Investing is how you put your money to work. Instead of just letting it sit in a bank account where its buying power slowly erodes due to inflation, you use it to buy assets—things like stocks or bonds—that have the potential to grow in value or pay you an income over time. It’s the single most powerful strategy for building real, long-term wealth.

This guide is built to give you a clear, no-nonsense plan to get started, even if you're starting from scratch. We’ll cut through the jargon and provide actionable steps, real-life examples, and a solid foundation of knowledge so you can invest with confidence.

In This Guide

- 1 Your Journey to Financial Growth Starts Here

- 2 Understanding the Core Building Blocks of Investing

- 3 How to Build Your First Investment Portfolio

- 4 A Step-by-Step Guide to Making Your First Investment

- 5 Exploring Investments Beyond Stocks and Bonds

- 6 Frequently Asked Questions for New Investors

- 6.1 1. How much money do I actually need to start investing?

- 6.2 2. What is the safest investment for a total beginner?

- 6.3 3. How do taxes work with my investments?

- 6.4 4. What is the difference between a stock and an ETF?

- 6.5 5. How do I choose the right brokerage platform?

- 6.6 6. What is a bull market versus a bear market?

- 6.7 7. Should I sell my investments if the market crashes?

- 6.8 8. What are dividends and how do they work?

- 6.9 9. How often should I check on my investments?

- 6.10 10. Is it better to pick individual stocks or buy funds?

- 7 It's Time to Put Your Money to Work

- 8 This article is for educational purposes only and is not financial or investment advice. Consult a professional before making financial decisions.

Your Journey to Financial Growth Starts Here

Jumping into the world of investing can feel intimidating, like trying to learn a brand-new language filled with confusing terms. Think of this guide as your personal translator. We're here to cut through the noise and replace that feeling of uncertainty with a straightforward, actionable plan.

Let’s be clear: investing isn’t some secret club reserved for the ultra-wealthy. It’s a tool—a powerful one—that anyone can learn to use to build a more secure financial future.

Think of it like planting a money tree. You start with a small seed (your initial investment). With knowledge, patience, and consistent care, that seed can grow into something substantial. We'll show you how to pick the right "seeds" (your investments), plant them in the best soil (your portfolio), and help them flourish. This all starts with a solid foundation, which is why we believe financial literacy is the key to building wealth.

What to Expect From This Guide

Our goal is to hand you a complete roadmap, taking you from understanding the absolute basics to confidently making your very first investment.

Here’s what we’ll cover:

- The Building Blocks: We’ll break down the essentials—stocks, bonds, and funds—in plain English. No confusing jargon, promised.

- Portfolio Construction: Learn the art and science of building a simple starter portfolio that aligns with your personal goals.

- Actionable Steps: We'll walk you through the practical stuff, like how to open an account and place your first trade.

- Expanding Your Horizons: Get a peek into other popular assets, including real estate and even cryptocurrencies.

To give you a bird's-eye view, here’s a quick summary of the main investment types we'll be exploring.

A Quick Look at Beginner Investment Options

| Investment Type | Risk Level | Best For | Real-Life Example |

|---|---|---|---|

| Stocks | High | Those seeking long-term growth who are comfortable with market ups and downs. | Buying shares of a company like Apple (AAPL). |

| Bonds | Low | Conservative investors who value stability and a predictable income stream. | Buying a U.S. Treasury Bond. |

| Mutual Funds / ETFs | Varies (Low to High) | Beginners who want instant diversification without having to pick individual assets. | Buying a share of the Vanguard S&P 500 ETF (VOO). |

| Real Estate | Medium to High | Anyone interested in a tangible asset that can generate rental income. | Purchasing a rental property or investing in a REIT. |

| Cryptocurrency | Very High | Tech-savvy investors with a very high tolerance for risk and volatility. | Buying a portion of a Bitcoin (BTC). |

By the time you're done with this guide, you won't just understand investing—you'll have the confidence to take those crucial first steps on your own path to financial independence.

Understanding the Core Building Blocks of Investing

Before you can build a solid house, you need to know the difference between a brick and a two-by-four. Investing works the same way. The entire financial world is built on a handful of core asset types, and getting to know them is your first real step toward building a portfolio that works for you.

Think of these as the main ingredients you'll be cooking with. Each has its own flavor, risk level, and purpose in your overall financial recipe. Let's break down the big ones in a way that actually makes sense.

