Falling in love with a property is easy; ensuring it's a sound investment is where the real work begins. The critical period between an accepted offer and closing, known as due diligence, is your most vital opportunity to investigate, verify, and protect your capital. This is the phase where fortunes are secured or lost, where a dream property is confirmed or a potential financial nightmare is averted. A simple walkthrough and a glance at the numbers are never enough. To truly succeed, you need a systematic, comprehensive approach to uncover potential liabilities, from hidden structural flaws and title defects to zoning restrictions and unexpected assessments.

This is precisely why a detailed real estate due diligence checklist is not just a tool, but a necessity for any serious investor. Think of it as your investigative framework, designed to prevent costly surprises and empower you with a complete picture of the asset you are acquiring. We are moving beyond the curb appeal to dissect the core components of a property’s viability. This guide will provide a definitive roadmap, breaking down the most critical areas of investigation with actionable steps, key documents to request, and expert insights. Our goal is to transform you from a hopeful buyer into a savvy, confident investor who makes decisions based on facts, not feelings. Let's begin the investigation.

In This Guide

- 1 1. Title Search and Ownership Verification

- 2 2. Property Inspection and Structural Assessment

- 3 3. Environmental Site Assessment (Phase I & II)

- 4 4. Survey and Boundary Verification

- 5 5. Financial Analysis and Appraisal Review

- 6 6. Zoning and Land Use Verification

- 7 7. Building Permit and Code Compliance Review

- 8 8. HOA Documentation and Financials Review

- 9 9. Utilities, Water Rights, and Service Verification

- 10 10. Insurance Availability and Liability Assessment

- 11 Real Estate Due Diligence: Item-by-Item Comparison

- 12 From Checklist to Closing: Turning Diligence into a Done Deal

- 13 Frequently Asked Questions (FAQ)

1. Title Search and Ownership Verification

The cornerstone of any sound real estate investment is confirming that the person selling the property actually has the legal right to do so. A title search is a comprehensive examination of public records to determine and confirm a property's legal ownership and find out if there are any claims or encumbrances against it. This crucial step in your real estate due diligence checklist ensures you are acquiring a "clear" or "marketable" title, protecting your investment from future legal challenges.

A professional title company or real estate attorney will meticulously review the "chain of title," which is the historical sequence of transfers for the property. They look for deeds, mortgages, wills, court judgments, tax records, and any other recorded documents that could affect ownership. The goal is to uncover hidden issues that could jeopardize your rights to the property after closing.

Real-Life Example: An investor in Texas was under contract for a seemingly perfect rental property. The title search revealed an old, unpaid mechanic's lien from a contractor who worked on the house five years prior. The $8,000 lien would have become the new owner's responsibility. By discovering it during due diligence, the investor was able to require the seller to pay it off before closing, preventing a costly surprise.

Actionable Tips for Title Verification

- Order a Preliminary Title Report Early: Request this report at least 30 days before your intended closing date. This gives you and your legal counsel ample time to review any "exceptions" (items not covered by title insurance) and address potential problems.

- Scrutinize All Exceptions: Pay close attention to easements, covenants, conditions, and restrictions (CC&Rs) listed in the report. An undiscovered utility easement could prevent you from building an addition, or a restrictive covenant might prohibit using the property for your intended commercial purpose.

- Always Secure Title Insurance: This is non-negotiable. An owner's title insurance policy protects you from financial loss due to defects in the title that were not discovered during the search, such as forged documents or undisclosed heirs. This is a one-time fee paid at closing that protects you for as long as you own the property.

- Verify the Seller’s Identity: Ensure the name on the purchase agreement matches the name on the title exactly. This simple check can prevent fraud, a critical step often detailed in resources about structuring wholesale real estate contracts.

2. Property Inspection and Structural Assessment

While a title search secures your legal ownership, a physical inspection secures the actual asset. A professional property inspection is a detailed, non-invasive examination of the property's condition, from its foundation to its roof. This critical step on your real estate due diligence checklist identifies existing defects, potential safety hazards, and the remaining useful life of major systems like HVAC, plumbing, and electrical. It provides the crucial data needed to understand the true cost of ownership beyond the purchase price.

