Financial freedom — not a luxury for the already wealthy. It’s a measurable destination that demands a map, discipline, and a strategy that actually works (not another motivational poster).

At Top Wealth Guide, we built that roadmap — clear, granular, no fluff. We show you how to calculate your number (the one that turns goals into deadlines), create multiple income streams that compound, and optimize your wealth-building approach with ruthless efficiency. Follow these steps… and you’ll have a practical blueprint for 2025 — executable, honest, and designed to move the needle.

In This Guide

Your Financial Freedom Number

Calculate Your Real Annual Expenses

Your financial freedom number is not motivational fluff-it’s the one cold, useful number that tells you when you can stop swapping hours for dollars. Without it you’re guessing-literally shooting in the dark. The math isn’t fancy; the hard part is brutal honesty about how you actually live (not how you Instagram).

Start by pulling three months of real statements-bank, cards-every charge, categorized, tallied. Don’t trust memory-people undercount by 15–30 percent when they guess. If your real average was $3,500 a month, that’s $42,000 a year-your baseline. Simple.

Now add the stuff everyone forgets-property taxes (if you own), auto insurance, medical premiums, dental, glasses, vet bills, home repairs, maintenance on the car. Irregular? Yes. Ignored? Also yes. Those line items usually tack on 10–20 percent to the baseline. So a $42,000 spend often becomes $46,200 to $50,400 once reality has its say.

Account for Healthcare, Inflation, and Hidden Costs

Healthcare is the wildcard-don’t pretend otherwise. If you’re on employer coverage now, price out individual/family plans once you’re not on a company plan-often $300–$800 a month (age and zip code matter). Inflation is the slow leak in your boat-3 percent annual inflation turns $50,000 today into about $67,200 in twenty years. Not dramatic? It is.

Use the 4 percent rule as your quick-and-dirty multiplier: divide annual expenses by 0.04 to find the portfolio you’ll need. Need $50,000 a year? That’s $1.25 million invested. It assumes a 4 percent withdrawal rate and that markets do the heavy lifting over time. Historically reasonable-some say optimistic in low-rate eras-but it’s a practical target, not a promise.

Set Your Target Based on Income and Timeline

Your path to the number depends on income and how long you can-or want-to grind. Earn $60k with $40k in expenses and you can reasonably save $15k–$20k a year if you’re disciplined-hit $1M in 15–20 years. Earn $120k with $50k expenses and you can save $50k–$60k a year-get there in 12–16 years. No mysticism-just multiplication and compound interest (the boring superpower).

