Financial independence isn't about being fabulously rich—it's about owning your time.

Think of it this way: financial independence (FI) is the milestone you reach when the income from your assets can fully cover your living expenses. At that point, working for a paycheck becomes a choice, not a necessity. This freedom is the ultimate goal—the power to design your life based on passion, not just the need to pay bills.

In This Guide

- 1 What Is Financial Independence Really?

- 2 How to Calculate Your Financial Independence Number

- 3 The Core Strategies for Building Your FI Portfolio

- 4 Finding Your Personal Path to Financial Independence

- 5 Your Actionable Starter Plan to Achieve FI

- 6 Navigating Common Risks on the Road to FI

- 7 Frequently Asked Questions About Financial Independence

- 7.1 1. What's the difference between being wealthy and being financially independent?

- 7.2 2. Is the 4% Rule still safe for early retirees?

- 7.3 3. Should I pay off my mortgage or invest more aggressively?

- 7.4 4. How do I account for healthcare costs without an employer?

- 7.5 5. What are the best investment accounts for reaching FI?

- 7.6 6. Can you really achieve FI on a low or average income?

- 7.7 7. How do I stay motivated when financial independence feels so far away?

- 7.8 8. What is "sequence of returns risk" and how do I manage it?

- 7.9 9. Does my FI number need to account for inflation?

- 7.10 10. What is the single most important first step to take?

What Is Financial Independence Really?

At its heart, financial independence boils down to a simple, powerful formula: you’re financially independent when your passive income is greater than or equal to your expenses. It's like planting an orchard. You spend years tending the trees (your investments), and eventually, they produce enough fruit (investment returns) to feed you all year long. You no longer have to trade your time for food.

This marks a huge mental shift from the traditional "time-for-money" grind. The journey to FI isn't about pinching every penny until it hurts; it's about being intentional with your money. It’s about knowing where your dollars are going, making smart decisions to save more, and investing with consistency. The goal is to build a portfolio of assets—like stocks, real estate, or a side business—that generates a reliable stream of cash. You create a system where your money works for you, so you don't have to.

For a deeper dive into the broader concept, our guide on achieving financial freedom provides additional context.

The Mindset Behind Financial Independence

More than just a number on a spreadsheet, FI is a philosophy built on reclaiming your most valuable, non-renewable resource: your time. It gives you the autonomy to truly design your life.

- Control Over Your Time: You get to decide how to spend your days. Want to launch a passion project, travel the world, volunteer, or just spend more time with family? You can.

- Reduced Financial Stress: There's a profound peace of mind that comes from knowing your bills are paid, no matter what. A sudden job loss or a dip in the market doesn't feel like a catastrophe when you aren't living paycheck to paycheck.

- More Life Options: FI opens doors that were previously locked. You can walk away from a toxic job, start a business without the pressure of immediate profitability, or take a year off to learn a new skill.

This isn't some niche idea anymore; it's catching on, especially with younger generations. A recent EY Global Wealth Research Report found that an incredible 87% of Gen Z respondents see financial independence as a primary life goal. This points to a major cultural shift where personal freedom and life satisfaction are valued just as much as financial security.

Financial independence isn't the end goal; it's the ultimate tool. It provides the freedom to build a life aligned with your true values, not one dictated by financial obligations.

This article is for educational purposes only and is not financial or investment advice. Consult a professional before making financial decisions.

How to Calculate Your Financial Independence Number

So, what does it take to actually become financially independent? It’s one thing to dream about it, but to make it real, you need a number—a concrete target to aim for. This is what we call your Financial Independence (FI) number.

Think of it as your personal finish line. It's the total amount you need to have invested so your money can support your lifestyle forever, even if you never earn another paycheck.

Figuring out this number is surprisingly simple. It really just boils down to two things: how much you spend each year and a "safe withdrawal rate"—the portion of your investments you can cash out annually without depleting your stash.

The Foundation: The 4 Percent Rule

The go-to guideline for this is the 4% Rule. It’s a concept that’s been battle-tested against historical stock market data and is the bedrock of most retirement planning. The rule suggests you can safely withdraw 4% of your portfolio's value in your first year of retirement, then adjust that amount for inflation each following year, with a very high chance your money will last at least 30 years.

