Most high earners assume their emergency savings strategy should mirror everyone else’s — copy the three-month rule, tuck it away, and call it a plan. That’s a mistake… and an expensive one.

At Top Wealth Guide, we see it every quarter: crossing into six-figure territory rewires your finances — the old emergency-fund playbook misses the new stressors. Your fixed costs are bigger, your income is often a tangled mix (clients, equity, bonuses, side hustles), and the risk of a lifestyle collapse — the kind that forces asset sales or drastic cuts — is higher than what average earners face.

This guide shows you exactly how much emergency savings you actually need — and where to position that money so it survives a shock but still earns something. Safety first… but returns matter, too.

In This Guide

Why Your Income Level Changes Everything

Your paycheck might be two or three times the national median – congrats, you’re not immune. You’re just carrying bigger risks. A high earner doesn’t face the same emergency as someone earning $60,000 a year; they face a different class of catastrophe. The stakes are higher, the expenses stickier, and recoveries are often slower – because the math changes when the numbers get larger. According to Vanguard’s July 2024 survey of 12,443 investors, emergency savings are the strongest predictor of financial well-being across all income levels, but once you cross into six-figure territory the calculation looks nothing like what the blog posts tell you. A Federal Reserve study found high-earner emergencies commonly land in the $50,000–$200,000 range – job loss, health crises, business downturns, long stretches without income. The old “three to six months of expenses” rule – cute, simple – collapses here, because your essential monthly outflows are much larger and your income streams are often scattered across salary, bonuses, equity, commissions, and side hustles. One disrupted stream doesn’t just trim your paycheck – it can trigger a cascade of lifestyle changes that are hard to pull off overnight.

Fixed costs trap high earners harder than anyone else

Your mortgage, private school tuition, country-club fees, luxury leases, household staff – these aren’t optional line items you can flip off like a light switch. They’re baked in. If you make $300,000 but $180,000 of that is locked into non-negotiable monthly obligations, your emergency math needs to cover that $180,000 baseline – not your gross income. Someone with $15,000 a month in fixed costs needs a wildly different safety net than someone with $3,000 in fixed costs – same headline income, totally different reality. That mismatch is where the nice-sounding rules of thumb fail you.

Income volatility demands larger cushions

Then add industry volatility on top of that. Salespeople on commission, founders, executives paid heavily in equity, consultants with feast-or-famine books – these folks don’t have a stable W-2 paycheck. If 40% of your comp is variable, you’re not really earning a steady $300k – you’ve got $180k guaranteed and a big, lumpy upside (and downside). That structure forces you to hold a bigger cushion – gaps between paychecks or bonus cycles can stretch into months. So sure, aim for six to twelve months of coverage – but calculate it against your actual fixed expenses (not your gross pay, not your aspirational lifestyle). That distinction separates those who weather the storm from those who sell at the wrong time or start slicing the things that actually matter.

How Much Should You Actually Set Aside?

