Most rental property owners leave money on the table. They roll rents forward like a lazy subscription — same price, year after year — ignore expense optimization (because spreadsheets are scary), and skip secondary income opportunities that could boost returns by 20–40%… That’s not oversight. It’s a business model built on inertia.

At Top Wealth Guide we’ve reverse-engineered the concrete strategies that separate high-performing landlords from average ones — dynamic pricing, ruthless cost audits, ancillary revenue (laundry, storage, pet fees, short-term stays), and systems that stop value leaking out the back door. This guide walks you through proven methods to increase rental income, cut costs, and diversify revenue streams — so your properties behave like businesses, not goodwill projects.

In This Guide

What Rent Should You Actually Charge

Research Your Market with Real Data

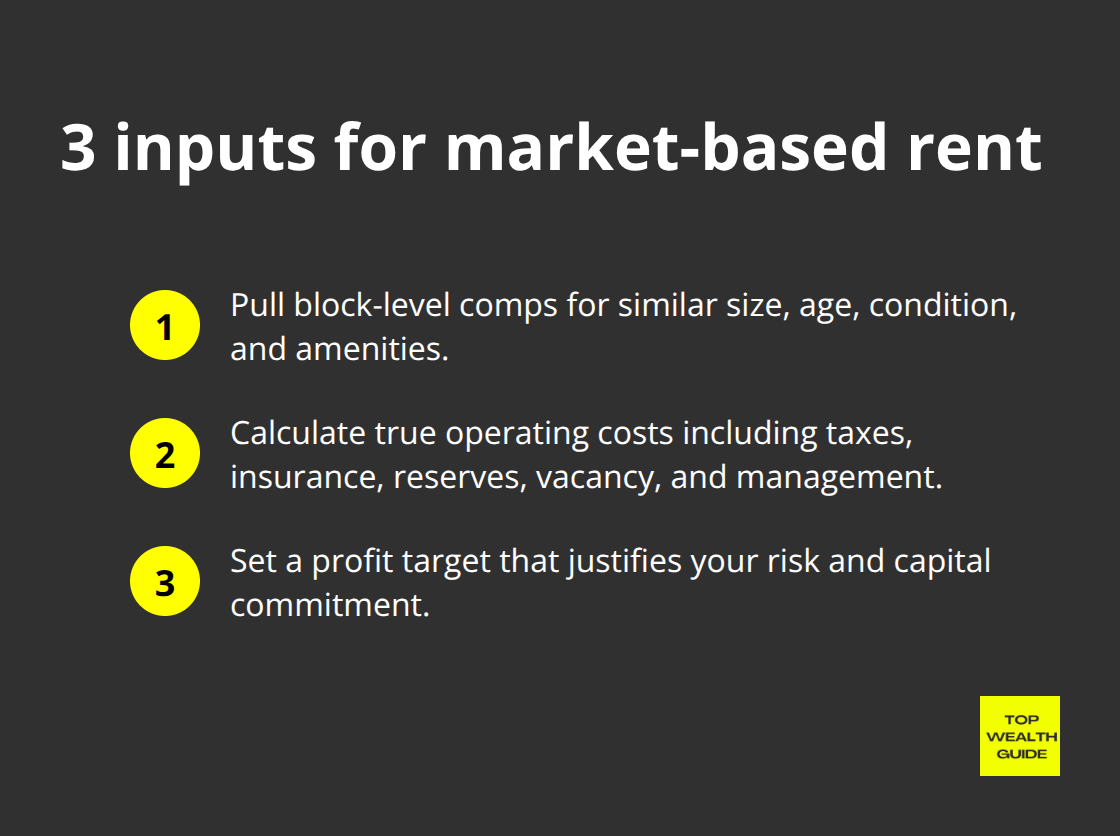

Most landlords lose money because they price emotionally – last year’s rent, the neighbor’s flyer, a “gut feel” – none of which tell you what the market will actually pay. Setting rent needs three hard inputs: what comparable units in your exact micro-neighborhood are getting, your true operating costs, and the profit you need to justify holding the asset.