A licensed inspector acts as your objective third-party expert, providing a comprehensive report that uncovers issues you might otherwise miss. Discovering that a roof needs a $15,000 replacement within two years or that an outdated electrical panel poses a safety risk can dramatically alter your investment calculations. This assessment empowers you to make an informed decision, negotiate repairs, or even walk away from a deal that could become a financial drain.

Real-Life Example: A couple buying their first home loved the charming, finished basement. During the inspection, the inspector used a moisture meter and found high readings behind the new drywall. Further investigation revealed a significant crack in the foundation that had been cosmetically covered up. The repair estimate was over $20,000. Armed with the inspection report, they successfully negotiated the full repair cost as a seller credit at closing.

Actionable Tips for Property Inspection

- Hire Certified Professionals: Do not cut corners. Engage an inspector certified by a reputable organization like the American Society of Home Inspectors (ASHI) or the National Association of Home Inspectors (NAHI). This ensures they adhere to strict standards of practice and a code of ethics.

- Attend the Inspection Personally: Being present allows you to see issues firsthand and ask the inspector questions in real-time. This provides valuable context that a written report alone cannot convey, a key tip when you are figuring out how to buy your first rental property.

- Budget for Specialized Inspections: A general inspection may recommend further evaluation. Be prepared to hire specialists for potential issues like termites, mold, radon, foundation problems, or sewer line integrity based on the initial findings.

- Use the Report for Negotiation: The inspection report is a powerful negotiation tool. Use the findings and contractor estimates for necessary repairs to ask for a price reduction or seller credits at closing.

- Act Within Your Contingency Period: Inspections are time-sensitive. Schedule them immediately after your offer is accepted (typically within 5-10 days) to ensure you have enough time to review the report, get repair quotes, and negotiate with the seller before your inspection contingency expires.

3. Environmental Site Assessment (Phase I & II)

An often-overlooked yet critical element of a real estate due diligence checklist is the environmental evaluation. An Environmental Site Assessment (ESA) is a formal investigation designed to identify potential or existing environmental contamination liabilities on a property. This process, governed by standards from organizations like ASTM International, protects buyers from unknowingly acquiring a property with costly cleanup obligations and potential legal issues stemming from hazardous substances.

The process typically begins with a Phase I ESA, which involves a comprehensive review of historical records, a physical site inspection, and interviews with past and present owners or operators. Its goal is to identify any Recognized Environmental Conditions (RECs). If the Phase I report identifies RECs, such as a former gas station on the site, a more invasive Phase II ESA may be necessary. This second phase involves collecting and testing soil, groundwater, or building materials to confirm the presence and extent of contamination.

Real-Life Example: A developer planned to buy a parcel of land for a new retail center. A Phase I ESA revealed that the site was formerly occupied by a dry-cleaning business from the 1960s to the 1980s. This raised a REC for potential soil contamination from cleaning solvents. A Phase II assessment confirmed the presence of hazardous chemicals, with a cleanup estimate exceeding $250,000. The developer terminated the contract, avoiding a massive environmental liability.

Actionable Tips for Environmental Assessments

- Always Order a Phase I for Commercial Properties: For any commercial or industrial property, or land with a history of such use, a Phase I ESA is non-negotiable. This step is essential to qualify for certain landowner liability protections under federal law.

- Consider a Phase I for Older Residential Properties: If you are purchasing a residential property built before 1990, especially one near industrial areas, a Phase I can uncover risks like asbestos, lead-based paint, or nearby soil contamination.

- Hire a Certified Environmental Professional: Ensure your consultant holds a relevant certification, such as a Certified Environmental Manager (CEM), and has significant experience in the property type and region you are investigating. This ensures the assessment meets industry and legal standards.

- Budget for a Potential Phase II: If the property has a high-risk history (e.g., former dry cleaner, manufacturing plant), proactively budget for the possibility of Phase II testing. This can cost thousands of dollars but is crucial for quantifying a multi-million dollar liability.

- Consult an Environmental Attorney: If the Phase I report identifies significant RECs, review the findings with a specialized environmental attorney to fully understand your potential liabilities, remediation obligations, and negotiation strategies with the seller.

