Most people manage money the way their parents did — rituals, rules-of-thumb, and whatever neighborhood wisdom stuck. At Top Wealth Guide, we watch the wealthy operate… and it’s a different playbook entirely.

The rules that separate the rich from everyone else? Not complicated. Not mystical. Just applied with intention — repeatedly — until the outcome is inevitable (boring discipline beats brilliant impulses, every time).

In This Guide

Why the 50/30/20 Rule Fails Wealthy People

The Math Breaks at High Income Levels

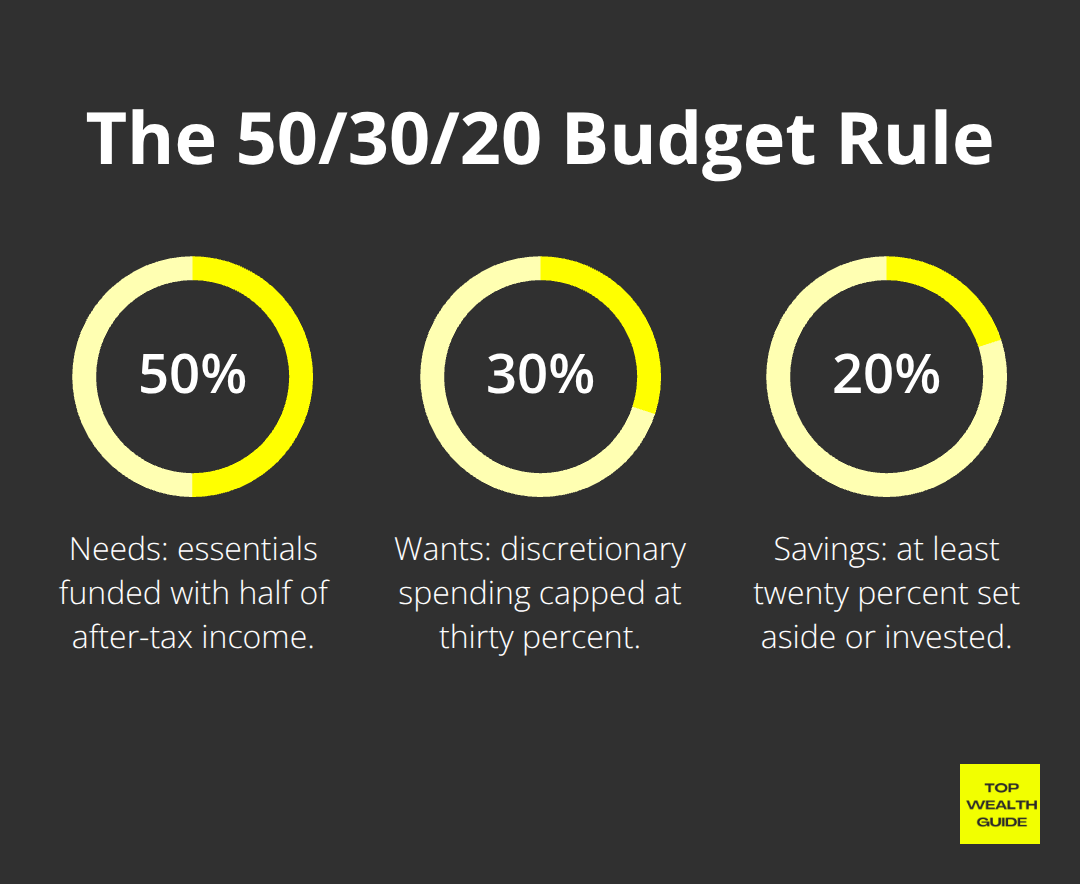

The 50/30/20 rule sounds tidy – almost moral: half your after-tax income on needs, thirty percent on wants, twenty percent to save. It’s elegant on a TED-stage slide and useful when your paycheck is predictable and your life is flatlined. But wealthy people don’t live in that world.

They get lump sums, capital gains, carried interest, consult checks – incomes that look like fireworks, not a metronome. Taxes become a multi-headed hydra. “Needs” morph as net worth climbs (a $500,000 earner’s “need” for housing is not your need). So the rule does what rules often do when stretched beyond their intent – it snaps. The percentages lose meaning; the framework collapses under its own tidy logic.

What Wealthy People Actually Track

The problem isn’t obsession with percentages – it’s obsession with outcomes. Wealth isn’t built by nice ratios; it’s built by the interplay of three things: income, assets, tax liability. High earners don’t ask, “What percent should I spend?” They ask, “How many dollars can I invest after taxes and still live the life I want?” They hunt for assets that beat inflation and ask where they’re bleeding money to taxes. Those are dollar questions – blunt, numeric, unsentimental. The framework that works treats wealth-building as outcome-based system, not a percentage-based one.