Stocks: Your Slice of the Pie

When you buy a stock, you're buying a tiny piece of a public company. Imagine you love a local pizza shop so much you buy a small ownership stake in it. If the shop thrives and profits soar, the value of your stake grows right along with it.

Companies sell these tiny pieces of themselves—called shares—to raise money for new projects, research, or paying down debt. As a shareholder, you get to share in the company's potential success. The main way you profit is through capital appreciation, which is just a fancy way of saying you sell your shares for more than you paid.

Some companies also pay dividends. These are regular cash payments shared with owners like you, kind of like the pizza shop giving you a cut of the profits every quarter. This makes stocks a powerful tool for both growth and generating income.

Real-Life Example: Let's say you bought one share of Microsoft (MSFT) for $300. A year later, the company has done well, and the share price rises to $350. Your capital appreciation is $50. In addition, Microsoft paid you $2.72 in dividends over that year. Your total return is $52.72.

Bonds: Playing the Role of the Bank

If stocks are about ownership, bonds are about lending. Sticking with our pizza shop analogy, buying a bond is like giving the owner a loan to buy a new, more efficient oven. In exchange, the owner promises to pay you back the full loan amount by a set date, all while making regular interest payments to you along the way.

Essentially, bonds are just loans you make to a government or a corporation. They are generally seen as less risky than stocks because their returns are far more predictable. You know exactly how much interest you'll get and when you’ll get your original investment back.

This predictability makes bonds a great stabilizing force in an investment portfolio, often smoothing out the bumps from the more volatile stock market. We dive much deeper into this relationship in our guide on the key differences between stocks and bonds.

Key Takeaway: The entire game of investing boils down to a trade-off between risk and return. Stocks offer the potential for higher returns but come with more risk. Bonds offer more stability and lower risk but with more modest returns.

Mutual Funds and ETFs: The All-in-One Baskets

What if you don't want to bet everything on just one pizza shop? That's where mutual funds and Exchange-Traded Funds (ETFs) come in. Think of them as pre-packed baskets holding a wide variety of investments—sometimes hundreds of different stocks or bonds all bundled together.

- Mutual Funds: These are investment portfolios actively managed by a professional. The fund manager does the work of picking and choosing the investments. Their price is set just once a day after the market closes.

- ETFs (Exchange-Traded Funds): These funds usually track a specific market index, like the S&P 500. The big difference is you can buy and sell them throughout the day, just like an individual stock.

ETFs, in particular, have been a game-changer for new investors. The explosion in ETF popularity has made it incredibly easy for anyone to get a diversified portfolio with just a small amount of money. In fact, as StateStreet.com reports on ETF trends, they continue to attract massive inflows from everyday investors. For a beginner, buying a single share of a broad-market ETF is one of the simplest and most effective ways to get started.

Comparing Your Core Options

Getting a handle on the basic differences will make your first investment decisions much clearer. This simple table breaks it all down.

| Feature | Stocks | Bonds | Mutual Funds / ETFs |

|---|---|---|---|

| What You Own | A share of a single company | A debt owed by an entity | A share of a diverse collection of assets |

| Primary Goal | Long-term growth | Stable income & principal protection | Instant diversification & market tracking |

| Risk Level | High | Low | Varies (Low to High) |

| Best For | Growth-focused investors | Conservative investors seeking stability | Beginners who want a simple, diversified start |

How to Build Your First Investment Portfolio

Alright, you've got the basics of what stocks, bonds, and other assets are. Now it's time to put them together. Think of it like cooking: you have all the ingredients, and building your first portfolio is about creating a recipe that suits your personal taste.

The most important idea to grasp here is asset allocation. That’s just the professional term for a simple, age-old concept: don't put all your eggs in one basket. By spreading your money across different kinds of investments, you cushion yourself if one part of your portfolio has a bad year.

Designing Your Portfolio Blueprint

Before you even think about clicking "buy," you need a plan. And that plan starts with your risk tolerance—which is really just a measure of how well you can stomach the market's natural ups and downs. Your age, when you need the money, and your general personality all factor into this.

Are you okay with bigger swings for the chance at bigger rewards? Or would you rather have a smoother ride, even if it means slower growth? Being honest with yourself here is the key to building a portfolio you can actually stick with when things get choppy. Our guide on how to determine your investment risk tolerance is a great place to start figuring this out.