Start with actual market data. Zillow Rental Manager and Rentometer pull live comps from your block – not the zip code five miles away. Location matters – a subway stop, a good school, or a grocery within walking distance can swing rents 20–30% inside the same city. Pull 10–15 comparables (same size, age, condition, amenities). Record rents, lease lengths, and how long they’ve been listed. Listings lingering past 30 days? Likely overpriced. Units gone in under two weeks? You were probably undercharging. This gives you the realistic ceiling and floor for your unit – not wishful thinking.

Calculate Your True Operating Costs

Next – know your costs. Most landlords guess and pay for it. Property taxes, insurance, maintenance reserves, vacancy allowance, and management fees add up – usually 25–35% of gross rent. Example: $4,000 taxes, $1,500 insurance, $3,000 repairs, 5% vacancy on $30,000 annual rent = $8,500 in costs. Your net isn’t the rent check – it’s what’s left after these bills.

Pick a profit target that fits the property and your risk tolerance. Single-family rents typically aim for 8–12% ROI; multi-family often 10–15% or more. Want 10% on a $300,000 asset? You need $30,000 profit. Add $8,500 operating costs and your annual rent target becomes $38,500 – roughly $3,208/month. Run this against your rental property cash flow analysis. If comps say $2,900–$3,100, you’re in the ballpark. If your math says $3,800, the market will tell you no – via vacancy, concessions, or a desperate price cut.

Implement Dynamic Pricing to Capture Demand

Dynamic pricing isn’t just for hotels and Airbnbs – it works for long-term rentals too. Adjust rents seasonally and for demand spikes instead of waiting for lease churn. If your market peaks in summer (moves, students, relocations) and slows in winter, nudge renewals 5–10% higher in June than in January. Simple.

Monitor local rents monthly – block-by-block shifts happen, and seasonal patterns matter. Cities like Raleigh, Nashville, and Austin have seen persistent 5–8% annual rent growth thanks to corporate relocations and in-migration. Increase at renewal – not mid-lease. Give notice 60–90 days ahead, personalize the outreach, and sweeten the deal with small incentives (carpet cleaning, a ceiling fan) to keep a good tenant. Replacing a tenant costs roughly $3,976 – so retaining someone with a modest bump beats turnover almost every time.

Use Data-Driven Tools to Remove Emotion

Use pricing tools that factor square footage, amenities, lease length, and local demand trends. They force decisions to align with market reality – not what’s “fair” or what you need to cover your mortgage. Once you’ve set a market-based baseline and understand seasonal dynamics, attack the other side: expenses. Trim what you spend and you increase what you keep – and this is where most landlords find the quickest, biggest gains.

Stop Bleeding Money on Preventable Costs

Rent checks are meaningless if you’re losing cash to sloppy systems and overpriced vendors. Most landlords treat property management like a hobby-no automation, no audits, no preventative maintenance-and then wonder why 30–40% of potential profit vanishes. The cure is surgical: automate what you can, renegotiate every contract every year, and stop treating repairs like surprises (expensive)…turn them into schedules (cheap).

