Wealth taxes are reshaping how investors think about their portfolios. Whether your country is considering them or already implementing them, understanding their impact matters for your financial future.

At Top Wealth Guide, we’ve created this guide to help you navigate the complexities of wealth taxation and adjust your investment strategy accordingly.

In This Guide

What Are Wealth Taxes and Where Do They Actually Exist?

How Wealth Taxes Work

Wealth taxes operate differently than the income taxes most investors know. Instead of taxing what you earn each year, they tax what you own, calculated as a percentage of your total net worth. This fundamental difference creates unique challenges for both governments and investors.

The Global Reality: Four Countries Still Tax Wealth

The OECD data tells a stark story: by 2021, only four OECD countries still imposed net wealth taxes-Colombia, Norway, Spain, and Switzerland. France abandoned its wealth tax in 2018 and replaced it with a real estate-specific tax instead. Germany’s constitutional court ruled its wealth tax unconstitutional in 1997, and the Netherlands Supreme Court struck down its version in 2021 and again in 2024. The pattern is unmistakable: wealth tax revenue shortfalls in OECD countries demonstrate that wealth taxes fail to deliver the revenue governments expected.

Norway’s 1% wealth tax prompted high-net-worth individuals to relocate. Spain’s solidarity wealth tax, which ranges from 1.7% to 3.5% on assets above EUR 3 million, generated far less revenue than projected and triggered moves to Portugal. When Spain combines its net wealth tax with personal capital income taxes, marginal effective tax rates exceed 100%-meaning your real investment returns disappear entirely to taxes. Switzerland maintains the highest wealth tax revenue relative to its size at about 1.19% of GDP in 2022, but even that represents only 4.35% of total tax revenue. The reason wealth taxes fail is straightforward: they cost too much to administer and people avoid them too easily. Valuing privately held businesses, tracing wealth through trusts and family structures, and preventing capital flight consume enormous resources while producing minimal revenue.

The U.S. Situation: Theoretical Risk, Real Debate

The United States currently has no federal wealth tax, though proposals circulated during recent presidential campaigns. Senators Bernie Sanders and Warren both advocated for wealth taxes targeting nearly all holdings of the very wealthy. These proposals face serious constitutional obstacles stemming from the 1895 Pollock v. Farmers’ Loan & Trust decision, which established that direct taxes must be apportioned among states. Any U.S. wealth tax would require either a constitutional amendment or a creative legal interpretation that most experts consider unlikely.

For American investors, wealth tax risk remains theoretical for now, but the conversation persists. If implemented, a 1% federal wealth tax would dramatically increase the effective tax rate on capital income. Depending on your asset type, combined federal rates could reach 48.8% to 65.8% when layered with existing capital gains and investment income taxes. This would eliminate the step-up in basis at death, a key estate planning advantage that currently allows heirs to inherit assets without owing capital gains taxes on appreciation.

