for those starting with a small budget who still want to build a diversified portfolio. Robinhood also offers a cash sweep program and an IRA with a 1% match, expanding its utility beyond basic trading.

Pricing and Subscription Model

- Standard Account: $0 commission on U.S. stocks, ETFs, and options trading. No account minimums are required.

- Robinhood Gold: A premium subscription ($5/month) that unlocks Nasdaq Level II data, in-depth Morningstar research reports, larger instant deposits, and a significantly higher APY on uninvested cash.

Pros & Cons of Robinhood

| Pros | Cons |

|---|---|

| ✅ Extremely intuitive, beginner-friendly interface | ❌ Advanced features require a paid Gold subscription |

| ✅ $0 commission trading on stocks, ETFs, options | ❌ Customer support can be less responsive than competitors |

| ✅ Fractional shares lower the barrier to entry | ❌ Can encourage more frequent trading, which may not be ideal for beginners |

| ✅ Expanding product line (IRAs, futures, index options) | ❌ Options and other complex products may be risky for new investors |

Best For: New investors looking for the fastest and simplest way to start buying stocks and ETFs without being overwhelmed.

Website: https://robinhood.com

2. Fidelity Investments

Fidelity Investments is a powerhouse full-service brokerage that has successfully adapted its robust platform for the modern investor, making it one of the best investment apps for beginners. It stands out by combining beginner-friendly features like zero-commission trades and no account minimums with an institutional-grade library of educational resources. This makes it a platform you can start with and grow into for decades.

Key Features & User Experience

Fidelity’s app offers a clean experience without sacrificing depth. A standout feature is “Stocks by the Slice,” which is their version of fractional shares, allowing you to invest in thousands of U.S. stocks and ETFs with as little as $1. This feature is crucial for beginners who want to build a diversified portfolio without a large initial investment. The platform is also lauded for its comprehensive research tools and a vast library of articles, webinars, and courses designed to help you learn how to start investing money.

Pricing and Subscription Model

- Standard Account: $0 commission on online U.S. stock, ETF, and options trades. No account minimums for retail brokerage or IRA accounts.

- Advanced Tools: Access to in-depth research, screeners, and platforms like Active Trader Pro is included at no extra cost for all customers.

Pros & Cons of Fidelity Investments

| Pros | Cons |

|---|---|

| ✅ Strong investor protections and deep educational content | ❌ The app can feel dense for absolute beginners |

| ✅ $0 commissions and fractional shares ("Stocks by the Slice") | ❌ The sheer volume of tools and information can be overwhelming at first |

| ✅ Broad range of investment products (stocks, ETFs, mutual funds) | ❌ Interface is less gamified than some competitors, which may be less engaging for some |

| ✅ Excellent research tools available for free | ❌ Options trading approval process is more rigorous than some apps |

Best For: Beginners who want a long-term, all-in-one platform with extensive educational resources to grow their knowledge.

Website: https://www.fidelity.com

3. Charles Schwab

Charles Schwab offers a powerful, full-service brokerage experience that is surprisingly accommodating for beginners. It stands apart by providing a clear growth path, allowing new investors to start with simple tools and graduate to more sophisticated features within the same platform. Its combination of zero-commission trades, strong customer support, and educational resources makes it one of the best investment apps for beginners planning for the long term.

Key Features & User Experience

Schwab's platform is robust yet manageable for newcomers. A standout feature is "Stock Slices," which allows for fractional share investing in S&P 500 companies with as little as $5. For those who prefer a hands-off approach, the Schwab Intelligent Portfolios robo-advisor offers automated portfolio management with no advisory fees, although it requires a higher initial investment. The platform is also known for its extensive library of low-cost index funds and ETFs, providing excellent building blocks for a diversified portfolio. For those looking to learn more about investing wisely, their educational content is top-tier.

Pricing and Subscription Model

- Standard Account: $0 commission for online U.S. stock and ETF trades. No account minimums for a standard brokerage account.

- Schwab Intelligent Portfolios: No advisory fees. Requires a $5,000 minimum investment.

- Intelligent Portfolios Premium: A one-time $300 planning fee and a $30/month advisory fee for unlimited access to a Certified Financial Planner.

Pros & Cons of Charles Schwab

| Pros | Cons |

|---|---|

| ✅ Great ecosystem for growing from beginner to expert | ❌ Robo-advisor has a high $5,000 minimum investment |

| ✅ "Stock Slices" enable diversification with just $5 | ❌ The platform can feel less streamlined than mobile-first apps |

| ✅ Strong educational resources and 24/7 support | ❌ Premium robo-advisor tier comes with subscription costs |

| ✅ No advisory fees on its standard robo-advisor | ❌ Cash allocation in robo-portfolios can be higher than competitors |

Best For: Beginners who want a long-term brokerage that offers robust tools, educational support, and the option for automated investing as their needs evolve.

Website: https://www.schwab.com

4. E*TRADE from Morgan Stanley

E*TRADE secures its place as one of the best investment apps for beginners by blending a user-friendly experience with the robust resources of a financial powerhouse, Morgan Stanley. It offers an excellent middle ground, providing more depth than the most basic apps without overwhelming new investors. Its strength lies in its comprehensive educational materials and a clear growth path for users as their needs evolve.

