Generational wealth planning is the strategic process of managing your assets—money, property, investments—so they can be passed down successfully through multiple generations. It's not just about leaving an inheritance; it’s about creating a thoughtful, long-term strategy to provide your family with a foundation for financial security and opportunity for years to come.

Think of it as ensuring the wealth you’ve worked so hard for continues to support and empower your loved ones long after you're gone.

In This Guide

- 1 Why Generational Wealth Planning Is Crucial Today

- 2 The Four Pillars of a Lasting Financial Legacy

- 3 Using Real Estate to Build Your Legacy Brick by Brick

- 4 Navigating Family Dynamics with Clear Communication

- 5 Assembling Your Professional Wealth Team

- 6 Frequently Asked Questions About Generational Wealth Planning

- 6.1 1. What is the difference between a will and a trust?

- 6.2 2. At what net worth should I start generational wealth planning?

- 6.3 3. How often should I review my estate plan?

- 6.4 4. How can I prepare my heirs to handle an inheritance?

- 6.5 5. What is the "step-up in basis" and why does it matter?

- 6.6 6. Can I use life insurance for generational wealth planning?

- 6.7 7. What happens if I die without a will?

- 6.8 8. Should my spouse and I have a joint estate plan?

- 6.9 9. What's the difference between treating heirs equally vs. equitably?

- 6.10 10. How can I give gifts tax-free while I'm alive?

Why Generational Wealth Planning Is Crucial Today

Building generational wealth is like planting a tree whose shade you may never enjoy. You’re not just accumulating money; you're creating a structure that can help your children, grandchildren, and even great-grandchildren get a powerful head start in life. It could be the down payment on a first home, the seed money for a business, or an education free from crushing debt.

This forward-thinking approach has never been more critical. We are living through a massive economic shift known as the "Great Wealth Transfer," which is reshaping family finances on a global scale. This isn’t an abstract future event—it's happening right now.

