Choosing the right life insurance can feel overwhelming. With countless providers, complex policy types, and confusing jargon, it’s easy to get stuck in analysis paralysis. The core problem is clear: how do you cut through the noise to find a reputable company that offers the coverage your family needs at a price that fits your budget? This guide is designed to solve that exact problem.

We’ve done the heavy lifting for you, researching and evaluating the best life insurance companies available today. Instead of spending hours comparing quotes across dozens of websites, you'll find a clear, concise breakdown of the top contenders right here. This roundup goes beyond simple lists, offering a detailed look into what makes each company stand out.

Inside this guide, you will discover:

- Ranked Profiles: A detailed look at leading insurers and modern platforms like Policygenius, Ladder, and State Farm.

- "Best For" Categories: Quickly identify the top company for term, whole, universal, or final expense insurance.

- Actionable Pros and Cons: Get a balanced view of each provider to weigh their strengths and weaknesses.

- Real-World Scenarios: See examples of how different people might use these companies.

- Direct Access: We provide screenshots and direct links to each platform, so you can start your application process immediately.

Our goal is to equip you with the information needed to make a confident and informed decision. This resource will help you compare the best life insurance companies efficiently, ensuring you secure the financial protection your loved ones deserve without the usual hassle. Let’s dive into our top picks.

In This Guide

- 1 1. Policygenius

- 2 2. SelectQuote

- 3 3. Ladder

- 4 4. Ethos

- 5 5. State Farm

- 6 6. Banner Life (Legal & General America)

- 7 7. USAA Life

- 8 Top 7 Life Insurance Companies At-a-Glance

- 9 Taking the Next Step Towards Financial Security

- 10 Frequently Asked Questions (FAQ)

- 10.1 1. What is the difference between term and whole life insurance?

- 10.2 2. How much life insurance do I need?

- 10.3 3. Do I need a medical exam to get life insurance?

- 10.4 4. What happens if I outlive my term life insurance policy?

- 10.5 5. Can I have multiple life insurance policies?

- 10.6 6. What factors affect my life insurance premium?

- 10.7 7. Who should be my beneficiary?

- 10.8 8. Is the life insurance death benefit taxable?

- 10.9 9. What is a "rider" in a life insurance policy?

- 10.10 10. How do online brokers like Policygenius and SelectQuote make money?

1. Policygenius

Best for: Comparing Multiple Carriers at Once

Policygenius stands out not as an insurance company itself, but as a powerful independent online marketplace and licensed broker. It solves one of the biggest challenges for life insurance shoppers: efficiently comparing personalized quotes from numerous top-rated insurers side-by-side. Instead of visiting multiple carrier websites and filling out separate applications, Policygenius streamlines the entire process into a single, user-friendly platform. This approach empowers you to find the most competitive rates and policy features without the hassle of managing several inquiries.

This platform excels by combining technology with human expertise. While the initial quote comparison is automated, Policygenius provides access to licensed, non-commissioned agents who offer guidance throughout the application and underwriting process. This hybrid model ensures you get both the convenience of a digital tool and the personalized support of a knowledgeable professional, all at no extra cost. The rates you see are the same as if you went directly to the insurer.

Real-Life Example:

Sarah, a 35-year-old with well-managed asthma, wasn't sure which company would offer the best rate. Instead of applying to five different insurers, she used Policygenius. The platform matched her with a carrier known for its favorable underwriting for her condition, saving her an estimated $15 per month compared to other quotes.

Key Features and User Experience

Policygenius is designed for clarity and education, making it one of the best life insurance companies to start your search with. The website is clean, the quote process is intuitive, and it’s packed with helpful resources.

- Product Selection: Compare a wide range of products including term life, whole life, universal life, and no-medical-exam policies.

- Carrier Network: The platform partners with a curated list of financially strong insurers, including well-known names like Prudential, AIG, and Pacific Life.

- Educational Tools: Their extensive library of articles, guides, and an easy-to-use life insurance calculator helps you determine your coverage needs before you even start shopping. Understanding how life insurance can be part of a larger financial strategy is crucial. You can learn more about using insurance in wealth-building strategies on topwealthguide.com.

Pricing and How It Works

Using Policygenius is completely free for the consumer. The platform earns a commission from the insurance company you ultimately choose, but this does not affect the price you pay for your premium.

