Mutual funds… facing the squeeze from those low-cost ETFs and their robo-advisor pals, yeah? Actively managed funds—bleeding $1.2 trillion in outflows over the last half-decade. Rough times in Mutualville.

But hey, hold the funeral. $27 trillion still parked in mutual fund accounts all over the U.S. of A. The real question here (and one we’ve been pondering at Top Wealth Guide) isn’t about calling time of death on mutual funds—no, no, no. It’s more about figuring out when they still earn their keep in your investment lineup.

In This Guide

What’s Really Happening to Mutual Funds Right Now

The data-it’s brutal. Vanguard’s actively managed equity funds shed $47 billion in 2024 alone, while their index cousins gobbled up $180 billion. Meanwhile, Fidelity’s active stock funds dropped $32 billion. This exodus started post-2020, as investors finally cracked the code of the fee game.

The Fee War Intensifies

Average expense ratios for actively managed equity funds hover around 0.74%-25% of these funds do better, cost-wise, compared to 0.15% for index domestic funds. Yeah, that gap? It’s a wealth shredder over decades. A $100,000 play over 30 years loses around $138,000 just to fee bleed (that’s if you’re betting on a 7% annual compounding). Fund firms? They’re math wizards-they get it. Even traditional stalwarts like T. Rowe Price jumped on the bandwagon, launching 15 new index babies in 2024.

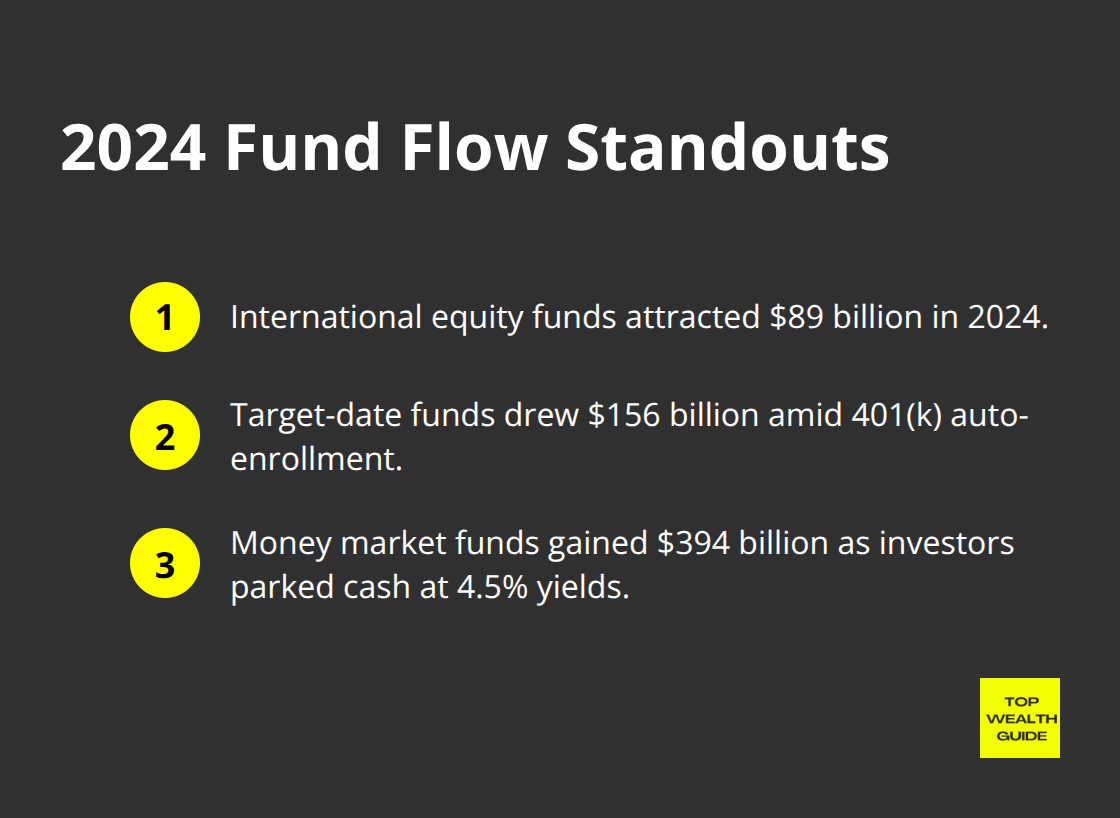

Money Flows Reveal Investor Priorities

Ah, international equity funds-they broke the trend. Attracting $89 billion in 2024 as investors chased growth beyond the languishing U.S. markets. Meanwhile, target-date funds are pulling in big-$156 billion, thanks to 401k auto-enrollment doing the heavy lifting. Then there are the money market funds-skyrocketing with $394 billion as investors parked their cash at 4.5% yields during volatile market hiccups.

Performance Data Exposes the Reality

Morningstar’s 2024 analysis paints a stark picture-active fund performance is struggling against passive heavyweights. Large-cap growth funds? Only 12% outshone the S&P 500. International funds did slightly better at 25%, but still let down investors coughing up premium fees for what was supposed to be ‘professional’ management.

