Most investors keep their money in stocks and bonds. At Top Wealth Guide, we believe that’s a missed opportunity.

Alternative investments can reduce your portfolio’s volatility, generate returns when markets decline, and protect your wealth from inflation. The right mix of real estate, commodities, private equity, and other assets strengthens your long-term financial position.

In This Guide

Why Alternatives Reduce Your Portfolio’s Biggest Weakness

How Alternatives Break the Stock-Bond Correlation Problem

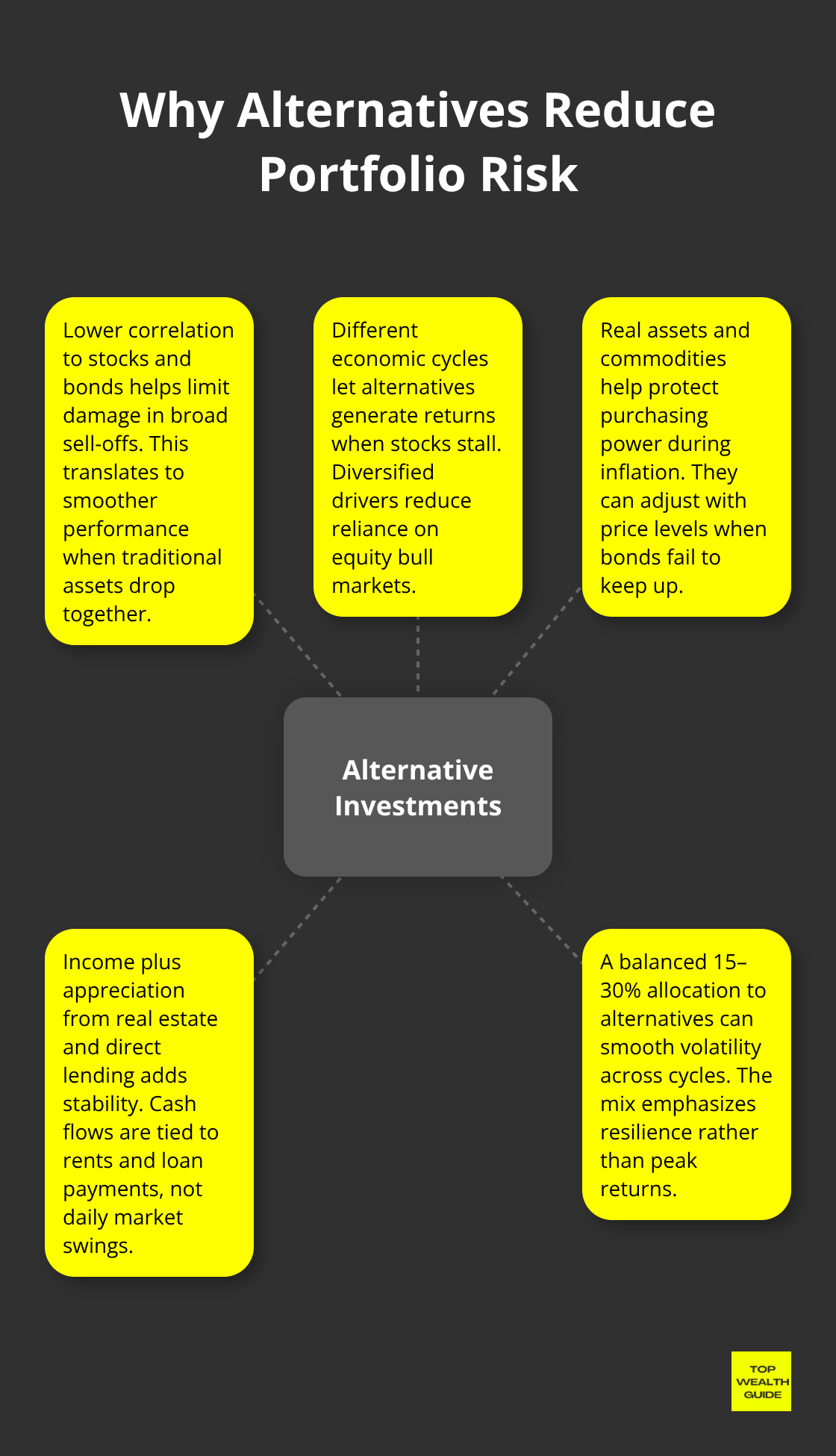

Most portfolios fail during market downturns because stocks and bonds move together when you need them most. When the S&P 500 drops 20%, traditional 60/40 portfolios typically fall 12–15% in tandem. Alternative investments break this pattern. Real estate, private equity, commodities, and hedge funds operate on different economic cycles, which means they generate returns when stocks stall.