To get accurate quotes, you will need to provide personal information such as your age, gender, health history, and lifestyle habits. This data allows the platform to generate personalized, real-time estimates. It is important to remember that these initial quotes are preliminary; the final premium is always determined by the insurer after the formal underwriting process is complete.

Policygenius: Pros vs. Cons

| Pros | Cons |

|---|---|

| Efficient Comparison: See quotes from multiple top-tier carriers in minutes. | Not an Insurer: Policygenius is a broker; the final policy is issued by a separate company. |

| Expert Guidance: Access licensed agents for unbiased support at no extra cost. | Requires Personal Data: You must provide personal information to see accurate quotes. |

| Free to Use: No fees or markups; you pay the same rate as going direct. | Final Rate Not Guaranteed: Initial quotes are estimates pending official underwriting. |

| Strong Educational Resources: Excellent tools and content for first-time buyers. | Process Can Take Time: The full application and underwriting timeline depends on the chosen carrier. |

Website: https://www.policygenius.com

2. SelectQuote

Best for: Agent-Assisted Comparison Shopping

SelectQuote operates as a well-established, independent insurance agency, offering a robust platform for comparing quotes from a wide array of highly-rated insurance carriers. Similar to a marketplace, its primary strength lies in saving consumers time and effort. Instead of individually researching and applying with multiple insurers, SelectQuote provides a centralized service where licensed agents guide you through finding the most suitable and cost-effective policy for your specific needs. This model blends technology with a human touch, ensuring a personalized shopping experience.

With a history spanning several decades, SelectQuote has refined its process to efficiently match clients with the right coverage. Their salaried, licensed agents provide no-obligation quotes and assist with the entire application process, from initial comparison to coordinating the underwriting requirements with your chosen insurer. This approach makes it one of the best life insurance companies to work with if you prefer having a dedicated professional to navigate the complexities of securing a policy.

Real-Life Example:

Mark, 45, was overwhelmed by the different types of life insurance. He filled out a form on SelectQuote and was connected with an agent who explained the pros and cons of term versus whole life for his situation. The agent handled all the paperwork, making a complicated process feel simple and saving Mark hours of research.

Key Features and User Experience

SelectQuote is designed to simplify the insurance buying journey, making it accessible even for those new to life insurance. The process typically begins online but transitions to a more personalized, agent-driven experience over the phone.

- Broad Carrier Network: The platform compares prices from dozens of trusted insurance carriers, giving you a comprehensive view of the market.

- Agent-Led Process: You work directly with a licensed agent who helps you understand your options and handles the application paperwork on your behalf.

- One Application Experience: You only need to provide your information once. SelectQuote coordinates the underwriting steps with the final insurer, streamlining what can be a lengthy process. This is particularly important when considering how life insurance fits into your long-term financial picture. You can explore more on this topic with our guide to estate planning strategies for millennial investors on topwealthguide.com.

Pricing and How It Works

Using SelectQuote's comparison service is entirely free. The company is compensated via commission from the insurance carrier that ultimately issues your policy. This structure means your premium is not inflated; you pay the same rate as you would if you approached the insurer directly.

The process starts with an online form or a phone call to gather basic information. A licensed agent then uses this data to find matching policies and will contact you to discuss the quotes and next steps. Final rates are always subject to the insurance company's official underwriting review, which may include a medical exam.

SelectQuote: Pros vs. Cons

| Pros | Cons |

|---|---|

| Saves Time: Compares dozens of carriers at once, eliminating individual research. | Agent Communication: You will receive phone calls and emails from agents as part of the process. |

| Expert Guidance: Salaried, licensed agents provide personalized, no-obligation assistance. | Experience Varies: Your final customer service experience depends on the specific insurer chosen. |

| Broad Carrier Access: A large network increases the chances of finding competitive rates. | Not an Insurer: SelectQuote is the agency; your policy and claims are managed by the carrier. |

| Free to Use: No cost to the consumer for their comparison and application services. | Final Rate Not Guaranteed: Initial quotes are estimates that can change after underwriting. |

Website: https://www.selectquote.com

3. Ladder

Best for: Digital-First Simplicity and Flexible Term Coverage

Ladder has carved out a niche in the life insurance industry by offering a purely digital, streamlined experience designed for the modern consumer. As a direct-to-consumer provider, Ladder focuses exclusively on term life insurance, making the process of getting a quote and applying for coverage remarkably fast and straightforward. This approach eliminates the traditional hurdles of in-person meetings and lengthy paperwork, allowing many applicants to get an instant decision in minutes.

