So, what exactly is financial literacy?

It's not about memorizing complex Wall Street formulas or becoming a day trader. At its heart, financial literacy is the practical, real-world skill set you need to make smart, confident decisions with your money. It’s about understanding how money works so you can finally make it work for you.

In This Guide

- 1 Decoding Financial Literacy: Your Personal Wealth Operating System

- 2 Building Your Financial Foundation, Pillar by Pillar

- 3 How Financial Skills Shape Your Investor Identity

- 4 Taking Stock of Your Current Financial Knowledge

- 5 Your Action Plan for Becoming Financially Savvy

- 6 Frequently Asked Questions About Financial Literacy

- 6.1 1. What's the very first step to becoming financially literate?

- 6.2 2. How is being financially literate different from being rich?

- 6.3 3. I have a lot of debt. Should I pay it off before I start investing?

- 6.4 4. What is the most important financial concept to understand?

- 6.5 5. How can I teach my kids about financial literacy?

- 6.6 6. Is it ever too late to improve my financial literacy?

- 6.7 7. What's the difference between a 401(k) and an IRA?

- 6.8 8. How much do I need for an emergency fund?

- 6.9 9. Do I need a financial advisor?

- 6.10 10. My credit score is low. What's the quickest way to improve it?

Decoding Financial Literacy: Your Personal Wealth Operating System

Think of financial literacy as the operating system for your financial life. Just like the OS on your phone or computer manages all the complex background tasks, financial literacy helps you manage your income, expenses, debts, and investments to get where you want to go. It’s having the confidence to understand money concepts and, more importantly, the ability to apply them to your own life.

Without this foundation, trying to manage your money can feel like navigating a new city without a map. But once you have it, you’re in the driver's seat, able to steer your financial future with purpose.

Why Financial Skills Matter More Than Ever

The need for solid financial skills has never been greater, but unfortunately, the data shows we're falling behind. Financial literacy in the U.S. has been stuck in place for nearly a decade. On average, American adults can only answer 49% of personal finance questions correctly.

Even more telling is our understanding of risk—a critical skill for anyone looking to invest. A shocking 36% of adults can correctly answer questions about financial risk, a number that has actually gone down in recent years. These eye-opening numbers come from the TIAA Institute's Personal Finance Index.

This gap reveals a powerful truth: a high income alone is no guarantee of financial security. As we cover in our guide on why financial education beats a high income every time, true wealth is built on a foundation of smart decisions, not just a big paycheck.

Financial literacy is the bridge between the money you earn and the life you want to live. It transforms your income from a simple number into a powerful tool for building freedom, security, and opportunity.