Key Features & User Experience

E*TRADE provides top-rated mobile and web platforms that are intuitive yet packed with features. A key advantage is access to Morgan Stanley’s professional research and insights, which can help beginners make more informed decisions. The platform also offers commission-free trading on mutual funds, a feature not always standard on other beginner-focused apps, allowing for easy diversification. It provides a more traditional brokerage experience with powerful tools that users can grow into.

Pricing and Subscription Model

- Standard Account: $0 commission for online U.S.-listed stocks, ETFs, and mutual funds. No account minimums.

- Options Trading: $0 commission, but a standard fee of $0.65 per contract applies. This fee can be reduced for active traders.

- Broker-Assisted Trades: A fee of $25 is charged for trades placed with the help of a broker.

Pros & Cons of E*TRADE from Morgan Stanley

| Pros | Cons |

|---|---|

| ✅ Excellent educational resources and market analysis | ❌ Broker-assisted trades come with a significant fee |

| ✅ $0 commission on stocks, ETFs, and mutual funds | ❌ Crypto trading is planned but not yet available |

| ✅ Backed by the institutional power of Morgan Stanley | ❌ The platform can have a steeper learning curve than simpler apps |

| ✅ Access to professional research and IPO offerings | ❌ Some advanced tools may be unnecessary for absolute beginners |

Best For: Beginners who want a feature-rich platform with strong educational support and the ability to grow into more advanced trading.

Website: https://us.etrade.com

5. SoFi Invest

SoFi Invest positions itself as a comprehensive financial hub, making it one of the best investment apps for beginners who want to manage their money and investments in one place. It successfully blends commission-free active trading with the guidance of an automated portfolio, offering a unique hybrid approach. The platform’s strength is its integration with SoFi’s broader ecosystem of banking, loans, and financial planning services.

Key Features & User Experience

SoFi offers two main paths for investors: active, self-directed trading and an automated robo-advisor service. The active trading side includes commission-free stock and ETF trades, plus a growing selection of options. Its automated investing service builds and manages a diversified portfolio for you, a feature that helps new investors learn more about the 9 best ways to build wealth. A standout benefit is access to Certified Financial Planners (CFPs) at no extra cost, providing professional guidance that is rare among beginner-focused apps.

Pricing and Subscription Model

- Active Investing: $0 commission on stock and ETF trades. No account minimums.

- Automated Investing: No advisory fees. SoFi’s robo-advisor is one of the few that offers automated management without charging a management fee, regardless of your balance.

Pros & Cons of SoFi Invest

| Pros | Cons |

|---|---|

| ✅ All-in-one app for banking, loans, and investing | ❌ Limited selection of advanced investment products |

| ✅ Access to Certified Financial Planners for guidance | ❌ Options trading can incur minor regulatory fees |

| ✅ Commission-free trading and fractional shares | ❌ The all-in-one approach might be overwhelming for some |

| ✅ Completely free automated investing (no advisory fees) | ❌ Fewer research tools than traditional brokerages |

Best For: Beginners who want a single app for all their financial needs, including access to professional advice alongside easy-to-use investing tools.

