Most people massively undersell the power of compound growth — they treat it like background wallpaper when it’s the whole damn house. A tiny, straightforward formula will tell you, in plain English, exactly how long it takes to double your money at any growth rate (no crystal ball required).

At Top Wealth Guide, we lean on the Rule of 72 — the six-second shortcut to financial clarity — to help readers make faster, smarter wealth-accumulation decisions. This tool cuts through the noise and hands you a clear timeline for hitting your goals…no fluff, just math.

In This Guide

What the Rule of 72 Reveals About Your Money

The Formula That Translates Percentages Into Action

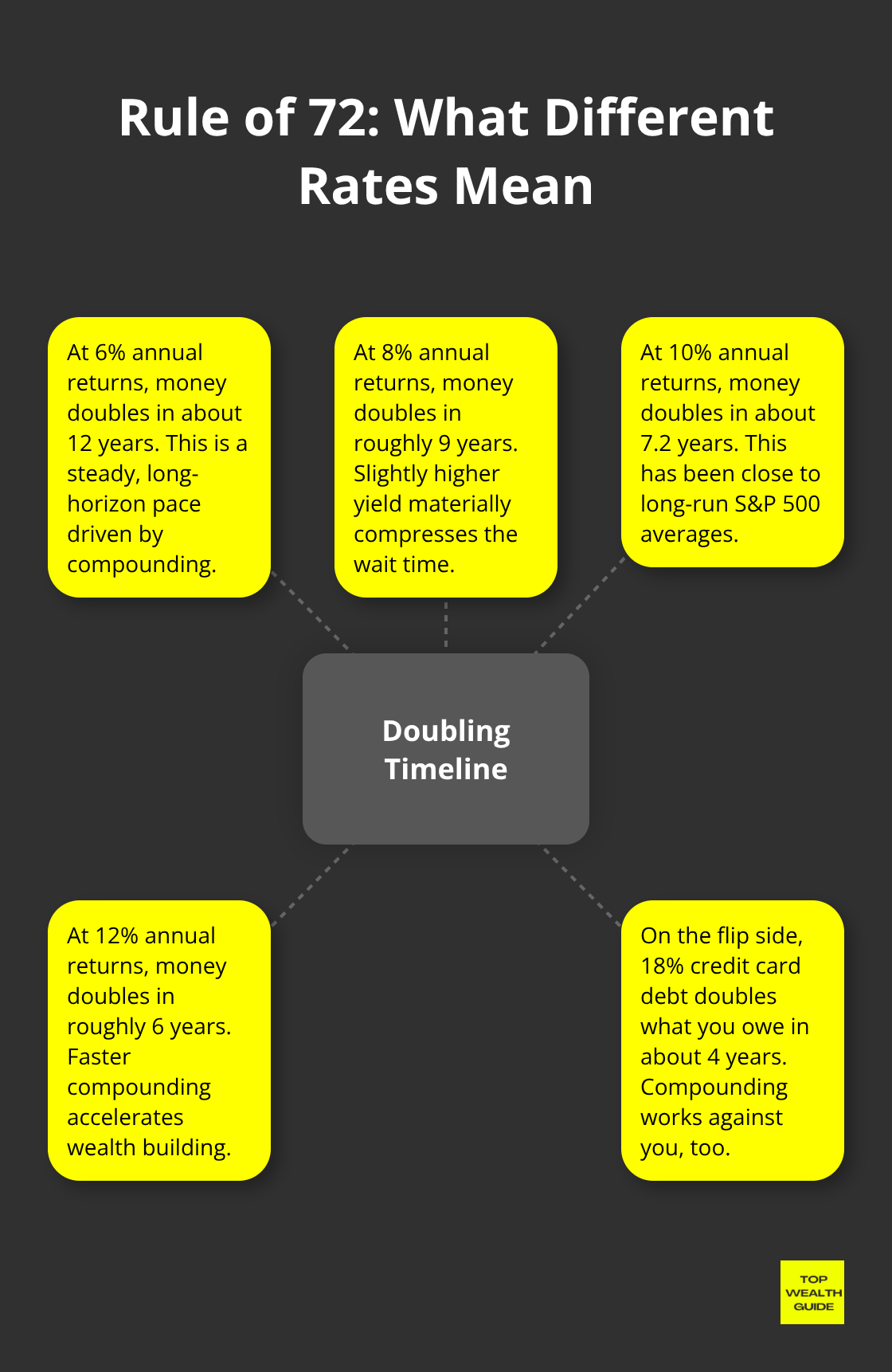

The Rule of 72 answers one crisp question: how many years until your money doubles? Take any annual growth rate – divide 72 by that rate – and you have your answer. Eight percent? Your money doubles in roughly 9 years (72 ÷ 8 = 9). Six percent? About 12 years (72 ÷ 6 = 12).

