Saving money is a great start, but it's a bit like treading water. You're keeping your head above the surface, but you aren't really going anywhere. Investing? That's about building the boat that will actually carry you to your financial destination. It is hands down the single most powerful tool you have for building real, long-term wealth.

In This Guide

- 1 Why Investing Is Essential for Your Financial Future

- 2 Understanding the Building Blocks of Investing

- 3 How to Open Your First Investment Account

- 4 Building Your First Portfolio and Managing Risk

- 5 Identifying Long-Term Growth Opportunities

- 6 Common Investing Mistakes and How to Avoid Them

- 7 Frequently Asked Questions (FAQ) for Beginner Investors

- 7.1 1. How much money do I really need to start investing?

- 7.2 2. What's the difference between an ETF and a mutual fund?

- 7.3 3. Should I be scared of market crashes?

- 7.4 4. How do I know my risk tolerance?

- 7.5 5. Is a robo-advisor a good option for a beginner?

- 7.6 6. What are dividends and how do they work?

- 7.7 7. Do I have to pay taxes on my investments?

- 7.8 8. What is dollar-cost averaging?

- 7.9 9. How often should I check my investment portfolio?

- 7.10 10. Is it better to pick individual stocks or buy index funds?

Why Investing Is Essential for Your Financial Future

A lot of us were taught that a good salary and a disciplined savings habit are the secrets to financial security. And while saving is a critical foundation, it's just not enough on its own. The problem is inflation, that quiet, steady force that chips away at the value of your cash year after year.

This is where investing changes the game. It puts your money to work for you, turning it into an engine for growth that can far outpace inflation.

The secret sauce behind all of this is a concept so powerful that Albert Einstein supposedly called it the "eighth wonder of the world": compound interest.

The Power of Compounding Over Time

Imagine a tiny snowball at the top of a very long hill. As it starts to roll, it picks up more snow, getting bigger. The bigger it gets, the more snow it collects with each turn, and it starts moving faster and faster. That's exactly how compounding works with your money.

Your initial investment earns a return. That return is then added to your original pot, creating a larger base. The next time you earn a return, it's on that new, bigger amount. Over time, this cycle creates exponential growth.

Let’s see how this plays out with a real-life example of two friends, Sarah and Ben:

- Sarah, the Early Starter: She invests $5,000 every year from age 25 to 35. After 10 years, she's put in a total of $50,000. Then, she stops adding money completely and just lets it grow.

- Ben, the Late Starter: He gets going at age 35 and invests the same $5,000 a year, but he does it all the way until he's 65. His total contribution is a hefty $150,000.

If we assume they both earned an average 8% annual return, the results are stunning. By age 65, Sarah's portfolio is worth roughly $1.1 million. Ben, despite investing three times as much money, ends up with around $788,000.

Sarah won because she gave her money more time to work its magic. This proves a vital point: when you start investing can be even more important than how much you invest. We dive much deeper into this phenomenon in our guide on the magic of compound interest explained.

Overcoming Common Beginner Fears

Once you really grasp how compounding works, it helps quiet down some of those common fears that stop people from getting started. Maybe you're worried about losing money in a market downturn, or you think you need a small fortune just to open an account.

But here’s the honest truth: the biggest financial risk you can take is not investing at all. Letting your money sit in a savings account is a guaranteed way to lose purchasing power to inflation over time.

Thankfully, the old barriers to entry have been torn down. You don't need thousands of dollars anymore. With fractional shares, you can start investing with as little as $1. The real challenge is making that mental shift from just saving money to actively building your wealth. This guide is here to walk you through exactly how to do that, one step at a time.

Understanding the Building Blocks of Investing

Before you can build a house, you need to know the difference between bricks, wood, and concrete. Investing is no different. To build a solid portfolio, you first have to get familiar with the fundamental components you'll be working with.

Think of it like this: each type of investment, or "asset class," has a specific job and its own personality. Some are built for speed and aggressive growth, while others are all about providing stability. Let's break down the main players you'll encounter on your journey.

Stocks: Owning a Slice of the Pie

When you buy a stock, you’re literally purchasing a small piece of ownership in a public company. If that company does well—by boosting its profits or creating the next big thing—the value of your share can climb right along with it. This is what makes stocks such a powerful engine for long-term growth.