The platform's standout feature is its flexibility. Ladder allows policyholders to adjust their coverage amount over time, a process they call "laddering." As your financial needs change, such as paying off a mortgage or your children becoming independent, you can apply to decrease your coverage and lower your premium directly from your online account. Conversely, if your needs grow, you can apply to increase it. This adaptability makes Ladder one of the best life insurance companies for those whose financial situations are likely to evolve.

Real-Life Example:

Alex and Jamie just bought their first home with a large mortgage. They used Ladder to get $1 million in term coverage quickly. Five years later, after a promotion, they applied to "ladder up" their coverage to $1.5 million to account for their growing family, all from their online dashboard.

Key Features and User Experience

Ladder is built for speed, transparency, and user control. The website interface is clean and intuitive, guiding users through a simple application process that can often be completed during a coffee break.

- 100% Digital Process: From quote to application and policy management, the entire experience is online.

- Adjustable Coverage: The unique ability to apply to increase or decrease your coverage amount (and premium) as your life changes.

- No Medical Exam Option: Many healthy applicants seeking coverage up to $3 million can qualify without a medical exam, based on their online health questionnaire.

- Transparent Policies: Features a 30-day money-back guarantee (the "free look" period) and no cancellation fees, offering peace of mind.

Pricing and How It Works

Ladder's pricing is competitive, with premiums determined by your age, health, lifestyle, and the amount and term length of coverage you select. You can get an instant, no-obligation quote on their website by answering a few basic questions.

The application asks for more detailed health and lifestyle information. Based on your answers, Ladder's algorithm provides an instant decision for many applicants. If approved, you can activate your coverage immediately by making your first payment. While the process is digital, licensed support is available via chat, email, or phone if you have questions. Securing your family's financial future is a key step; you can discover more about achieving financial freedom on topwealthguide.com.

Ladder: Pros vs. Cons

| Pros | Cons |

|---|---|

| Fast, Simple Online Process: Get a quote and decision in minutes, not weeks. | Term Life Only: Does not offer whole life, universal life, or other permanent policies. |

| Flexible Coverage: Easily apply to adjust your coverage up or down after purchase. | State Limitations: Not all features and coverage amounts are available in every state. |

| No-Exam Potential: High coverage limits (up to $3M) may be available without a medical exam. | No In-Person Agents: The model is entirely digital, which may not suit everyone. |

| User-Friendly Management: Manage your policy entirely through a simple online dashboard. | Final Rate Depends on Health: Your final premium is based on the information you provide. |

Website: https://www.ladderlife.com

4. Ethos

Best for: A Fast, Digital-First Application Process

Ethos modernizes the life insurance application process by focusing on speed, simplicity, and accessibility. Acting as a licensed producer and administrator, Ethos leverages technology to connect applicants with policies from established, reputable insurers. Its primary strength lies in its streamlined online platform, which allows many users to apply for term or whole life coverage in minutes and, in many cases, receive an approval decision the same day without needing a medical exam. This approach is ideal for individuals who value a low-friction, digital-first experience.

By removing common barriers like in-person meetings and lengthy paperwork, Ethos makes obtaining life insurance significantly more convenient. The platform uses data and algorithms to assess risk, which is why most applicants can bypass the traditional medical exam. This makes it one of the best life insurance companies for those seeking immediate coverage to protect their families' financial future. Ethos is not an insurer itself but a tech-forward gateway to policies from trusted carriers.

Real-Life Example:

Priya, a 28-year-old software developer, wanted to get life insurance but kept putting it off because she thought it would be a hassle. She applied with Ethos on her lunch break, answered a few health questions, and was approved for a 20-year, $500,000 term policy in under 15 minutes without a medical exam.

Key Features and User Experience

Ethos is built for the modern consumer, emphasizing a clean interface and an intuitive, straightforward application that can be completed entirely online. The user journey is designed to be quick and transparent from start to finish.

- Product Selection: Ethos offers term life insurance for younger applicants and guaranteed-issue whole life policies for seniors, matching users to the appropriate product based on their age and needs.

- Carrier Network: Policies are underwritten by financially sound partners like Legal & General America, Ameritas Life Insurance Corp., and TruStage, ensuring the reliability of your coverage.