Ten percent? Cuts the timeline to 7.2 years (72 ÷ 10 = 7.2). This isn’t theory for MBA textbooks – it’s how compound interest actually behaves out in the market.

Look at the long view: the S&P 500 has averaged about 10% annually from 1928 through 2023. Translation – an index investor historically doubled wealth every ~7.2 years. That’s the rule’s gift: it turns abstract percentages into a timeline you can act on. It works because returns compound – not add – and compounding is exponential, not linear. People know compounding matters, but they can’t see it. The Rule of 72 puts the numbers in plain sight.

How Starting Age Creates Massive Wealth Gaps

Age is the silent multiplier. Start early and time does the heavy lifting. A 20-year-old who puts away $1,000 at a 7.2% return sees that money double every 10 years – by 70 it’s about $32,000. Start the same $1,000 at 30 and you end up around $16,000. Ten years delayed = halving your outcome. Brutal.

Now swap to 10% returns (the historical S&P number) – the 20-year-old walks away with roughly $128,000; the 30-year-old, about $64,000. Two percentage points – 8% to 10% – trim doubling time from 9 to 7.2 years. Over five decades that’s five extra doubling cycles. That’s why your choice of vehicle (index funds, active bets, whatever) and the timing of your start are non-negotiable if you want to build real financial independence (yes, that link again: financial independence). Small shifts in rate, massive shifts in outcome.

The Hidden Cost of Debt That Compounds Against You

The Rule of 72 cuts both ways – it reveals the cruelty of debt. A $1,000 balance at 18% APR doubles in about 4 years (72 ÷ 18 = 4). Let it sit for 8 years and you’re at $4,000. Credit card rates commonly top 15% – meaning your liabilities are compounding faster than most people’s assets (see: credit card interest commonly exceeds 15%). The math is indifferent to intent.

This formula strips emotion from the decision. It forces you to see what choices cost over time. The same exponential engine that builds generational wealth will, if misapplied, compound your ruin. So focus – pay down high-rate debt first, then feed the machine with disciplined investing. Compounding is your friend – until it’s working for someone else.

Real-World Applications for Wealth Building

Investment Returns Translate Into Years of Your Life

Investment returns aren’t abstract percentages-they’re timelines. Six percent a year? That’s doubling your money in roughly 12 years. Eight percent? Nine years. Twelve percent? Six years. The difference between 6% and 12% isn’t an Excel argument-it’s six years of your life. So yes, pick your investments like you’re picking how many years you want to work.

A low-cost S&P 500 index fund averaging 10% historically doubles wealth every 7.2 years; a bond fund at 4% takes 18 years. Over 40 years that six-point spread compounds into absurd results: the stock investor goes through about eight doublings, the bond investor gets two. The market doesn’t care about your feelings about volatility-only about rate and horizon.

If you’re 30 with 35 years until retirement, a 2% difference feels small-until you plug in the numbers and realize you’ll likely work an extra 5–7 years to reach the same nest egg. Nobody’s screaming about fees in the streets because fees kill outcomes quietly. A mutual fund charging a 1% expense ratio doesn’t sound dramatic-until you reverse the Rule of 72. That 1% drag on a 7% gross return drops you to 6% net. Your money doubles every 12 years instead of 10. Over 40 years, that’s two full doubling cycles vaporized-potentially hundreds of thousands of dollars you never actually signed away.