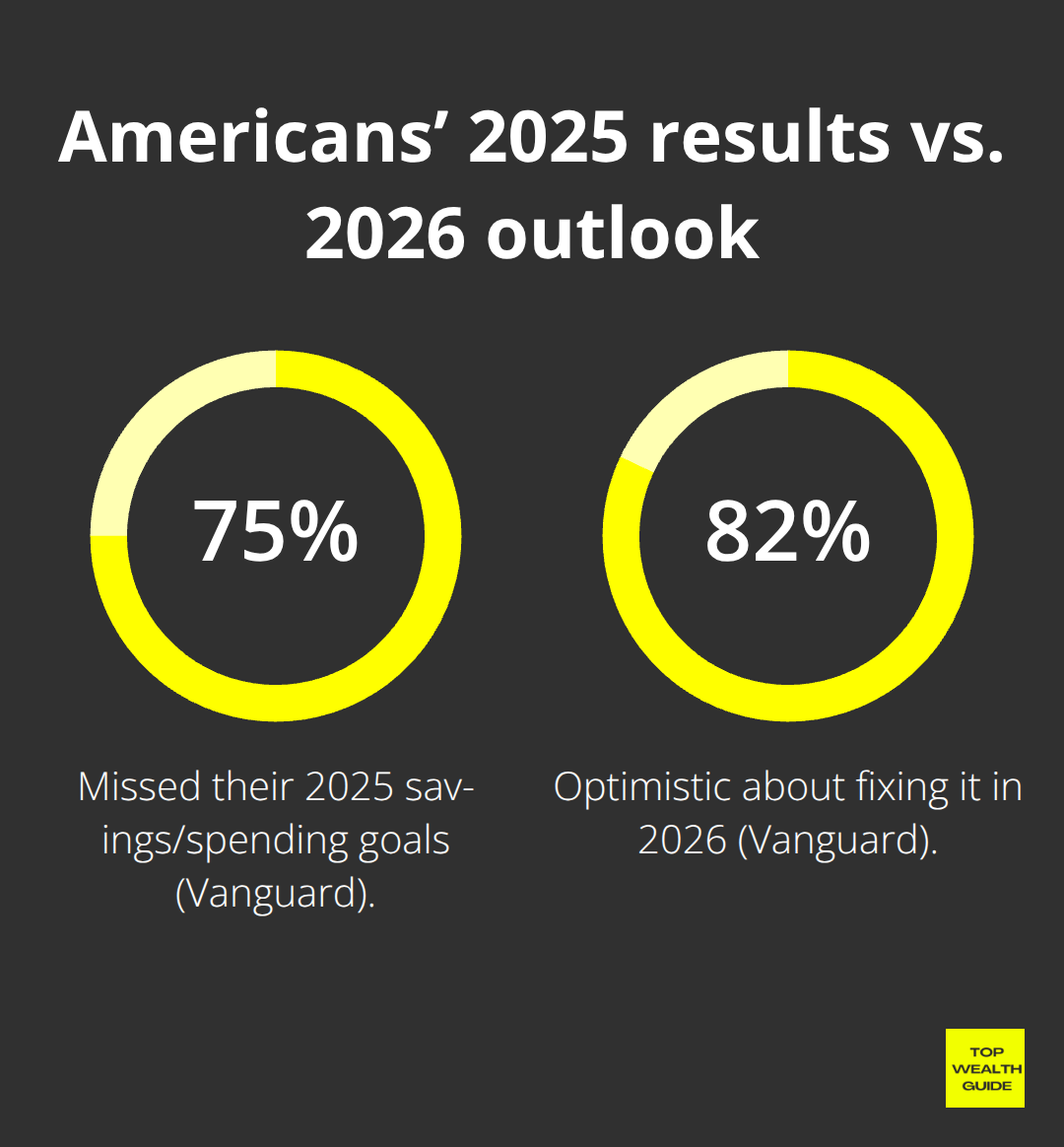

Vanguard found 75 percent of Americans missed their savings/spending goals in 2025-yet 82 percent were optimistic about fixing it in 2026. Translation: people underestimate what discipline actually costs. First rule-build a 3–6 month emergency fund. Even $10,000 in a high-yield account at 4–5 percent saves you from derailing progress when the car fails or a medical bill lands.

Lock the number down-write it, pin it, tattoo it (metaphorically). Treat it as non-negotiable. This isn’t pep talk; it’s arithmetic with a deadline. Once you know the target, accelerate-build multiple income streams that compound faster than a single paycheck ever will by building multiple income streams.

Multiple Income Streams Accelerate Your Timeline

Why a Single Paycheck Fails

Relying on one paycheck is not a plan – it’s a vulnerability. The world shifted in 2024–2025: AI platforms matched talent to high-paying gigs, remote work normalized side hustles, and the math changed. People who reach financial freedom in 10–12 years don’t do it on salary alone. They stack income. Example: $80k salary, save $20k a year – you need roughly 50 years to get to $1M (and that’s before inflation robs you blind). Now add $30k in rental income and a $15k side venture – boom – you’re saving $45k–$50k a year and cut the horizon to 20–25 years. Not luck. Architecture.

Layer Your Income Sources Strategically

Your day job buys you stability – rent, groceries, mental sanity. Everything above that buys your exit ticket. If you’re employed, stay steady-milk the paycheck, capture the 401(k) match (free money), and use that stability to build layer two. If you run your own show, lock in recurring revenue first (consulting retainers, productized services) before you chase shiny, volatile projects.

Real estate compounds in ways most people underappreciate. A rental that throws off $500–$800 a month (after mortgage, taxes, maintenance) boosts your savings by $6k–$9.6k a year. Buy a $250k property with 20% down ($50k), rent it at $1,800, cover a $1,200 mortgage plus taxes, insurance, maintenance – you net $400–$600. Reinvest that into another property in 7–10 years, and you’ve started compounding toward a portfolio that pays $2k–$3k a month passively. The FIRE crowd isn’t fantasizing – done right, real estate gives you diversification, tax perks (depreciation, deductions) and after-tax returns that outpace a vanilla stock-only approach.