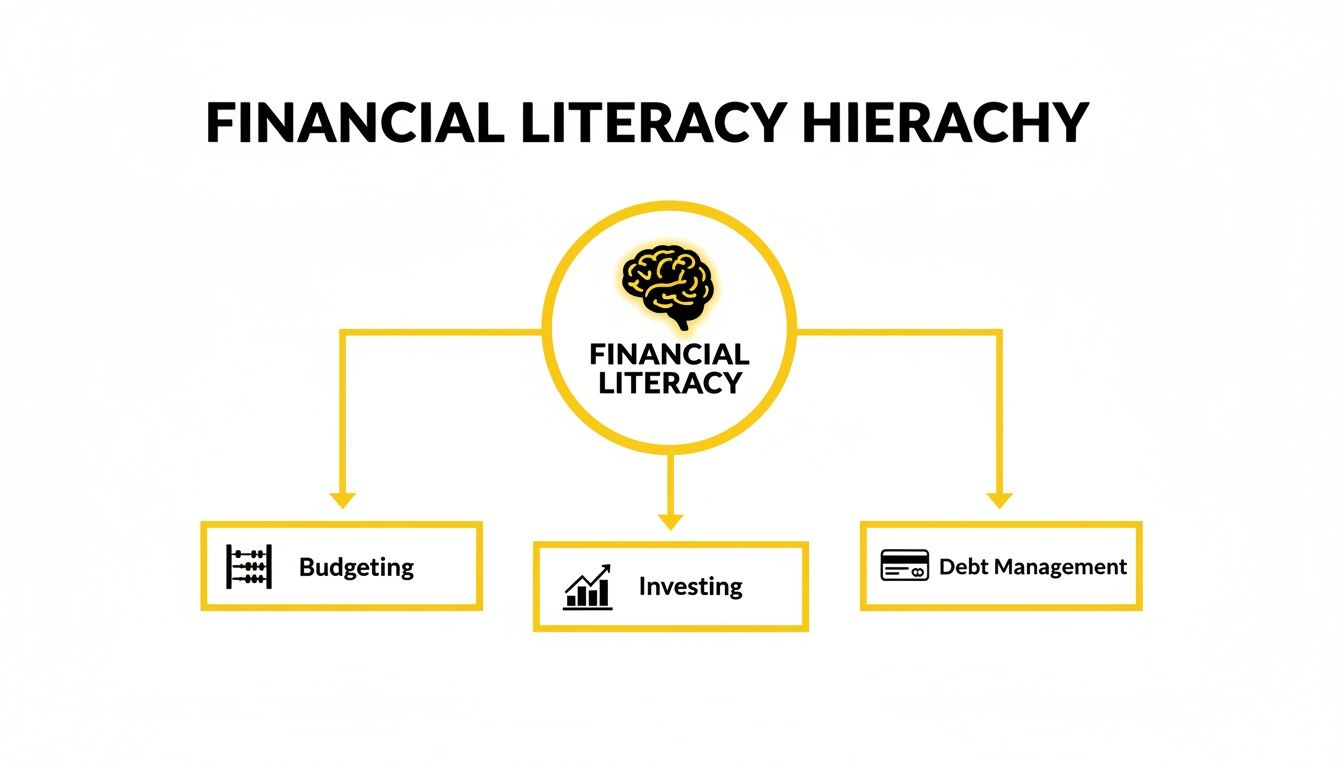

The Core Pillars of Financial Literacy

To get a real handle on financial literacy, it helps to break it down into its core components. Think of these as the essential pillars holding up your financial structure. Each one supports the others, creating a stable foundation for building long-term wealth.

Here’s a look at what those pillars are and what they mean in practical terms.

| Pillar | What It Means | Real-Life Example |

|---|---|---|

| Budgeting & Cash Flow | Knowing exactly where your money comes from and where it goes each month. | Sarah tracks her spending and finds she's spending $250/month on lunches out. She starts packing a lunch 3 days a week, freeing up $150 for her savings goal. |

| Saving & Emergency Funds | Setting aside money for future goals and unexpected life events. | When Mark's car breaks down with a $1,200 repair bill, he uses his emergency fund instead of going into credit card debt. |

| Investing Principles | Using your money to acquire assets that have the potential to grow in value. | Instead of leaving her savings in a low-interest account, Maria invests in a low-cost index fund to take advantage of compound growth for her retirement. |

| Credit & Debt Management | Using debt strategically and maintaining a healthy credit profile. | David wants to buy a house. He pays his bills on time and keeps his credit card balances low to improve his credit score, qualifying for a better mortgage rate. |

Mastering these areas is what separates financial stress from financial freedom. They are the building blocks for every money decision you'll ever make.

Building Your Financial Foundation, Pillar by Pillar

Knowing the different parts of financial literacy is one thing, but actually putting them together to build a strong financial future? That's a whole different ballgame.

Think of it like building a house. You wouldn't dream of putting up the walls before you've poured a solid foundation. And you certainly wouldn't start shingling the roof before the frame is in place. Each piece of your financial knowledge supports the others, creating a structure that can stand strong through any economic storm.

It's all about mastering your money one step at a time. Let's walk through the six essential pillars that will become the bedrock of your financial life, using some real-world examples to show how they fit together.