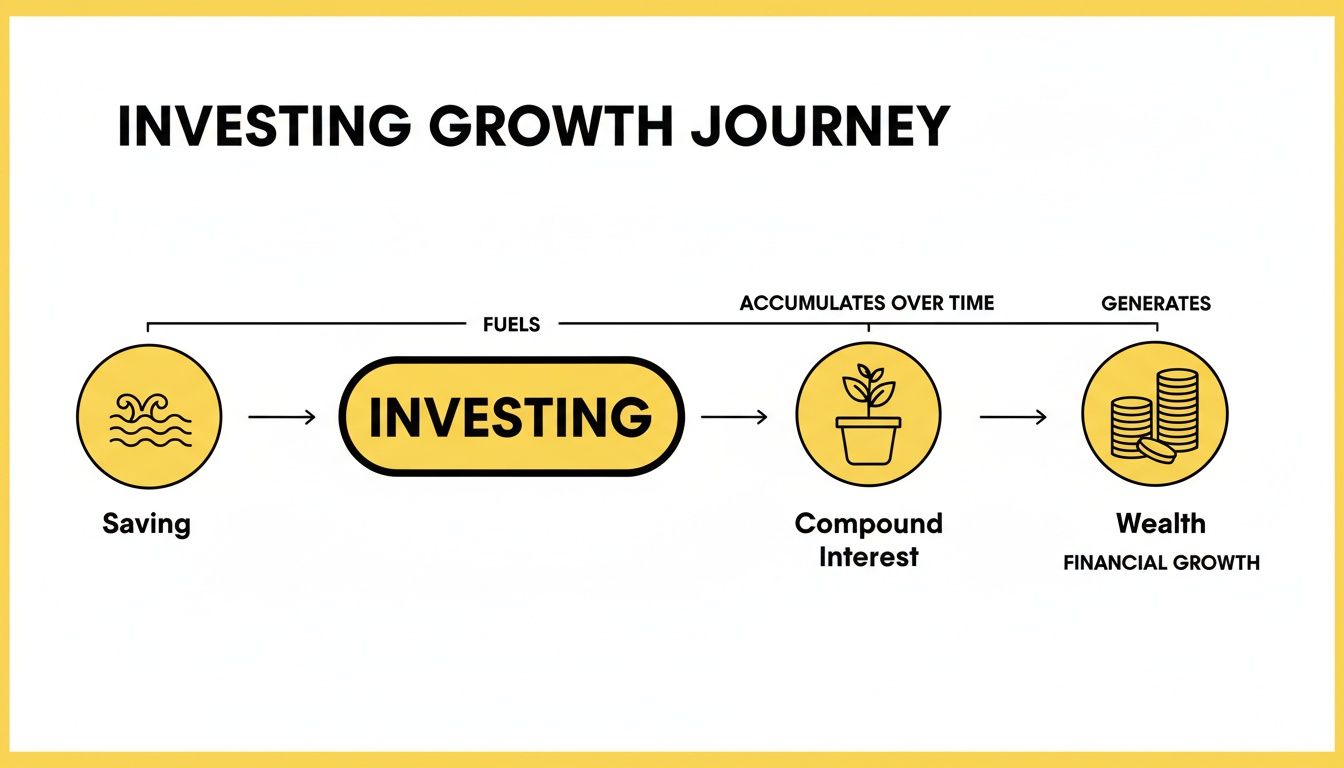

For example, buying a single share of a company like Apple means you own a tiny fraction of every iPhone sold and every new service launched. Your success is tied directly to the company's performance. Of course, the flip side is that if the company struggles, the value of your share can go down, too.

This is the classic path investors follow: you start by saving, then you invest that money, and finally, you let the magic of compound interest turn it into real wealth.

The key takeaway is that investing is the step that truly activates your money, transforming your savings into something that can grow substantially over time.

Bonds: Lending a Helping Hand

If stocks are all about ownership, then bonds are all about being a lender. When you buy a bond, you're essentially loaning money to an organization, usually a government or a large corporation.

In exchange for your loan, they promise to pay you back the full amount on a specific date in the future, plus they'll make regular interest payments to you along the way. Think of it like a formal IOU. For instance, if you buy a 10-year U.S. Treasury bond, you are lending money to the U.S. government, which is considered one of the safest investments in the world. Because the returns are more predictable, bonds are generally considered much less risky than stocks, making them a source of stability in a portfolio.