Launch Digital Products for Rapid Revenue

Digital products and side ventures are the fastest way to add revenue without heavy capital. Online course, e-book, consulting retainer – they take months to launch but each sale costs next-to-nothing in marginal time. One person buying your $497 course doesn’t require you to work extra hours. If a side venture costs $5k to start and hits $500 a month in six months, you’ve recouped your investment and created a permanent income stream. Most people never start because they overthink. The people who do shave 5–10 years off their path to financial freedom – same salary, different outcome.

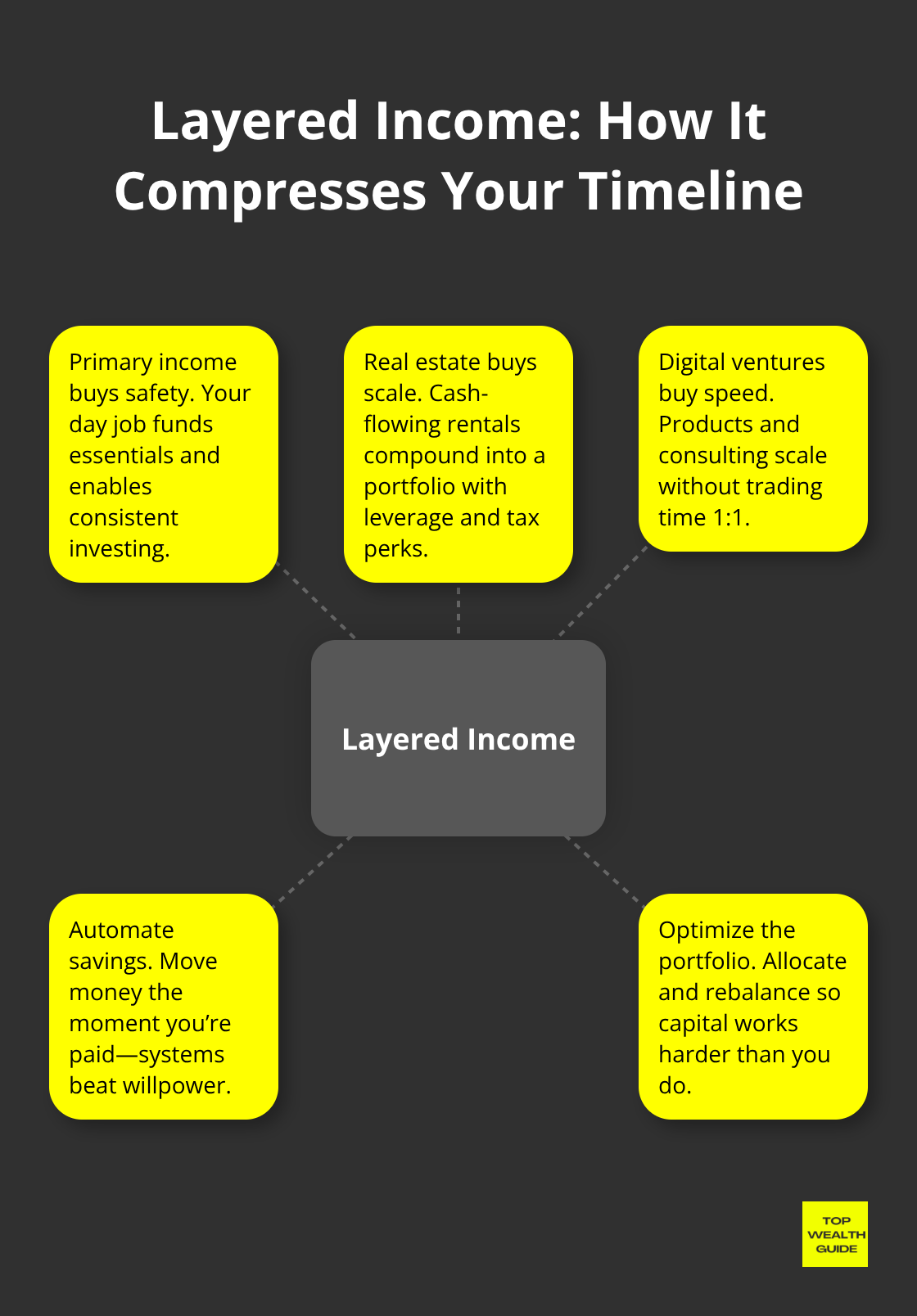

Compress Your Timeline Through Layered Income

Stack deliberately – primary income buys safety, real estate buys scale, digital ventures buy speed. That’s how timelines compress. Then optimize deployment: automate savings, wipe out debt with purpose, and get your portfolio to work harder than you do.