Budgeting and Cash Flow: Your Financial Blueprint

Every great construction project starts with a blueprint. For your finances, that blueprint is your budget. It's not about restricting yourself; it's about giving every single dollar a job to do. It’s about being intentional with your money.

First, you need to get a handle on your cash flow—what’s coming in (income) versus what’s going out (expenses). Seriously, track it for just one month. The clarity you'll gain is incredible. You might be shocked to find that your daily coffee run is costing you over $700 a year, or that a few forgotten subscriptions are quietly bleeding your bank account dry. This awareness is the first, most crucial step toward making your money work for you.

Savings and Emergency Funds: Pouring the Foundation

Once you have your blueprint, it's time to pour the concrete. In this analogy, your savings and emergency fund are the foundation of your financial house. This is what protects everything you build on top of it from life's inevitable surprises—a sudden job loss, an unexpected medical bill, or a car that decides to die on you.

Without this safety net, a single financial shock can send you scrambling for high-interest credit cards, setting you back for years. The classic rule of thumb is to have three to six months of essential living expenses tucked away. This isn't just a pile of cash; it's freedom from fear. It's the peace of mind that allows you to make smart, long-term investment decisions instead of panicked, short-term ones. For a deeper dive, our guide on how to build an emergency fund has the strategies you need to create a buffer that can handle anything.

The diagram below really shows how these foundational skills, like budgeting and managing debt, are the base of the entire financial skill set.

As you can see, mastering the basics is the only way to effectively move on to more complex strategies like investing.

The Other Essential Pillars

Beyond the blueprint and foundation, a few other pillars are non-negotiable for a sturdy financial house.

- Investing Principles: This is the frame of your house—the beams and supports that let it grow taller and stronger. Understanding core concepts like compound interest and asset allocation is how you turn your savings into real, lasting wealth.

- Credit and Debt Management: Think of this as the plumbing and electrical systems. When managed well, credit is an incredibly powerful tool that helps you buy a home or a car. But if you manage it poorly, you're looking at leaks and shorts that can damage the entire structure.

- Understanding Taxes: Taxes are like the local building codes and property laws you have to follow. A smart homeowner learns how to work within the rules, using deductions and tax-advantaged accounts (like a 401(k) or an IRA) to legally minimize their tax bill and keep more of what they earn.

- Risk Management: This is your homeowner's insurance and your security system, all rolled into one. It’s about protecting what you've built through things like health and life insurance, disability coverage, and a diversified investment portfolio. It’s your defense against unforeseen disasters.

You can see how interconnected all of this is. A solid budget frees up money for your emergency fund. That emergency fund gives you the confidence to invest for the long haul. This holistic view is the true power of financial literacy.

How Financial Skills Shape Your Investor Identity

Financial literacy isn't some rigid, one-size-fits-all checklist. Think of it more as a dynamic skillset you adapt to your own personal goals. The knowledge a brand-new investor needs is worlds apart from what a seasoned real estate pro relies on every single day. The real key is understanding what financial literacy means for your path—that’s how you turn abstract concepts into actual wealth.

Your investor identity really dictates which skills you need to sharpen. It's like a toolbox: a carpenter and a plumber might own the same hammer, but they use completely different tools to get their respective jobs done. In the same way, different investors have to master specific financial skills to win in their chosen arena. This focused approach is what separates people who just save money from those who strategically build a legacy.

The Beginner Investor

When you're just starting out, the name of the game is building foundational habits. The goal isn't to hit a home run by picking the next hot stock; it's to develop the discipline that makes long-term investing even possible. This all starts with mastering the art of living below your means and making those first, crucial, consistent investments.

The single most important skill here is automating savings and investments. It’s a simple move, but it takes emotion and indecision completely out of the picture, forcing you to pay yourself first. You also need to get a handle on the basics of compound interest and the mental games that investing can play with you. In our article about how money psychology controls your investment decisions, we dig into how your mindset can be your greatest asset or your worst enemy.