Imagine your investment portfolio is a magic spring. The 4% Rule tells you how much water you can take from it each year without ever worrying about it running dry. The spring replenishes itself through investment growth, hopefully growing faster than what you're taking out.

To calculate your FI number, you just flip this rule around. If 4% of your portfolio is what you can spend each year, then your total portfolio needs to be 25 times your annual expenses. Why 25? Because 100% divided by 4% equals 25.

Your FI Number = Your Annual Expenses x 25

This formula is a game-changer. It turns a fuzzy dream into a clear, measurable goal. It’s the number you need to see in your investment accounts before you can confidently pop the champagne and declare yourself financially free.

The idea is simple: once your passive income from investments grows large enough to cover all your living expenses, you've made it.

A Real-World Example: Calculating Alex's FI Number

Let's walk through this with a quick example. Meet Alex, a 30-year-old graphic designer who wants to find their personal FI number. The absolute first step is getting a handle on their spending.

Step 1: Calculate Annual Expenses

Alex starts by tracking every dollar for a few months to see exactly where the money goes. You can't hit a target you can't see, so this step is non-negotiable.

| Expense Category | Monthly Cost | Annual Cost |

|---|---|---|

| Housing (Rent, Utilities) | $1,800 | $21,600 |

| Transportation (Car Payment, Gas, Insurance) | $400 | $4,800 |

| Food (Groceries & Dining Out) | $600 | $7,200 |

| Healthcare (Premiums, Co-pays) | $250 | $3,000 |

| Personal & Entertainment (Subscriptions, Hobbies) | $350 | $4,200 |

| Student Loans | $400 | $4,800 |

| Total | $3,800 | $45,600 |

After adding everything up, Alex discovers their total annual spending is $45,600. This is the magic number—the annual income their investments need to generate.

By the way, while you're tallying up expenses, it's the perfect time to get a full picture of your finances. If you're curious, our guide on how to calculate net worth is a great place to start.

Step 2: Apply the 25x Rule

Now that Alex has their annual spending figure, the final calculation is easy.

- FI Number = Annual Expenses x 25

- FI Number = $45,600 x 25

- FI Number = $1,140,000

And there it is. Alex's target is $1.14 million. This isn't just a random, pie-in-the-sky number. It’s a data-driven goal that makes the whole journey toward financial independence feel real and, most importantly, achievable.

This article is for educational purposes only and is not financial or investment advice. Consult a professional before making financial decisions.

The Core Strategies for Building Your FI Portfolio

Calculating your FI number is the "what"; building your investment portfolio is the "how." The whole journey to financial independence runs on a smart, consistent investment strategy that puts your savings to work. While you could invest in a million different things, most people who successfully reach FI build their wealth on a few time-tested pillars.

There's no single "right" way to build a portfolio. In reality, a solid plan usually mixes different approaches to find a good balance between risk and reward. For most people chasing FI, the foundation is built on three core pillars: stock market investing, real estate, and diversified passive income streams.

Pillar 1: Low-Cost Index Funds and ETFs

For most people, this is the simplest and most effective place to start. Forget about trying to pick the next Amazon or Google—a game even the pros rarely win. Instead, you can own a tiny piece of the entire market. That's the simple magic of low-cost index funds and Exchange-Traded Funds (ETFs).

These funds bundle together hundreds, sometimes thousands, of stocks into a single investment. For example, when you buy a share of an S&P 500 index fund, you're instantly investing in the 500 biggest companies in the U.S. The whole idea is based on a powerful premise: it's far more reliable to bet on the long-term growth of the overall economy than to bet on a few individual companies.

This method has some huge advantages:

- It’s simple. This is as "set it and forget it" as investing gets, with no need to constantly check stock prices.

- It’s cheap. Index funds have incredibly low fees, which means more of your money stays in your pocket, compounding over time.

- It’s proven. Over the long haul, a diversified portfolio of index funds has historically delivered powerful returns.

The goal here isn't to become a stock-picking genius. It's about building the boring, consistent habit of putting money into these funds every single month. To dive deeper, check out our guide on what are index funds and see exactly how they work.