Website: https://www.sofi.com/invest

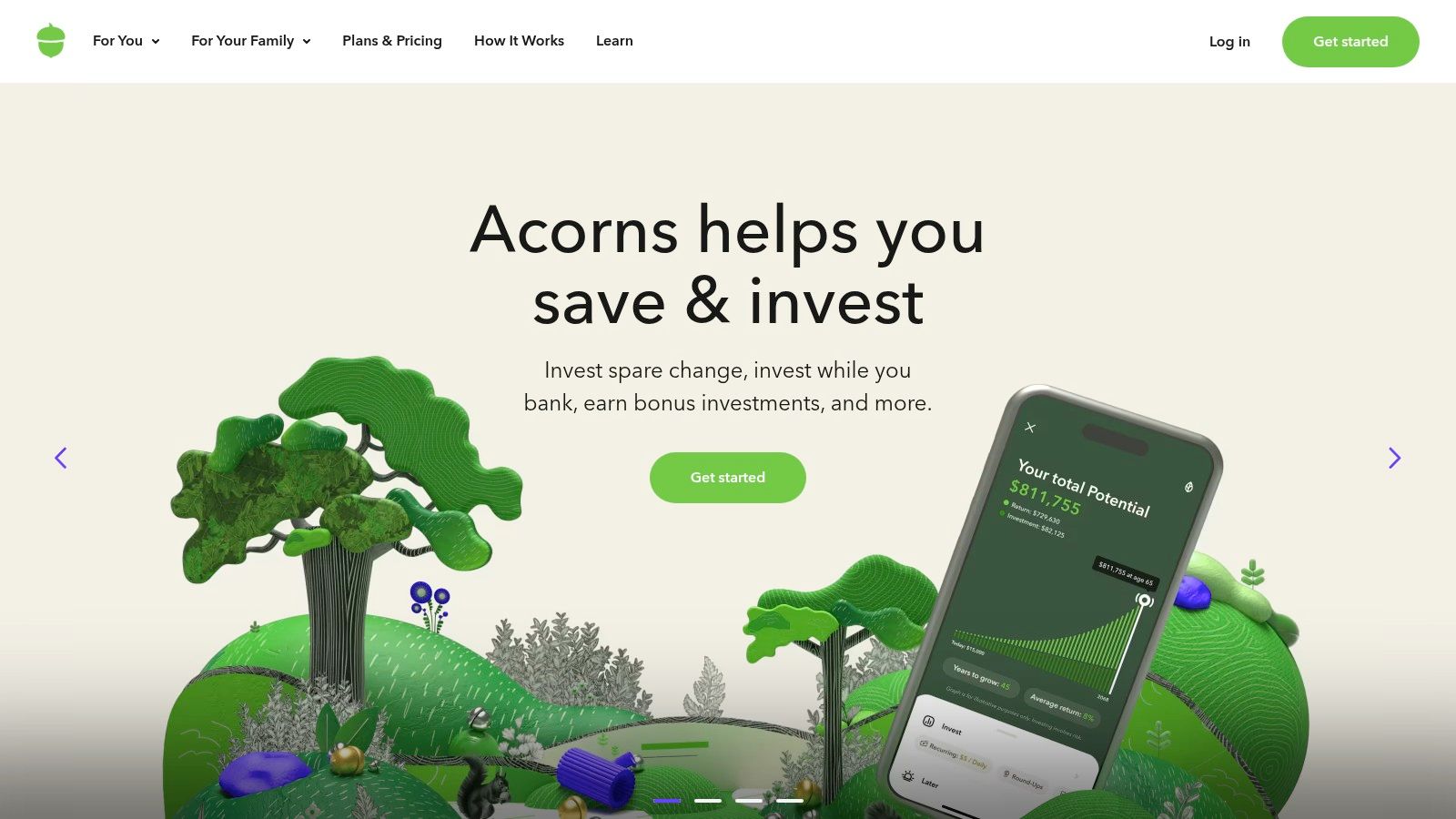

6. Acorns

Acorns makes our list of the best investment apps for beginners by automating the entire process of saving and investing. Its signature feature is "Round-Ups," which automatically invests the spare change from your daily purchases. This set-and-forget model removes the friction of manually transferring money, making it effortless for novices to start building a portfolio without even thinking about it.

Key Features & User Experience

The core of the Acorns experience is simplicity. After linking your bank accounts, the app automatically rounds up transactions to the nearest dollar and invests the difference into a diversified ETF portfolio tailored to your risk tolerance. A key feature is its all-in-one financial wellness system, which bundles investing, retirement (Acorns Later), and checking accounts (Acorns Checking) into a single subscription. The platform also offers extensive educational content to help users understand fundamental financial concepts.

Pricing and Subscription Model

Acorns uses a flat-fee subscription model, which simplifies its cost structure.

- Acorns Personal: $3/month for an investment account, retirement IRA, and a checking account.

- Acorns Family: $5/month for everything in Personal, plus investment accounts for kids (Acorns Early).

Pros & Cons of Acorns

| Pros | Cons |

|---|---|

| ✅ Set-and-forget investing via automatic Round-Ups | ❌ Flat monthly fees can be high for very small account balances |

| ✅ Extremely low barrier to entry, start with just $5 | ❌ Less control over individual investment choices |

| ✅ Bundles investing, retirement, and checking | ❌ Limited options for advanced or active traders |

| ✅ Strong focus on financial education | ❌ Promotional perks and IRA matches are subject to change |

Best For: Individuals who want to start investing passively without changing their daily habits or making active decisions.

