Figuring out the "best" health insurance plan in the USA isn't a one-size-fits-all answer. For a freelance graphic designer who wants total flexibility in choosing doctors, a PPO plan from Blue Cross Blue Shield might be perfect. But for a family focused on integrated, lower-cost care, an HMO from Kaiser Permanente could be the better fit. It all comes down to a personal calculation: balancing what you pay each month (your premium) against what you'll pay when you actually need care (your deductible and copays).

In This Guide

- 1 Decoding Your US Health Insurance Options

- 2 Comparing HMO vs. PPO vs. EPO vs. POS Plans

- 3 Evaluating Top National Health Insurance Providers

- 4 Choosing Between ACA Marketplace and Employer Coverage

- 5 How Your State Affects Insurance Costs and Quality

- 6 Frequently Asked Questions (FAQ)

- 6.1 1. What’s the difference between a deductible and an out-of-pocket maximum?

- 6.2 2. Can I get health insurance outside of open enrollment?

- 6.3 3. Are Health Savings Accounts (HSAs) a good idea?

- 6.4 4. How do I make sure my doctor is in-network?

- 6.5 5. What do the ACA Marketplace metal tiers (Bronze, Silver, Gold, Platinum) mean?

- 6.6 6. What's the difference between a copay and coinsurance?

- 6.7 7. Does short-term health insurance count as "real" insurance?

- 6.8 8. How do ACA Marketplace subsidies work?

- 6.9 9. Can I have more than one health insurance plan?

- 6.10 10. What happens if I don't have health insurance?

Decoding Your US Health Insurance Options

Navigating the world of American health insurance can feel overwhelming, but it doesn't have to be. We're going to break it down, giving you a clear framework for making a smart decision, whether you're self-employed, covering a family, or planning for retirement. This guide, written by our team with over a decade of experience in personal finance and insurance analysis, cuts through the jargon to explain the core plan types, where to get them, and how factors like where you live and which doctors you see can drastically change your costs.

Choosing a health plan is one of the most important financial decisions you'll make, safeguarding both your health and your bank account. A 2025 KFF survey highlighted that the average annual premium for an employer-sponsored family plan hit $26,993—a massive line item in any budget. Getting a handle on your options is the only way to manage that expense. While this guide focuses on medical coverage, keep in mind that it's just one piece of your financial safety net. You can learn about other crucial protections in our guide comparing whole life vs term life insurance policies.

Core Components of Any Health Plan

Before you can compare plans, you have to speak the language. Every single health plan is built on a handful of key terms that dictate how and when you pay for your medical care.

| Term | What It Means | Real-World Example |

|---|---|---|

| Premium | Your fixed monthly payment to the insurance company just to keep your plan active. | You pay $450 every month, regardless of whether you visit a doctor. |

| Deductible | The amount you have to pay out-of-pocket for medical services before your insurance plan starts chipping in. | Your plan has a $3,000 deductible. You are responsible for the first $3,000 of your medical bills. |

| Copay | A flat fee you pay for a specific service, like a check-up or a prescription refill. | Your plan has a $30 copay for each primary care doctor visit. |

| Out-of-Pocket Max | The absolute most you will pay for covered medical services in a single year. Think of it as your financial safety net. | Your OOP max is $8,000. After you spend that amount on deductibles and copays, insurance covers 100%. |

At its core, the trade-off in health insurance is straightforward: plans with low monthly premiums almost always come with high deductibles. If you want a plan with a low deductible, you can expect to pay a much higher premium each month.

Our goal is to give you the confidence to pick a plan that not only protects your health but also fits your budget. Your health coverage should be a strategic asset, not a financial burden.

Comparing HMO vs. PPO vs. EPO vs. POS Plans

Figuring out the "alphabet soup" of health insurance—HMO, PPO, EPO, and POS—is where you really start to find the best coverage in the USA. Instead of just listing features, let's break these down with real-world scenarios. We'll see how their core differences in networks, referrals, and costs actually play out for your wallet and your health.