- No-Medical-Exam Focus: The vast majority of applicants between the ages of 20 and 65 can secure coverage without undergoing a medical exam, receiving an instant decision based on their application answers and data verification. Life insurance is a cornerstone of financial stability; learn more about why you need to start retirement planning today to see how it fits into a larger strategy.

Pricing and How It Works

Getting a quote on the Ethos platform is free and instant. You provide basic personal details, health information, and lifestyle habits to see an estimated premium. If you proceed with the application, Ethos uses this information for its accelerated underwriting process to provide a final decision and rate.

Because Ethos is a technology platform and broker, the cost of your policy is not marked up. You pay the premium set by the underwriting partner company. The company is currently not available to residents of New York. The final premium is contingent on the verification of the information provided in your application.

Ethos: Pros vs. Cons

| Pros | Cons |

|---|---|

| Fast, Digital Experience: Apply online in minutes with same-day coverage possible. | Not an Insurer: Ethos is a platform; your policy is from a partner carrier. |

| No Medical Exam for Most: Avoids the hassle of traditional underwriting for many applicants. | Not Available in New York: Residents of New York cannot use the platform. |

| Simple Product Offering: Easy-to-understand term and guaranteed-issue whole life options. | Limited Policy Customization: Fewer riders and options compared to traditional insurers. |

| Access to Trusted Carriers: Policies are backed by established, financially strong companies. | Final Rate Depends on Underwriting: The initial quote is an estimate until the application is fully processed. |

Website: https://www.ethoslife.com

5. State Farm

Best for: Personalized Service Through a Nationwide Agent Network

State Farm is one of the most recognizable names in insurance, and it extends its strong brand reputation to the life insurance sector. It provides a unique blend of digital convenience and traditional, personalized agent support. While many modern insurers are moving to an online-only model, State Farm maintains a vast network of local agents, making it an ideal choice for those who prefer face-to-face interaction and a single point of contact for all their insurance needs, from auto to life.

This hybrid approach allows prospective customers to get online quotes for certain term policies to start their research, but the real value comes from its agent-centric model. Agents can guide you through a broader and more complex product lineup, including specialized options not available online. This makes State Farm one of the best life insurance companies for consumers seeking a long-term relationship with an agent who understands their complete financial picture.

Real-Life Example:

The Garcia family already had their home and auto insurance with a local State Farm agent. When they had their first child, they met with their agent to review their finances. The agent helped them bundle a new term life insurance policy with their existing coverage, qualifying them for a multi-policy discount.

Key Features and User Experience

State Farm's website offers a clean starting point for exploration, with clear sample rates and basic term life quotes available. However, the experience is designed to funnel users toward a local agent for in-depth needs analysis and application.

- Product Selection: Offers a full suite of products including term, whole, and universal life. Unique options like Return of Premium and renewable term policies are also available.

- 'Instant Answer' Term: For eligible applicants (typically younger and in good health), State Farm offers a small-term policy of up to $50,000 that can be approved in-office with an agent, no medical exam required.

- Nationwide Agent Support: With thousands of agents across the country, you can get personalized service for applications, policy management, and claims. This local presence is a significant differentiator.

- Financial Stability: State Farm holds top-tier financial strength ratings, providing peace of mind that the company will be there to fulfill its obligations. Properly structured life insurance is a key part of long-term financial security; you can explore related concepts with these wealth preservation strategies for uncertain times on topwealthguide.com.

Pricing and How It Works

While you can get initial term life quotes online, final pricing and access to the full product catalog require speaking with a State Farm agent. The company is known for competitive pricing, especially for existing customers who bundle multiple policies like auto and home insurance.

The application process is typically handled through an agent who will help you complete the necessary paperwork and guide you through the underwriting requirements. While the 'Instant Answer' policy is streamlined, other policies will likely require a full underwriting process, including a medical exam.