Website: https://www.acorns.com

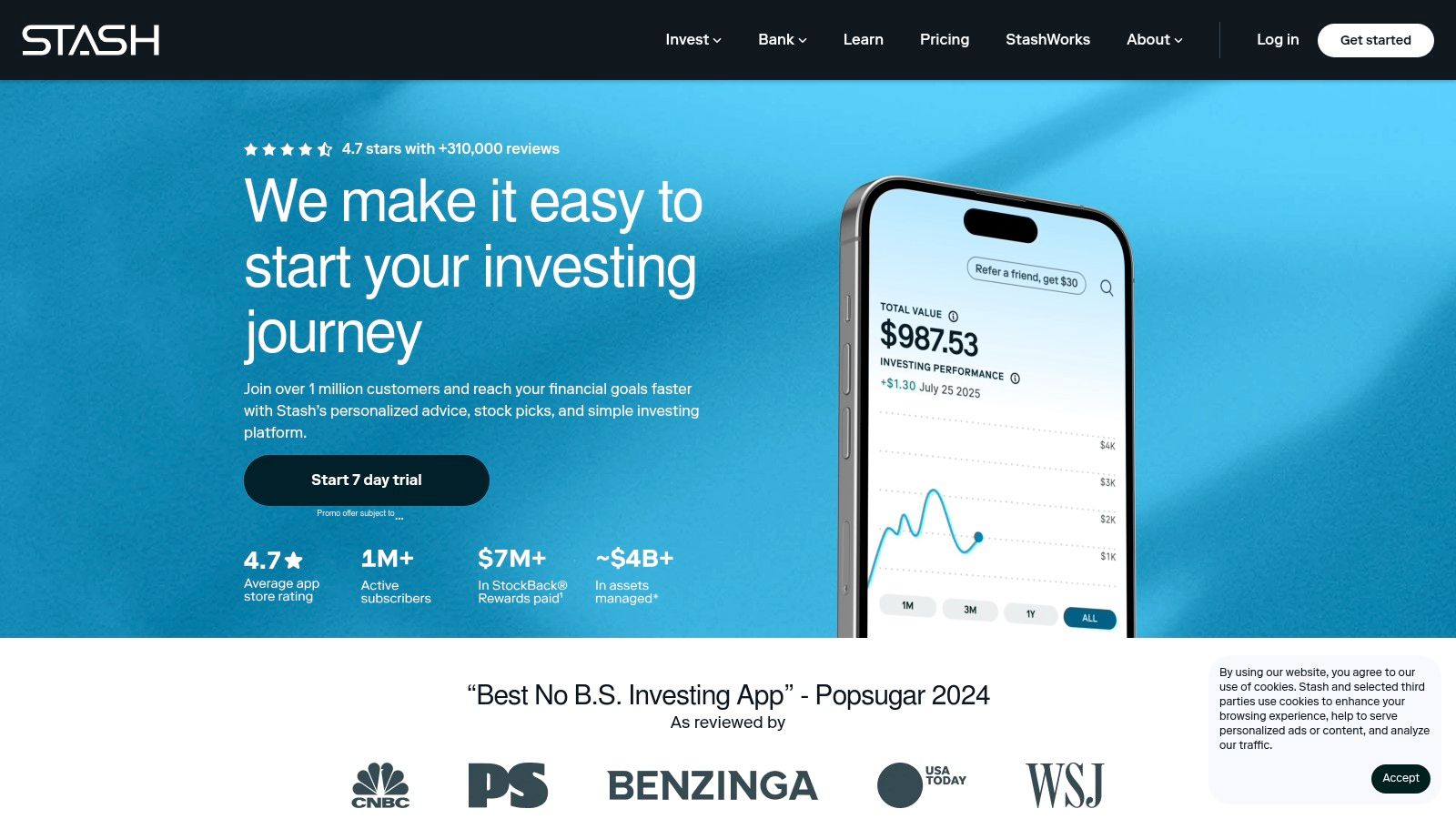

7. Stash

Stash is an all-in-one financial platform designed to make investing accessible and understandable for complete novices. It uniquely blends a personal brokerage account, automated portfolios, retirement accounts, and banking into a single subscription-based service. The platform's core philosophy is to empower users through education and guided choices, making it one of the best investment apps for beginners who want a more structured start.

Key Features & User Experience

Stash simplifies investing by allowing users to purchase fractional shares of thousands of individual stocks and ETFs, often grouped by themes like "Clean & Green" or "Delicious Dividends." A standout feature is the Stock-Back® Card, a debit card that rewards users with pieces of stock for their everyday purchases. The app also heavily integrates financial education, offering guidance and articles to help users build confidence. For those looking to learn more about the fundamentals, our investing for beginners guide provides additional context.

Pricing and Subscription Model

Stash operates on a tiered monthly subscription model rather than per-trade commissions.

- Stash Growth: $3/month for access to a personal investment account, the Stock-Back® Card, and retirement accounts (Traditional or Roth IRA).

- Stash+: $9/month includes everything in Growth, plus two custodial investment accounts for kids, exclusive market insights, and a 1% Stock-Back® bonus on purchases.

Pros & Cons of Stash

| Pros | Cons |

|---|---|

| ✅ All-in-one platform combines banking and investing | ❌ Monthly fees can be costly for very small account balances |

| ✅ Strong focus on education for new investors | ❌ Limited to specific trading windows, no intraday trading |

| ✅ Stock-Back® rewards program is a unique incentive | ❌ Not ideal for active traders or advanced investors |

| ✅ Themed ETFs help simplify portfolio diversification | ❌ Fewer advanced tools and research than competitors |

Best For: Beginners who want a guided, all-in-one app that combines banking, investing, and financial education within a simple subscription model.