Understanding the Great Wealth Transfer

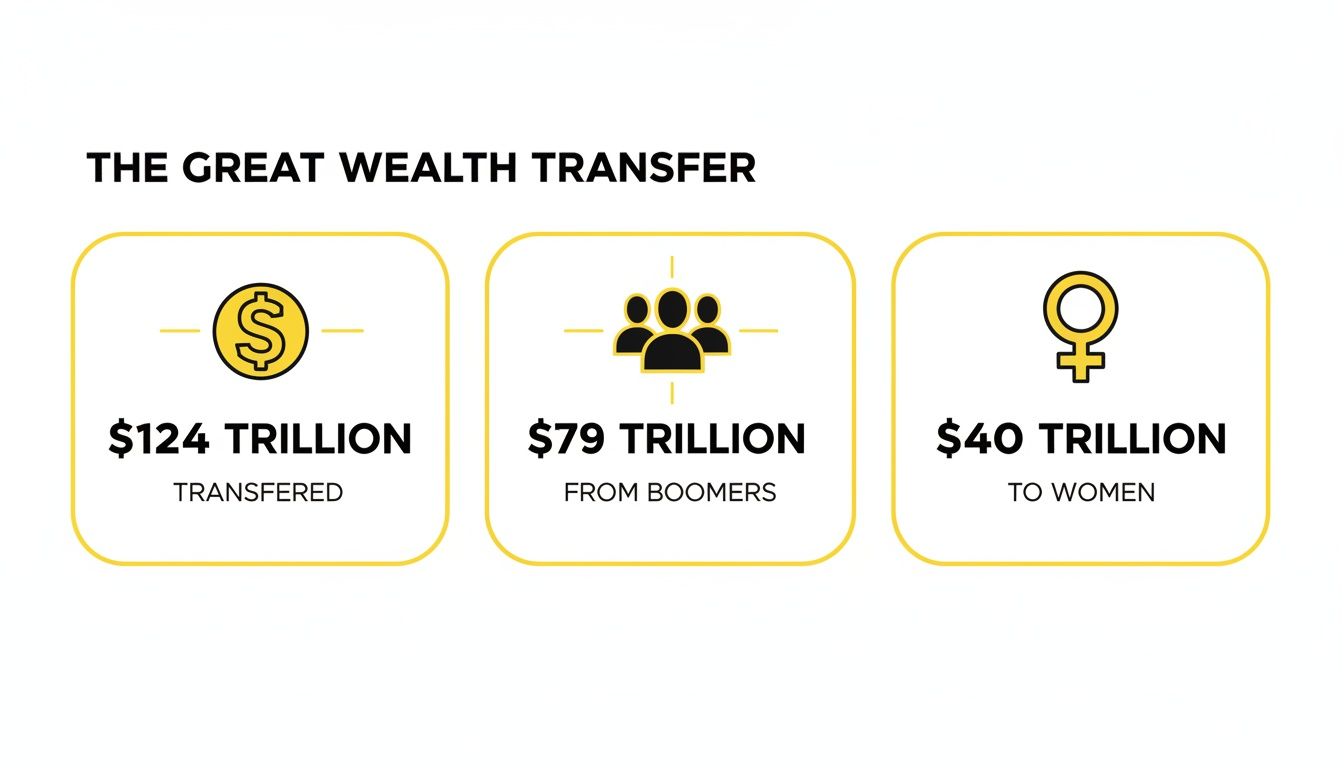

The Great Wealth Transfer is a colossal movement of assets from older generations, primarily Baby Boomers and the Silent Generation, to their heirs. The numbers are staggering. A 2025 report from Cerulli Associates projects that an estimated $124 trillion will change hands by 2048 in the U.S. alone.

Of that, a massive $79 trillion will come from Baby Boomers, flowing down to Gen X, Millennials, Gen Z, and charitable causes. You can read the full research on these wealth transfer projections on Fortune to fully grasp the scale of what's happening.

This infographic breaks down the key figures of this historic event.

The data makes it clear: a monumental amount of wealth is in motion. This presents a once-in-a-lifetime opportunity for families who are prepared, but it also carries huge risks for those who aren’t.

Without a solid plan, this incredible opportunity can vanish surprisingly fast. We've all heard the "shirtsleeves to shirtsleeves in three generations" proverb, and the statistics back it up. A huge portion of inherited wealth is often lost by the second or third generation due to poor planning, family conflicts, or a simple lack of financial know-how.

This is where generational wealth planning makes all the difference. It moves beyond just transferring assets and focuses on building a lasting framework through:

- Financial Education: Equipping heirs with the skills to manage wealth responsibly.

- Shared Values: Bringing the family together around a common purpose for their legacy.

- Strategic Structures: Using legal tools like trusts and estate plans to shield assets from unnecessary taxes, creditors, and poor decisions.

Ultimately, the goal is to build a legacy of opportunity that lasts. It’s about thinking bigger and learning how to define wealth beyond money and possessions.

The Four Pillars of a Lasting Financial Legacy

Creating a financial legacy that endures isn't about one single decision. It's a carefully coordinated strategy built on several essential components. Think of it like building a house meant to weather any storm—you need a solid foundation and strong, interconnected pillars to ensure it stands for generations.

These four pillars work together to shield your assets from risk, encourage growth, and ensure your legacy passes to your loved ones smoothly and with purpose. Breaking it down this way makes the whole process feel much more manageable. Each pillar tackles a specific part of your financial life, from the legal paperwork that spells out your wishes to the smart strategies that keep your wealth growing long after you’re gone.

Pillar 1: Foundational Estate Planning

This is the absolute bedrock of your entire plan. Foundational estate planning is all about creating the essential legal documents that give voice to your wishes and protect your family. Without them, your life's work could get tangled up in probate—a lengthy, public, and often expensive court process. Worse, the state gets to decide who gets what, not you.

The core tools here are non-negotiable:

- A Will: This is your direct instruction manual for what happens to your assets. It names an executor to carry out your plans and, crucially, names guardians for any minor children.

- Powers of Attorney: These documents are lifesavers if you become unable to manage your own affairs. A durable power of attorney for finances lets a trusted person handle your money, while a healthcare power of attorney empowers them to make medical decisions for you.