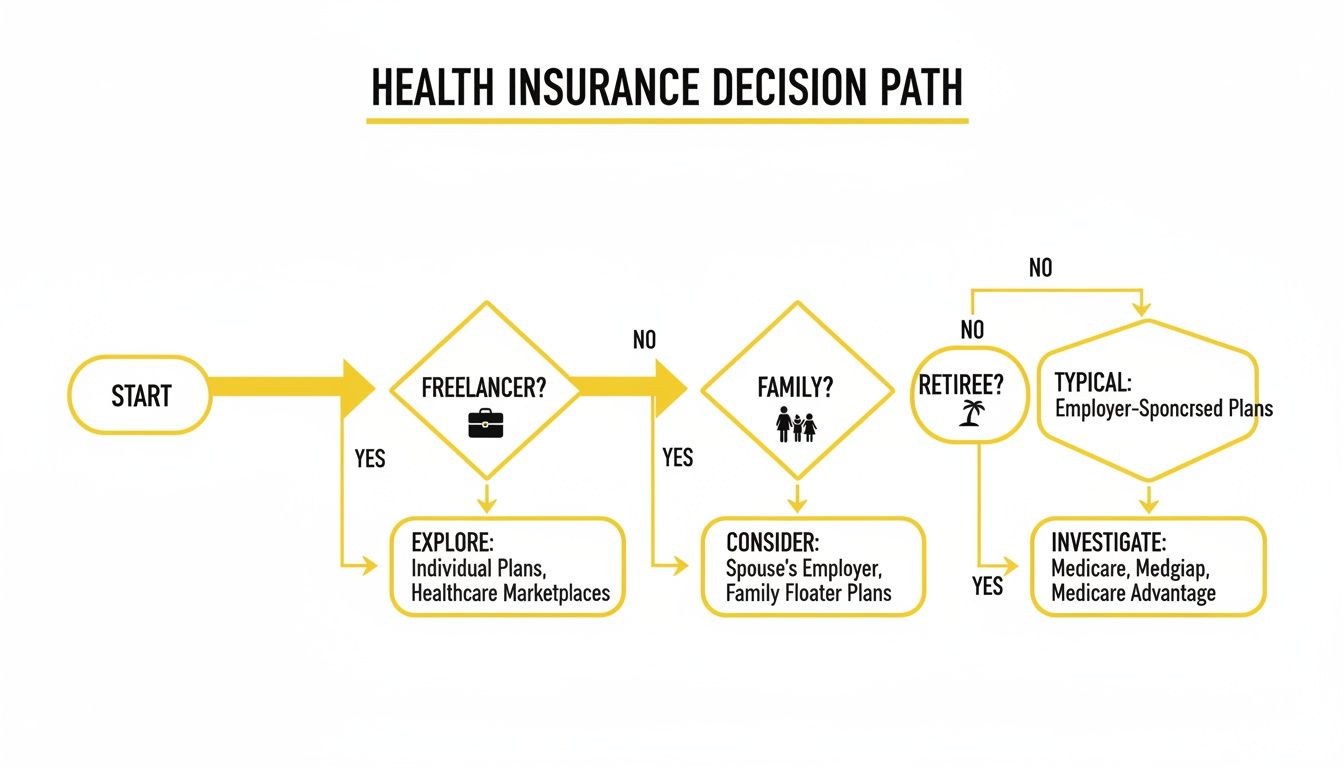

This decision tree is a great starting point. It helps you quickly see how your life stage—whether you're a freelancer, raising a family, or retired—points toward certain plan types.

As the chart shows, your job and family situation are the first big clues to narrowing down the right health insurance.

The Cost-Conscious Individual: HMOs

HMOs (Health Maintenance Organizations) hinge on one key relationship: the one you have with your primary care physician (PCP). Your PCP is your main point of contact for everything. Need to see a specialist? You’ll need a referral from them first. And you absolutely must stick to their approved list of in-network providers for your care to be covered.