Website: https://www.stash.com

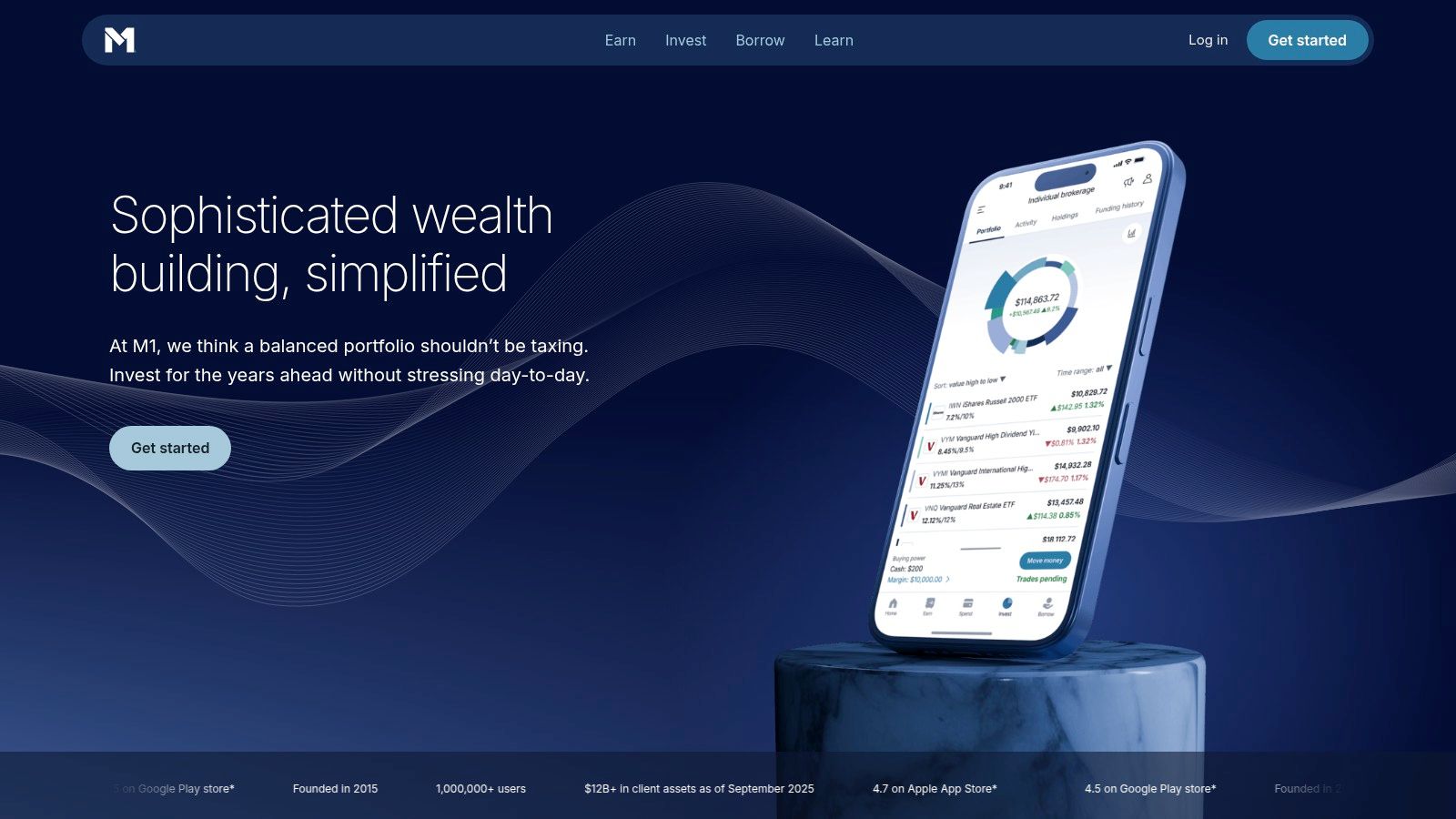

8. M1 Finance

M1 Finance offers a unique hybrid approach, blending the automation of a robo-advisor with the control of a self-directed brokerage. Its standout feature is the "Pie" based investing system, which allows beginners to visually construct and manage a diversified portfolio. This makes it one of the best investment apps for beginners who want a structured, long-term, and hands-off strategy without paying advisory fees.

Key Features & User Experience

The platform is built around customizable "Pies", where each slice represents a stock or ETF you choose. You set a target percentage for each slice, and M1 automatically allocates your deposits to maintain that balance. This automation is perfect for dollar-cost averaging. A key feature is one-click rebalancing, which realigns your portfolio to its targets. M1 also offers extremely precise fractional shares (down to 1/100,000th of a share), ensuring every dollar is invested according to your plan.

Pricing and Subscription Model

- Standard Account: $0 commission on trades. No account minimums to get started. A $3 monthly platform fee applies to clients with less than $10,000 in combined M1 assets or without an active M1 Personal Loan.

- M1 Plus: A premium subscription ($3/month) that offers a second daily trading window, custodial accounts, and higher rates on its high-yield savings account and personal loans.

Pros & Cons of M1 Finance

| Pros | Cons |

|---|---|

| ✅ Excellent automation for portfolio management | ❌ Not suitable for active or day traders due to scheduled trade windows |

| ✅ Visual "Pie" interface simplifies diversification | ❌ Limited trading windows (one or two per day) |

| ✅ Highly precise fractional shares ensure all money is invested | ❌ Platform fee may apply to accounts with smaller balances |

| ✅ Great for hands-off, long-term investors | ❌ Limited research tools compared to traditional brokerages |

Best For: Long-term, set-it-and-forget-it investors who want to build and automate a custom portfolio without manual rebalancing.