State Farm: Pros vs. Cons

| Pros | Cons |

|---|---|

| Strong Brand & Financials: A trusted, financially stable company with a long history. | Agent-Focused Process: Most products and the full application require working with an agent. |

| Extensive Agent Network: Personalized, local service is readily available across the U.S. | Limited Online Options: The digital experience is not as robust or self-service as online-first competitors. |

| Specialized Products: Offers unique policies like Return of Premium and Instant Answer Term. | State Variations: Policy availability and issuing companies can differ in certain states (e.g., NY, WI). |

| Bundling Discounts: Potential for significant savings when combined with other State Farm policies. | Not Ideal for Direct Buyers: Those who prefer a fully online, agent-free process may find it cumbersome. |

Website: https://www.statefarm.com

6. Banner Life (Legal & General America)

Best for: Affordable Long-Term Coverage

Banner Life, operating under the Legal & General America (LGA) brand, is a powerhouse in the term life insurance market. It consistently ranks as one of the most affordable options, especially for consumers seeking long-term policies. While many carriers cap their term lengths at 30 years, Banner Life extends its offerings up to an impressive 40 years, providing a unique solution for those with long-term financial obligations like a 30-year mortgage or young children. This focus on providing cost-effective, extended-duration coverage makes it a top choice for families and individuals planning for the distant future.

The company has successfully blended competitive pricing with a modern, streamlined application process. Through its digital platform, many applicants can receive an underwriting decision without a medical exam, thanks to its accelerated underwriting program. This commitment to leveraging technology to simplify the customer journey, combined with its strong financial backing from the global Legal & General Group, establishes Banner Life as one of the best life insurance companies for securing reliable and inexpensive term protection.

Real-Life Example:

A couple in their early 30s just took out a 30-year mortgage. To ensure the mortgage would be paid off if one of them passed away, they wanted coverage that lasted the full loan term. Banner Life offered them a highly affordable 30-year term policy, giving them peace of mind for the entire duration of their home loan.

Key Features and User Experience

Banner Life’s focus is clear: deliver high-quality term life insurance efficiently and affordably. The digital experience is straightforward, allowing users to get quick online quotes and begin the application process with ease.

- Extensive Term Options: Banner offers term lengths of 10, 15, 20, 25, 30, 35, and 40 years, providing more flexibility than many competitors.

- High Coverage Amounts: Policies are available with face amounts well over $10 million, catering to high-net-worth individuals and those with significant protection needs.

- Accelerated Underwriting: Healthy applicants under a certain age may qualify for the AppAssist program, potentially skipping the medical exam and receiving a decision in days rather than weeks.

- Term Riders: Policyholders can add riders for additional protection, such as a waiver of premium or a children's rider.

Pricing and How It Works

Banner Life is known for its highly competitive premiums, particularly for younger, healthier applicants. You can get an initial quote online by providing basic information about your age, health, and desired coverage.

These initial quotes are preliminary estimates. The final rate is determined after you submit a formal application and complete the underwriting process, which may or may not include a medical exam depending on your profile. It's important to note that while Banner Life is the underwriter in most states, its affiliate, William Penn, issues policies in New York. This is a structural distinction that doesn't impact the quality or pricing of the policy.

Banner Life: Pros vs. Cons

| Pros | Cons |

|---|---|

| Exceptional Affordability: Consistently offers some of the lowest rates for term life insurance. | Brand Confusion: The relationship between LGA, Banner, and William Penn can be unclear to consumers. |

| Long Term Lengths: One of the few carriers offering a 40-year level term policy. | Not Available in NY: Banner does not issue policies in New York; William Penn handles this state. |

| High Coverage Ceilings: Can accommodate needs for multi-million dollar policies. | Limited Policy Types: Primarily focused on term life; fewer permanent life options compared to others. |

| Modern Underwriting: Potential for a quick, no-medical-exam approval process. | Direct Sales Limited: Policies are primarily sold through independent agents and brokers. |