The Dollar-Amount Approach That Works

High-income budgeting starts with a number – not a ratio. You decide: this year I will put $100,000 to work. Then you automate it – retirement accounts, taxable brokerage, real-estate down payments, business reinvestment – make it happen before you see the dollars. If you earn $200,000 and want $100,000 invested, you structure accounts so the money leaves the moment it arrives. That removes thinking – and feeling – from the most dangerous part of personal finance. Emotion is where budgets fail. Automation is where compounding wins. This is old-school Buffett logic reframed: set the target first, live within what’s left, and let time do its brutal, beautiful work. For high earners that means pick a dollar goal, protect it from lifestyle creep, and let math do the heavy lifting.

The Lifestyle Inflation Trap

Here’s the arc: income rises, taste follows – bigger apartment, nicer restaurants, upgrade travel – and somehow your “save 20%” badge remains the same. That’s not saving; that’s disguised consumption. It kills momentum. The antidote is simple and merciless: increase your investment target faster than your income rises. Income +30%? Your investment target should rise more than 30%. Your lifestyle can ascend – fine – but only if it doesn’t cannibalize compounding. Discipline here separates earners from accumulators. One group gets a raise; the other buys a faster treadmill and never gains ground.

Moving From Income to Assets

Switching from percentages to outcomes requires a mental reboot. Stop cataloging spending categories. Start measuring accumulation. Money ceases to be a thing to divide and becomes a tool to build assets. Once you think in assets, everything changes – the questions, the accounts, the discipline. The next moves are mechanical: automate the dollar targets, create multiple income engines, and channel surplus into things that appreciate or produce cash. Do that and the math stops being cute and starts being formidable.

The Power of the Pay Yourself First Principle

Automation Removes the Willpower Problem

The pay yourself first principle reads like common sense until you try to do it the old-fashioned way – with hope and willpower. Spoiler: hope doesn’t pay bills. The minute something tempting shows up (a sale, a dinner, a gadget) intentions collapse. The wealthy don’t rely on heroic discipline; they remove the option to fail. Money exits your account the day you get paid – before you see it, before you touch it, before temptation gets a vote. Not a new idea… but execution separates the talkers from the builders.

Automate transfers to a brokerage, retirement account, or investment vehicle the instant payroll hits. If you make $150,000 and decide to invest $50,000 a year, that’s $4,167 a month – automatic, non-negotiable, invisible. You then live on the remainder. Why does this work?

Because it eliminates the behavioral fight. Manually moving money is friction – friction kills habit. Automation preserves it.

For higher earners, set up accounts so funds flow into investments before lifestyle spending is even possible. Max a 401(k) ($23,500 in 2024), push $7,000 into an IRA, route surplus to a taxable brokerage – all on autopilot. Whatever’s left is your true budget. It flips the script: you’re not depriving yourself; you’re institutionalizing asset creation first and consumption second.

Building Multiple Income Streams

Multiple income streams matter because a single paycheck – even a big one – is a fragile thing. A $200,000 W-2 is great… until it’s gone. One layoff, one health scare, one market shock and the machine stops. Smart people treat their salary as foundation, not fortress. They build secondary revenue: rentals that cough up cash flow, dividend portfolios that pay quarterly, side businesses that scale beyond the founder.

The math is brutal – and beautiful. Someone with $200k in W-2 income who sets up a rental producing $2,000 a month ($24k a year) boosts capacity by 12% without daily effort once the property is in place. Over twenty years, that $24k compounds into meaningful net worth. Specificity matters: not vague “hustles,” but income engines that require front-loaded work and then hum along.

Turn a consulting gig into a product – templates, systems, outsourced delivery – and you convert time-for-money into scalable revenue. Real estate yields monthly cash without constant work. Dividend stocks pay whether you’re awake or asleep. Aim for three to five distinct streams that don’t all fall together when one market hiccups. And here’s the rub on lifestyle inflation: if your side income climbs from $500 to $2,000 a month, don’t spend it on a nicer life – plow it into another asset that will itself produce income.

Consistency Weaponizes Time

Consistent contributions compounding – that’s the lever. A 35-year-old investing $15,000 a year at 8% hits roughly $1.2 million by 65. Not from luck. Not from timing the market. From thirty years of boring, mechanical consistency. Bump contributions by 3% a year (match pay growth) and you’re closer to $1.8 million. The numbers are merciless – and predictable.

Buffett’s point wasn’t glamour; it was monotony. Wealth is boring. You don’t hunt for fireworks; you automate the steady stream. You don’t stress over timing; you fund positions methodically. You don’t micro-optimize each dollar; you optimize the system that remits those dollars before you see them. That’s the ugly, unsexy truth: build the machine and let time do the heavy lifting.

Nail these three pillars – automation, diversified income, and relentless contributions – and your wealth engine runs with minimal babysitting. The next problem becomes managing what you’ve accumulated: diversify, protect taxes, deploy strategically. But that’s a future-you problem. Right now – automate, build, repeat.