Other Key Players to Know

While stocks and bonds are the core ingredients for most beginners, you'll definitely come across a few other important asset classes.

- Real Estate: This involves buying physical property, like a house or an office building, hoping it will increase in value or generate rental income. It's an asset you can see and touch, but it often requires a lot more money and hands-on work to get started.

- Mutual Funds & ETFs: These aren't single assets but rather baskets that hold many different investments at once. For instance, an S&P 500 index fund holds small pieces of the 500 largest U.S. companies. They offer instant diversification, which is a cornerstone of smart investing. To dive deeper, you can check out our simple guide on what index funds are and how they can simplify your life.

The goal isn't to find the single "best" investment. It's to understand how these different building blocks work together to create a balanced portfolio that fits your goals and your life.

Comparison of Core Investment Types for Beginners

This table breaks down the key characteristics of stocks, bonds, and funds to help new investors understand their differences at a glance.

| Asset Class | Risk Level | Potential Return | Best For… | Real-Life Example |

|---|---|---|---|---|

| Stocks | Higher | Higher | Long-term growth seekers comfortable with market ups and downs. | Buying shares of a company like Microsoft or Tesla. |

| Bonds | Lower | Lower | Investors seeking stability, income, and capital preservation. | Loaning money to the U.S. government via a Treasury bond. |

| ETFs / Mutual Funds | Varies (often Medium) | Varies (often Medium) | Beginners who want instant diversification without picking individual stocks. | Buying an S&P 500 index fund to own a piece of 500 companies at once. |

Grasping these fundamental differences is the first real step toward making smart decisions with your money. Stocks offer the shot at high growth but come with volatility. Bonds give you stability but with more modest returns. By knowing these trade-offs, you can start thinking about which ingredients you want to use in your own investment recipe.

How to Open Your First Investment Account

Alright, you've got a handle on what investments are. Now for the fun part: actually doing it. Opening an investment account is how you turn theory into a real, wealth-building machine. It's your ticket to the financial markets, and honestly, it’s much easier than most people imagine.

The whole process boils down to two key decisions: picking the right type of account for your goals and then choosing a brokerage firm to open it with. Let's walk through the options so you can figure out the best place to start.

Choosing Your Account Type

Think of investment accounts like different kinds of savings buckets. They all hold your investments, but they're designed for different purposes—especially when it comes to taxes. The main two flavors you'll run into are retirement accounts and standard brokerage accounts.

Retirement Accounts (IRA, 401(k)): These are built for one thing: saving for your future self. Their superpower is the massive tax breaks they offer. Depending on the type, you either get a tax deduction now or your money grows and comes out completely tax-free later. The trade-off? There are rules on how much you can put in each year and penalties if you try to take the money out before you hit retirement age.

Standard (Taxable) Brokerage Account: This is your all-purpose, flexible investment account. No limits on contributions, no age restrictions on withdrawals. It's the perfect tool for goals outside of retirement, like stashing away cash for a down payment or just building a pot of money you can access anytime. The catch is that you'll owe taxes on your investment gains along the way.

If you want to get into the nitty-gritty of how these accounts work, you can learn more about what an investment account is and see which one truly fits your life.

For a lot of beginners, a Roth IRA is a fantastic place to start. You put in money you've already paid taxes on, and in return, every penny of growth and all your withdrawals in retirement are 100% tax-free. That tax-free compounding is one of the most powerful wealth-building tools out there.

Choosing the Right Investment Account: A Comparison

So, which account makes the most sense for you? This table breaks down the most common options to help you match your financial goals to the right account.

| Account Type | Primary Purpose | Key Tax Advantage | Best For Beginners Who… |

|---|---|---|---|

| Standard Brokerage | General investing | Flexibility; no withdrawal age restrictions | Want to invest for goals other than retirement (e.g., a house). |

| Roth IRA | Retirement savings | Tax-free growth and tax-free withdrawals in retirement | Want to lock in tax savings now and expect to be in a higher tax bracket later. |

| Traditional IRA | Retirement savings | Tax-deductible contributions in the present | Need an immediate tax break and expect to be in a lower tax bracket in retirement. |

| 401(k) / 403(b) | Employer-sponsored retirement | Often includes an employer match (free money!) | Have access to a workplace retirement plan and want to maximize savings. |

Each account has its own strengths, but the key is just to pick one and get started. You can always open other accounts later as your financial situation evolves.