- Real-Life Scenario: Take Sarah, a healthy 28-year-old graphic designer. She mainly needs coverage for annual check-ups and the occasional surprise illness. Her top priority is keeping her monthly premium as low as possible. An HMO is a perfect match. She picks a PCP she likes to coordinate her care, and her predictable, low costs fit neatly into her budget. In return for a much lower premium and simple copays, she accepts the trade-off: she can't just go see that out-of-network dermatologist she heard about and expect insurance to pay for it.

An HMO is a structured, budget-friendly plan built for people who are happy to have a PCP manage their healthcare and don't expect to need out-of-network doctors.

The Flexibility-Focused Family: PPOs

PPOs (Preferred Provider Organizations) are all about freedom, but that freedom comes at a price. You don't need a PCP to act as a gatekeeper, and you can book appointments with specialists directly. The biggest perk is the ability to see doctors both inside and outside the network, though you’ll always pay less if you stay in-network.

- Real-Life Scenario: The Johnson family has two young kids and lives in the suburbs. They want to see a specific pediatric specialist at a top-tier children's hospital that isn't in every insurance network. For them, a PPO is the clear winner. They pay a higher monthly premium, but what they get in return is priceless peace of mind. They can see any doctor they choose without waiting for referrals and know that even if they go out-of-network, a portion of the bill will still be covered. This kind of flexibility is crucial for complex needs, much like when you compare car insurance quotes online to ensure a policy covers all your specific risks.

The Hybrid Models: EPO and POS

What if you want something between the strict rules of an HMO and the high cost of a PPO? That’s where the hybrid plans, EPOs and POSs, come into the picture. They offer a blend of features to hit that middle ground.

EPOs (Exclusive Provider Organizations) feel like a more modern HMO. You get the freedom to see in-network specialists without a PCP referral, which is a huge plus. The catch? Just like an HMO, there is zero coverage for out-of-network care unless it's a legitimate, life-threatening emergency.

POS (Point of Service) plans are a true mix of HMO and PPO features. You choose a PCP and need referrals for in-network specialists (the HMO part). But you also have the option to go out-of-network if you're willing to pay more (the PPO part).

Quick Comparison: HMO vs PPO vs EPO vs POS

Sometimes, seeing it all laid out is the easiest way to understand the trade-offs. This table shows how each plan type stacks up based on what you might be looking for.

| Scenario | HMO (Health Maintenance Organization) | PPO (Preferred Provider Organization) | EPO (Exclusive Provider Organization) | POS (Point of Service) |

|---|---|---|---|---|

| "I want the lowest premium" | Best Choice. Designed for affordability with strict network rules. | Highest Cost. Premiums are higher in exchange for maximum flexibility. | Good Choice. Often cheaper than a PPO but more than an HMO. | Moderate Cost. Usually priced between an HMO and a PPO. |

| "I need to see specialists directly" | Not Ideal. Requires a referral from your primary care physician for every specialist visit. | Best Choice. No referrals are needed to see any specialist, in or out-of-network. | Good Choice. No referrals needed for in-network specialists. | Not Ideal. Requires a referral from your PCP for in-network specialists. |

| "I want out-of-network coverage" | No Coverage. All care must be in-network, except for true emergencies. | Best Choice. Offers coverage for out-of-network care, but at a higher cost-sharing rate. | No Coverage. Strictly in-network only, similar to an HMO. | Good Choice. Provides out-of-network options, but requires you to file claims. |

| "I travel frequently for work" | Risky. Your coverage is limited to a specific geographic area and network. | Best Choice. The large, nationwide network and out-of-network benefits are ideal. | Risky. Limited to the plan's network, which may be regional. | Good Choice. Offers a safety net with out-of-network options while traveling. |

Ultimately, the best plan isn't about which one is "better" in a vacuum, but which one is the right tool for your specific life situation and healthcare priorities.

Evaluating Top National Health Insurance Providers

Picking the right plan type—like an HMO or PPO—is a huge first step, but it’s only half the story. The company behind that plan truly defines your day-to-day healthcare experience. When you're looking for the best health insurance plans in the USA, you have to dig into the major national providers, because their networks, customer service, and overall way of doing things will directly affect your access to care and your wallet.