Why This Matters for Your Portfolio

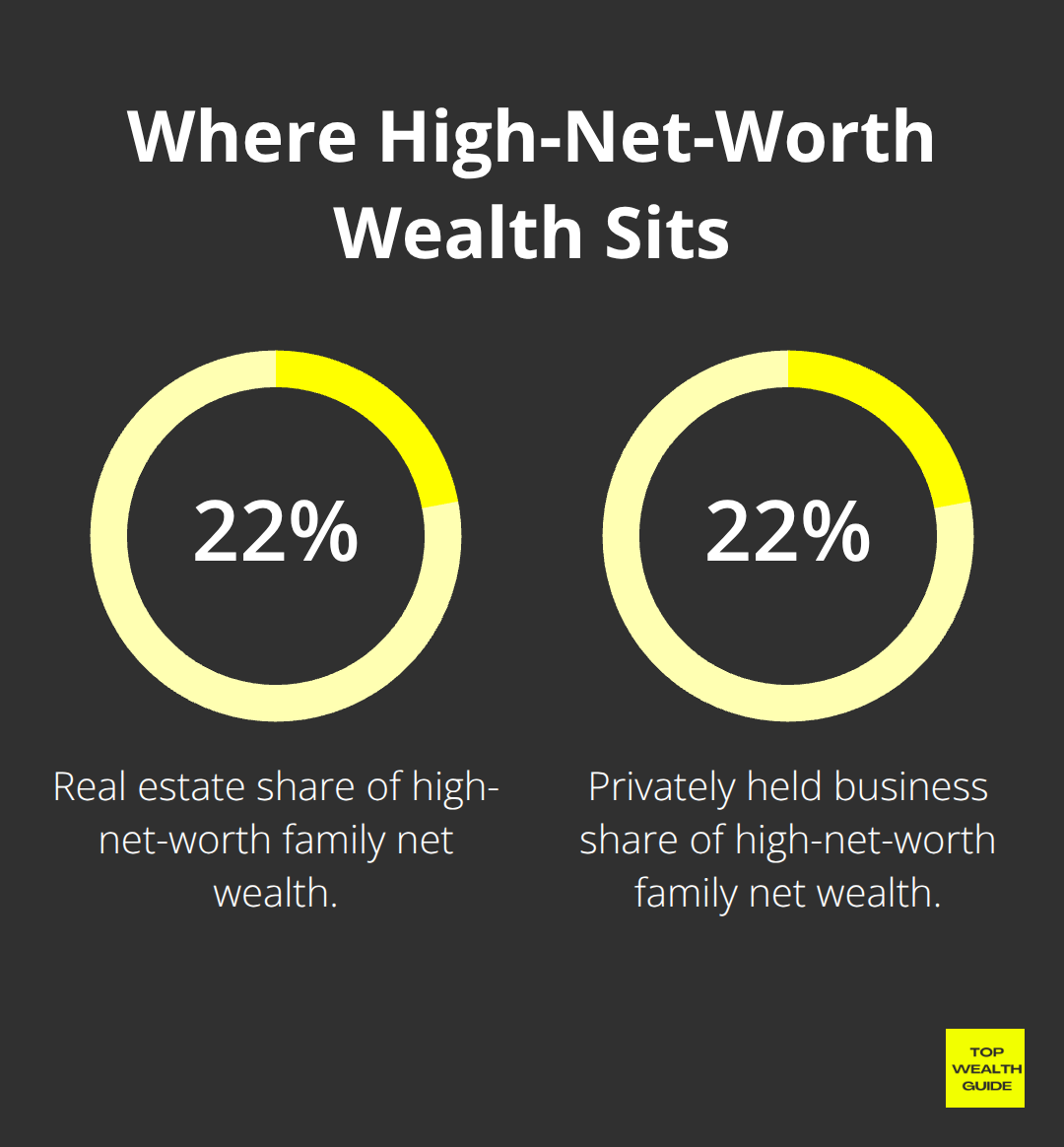

For investors with significant real estate holdings or alternative investments, the implications would be severe. Real estate represents roughly 22% of net wealth among high-net-worth families, and privately held businesses account for another 22%. A wealth tax would force difficult decisions about asset structure, leverage, and geographic location that most investors today don’t face. Understanding how these taxes could reshape your investment decisions requires examining the specific portfolio impacts that would follow implementation.

How Wealth Taxes Reshape Your Portfolio Decisions

The Math Behind Wealth Tax Drag

A wealth tax fundamentally changes how you should structure your investments because it attacks net worth rather than income or gains. If implemented, the math becomes brutal. Spain’s experience shows that combining a 1.7% to 3.5% wealth tax with capital income taxes creates marginal effective tax rates exceeding 100%. This means you lose money on safe, low-return assets like bonds simply from the wealth tax alone, regardless of what those bonds earn. Your investment strategy must shift away from the conventional wisdom of diversification across asset classes toward concentration in assets that generate returns high enough to offset wealth tax drag.