Automate Rent Collection and Tenant Communication

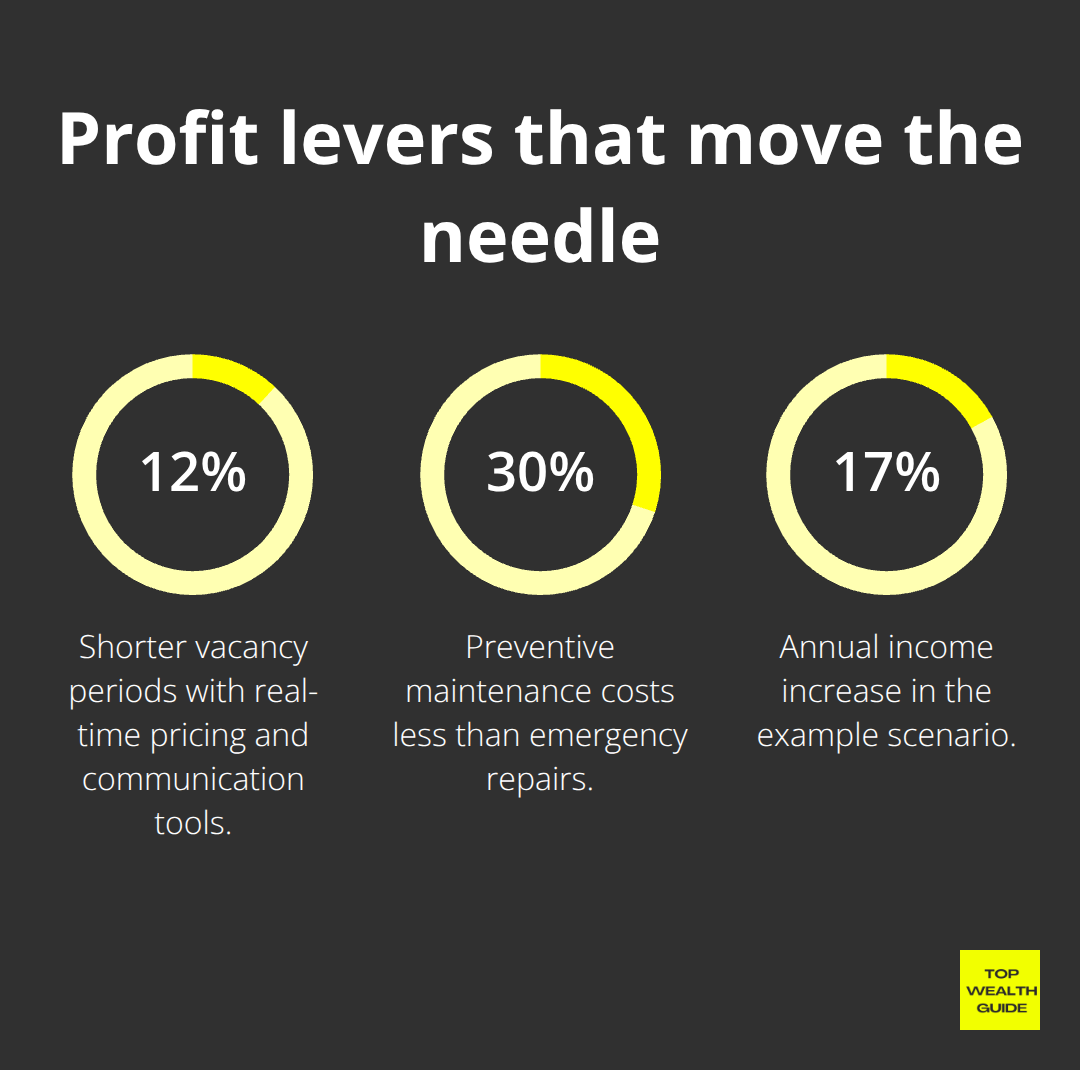

Use property management software to centralize rent collection, tenant messages, and maintenance tracking-one dashboard, far fewer headaches. When rent moves automatically via ACH or card, you stop chasing checks and get paid faster-most systems report about 12% shorter vacancy periods when landlords use real-time pricing and communication tools. Short sentence: automation pays.

Tenant communication matters more than landlords think: one automated nudge 60–90 days before lease renewal, coupled with a tiny incentive-carpet cleaning, a ceiling-fan upgrade-costs almost nothing and keeps people from ghosting you. The math is savage-replacing a tenant runs roughly $3,976, per industry data-so a $200 retention incentive is a no-brainer.

Renegotiate Service Contracts Every Year

Your vendor rates are old news. Property taxes, insurance, maintenance, landscaping-they all creep up unless you push back. Do annual review meetings with every provider-HVAC, plumbers, electricians, property managers, insurance brokers. Get three quotes and use them as leverage. If one broker bids $1,600 and your incumbent asks $1,800, you have the ammunition to cut costs.

Think about switching to a landlord liability policy instead of a full-coverage structure-landlords often save $25–$50 a month while keeping legal defense coverage. And for crying out loud, preventative maintenance costs 30% less than emergency repairs. Replace HVAC filters quarterly, inspect roofs annually, and fix small plumbing leaks the day you see them-not after you find mold.