Real-Life Example: The Johnson family had a clear will that outlined how their family home and savings should be divided among their three children. When they passed, the executor settled the estate in just a few months. Their neighbors, who died without a will, left their family to face years of infighting and costly legal battles in probate court.

Pillar 2: Strategic Investment and Growth

Keeping the wealth you have is only half the battle; you also have to grow it. Strategic investing is what ensures your assets outpace inflation and continue to build value for the next generation. A well-designed portfolio is the engine of your financial legacy, constantly working to create new opportunities for your heirs.

This pillar isn’t about chasing hot stock tips or short-term fads. It’s about building a long-term vision with a mix of assets that match your family's goals and comfort with risk. If you're looking to dive deeper, you can learn more about how to effectively manage your wealth for long-term growth in our detailed guide.

Common investment vehicles that stand the test of time include:

- Stocks and Bonds: A balanced mix of equities (stocks) provides the potential for growth, while bonds offer stability and predictable income.

- Real Estate: Rental properties can generate a steady stream of cash flow and appreciate significantly over decades, becoming a tangible asset to pass down.

- Business Ownership: A family business can be a powerful wealth-creation machine, provided there's a clear succession plan in place.

Pillar 3: Advanced Trust Structures

If a will is the basic instruction manual, think of a trust as the complete, detailed playbook. A trust is a legal entity that you create to hold and manage assets for your beneficiaries. It offers a level of control, privacy, and protection that a simple will just can't match. This table compares the two most common types:

| Feature | Revocable Living Trust | Irrevocable Trust |

|---|---|---|

| Flexibility | You can change or cancel it at any time. | Generally cannot be changed or canceled once created. |

| Primary Benefit | Avoids probate; maintains your control during your lifetime. | Provides asset protection from creditors and can remove assets from your taxable estate. |

| Best For | Most families who want a straightforward way to manage assets and skip probate. | High-net-worth individuals focused on tax reduction and creditor protection. |

By using an irrevocable trust, for example, you could specify that a grandchild's inheritance can only be used for education or a down payment on a first home. This ensures the money is used exactly as you intended.

Pillar 4: Tax-Efficient Transfer Tactics

The final pillar is all about making sure your heirs get to keep as much of your legacy as possible by legally minimizing the tax bite. Without a smart plan, a huge chunk of your estate could be lost to federal and state taxes. But with a few proactive strategies, you can significantly reduce that burden.

Key tactics to discuss with your advisor include:

- Strategic Gifting: The IRS allows you to gift a certain amount to anyone you want each year, completely tax-free. For 2024, that annual gift tax exclusion is $18,000 per person. Done consistently, this is a simple way to reduce the size of your taxable estate over time.

- Step-Up in Basis: This is a powerful tax provision. When an heir inherits an asset like a stock portfolio or a piece of real estate, its original cost basis is "stepped up" to its fair market value on the date of death. This can wipe out or drastically reduce the capital gains taxes they would owe if they decide to sell the asset.

Core Components of Generational Wealth Planning

Here’s a quick summary of how these four pillars come together to form a complete strategy. Each one has its own set of tools and a clear objective, but they are most powerful when they work in harmony.

| Pillar | Key Tools and Instruments | Primary Goal |

|---|---|---|

| Foundational Estate Planning | Wills, Powers of Attorney, Healthcare Directives | To legally document your wishes and avoid probate court. |

| Strategic Investment & Growth | Stocks, Bonds, Real Estate, Business Interests | To grow assets over the long term, outpacing inflation. |

| Advanced Trust Structures | Revocable Living Trusts, Irrevocable Trusts | To provide asset protection, control, and privacy. |

| Tax-Efficient Transfers | Strategic Gifting, Step-Up in Basis, Life Insurance | To minimize estate, gift, and capital gains taxes. |

By weaving these four pillars into a single, cohesive strategy, you move beyond simply leaving money behind. You create a resilient and thoughtful generational wealth plan that preserves not only your assets but also your values, securing your family’s future for decades to come.