How Expense Ratios Compound Against Your Wealth

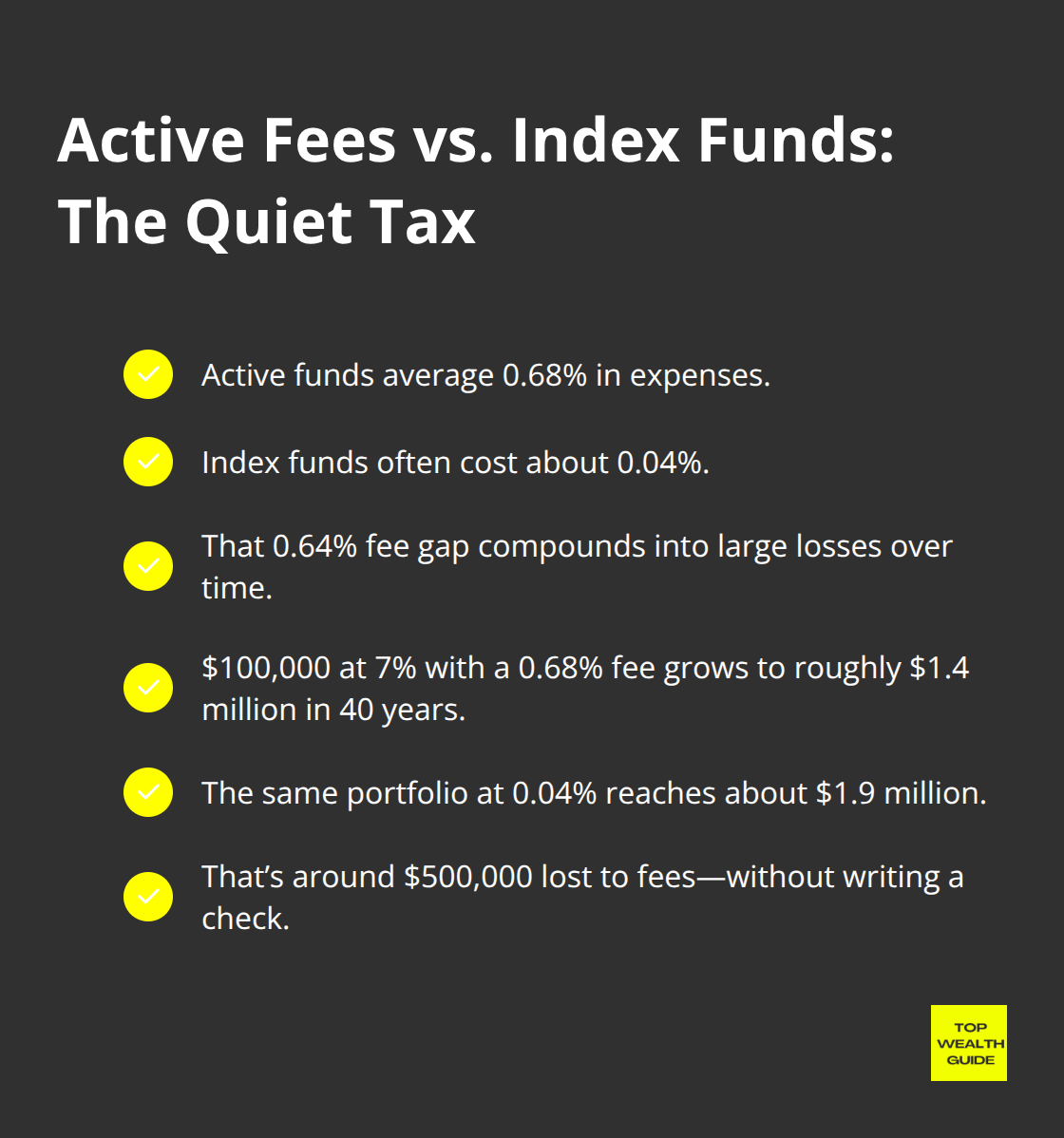

Vanguard’s numbers show expense ratios across active funds average 0.68% while index funds cost 0.04%. That 0.64% gap is boring on a statement and ruinous over time. The tiniest fee becomes the largest wealth killer once time enters the equation.

A $100,000 portfolio returning 7% but paying a 0.68% fee grows to roughly $1.4 million over 40 years. The identical portfolio in a 0.04% index fund hits about $1.9 million. Congratulations-you just paid half a million dollars for nothing (and never wrote a check). That’s the industrial-strength quiet tax of active management.

Retirement Planning Demands Precision With the Rule of 72

A 25-year-old aiming for $1 million by 65 has 40 years of compounding. At 7% they need roughly $66,000 today. At 10% they need $22,000. That’s a $44,000 swing in starting capital-or 18 extra years of saving. Precision matters because time is the secret weapon, and higher returns are the cheat code if you’re late to the game.

People consistently underestimate how much time can make up for lousy returns-and overestimate how much returns can make up for not starting. Start early. Fee-snipe. Compound relentlessly.

Side Hustles and Business Growth Follow the Same Math

Side hustles obey the same brutal math. If your side hustle throws off $500 a month and you reinvest it at 12% annually, money doubles every six years. After 18 years that $6,000-per-year contribution compounds into roughly $24,000 without you adding another dime. Bump it to $1,000 monthly and reinvest at 15%-doubling every ~4.8 years-and 18 years can turn into $72,000. The rate of return on your side income matters as much as the income itself.