This raises a nagging question: if the majority of mutual funds can’t pull their weight in returns to justify the fees, then what alternatives are truly giving modern portfolios the bang for their buck?

Which Investment Options Actually Beat Mutual Funds?

Okay, folks, let’s dive in. ETFs-these little wonders-squash mutual funds in the cost showdown. It’s all about the numbers. Vanguard’s S&P 500 ETF skims just 0.03% annually off the top. Meanwhile, similar mutual funds are gouging folks at 0.14% or more. Do the math-that’s $1,100 flying away from a $100,000 investment over a decade. In 2024, Schwab’s Total Stock Market ETF pulled in a whopping $23 billion while those active mutual funds kept hemorrhaging cash.

ETFs Deliver Superior Tax Efficiency

Next up-tax advantages that are, frankly, huge. ETFs remain more tax-efficient, saving investors heaps in annual taxes. They use in-kind redemptions to kick out low-basis shares with style, while mutual funds? They’re stuck selling securities to meet redemptions-triggering tax events for everyone. On a $500,000 portfolio, you’re pocketing about $2,800 more annually in tax savings with ETFs than with those stodgy mutual funds.

Individual Stocks Offer Direct Control

Let’s break this down-individual stocks, it’s all about control, baby. Tesla believers hit a jackpot with a 743% gain from 2019 to 2021, while tech mutual funds plodded along with just 67%. The downside? Picking winning stocks means dedicating serious time-8 to 12 hours a week, to be exact-poring over financial statements and charting market moves. No surprise, then, 80% of solo stock jockeys can’t beat the market over time.

Robo-Advisors Cut Costs and Complexity

Enter robo-advisors-Betterment and Wealthfront charge a sleek 0.25% annually, slicing the cost of typical mutual funds in half. These platforms do the heavy lifting, automatically rebalancing portfolios, plucking tax losses, and tweaking risk levels as the years pile on. Tax-loss harvesting can boost after-tax returns by up to 0.77% each year. And hey, M1 Finance? They’ll go a step further with zero management fees for vanilla portfolios.

The drawback? Limited customization and one-size-fits-all strategies that might not jive with your unique financial tapestry. So, here’s the million-dollar question-when do you stick with old-school mutual funds, even with their higher costs and tax headaches?