Cut Operating Costs Through Energy Efficiency

Energy efficiency upgrades save roughly $450 per year on a 2‑bed unit. If utilities are included in rent, that’s pure margin. LED lights in common areas, better insulation-these aren’t sexy, but they reduce operating costs and make the property more attractive to cost-conscious tenants.

Build Systems That Run Without You

Automation isn’t optional-it separates a scalable business from a time-sucking side gig. Rent software stops the check-chase. Maintenance portals let tenants log issues digitally so you can triage without phone tag. A home-warranty for major appliances and systems prevents a surprise $5,000 HVAC hit from blowing up your cash flow.

Good property management platforms also spit out year-end tax docs-useful when you’re itemizing mortgage interest, depreciation, repairs, travel for maintenance, and property taxes. Automation + preventative maintenance + annual renegotiation typically trims operating expenses by 10–15% without trashing tenant experience or property quality. That’s direct profit improvement-and it primes you for the next lever: income diversification beyond base rent.

Stop Leaving Money on the Table

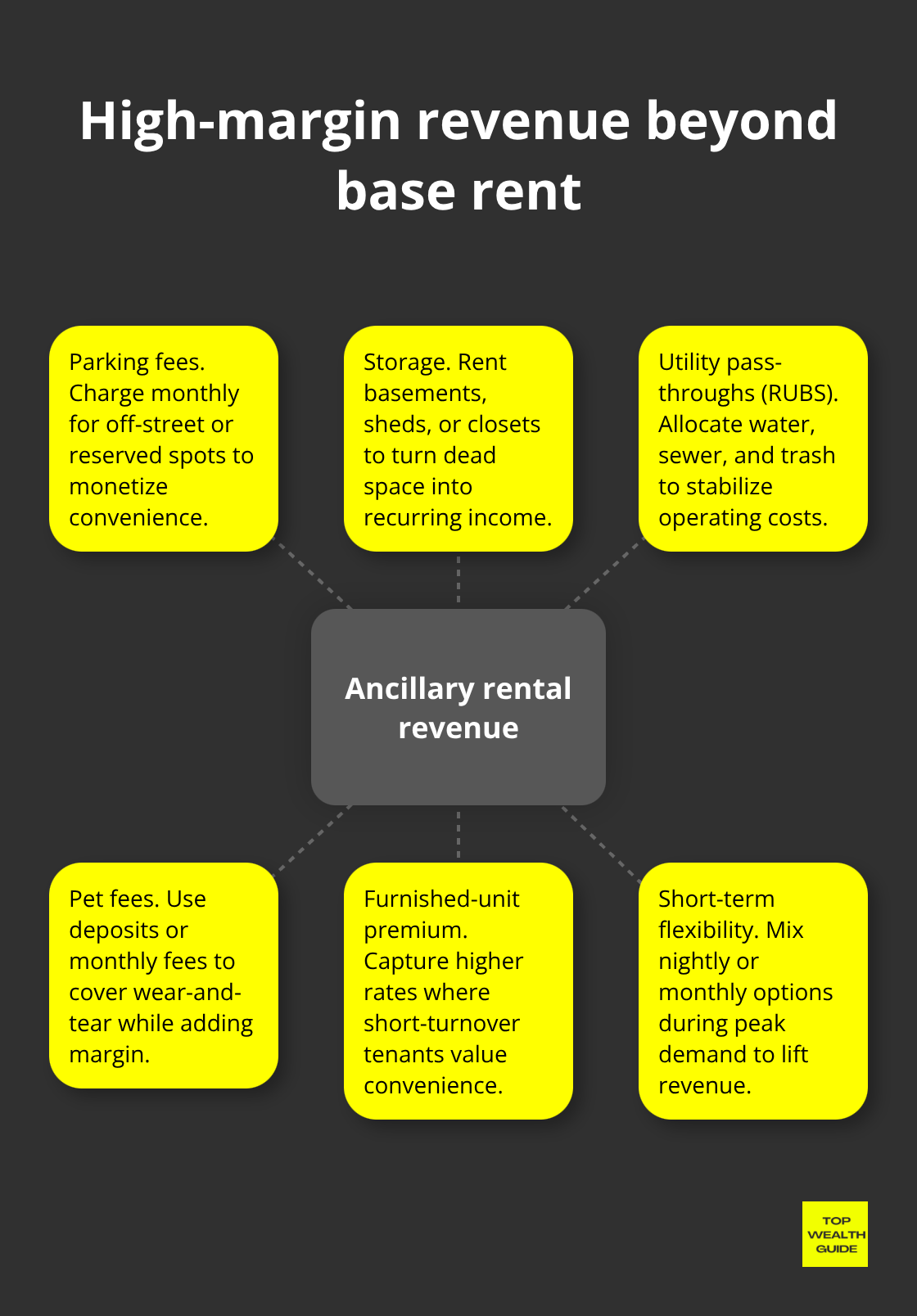

Base rent is your floor – not your ceiling. Most landlords treat monthly payments like a single, static stream and walk past 20–40% of revenue waving goodbye.

Parking fees, storage, utility pass-throughs via RUBS, pet charges, furnished-unit premiums, and short-term flexibility are all cash cows – low marginal work, high margin. The winners in real estate today aren’t simply charging more for four walls; they’re charging for everything else.

Premium Services That Tenants Actually Want

In-unit laundry moves the needle – more than granite countertops ever did. Smart-home gear (digital locks, video doorbells, smart thermostats) cuts maintenance tickets and can qualify for utility rebates from providers like LADWP or SoCal Edison – rebates that offset your install costs. Furnished units routinely command 10–20% premiums in high-turnover markets – think corporate relocations, travel nurses, contract auditors – clients who will pay convenience without negotiating. If your market hosts those folks, furnishing is near-free profit (minimal ops lift). Off-street parking, high-speed internet, dishwashers – not luxuries anymore. They’re baseline. Charge for them separately ($50–150/month for parking, depending on location), or bake them into a premium rent. The sin is not charging at all.

Generate Secondary Revenue Without Complexity

