Most investors panic when market volatility strikes — they bolt for the exit, sell low, lock in losses, and then stand on the sidelines watching the rally like it’s a Netflix show (regret streaming in HD).

At Top Wealth Guide, we’ve seen the opposite approach work — reliably. The investors who actually profit treat market swings as a sale aisle, not a siren; they lean in, buy the dips, and let compounding do the heavy lifting. Simple. Unsexy. Effective.

In This Guide

What Volatility Actually Costs You When You Panic

Volatility is just a measure of how fast and how far prices swing – think of it as the market’s mood ring. On December 29, 2025, the CBOE Volatility Index closed at 14.20 – relatively calm. Calm, though, is a short-lived luxury. When the tape turns ugly, one dumb decision – selling into a 10% drop or hiding in cash waiting for a mythical “perfect” entry – can erase years of gains. The S&P 500 has ripped off two-day declines north of 10% after policy shocks (tariff headlines, surprise guidance, you name it). Missing the best days over decades slashes returns – and the worst part? The best days and the worst days sit cheek by jowl, so panic-selling to avoid pain is the fastest route to missing the rebound.

The Numbers Behind Staying Invested

Morningstar’s data is stubbornly blunt. Years with fewer than ten really volatile days produced roughly 20% returns amid about 3% GDP growth. In 2008, 72 of 253 trading days moved ±2% or more – brutal – and yet the market staged significant recoveries, often posting double-digit rallies afterward.

These aren’t theoretical – they’re the arithmetic of real investor experiences. Volatility creates mispricings. When fear runs the show, stocks get oversold – and oversold stocks give disciplined investors actual, actionable entry points.

How Smart Investors Weaponize Market Fear

Fear feeds volatility – and volatility feeds fear. But that feedback loop is also a profit machine if you come prepared. When the VIX spikes, protective puts become pricey – which makes the market a great place to sell income strategies if your underlying holdings are quality names. Equity-market-neutral shops buy the oversold deciles and short the frothy ones – stripping out directional risk and punching through volatility for alpha. Merger-arbitrage players exploit deal-price dislocations. Relative-value strategies hunt divergence between otherwise correlated securities – betting they snap back. The minimum volatility asset class historically hands investors asymmetric outcomes – softer downside, reasonable upside participation. That asymmetry matters.

Preparation Separates Profit Takers from Panic Sellers

Volatility spikes aren’t prophecy – they’re invitations. The gap between the panic seller and the profit taker isn’t timing or luck; it’s preparation. Written goals (yes, actually written), diversified allocations across equities, bonds, real assets and alternative sleeves, and disciplined rebalancing during dislocations – that’s the playbook. The winners aren’t the people predicting the market’s next tantrum; they’re the ones who act when prices depart from fundamentals.

Do this work now, and when the next correction shows up – and it will, sooner than most expect – you’ll be the person buying while everyone else is selling.

Building a Portfolio That Profits From Volatility

Why Different Assets Move in Different Directions

Volatility rewards diversification – not because diversification is cozy, but because markets move like a busy intersection: different lanes, different speeds, different directions. When stocks crater 15%, quality bonds often act like ballast – they stabilize or even climb. When growth stalls, real assets (think inflation-protected securities) hold their ground. A 60/40 split historically smooths the ride far better than 100% equities – especially during the sharp 10%+ drops that show up every few years. 2008 made this painfully clear – balanced portfolios recovered faster because bonds provided calm while equities found their floor. You need exposure to equities, fixed income, real assets, and some non-traditional plays; concentration in one bucket is how people panic-sell at the worst moment.

Sectors Shift When Rates Change

Sector selection matters as much as asset class. When the Fed cuts rates (which usually follows market turmoil), rate-sensitive sectors – utilities, consumer staples – tend to hold up better than cyclical names. Build a core that survives multiple scenarios – not to pick which one hits, but to weather them all without flinching. That removes the useless burden of forecasting and replaces it with preparation.

Dollar-Cost Averaging Removes the Timing Trap

Dollar-cost averaging during swings works because it fixes the paralysis of timing. Waiting for the perfect bottom is a trap – nobody finds it. Commit a fixed amount every month into core holdings, whatever the price. The S&P 500 fell over 10% in two days after April tariff announcements in recent years – that’s exactly when most people froze. A disciplined investor putting $500 monthly into index funds or select names buys more when prices are depressed, fewer when frothy – automatic rebalancing without drama.