Pillar 2: Real Estate Investing

While index funds are a hands-off way to grow wealth, real estate gives you a tangible asset you can see and touch—one that can produce both appreciation and steady cash flow. Owning rental properties is a classic path to passive income. Your tenants' rent covers the mortgage and other costs, and the rest is profit in your pocket.

Real estate brings unique benefits to the table that you just don't get with a stock portfolio. It often acts as a great hedge against inflation, since rents and property values tend to rise with the cost of living. You can also use leverage—using the bank's money (a mortgage) to buy a much larger asset—and take advantage of some pretty significant tax breaks.

Real estate investing turns a basic human need—shelter—into a powerful income-producing asset. It's a way to build equity and generate cash flow simultaneously, providing a stable foundation for a diversified FI portfolio.

Of course, it's not a completely passive gig. Being a landlord means dealing with tenants, fixing leaky faucets, and managing the property. But for those who are up for it, real estate can be an absolute powerhouse for building wealth.

Pillar 3: Diversified Passive Income Streams

This third pillar takes you beyond traditional assets and into the world of creating your own income sources. This could be anything from selling digital products and online courses to building a side hustle that eventually runs on its own. The strategy is all about building systems that make money for you, even when you’re not actively working on them.

Looking at these pillars side-by-side can help clarify how they fit into a larger plan.

| Strategy | How It Works | Best For… | Key Challenge |

|---|---|---|---|

| Index Funds/ETFs | Own a slice of the entire market, growing with the broad economy. | The hands-off investor who values simplicity and long-term, proven growth. | Requires patience and discipline to ride out market volatility without panicking. |

| Real Estate | Earn rental income and profit from rising property values. | The hands-on investor who wants a tangible asset and is willing to manage properties. | Higher initial capital required and can be illiquid; involves landlord responsibilities. |

| Passive Income | Create assets (courses, ebooks, software) or build scalable businesses. | The entrepreneurial investor who enjoys creating and is willing to put in upfront work. | Income can be inconsistent at first; requires a specific skill set or knowledge. |

The great news is that building wealth is more accessible than ever before. According to the World Bank's Global Findex Database, 79% of adults globally now have a financial account. This is a huge leap forward, empowering more people around the world to save, invest, and work toward their own financial goals.

Ultimately, reaching financial independence isn’t about picking just one perfect strategy. It's about combining these pillars in a way that feels right for your timeline, risk tolerance, and personal goals. The result is a robust portfolio that can support you for a lifetime.

This article is for educational purposes only and is not financial or investment advice. Consult a professional before making financial decisions.

Finding Your Personal Path to Financial Independence

The journey to financial independence isn’t a single, rigid highway. Think of it more like a network of scenic routes, each leading to the same destination: freedom. The path you choose should feel right for you—it needs to align with your personal values, lifestyle ambitions, and what you truly want out of life. Not everyone needs a multimillion-dollar portfolio to feel free.

Understanding the different "flavors" of FI helps turn an intimidating concept into a personal and attainable goal. It shifts the focus from a one-size-fits-all number to a customized target that genuinely reflects your definition of a life well-lived.

Lean FI: A Minimalist Approach to Freedom

Lean FI is tailor-made for those who prioritize time and freedom above all else. This path is built around a low-cost, minimalist lifestyle, which allows you to hit your FI number much faster than you might expect. The goal isn’t about deprivation; it’s about intentional living, where you find more joy in experiences than in possessions.

Someone on the Lean FI path might have a nest egg between $500,000 and $1,000,000, which comfortably supports an annual budget of around $20,000 to $40,000. The biggest draw here is speed—you can reach the finish line with a much shorter savings period.

Fat FI: Living Large Without the 9-to-5

At the other end of the spectrum, you’ll find Fat FI. This is the path for anyone who wants to maintain a high standard of living after leaving the workforce, without compromising on luxuries like international travel, fine dining, or expensive hobbies. It’s financial independence with a very generous buffer built in.

Pursuing Fat FI means aiming for a much larger nest egg, typically $2.5 million or more, to support annual spending of $100,000+. While it takes significantly longer to achieve, the payoff is a life of abundance and the peace of mind that you can easily handle any unexpected expenses.