Parking, storage, and utility pass-throughs are the low-hanging fruit – simple, fast, and effective. Shared parking and spare storage spaces (basements, attics, sheds) turn dead square footage into recurring income with zero maintenance. Utility billing via RUBS shifts consumption incentives and stabilizes your operating costs. Pets? Two levers: one-time deposits ($300–500) or monthly pet fees ($25–50). Monthly wins fast – they compound – and they attract tenants who expect to pay for the privilege of having a dog.

Capture Premium Rates Through Short-Term Flexibility

Short-term rental flexibility lets you arbitrage demand – capture premium nightly rates in peak seasons and keep long-term stability when things cool. A $3,000/month unit can yield $4,500+ in a high-demand window through nightly pricing – then slide back into a long-term lease when the wave passes. It requires explicit lease language and a property-management setup that can juggle both models – yes, overhead – but the revenue swing justifies it. Month-to-month options and Airbnb-compatible clauses attract tenants who value flexibility – and give you the right to cash in when events, tourism, or corporate demand spike.

Final Thoughts

The gap between average landlords and top performers comes down to three brutal truths – pricing discipline, cost control, and revenue diversification. Market research takes emotion out of rent-setting (because hope is not a pricing strategy), automation and preventative maintenance stop cash from leaking out the back door, and secondary income-parking, storage, furnished premiums, short-term flexibility-tacks on 20–40% to your rental revenue with a fraction of the work. This isn’t theory; it works across single-family homes, multifamily units, and short-term rentals.

Do the math – a landlord who lifts rents to market, trims operating costs by 10–15%, and tacks on $200–300 a month in ancillary income for a $3,000-rent unit moves from about $36,000 annual gross to roughly $42,000. That’s a 17% jump. Over five years that compounds into roughly $30,000 extra cash flow; over a decade, about $60,000. The math rewards action over inertia…always.

Start with one lever. Run your comps and reset rent to market – audit vendor contracts and cut one cost – add parking or storage fees. Pick the easiest win, execute it cleanly, then layer the next (systems and discipline compound faster than luck ever will). For a deeper playbook on building real-estate-centered wealth – frameworks, timelines, and the boring-but-powerful tactics – visit Top Wealth Guide to explore long-term financial growth.