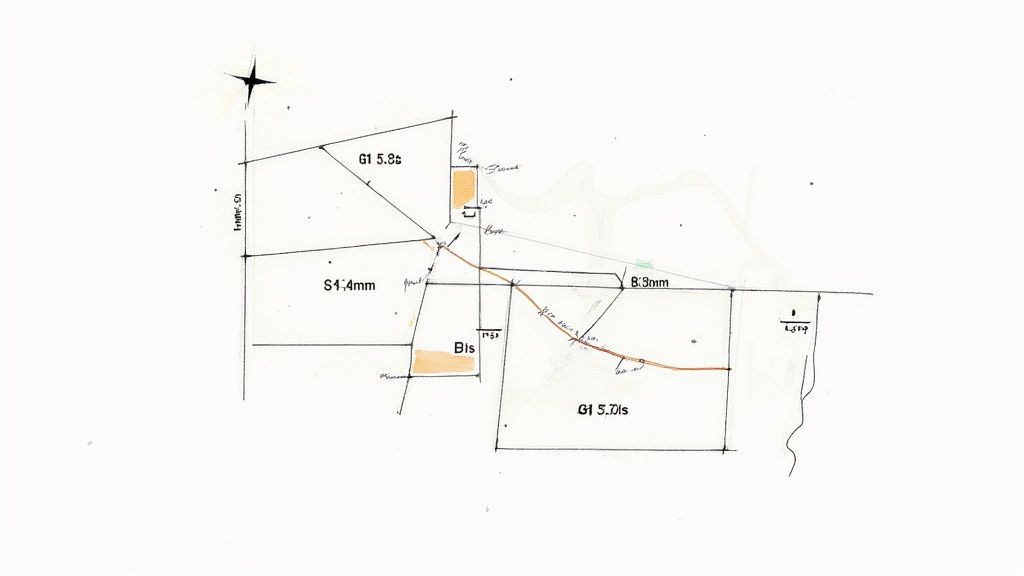

4. Survey and Boundary Verification

While a title search confirms who owns the property, a survey confirms what you actually own. A professional survey is a precise measurement and mapping of a property's legal boundaries, physical features, easements, and any potential encroachments. This step in your real estate due diligence checklist is essential for providing a legal, verifiable map of the land and improvements you are purchasing, preventing costly disputes over property lines and land use rights down the road.

A licensed surveyor will physically visit the property to locate and verify its corners and boundary lines as described in the deed. They create a detailed map or plat that illustrates the property's dimensions, the exact location of buildings, fences, and driveways, and identifies any easements or rights-of-way that could restrict your use of the land. This visual confirmation is critical for verifying that what you see is what you legally get.

Real-Life Example: A buyer purchased a home with a large, fenced-in backyard, perfect for their future pool. After closing, they hired a pool company, which required a new survey. The survey revealed that the back fence and about 10 feet of the yard were actually encroaching on the neighbor's property. The buyer had to remove the fence and abandon their pool plans, a costly and frustrating mistake that an upfront survey would have prevented.

Actionable Tips for Survey Verification

- Request an Updated Survey: Do not rely on an old, outdated survey. A new survey, preferably an ALTA/NSPS Land Title Survey for commercial properties, provides the most accurate and current information. Aim to use a survey that is less than two years old and reflects any recent changes to the property.

- Identify and Address Encroachments: The survey is your best tool for spotting encroachments, such as a neighbor's fence built two feet onto your property or your own driveway extending onto theirs. Discovering these issues early allows you to negotiate a resolution, such as a boundary line agreement, before closing.

- Verify Setbacks and Improvements: A survey confirms that all structures, like a garage or deck addition, are built within the required legal setback lines defined by local zoning ordinances. This prevents future compliance issues or orders to remove an illegally placed structure.

- Cross-Reference with the Title Report: Carefully compare the legal description on the survey with the one in the preliminary title report. Any discrepancies must be investigated and resolved by your attorney and the title company to ensure the documents are perfectly aligned before you finalize your investment, a key part of your journey in learning how to find investment properties.

5. Financial Analysis and Appraisal Review

Beyond confirming ownership, a critical part of your real estate due diligence checklist is ensuring the property's purchase price is justified by its actual market value. A professional appraisal provides an unbiased, expert valuation of the property, serving as a vital reality check for your investment. This step is almost always required by lenders, as it protects both them and you from overpaying and entering a financially unsound deal.

