Most retirees lean on Social Security alone — about $1,907 a month, on average. That’s not a plan; it’s a hope… and hope doesn’t pay the electric bill or fund a calm retirement.

Dividend-growth investing is the practical alternative — less headline-grabbing than NFTs, more reliable than market timing. It’s how you build a second income stream that compounds over decades (slow, steady, almost boring — which, in this case, is a feature).

At Top Wealth Guide, we’ve seen dividend-paying stocks convert precarious retirements into something sturdier. This guide shows you exactly how to construct a portfolio that generates rising income while protecting purchasing power from inflation — not a miracle, just math and discipline.

In This Guide

The Math Behind Dividend Growth

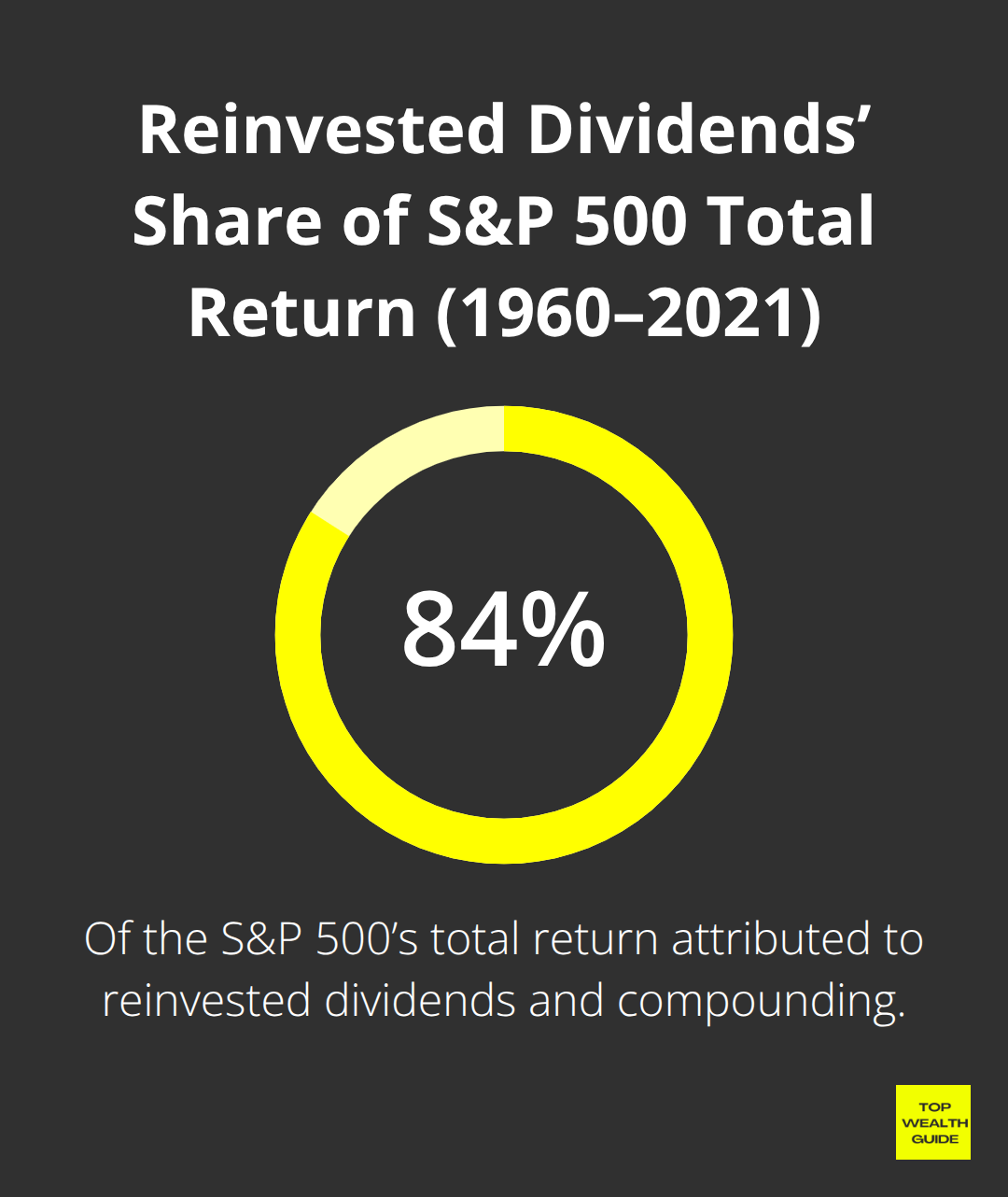

Dividend-paying stocks don’t just compete – over long stretches they obliterate non-dividend payers. Hartford Funds dug into the S&P 500 and found that reinvested dividends and compounding drive returns far more than price appreciation alone. That’s not window dressing – that’s the engine. A stock that grows 6 percent annually but pays nothing produces far less wealth than one that grows 4 percent and pays 2 percent in dividends – especially over 20 or 30 years. Since 1973, dividend-growth stocks have delivered higher returns with noticeably lower volatility than their non-dividend peers, per the same research. Why care? Because volatility kills retirees – sudden market hits force you to sell at losses to pay the bills. Dividend stocks give you cash flow that isn’t hostage to the market’s mood.

Reinvestment Compounds Faster Than You Expect

Here’s the part people miss: compounding on dividends is a multiplier – quietly ruthless. A 3 percent yield reinvested annually on a $100,000 portfolio grows to roughly $180,000 after 20 years, assuming a 5 percent price appreciation and no new money. Strip out the dividend and you’re at about $160,000 – a $20,000 gap on identical underlying returns.

Add steady contributions over decades and that gap explodes. Start early and consistency wins – not flash trades or timing heroics. A 35-year-old putting $500 a month into dividend growers until 65 will likely out-accumulate a 50-year-old who throws in $1,500 monthly (yes, even with the higher savings rate). Time and consistency – the boring superpowers.

Taxes Don’t Have to Destroy Your Returns

Taxes sneak up on investors – until April arrives and you realize the drag. Qualified dividend income gets preferential rates – typically 15 percent or 20 percent depending on income – versus ordinary income that can hit 37 percent. That’s a structural edge versus bond interest or short-term gains. Put dividend stocks in tax-advantaged accounts (IRAs, 401(k)s) and you wipe out tax drag during accumulation. In taxable accounts, reinvesting dividends in the same holdings keeps you in the compounding machine without triggering taxable churn. And retirees often land in lower brackets – married filers might pay zero federal tax on qualified dividends up to roughly $89,250 of income (2024 figures), which makes the math even friendlier. The point: dividend strategies, done with account-awareness, naturally tilt toward tax efficiency.