When Do Mutual Funds Still Win

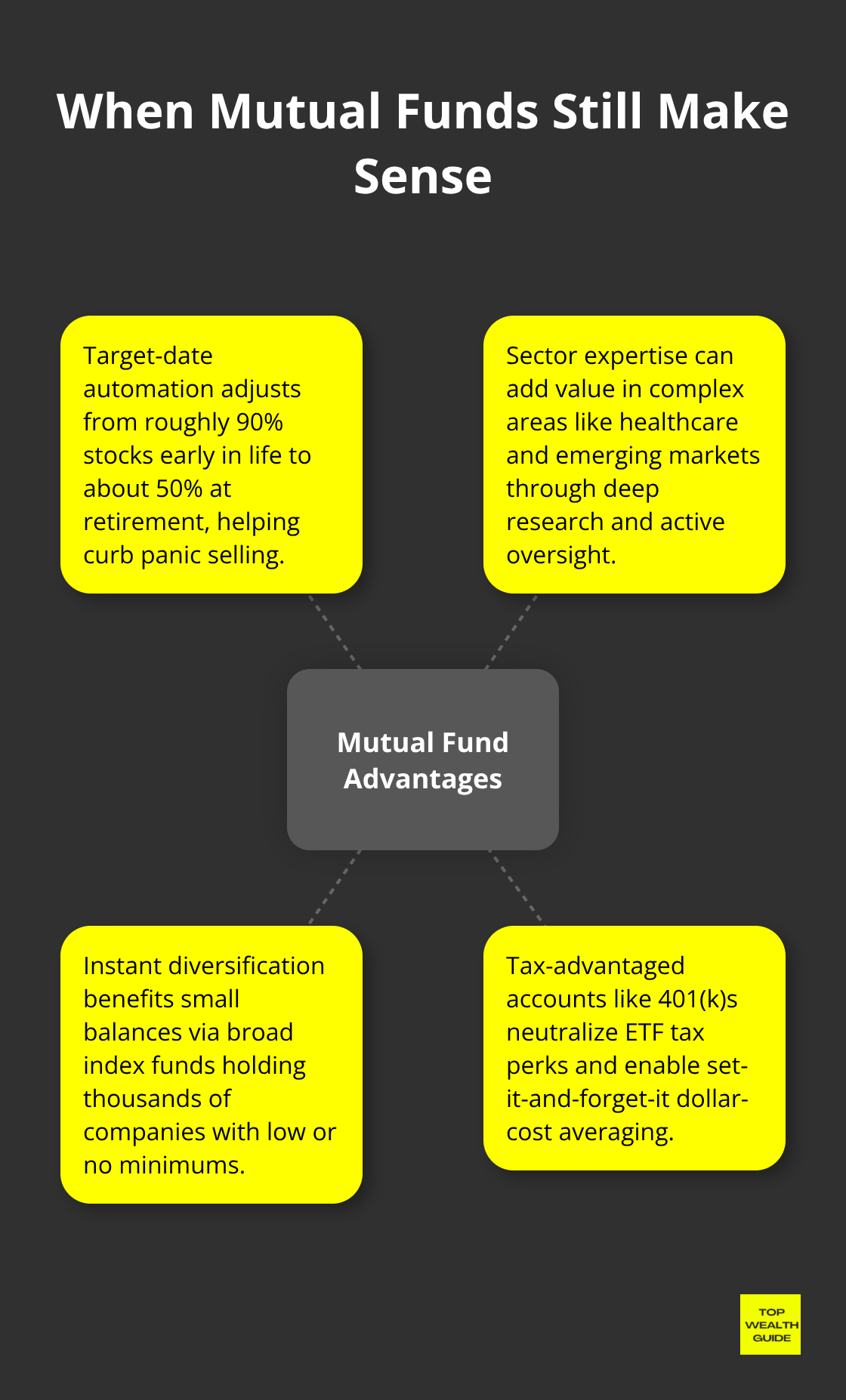

Target-date funds are the undisputed champs of retirement accounts – and here’s why. Vanguard’s Target Retirement 2055 Fund manages to capture a whopping $180 billion in assets by doing this intuitive thing: shifting smoothly from 90% stocks when you’re a not-so-worried 30-year-old, to a more conservative 50% stocks once you hit retirement mode.

This automatic smart-pilot move is the ultimate shield against the notorious blunder of panic-selling – remember when the 2020 crash made everyone lose their heads? Target-date fund holders kept their cool, unlike those DIY adventurers who bailed out and, well, got slammed with massive losses.

Fidelity’s Freedom Funds are playing the fee game right – they charge only 0.12% annually while juggling the mind-numbing complexity of rebalancing across a universe of 10,000+ holdings spanning U.S. stocks, international markets, and bonds. These fund managers are not flying by the seat of their pants – they’re making these allocation calls grounded in decades of hardcore research, steering clear of the emotional roller-coaster that market volatility throws at you.

Professional Management Tackles Specialized Sectors

So, diving into specific sectors that make your head spin? That’s where sector-specific mutual funds really shine. Take T. Rowe Price’s Health Sciences Fund-this powerhouse has been serving up 8.35% annual returns over the past decade. How? By expertly navigating the maze of FDA approvals, patent cliffs, and biotech regs that trip up solo investors. These managers? They’re clocking in over 60 hours a week to crack the code on drug pipelines and regulatory shifts.

And if emerging markets are your thing, Vanguard’s Emerging Markets Stock Index fund is the knight in shining armor, handling currency risks and political curveballs across a dizzying 27 countries. Retail investors don’t stand a chance trying to track all this from their kitchen table. These managers? They’re like globe-trotting diplomats, deep into local relationships and regulatory labyrinths that would take years for you to even start understanding.

Small Account Balances Need Instant Diversification

Got just $1,000 to kick things off? With mutual funds, it’s like bringing a bazooka to a knife fight against individual stocks when you’ve got small balances. Imagine buying 10 individual stocks – you’re dropping $70-100 just on trading. But Schwab’s Total Stock Market Index Fund has zero minimums and throws you into ownership of 4,000+ companies in one swift move. Face it – if you’ve got a $2,000 portfolio and want to spread risk across 20+ stocks, trading fees eat up 10% of your cash. Ouch.

And those money market funds, like Vanguard’s Federal Money Market, provide liquidity and rock-solid stability while keeping $1 share prices (outdoing high-yield savings accounts all day, every day). They offer that liquid safety net individuals bonds can’t touch for us mere mortals.

Tax-Advantaged Accounts Favor Mutual Funds

401(k) plans – they’re like the ultimate locker room with limited plays, and mutual funds often lineup as the top draft picks available. Those target-date funds in these accounts? They’re winning with dollar-cost averaging magic through automatic payroll deductions. Plus, the tax-deferred growth within these accounts wipes out the supposed tax efficiency perks that ETFs boast about in taxable settings.

Final Thoughts

Mutual funds-yeah, not quite six feet under, but they’re definitely not the default go-to anymore. The stats? A staggering $1.2 trillion has bolted from actively managed funds over the past five years, while ETFs and index funds have been cashing in big time. But, hey, there’s still $27 trillion parked in mutual funds. Why? Some good reasons there.

So, here’s the deal. You go for mutual funds when you need that auto-pilot glide path towards retirement (target-date, check), some pro brains for those trickier sectors like healthcare or emerging markets, or when you want instant diversification with less than $5,000 to play with. But hit the skip button if you’re comfortable with ETF trades, need tax efficiency that’s top-notch, or just want to be hands-on with your stocks.

First step? Dive into an audit of all your holdings. Total up those fees (if you’re above 0.5% annually, it’s time for some tough questions). Align your investment timeline with your fund types, and give your whole strategy a yearly check-up. We over at Top Wealth Guide suggest seeing mutual funds as the special ops in your portfolio squad. Focus on the total cost picture, tax hits, and whether that fancy professional management is actually pumping value into your situation.