An appraiser evaluates the property based on its condition, location, size, and features, comparing it against recent sales of similar properties in the area (known as "comparables" or "comps"). This analysis produces a formal report that determines the property's fair market value, which directly impacts financing, negotiation leverage, and your overall investment strategy. A significant discrepancy between the appraisal and your offer price can halt a deal or open the door for renegotiation.

Real-Life Example: A buyer offered $550,000 for a house in a hot market. The lender's appraisal came back at only $525,000, creating a $25,000 gap that the bank would not finance. This "appraisal gap" gave the buyer leverage. Instead of walking away, they used the official appraisal report to renegotiate with the seller, who agreed to lower the price to $530,000, with the buyer covering the remaining $5,000 gap in cash.

Actionable Tips for Appraisal and Financial Review

- Review the Appraisal Report Immediately: Don’t just look at the final number. Scrutinize the report for the comparables used, any adjustments made, and notes on the property's condition. If the appraiser notes significant deferred maintenance, it can be a powerful tool for negotiating repairs or a price reduction.

- Challenge a Low Appraisal if Necessary: If the appraisal comes in well below the agreed-upon price and you believe it's inaccurate, you can contest it. Provide your own set of recent, relevant comparable sales to the lender and request a reconsideration or a new appraisal.

- Conduct Your Own Investment Analysis: For income-generating properties, an appraisal is just one piece of the puzzle. You must perform a separate, detailed financial analysis to project cash flow, return on investment (ROI), and net operating income (NOI). Using a comprehensive real estate investment calculator can help you accurately model different scenarios and verify the property's profitability.

- Use the Appraisal for Tax Purposes: A purchase-price appraisal can sometimes be used as evidence to appeal your property tax assessment if you believe it is too high, potentially saving you thousands over the life of your ownership.

6. Zoning and Land Use Verification

Beyond the physical structure, a property's value and utility are fundamentally defined by what you are legally allowed to do with it. Zoning and land use verification is the process of examining local regulations, building codes, and future development plans to ensure your intended use for a property is permitted. This essential part of your real estate due diligence checklist protects you from purchasing a property that you cannot develop or operate as planned, preventing costly compliance battles or a complete loss on your investment.

Local municipalities create zoning ordinances to control development, manage growth, and ensure land uses are compatible. An investor must meticulously check the property's specific zoning classification (e.g., R-1 for single-family residential, C-2 for general commercial) and the associated rules. A seemingly perfect commercial lot might be useless if local ordinances prohibit the specific type of business you plan to open, or if future highway plans are slated to cut directly through it.

Real-Life Example: An entrepreneur bought a charming old house with the goal of converting it into a bed and breakfast. After closing, they discovered that while the area was zoned for mixed-use, a specific overlay district prohibited transient lodging (rentals under 30 days). Their business plan was rendered impossible by a zoning rule they failed to verify, turning their investment into a major financial loss.

Actionable Tips for Zoning Verification

- Request an Official Zoning Letter: Contact the local city or county planning and zoning department to request a formal zoning verification letter. This document provides written confirmation of the property’s current zoning designation and a reference to the specific ordinance sections that apply.

- Review the Comprehensive Plan: Don't just look at current zoning; investigate the future. A municipality's comprehensive plan outlines development goals for the next 5, 10, or even 20 years. This can reveal plans for new roads, parks, or rezoning initiatives that could dramatically impact the property's value and use.

- Investigate Non-Conforming Uses: If the property's current use doesn't match its zoning (e.g., a small shop in a residential zone), it may be a "legal non-conforming use." These often come with strict limitations, such as prohibitions on expansion or a requirement to cease use if the property is vacant for a certain period. Consult a zoning attorney to understand the exact status and risks.

- Check for Variances and Permits: Investigate the property's history of applications for variances (permission to deviate from zoning rules) or conditional use permits. This history can reveal past challenges with the property and how flexible the local zoning board is.

7. Building Permit and Code Compliance Review

A crucial part of any real estate due diligence checklist involves ensuring that the property you intend to purchase is not just physically sound, but also legally compliant. A building permit and code compliance review verifies that all structures, additions, and significant improvements on the property were completed with the necessary government approvals. This step protects you from inheriting illegal, unsafe, and potentially costly construction issues that could become your problem after closing.