Real Estate and Alternative Investments Face Pressure

Building wealth with real estate and alternative investments face particular pressure because they’re difficult to value, easy to trace, and likely to draw regulatory scrutiny in any wealth tax system. Norway’s experience demonstrates this directly: when the 1% wealth tax took effect, high-net-worth individuals relocated to avoid it, taking their capital elsewhere. For investors holding significant real estate or private business stakes, a wealth tax would force immediate decisions about whether to hold for long-term appreciation or liquidate to reduce taxable net worth.

The step-up in basis disappears under wealth tax proposals, meaning heirs would owe capital gains taxes on inherited appreciation rather than receiving a clean slate. This alone justifies reconsidering whether to hold concentrated positions in real estate or private equity until death, since those positions become tax liabilities for your heirs.

Three Concrete Actions to Take Now

Your tactical response should focus on three concrete actions. First, accelerate income-producing asset transfers to tax-advantaged accounts now, while the step-up in basis still exists. The 2026 estate and gift tax exemption sits at $15 million per individual, and annual gift exclusions allow $19,000 per recipient. Use these limits aggressively to move appreciated assets into trusts or directly to heirs before any wealth tax materializes.

Second, evaluate whether holding private businesses or concentrated real estate positions makes sense at your current net worth level. If your net worth exceeds $10 million and you hold more than 40% in real estate or illiquid assets, wealth tax exposure becomes material in any realistic proposal. Consider diversifying into liquid, high-growth equities that are easier to manage under a wealth tax regime and generate returns that outpace the tax drag.

Third, document your asset valuations meticulously now. Switzerland’s cantonal wealth taxes and Spain’s solidarity tax both create valuation disputes that consume years and legal fees. Maintain detailed cost basis records, professional appraisals for real estate and businesses, and clear documentation of asset ownership to prevent disputes if a wealth tax appears.

Preparing Your Strategy Before Implementation

The time to prepare is before implementation, not after. Valuation challenges alone justify starting this work immediately. If a wealth tax proposal gains traction in your jurisdiction, the window to restructure your holdings closes quickly. Investors who wait until legislation passes face forced sales, rushed decisions, and higher transaction costs. Those who act now position themselves to make deliberate choices about asset location, leverage, and diversification that align with their long-term goals rather than react to sudden tax changes. Understanding how to structure your portfolio for potential wealth tax scenarios requires examining the specific tax-efficient investment approaches that work best under these constraints.

Restructure Your Portfolio Before a Wealth Tax Arrives

Wealth tax implementation forces immediate portfolio restructuring, and investors who act before legislation passes position themselves most effectively. The window for deliberate decision-making closes the moment a wealth tax proposal gains legislative traction. Your strategy must shift from conventional diversification toward intentional asset placement that minimizes exposure to wealth tax drag while maintaining growth potential.

Identify Assets That Cannot Justify Their Tax Burden

Start by identifying which assets in your portfolio generate returns insufficient to justify their wealth tax burden. A bond yielding 4% annually faces a wealth tax drag that consumes a significant portion of that return. In Spain’s scenario where marginal effective tax rates exceed 100%, you lose wealth simply holding low-yield assets. This forces a difficult but necessary calculation: does this asset belong in your portfolio at all, or should you redeploy that capital into higher-return investments that generate sufficient income to absorb wealth tax costs?

The answer depends on your specific net worth, risk tolerance, and investment timeline, but the framework remains constant. High-growth equities, private equity positions with 15% to 20% annual returns, and alternative investments that compound aggressively become more attractive under wealth tax scenarios because their returns outpace the annual tax drag. Conversely, dividend stocks yielding 2% to 3% and investment-grade bonds become liabilities rather than portfolio stabilizers.