The Stock Market and Real Estate Investor

Once you start to specialize, the required skills go much deeper. A stock market investor has to learn how to dissect a company’s financial health. That means poring over balance sheets and income statements to figure out its real value, not just what the ticker price says.

A real estate investor, on the other hand, needs a totally different set of analytical chops. Their success lives and dies by their ability to accurately calculate cash flow, capitalization rates (cap rates), and return on investment (ROI) for any given property. For instance, a financially savvy investor doesn't just glance at the asking price; they'll use an investment property calculator to project expenses like vacancies, repairs, management fees, and taxes to see if a deal actually makes money.

The Crypto and Generational Wealth Builder

Diving into newer, more volatile assets like cryptocurrency requires an even more specialized toolkit. A crypto investor absolutely must have a rock-solid grasp of risk management and portfolio allocation. Understanding the tech behind the coin and being able to spot the difference between a legitimate project and pure hype is everything.

Meanwhile, the generational wealth builder is playing the longest game of all. Their focus is on estate planning, tax optimization, and asset protection. They concentrate on building structures like trusts and using tax-advantaged accounts to make sure their wealth is passed down efficiently to the next generation.

Financial literacy isn't about knowing everything. It's about knowing what matters for the path you've chosen and mastering those specific skills with absolute precision.

This generational focus highlights a pretty interesting point: there's a clear knowledge gap between different age groups. Recent survey data reveals that only 36% of Gen Z adults scored between 51% and 100% on financial literacy tests, a big drop from the 59% of baby boomers. The silver lining? 52% of Gen Z say that today's economic uncertainty has motivated them to get smarter with their money—a very promising trend for the future.

To help you see where you might fit in, the table below breaks down the most critical skills needed for different types of investors.

Key Financial Literacy Skills by Investor Type

This table contrasts the essential skills for various investment paths, giving you a clear idea of which areas you might need to work on to reach your goals.

| Investor Profile | Primary Goal | Essential Financial Skill |

|---|---|---|

| The Beginner Investor | Build consistent investing habits. | Automating savings and understanding compound interest. |

| The Stock Market Investor | Identify undervalued companies for long-term growth. | Financial statement analysis and market valuation. |

| The Real Estate Investor | Generate passive income through property. | Cash flow analysis and calculating return on investment. |

| The Crypto Investor | Capitalize on a high-growth, high-risk asset class. | Risk management and understanding blockchain technology. |

| The Generational Wealth Builder | Preserve and transfer wealth across generations. | Estate planning and advanced tax optimization strategies. |

At the end of the day, figuring out your investor profile is the first real step. When you focus on the skills that are most relevant to your personal ambitions, you put yourself on the fast track to financial mastery.

Taking Stock of Your Current Financial Knowledge

Before you can build a stronger financial future, you have to get a clear picture of where you stand today. Improving your financial literacy really starts with a little self-awareness—figuring out what you already know and, just as importantly, where the gaps are. This isn't about passing some test; it's about creating a personal roadmap for growth.

Think of it like a personal financial health checkup. An honest look at your habits and your current knowledge base lets you focus your energy where it will make the biggest impact. The whole point is to move from a place of uncertainty to one of clarity, so you can start taking actions that actually move the needle.

A Quick Self-Assessment Quiz

Let's get started. Ask yourself these straightforward questions. Your answers will quickly show you where you're already strong and what areas might be ripe for improvement.

- Compound Interest: Could you explain how compound interest works to a friend in 60 seconds or less?

- Credit Score: Do you know your exact credit score right now and the top two factors that are influencing it?

- Debt Details: Are you aware of the interest rates on all your debts, from credit cards to car loans?

- Net Worth: Could you calculate your net worth today without having to look up the formula? Learn more about this crucial metric with our simple guide on how to calculate net worth.

- Insurance Coverage: Do you know what your insurance policies (health, auto, home) actually cover and what your deductibles are?

If you answered "no" or "I'm not sure" to a few of these, that’s perfectly fine. In fact, it's great! It just gives you a clear, specific place to start.