Someone in their 20s with decades to go before retirement can afford to be more aggressive with a stock-heavy portfolio. On the other hand, someone getting close to retirement will probably want to dial back the risk to protect what they’ve already built.

Real-World Portfolio Examples

To make this less abstract, let's look at a few common portfolio models. These aren't strict rules, just starting points to show you how this all works in the real world. Pay close attention to how the mix of stocks and bonds shifts depending on the investor’s goals.

- The Conservative Investor (e.g., Sarah, 60, nearing retirement): Sarah's main goal is to protect her money and generate steady income. Her portfolio is built on the stability of bonds, with a smaller allocation to stocks for some growth.

- The Balanced Investor (e.g., Mark, 40, saving for multiple goals): This is a classic middle-of-the-road strategy. Mark wants to capture stock market growth while using bonds as a shock absorber. It's a true blend of growth and safety.

- The Aggressive Investor (e.g., Emily, 25, just starting her career): Emily has a long road ahead of her. She is willing to ride out more volatility for the shot at higher returns over the long term. Her portfolio is dominated by growth-focused stocks.

A quick but important note: a modern portfolio isn’t complete without looking beyond your own backyard. While the U.S. markets have been a powerhouse, some of the best returns lately have come from international stocks. Including global investments isn’t just a nice-to-have anymore; it's a core strategy for tapping into growth all over the world. You can see what the experts at Fidelity.com are saying about the global outlook.

This table gives you a clear picture of how these different approaches might break down.

Sample Beginner Portfolio Models by Risk Tolerance

| Portfolio Model | Stock Allocation | Bond Allocation | International Allocation | Ideal Investor Profile |

|---|---|---|---|---|

| Conservative | 30% | 60% | 10% | Prefers stability and income; low tolerance for risk. |

| Balanced | 50% | 30% | 20% | Seeks a mix of growth and safety; medium tolerance for risk. |

| Aggressive | 70% | 10% | 20% | Aims for maximum long-term growth; high tolerance for risk. |

As you can see, your asset allocation is a deeply personal choice. There's no single "best" portfolio out there—only the portfolio that is best for you. By understanding your own comfort with risk and using these models as a guide, you're ready to build a solid, diversified foundation for your entire investment journey.

A Step-by-Step Guide to Making Your First Investment

Alright, you've got a blueprint for your portfolio. Now for the exciting part—turning that plan into reality. Let's walk through the exact steps to place your very first investment, cutting through the jargon so you can move forward with total confidence.

First things first, your money needs a home where it can actually work for you. That home is your investment account.

Choosing the Right Investment Account

Think of an investment account like a container for your assets. Each one is designed for a different purpose and comes with its own set of rules—and, most importantly, different tax advantages. Picking the right one is a crucial first step.

- Brokerage Account: This is your all-purpose, flexible account. You can put money in and take it out whenever you want (you’ll just pay taxes on your profits when you sell). It’s perfect for any financial goal that isn't specifically for retirement.

- Roth IRA (Individual Retirement Arrangement): This account is a powerhouse for retirement savings. You contribute money you've already paid taxes on, which means your investments can grow 100% tax-free. While it's built for the long haul, you can pull out your original contributions without penalty if you ever need to.

- 401(k) or 403(b): You'll find these retirement plans offered through your job. Their biggest superpower is the employer match—this is literally free money your company chips in when you contribute. If your employer offers a match, grabbing every penny of it should be your top priority.

Here’s a quick breakdown of how these popular accounts stack up.

| Account Type | Key Feature | Primary Use Case | Tax Benefit |

|---|---|---|---|

| Brokerage Account | Maximum flexibility | General investing, non-retirement goals | Pay taxes on gains when you sell |

| Roth IRA | Tax-free growth and withdrawals | Long-term retirement savings | Post-tax contributions, tax-free withdrawals |

| 401(k) | Employer match ("free money") | Employer-sponsored retirement savings | Pre-tax contributions, tax-deferred growth |

Funding Your Account and Placing Your First Trade

Once your account is open, you’ll link it to your bank and move some money over. A lot of people get stuck here, wondering, "How much do I need to start?" The answer is way less intimidating than you think.

Thanks to things like zero-commission trading and fractional shares, you can start with just about any amount. In fact, we have a whole guide on how to invest with little money if you're curious. The important thing isn't starting with a fortune; it's simply starting.