That’s the real acceleration – compounding with design, not hope.

Optimize Your Wealth-Building Strategy

Automate Your Savings Before You Spend

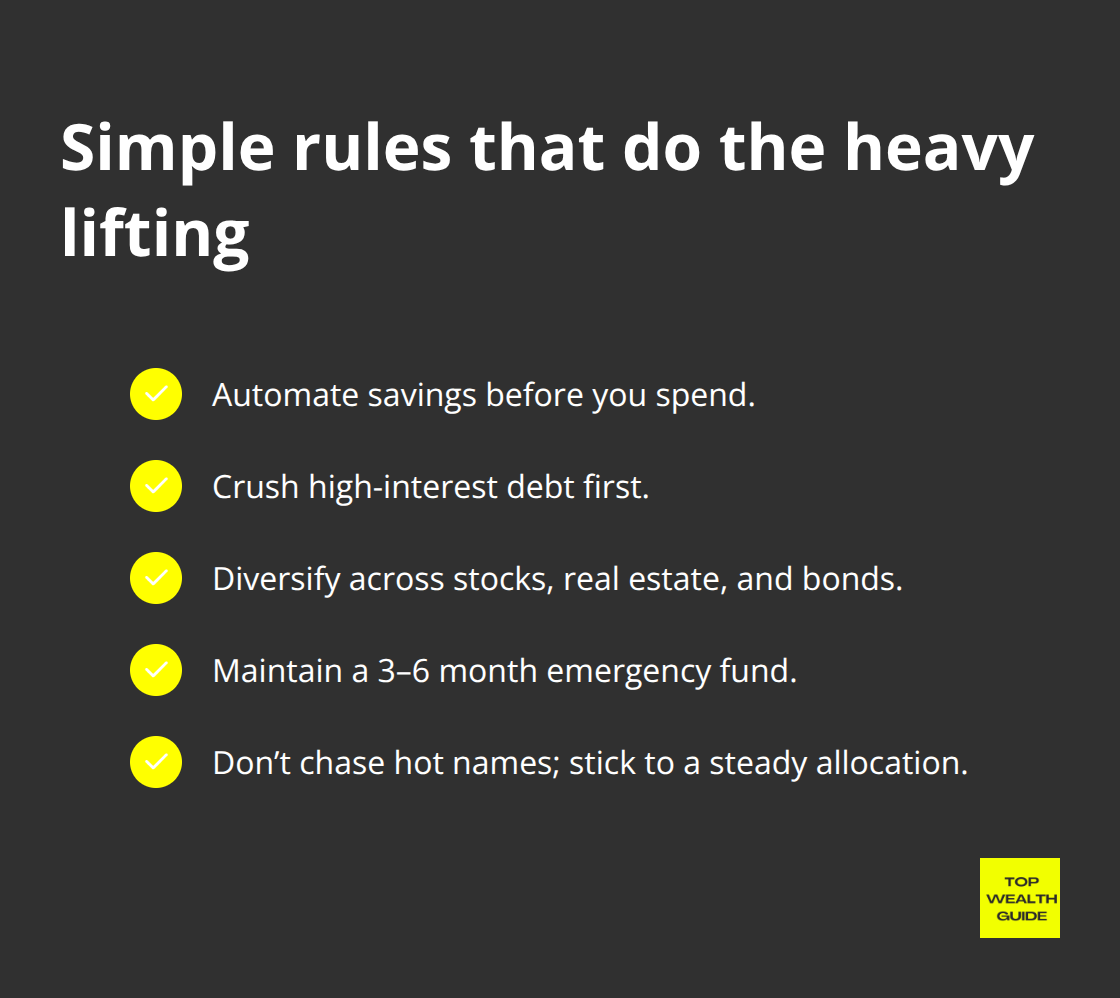

Automation is the difference between people who hit financial freedom and people who keep talking about it at dinner parties. Willpower is flimsy – you need systems that move money before temptation shows up. The second your paycheck clears, have a transfer already scheduled to a separate savings or investment account. Make it recurring – even $500 a month does the heavy lifting. That money never hits your checking account, so you never get the chance to fritter it away. One year of discipline and you’ve squirrelled away $6,000 that’s already compounding. Five years and you’ve been forced to save $30,000 while mostly living your life.