Barista FI: The Best of Both Worlds

Barista FI offers a flexible and popular middle ground. This approach is for people who have saved enough to cover their basic living expenses with their investments but still choose to work a low-stress, part-time job. Often, this is for fun money or, more practically, for benefits like health insurance.

The name comes from the idea of working at a coffee shop, but it could be any passion project or enjoyable work. This path dramatically lowers the pressure to save an enormous nest egg and allows you to leave a high-stress career much sooner. The real beauty of Barista FI is its perfect balance of work and freedom.

Financial independence is deeply personal. The right path isn't the one that's fastest or largest; it's the one that aligns with your values and brings you the most fulfillment along the way.

To help you find your best fit, it helps to see these frameworks side-by-side.

Comparing Financial Independence Frameworks

Here's an overview of the different FI lifestyles, their requirements, and the pros and cons of each approach to help you find the right fit.

| FI Framework | Typical Annual Spending | Estimated Nest Egg Size | Primary Advantage | Main Trade-Off |

|---|---|---|---|---|

| Lean FI | $25,000 – $40,000 | $625,000 – $1,000,000 | Achievable much faster; maximum time freedom. | Requires a permanently frugal and minimalist lifestyle. |

| Fat FI | $100,000+ | $2,500,000+ | Ultimate financial comfort and security. | Takes much longer to achieve; requires a high income. |

| Barista FI | Covers necessities with investments | $750,000 – $1,500,000+ | Reduces the FI number and allows an earlier career exit. | Not fully work-optional; relies on part-time work for perks/extra cash. |

Ultimately, many people end up combining elements from each path. For instance, you might start with a Lean FI goal and then explore ways to build extra income streams to move toward a more comfortable lifestyle down the road. If you're looking for inspiration, our guide on how to create multiple income streams can give you some practical ideas.

This article is for educational purposes only and is not financial or investment advice. Consult a professional before making financial decisions.

Your Actionable Starter Plan to Achieve FI

Alright, we've talked about the "what" and the "why" of financial independence—your FI number, savings rates, and all the different strategies. But knowing the theory is one thing; putting it into practice is where the real magic happens. This is your roadmap. No complex jargon, just a clear, step-by-step plan to get you moving today.

Think of it like building a house. You can't put up the walls before you've poured a solid foundation. These initial steps are that foundation—the concrete and steel that will support your wealth for decades to come. Let's get to work.

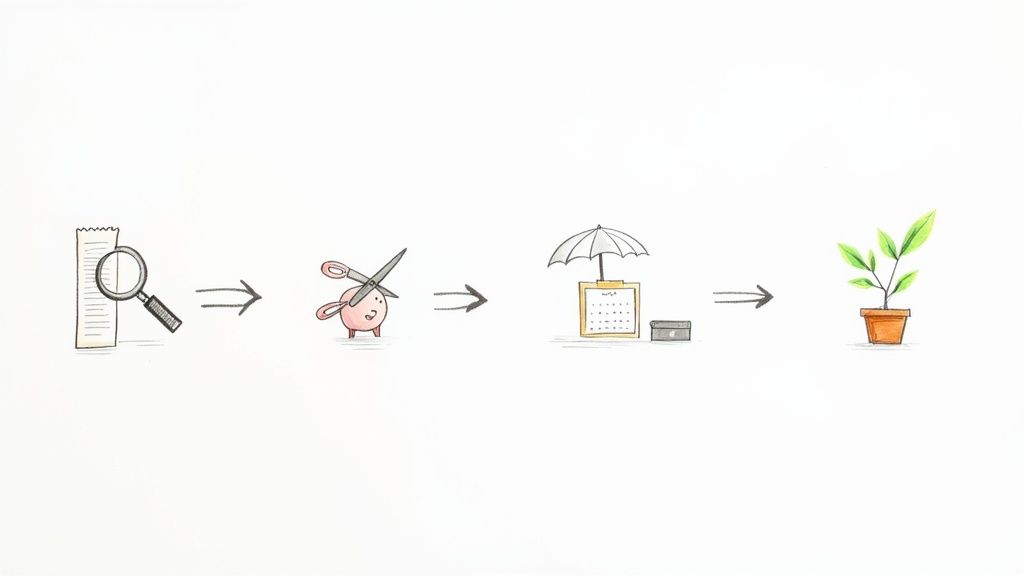

Step 1: Master Your Cash Flow

You can't fix a leak if you don't know where the water is coming from. The absolute first thing you must do is track your income and spending meticulously for a month or two. This isn't about shaming yourself or creating a painful budget; it’s simply about gaining awareness.