Each major carrier has its own personality. Some are all about building massive, go-anywhere networks. Others focus on a more integrated, all-in-one approach to care. And plenty compete by offering the most affordable options for certain groups of people. Getting a feel for these different philosophies is key to making a choice you'll be happy with long-term.

This image really boils it down to the three main flavors you'll find: carriers with sprawling networks, providers with their own hospital systems, and those laser-focused on affordable family plans. Your personal priorities will point you toward the right model.

Top Provider Comparison

| Provider | Best For | Key Strengths | Potential Drawbacks |

|---|---|---|---|

| Blue Cross Blue Shield (BCBS) | Nationwide Access & Choice | Largest provider network in the US; high brand recognition and trust. | Costs can be higher; experience varies by state/local company. |

| Kaiser Permanente | Integrated, Coordinated Care | All-in-one system (plan, hospital, doctors); high patient satisfaction. | Limited to specific states and service areas; network is very restrictive. |

| UnitedHealthcare (UHC) | Diverse Plan Options | Wide variety of plans including short-term and dental; strong digital tools. | Customer service can be inconsistent; network size varies by plan. |

| Ambetter | Affordable ACA Marketplace Plans | Focus on subsidized Marketplace coverage; often the most affordable option. | Smaller networks than national giants; primarily serves the individual market. |

| Anthem (part of BCBS) | Seniors & Specific Demographics | Strong in Medicare Advantage and HMO plans for those under 65. | Operates under the BCBS umbrella, so not a fully distinct national choice. |

Blue Cross Blue Shield: The Network Titan

The Blue Cross Blue Shield (BCBS) Association isn't one single company but a federation of independent, local ones. Their calling card is the sheer size of their nationwide provider network. If you travel a lot or simply want the greatest possible choice of doctors and hospitals, a BCBS plan is almost always a front-runner. That massive access is a big reason they're such a dominant force in the market.

In fact, recent analyses often place Blue Cross Blue Shield at the top of the heap for HMO, PPO, and POS plans. Their Silver-tier HMO premiums, for instance, are highly competitive, averaging around $490 per month. For many people, that blend of a huge network and sensible pricing makes BCBS the default starting point.

Kaiser Permanente: The Integrated Care Champion

Kaiser Permanente plays a completely different game. It’s an integrated delivery system, which is a fancy way of saying the health plan, the hospitals, and the doctors all work for the same team. This setup is built for highly coordinated care, allowing your primary doctor and specialists to seamlessly share information and collaborate on your health.

This all-in-one model often translates to higher patient satisfaction and better medical outcomes. Kaiser Permanente really shines with its EPO plans, boasting an incredibly low claim denial rate of just 8.1%. That kind of reliability is a huge selling point if you want a straightforward, predictable healthcare experience without the stress of fighting with your insurer over bills.

Ambetter and Anthem: Leaders in Niche Markets

While BCBS and Kaiser are the giants, other carriers have become powerhouses by zeroing in on specific needs. Ambetter, for example, has built a solid reputation for offering affordable ACA Marketplace plans. This makes them a go-to choice for families with kids who need good coverage that won’t drain their savings.

Anthem, which is actually part of the BCBS family in many states, often excels in the HMO space. They are particularly strong in providing competitive plans for seniors under 65 who aren't on Medicare yet. By concentrating on specific plan types and demographics, they can deliver really well-priced, tailored solutions.

Choosing a provider is as much about their philosophy as their network. Do you value the freedom of a massive PPO network, the seamless coordination of an integrated system, or the targeted affordability of a niche player?

While you're shoring up your health coverage, it's also a good time to think about other parts of your financial safety net. To make sure your family is fully protected, take a look at our guide on the best life insurance companies.

Choosing Between ACA Marketplace and Employer Coverage

For most of us, health insurance comes from one of two places: our job or the Affordable Care Act (ACA) Marketplace. This isn't just a simple choice; it's a major financial decision that hinges on your job, your income, and your family's needs. Let's break down which path makes the most sense.

Think of the official HealthCare.gov portal as the front door for millions of Americans seeking ACA coverage. It's the federal government's hub for individuals and families who don't have access to a workplace plan.