This review process involves cross-referencing the existing physical structure with official records from the local building department. The goal is to identify any "unpermitted work," such as a master bedroom addition built without a permit or a basement finished into a living space without proper inspections. Discovering these discrepancies before you buy allows you to address the financial and safety risks, preventing future headaches with code enforcement, insurers, or when you eventually decide to sell.

Real-Life Example: A buyer purchased a home advertised with a "bonus room" built over the garage. Years later, when they went to sell, the new buyer's inspector discovered the room was unpermitted. The local building department required them to either tear it down or bring it up to code, which involved thousands in structural and electrical work. This issue, which should have been caught during their own due diligence, significantly delayed their sale and cost them money.

Actionable Tips for Permit and Code Review

- Request All Permit Records from the Seller: Ask the seller to provide copies of all building permits, inspection sign-offs, and the final Certificate of Occupancy for any work completed during their ownership. This is your starting point for verification.

- Independently Verify with the Building Department: Do not rely solely on the seller's documents. Contact the local municipal building or planning department to request the official permit history for the property address. Compare this official record against the physical property and the seller's disclosures.

- Identify Unpermitted Work: During your property inspection, look for telltale signs of work that may lack permits, such as a recently added deck, a new bathroom in the basement, or an enclosed garage. If it looks new or different from the original structure, it warrants a permit check.

- Budget for Remediation Costs: If unpermitted work is found, hire a licensed contractor to estimate the cost of bringing it into compliance. This could involve "as-built" permits, which are often more expensive, or even require deconstruction and rebuilding the work to current code standards.

- Negotiate a Solution: Use the cost estimates for remediation as a powerful negotiating tool. You can ask the seller to fix the issues before closing, provide a credit to cover the future costs, or reduce the overall purchase price to account for the defect. For larger-scale issues, particularly in commercial properties, understanding these details is a fundamental part of a solid investment strategy, as outlined in guides for commercial real estate for beginners.

8. HOA Documentation and Financials Review

When a property is part of a homeowners association (HOA) or condominium association, your due diligence extends beyond the four walls of the unit. You are not just buying a home; you are buying into a community governed by a specific set of rules and financial obligations. A thorough review of all HOA documentation is an essential part of any real estate due diligence checklist, as it reveals the true cost and restrictions of ownership.

This process involves a deep dive into the association's governing documents, financial health, and operational history. An HOA with mismanaged funds, restrictive covenants that conflict with your plans, or looming special assessments can turn a dream property into a financial nightmare. Uncovering these details early protects you from unexpected costs and lifestyle limitations after you close.

Real-Life Example: An investor bought a condo intending to use it as a short-term rental. They glanced at the HOA rules but missed a key amendment passed a year earlier that restricted all rentals to a minimum of six months. After closing, they were unable to execute their business plan and were stuck with a property that didn't fit their investment model. A thorough review of all HOA documents, including recent amendments and meeting minutes, would have exposed this critical restriction.

Actionable Tips for HOA Review

- Request and Scrutinize Governing Documents: Obtain and carefully read the HOA's Covenants, Conditions, and Restrictions (CC&Rs), bylaws, and rules. These documents outline your obligations and restrictions regarding pets, rentals, property modifications, and parking.

- Analyze Financial Health: Request at least three years of the HOA's financial statements, including the balance sheet and income statement. Look for consistent fee increases, a history of special assessments, and signs of underfunding that could indicate future financial instability.

- Examine the Reserve Study: A reserve study is a long-term capital planning tool that estimates the life expectancy and replacement cost of the community’s major assets (roofs, elevators, pools). Ensure the reserve fund is adequately funded according to this study to avoid sudden, large assessments for major repairs. A reserve fund that is less than 70% funded is often considered a red flag.

- Confirm All Fees and Pending Assessments: Verify the current monthly or quarterly HOA fees and ask specifically, in writing, if there are any pending or planned special assessments. This prevents discovering after closing that you owe thousands for a capital project that was already approved.

- Check for Existing Liens: A title search should reveal this, but it is wise to directly confirm with the HOA that there are no outstanding liens against the specific property for unpaid assessments. An existing lien for over $5,000 in unpaid dues could become your responsibility.