Once you see exactly where your money goes, you can calculate your savings rate—the percentage of your take-home pay that you save and invest. This number, more than anything else, determines how quickly you'll reach FI.

- Action Tip: Grab a simple spreadsheet or use an app like YNAB or Mint to make tracking automatic. The goal here is honesty, not perfection. Find out what you actually spend, not what you think you spend.

Step 2: Eliminate High-Interest Debt

Think of high-interest debt as trying to climb a mountain while carrying a backpack full of bricks. Credit card and personal loan debt, with interest rates often topping 20%, actively sabotages every step you take toward building wealth.

Your mission is to aggressively attack any debt with an interest rate over 7-8%. There are two battle-tested strategies to get this done:

- The Avalanche Method: You start by throwing every extra dollar at the debt with the highest interest rate. Mathematically, this is the fastest and cheapest way to become debt-free.

- The Snowball Method: You focus on paying off your smallest debts first to score some quick wins. Those psychological victories can be incredibly motivating and help you build momentum for the bigger debts.

Honestly, which method you choose matters less than just starting. Pick one and get going. Every dollar you free up from interest payments is a dollar you can put to work for your future.

Step 3: Build Your Financial Moat

Life happens. Cars break down, medical bills appear out of nowhere, and jobs can be unstable. An emergency fund is your financial moat, protecting your castle (your investments) from these unexpected attacks.

Your target is to save 3 to 6 months' worth of essential living expenses. Keep this cash in a separate, easily accessible high-yield savings account. It’s not an investment; it's insurance. This fund prevents you from having to sell your long-term investments at the worst possible time just to cover a crisis.

An emergency fund isn't just a savings account. It's insurance against making panicked, short-sighted financial decisions under pressure.

Step 4: Automate Your Investments

With high-interest debt gone and your financial moat in place, it’s time to put your wealth-building on autopilot. Automation is your best friend in investing. It removes emotion, forgetfulness, and procrastination from the equation.

First, focus on your tax-advantaged accounts. If your job offers a 401(k) with a company match, contribute at least enough to get 100% of that match. It's an instant, guaranteed return on your money. After that, work on maxing out a Roth or Traditional IRA.

- Action Tip: The simplest trick in the book? "Pay yourself first." Set up automatic transfers from your checking account to your investment accounts for the day after you get paid. Your future self will thank you.

By tackling these four steps in order, you turn the huge, abstract goal of financial independence into a series of small, achievable wins.

This article is for educational purposes only and is not financial or investment advice. Consult a professional before making financial decisions.

The journey to financial independence is rewarding, but it's rarely a straight line. Think of it like a long road trip—you'll hit patches of bad weather and unexpected detours. Knowing what these bumps in the road look like ahead of time is the key to building a plan that won't just survive them, but thrive.

Three of the biggest challenges you'll almost certainly face are market volatility, the quiet drain of inflation, and the ever-present temptation of lifestyle creep. Let's break down what they are and how to keep them from derailing your progress.

Market Volatility and Sequence of Returns Risk

If you're investing, you're going to experience market volatility. It's the natural rhythm of the stock market—the ups and downs that come with the territory. Most of the time, you can just ride it out. But when a big downturn happens can make all the difference, especially when you're close to pulling the trigger on retirement. This is what we call sequence of returns risk.

Imagine you’ve worked for decades, hit your FI number, and quit your job… right before a massive market crash. You’d be forced to sell your investments at rock-bottom prices just to pay your bills. This can cripple your portfolio’s ability to bounce back, draining your nest egg far quicker than you ever anticipated. Getting a solid handle on what is market volatility is a non-negotiable part of preparing for this.

The Stealthy Threat of Inflation

Inflation is the silent thief of your future wealth. It quietly chips away at what your money can actually buy. A 3% inflation rate doesn't sound like much, but over 24 years, it will cut your purchasing power in half. For anyone planning a retirement that could last 30, 40, or even 50 years, this is a massive deal.