The Simple Steps to Get Started

Once you've picked an account, the sign-up process is refreshingly simple. You can do it all online in about 15 minutes.

Here's what you'll need to have handy:

- Personal Information: Your name, address, date of birth, and Social Security Number.

- Contact Details: Your email and phone number.

- Employment Status: Your employer's name and address (this is a standard regulatory question).

- Bank Account Information: The routing and account numbers for the bank you'll use to send money from.

With that info ready, just head over to the website of a brokerage you trust—like Fidelity, Vanguard, or Charles Schwab—and follow the on-screen prompts. The last step is to link your bank and make your first deposit.

That's it. Congratulations, you're officially an investor.

Building Your First Portfolio and Managing Risk

Alright, you've opened your investment account and put some money in it. Now comes the fun part. You get to shift from being a spectator on the sidelines to being the architect of your financial future. Your job is to build a portfolio—which is just a collection of investments—that's designed to make your money work for you over the long haul. This is where you learn to manage risk, not just gamble.

If you only take one thing away from this guide, let it be this: diversification. We've all heard the old saying, "don't put all your eggs in one basket," and in the world of investing, that's the golden rule. Putting all your cash into a single company's stock is a surefire way to lose sleep at night, because your entire financial well-being hinges on its performance.

True diversification is about spreading your money around. Think of it as investing across different asset types, various industries, and even in different countries. The idea is that when one part of your portfolio takes a hit, another part might be doing just fine, which helps smooth out the ride and shield you from devastating losses.

Finding Your Asset Allocation Mix

Asset allocation sounds complicated, but it's really just about deciding how to slice up your investment pie, primarily between stocks and bonds. The right mix for you comes down to a few personal factors: your age, what you're saving for, and frankly, how well you can sleep at night when the market gets choppy.

To get a better handle on your personal comfort level, you should definitely check out our guide on how to determine your investment risk tolerance.

A classic starting point for many investors is the 60/40 portfolio. This is a simple but effective model where you put 60% of your money into stocks for growth potential and the other 40% into bonds for a bit of stability.

But this isn't a set-it-and-forget-it rule for life. Your asset allocation should change as you do:

- Younger Investors (20s-30s): You've got decades before you need the money, so you can afford to take on more risk in exchange for potentially higher returns. An 80% or even 90% allocation to stocks could make a lot of sense.

- Mid-Career Investors (40s-50s): As retirement gets closer, you'll naturally want to start protecting the money you've already grown. This is a great time to shift toward a more balanced mix, like that classic 60/40 split.

- Investors Nearing Retirement (60s+): At this point, the game is all about preservation. Protecting your nest egg is the number one priority, so a more conservative mix—maybe 40% stocks and 60% bonds—is often the way to go.

This slow and steady shift from a more aggressive stance to a conservative one is a core strategy for smartly managing risk over your entire investing lifetime.

Simple Portfolio Models for Beginners

The good news is that building a well-diversified portfolio doesn't have to be a massive headache. You can get incredible diversification with just a couple of low-cost index funds or ETFs. Here are two incredibly popular and effective models to get you started.

| Portfolio Model | Asset Allocation Example | Who It's Best For | Key Benefit |

|---|---|---|---|

| The Two-Fund Portfolio | 60% in a Total World Stock Index Fund, 40% in a Total World Bond Index Fund | The ultimate minimalist who wants maximum global diversification with minimal effort. | Incredibly simple to manage while capturing returns from markets all over the globe. |

| The Three-Fund Portfolio | 50% in a US Stock Index Fund, 30% in an International Stock Index Fund, 20% in a US Bond Index Fund | Beginners who want more control over their US vs. international exposure. | Allows you to fine-tune your allocation and potentially benefit from valuation differences. |

These models are so effective because they automatically spread your investment across thousands of companies and bonds. That's instant, robust diversification without having to pick individual winners.

Why You Should Invest Beyond Your Borders

It's completely natural for people to invest in companies they know and see every day, which usually means sticking close to home. But if you only invest in US stocks, you're essentially betting on just one horse in a global race. There are huge opportunities for growth and diversification out there in the rest of the world.