Website: https://m1.com

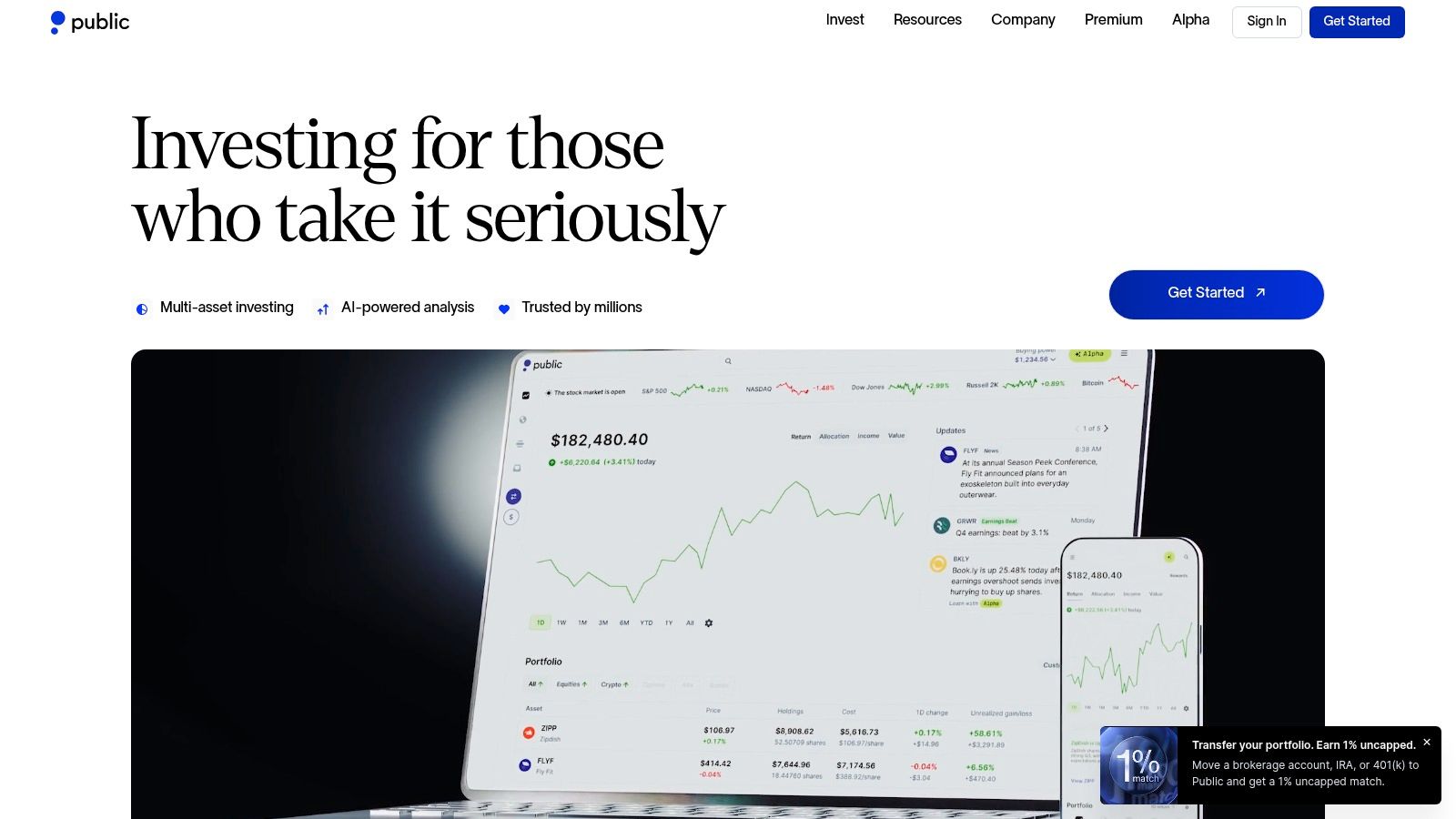

9. Public

Public carves out a unique niche among the best investment apps for beginners by blending traditional stock trading with a strong social community and an emphasis on lower-risk assets. The platform offers commission-free trading for stocks and ETFs while also providing easy access to alternative investments like U.S. Treasury Bills and diversified bond portfolios, making it an excellent choice for newcomers looking to build a balanced portfolio from day one.

Key Features & User Experience

The platform's interface is clean and designed to demystify investing. A standout feature is its social feed, where users can follow experienced investors, share insights, and discuss market trends, which shortens the learning curve. Public also offers direct access to a Treasury Account, allowing users to buy T-Bills with transparent fees and SIPC protection. The Bond Account further simplifies diversification by automatically allocating funds across a curated selection of corporate and government bonds.

Pricing and Subscription Model

- Standard Account: $0 commission on stock and ETF trades. No account minimums.

- Treasury Account: A transparent management fee is included in the displayed yield, making it easy to understand your net return.

- Bond Account: Similar to the Treasury Account, a small management fee is applied.

Pros & Cons of Public

| Pros | Cons |

|---|---|

| ✅ Social features help beginners learn from a community | ❌ Fees apply to non-stock/ETF products like Treasuries and Bonds |

| ✅ Easy access to lower-risk assets like T-Bills and bonds | ❌ Yields on fixed-income products are subject to market fluctuations |

| ✅ $0 commission trading for stocks and ETFs | ❌ The social feed can sometimes create noise or encourage herd mentality |

| ✅ Clean, educational, and beginner-friendly interface | ❌ Fewer advanced tools compared to more traditional brokerages |

Best For: New investors who want a community-driven experience and wish to easily diversify beyond stocks into lower-volatility assets.

Website: https://public.com

10. Webull

Webull positions itself as a step up from the most basic platforms, making it one of the best investment apps for beginners who are eager to learn and grow. It offers zero-commission trading for stocks, ETFs, and options, combined with a suite of analytical tools that are typically reserved for more advanced traders. Its strength lies in balancing accessibility for newcomers with the robust features that an investor won't immediately outgrow.

Key Features & User Experience

Webull provides a more data-rich environment than many competitors, featuring advanced charting tools, technical indicators, and real-time data streams. A standout feature is its paper trading simulator, which allows beginners to practice trading with virtual money. This is an invaluable tool for building confidence and testing strategies without financial risk. The platform also supports fractional shares with a low $5 minimum, making it easy to invest in high-priced stocks on a budget. The app even offers cryptocurrency trading, and you can get an overview with our guide on how to invest in cryptocurrency.

Pricing and Subscription Model

- Standard Account: $0 commission on U.S. stocks, ETFs, and options trading. No account minimums required to open an account.

- Webull Premium: A subscription that provides access to advanced real-time data (Nasdaq TotalView), higher APY on uninvested cash, and other perks for active traders.