Website: https://www.lgamerica.com

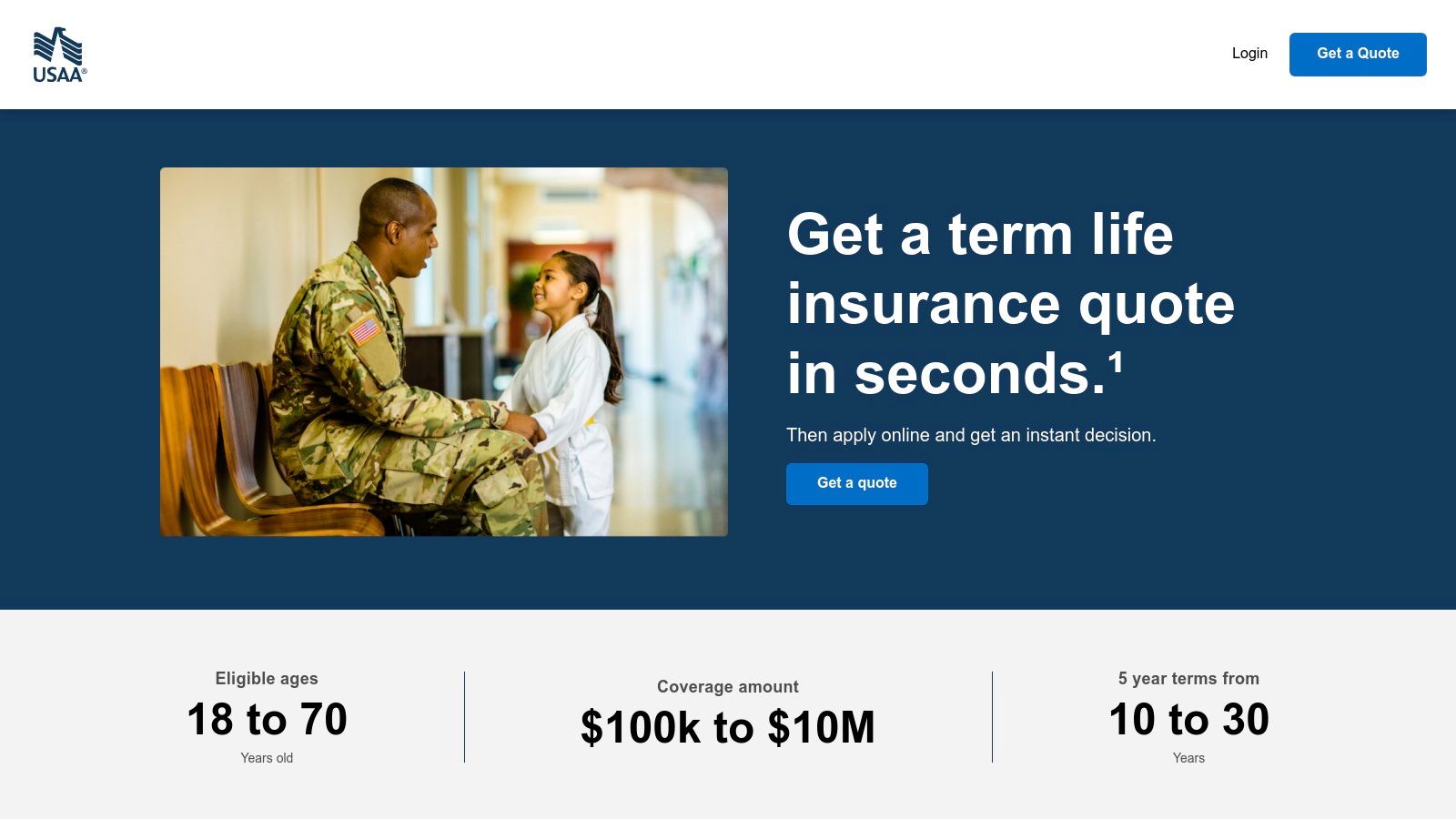

7. USAA Life

Best for: Military Members, Veterans, and Their Families

USAA Life has built an exceptional reputation for serving the unique needs of the military community. It stands out by offering products designed with the realities of military life in mind, such as coverage during wartime and options for separating service members. For those with military affiliations, USAA's deep understanding of their needs and top-tier customer service make it a premier choice.

The company excels at providing a simple, digital-first experience for its term life products, allowing users to get quick online quotes and often receive a rapid decision. For military members, USAA offers specialized features, like the Military Protection Plus rider, which adds valuable benefits not found elsewhere. This specialized care for service members makes USAA one of the best life insurance companies for military families. While some products are available to the public, its core strength is serving those who serve.

Real-Life Example:

Captain Evans is preparing for deployment. She used USAA to purchase a term life policy with a Military Protection Plus rider. This gives her extra coverage to offset lost SGLI benefits in certain situations and guarantees her future insurability after she leaves the service, regardless of her health.

Key Features and User Experience

USAA Life's website is streamlined and user-friendly, prioritizing a hassle-free quote and application process. The platform is designed to provide clear information, especially for its core military audience.

- Product Selection: Focuses on term and permanent life insurance options designed for financial readiness.