Using Real Estate to Build Your Legacy Brick by Brick

When you think about building wealth that lasts, it's hard to ignore real estate. Unlike stocks and bonds, property is something you can see and touch—a tangible piece of your legacy. It’s more than just a home or an office building; it's a powerful engine for creating wealth that can support your family for generations.

The right properties can generate income, grow in value, and even provide some fantastic tax advantages. This isn’t about just buying a house and calling it a day. It’s about strategically building a portfolio that acts as a financial foundation for your family, brick by brick.

Core Real Estate Strategies for Legacy Building

For families who are serious about creating lasting wealth, a few real estate strategies stand out. These go beyond basic ownership and are designed to maximize what you can pass down while minimizing the tax bite and other headaches for your heirs.

Two of the most powerful concepts are building a portfolio of income-producing properties and understanding the magic of the "step-up in basis."

- Investment Properties for Passive Income: Owning rental properties, whether they’re single-family homes or commercial buildings, creates a steady stream of cash. You can use that income to buy more properties, support your family’s goals, or simply let it compound while the property itself hopefully appreciates over time.

- The Power of Step-Up in Basis: This is a huge deal for anyone inheriting property. When an heir receives a property, its cost basis is "stepped up" to whatever it's worth on the date of the owner's death. This means if they turn around and sell it, they only owe capital gains tax on the growth that happens after they inherit it, potentially saving them tens or even hundreds of thousands of dollars.

Advanced Tools for Property Transfer

Once you get into more complex planning, there are specialized tools that can help you transfer property with incredible efficiency and control. These legal instruments are designed to move high-value real estate out of your taxable estate, often while letting you keep some control during your lifetime.

A Qualified Personal Residence Trust (QPRT) is a fantastic example. A QPRT is an irrevocable trust where you can place your primary or second home for a specific number of years. You get to keep living there, business as usual. But when the term is up, the home officially passes to your kids or other beneficiaries—and its value for gift tax purposes was locked in at a much lower rate years ago.

Real Estate in Action: A Family Legacy Scenario

Think of the Chen family. They started small, buying a duplex in their city back in the 1980s. Over 30 years, they used the rental income to pay down the mortgage and reinvested in two more properties. By the time they retired, they owned them all outright.

This portfolio did much more than just fund their retirement. When their grandkids came along, the Chens used the rental income to open 529 college savings plans. Later, they helped their first grandchild with a down payment on a home, giving them a huge head start. The properties themselves, now worth millions, are set to pass to their children with a stepped-up basis, protecting all that hard-earned value from capital gains taxes.

Real estate’s role in the ongoing Great Wealth Transfer is massive. It’s expected to account for $25 trillion of the $124 trillion in U.S. assets changing hands by 2048, with younger generations showing a strong appetite for housing investments.

Whether you're just getting started or already manage a portfolio, understanding how to invest in real estate is a fundamental piece of any solid generational wealth plan.

You can have the most brilliant financial plan on paper, but it can completely unravel without one crucial element: open and honest family communication. The human side of things is often the biggest hurdle in generational wealth planning. Unspoken expectations, secrets, and old family tensions have a nasty habit of derailing even the most carefully crafted strategies.

It's a sobering statistic, but research shows that an incredible 90% of family wealth is gone by the third generation. More often than not, this isn't due to bad investments but a breakdown in communication and trust.

To beat those odds, successful families start thinking about their legacy as a shared mission, not a private affair. It all begins with breaking the old taboo of never talking about money. These conversations are vital for preparing your heirs, managing everyone's expectations, and getting the whole family on the same page about the purpose behind the wealth.

What is Family Governance?

This is where the idea of family governance comes in. Think of it as creating a constitution for your family's financial future. It's a structured way to make decisions together, communicate clearly, and weave your core values into how your wealth is managed for years to come.

A family governance framework isn't about setting rigid, suffocating rules. It's about creating clarity. It gives you a roadmap for tackling complex issues, from teaching the younger generation about financial responsibility to sorting out disagreements before they blow up. It helps ensure your wealth becomes a tool for unity, not a source of division.