The site is designed to walk you through finding and enrolling in a plan, especially connecting people with subsidized options they might not otherwise afford.

Employer-Sponsored Plans: The Traditional Go-To

For a long time, getting health insurance through your job has been the standard in the U.S. The biggest draw? Your employer foots a significant chunk of the bill. This direct contribution dramatically cuts down your monthly premium, making it a powerful employee benefit. It's no surprise that satisfaction with job-based insurance is consistently high.

At its core, an employer plan's value comes from shared cost. Your company pays a huge slice of the premium, making top-tier coverage affordable in a way it simply isn't on your own.

The ACA Marketplace: An Essential Safety Net

The ACA Marketplace, which you can access through sites like HealthCare.gov, is a lifeline for a huge and growing part of our workforce. It's built for freelancers, entrepreneurs, gig workers, and anyone who finds themselves between jobs. Its entire purpose is to make sure people without access to workplace coverage can still get insured. The game-changer here is the income-based subsidies, particularly the Premium Tax Credit (PTC). These credits can slash monthly premiums, putting insurance within reach for millions who would otherwise be locked out by high costs.

A Tale of Two Scenarios: Freelancer vs. Corporate Manager

Let’s see how this plays out in the real world.

-

Maria, the Freelance Designer: As a self-employed professional, Maria's income can swing from month to month. The ACA Marketplace is tailor-made for her situation. She enters her estimated annual income and immediately qualifies for a PTC, dropping her monthly premium for a great Silver plan from $450 down to just $120. She just needs to remember to update her income if she has a great year to avoid owing money back at tax time.

-

David, the Corporate Manager: David works for a large company with a fantastic PPO plan. His employer covers 80% of the premium for his entire family. Even though his share is still a few hundred dollars, the plan's low deductible and massive network make it an unbeatable deal. For David, sticking with his employer's plan is a no-brainer.

When you're a freelancer like Maria, managing unpredictable income alongside health costs requires smart financial planning. An unexpected medical bill can derail everything, which is why it’s so important to learn how to build an emergency fund to handle those out-of-pocket surprises.

In the end, your decision really boils down to access. If you have a solid health plan offered through your job, the cost-sharing benefits are almost impossible to beat. But if you don't, the ACA Marketplace is an indispensable resource that provides a subsidized, reliable alternative to get the care you need.

How Your State Affects Insurance Costs and Quality

When it comes to health insurance, your zip code is one of the single most important factors driving both cost and quality. The search for the best health insurance plans isn't just about comparing carriers; it's a geographic puzzle. State regulations, the number of insurers competing locally, and the going rate for healthcare services create a patchwork of wildly different insurance markets across the country.

This is why identical coverage can cost hundreds of dollars more per month in one state than in another. Think about it: states with more insurance companies fighting for your business on the ACA Marketplace usually have lower premiums. On the flip side, if you live in an area dominated by just one or two major hospital systems, insurers pay more for care, and you can bet those costs get passed right on to you.

Getting a handle on these regional differences gives you a strategic edge. It's the reason moving just a few miles across a state line can completely change your healthcare budget and even the doctors you can see.

The Impact of State Policies and Market Health

State governments have a massive say in how their local insurance markets operate. Some states, like California and New York, run their own ACA marketplaces and have added extra consumer protections and subsidies. These proactive steps often create more stable premiums and encourage more people to sign up, leading to a healthier and more balanced insurance pool.

Other states simply use the federal HealthCare.gov platform and have fewer of their own rules. This can sometimes mean less competition and prices that swing wildly from one year to the next. The number of insurers in the game is a key sign of a healthy market; more competition is almost always a good thing for consumers.

The health of a state's insurance market directly reflects its policies and level of competition. A robust market with multiple carriers and strong state oversight is the foundation for affordable, high-quality coverage.

Contrasting the Best and Worst States for Coverage

The gap between states isn't just an idea—it's a documented reality with real financial implications for the people living there.