Ready to place that first trade? While every brokerage platform looks a little different, the core process is always the same:

- Search for Your Investment: Use the search bar and type in the ticker symbol for the stock or ETF you want to buy (for example, "VOO" for the Vanguard S&P 500 ETF).

- Enter the Amount: You can decide to buy a specific number of shares or, even easier, just invest a flat dollar amount like $100.

- Choose Your Order Type: As a beginner, stick with a Market Order. This is the simplest option and tells the platform to buy your investment right away at the best available price.

- Review and Confirm: Give the details one last look and hit that "Buy" or "Trade" button.

And just like that, you're officially an investor. Congratulations!

The Power of Dollar-Cost Averaging

So, you've made your first investment. How do you keep the momentum going without stressing over the market's daily drama? The secret is a strategy called Dollar-Cost Averaging (DCA).

Instead of trying to "time the market" by dumping in a lump sum when you think prices are low, DCA is about investing a fixed amount of money on a regular schedule—say, $100 every month—no matter what the market is doing.

This simple, automated approach is a game-changer for two big reasons:

- It takes emotion out of the equation. You stick to your plan, which prevents you from making panicked decisions when the market gets rocky.

- It averages out your purchase price. When prices are down, your fixed $100 buys more shares. When prices are up, it buys fewer. Over time, this smooths out your cost and reduces the risk of buying everything at a peak.

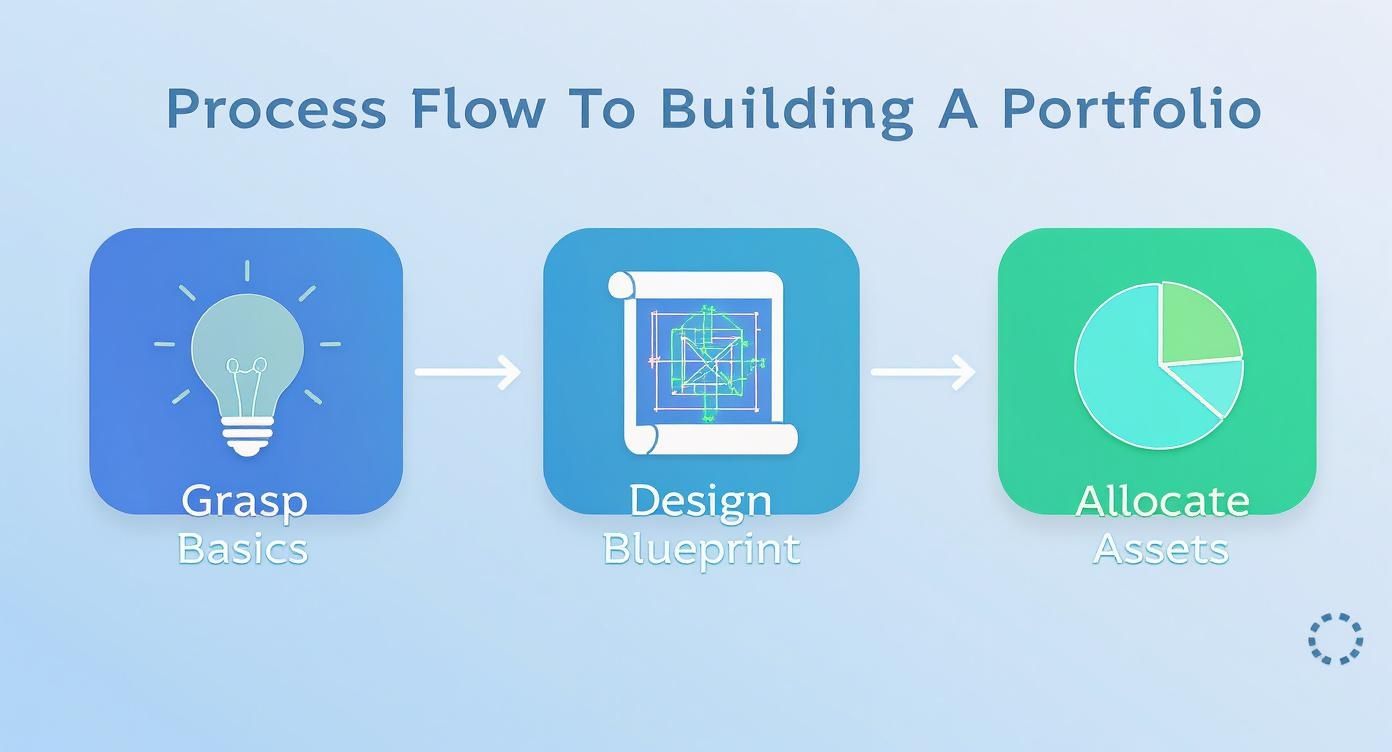

This simple flow shows you how to put it all together.