Think about it this way: while many US stocks are trading at high valuations (over 22 times forward earnings), international markets outside the US are trading at just 15 times earnings. And emerging markets? They’re even cheaper at 13 times earnings. For a beginner, this is a big deal. Non-US stocks are roughly 35% cheaper right now, which suggests that spreading your bets across different countries isn't just a good idea—it's a practical strategy with real financial upside.

By combining a smart asset allocation with global diversification, you build a resilient portfolio—one that’s designed not just to grow, but to withstand the inevitable bumps in the road.

This framework gives you a solid foundation to build on. You aren't just buying stocks and bonds; you are strategically building a financial engine designed to work for you for decades to come.

Identifying Long-Term Growth Opportunities

Successful long-term investing isn't about chasing fleeting headlines or jumping on the latest hot stock tip. It’s really about seeing the big picture—the powerful, sweeping trends that are fundamentally reshaping our world. If you can learn to think this way, you can position your portfolio to grow alongside the major shifts happening in technology, society, and the global economy.

Forget trying to find a needle in a haystack. Your real goal is to identify the whole haystack. Think about the massive changes that will create brand new markets and reinvent old industries over the next decade or more.

The Technological Revolution

Let’s face it, technology is the engine of growth today. Things that felt like science fiction just a few years ago are now becoming everyday realities, and that creates incredible opportunities for investors who are paying attention.

Artificial intelligence is leading the charge. We're seeing a massive wave of AI-related investment approaching USD 500 billion, and it's completely changing the economic landscape. It's a critical trend for any new investor to grasp. For example, while US stocks are projected to see earnings grow by 13.5%, a huge chunk of that is driven by tech and AI-focused companies. This shows that AI's influence goes far beyond just a few tech stocks; it's lifting broad market performance. You can explore more insights on global market trends to get a better sense of this impact.

Beyond AI, here are a couple of other major tech trends to keep on your radar:

- Renewable Energy: The world is slowly but surely moving away from fossil fuels. This transition to solar, wind, and other clean energy sources is creating a new generation of leaders in the energy industry.

- Biotechnology: Breakthroughs in areas like gene editing and personalized medicine are revolutionizing healthcare. We're on the cusp of being able to treat diseases that were once considered incurable.

Growth in Emerging Markets

While established economies like the United States and Europe are relatively mature, many developing nations are just starting to hit their growth spurt. These emerging markets are a powerhouse of future growth, fueled by huge demographic and economic forces.

As an investor, your goal is to see where the world is going and get there first. Identifying these long-term trends allows you to invest in the future, not just the present.

Two key things are driving this explosion: a rising consumer class and the rapid spread of digital technology. In countries across Asia, Africa, and Latin America, millions of people are joining the middle class. For the first time, they have real purchasing power and are eager for everything from smartphones and cars to better healthcare and education.

Comparing Long-Term Growth Drivers

Knowing where future growth might come from helps you build a smarter, more forward-thinking portfolio. Here's a simple breakdown of how these big opportunities stack up.

| Growth Driver | Primary Focus | Key Opportunities | Risk Profile |

|---|---|---|---|

| Technology (AI, Biotech) | Innovation in established economies | Disruptive companies, efficiency gains | Higher volatility, high growth potential |

| Emerging Markets | Demographic and economic shifts | Rising consumer demand, infrastructure | Higher political/currency risk, high growth potential |

By making sure your portfolio has some exposure to these long-term themes, you're doing more than just allocating money between stocks and bonds. You're investing with a clear vision, setting yourself up to benefit from the most important changes shaping our collective future.

Common Investing Mistakes and How to Avoid Them

Knowing what not to do is just as important as knowing what to do. The investing world is full of potential traps, but by understanding the most common ones, you can sidestep them and keep your long-term goals on track.

Let's walk through the biggest pitfalls that catch new investors off guard.

Mistake 1: Emotional Investing

The single biggest threat to your portfolio isn't a market crash—it's your own human nature. When you let fear and greed take the wheel, you're headed for trouble. This usually leads to two classic blunders: panic selling during a dip and chasing hype because of a Fear of Missing Out (FOMO).

Think back to March 2020. When markets plunged, countless beginners saw their account balances shrink for the first time and sold everything. They locked in their losses out of pure fear. Meanwhile, those who simply held on not only recovered but rode the powerful rebound that followed.

The most successful investors are often the most boring. They create a solid plan and stick to it, tuning out the daily noise and focusing on their long-term goals.