Accelerate Wealth Transfer While Current Rules Exist

The 2026 annual gift exclusion allows you to transfer $19,000 per recipient without triggering gift taxes, or $38,000 if you’re married and your spouse consents to split gifts. For investors with net worth exceeding $10 million, this represents a concrete opportunity to move appreciated assets into the hands of heirs or trusts now, before any wealth tax materializes. A parent with $15 million in net worth can transfer approximately $76,000 annually to four adult children through annual exclusions alone, reducing taxable net worth by $912,000 over a decade without consuming any of the $15 million lifetime exemption.

More aggressive strategies involve establishing grantor retained annuity trusts (GRATs) or intentionally defective grantor trusts (IDGTs) that transfer future appreciation to heirs while minimizing gift tax consequences. These structures require professional legal and tax advice, but they become exponentially more valuable if wealth tax risk increases. The step-up in basis disappears under any realistic wealth tax proposal, meaning your heirs currently inherit appreciated assets without owing capital gains taxes on the appreciation that occurred during your lifetime. Once that advantage vanishes, the calculus shifts entirely: holding concentrated positions in real estate or private businesses until death becomes a tax trap rather than a strategy.

Reposition now by converting appreciated real estate into liquid equities within tax-advantaged accounts where possible, or by establishing charitable remainder trusts if philanthropy aligns with your values. These moves reduce your net worth while maintaining investment returns and establishing a defensible position if wealth tax legislation emerges.