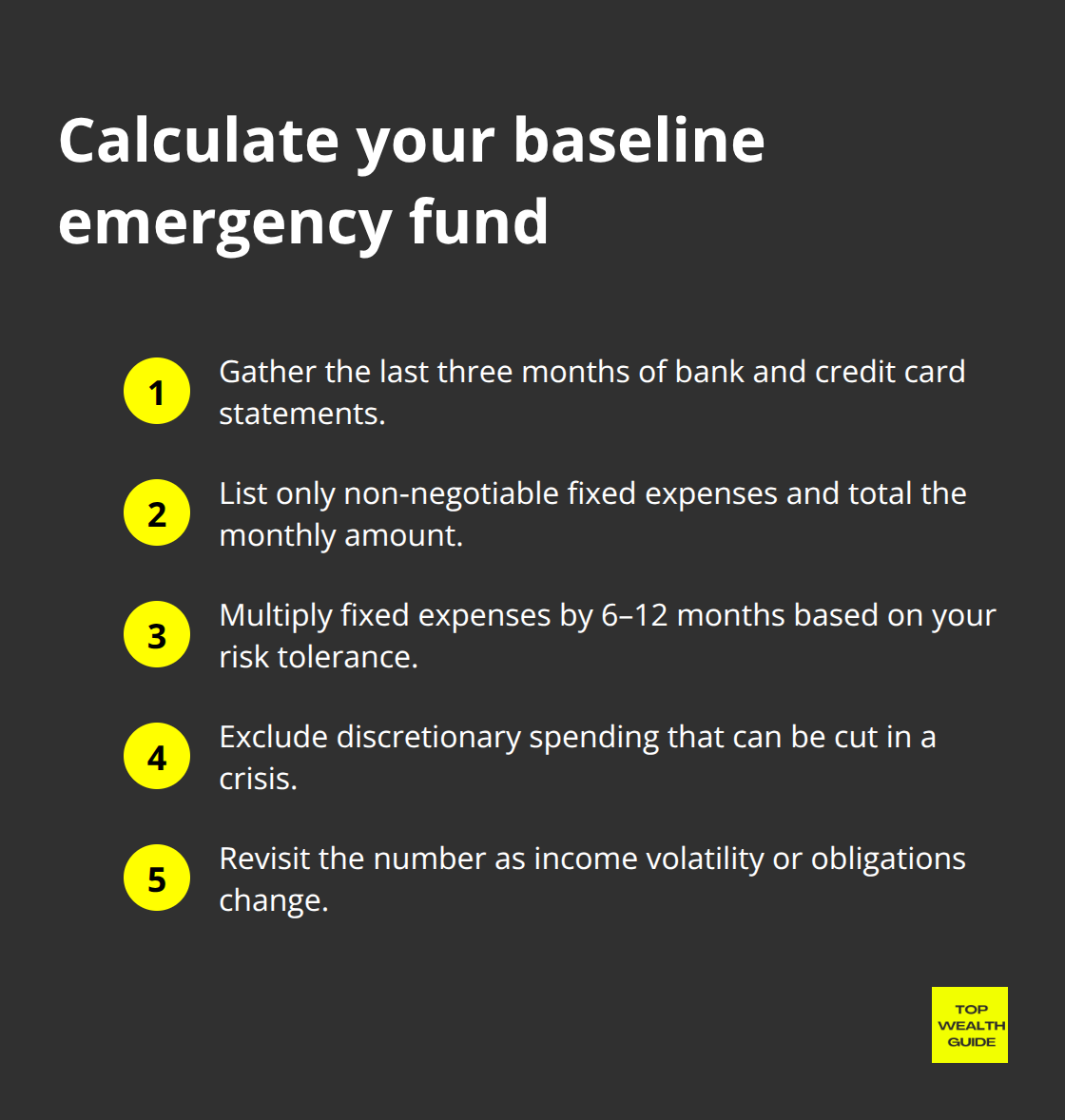

Calculate Your True Fixed Expenses

The six-to-twelve-month rule isn’t wrong for high earners-it’s just lazy without context. Start here: pull your last three months of bank and credit card statements and calculate your true fixed expenses on non‑negotiable items each month. Not your gross income. Not what you think you spend. The real number. If that total is $18,000 monthly (mortgage, insurance, utilities, childcare, loan payments, household staff), then six months means $108,000 sitting in reserve. Twelve months means $216,000. That’s your baseline math-and it’s a radically different reality than someone earning the same salary with $6,000 in fixed costs.

The delta between fixed obligations and total spending is where most people get sloppy. If you spend $25,000 a month but only $15,000 is locked into obligations you cannot rip out overnight-mortgage, tuition, insurance-then your emergency fund needs to cover that $15,000 for six to twelve months, not the full $25,000. The discretionary slice (restaurants, flights, memberships, shiny things) can compress in a real emergency. That distinction separates a fund that actually protects you from one that just makes you feel prudent.

Account for Income Volatility and Timing

Where your income comes from dictates how much oxygen your finances need. A W‑2 worker with a stable employer and a predictable bonus needs less runway than a consultant whose paychecks swing like a pendulum-or a founder whose revenue depends on closing deals. Income volatility destabilizes nearly half of American households; if that’s you, bigger buffer.