As you can see, successful investing is all about starting with the fundamentals, creating a personalized plan, and then consistently putting your money to work based on that plan.

By choosing the right account, making that first trade, and then setting up automatic contributions, you're not just investing—you're building a sustainable system for creating real wealth.

Exploring Investments Beyond Stocks and Bonds

Once you've got a handle on stocks and bonds, you can start looking for other ways to make your money work for you. It's a bit like a chef adding new spices to a familiar recipe—alternative assets can bring exciting new dimensions to your portfolio.

What's great about these investments is that they often move to a different rhythm than the stock market. That can be a fantastic way to add some balance and stability when things get choppy. Think of them as the next level in your financial toolkit. They won't replace your core investments, but they can definitely complement them, opening up different avenues for growth as you become more confident.

Let’s dive into two of the most talked-about options: real estate and cryptocurrency.

Real Estate Investing Without the Hassle

Owning property has been a cornerstone of wealth-building for generations. But let’s be real—not everyone has the down payment for a house or the desire to be a landlord. That's where Real Estate Investment Trusts (REITs) come into the picture.

A REIT is simply a company that owns or finances properties that generate income, like apartment complexes, office buildings, or shopping malls.

Buying a share of a REIT is as easy as buying a stock. With just a few clicks, you get a piece of the real estate market and can earn a slice of the rental income (paid out as dividends) without ever having to unclog a toilet. It’s a wonderfully simple way for beginners to get started.

A Clear-Eyed Look at Cryptocurrency

It’s impossible to talk about modern investing without touching on cryptocurrency. Assets like Bitcoin and Ethereum, built on a technology called blockchain, have carved out a brand new, high-risk, high-reward corner of the financial universe.

This is an area where you absolutely must tread carefully. The value of cryptocurrencies is famously volatile—we're talking about massive price swings that can happen overnight.

Because of this, it’s smart to think of crypto as a purely speculative play, not a cornerstone of your retirement savings. If you decide to jump in, only invest an amount of money you would be genuinely okay with losing.

Important Takeaway: Picture your investment portfolio as a pyramid. Your diversified stocks and bonds form the huge, stable base. Alternative assets like REITs and crypto are for the very tip—they add a little extra potential for growth without risking the whole structure.

Comparing Alternative Asset Classes

Seeing the core differences side-by-side can really help clarify where—or if—these assets fit into your financial strategy. This table cuts right to the chase.

| Feature | REITs | Cryptocurrency |

|---|---|---|

| Primary Goal | Steady income and property appreciation | High-risk growth and speculation |

| Typical Volatility | Medium | Very High |

| What You Own | A share in a portfolio of real estate | Digital tokens on a blockchain |

| Best For | Investors seeking income and diversification | Risk-tolerant investors exploring new tech |

Branching out like this is a natural next step in your journey as an investor. Understanding how investment diversification beyond stocks and bonds works is a critical skill for building a portfolio that can weather any storm.

It's also wise to keep an eye on global investment trends. For example, tracking where global foreign direct investment (FDI) is flowing can give you a clue about economic stability and potential growth areas around the world. For a new investor, following these capital flows can point you toward where future opportunities might pop up. You can discover more insights about investment statistics at Wisemoneytools.com.

This article is for educational purposes only and is not financial or investment advice. Consult a professional before making financial decisions.

Frequently Asked Questions for New Investors

Getting into the world of investing is going to bring up a lot of questions. That’s a good thing—it means you’re thinking critically about your money and where it’s going. To help cut through the noise, let’s tackle the ten most common questions that come up for beginners.

1. How much money do I actually need to start investing?

You can start with as little as $1. This is probably the most surprising answer for new investors, but it's absolutely true. The old myth that you need a small fortune just to get in the game is completely outdated. Thanks to zero-commission trading and fractional shares (which let you buy a slice of a stock), the barrier to entry has never been lower. The key isn't how much you start with; it’s about building the habit of investing consistently.