Most strong family governance plans include a few key pieces:

- A Family Mission Statement: A short document that spells out your family's values, goals, and the "why" behind the wealth.

- Regular Family Meetings: Scheduled get-togethers to discuss financial updates, learn new things, and talk about charitable goals in an open forum.

- Conflict Resolution Protocols: A pre-agreed process for handling disagreements fairly and constructively.

- Educational Roadmaps: A plan to teach financial literacy to younger family members in an age-appropriate way.

Two Very Different Approaches to Communication

The difference between being proactive with communication and just hoping for the best is night and day. It can genuinely determine whether your plan succeeds or fails. Here’s a quick comparison.

| Communication Style | Proactive Governance | Passive Avoidance |

|---|---|---|

| Financial Discussions | Open, structured, and regular family meetings. | Avoided or held in secret, leading to surprises and distrust. |

| Heir Preparation | Deliberate education on financial literacy and values. | Heirs are left unprepared and may lack the skills to manage wealth. |

| Conflict Handling | Clear protocols for resolving disputes are in place. | Disagreements fester, leading to resentment and legal battles. |

| Outcome for Legacy | High probability of wealth preservation and family unity. | High risk of wealth depletion and fractured relationships. |

Taking this kind of organized approach is a game-changer. For a closer look at the practical steps involved, our guide on how to transfer wealth to the next generation effectively offers more detailed strategies.

Real-Life Example: The Family Bank

The Miller family wanted to empower their children without just writing a blank check. So, they established a "Family Bank"—a formal entity funded with a portion of their estate. Family members could apply for loans for specific things, like college tuition, a business startup, or a down payment on a first home.A family council reviewed each loan application based on clear criteria laid out in their family constitution. This approach taught the younger generation real-world lessons in financial discipline, entrepreneurship, and accountability, all while bringing the family closer. The "bank" transformed their wealth from a simple inheritance into a sustainable engine for opportunity.

Assembling Your Professional Wealth Team

Building a legacy that lasts is not a DIY project. Trying to go it alone is like a CEO trying to run every single department—from legal to finance to marketing—all by themselves. It’s a recipe for burnout and costly mistakes.

Building generational wealth requires a dedicated team of professionals. Think of them as your personal board of directors, each bringing a unique and crucial expertise to the table. They work in concert to navigate the tricky intersections of law, finance, and taxes, turning your vision into a practical, legally sound reality.

Your Core Professional Team

You need a few key players in your corner. These four roles are the pillars of a well-built plan. While you might find a professional who can wear a couple of these hats, it's vital to have dedicated expertise covering each area.

- Estate Planning Attorney: This is the legal architect of your legacy. They’re the ones who draft the ironclad documents—your will, trusts, and powers of attorney—that translate your wishes into legally binding instructions. Their job is to make sure your assets go exactly where you want them to, with as little legal friction (and probate) as possible.

- Certified Financial Planner (CFP®): The CFP® is your team's quarterback. They take a 30,000-foot view of your entire financial world, making sure your investment strategy, retirement plans, and wealth transfer goals all work together. They’re the one who ensures all the moving parts are humming in harmony.

- Certified Public Accountant (CPA): Your CPA is so much more than a tax preparer. In the world of wealth planning, they are your tax strategist. Their real value comes from advising on how to minimize estate taxes, gift taxes, and capital gains, ensuring that your legacy isn't chipped away by Uncle Sam.

- Insurance Specialist: This is your risk manager. They look at your family's situation and protect your estate from life's curveballs. Using tools like life insurance, they can create immediate liquidity to cover estate taxes or provide a tax-free inheritance for your heirs.

Vetting Your Advisors

Choosing the right people is everything. We are in the middle of a massive $83.5 trillion generational handover, and the landscape is shifting. A staggering 81% of younger, high-net-worth inheritors say they will fire their parents' advisors if the firm doesn't meet their modern, values-driven expectations. You can read more about this generational wealth transfer on World Luxury Chamber.