9. Utilities, Water Rights, and Service Verification

Beyond the physical structure, a property's viability hinges on its connection to essential services. Verifying the availability, cost, and reliability of utilities like water, sewer, electricity, gas, and internet is a non-negotiable part of any comprehensive real estate due diligence checklist. This step ensures the property is habitable, functional for its intended use, and won't come with crippling unforeseen expenses or service limitations.

This investigation is particularly critical for rural or developing properties. For example, a property without access to municipal water may rely on a well, which introduces variables like water quality, flow rate, and maintenance costs. Similarly, discovering a property relies on an aging septic system could mean a sudden replacement cost of over $10,000. Neglecting to confirm these services can transform a promising investment into a logistical and financial nightmare.

Real-Life Example: A family bought a beautiful rural property, assuming they could easily get high-speed internet for their work-from-home jobs. After moving in, they discovered the only available service was a slow, unreliable satellite connection, making their jobs nearly impossible. A simple check with local internet service providers during due diligence would have revealed this deal-breaking limitation.

Actionable Tips for Utility Verification

- Request Past Utility Bills: Ask the seller for at least 12 months of utility bills (electric, gas, water, sewer). This provides a realistic estimate of operating costs and reveals any unusual spikes that might indicate an underlying issue, like a water leak or inefficient HVAC system.

- Conduct Professional Inspections: For properties with private systems, inspections are crucial. Have a qualified professional conduct a well water quality and flow rate test. If a septic system is present, a separate, thorough septic inspection is essential to assess its condition and lifespan.

- Verify Service Availability and Quality Directly: Do not rely solely on the seller's claims. Contact local utility providers directly to confirm service availability, connection fees, and any planned outages or infrastructure issues. For internet, check provider websites using the exact address to see what plans and speeds are actually available, which is a key factor for marketability.

- Investigate Water Rights: In arid or water-scarce regions, water rights can be more valuable than the land itself. Research the property's water rights status with the relevant state agency or local water district. Understand the type of right, its priority date, and any restrictions on usage, as this can severely limit future development or agricultural use.

- Identify All Easements: Carefully review the title report and survey for any utility easements. An undiscovered easement running through the middle of the property could prevent you from building a pool, an addition, or even specific types of landscaping, significantly impacting your plans for the property.

10. Insurance Availability and Liability Assessment

An often-overlooked but critical component of your real estate due diligence checklist is assessing the insurability of the property. Beyond simply getting a quote, this involves a deep dive into the availability, cost, and potential limitations of coverage. This assessment ensures you can secure adequate protection for your asset and uncovers any hidden liability risks that could impact your financing, budget, and long-term ownership.

Failing to investigate insurance early can lead to disastrous surprises. You might discover the property is located in a high-risk zone, like a 100-year floodplain or a wildfire-prone area, leading to prohibitively expensive premiums or even an outright denial of coverage from most carriers. A property’s claims history or outdated systems, such as old electrical or plumbing, can also render it difficult to insure.

Real-Life Example: A buyer in Florida was under contract for a coastal home. They waited until the week before closing to secure insurance, only to find that due to the home's age and proximity to the water, major carriers refused to write a new policy. The only option was a state-run "insurer of last resort" with premiums nearly triple what they had budgeted, which made the investment financially unviable and forced them to cancel the contract.

Actionable Tips for Insurance and Liability Assessment

- Obtain Multiple Insurance Quotes Early: Don't wait until the last minute. Contact several insurance providers as soon as your offer is accepted to get preliminary quotes. This gives you a realistic understanding of annual costs to factor into your holding cost analysis.

- Verify High-Risk Zone Status: Use FEMA's Flood Map Service Center to check if the property is in a designated flood zone, which would mandate expensive flood insurance. Similarly, research state-specific maps for wildfire or hurricane risks that dramatically affect premiums and availability.

- Request a CLUE Report: The Comprehensive Loss Underwriting Exchange (CLUE) report details the property's insurance claims history for the past seven years. A history of water damage or liability claims can lead to significantly higher rates or make it difficult to find coverage.

- Scrutinize Policy Exclusions: Carefully review what a standard policy does not cover. Common exclusions include mold, earthquakes, and certain types of water damage. Understand what additional riders or separate policies you may need for comprehensive protection.

- Align with Lender Requirements: Your mortgage lender will have specific insurance requirements. Ensure the coverage you can obtain meets or exceeds these minimums, as failure to do so can jeopardize your loan approval right before closing.