JPMorgan’s long-term capital market assumptions show hedge funds’ median expected returns could rival U.S. equities over extended periods, yet they’ve historically outperformed during downturns. That distinction matters more than chasing peak returns in bull markets. A portfolio weighted 15–30% toward alternatives-a guideline supported by major institutional advisors-smooths volatility across market cycles because these assets don’t track the same triggers as public equities.

Why Private Equity and Direct Lending Outperform in Downturns

Private equity doesn’t mark to market daily like stocks; valuations reflect underlying business performance over years, not hourly sentiment shifts. Direct lending offers yields that compensate for illiquidity while remaining insulated from equity-market panic. Real estate provides tangible income through rent and capital appreciation uncorrelated to stock performance. Commodities like gold and agricultural products hedge inflation pressure that bonds cannot offset.

The CAIA Association reports alternative investments have grown from $4.8 trillion to $22 trillion, reflecting institutional recognition that this diversification works.

Inflation Protection Through Real Assets and Infrastructure

Inflation erodes wealth silently, and traditional bonds offer virtually no protection in rising-rate environments. Alternatives address this gap directly. Farmland blends real estate and commodity exposure, delivering land appreciation alongside cash flow from agricultural operations-a dual hedge against both inflation and economic stagnation.

Private real estate debt has emerged as attractive after commercial valuations reset, offering income-focused exposure with different risk characteristics than traditional loans. Infrastructure investments, another growing alternative category, support long-term inflation protection because their cash flows typically adjust with inflation indices.

Building a Resilient Portfolio Structure

If you allocate strategically across sub-sectors and multiple fund managers, concentration risk drops significantly, and you capture returns from different economic scenarios. A typical private investments portfolio anchoring 40–60% in private equity, with the remainder split among real assets, private credit, and growth equity, mirrors a traditional 60/40 structure but targets higher resilience.

The key actionable step: avoid lumping all alternatives into one illiquid position. Spread capital gradually over 3–5 years across drawdown funds, evergreen strategies, and fund-of-funds structures so you remain invested through multiple fund lifecycles and market cycles. This staged approach prevents forced selling during downturns and reduces sequence-of-returns risk that sabotages many portfolios.

With your portfolio structure in place, the next step involves selecting which specific alternative assets fit your personal risk tolerance and financial timeline.

The Four Alternative Asset Classes That Matter

Real Estate: The Most Accessible Alternative

Real estate stands out as the most accessible alternative for most investors, and you should prioritize it over theoretical alternatives. Physical rental properties generate monthly cash flow while appreciating over decades, creating a dual return stream that stocks cannot match. If direct property ownership feels too demanding, REITs offer public market liquidity with real estate exposure, though they correlate more closely with equities than private real estate does.

Real estate crowdfunding platforms lower minimum investments to $500–$1,000, letting you own fractional interests in commercial or residential projects. The critical decision separates private real estate (higher returns, illiquid, 7–10 year holds) from REITs (liquid, lower expected returns, easier monitoring). Institutional investors allocate roughly 15–25% of alternative portfolios to real assets including real estate, land, and infrastructure. Farmland specifically blends appreciation with inflation-adjusted cash flow from agricultural operations, making it particularly valuable during rising-rate environments.

Commodities and Precious Metals: Strategic Insurance

Commodities like gold, silver, oil, and agricultural products hedge inflation when bonds fail. Gold serves as a store of value during equity downturns and currency weakness, but it generates no income, so holding 5–10% provides insurance without dragging returns. Agricultural commodities and energy offer different economic triggers than equities; when supply shocks hit or inflation spikes, these assets outperform.

You can access commodities through ETFs, futures contracts (more complex), or physical ownership (gold coins face storage and insurance costs). Precious metals held over one year receive long-term capital gains treatment, but collectible coins face a 28% tax rate under IRS rules, so understand the tax structure before committing significant capital. This distinction shapes your after-tax returns substantially.

Private Equity and Hedge Funds: Higher Returns, Longer Timelines

Private equity funds invest in operating companies over 5–10 year lifecycles, targeting 15–25% annual returns through operational improvements and leverage. These funds require accredited investor status (net worth exceeding $1 million excluding your primary home, or annual income above $200,000 for two consecutive years). Hedge funds employ diverse strategies: some short stocks during downturns, others use options to reduce volatility, and others pursue merger arbitrage or distressed credit.