Pros & Cons of Webull

| Pros | Cons |

|---|---|

| ✅ Robust charting and analytical tools for learning | ❌ The interface can be overwhelming for absolute beginners |

| ✅ Paper trading feature is excellent for practice | ❌ Focus on technical data may encourage short-term trading |

| ✅ $0 commission on stocks, ETFs, and options | ❌ Premium data and features require a subscription fee |

| ✅ No account minimums or fees for inactivity | ❌ Customer support is primarily online-based |

Best For: Ambitious beginners who want a platform with advanced tools they can grow into without paying commissions.

Website: https://www.webull.com

11. NerdWallet (Best Investment Apps roundup)

Instead of being a direct investment platform, NerdWallet serves as an invaluable research tool for those trying to choose from the best investment apps for beginners. It functions as a comprehensive, editorially-driven comparison site, saving new investors countless hours of research by consolidating key information in one place. Its strength lies in providing unbiased, side-by-side comparisons of features, fees, and current promotions across the industry's top platforms.

Key Features & User Experience

NerdWallet excels at breaking down complex financial topics into easy-to-understand guides and articles. A key feature is its constantly updated ranking tables, which allow users to filter and sort investment apps based on criteria like account minimums, trading fees, and available assets. The platform provides beginner-friendly glossaries and clear explainers, helping you understand the pros and cons of each app before committing. This approach empowers you to make an informed decision tailored to your specific financial goals and risk tolerance.

Pricing and Subscription Model

- Standard Access: NerdWallet is completely free to use. Its revenue comes from partnerships with financial institutions, so you can access all its reviews and comparison tools without a subscription.

Pros & Cons of NerdWallet

| Pros | Cons |

|---|---|

| ✅ Saves time by consolidating the latest pricing and promotions | ❌ Does not provide direct investment services; it's a research tool |

| ✅ Wide coverage and reliable, in-depth editorial oversight | ❌ Some listings are influenced by partner offers; always verify terms |

| ✅ Free and easy to use as a powerful decision-making aid | ❌ Information overload is possible for absolute beginners |

| ✅ Excellent educational resources for learning investing basics | ❌ App recommendations are primarily focused on the U.S. market |

Best For: Beginners who want to compare multiple investment apps and understand the fine print before opening an account.

Website: https://www.nerdwallet.com/best/investing/stock-apps

12. Investopedia (Best Investing Apps/Guides)

While not a trading platform itself, Investopedia is arguably one of the most crucial "apps" for beginners. It serves as an essential educational launchpad, providing the foundational knowledge needed to use other investment apps wisely. Its strength lies in breaking down complex financial concepts, offering unbiased broker reviews, and providing step-by-step guides that demystify the entire investing process.

Key Features & User Experience

Investopedia excels with its vast library of educational content. A key feature is its detailed brokerage comparisons and reviews, which analyze the best investment apps for beginners with rigorous, independent testing. These guides often include screenshot-driven walkthroughs showing you exactly how to open an account or place your first trade. This allows you to understand how a platform works and what to expect before you commit any real money.

Pricing and Subscription Model

- Standard Access: $0. All of Investopedia's educational articles, guides, reviews, and market analysis are completely free to access.

- Investopedia Academy: Paid courses on specific topics are available for those seeking a more structured, in-depth learning experience.

Pros & Cons of Investopedia

| Pros | Cons |

|---|---|

| ✅ Excellent, free educational resources to avoid common mistakes | ❌ Not a brokerage platform; you can't actually invest here |

| ✅ In-depth, unbiased reviews of trading platforms | ❌ Can be overwhelming due to the sheer volume of information |

| ✅ Helps beginners make an informed choice on where to invest | ❌ Some content may be too advanced for absolute beginners |

| ✅ Strong independent editorial content and testing | ❌ Does not provide personalized financial advice |

Best For: Beginners who want to learn the fundamentals of investing and compare platforms before opening an account.

Website: https://www.investopedia.com

Investment Apps for Beginners: At a Glance

To help you decide, here is a side-by-side comparison of our top picks, focusing on what matters most to new investors.

| App | Best For | Account Minimum | Key Feature for Beginners |

|---|---|---|---|

| Fidelity | All-Around Excellence | $0 | Extensive free educational resources. |

| SoFi Invest | Integrated Banking & Advice | $0 | Free access to Certified Financial Planners. |

| Robinhood | Simplicity & Speed | $0 | The most intuitive user interface. |

| Acorns | Passive "Set-and-Forget" | $0 to start; $5 for portfolio | "Round-Ups" to invest spare change automatically. |

| Webull | Ambitious Learners | $0 | Paper trading to practice without risk. |

| Public | Community & Alternative Assets | $0 | Access to T-bills and bonds alongside stocks. |

Real-Life Scenario: Choosing the Right App

Let's consider two different beginners to see how this comparison works in practice.

-

Scenario 1: Maria, the Busy Professional

- Goal: Start investing for retirement but has very little free time. She wants an automated, hands-off approach.

- Best Fit: Acorns. Maria can set up "Round-Ups" and automatic weekly deposits. The app will invest her money in a diversified portfolio without her needing to actively manage it. The monthly fee is simple and predictable.

-

Scenario 2: Alex, the Curious Student

- Goal: Learn about the stock market with a small amount of money ($200). He wants to understand how trading works and practice before using real funds.

- Best Fit: Webull. Alex can use the paper trading feature to learn the platform and test strategies risk-free. When he's ready, he can deposit his $200 and use fractional shares to buy pieces of several different companies, all while using the app's charts to learn more about market movements.