Where Your Money Actually Grows

Build Your Asset Architecture First

We worship containers – 401(k)s, IRAs, envelopes – and then wonder why the returns are underwhelming. The wealthy do the opposite: they design an architecture first-stocks for liquidity and long-term compounding, real estate for leverage and tax friction, alternatives for uncorrelated upside. Then they route everything through tax-optimized channels so Uncle Sam takes less. Most people invert this-pick the account (usually whatever their employer offers), stuff whatever fits, and hope.

That fails because the container is not the point-the contents are.

Start by choosing asset allocation based on timeline and risk tolerance, not on account labels. A 35-year-old with thirty years to run can tolerate volatility; a 55-year-old cannot. Once you know the right mix of stocks, real estate, and alternatives for your situation, then add the tax machinery. Sequence matters-this isn’t decorative, it’s functional.

Maximize Tax-Deferred Accounts

Fill tax-deferred buckets first-401(k) contributions reduce taxable income dollar-for-dollar, and growth compounds tax-free until withdrawal. For 2024, that’s $23,500 in a 401k and $7,000 in an IRA. After those are full, a taxable brokerage account is your overflow.

In a taxable account, stash tax-inefficient assets (bonds, REITs, actively traded funds) in the lower-priority slots and put tax-efficient holdings (broad index funds, individual stocks you’ll hold for years) in the front. This is not ideology-it’s arithmetic. A $100,000 investment in a high-dividend REIT inside a 401k grows tax-free; the same $100,000 in a taxable account leaks 2–3% a year to taxes, which compounds into real dollars lost over two decades. Tiny percentages turn into big mistakes.

Leverage Real Estate Tax Advantages

Real estate turbocharges the math. The IRS allows rental property owners to deduct an annual depreciation amount from income, and long-term capital gains on sale get preferential rates (15–20% federal versus up to 37% on ordinary income). That’s not a bug in the system-it’s baked in.

If you earn $250,000 in W-2 income but own a rental that produces a $30,000 taxable loss via depreciation, you’ve just shaved $30,000 off taxable salary. Add another property or two and the effect compounds. The tax code privileges asset ownership over wage income-understand that and you stop being shocked when the wealthy behave the way they do.

Diversify Into Alternatives

Alternatives-private equity, hedge funds, commodities, direct business bets-exist for one reason: uncorrelated returns. When public markets hiccup, some private deals or hard assets often hold up. Ultra-high-net-worth folks might allocate as much as 50% to alternatives; the typical retail investor is at 5%. That gap? Not luck. It’s intentional diversification.

You don’t need a family office anymore. Crowdfunded real estate, tokenized assets, and lower fund minimums let someone with $50,000 buy exposure to private deals and real assets-introducing uncorrelated return streams without requiring mythical scale.

Protect Assets With Insurance and Structure

This is where most brilliant returns disappear overnight. A $2 million net worth with only $100,000 in umbrella coverage is essentially exposed. A single lawsuit-car accident, tenant injury, slip-and-fall-can wipe out decades of compounding. Umbrella policies are cheap relative to risk: $200–400 a year for $1–2 million in extra coverage. For anyone with assets, that’s non-negotiable.

Equally important: structure. Owning a rental in your personal name exposes everything to claims. Holding it in an LLC compartmentalizes liability-if something goes wrong, the suit hits the LLC, not your primary home or investment accounts. Setup costs $500–1,500 and could save you hundreds of thousands. Trusts play a similar structural role for estate planning and tax efficiency: revocable living trusts avoid probate and keep things private; irrevocable trusts can remove assets from taxable estates and shield them from creditors. These aren’t luxuries-they’re basic architecture that separates those who keep wealth from those who don’t.

Final Thoughts

Wealthy people do boring things brilliantly – they pick a dollar target for annual investing and make it automatic before the money ever hits their hands. Automate first, live on what remains…that small behavioral tweak separates accumulators from mere earners. Pay yourself first (seriously – set it and forget it), build multiple income streams so one paycheck doesn’t write your life story, and then let compounding do the long, boring work over decades.

Your asset architecture matters far more than the names on your accounts – fill tax-deferred buckets first, then send surplus into taxable accounts with tax-efficient holdings. Real estate isn’t optional – depreciation and preferential capital gains are literally baked into the tax code, and alternatives add uncorrelated returns that smooth the ride. And don’t be cute – insurance and sensible legal structures protect what you’ve built from a single lawsuit or claim.

Start now. Automate your first investment target this month. Open a second income stream within ninety days, set up an LLC for any rental property, and buy umbrella coverage – small moves, outsized impact. Visit Top Wealth Guide to access practical guides on investing, real estate, entrepreneurship, and long-term financial planning that turn these principles into action.