How to Avoid It: The simplest cure is a strategy called dollar-cost averaging. You just invest a fixed amount of money on a regular schedule—say, $200 every month—no matter what the market is doing. By automating it, you take emotion out of the picture entirely.

Mistake 2: Trying to Time the Market

"Buy low, sell high" is the oldest advice in the book, but trying to predict the market’s next peak or valley is a fool's errand. Even the pros get it wrong constantly. More often than not, trying to time the market just means you’re sitting on the sidelines when the market has its best days.

And those days are critical. A Fidelity study revealed that if you missed just the 10 best days in the stock market between 1980 and 2020, your total returns would have been sliced in half. The lesson is simple: it's about time in the market, not timing the market.

Mistake 3: Ignoring Fees and Costs

Investment fees might look tiny—often just a fraction of a percent—but they are silent killers of long-term growth. A 1% annual fee doesn't sound like a big deal, but thanks to the power of compounding, it can cost you tens of thousands of dollars over your lifetime.

Actionable Tip: Always check the fees. When you're picking your investments, hunt for low-cost index funds and ETFs. You can easily find options with expense ratios below 0.10%, and targeting these will give you a massive advantage over the long run.

We dive deeper into these and other wealth-destroying habits in our detailed guide on common investment mistakes that destroy wealth. Getting familiar with these errors is the first step to building a smarter, more resilient portfolio.

Frequently Asked Questions (FAQ) for Beginner Investors

1. How much money do I really need to start investing?

You can start with as little as $1. Modern brokerages offer fractional shares, meaning you can buy a small piece of an expensive stock without needing to afford a full share. The key is building the habit of consistent investing, not the initial amount.

2. What's the difference between an ETF and a mutual fund?

Both are baskets of investments that offer instant diversification. The main difference is how they trade. ETFs trade like stocks on an exchange, with prices changing throughout the day. Mutual funds are priced only once per day, after the market closes. ETFs often have lower fees and are generally more tax-efficient, making them a popular choice for beginners.

3. Should I be scared of market crashes?

Market downturns are a normal part of investing. While they feel unsettling, long-term investors see them as opportunities to buy assets at a discount. The key is to avoid panic selling. A well-diversified portfolio and a focus on your long-term goals are your best defenses.

4. How do I know my risk tolerance?

Your risk tolerance depends on your financial goals, your time horizon (when you'll need the money), and your personal comfort with market volatility. A 25-year-old saving for retirement can typically take more risk than a 60-year-old. Many online brokers offer short quizzes to help you determine your risk profile.

5. Is a robo-advisor a good option for a beginner?

Yes, absolutely. Robo-advisors use algorithms to build and manage a diversified portfolio for you based on your goals and risk tolerance. They are low-cost, accessible, and an excellent way to get started without needing extensive knowledge.

6. What are dividends and how do they work?

Dividends are payments made by a company to its shareholders, usually from its profits. You can receive them as cash or, more powerfully, reinvest them to buy more shares of the company, which helps your investment compound even faster over time.

7. Do I have to pay taxes on my investments?

Yes, investment gains are typically taxable. When you sell an investment for a profit, it's called a capital gain. However, you can use tax-advantaged accounts like a Roth IRA or 401(k) where your investments can grow tax-free or tax-deferred, significantly reducing your tax burden.

8. What is dollar-cost averaging?

It's a strategy where you invest a fixed amount of money at regular intervals (e.g., $100 every month), regardless of market conditions. This approach helps average out your purchase price over time and removes the emotion from trying to "time the market."

9. How often should I check my investment portfolio?

For long-term investors, checking too often can lead to anxiety and emotional decisions. A healthy approach is to review your portfolio once or twice a year to ensure it's still aligned with your goals and to rebalance if necessary.

10. Is it better to pick individual stocks or buy index funds?

For the vast majority of beginners, buying broad-market index funds or ETFs is the recommended strategy. It provides instant diversification across hundreds or thousands of companies, which is far less risky than trying to pick individual winning stocks.

Ready to take control of your financial future? At Top Wealth Guide, we provide the strategies and insights you need to build and manage your wealth effectively. Explore our resources and start your journey today.

Learn more at Top Wealth Guide

This article is for educational purposes only and is not financial or investment advice. Consult a professional before making financial decisions.