Recognizing the Red Flags

Sometimes, our daily habits are the best indicators of our financial literacy. Low financial literacy often shows up as recurring, stressful money problems that feel impossible to escape. Recognizing these patterns is the first step toward finally breaking them.

The table below contrasts some common signs of low financial literacy with the habits of someone who is financially confident. See which column feels more like your current situation.

| Red Flags of Low Financial Literacy | Habits of High Financial Literacy |

|---|---|

| Chronic Overdraft Fees: Frequently spending more than what's in your account. | Consistent Budgeting: Actively tracking income and expenses to stay within your means. |

| Money Anxiety: Feeling stressed or avoidant when discussing finances. | Proactive Planning: Regularly reviewing financial goals and adjusting as needed. |

| Late Payment Penalties: Often missing due dates for bills and credit cards. | Automated Payments: Using technology to ensure bills are always paid on time. |

| No Emergency Savings: Having no financial cushion for unexpected expenses. | Prioritized Savings: Maintaining a dedicated emergency fund with 3-6 months of expenses. |

Identifying with the left column isn't a sign of failure—it's an opportunity. Each one of those red flags is a signal pointing you toward a specific skill you can build. By taking an honest inventory of your knowledge and habits, you can turn that vague financial stress into a clear, actionable plan for building lasting confidence and control.

Your Action Plan for Becoming Financially Savvy

Knowing about money and actually doing something with it are two very different things. Knowledge without action is just trivia. To really get a handle on your finances, you have to put what you learn into practice. This is your game plan—a straightforward, step-by-step guide to boosting your financial intelligence, starting with small things you can do today.

The key here is building momentum. Getting better with money is a marathon, not a sprint. It’s all about stringing together small, consistent wins that add up to massive long-term gains in both your confidence and your net worth.