Evaluate businesses by trajectory, not just today’s revenue. Something compounding at 25% a year doubles every 2.88 years; something at 8% doubles every nine years. One builds a lifestyle business-pleasant, predictable. The other builds a sellable asset that actually funds your retirement. The Rule of 72 forces a sharper question: not “How much does this business make today?” but “How fast does it compound?” Growth speed separates the ventures that buy you freedom from the ones that keep you employed.

How to Pick Investments That Actually Accelerate Your Doubling Timeline

The Four-Year Gap That Determines Your Retirement

Small differences in return – massive differences in time. The Rule of 72 is a blunt instrument that tells a brutal truth: 6% doubles your money in 12 years; 10% does it in 7.2. That four-year wedge? Over a career it compounds into five extra doublings. Most people chase the next hot ticker or a dopamine hit from headlines – while the math that actually sculpts your balance sheet sits ignored. Stop mistaking noise for edge. The real lever is yield – lock a structural advantage and you buy years back (literally) of life you can spend out of the workforce.

Why Active Management Destroys Your Wealth Silently

Give up the fantasy that someone picking stocks for you will outpace the market enough to justify the fees. Vanguard data shows the average active fund charges 0.68% in expenses while index funds cost 0.04% – that 0.64% gap chews through returns like rust. Over 40 years on a $100,000 portfolio that spread erases two full doubling cycles. Two. Full. Cycles.

An S&P 500 index fund has historically returned about 10% annually; a bond fund, closer to 4%. This isn’t debate fodder – it’s calendar math. Choose poorly and you’ve volunteered to work an extra 5–7 years to hit the same retirement number. If you’re under 50 with a 20-plus year horizon, bonds are a safety theater that quietly bankrupts your future. The numbers don’t care how comfortable you feel. A $100k in a 0.68% active fund at 7% becomes roughly $1.4M over 40 years. The same in a 0.04% index fund? About $1.9M. You just paid half a million for nothing – no paperwork, no audit, just forgotten fees. Call it the quiet tax of active management.

Multiple Income Streams Compound Faster Than One

Don’t build side hustles because it sounds diversified – build them because they change the math. Compound interest (https://www.westernsouthern.com/investments/how-does-compound-interest-work) is the catalytic converter of wealth. A $500-per-month side gig at 12% doubles every six years; $1,000 at 15% every 4.8 years. In 18 years that $1,000-a-month habit grows into about $72,000 without additional sweat.

Focus on which incomes compound – not which pay the most today. Freelancing pays well but is linear: you trade hours for dollars. Digital products, software, licensing – they scale; they decouple time from output. A business growing 25% annually doubles every 2.88 years; at 8% it takes nine. That gap is the difference between a sellable asset worth millions and a glorified job with nicer business cards.