Tax-loss harvesting magnifies the advantage: sell a loser, claim the deduction, redeploy into a similar (not identical) security – stay invested, reduce your tax bite. Rebalance quarterly or semi-annually to force the hardest habit: sell winners, buy losers. When volatility pushes your stock allocation from 60% to 75% (because bonds held up), trim stocks and add bonds. Mechanical discipline turns gut-wrenching emotion into a checklist.

Finding Quality Names at Discount Prices

Undervalued stocks emerge during selloffs because fear is indiscriminate – the good get knocked with the bad. Look for companies with durable advantages, predictable cash flow, and reasonable long-run valuations; when volatility hits and they trade at discounts, they become obvious buys. Use screeners to find quality names below their three-year average P/E during corrections. Deploy cash in stages – not all at once – so you participate in the rebound without betting the farm on a single entry. That staged approach positions you to benefit when the market misprices stuff again (and it will).

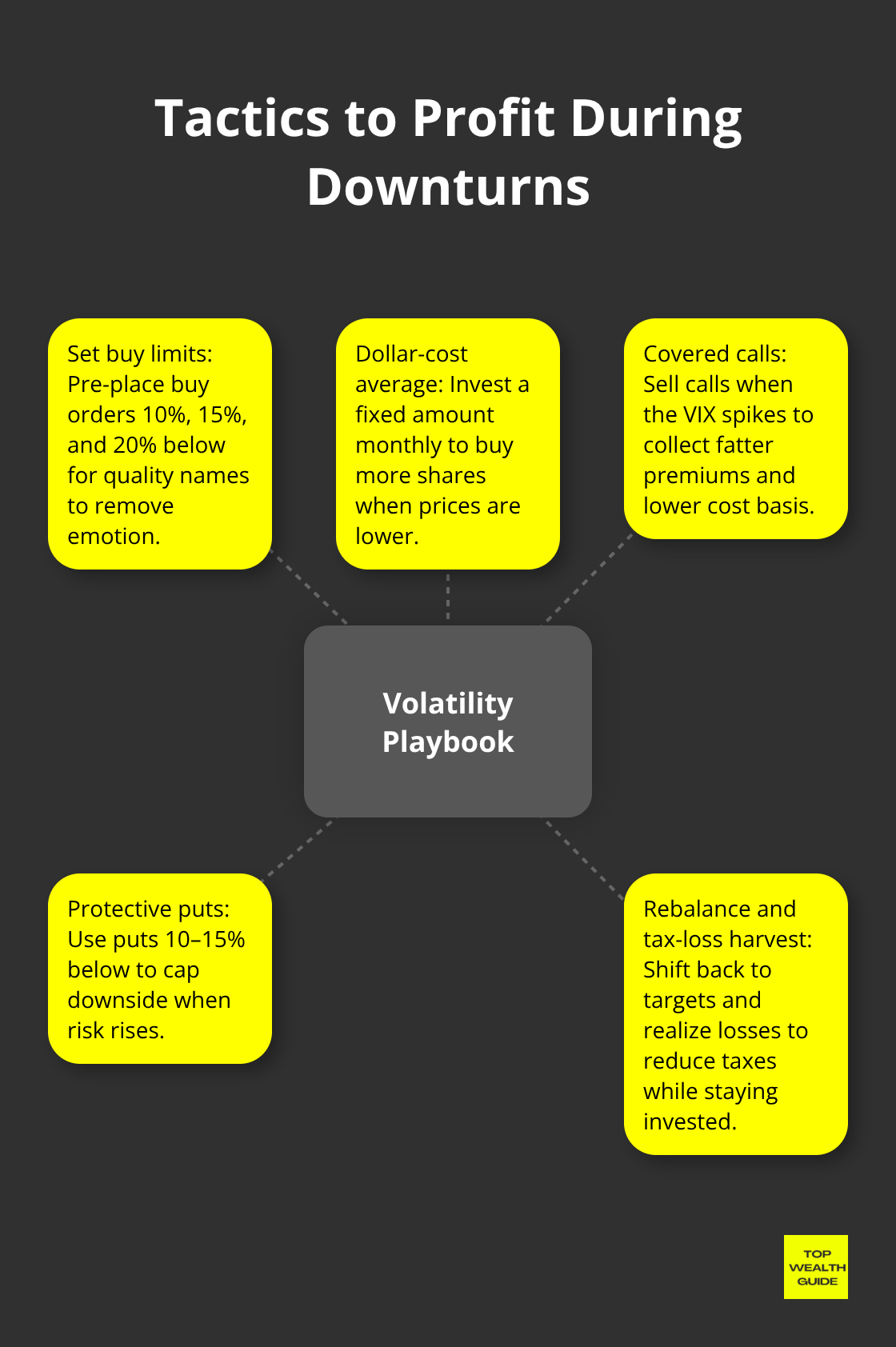

Tactical Moves to Profit During Market Downturns

Set Buy Limits Before Volatility Strikes

Decide what you’ll pay before the market starts yelling at you-set buy orders at price levels for quality names you already own or have actually researched. When the S&P 500 drops 10% (historically a two-to-three-yearish event), your limit orders fire off-no sweating the red numbers, no paralysis.

The yearly average return of the S&P 500, dividends included, is 10.5% over the last 100 years-so this isn’t superstition, it’s arithmetic. Place limits at 10%, 15% and 20% below today’s prices for core holdings, fund them with cash set aside specifically for corrections, and let discipline do the heavy lifting. Emotion stays on the bench-you already made the decision before the panic arrived.

Generate Income Through Options When Volatility Spikes

Sell covered calls when the VIX spikes and option premiums balloon-simple, effective, and underappreciated. Best used on stocks you want long-term but wouldn’t lose sleep if they left at a modest premium. Sell a three‑month call about 8–12% above today’s price and pocket the premium now. Investors lower their cost basis this way-immediate cash, lower effective price. If the stock rips past the strike, fine-you lock in the gain plus premium. If it stalls or slides, you keep the premium and own the position cheaper. In volatile markets the premiums are fat enough to make this worth your time. On a $10,000 position, 2–3% quarterly from covered calls is real money-$200–300 every three months-reduces sequence-of-returns risk. Protective puts are the other side of the pillow: buy a put 10–15% below to cap downside-insurance is expensive when fear spikes, but it buys you optionality.