Someone with $200,000 guaranteed salary and $100,000 variable comp should plan for longer gaps than someone with $300,000 guaranteed. Timing matters. If your bonus hits in March but you’ve got eleven months of expenses beforehand-you need twelve months of cover. Equity that vests quarterly? Fine-but the dry spells between liquidity events are the cliff you must plan for. A high earner with multiple income streams should map actual payment dates and identify the longest drought-that gap is the real target your emergency fund needs to absorb.

Identify Your True Emergency Window

Spoiler: the generic six‑month rule is a rounding error for most high earners. When you layer income volatility, lifestyle stickiness, and the fact that big financial problems take time to untangle, most people land between nine and fifteen months of fixed expenses. Once you lock that target number, the equally important question is where you park the cash-because where it sits determines whether it’s dead money or quietly working for you while you wait for the emergency that may never come.

Where to Park Your Emergency Fund

High-Yield Savings Accounts: The Core Foundation

High earners face a brutal choice: keep the emergency fund in checking where it’s usable but useless (0% interest), or chase yield and build friction when chaos hits. The smart answer lives between those extremes. A high-yield savings account is the sensible foundation-think Marcus, American Express, Ally-right now they offer rates around 4% APY. On a $150,000 emergency fund, that’s roughly $6,000 a year-money that keeps pace with life instead of watching your purchasing power fade.

The number 0% seems to be not appropriate for this chart. Please use a different chart type.

Inflation ran about 2.6% year-over-year in November 2025 (yes-that matters)…so that extra yield is not a nicety; it’s the difference between your cushion holding value or slowly deflating. Money market accounts mirror that yield and add check-writing or debit-card access-so when real emergencies occur, you don’t wait three days for a transfer to clear. The biggest rookie mistake is splitting the fund across five institutions-confusion kills preparedness. Pick one high-yield savings account at a bank with zero monthly fees and no minimums-Ally, Marcus, American Express fit the bill-and park the full target there.

The Two-Tier Approach: Accessibility Plus Returns

If you want to squeeze a little more without sacrificing immediacy, tuck 20–30% of the fund into short-term Treasuries or a three-month CD ladder. T-bills mature in weeks, short CDs in months-minimal liquidity friction, and you pick up 50–100 basis points extra yield. The two-tier setup gives you an instantly available core cushion and a secondary tranche that earns a bit more but still converts to cash before most crises spin out.

