Most investors leave money on the table by ignoring tax loss harvesting. This strategy lets you convert portfolio losses into real tax savings that compound over time.

At Top Wealth Guide, we show you exactly how to identify losing positions, replace them strategically, and avoid costly mistakes like the wash sale rule. The result is a portfolio that works harder for your after-tax returns.

In This Guide

How Tax Loss Harvesting Works

Tax loss harvesting sounds complex, but the mechanics are straightforward. You sell an investment that has declined in value to lock in the loss, then use that loss to offset capital gains elsewhere in your portfolio. A $5,000 loss cancels out a $5,000 gain, reducing your taxable income by that amount. The IRS allows you to offset an unlimited amount of capital gains with losses in the same year. If your losses exceed your gains, you can deduct up to $3,000 of ordinary income annually, with any remaining losses carried forward indefinitely to future years.

Understanding Loss Offsets and Tax Brackets

A $30,000 loss offsets $25,000 of gains, leaving $5,000 to offset $3,000 of ordinary income in the current year and $2,000 of losses to use against future gains. The tax savings depend directly on your tax bracket. This is why tax loss harvesting delivers real cash benefits, not theoretical ones.

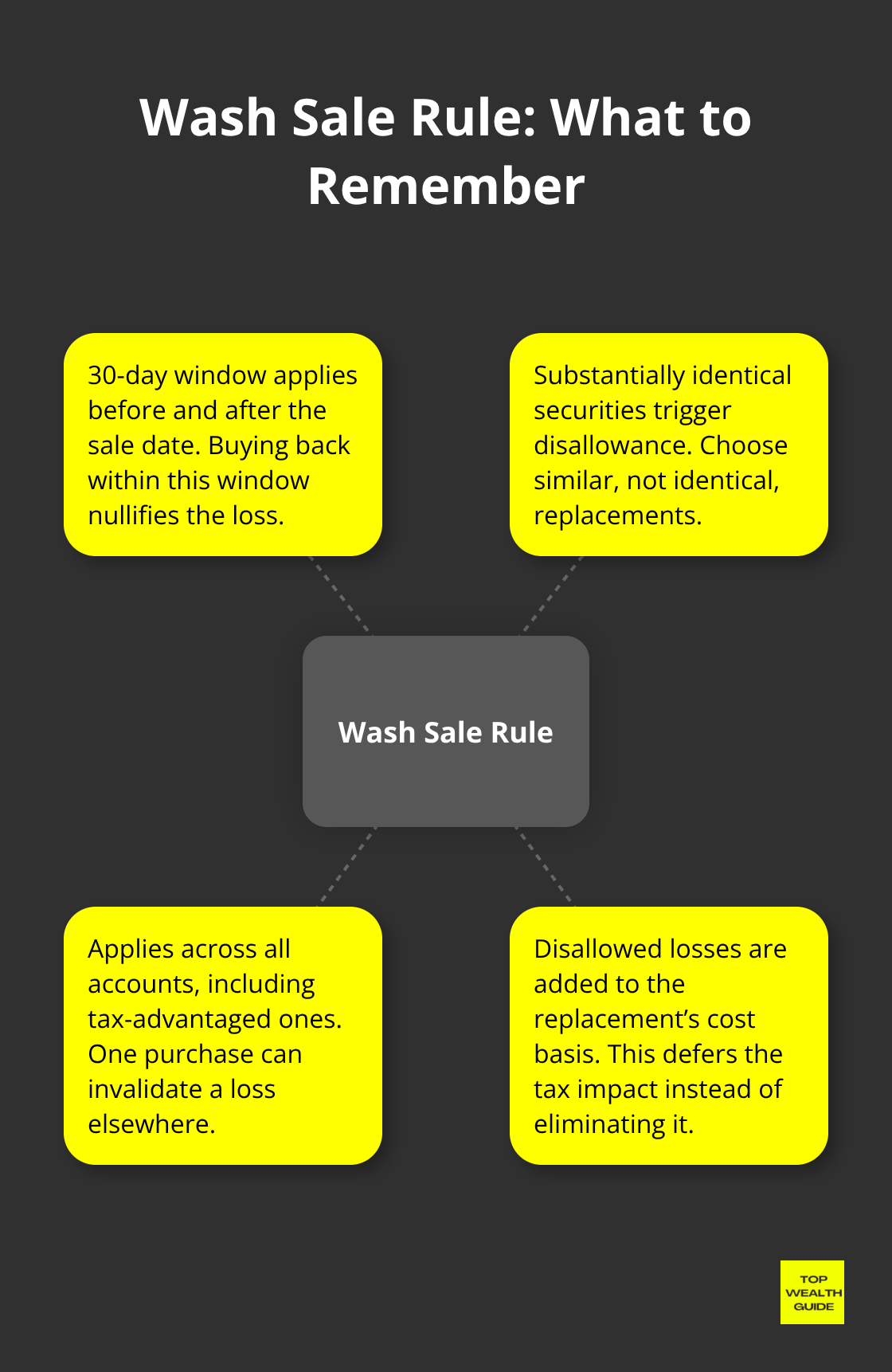

The Wash Sale Rule Explained

The IRS wash sale rule is where most investors stumble. You cannot buy the same or substantially identical security within 30 days before or after selling at a loss, or your deduction disappears. The 30-day window extends both directions from your sale date, and it applies across all your accounts simultaneously (including IRAs and 401(k)s). If you sell XYZ stock in December at a loss and buy it back in January within that 30-day window, the loss is disallowed and added to the cost basis of the replacement shares instead. This creates a hidden tax liability later.

Avoiding the Wash Sale Trap