JPMorgan’s analysis indicates hedge fund median returns could match U.S. equities over long horizons while delivering superior downside protection. The trade-off is clear: higher fees (typically 2% management fee plus 20% performance fee for hedge funds) and illiquidity versus better risk-adjusted returns. Fund-of-funds structures handle manager selection for you but add an extra layer of fees; direct fund access requires more due diligence but preserves higher net returns. Try allocating 10–15% to private equity and 5–10% to hedge funds within your alternatives bucket, then expand only after understanding the specific fund’s strategy and track record during market downturns.

Cryptocurrency: Speculation, Not Diversification

Bitcoin and Ethereum have appreciated dramatically, but they remain uncorrelated with traditional assets in ways that create portfolio chaos rather than balance. Cryptocurrency lacks cash flow, intrinsic business value, or inflation protection mechanisms, making it a pure momentum bet. Staking income (earning yields by holding certain digital assets) adds a return stream, but regulatory clarity remains absent.

If you allocate to crypto, cap it at 2–5% of your total portfolio and treat it as venture-stage risk capital, not core wealth protection. The IRS taxes cryptocurrency transactions as ordinary income when held under one year and long-term capital gains beyond one year, but every transaction (even trades between different coins) triggers a taxable event. Tax-loss harvesting in crypto can offset gains elsewhere in your portfolio, which is the only genuine tax advantage. Avoid crypto as a diversification tool; it correlates with risk sentiment alongside equities during stress periods, defeating the purpose of alternatives.

With these four asset classes mapped out, the next step involves matching your personal risk tolerance and financial timeline to the right allocation strategy.

How to Build an Alternative Portfolio That Actually Works

Map Your Financial Reality First

Most investors fail at alternatives because they treat them like stocks: buy, monitor quarterly, hope for the best. That approach costs you money through forced selling during downturns and missed opportunities to deploy capital strategically. Start instead by mapping your specific situation, then build systematically over years rather than months.

Your first decision separates success from regret: how much of your investable assets can stay locked away for 7–10 years without touching them? If you need cash within five years, alternatives create problems, not solutions. Accredited investor status matters too-you need net worth exceeding $1 million (excluding your primary residence) or annual income above $200,000 for two consecutive years to access most private equity and hedge funds. If you fall short, focus on real estate crowdfunding, REITs, and direct lending platforms that accept lower minimums.

Calculate Your Current Gap and Set a Realistic Target

Next, calculate your current allocation to alternatives honestly. Most advisor-managed portfolios sit at 6% alternatives exposure, while institutional investors average 24%. That gap reflects opportunity. A realistic starting point targets 15–30% of your investable assets in alternatives over a three to five year ramp-up period.

If you have $500,000 to invest, that means deploying $2,500–$5,000 monthly into alternatives rather than dumping $75,000 upfront. Staged deployment prevents you from buying into market peaks and keeps you committed through inevitable down markets where alternatives prove their worth.

Choose Your Execution Strategy and Advisor

Execution matters more than asset selection. Work with a financial advisor who specializes in alternatives-not your local stockbroker who treats them as exotic add-ons. Quality advisors guide you toward fund-of-funds structures for simplicity or direct fund access for higher net returns, depending on your sophistication level.

Start with one real estate investment (either a rental property or crowdfunding platform), one private equity fund-of-funds, and one direct lending or private credit platform. This tri-pillar approach captures diversification without overwhelming complexity.

Monitor Performance Through Market Cycles

Rebalance annually by reviewing fund performance during market downturns specifically-how did each manager perform when the S&P 500 dropped 15% or more? Consistency through cycles matters infinitely more than peak returns. If a private equity fund returned 25% during the 2021 bull market but lost 8% in 2022 while others lost 2%, that manager takes unnecessary risk.

After three years of steady contributions and annual reviews, your portfolio naturally expands to five to eight positions across real estate, private equity, hedge funds, and direct lending. At that point, alternatives stop feeling like speculation and start functioning as your wealth’s true engine.

Final Thoughts

Alternative investments strengthen long-term wealth building because they operate independently of stock market cycles. When equities decline, private equity, real estate, and direct lending continue generating returns based on underlying business performance and tangible assets rather than market sentiment. This separation transforms a portfolio from reactive to resilient.

Institutional investors allocate 24% to alternatives on average, while most advisor-managed portfolios sit at 6%. That gap represents billions in missed diversification and downside protection. Moving from 6% to 15–30% over three to five years meaningfully reduces your portfolio’s vulnerability to the next market correction.

Calculate your existing alternatives exposure honestly today, not after the next 20% market decline. If you fall below 15%, identify which asset class fits your situation first: rental properties or crowdfunding for real estate access, fund-of-funds for simplified private equity exposure, or direct lending platforms for income-focused strategies. Start small, deploy capital gradually, and review performance annually through market cycles rather than peak returns. Visit our detailed strategies guide to explore how to integrate alternatives into your wealth plan systematically.