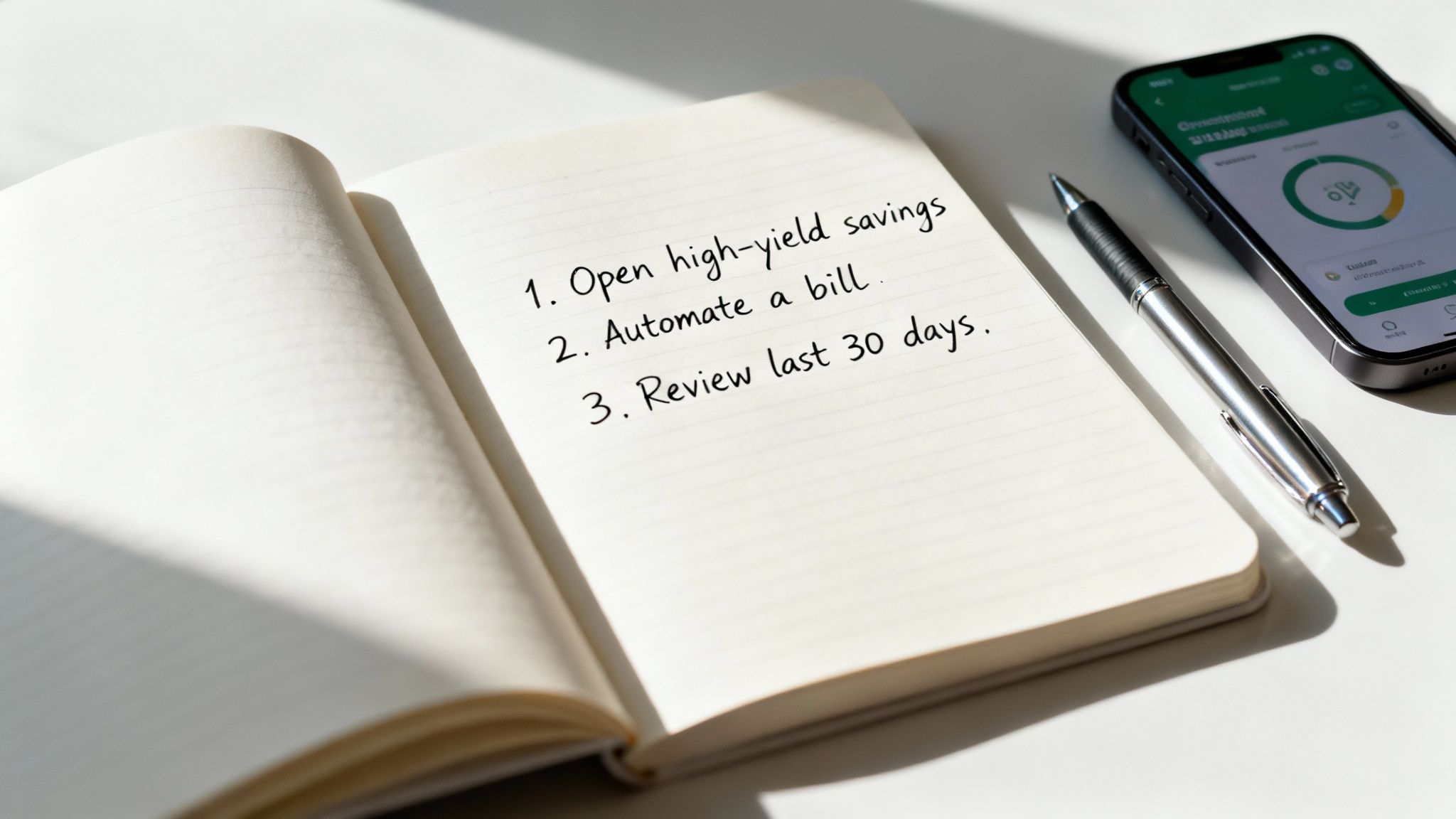

Start with Small Wins Today

Trying to fix your entire financial life overnight is a surefire way to get overwhelmed and quit. So don't do that. Instead, just pick one or two of these simple actions to knock out this week. Think of them as the first few bricks in a solid financial foundation.

Do a 30-Day Forensic Audit: Log into your bank account and see where your money really went over the last month. Don't judge, just observe. Grab a notebook or a simple app and categorize every expense. The goal is pure, unfiltered awareness. You can't change what you don't see.

Automate One Bill: Pick one recurring bill—your phone, a streaming service, anything—and set it on autopilot. This tiny action frees up mental space and helps you dodge those infuriating late fees. It's a simple first step toward better cash flow management.

Open a High-Yield Savings Account (HYSA): This honestly takes about 15 minutes online. HYSAs pay way more interest than the dusty old savings account at your traditional bank, so your money starts working for you immediately. Kickstart your emergency fund by moving your first $100 into it.

These tasks might seem small, but they create a huge psychological shift. You’re no longer just a passenger watching your finances happen; you're in the driver's seat.

Curate Your Financial Education

Once you start taking action, you'll need good information to keep the momentum going. The internet is a firehose of financial noise, so it’s critical to find sources you can trust. A focused learning path will get you much further than randomly clicking on articles or watching videos.

Here’s a quick breakdown of where to find solid info.

| Resource Type | Best For | Top Recommendation | Why It Works |

|---|---|---|---|

| Books | Deep, foundational knowledge and timeless principles. | The Simple Path to Wealth by JL Collins | It cuts through the jargon and simplifies investing and wealth-building into a strategy anyone can follow. |

| Podcasts | Learning on the go and hearing diverse perspectives. | The Ramsey Show | Delivers practical, no-nonsense advice for getting out of debt and building a solid financial life from the ground up. |

| Government Sites | Unbiased, authoritative information on financial rules. | Investor.gov | Run by the SEC, it's packed with objective tools and resources to help you invest wisely without any sales pitch. |

The goal isn’t to consume endless content. It’s to find a few trusted voices that click with you and—this is the most important part—actually apply their advice to your own life.

Build Your Financial Toolkit

As you learn more, you'll want better tools. Thankfully, modern apps can automate tasks that used to take hours of manual work, making it easier than ever to implement what you're learning. To get a better handle on this, check out our guide on setting SMART financial goals for a prosperous future, which shows you how to turn your big ideas into an actionable plan.