Where Quality Separates Winners From Traps

Not all dividends are created equal. A high yield often reads like a siren song – attractive, loud, and usually signaling trouble (unsustainable payouts, deteriorating fundamentals). Companies that raise dividends consistently (even modestly) are signaling financial strength and managerial discipline. Check the payout ratio – if a company hands back 60–70 percent of earnings, there’s not much left to reinvest or to cushion a downturn. The real winners keep payout ratios at levels that allow growth and safety. That’s the difference between dividend aristocrats (25+ years of raises) and dividend traps that implode when the business turns south. Your next move: learn to spot companies that can actually sustain and grow payouts through cycles – not just the ones dangling the juiciest yield today.

Building Your Dividend Growth Portfolio

Retirement success is less about clever theories and more about the grind – execution. You can read every book, watch every webinar, but if you don’t have a repeatable system for finding companies that will actually raise dividends for decades, for spreading your capital so your holdings don’t all fall off a cliff at once, and for putting cash to work month after month regardless of the headlines, you’ll end up nervous and underfunded.

Screen for Proven Dividend Growers

Start with dividend aristocrats and dividend growers – names that have increased payouts for 10+ consecutive years. That streak signals management buy-in and financial durability. Think PepsiCo, Colgate-Palmolive, Air Products and Chemicals, Kimberly‑Clark – firms that lifted dividends through recessions, that (in Morningstar speak) sit behind wide moats, and that trade at sane multiples. Use Morningstar’s distance-to-default metric to vet balance-sheet risk – lower is better; lower means the dividend’s less likely to get cut. Peek at the payout ratio when you find a candidate: 55–70% of earnings returned to shareholders is the sweet spot – room to grow the payout and some built-in downside protection. Anything north of 80%? Fragile. EOG Resources, for instance, yields 3.64%, has a narrow moat, and returns roughly 70% of free cash flow to shareholders – income plus flexibility. That’s the kind of balance you want.

Diversify Across Sectors and Asset Types

Don’t confuse diversification with a list of names – spread across sectors and asset types. Utilities give you low-to-mid single-digit yields (roughly 2.84%); REITs run higher (around 4.19%); energy‑infrastructure – ONEOK, Enterprise Products Partners, Williams Companies – offers even more yield but different cash-flow drivers. The rookie mistake: go for the highest yield first.