- Military-Specific Benefits: Offers features like severe injury benefits and options to replace SGLI (Servicemembers' Group Life Insurance) upon retirement or separation from the military.

- Eligibility: Life insurance products are available to U.S. military members, veterans who have honorably separated, and their eligible family members.

- Coverage Amounts: Policies are flexible, with coverage typically ranging from $100,000 up to $10 million, accommodating various financial protection needs.

Pricing and How It Works

Getting a quote from USAA Life is a straightforward online process. You will provide standard information about your age, health, and lifestyle to receive an initial estimate. For many term policies, especially those under a certain coverage amount, the application can be completed online with a quick decision.

While USAA is known for competitive pricing, the final premium is determined after underwriting. Military members find unique value in riders and policy features that are not reflected in the initial price but add significant protection relevant to their service. For permanent life policies or more complex needs, you will be guided to speak with a licensed USAA representative.

USAA Life: Pros vs. Cons

| Pros | Cons |

|---|---|

| Exceptional Customer Service: Highly regarded for its commitment to member and customer satisfaction. | Eligibility is Restricted: Primarily serves military members, veterans, and their families. |

| Military-Focused Features: Specialized riders and policies designed for the unique risks of military service. | Limited Permanent Life Info Online: Detailed information on whole or universal life often requires a call. |

| Simplified Online Process: Quick quotes and applications for term life, often without a medical exam. | Availability Varies: Product offerings and specific features can differ depending on your state of residence. |

| Understands Military Life: Policies are built with an understanding of deployment, SGLI, and other service-related needs. | Not a Fit for General Public: Those without a military connection cannot access their policies. |

Website: https://www.usaalife.com

Top 7 Life Insurance Companies At-a-Glance

| Company | Best For | Application Process | Why It Stands Out |

|---|---|---|---|

| Policygenius | Side-by-Side Quote Comparison | Digital Marketplace | Compares top carriers in one place with expert agent help. |

| SelectQuote | Agent-Assisted Shopping | Phone/Agent Driven | An agent guides you through quotes from dozens of insurers. |

| Ladder | Flexible Term Coverage | Fully Digital (App) | Quick online process; easily adjust coverage up or down. |

| Ethos | Fast No-Exam Policies | Fully Digital | Apply in minutes and get an instant decision for term or whole life. |

| State Farm | In-Person Agent Service | Hybrid (Online & Agent) | Great for bundling policies with a trusted local agent. |

| Banner Life | Affordable Long Terms | Digital/Broker | Offers highly competitive rates, especially for 30- and 40-year terms. |

| USAA Life | Military & Veterans | Digital & Phone | Specialized policies and riders designed for service members. |

Taking the Next Step Towards Financial Security

Navigating the world of life insurance can feel complex, but this guide has armed you with the essential information to make a confident and informed decision. We’ve explored a range of the best life insurance companies, from innovative online brokers like Policygenius and Ladder to established giants like State Farm and Banner Life. Each provider offers a unique combination of strengths, whether it's speed, affordability, policy variety, or exceptional customer service.

The key takeaway is that there is no single "best" company for everyone. The right choice is deeply personal and depends entirely on your individual circumstances, financial goals, and health profile. What works for a healthy 30-year-old seeking a simple term policy through an app like Ethos will be vastly different from what a 55-year-old needs when planning for final expenses or complex estate strategies.

By understanding the distinct advantages of each company, you are now better equipped to align your needs with the right provider. Remember the core principles we discussed: financial strength is non-negotiable, underwriting processes vary significantly, and the cheapest quote isn't always the best value.

Your Action Plan for Choosing a Policy

Feeling empowered is one thing; taking action is another. To bridge that gap, here is a practical, step-by-step plan to guide you from research to application. This structured approach will help you organize your thoughts and ensure you don’t miss any crucial details in your search for one of the best life insurance companies.

- Define Your "Why": Before you get a single quote, clearly articulate why you need life insurance. Is it to replace your income for your family, cover a mortgage, fund a child’s education, or leave a legacy? Your "why" determines how much coverage you need and for how long.

- Calculate Your Coverage Needs: Use an online life insurance calculator or the simple DIME (Debt, Income, Mortgage, Education) method to estimate your required death benefit. Don’t just guess; a data-driven approach ensures your family is truly protected, not just partially covered.