The solution is straightforward: replace the losing position with a highly correlated but not substantially identical security. If you own a losing broad-market index fund, swap it for a different index fund tracking the same market. If you hold individual stocks, move to a sector ETF or a different company in the same industry. The key is maintaining your market exposure while sidestepping the wash sale trap. Track this across all your accounts manually since brokers only monitor wash sales within the same account.

Dividend Reinvestment and Hidden Triggers

If you reinvest dividends from the sold security during the 30-day window, you can accidentally trigger a wash sale and forfeit part of your tax break, so avoid dividend reinvestment temporarily after harvesting a loss. This oversight costs investors thousands in lost deductions each year. Once you understand these mechanics, you can move forward with confidence to identify which positions in your portfolio actually warrant harvesting and which strategies work best for your specific holdings.

Tailoring Harvesting to Your Portfolio Mix

Stock-Heavy Portfolios: Capturing Frequent Losses

Stock-heavy portfolios offer the most harvesting opportunities because individual stocks create frequent losses across different positions. A concentrated stock portfolio typically holds 10 to 30 positions, and 5% to 10% declines are common in an average year. This volatility works in your favor. When a holding drops 8% or more from your purchase price, you have a genuine harvesting candidate. You sell the losing stock, lock in the loss, then immediately purchase a different stock in the same sector or a sector ETF that tracks similar companies. If you own Apple shares down 12%, you might swap them for an equal position in the Nasdaq-100 ETF or a different technology stock. Your market exposure stays intact, but you’ve captured a tax loss worth real dollars. For someone in the 32% federal tax bracket, a $5,000 loss generates $1,600 in immediate tax savings. The critical move is documenting which specific shares you sold using specific identification rather than first-in-first-out accounting. Most brokers now offer tools to identify the highest-cost shares automatically, which maximizes your loss while preserving your remaining positions at lower cost basis.