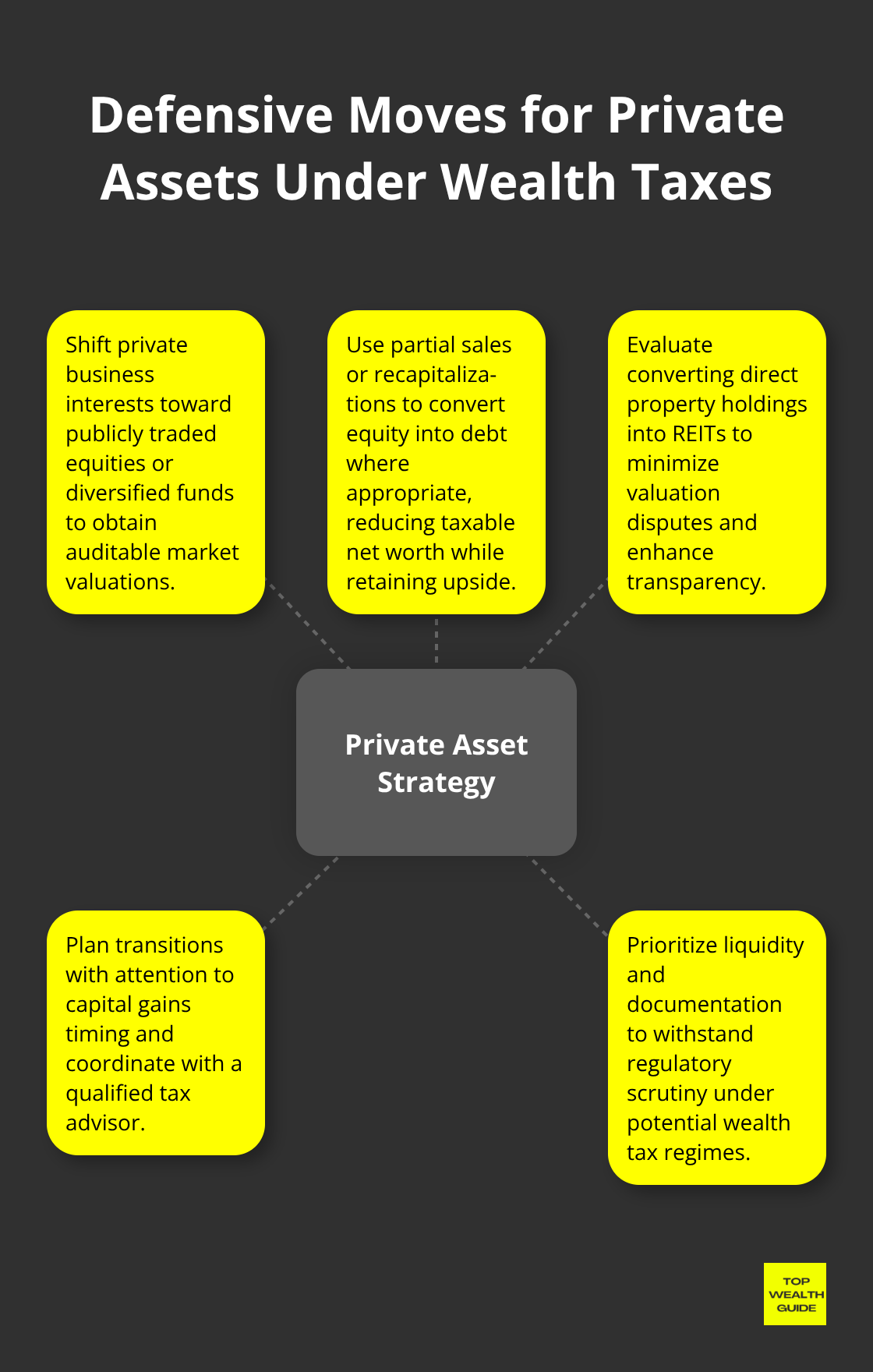

Reposition Private Assets Into Liquid, Auditable Holdings

Private businesses and concentrated real estate positions create valuation disputes that consume legal fees and administrative resources in any wealth tax system. Wealth tax implementation triggers valuation disputes between taxpayers and authorities, as demonstrated by countries with existing wealth taxes. Investors holding 40% or more of net worth in illiquid or privately held assets face disproportionate wealth tax exposure because these assets invite regulatory scrutiny and valuation challenges.

Transition privately held business interests into publicly traded equity positions or diversified fund holdings that generate auditable market valuations. If you own a successful business valued at $5 million, consider a partial sale or recapitalization that converts your stake into both equity and debt instruments; the debt portion reduces your taxable net worth while the equity portion maintains upside exposure. Real estate investors should evaluate whether holding multiple properties justifies the wealth tax burden compared to converting properties into real estate investment trusts (REITs) where valuations are transparent and defensible.

REITs generate dividend income that appears on tax returns as ordinary income, but they eliminate the valuation disputes that plague direct property ownership under wealth tax regimes. This approach sacrifices some tax efficiency in the current environment but positions you defensively against future wealth tax scenarios. The transition requires careful attention to capital gains taxes and timing, which means consulting a tax advisor becomes essential rather than optional.

Final Thoughts

Wealth taxes represent a genuine threat to investment portfolios, even if implementation remains uncertain in the United States. The evidence from countries that have implemented them shows a consistent pattern: administrative costs exceed revenue, capital flight accelerates, and investors face marginal effective tax rates that eliminate returns on conservative assets. Your response should not wait for legislation to pass.

The investors who suffer most are those who delay restructuring their holdings. Start by identifying which assets in your portfolio generate returns too low to justify their wealth tax burden-bonds yielding 4% and dividend stocks yielding 2% to 3% become liabilities under wealth tax scenarios because the annual tax drag consumes a material portion of returns. Simultaneously, accelerate wealth transfers to heirs and trusts using current annual gift exclusions and lifetime exemptions while the step-up in basis still exists, since the 2026 annual gift exclusion of $19,000 per recipient represents concrete opportunity to reduce your taxable net worth without consuming your lifetime exemption.

Reposition private assets into liquid, auditable holdings to eliminate valuation disputes that consume legal fees and administrative resources. Real estate and privately held businesses invite regulatory scrutiny, so converting concentrated positions into REITs or diversified equity holdings creates defensible valuations that withstand scrutiny. Track legislative developments at the federal and state level, particularly proposals that gain committee attention or bipartisan support, and visit Top Wealth Guide for practical strategies and market insights to help you navigate complex financial decisions that align with your specific circumstances.