2. What is the safest investment for a total beginner?

While no investment is 100% risk-free, broad-market index fund ETFs are an excellent first step for most beginners. These funds, like one that tracks the S&P 500, give you instant diversification by spreading your money across hundreds of America's largest companies. This built-in safety net means you aren't putting all your eggs in one basket. If one company struggles, it doesn't sink your whole portfolio.

3. How do taxes work with my investments?

Investment taxes are simpler than they sound. You generally only pay taxes on your profits—known as capital gains—and only when you actually sell an investment for more than you paid.

- Short-Term Capital Gains: If you sell an asset you've owned for a year or less, the profit is taxed at your regular income rate.

- Long-Term Capital Gains: If you hold it for more than a year, your profit is taxed at a much lower long-term rate.

Using tax-advantaged accounts like a Roth IRA or a 401(k) can seriously reduce or even eliminate your tax bill on investment growth.

4. What is the difference between a stock and an ETF?

A stock is a single ingredient, while an ETF is the entire meal. A stock represents a piece of ownership in one specific company, like Apple or Amazon. An ETF (Exchange-Traded Fund), on the other hand, is a basket containing many different stocks or bonds, all bundled into one security you can trade just like a single stock. It's diversification, simplified.

5. How do I choose the right brokerage platform?

The right brokerage for you is the one that feels easy to use and doesn't drain your account with fees. Look for a platform with low or zero commission fees, a clean interface, solid customer support, and access to the investments you want. For beginners, trusted platforms like Fidelity, Vanguard, and Charles Schwab are excellent places to start.

6. What is a bull market versus a bear market?

These are just Wall Street terms for the market's overall trend. A "bull" market is a period of widespread optimism when stock prices are generally rising. A "bear" market is the opposite—a time of pessimism and falling prices, officially defined as a drop of 20% or more from recent highs.

7. Should I sell my investments if the market crashes?

Panic-selling during a downturn is one of the biggest and most costly mistakes an investor can make. The best move is usually to do nothing or even continue investing as planned through dollar-cost averaging. History has shown that markets recover from every single crash. Selling when prices are at their lowest just locks in your losses.

8. What are dividends and how do they work?

Dividends are small, regular cash payments that some companies distribute to shareholders as a way of sharing profits. You can take the cash, but the real magic happens when you automatically reinvest them. This uses your dividend payment to buy more shares of that same stock, creating a powerful compounding effect that can significantly accelerate your portfolio's growth over time.

9. How often should I check on my investments?

For a long-term investor, checking your portfolio too often causes more harm than good. Watching daily ups and downs is a recipe for anxiety. A good rhythm is to check in on your portfolio maybe once a quarter, or even just twice a year. This is enough to ensure you're on track with your goals without getting spooked by meaningless market noise.

10. Is it better to pick individual stocks or buy funds?

For the overwhelming majority of beginners, buying diversified, low-cost index funds or ETFs is the smarter, safer, and more reliable path. Successfully picking individual stocks takes an enormous amount of research and time, and even professional fund managers struggle to consistently beat the market average. Funds give you a piece of the entire market in one click.

This article is for educational purposes only and is not financial or investment advice. Consult a professional before making financial decisions.

It's Time to Put Your Money to Work

You've made it through the fundamentals. You now understand the difference between a stock and a bond, how to think about risk, and the actual, practical steps needed to open an account and make your first investment. That's the hard part, and it's already behind you.

What truly separates successful investors from the rest isn't a secret stock tip or a magic formula. It’s simply starting. It's about developing the discipline to stick with your plan, even when the market feels chaotic, and trusting the process you've laid out for yourself.

Think of it like planting a tree. You won't see a towering oak overnight. But with consistent care—a little bit of water, some sunlight—that tiny sapling grows stronger every year, eventually providing shade and security for generations. Your investments work the same way.

This guide was designed to be your starting map. Use it to navigate those first few decisions with confidence, knowing that every dollar you invest today is a vote for the future you want to build. You have the knowledge. You have the tools. The only thing left to do is begin.

This article is for educational purposes only and is not financial or investment advice. Consult a professional before making financial decisions.

Ready to take your financial knowledge to the next level? Subscribe to Top Wealth Guide for exclusive insights and proven wealth-building strategies. Start your journey at https://topwealthguide.com.