Balanced and Diversified Portfolios: Systematic Monitoring

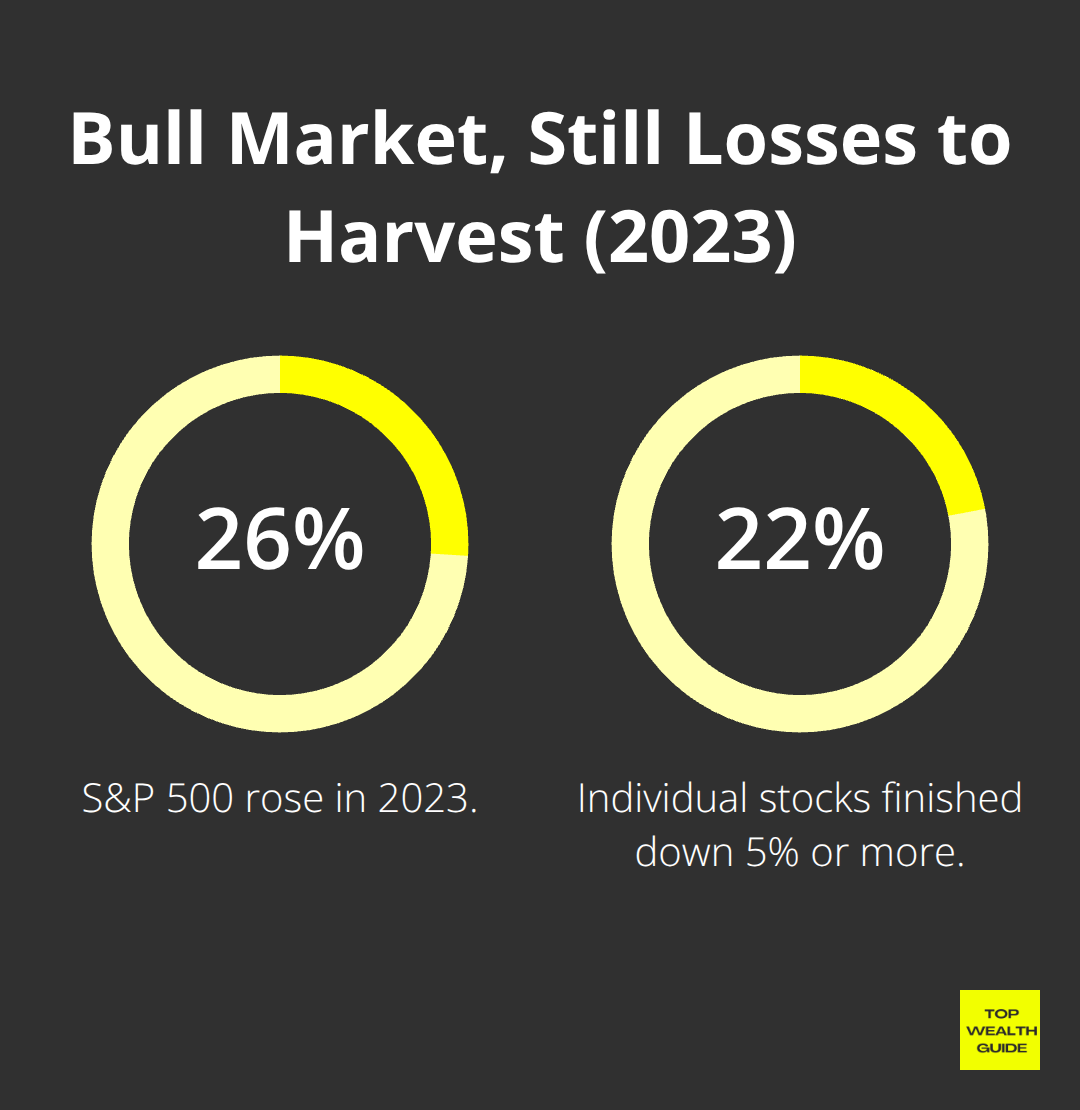

Balanced and diversified portfolios require a different approach because losses occur less frequently across broad holdings. A portfolio split between index funds, bonds, and a few individual stocks generates fewer harvesting moments than a concentrated stock portfolio. However, this is where daily or monthly monitoring becomes valuable. Technology can help investors enhance their returns by continually monitoring their portfolios for tax-loss harvesting opportunities. Even when the S&P 500 rose 26% in 2023, roughly 22% of individual stocks finished the year down 5% or more, meaning losses exist even in bull markets. If your portfolio holds both VOO (Vanguard S&P 500 ETF) and VTI (Vanguard Total Stock Market ETF), and VTI drops below your cost basis, you can harvest that loss by swapping into VOO temporarily.

They track similar but not identical indexes, so the wash sale rule doesn’t apply.