What High Earners Must Avoid

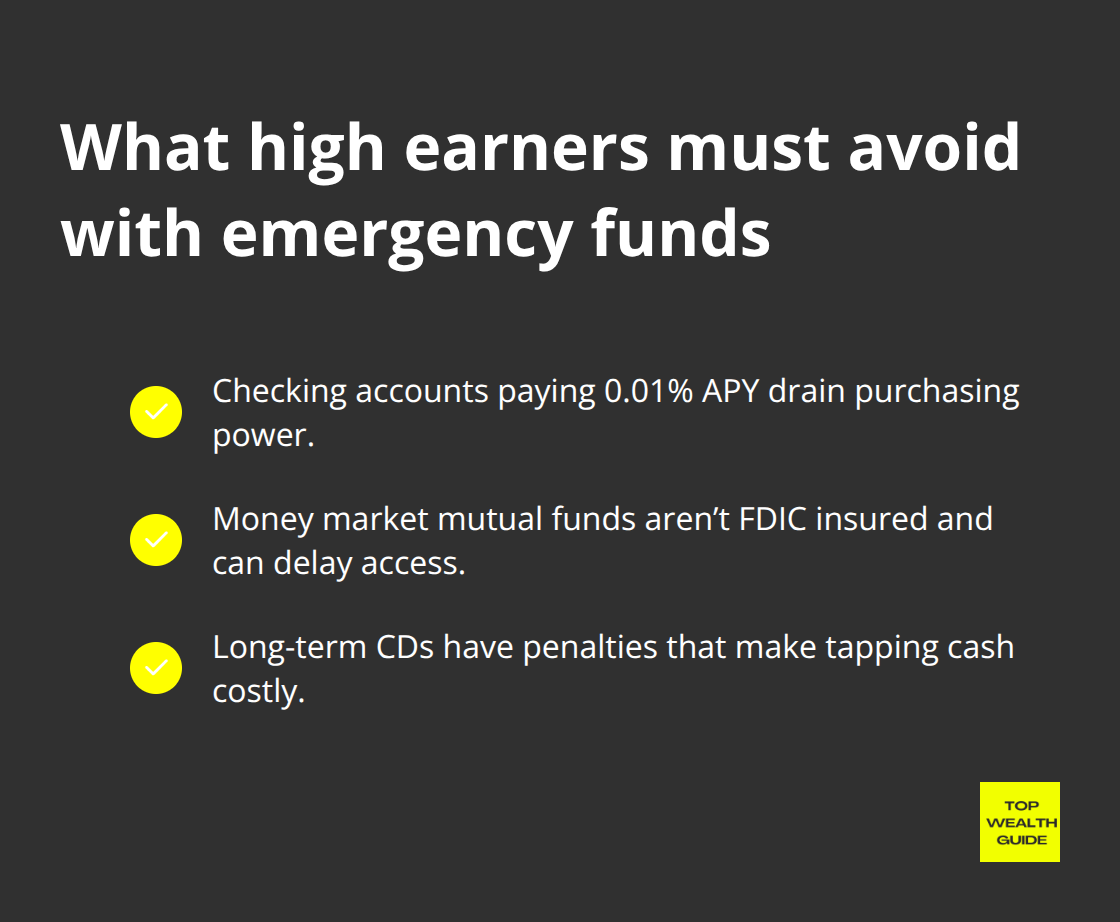

High earners often treat an emergency fund like a savings problem when it’s a positioning problem. A checking account at a big bank pays 0.01% APY-on $150,000 that’s $15 a year while inflation quietly eats $3,900. Even worse: if the account sits where you pay bills and run daily spending, the psychological distance disappears-and your emergency fund becomes a piggy bank.

Beware money market mutual funds-they sound safe but aren’t FDIC insured, can impose redemption windows or fees, and sometimes take two business days to convert to cash. That defeats the purpose when you need immediate liquidity. CDs with early-withdrawal penalties are worse-lock emergency cash into a one-year CD and you’ve created a scenario where tapping it costs you money. That pushes people to use a credit card instead, turning a short-term hit into a long-term debt problem.

Building Your Emergency Fund Strategy

Federal Reserve data show 36% of Americans would struggle with a $400 surprise expense (that number exists partly because people park money in low-access, low-yield places-and then lose the discipline to use them properly). High earners can do better. Open a high-yield savings account today-the application takes ten minutes-and fund it to your target (nine to fifteen months of fixed expenses). Automate monthly transfers so the account grows without constant willpower. That’s the foundation. Once that core is fully funded and you won’t touch it except for true catastrophe, then consider layering in Treasury bills or a CD ladder for a little extra return. Simple. Practical. And annoying to beat.

Final Thoughts

An emergency fund isn’t a luxury reserved for the modestly paid-it’s the difference between surfing a financial shock and watching your life unravel in real time. Earn six figures and a job loss, health scare, or revenue hiccup doesn’t merely trim your paycheck; it attacks the fixed commitments that structure your life-the mortgage, the tuition, the non-refundable decisions you can’t undo overnight. No cash cushion and you’re making panic purchases: selling at the wrong moment, piling on debt, or axing the things that actually matter to your family.

The math gets boringly simple once you stop following vague rules and start doing the work. Itemize your true fixed expenses. Add a buffer for income volatility. Target nine to fifteen months of coverage-pick a number toward the top if you’ve got kids, a big home, or irregular income. Then park that money where it does two things: stays liquid and earns something. High-yield savings as the bedrock – accessible, safe – with short-term Treasuries or CDs layered in if you want the extra yield (and can tolerate the mild haircuts to liquidity).

Make no mistake-this is not a “set it and forget it” toy. Life changes. Careers pivot. Houses grow (and so do mortgage payments). Review your target annually, or whenever something material shifts-new job, new spouse, private school tuition, a move. What covered you at 35 often won’t cut it at 45.

We at Top Wealth Guide focus on pragmatic strategies that survive the real world-emergency savings is the foundation. Build the cushion first; everything else becomes optional.