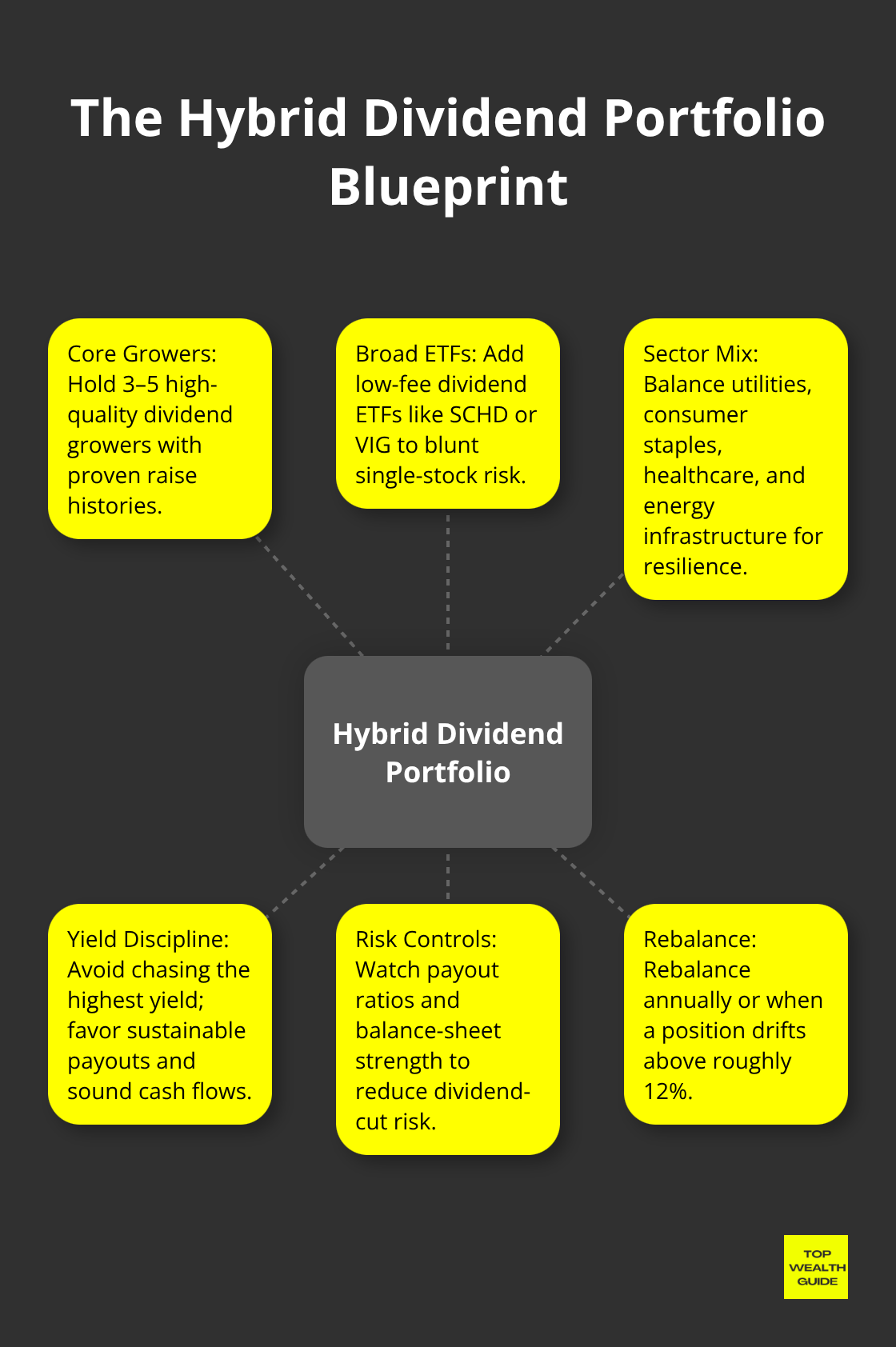

AES paying 5.0% sounds sexy until the dividend stalls and the payout becomes a hostage to commodity prices or capital needs. Instead, build a core of high-quality dividend growers (3–5 conviction holdings with proven histories), then fill gaps with diversified dividend ETFs – SCHD, VIG – to blunt single-stock risk. The hybrid approach gives you both conviction and breadth without inducing analysis paralysis.