Real Estate Investment Portfolios: Targeting Dividend Income

Real estate investment portfolios work differently because REITs and rental properties generate depreciation deductions and ordinary income that create different harvesting dynamics. If you own REIT shares that have declined, harvesting those losses offsets REIT dividend income, which faces higher tax rates than long-term capital gains. A $4,000 REIT loss in a high tax bracket saves substantial current taxes while you reinvest into a different REIT or real estate sector fund. The tax benefit here exceeds what you’d capture from harvesting stock losses because REIT dividends face higher ordinary income rates than long-term capital gains.

The Universal Principle Across Portfolio Types

The key insight across all three portfolio types is straightforward: harvesting isn’t about timing market bottoms or predicting reversals. You systematically capture losses whenever they appear and convert them into measurable tax savings that compound over years. This approach works whether you hold concentrated stocks, diversified index funds, or real estate investments. The specific mechanics change, but the underlying principle remains constant. Once you understand how to identify harvesting opportunities within your portfolio structure, the next step involves the practical execution-knowing exactly when to harvest and how to document these transactions to maximize your tax benefits.

Practical Steps to Implement Tax Loss Harvesting

Set Up Quarterly Monitoring to Catch Losses Early

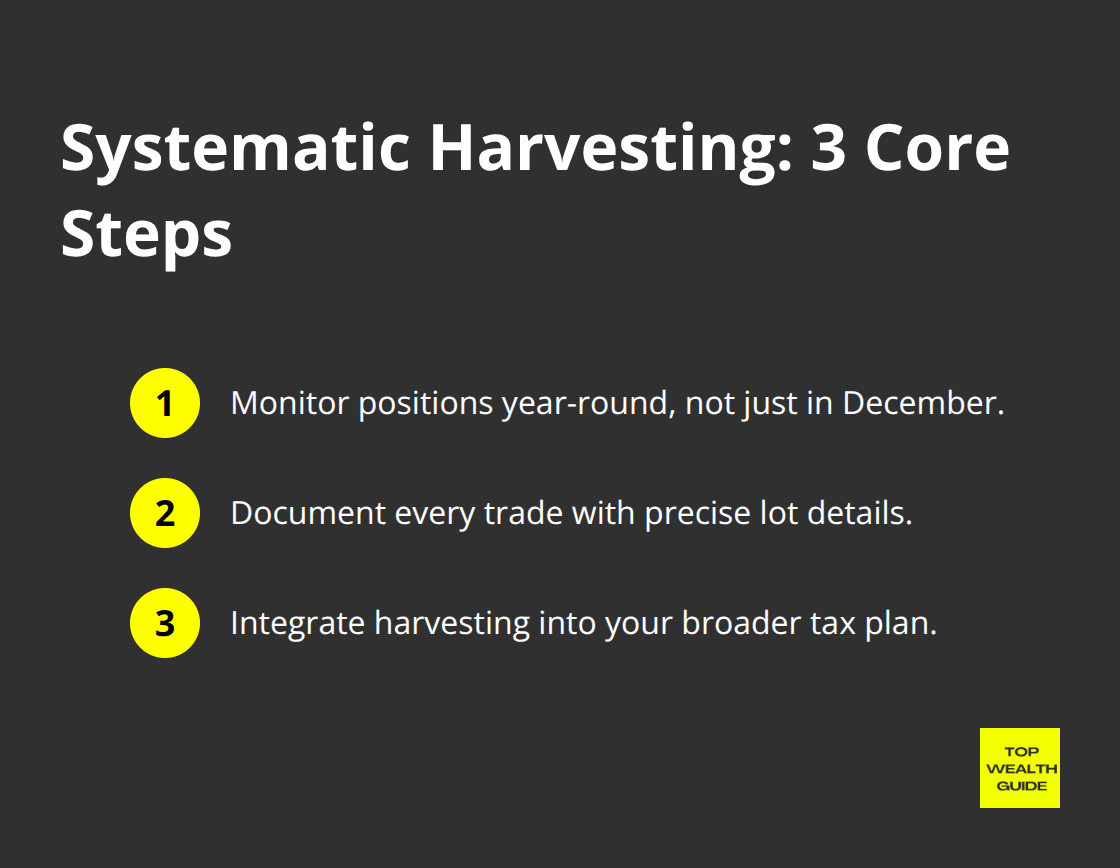

Most investors harvest losses sporadically, capturing only the obvious ones and missing the consistent opportunities that compound into thousands in annual tax savings. The difference between casual harvesting and systematic harvesting comes down to three practical steps: monitoring positions throughout the year instead of scrambling in December, documenting every transaction with precision, and integrating harvesting into your broader tax strategy rather than treating it as an isolated tactic.