Rebalance Your Portfolio When Volatility Distorts Allocations

Volatility will mangle your target allocation faster than you think. A 60/40 portfolio can look like 70/30 after a rout-suddenly you’re overexposed to the thing that burned you. Rebalance quarterly or semi-annually without debate. Trim roughly 10% of stocks and redeploy into bonds or real assets. Feels perverse-sell the winners, buy the losers-that’s literally why it works. Discipline during downturns rewarded the rebalancers in 2009; the mechanics are boring, the outcome is powerful.

Harvest Tax Losses to Amplify Your Edge

Tax-loss harvesting is a multiplier on rebalancing. Sell a holding down about 15%, claim the loss against gains, then buy a similar (not identical) security-lock the tax benefit, stay invested, reset your cost basis lower. Do this on a cadence (twice a year is reasonable) and you’ll shave 1–2% off your annual tax drag-compounding matters over decades. Make it mechanical: don’t overthink, don’t “time” it-just execute on schedule.

Final Thoughts

Market volatility isn’t something you survive-it’s something you exploit. The folks who sat through 2008, 2020, and every puke-and-repeat in between didn’t get lucky; they built real wealth. The panickers? They locked in losses and spent years digging out. The gap wasn’t IQ or fate-it’s preparation and discipline, applied before markets turn ugly.

Start the action plan now-don’t wait for the sirens. Write down your financial goals and tell someone you trust (a spouse, a family member, an advisor) so volatility becomes a checklist, not a crisis. Set buy limits at 10%, 15%, and 20% below today’s prices for quality holdings you actually want to own-fund those brackets with cash reserved for downturns-and let discipline fire those orders when prices drop and everyone else is panic-selling.

Build a diversified portfolio across equities, bonds, real assets, and non-traditional strategies. Rebalance quarterly-no debate-trim winners, buy losers. Harvest tax losses to reduce your annual drag. Sell covered calls when the VIX spikes to generate immediate income. And for the love of compound returns, stay invested through the noise-because the best days cluster near the worst days.

Visit our investing guides to develop a plan tailored to your goals and risk tolerance-and prepare for the next market volatility event before it shows up.