Real Estate Due Diligence: Item-by-Item Comparison

| Checklist Item | What It Involves | Why It's Critical | Potential Red Flags |

|---|---|---|---|

| 1. Title Search | Reviewing public records to confirm legal ownership and find claims. | Ensures the seller has the right to sell and you receive a clear title. | Unpaid tax liens, contractor liens, undisclosed heirs, boundary disputes. |

| 2. Property Inspection | Professional assessment of the property's physical condition and major systems. | Uncovers hidden defects, deferred maintenance, and safety issues. | Foundation cracks, old/faulty wiring, evidence of water damage, failing roof. |

| 3. Environmental Assessment | Investigating potential contamination from past land uses. | Protects you from massive cleanup costs and legal liability. | History as a gas station/dry cleaner, proximity to industrial sites, soil discoloration. |

| 4. Survey & Boundary | Professional mapping of property lines, easements, and encroachments. | Prevents disputes with neighbors and confirms what you actually own. | Neighbor's fence on your property, structures built over setback lines. |

| 5. Financials & Appraisal | Verifying market value and, for rentals, analyzing income/expenses. | Prevents overpaying and confirms the investment is financially sound. | Appraisal below purchase price, high vacancy rates, inconsistent rental income. |

| 6. Zoning & Land Use | Confirming that your intended use of the property is legally permitted. | Avoids buying a property you can't use as planned (e.g., for a business). | Zoning restrictions against short-term rentals, non-conforming use status. |

| 7. Permit & Code Review | Checking municipal records for permits on all additions and renovations. | Protects you from illegal, uninspected, and unsafe construction. | A "new" bathroom or deck that doesn't appear in the city's permit history. |

| 8. HOA Document Review | Analyzing an HOA's rules, financial health, and planned assessments. | Uncovers hidden costs, restrictive rules, and potential future fees. | Underfunded reserves, pending lawsuits against the HOA, restrictive rental caps. |

| 9. Utilities & Services | Verifying access to essential services like water, sewer, and internet. | Ensures the property is habitable and functional without costly surprises. | Property relies on an old septic system, no access to high-speed internet. |

| 10. Insurance & Liability | Assessing the property's insurability and potential premium costs. | Avoids buying a property that is uninsurable or has exorbitant premiums. | Location in a flood/wildfire zone, extensive history of insurance claims. |

From Checklist to Closing: Turning Diligence into a Done Deal

Navigating the extensive journey of real estate due diligence can feel like an exhaustive expedition. From meticulously verifying title records and commissioning a Phase I Environmental Site Assessment to scrutinizing HOA financials and confirming zoning compliance, the process is undeniably intensive. However, this is not just procedural box-ticking. Each step you've taken through this real estate due diligence checklist is a deliberate act of risk mitigation and value discovery. You've moved beyond the listing photos and marketing brochures to uncover the true, unvarnished story of the property.

The ultimate goal of this rigorous investigation isn't to uncover a flawless property, as such a thing rarely exists. Instead, the objective is to build a complete, transparent picture of your potential investment. It's about trading assumptions for facts and replacing uncertainty with a deep, quantifiable understanding of the asset you are about to acquire. This comprehensive knowledge is your most powerful negotiating lever and your most reliable shield against future financial surprises.

The Power of Information: Your Strategic Advantage

Think of the due diligence period as the time when the power dynamic shifts in your favor. The information you gather from property inspections, financial audits, and permit reviews becomes your strategic arsenal.

- For Negotiation: Did the structural assessment reveal a need for roof repairs costing $15,000? This is not just a problem; it's a data point you can use to renegotiate the purchase price or request seller concessions.

- For Budgeting: Discovering that the HVAC system has only two years of life expectancy left allows you to proactively budget for its replacement, preventing a costly emergency down the line.

- For Protection: Uncovering an undisclosed easement or a zoning restriction that conflicts with your plans gives you the critical insight needed to walk away from a deal that is fundamentally misaligned with your goals, saving you from a potentially disastrous investment.

By systematically working through each item on the checklist, from the broad strokes of a market analysis to the fine print of an insurance policy, you transform yourself from a hopeful buyer into an informed, empowered investor.