Start with a quarterly review schedule to examine every holding in your taxable accounts. During each review, identify positions that have declined at least 5% from your cost basis. This threshold matters because trading costs and bid-ask spreads typically consume 0.1% to 0.5% of the transaction value, so harvesting smaller losses often wastes money on execution costs. A $2,000 loss might cost $10 to $25 in trading friction, leaving you with minimal tax benefit after accounting for the effort.

Focus on Losses That Exceed Your Transaction Costs

Focus instead on losses where tax savings meaningfully exceed transaction costs. Up to $3,000 can be deducted against ordinary income if your losses exceed gains. Use your broker’s specific identification tool to sell the highest-cost shares first, which maximizes your loss while keeping lower-cost shares that can appreciate with lower future tax liability. Vanguard’s MinTax cost basis method automates this selection in many cases, eliminating guesswork. If your broker lacks this tool, manually track which lot you’re selling by recording the purchase date, quantity, and original price before you execute the sale. This documentation becomes essential when the IRS questions your deductions later.

Create a Harvesting Spreadsheet and Track Wash Sales

Documentation is where most investors fail, creating unnecessary tax exposure. After each harvest, create a simple spreadsheet with the security name, sale date, sale price, original cost basis, loss amount, and the replacement security purchased. Include the purchase date and price of the replacement to prove you didn’t violate the wash sale rule. Set a calendar reminder for 31 days after each sale to confirm you haven’t accidentally repurchased the original security.

This matters because the wash sale rule applies across all accounts, and dividend reinvestment can trigger it without your awareness. If you own the same security in an IRA and sell it in a taxable account, the IRA purchase within 30 days disallows the taxable loss entirely. Many investors discover this mistake only when preparing taxes months later.

Coordinate Harvesting With Your Tax Professional Before Year-End

Beyond documentation, coordinate harvesting with your annual tax planning conversation with a tax professional or CPA before December 31st. At that point, you know your income for the year and can calculate whether harvesting additional losses makes sense. If you earned significantly more than expected, harvesting $10,000 in losses might save $3,700 in taxes for a high-income earner in the 37% bracket. If your income was lower, those same losses might only save $2,400.

Your tax professional can also identify carryforward losses from prior years that you may have forgotten, unlocking tax savings you’ve already paid for. The coordination step prevents you from harvesting losses you don’t need while ensuring you capture losses when their tax value is highest. This systematic approach transforms tax loss harvesting from an occasional accident into a repeatable process that consistently adds 30 to 50 basis points annually to your after-tax returns.

Final Thoughts

The real power of tax loss harvesting emerges when you treat it as a year-round discipline rather than a December scramble. Most investors wait until late November to examine their portfolios, missing months of opportunities and forcing rushed decisions under time pressure. Instead, harvest losses consistently throughout the year whenever positions decline meaningfully, which captures losses when they occur naturally and gives you flexibility to replace positions strategically.

Carryforward losses deserve your attention because they represent tax savings you’ve already earned but haven’t yet used. If you harvested $8,000 in losses this year but only realized $5,000 in gains, your remaining $3,000 loss offsets ordinary income now, and the unused $2,000 carries forward indefinitely to future years. Many investors forget about these carryforwards, missing opportunities to use them strategically when income spikes or gains materialize.

A qualified tax advisor reviews your full financial picture, identifies which losses deliver the highest tax value based on your specific bracket, and ensures you don’t inadvertently trigger wash sales across multiple accounts. They also spot opportunities you might miss, like harvesting REIT losses to offset dividend income or timing harvests to maximize deductions in high-income years. We at Top Wealth Guide emphasize that consistent tax loss harvesting compounds over time, adding 30 to 50 basis points annually to your after-tax returns.