Invest Consistently Regardless of Market Conditions

Consistency beats timing – every time. Commit to a fixed monthly amount – $500, $1,000, $2,000 (whatever you can afford) – and stick to it. Dollar-cost averaging isn’t magic, but it removes emotion: when prices fall, your fixed contribution buys more shares; when prices rise, you buy fewer. Over decades that discipline compounds into serious wealth. A 40‑year‑old contributing $800 per month for 25 years will almost always beat the person waiting for the “perfect” entry or making erratic, confidence-driven lump sums. Volatility becomes an ally – lower prices increase your long-term share accumulation.

The true exam for a dividend portfolio comes when markets go south. That’s when these holdings show their mettle – not in flashy price moves but in steady cash flow that lets you ignore the noise and keep doing the sensible thing. Stay the course.

Common Mistakes in Dividend Investing

Yield Chasing Destroys Long-Term Returns

Hunting for yield like it’s a sport – that’s the rookie move. A 6 percent dividend looks sexy on paper until a year later the company hacks it down because the payout ratio sits at 95 percent of earnings – which means zero margin for error when revenue slips or capital needs spike. High yield can be a siren song.

Altria yields 7.31 percent and trades roughly 11 percent below Morningstar’s fair value. Sounds great-until you remember the business is structurally shrinking as smoking rates decline. The dividend survives because management chooses to prioritize it (political will > economics sometimes) but growth? Stalled. Chasing the juiciest yield without asking whether the company can actually sustain and grow that payout is how you end up holding the hot potato as the stock collapses.

The real wealth-builders are boring – 3 to 4 percent yields with 5 to 8 percent annual dividend growth baked in. PepsiCo yields 3.92 percent and is a dividend aristocrat with 25-plus consecutive years of increases. That consistency matters way more than a fleeting 6 percent that evaporates. Look at payout ratios first. If a firm returns 55 to 70 percent of earnings to shareholders, there’s room to grow the dividend and absorb a downturn. Anything above 80 percent? Red flag – the company has painted itself into a corner.

Distance-to-default – a Morningstar-ish metric for balance-sheet strength – tells you how far a company is from financial distress. Lower distance-to-default equals higher risk of a dividend cut. Screen for companies with real moats (not marketing fluff), low uncertainty ratings, and balance sheets that prove they can survive a recession without slashing payouts.

Concentration Risk Wipes Out Portfolios

Over-concentration is just another flavor of gambling. No single stock should be more than 5 to 10 percent of your holdings – and even that upper bound is only if it’s a conviction pick with ironclad fundamentals. Too many retirees pile into one high-yield energy-name like ONEOK or Enterprise Products Partners, convinced cash flow is bulletproof – then a sector downturn or policy shift vaporizes 20 to 30 percent of their portfolio in months.

Diversify across sectors – utilities, consumer staples, healthcare, energy infrastructure – so one stumble doesn’t become a catastrophe. A hybrid approach works: build a core of 4 to 6 high-conviction dividend growers you actually understand, then fill the rest with low-fee dividend ETFs like SCHD or VIG to capture broad exposure without single-stock risk. Conviction plus protection.

Rebalance annually (or whenever a holding drifts above 12 percent). Discipline beats hope. The math is brutal – a portfolio weighted 40 percent into one stock that falls 30 percent loses 12 percent of total value; in a diversified portfolio that same hit costs you about 3 percent. Over 20 years that difference compounds into the gap between a comfortable retirement and a stressful one.

Final Thoughts

Dividend-growth investing rewards discipline more than cleverness – not sexy, but effective. Hartford Funds found reinvested dividends drove 84 percent of the S&P 500’s total return from 1960 to 2021 – that’s not a thesis, it’s the plumbing that builds retirement security. Three practical moves tilt the odds in your favor: screen for companies with durable dividend-growth histories and payout ratios between 55–70 percent of earnings, diversify across sectors and tack on low-fee ETFs like SCHD or VIG to blunt single-stock risk, and invest steadily each month no matter the market’s drama.

Keep an eye on the payout ratio, the dividend-growth rate (target roughly 5–8 percent annually if you want to outpace inflation), and valuation versus fair value as you add positions. Rebalance once a year to stop concentration creep – it sneaks up on you. And don’t get trapped by the classic investor sins: yield chasing, over-concentration, and pretending sustainability signals don’t matter. Nail these three disciplines and a portfolio becomes less a gamble and more a rising income stream that protects purchasing power over decades.

Start small – one or two conviction holdings you actually understand – then plug a diversified dividend ETF into the mix to broaden exposure. We at Top Wealth Guide deliver practical frameworks and market insights so you can build wealth methodically. A second income stream that compounds quietly for 20, 30, 40 years turns hope into a plan – slow, boring, and devastatingly effective.