- Budgeting Apps: Tools like YNAB (You Need A Budget) or Mint are game-changers. They help you track spending, set goals, and see your entire financial world in one spot.

- Investment Platforms: Brokerages like Fidelity or Vanguard have made it incredibly easy to open an IRA or brokerage account and start investing, even with just a little bit of money.

- Credit Monitoring Services: Use a free service like Credit Karma to keep an eye on your credit score and, more importantly, understand the factors that are driving it up or down.

By blending small, consistent actions with a curated education and the right tools, you create a powerful system for growth. This is exactly how you turn financial literacy from a vague concept into a real-world skill that pays you back for the rest of your life.

Frequently Asked Questions About Financial Literacy

1. What's the very first step to becoming financially literate?

The single best first step is to track your money for 30 days. Don't change anything; just observe. Log every dollar that comes in and every dollar that goes out using a notebook or a simple app. This act of awareness provides the crucial data you need to make informed decisions later.

2. How is being financially literate different from being rich?

Being rich is about having a high net worth or income at a specific moment in time. Financial literacy is the knowledge and skill set required to build, manage, and sustain wealth over the long term. Someone can become rich through luck (like a lottery win) but lose it all without financial literacy. Conversely, a person with modest income can build significant wealth over time through literate financial practices.

3. I have a lot of debt. Should I pay it off before I start investing?

This is a common dilemma. The answer often comes down to interest rates. A widely accepted strategy is to pay off any high-interest debt (typically anything over 7-8%, like credit cards) as aggressively as possible, as the interest you're paying is likely higher than what you could reliably earn in the market. For low-interest debt (like some mortgages or student loans), it can make mathematical sense to invest while making minimum payments, especially if your employer offers a 401(k) match.

4. What is the most important financial concept to understand?

Compound interest is arguably the most powerful force in finance. It's the concept of your earnings generating their own earnings. Understanding how it works—both for you (in investments) and against you (in debt)—is fundamental to building long-term wealth.

5. How can I teach my kids about financial literacy?

Start with three simple concepts: earning, saving, and spending. A clear jar for savings makes the concept tangible. Link allowance to chores to teach the concept of earning. When they want to buy something, guide them through the decision of spending their saved money. Involving them in small family financial discussions, like budgeting for a vacation, can also be highly effective.

6. Is it ever too late to improve my financial literacy?

Absolutely not. The principles of sound financial management—budgeting, saving, investing, and managing debt—are effective at any age. While starting earlier provides more time for compounding, taking control of your finances today will put you in a significantly better position for tomorrow, regardless of your starting point.

7. What's the difference between a 401(k) and an IRA?

A 401(k) is an employer-sponsored retirement plan, often with a company match (which is essentially free money). An IRA (Individual Retirement Account) is something you open on your own. Both offer tax advantages for retirement savings but have different contribution limits and rules.

8. How much do I need for an emergency fund?

The standard recommendation is three to six months' worth of essential living expenses. This includes costs like housing, utilities, food, and transportation. If your income is unstable or you have dependents, aiming closer to six months is a safer bet. This fund should be kept in a liquid, easily accessible account like a high-yield savings account.

9. Do I need a financial advisor?

It depends on your confidence and the complexity of your situation. Many people successfully manage their own finances using low-cost index funds. However, if you're dealing with a complex situation (like inheritance, business ownership, or estate planning) or simply feel overwhelmed, a qualified, fee-only financial advisor can provide valuable guidance and accountability.

10. My credit score is low. What's the quickest way to improve it?

Two factors have the biggest impact on your credit score: your payment history and your credit utilization ratio (how much of your available credit you're using). The fastest way to see improvement is to make all your payments on time and pay down your credit card balances to get your utilization below 30% of your total credit limit.

This article is for educational purposes only and is not financial or investment advice. Consult a professional before making financial decisions.