- Real-Life Example: The Garcia family is planning to retire and move. In their current home state of Florida, a benchmark Silver plan might cost them around $1,500 per month. By moving to Massachusetts, a state consistently ranked among the best for healthcare access and quality, a similar plan could be closer to $1,100, thanks to a more competitive market and stronger state subsidies. Over a year, that's a saving of nearly $5,000.

National healthcare rankings confirm this disparity. Massachusetts consistently ranks as a top state for health insurance in the USA, earning high scores for both access and quality. At the other end of the spectrum, states like New Mexico, North Carolina, and West Virginia face significant challenges, weighed down by issues like having fewer hospitals per capita and high uninsured rates. You can explore the complete state-by-state breakdown to see how these scores are calculated.

This data drives home a critical point: where you live can be just as important as the plan you choose. If you have some geographic flexibility—maybe you're a remote worker or getting ready to retire—picking a state with a strong healthcare system can lead to huge long-term savings and, more importantly, better health.

Frequently Asked Questions (FAQ)

1. What’s the difference between a deductible and an out-of-pocket maximum?

Your deductible is the amount you must pay for covered health services before your insurance plan starts to pay. The out-of-pocket maximum is the absolute most you'll have to pay for covered services in a plan year, including deductibles, copayments, and coinsurance. Once you hit this limit, your insurance pays 100% of the cost for covered benefits.

2. Can I get health insurance outside of open enrollment?

Yes, if you have a qualifying life event. Events like getting married, having a baby, moving, or losing other health coverage can make you eligible for a Special Enrollment Period (SEP), allowing you to enroll in a new plan outside the standard open enrollment window.

3. Are Health Savings Accounts (HSAs) a good idea?

Yes, for many people. If you have a High-Deductible Health Plan (HDHP), an HSA is a powerful tool. It offers a triple tax advantage: contributions are tax-deductible, the money grows tax-free, and withdrawals for qualified medical expenses are tax-free. The funds also roll over year after year.

4. How do I make sure my doctor is in-network?

The best way is a two-step process. First, use the provider directory on the insurance company’s official website for the specific plan you're considering. Second, call your doctor's office directly. Ask the billing staff to confirm they are in-network for that exact plan name, as networks can vary even within the same insurance company.

5. What do the ACA Marketplace metal tiers (Bronze, Silver, Gold, Platinum) mean?

The metal tiers indicate how you and your insurer split costs; they do not reflect the quality of care.

- Bronze: Lowest monthly premium, highest out-of-pocket costs.

- Silver: Moderate premium, moderate out-of-pocket costs. Crucially, only Silver plans are eligible for extra Cost-Sharing Reductions (CSRs) if your income qualifies.

- Gold: High premium, low out-of-pocket costs.

- Platinum: Highest premium, lowest out-of-pocket costs.

6. What's the difference between a copay and coinsurance?

A copay is a fixed amount (e.g., $30) you pay for a covered service. Coinsurance is a percentage (e.g., 20%) of the cost of a covered service you pay after you've met your deductible.

7. Does short-term health insurance count as "real" insurance?

No. Short-term plans are not ACA-compliant. They do not have to cover essential health benefits and can deny coverage for pre-existing conditions. They are meant as a temporary gap-filler, not a long-term solution.

8. How do ACA Marketplace subsidies work?

There are two types. The Premium Tax Credit (PTC) lowers your monthly premium based on your income. Cost-Sharing Reductions (CSRs) are extra savings that lower your deductible and copays, available only to those who qualify by income and choose a Silver plan.

9. Can I have more than one health insurance plan?

Yes, this is possible through "coordination of benefits." For example, you might be on both your employer's plan and your spouse's plan. One plan is designated as primary and pays first, while the secondary plan may cover some of the remaining costs.

10. What happens if I don't have health insurance?

While the federal tax penalty is gone, some states (like Massachusetts, California, and New Jersey) have their own penalties. More importantly, you are fully exposed to the high cost of medical care, and a single accident or illness could lead to crippling medical debt. Health insurance provides essential financial protection. For more on this, see why your emergency savings account isn't big enough.

This article is for educational purposes only and is not financial or investment advice. Consult a professional before making financial decisions.