Key Takeaways: From Diligence to Decision

As you move toward closing, remember these core principles. First, no detail is too small. A seemingly minor discrepancy in a property survey or an overlooked clause in an HOA's bylaws can have significant long-term consequences. Second, trust but verify. Always seek primary source documentation and professional third-party opinions rather than relying solely on the seller's representations. Finally, understand that due diligence is an ongoing process. The skills and habits you develop now will serve you in every future real estate transaction, building a foundation of sound investment practices.

This real estate due diligence checklist is more than a guide; it is a framework for making confident, intelligent decisions. It ensures the property you ultimately close on is not a source of hidden liabilities but a solid cornerstone for building lasting wealth and achieving your financial objectives. You have done the hard work, gathered the facts, and are now prepared to make a final, well-reasoned decision, turning your diligent efforts into a successful, done deal.

Frequently Asked Questions (FAQ)

1. What is the most critical item on a real estate due diligence checklist?

While all items are important, the two most fundamental are the Title Search and the Property Inspection. A title search ensures you can legally own the property without claims against it, and a property inspection ensures the physical asset you're buying is sound. Without these two, the other checks have little meaning.

2. How long is the typical due diligence period?

For residential properties, the due diligence period (often called the inspection or contingency period) is typically 7 to 14 days. For complex commercial properties, it can be 30, 60, or even 90 days, depending on what was negotiated in the purchase agreement.

3. Can I perform due diligence myself to save money?

While you can do some preliminary research yourself (like checking zoning maps online), you should never skip hiring licensed professionals for critical tasks. A qualified home inspector, surveyor, title company, and environmental consultant have the expertise and tools to uncover issues you would miss, saving you from potentially catastrophic costs.

4. What happens if I find a major problem during due diligence?

If your contract has a due diligence or inspection contingency, finding a major issue gives you several options:

- Negotiate: Ask the seller to repair the issue, provide a credit at closing, or lower the purchase price.

- Walk Away: If the issue is too large or the seller won't negotiate, you can terminate the contract and (usually) get your earnest money deposit back.

- Accept: If the issue is manageable, you can choose to accept the property as-is and handle the repairs yourself after closing.

5. Is an environmental assessment necessary for a residential property?

It's not standard for most residential purchases, but it's highly recommended if the property is old (potential for asbestos/lead paint), located near current or former industrial sites, or if there's any suspicion of underground oil tanks or soil contamination.

6. How is commercial real estate due diligence different from residential?

Commercial due diligence is far more intensive, especially on the financial side. It includes a deep analysis of leases, tenant creditworthiness, rent rolls, service contracts, and operating statements. Environmental assessments (Phase I ESA) and ALTA/NSPS Land Title Surveys are also standard practice for commercial deals but rare for residential.

7. What is a "contingency" in a real estate contract?

A contingency is a clause that allows a buyer to back out of a deal without penalty if a certain condition is not met. Common examples include an inspection contingency, a financing contingency (if the buyer can't get a loan), and an appraisal contingency (if the property appraises for less than the sale price).

8. What is the difference between an easement and an encroachment?

An easement is a legal right for someone else to use a portion of your property for a specific purpose (e.g., a utility company's right to access power lines). An encroachment is an illegal intrusion onto your property by a neighbor's structure, like a fence or shed. A survey is the best way to identify both.

9. How do I review HOA documents if I'm not a lawyer?

While a legal review is best, you can identify key points. Look for sections on rentals (are they allowed?), special assessments (history and triggers), rules and regulations (pets, parking, modifications), and review the budget to see if the reserve fund is healthy. Pay close attention to meeting minutes, which can reveal ongoing disputes or planned projects.

10. What's the biggest mistake investors make during due diligence?

The biggest mistake is rushing the process or skipping steps due to excitement or pressure. Every item on the checklist exists to protect you from a specific, costly risk. Assuming everything is fine without verifying it is a recipe for a bad investment. Take your time and be thorough.

This article is for educational purposes only and is not financial or investment advice. Consult a professional before making financial decisions.

Ready to take your real estate investment knowledge to the next level? The detailed strategies in this checklist are just the beginning of building a powerful investment portfolio. For more in-depth guides, advanced financial tools, and expert insights designed to accelerate your wealth-building journey, explore the resources at Top Wealth Guide. Visit Top Wealth Guide to access a comprehensive library of content that will help you master every aspect of real estate and beyond.