Track Your Portfolio Quarterly to Stay on Target

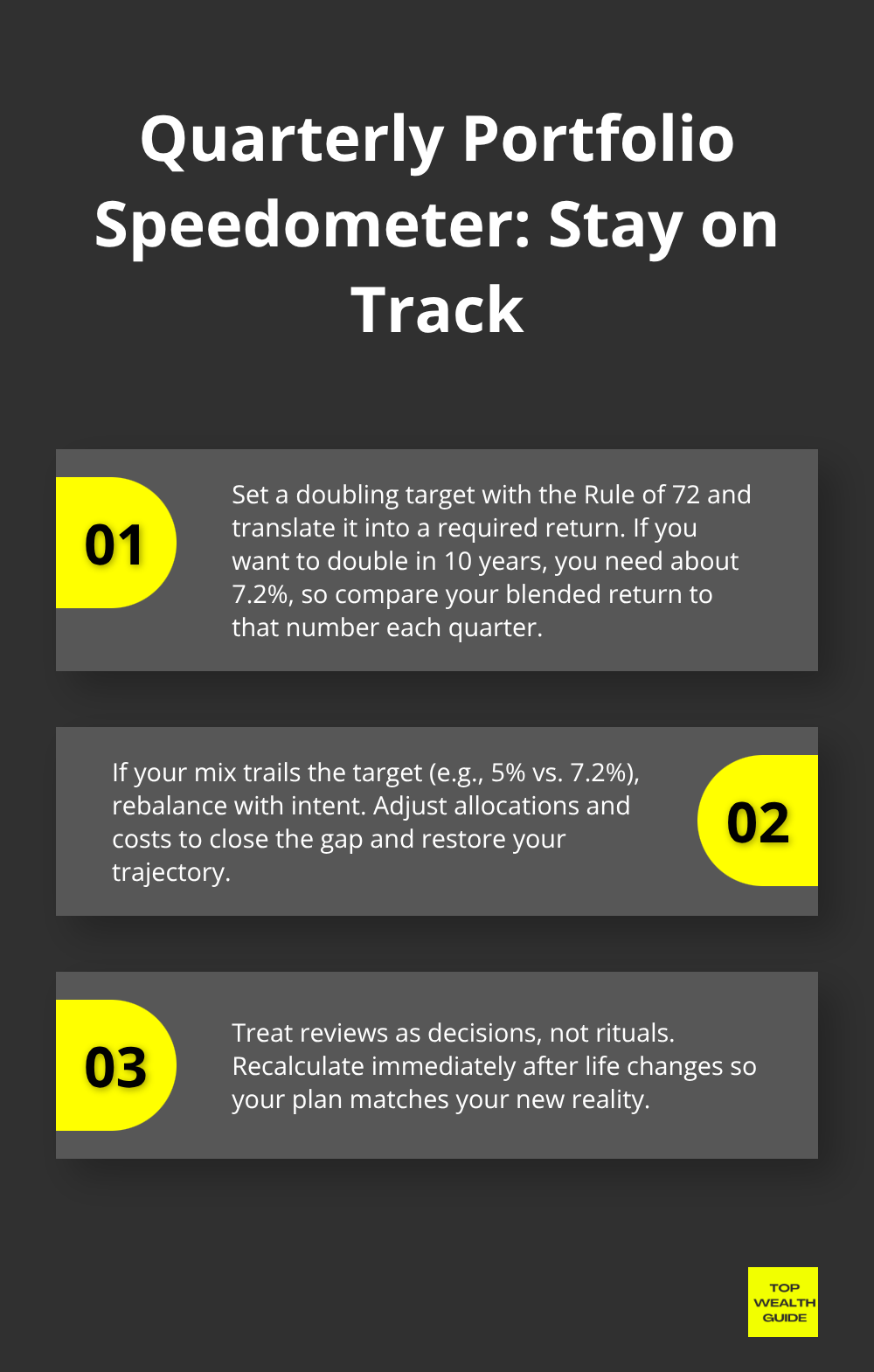

Use the Rule of 72 (https://money.usnews.com/investing/articles/the-rule-of-72) in reverse as a speedometer: want to double in 10 years? You need a 7.2% blended return. If your mix is averaging 5%, you’re off target – rebalance. Quarterly reviews force decisions; annual check-ins are a procrastinator’s alibi. When life changes (raise, inheritance, job swap), recalc immediately.

Here’s the pain: a 30-year-old with $50k and a 7% return reaches roughly $1.6M by 65. The same person at 40 with $50k hits about $400k. That lost decade doesn’t come back. Every year you delay costs you a chunk of a doubling cycle – and those chunks become a retirement you can’t buy back.

Final Thoughts

The Rule of 72 strips away complexity and hands you one, brutally useful number: how many years until your money doubles. Divide 72 by your return rate and you have a timeline – plain, arithmetic, impossible to ignore. A 7% return doubles your wealth in roughly 10 years; a 10% return does it in 7.2 years. The difference between those two? Not theory – it’s years of your life you either slog through or don’t.

Why it matters is obvious when you stop treating percentages like wallpaper and start treating them like time. Percentages feel abstract; time is visceral. Most people don’t fail at building wealth because they lack discipline – they fail because they can’t connect today’s choices to tomorrow’s life. The Rule of 72 makes that link visible. It explains why starting at 25 instead of 35 isn’t a cute footnote – it’s the difference between retiring at 55 or 65. It makes painfully clear how a tiny 0.64% fee gap between an active manager and an index fund becomes-over 40 years-half a million dollars (yes, half a million).

The real power of the Rule of 72 is tactical: use it to make one decision at a time. Want to double your money in 10 years? You need about 7.2% compound returns – does your portfolio clear that bar? Considering a side hustle? Ask what rate it compounds at, not just the hourly pay. We at Top Wealth Guide built this content because the Rule of 72 is the fastest way to stop treating wealth building like something that happens to you and start treating it like something you control. Simple math. Big consequences. Use it.