So, when you're interviewing potential team members, don't be shy. Ask the tough questions about their experience, their philosophy, and—most importantly—how they get paid.

| Advisor Role | Key Question to Ask | Common Fee Structures |

|---|---|---|

| Estate Attorney | "How much of your practice is dedicated to estate planning for families like mine?" | Flat Fee (for documents), Hourly Rate |

| CFP® | "Are you a fiduciary? How do you coordinate with other professionals on a client's team?" | Fee-Only (AUM %), Fee-Based (Commission + Fee) |

| CPA | "What strategies do you recommend for tax-efficient wealth transfer?" | Hourly Rate, Retainer Fee |

| Insurance Specialist | "How do you determine the appropriate amount and type of coverage for a legacy plan?" | Commission-Based |

A cohesive team is one where the members communicate with each other. The most effective plans are created when your attorney, CFP®, and CPA collaborate to ensure your legal, investment, and tax strategies are perfectly aligned.

Ultimately, who you hire is a deeply personal choice. For a deeper dive into this, you might find our article on whether you really need a financial advisor in today’s market helpful. Taking the time to build your dream team is the foundational step in making sure your legacy stands the test of time.

Frequently Asked Questions About Generational Wealth Planning

1. What is the difference between a will and a trust?

A will is a legal document that outlines your wishes for asset distribution and guardianship after your death, but it must go through a public court process called probate. A trust is a private legal entity that holds your assets for beneficiaries. Assets in a trust typically avoid probate, allowing for a faster, more private transfer of wealth.

2. At what net worth should I start generational wealth planning?

There is no magic number. Planning is about intent, not just asset size. Even a modest estate benefits from a basic will and designated beneficiaries. The key is to start with a foundational plan and allow it to grow and adapt as your wealth increases.

3. How often should I review my estate plan?

You should review your plan every 3-5 years, or whenever a major life event occurs. This includes marriage, divorce, the birth of a child, a significant change in financial status, or major updates to tax laws.

4. How can I prepare my heirs to handle an inheritance?

Financial education is crucial. Start by having age-appropriate conversations about money, involve them in family financial discussions, and establish a family mission statement. You can also use trusts that distribute assets at different ages (e.g., 25, 30, and 35) to give heirs time to mature financially.

5. What is the "step-up in basis" and why does it matter?

It's a valuable tax provision. When an heir inherits an asset like stock or real estate, its cost basis is "stepped up" to its fair market value on the date of death. This means if the heir sells the asset, they only pay capital gains tax on the appreciation that occurred after they inherited it, potentially saving them a significant amount of money.

6. Can I use life insurance for generational wealth planning?

Absolutely. Life insurance provides an immediate, tax-free death benefit to your heirs, which can be used to pay estate taxes, settle debts, or serve as a direct inheritance. Placing a policy inside an Irrevocable Life Insurance Trust (ILIT) can also protect the payout from being included in your taxable estate.

7. What happens if I die without a will?

Dying "intestate" (without a will) means the state decides how to distribute your assets according to its laws. This process is public, can be lengthy, and the state's decisions may not align with your wishes, potentially leaving out intended beneficiaries.

8. Should my spouse and I have a joint estate plan?

While you will plan as a couple, each of you should have your own individual will and powers of attorney. This is essential for directing separately owned assets or addressing complexities like children from a previous marriage. The goal is to have coordinated individual plans that work together to achieve your shared vision.

9. What's the difference between treating heirs equally vs. equitably?

"Equal" means everyone gets the same amount (e.g., 33.3% each). "Equitable" means each person gets what is fair for their specific situation. For example, a child with special needs may require a larger share placed in a specialized trust, which is equitable even if it isn't an equal split with their siblings.

10. How can I give gifts tax-free while I'm alive?

You can use the annual gift tax exclusion. In 2024, you can give up to $18,000 to as many individuals as you want without filing a gift tax return. This is a simple and effective strategy to reduce your future taxable estate while helping your loved ones in the present.

Ready to build your own legacy? At Top Wealth Guide, we provide the insights and strategies you need to navigate stocks, real estate, and more. Explore our resources today and start turning your financial goals into a reality.

This article is for educational purposes only and is not financial or investment advice. Consult a professional before making financial decisions.