For your emergency fund, pair automation with a high-yield savings vehicle earning roughly 4–5 percent. Bread Savings CDs, for example, offer APYs from 3.75 to 4.15 percent on 1–5 year terms – you lock in rates for near-term goals without touching long-term investments. The math is brutal: skip automation for a year and you forfeit compounding on thousands of dollars – money you’ll never get back.

Attack Debt With Ruthless Priority

Debt is an anchor – it keeps you treading water. High-interest credit card debt (think 18–24 percent APR) will undo more progress than any investment will create. Consider balance-transfer cards (the Citi Simplicity Card, for instance) with 0 percent intro APR for 21 months and no annual fee – consolidation becomes sane if you can resist reloading the balance. Or a debt consolidation loan (Avant offers APRs roughly 9.95 to 35.99 percent for $2,000–$35,000) to roll multiple payments into one predictable monthly obligation and reduce interest pain.

Crush this first – before you go gung-ho investing. Once debt is gone, reroute that payment into investments. Someone paying $400 a month on cards who eliminates the debt and invests the $400 instead suddenly has $4,800 a year more going into assets. Over twenty years at a 7 percent return, that converts to roughly $2.2 million. That’s not fantasy – that’s math.

Diversify Across Assets and Industries

Diversification isn’t glamorous – it’s survival. Blend stocks, real estate, and bonds so downturns don’t crush you. A sensible rule of thumb: 60 percent low-cost index funds (US + international), 20 percent real estate (either direct ownership or REITs), 20 percent bonds or inflation-protected securities. Robo-advisors like Fidelity Go and Schwab Intelligent Portfolios will rebalance this automatically – minimal fees, much less drama.

Don’t chase hot names or the latest shiny asset. Compounding rewards boring, steady allocation far more reliably than it rewards luck. Real estate, in particular, compounds in ways most people underappreciate. A rental that nets $500–$800 a month after mortgage, taxes, and upkeep adds $6,000–$9,600 a year to your savings. Buy a $250,000 property with 20 percent down ($50,000), rent it for $1,800, cover a $1,200 mortgage plus taxes and insurance – you pocket $400–$600 monthly. Reinvest those proceeds into another property in 7–10 years and you’ve begun stacking a portfolio that pays $2,000–$3,000 a month passively. Real estate gives you diversification, tax perks (depreciation and deductions), and after-tax returns that often outpace a pure-stock approach.

Keep it simple. Automate the habit. Obliterate the high-interest debt. Diversify sensibly.

Do that – and the compounding does the heavy lifting.

Final Thoughts

You’ve got the framework. Now be merciless-calculate your financial-freedom number with brutal honesty about what you actually spend, not what you wish you spent. Build that number by stacking income streams: keep your day job (stable runway), layer in real estate that compounds, and launch a digital venture that scales without you babysitting it. Then optimize like a machine-automate savings before you ever see the money, annihilate high-interest debt, and diversify across assets so a downturn doesn’t send your plan into cardiac arrest.

The math is almost comforting in its brutality. Someone making $80k with $50k in expenses who saves $20k a year hits roughly $1.25 million in about 20 years. Add $30k in rental income and a $15k side venture and suddenly that 20-year slog compresses to 12–15 years. Not luck. Architecture. Vanguard data says 75 percent of Americans missed their 2025 savings targets, yet 82 percent expect a rebound in 2026-which tells you most people know what to do, they just don’t execute.

Start this month-small moves that compound. Open a high-yield savings account for an emergency fund (3–6 months of expenses minimum) and set up automatic transfers from your paycheck before you see the money. If you carry high-interest debt, explore balance-transfer cards or consolidation loans to stop the bleeding, then pick one income stream beyond your job-real estate, an online course, a consulting retainer-and commit to launching it within 90 days. Top Wealth Guide offers practical guides and tools to help you execute this roadmap-calculators, templates, and step-by-step strategies for building wealth across personal finance, investing, real estate, and side hustles.

![Your Complete Financial Freedom Roadmap [2025 Edition] Your Complete Financial Freedom Roadmap [2025 Edition]](https://topwealthguide.com/wp-content/uploads/emplibot/financial-freedom-hero-1766970939-1024x585.jpeg)