- Gather Your Information: Have your personal information ready before you start shopping. This includes your driver’s license number, Social Security number, basic medical history (including medications and doctor’s information), and financial details like your income and net worth.

- Compare Quotes Strategically: Don't just get one quote. Use a comparison tool like Policygenius or SelectQuote to see rates from multiple carriers at once. This is the single most effective way to ensure you are getting a competitive price.

- Be Honest on Your Application: The temptation to omit a minor health issue to get a better rate can be strong, but it's a critical mistake. Misrepresentation on a life insurance application is considered fraud and can lead to your policy being voided when your family needs it most.

- Prepare for the Underwriting Process: Whether it's an accelerated process with Ladder or a traditional medical exam, understand what's required. Schedule your medical exam for the morning while you are fasted, and avoid caffeine, strenuous exercise, and alcohol for at least 24 hours beforehand for the most accurate results.

- Review and Sign: Once your policy is approved and issued, review it carefully. Make sure all names, coverage amounts, and policy details are correct. Sign the delivery receipt, make your first premium payment, and store the physical policy in a safe place where your beneficiary can find it.

Choosing a life insurance policy is one of the most significant and selfless financial decisions you can make. It’s an act of love, providing a durable safety net that protects your loved ones from financial hardship during an emotional time. By following a methodical process and using the insights from this guide, you can secure the right protection and gain invaluable peace of mind.

Frequently Asked Questions (FAQ)

1. What is the difference between term and whole life insurance?

Term life insurance provides coverage for a specific period (e.g., 10, 20, or 30 years) and pays a benefit only if you pass away during that term. It is generally more affordable. Whole life insurance provides lifelong coverage and includes a cash value component that grows over time. It is significantly more expensive than term life.

2. How much life insurance do I need?

A common rule of thumb is to get coverage equal to 10-12 times your annual income. However, a more accurate method is to calculate your specific needs, including debt (mortgage, car loans), income replacement for your family, future education costs for children, and final expenses (DIME method).

3. Do I need a medical exam to get life insurance?

Not always. Many companies, like Ladder and Ethos, offer "no-exam" or accelerated underwriting policies, especially for younger, healthier applicants seeking coverage under a certain amount (e.g., $1-3 million). They use your application answers and third-party data to assess risk instead.

4. What happens if I outlive my term life insurance policy?

If you outlive your term policy, the coverage simply expires. You do not receive any money back unless you purchased a specific "Return of Premium" rider, which is more expensive. At expiration, you can choose to apply for a new policy, but rates will be based on your current age and health.

5. Can I have multiple life insurance policies?

Yes, you can have multiple policies. This strategy, known as "laddering," involves buying policies of different term lengths and amounts to match your changing financial obligations over time. For example, you might have a 30-year policy for your mortgage and a separate 20-year policy for your children's education.

The primary factors are your age, gender, health status (including family medical history), lifestyle (e.g., smoking, dangerous hobbies), the type of policy you choose (term vs. whole), the coverage amount, and the term length.

7. Who should be my beneficiary?

Your beneficiary can be any person, trust, or entity you choose. Most people name their spouse, children, or a trust set up for their family. It is crucial to name a primary and a contingent (backup) beneficiary and to keep these designations updated after major life events like marriage or divorce.

8. Is the life insurance death benefit taxable?

In most cases, the death benefit paid to beneficiaries is not subject to federal income tax. However, the benefit may be included in your estate for estate tax purposes if your estate is large enough to be subject to taxation.

9. What is a "rider" in a life insurance policy?

A rider is an optional add-on to a standard life insurance policy that provides extra benefits or protection. Common riders include a waiver of premium (which pays your premium if you become disabled), an accelerated death benefit (which allows you to access a portion of your death benefit if you're terminally ill), and a child rider (which provides a small amount of coverage for your children).

10. How do online brokers like Policygenius and SelectQuote make money?

These platforms are licensed insurance brokers. They earn a commission from the insurance company you ultimately choose to buy a policy from. This commission is built into the insurer's standard pricing, so you do not pay any extra fees for using their comparison services.

Ready to take control of your entire financial future, not just your insurance needs? The team at Top Wealth Guide provides expert insights and actionable strategies to help you build and protect your wealth. Explore our resources at Top Wealth Guide to continue your journey toward financial independence.

This article is for educational purposes only and is not financial or investment advice. Consult a professional before making financial decisions.