These examples show how your personal goals and learning style directly influence which app is the "best" for you.

Final Thoughts

Navigating the world of investing for the first time can feel overwhelming, but the digital tools available today have made it more accessible than ever. As we've explored, the journey to finding the best investment apps for beginners is not about identifying one universally superior platform. Instead, it's about matching a specific app's strengths to your personal financial goals, learning style, and investment philosophy.

From the commission-free simplicity of Robinhood and Webull for active, self-directed trading, to the comprehensive, research-rich environments of established brokers like Fidelity and Charles Schwab, the options are diverse. If you prefer a hands-off approach, robo-advisors like SoFi Invest or micro-investing platforms like Acorns can automate the process, building your portfolio with minimal effort. Meanwhile, apps like M1 Finance offer a unique hybrid model, blending automated investing with customizable control, perfect for those who want a structured yet personalized strategy.

Your Actionable Path Forward

The most critical step is moving from research to action. Your ideal app is the one that empowers you to start, stay consistent, and feel confident in your decisions. Don't let the pursuit of the "perfect" platform lead to paralysis.

To make your final decision, consider these core factors:

- Your Starting Capital: If you're starting small, an app with no account minimums and the ability to buy fractional shares (like SoFi, Fidelity, or Public) is essential.

- Your Time Commitment: Be honest about how much time you want to spend managing your investments. If you're busy, a set-it-and-forget-it robo-advisor or a micro-investing app like Acorns might be the most sustainable choice.

- Your Learning Goals: Do you want an app that simply executes trades, or one that provides deep educational resources? Platforms like Fidelity and E*TRADE excel in investor education, helping you grow your knowledge alongside your portfolio.

- Your Ultimate Objective: Are you saving for retirement in 30 years or a down payment in five? Your timeline will heavily influence whether you lean towards long-term, diversified ETFs or take a more active role in stock selection.

Choosing one of the best investment apps for beginners is a foundational step in your wealth-building journey. The right tool will not only facilitate your transactions but also serve as your partner in financial education and growth. The most important thing is to begin. Start small, learn as you go, and let the power of compounding work for you. Your future self will thank you for taking this decisive step today.

Frequently Asked Questions (FAQ)

1. Which investment app is truly the best for a complete beginner?

For a complete beginner, Fidelity is often the top recommendation. It combines $0 account minimums, fractional shares, and zero commissions with an outstanding library of educational content. It's a platform you can start with and never outgrow. If you prefer pure simplicity, Robinhood is the easiest to start with.

2. Can I actually make money with just a small initial investment?

Yes. Thanks to fractional shares, you can invest with as little as $1 or $5. While you won't get rich overnight, the key is consistency. Regularly investing small amounts allows you to take advantage of dollar-cost averaging and compound growth over time, which is how most people build wealth.

3. Are my investments safe in these apps?

Yes, for the most part. Brokerage accounts in the U.S., including those on these apps, are typically protected by the Securities Investor Protection Corporation (SIPC). SIPC insurance protects your securities up to $500,000 in the event the brokerage firm fails. It does not protect against market losses from your investment decisions.

4. What is the difference between a stock and an ETF?

A stock represents ownership in a single company (e.g., Apple). An ETF (Exchange-Traded Fund) is a collection of many different assets, like stocks or bonds, bundled into one fund. For beginners, ETFs are an excellent way to achieve instant diversification and reduce risk.

5. Do I have to pay taxes on my investment gains?

Yes. If you sell an investment for a profit, that gain is considered taxable income. The tax rate depends on how long you held the investment. Short-term capital gains (held less than a year) are taxed at your ordinary income rate, while long-term capital gains (held over a year) are taxed at a lower rate.

Fractional shares are portions or "slices" of a single share of a company's stock. They are crucial for beginners because they allow you to invest in expensive stocks (like Amazon or NVIDIA) with a small amount of money, such as $10. This makes it possible to build a diversified portfolio even with a limited budget.

7. What's the difference between an active investing app and a robo-advisor?

An active investing app (like Robinhood or Webull) requires you to choose and manage your own investments (stocks, ETFs, etc.). A robo-advisor (like the automated services from SoFi or Acorns) automatically builds and manages a diversified portfolio for you based on your goals and risk tolerance. It's a "hands-off" approach.

While many apps offer "$0 commission" trading, be aware of other potential fees. These can include subscription fees (Acorns, Stash), transfer-out fees if you move your account, wire transfer fees, and minor regulatory fees on stock sales. Always read the app's fee schedule.

9. Should I use a paper trading feature before investing real money?

Absolutely. If an app like Webull offers a paper trading (or virtual trading) simulator, it is an invaluable tool. It allows you to learn the platform's interface, practice placing trades, and test strategies without risking any real money. This can significantly boost your confidence before you start.

10. How many investment apps should I use?

For a beginner, it's best to start with just one app. This helps you avoid getting overwhelmed and allows you to focus on learning one platform well. Once you become more experienced, you might find reasons to use multiple platforms for different purposes, but simplicity is key when you're starting out.

Ready to deepen your financial knowledge beyond just the apps? At Top Wealth Guide, we provide comprehensive resources, expert analysis, and actionable strategies to help you navigate every stage of your investment journey. Visit Top Wealth Guide to continue learning and build a smarter financial future.