Your FI number is a moving target because of inflation. If your investments aren't consistently growing faster than the rate of inflation, you're effectively losing money. Your carefully crafted budget will start to feel tight, and you'll face the tough choice of either cutting back or outliving your savings.

Lifestyle Creep: The Silent Saboteur

It’s human nature. You get a raise or a promotion, and suddenly you feel like you deserve a nicer car, a bigger apartment, or fancier dinners out. This slow, often unnoticed, increase in spending is lifestyle creep, and it’s one of the biggest enemies of financial independence.

It's not that you can't enjoy the fruits of your labor, but if every income boost is matched by a spending boost, you're just running in place. Every time you upgrade your lifestyle, you’re also pushing your FI finish line further into the future. That 15-year plan can easily stretch to 25 if you're not consciously keeping your spending in check.

The greatest risk to a financial plan is not a market crash, but a failure to account for human behavior. Staying disciplined through market swings and lifestyle temptations is what separates those who reach FI from those who don't.

It's also important to remember that these personal risks are happening against a backdrop of global economic shifts. The International Monetary Fund's Global Financial Stability Report often points out that risks like inflated asset prices and market pressures are high. You can read more about these global financial trends on IMF.org, which really drives home why having a resilient plan is so critical.

This article is for educational purposes only and is not financial or investment advice. Consult a professional before making financial decisions.

Frequently Asked Questions About Financial Independence

1. What's the difference between being wealthy and being financially independent?

Wealth is typically measured by net worth (assets minus liabilities). While a high net worth is often a component of FI, they are not the same. Financial independence is specifically about cash flow—having enough passive income from your assets to cover your living expenses. You can be wealthy with illiquid assets (like art or a large home) but still not be financially independent if you don't have enough income to pay your bills without working.

2. Is the 4% Rule still safe for early retirees?

The 4% Rule is a solid starting point, but it was originally based on a traditional 30-year retirement. For those planning a 40 or 50+ year retirement, a more conservative withdrawal rate of 3% to 3.5% is often recommended to increase the odds of the portfolio lasting a lifetime. Flexibility is key; being willing to reduce spending during market downturns can dramatically improve your plan's resilience.

3. Should I pay off my mortgage or invest more aggressively?

This is a classic debate with no single right answer. Paying off your mortgage offers a guaranteed, risk-free return equal to your mortgage interest rate. Investing that money in the stock market offers the potential for higher returns, but comes with risk. A common approach is to pay off any mortgage with an interest rate above 4-5% and invest if the rate is lower, but it ultimately depends on your personal risk tolerance.

4. How do I account for healthcare costs without an employer?

This is a major hurdle for early retirees in the U.S. Key strategies include:

- Using the Health Insurance Marketplace, where subsidies may be available depending on your income.

- Pursuing "Barista FI," working a part-time job primarily for its health benefits.

- Budgeting for higher premiums and out-of-pocket costs as a specific line item in your FI number calculation.

5. What are the best investment accounts for reaching FI?

Prioritize tax-advantaged accounts first:

- 401(k) or 403(b) up to the employer match: This is an instant, guaranteed return.

- Health Savings Account (HSA): Offers a triple tax advantage (tax-free contributions, growth, and withdrawals for medical expenses).

- Roth or Traditional IRA: Powerful accounts for tax-advantaged growth.

- Taxable Brokerage Account: After maxing out the above, this account offers the most flexibility for early withdrawals.

6. Can you really achieve FI on a low or average income?

Yes, but it requires extreme discipline and a very high savings rate (often 50%+). The key is to focus relentlessly on two things: minimizing your expenses ("the gap") and continuously finding ways to increase your income through new skills, side hustles, or career progression. The journey may be longer, but the principles remain the same.

7. How do I stay motivated when financial independence feels so far away?

The journey to FI is a marathon. To stay motivated, focus on smaller milestones. Celebrate hitting your first $10k, $50k, and $100k invested. Track your net worth monthly to visualize your progress. Creating a "freedom fund" chart and coloring it in as you save can be a powerful motivator. Joining an online FI community can also provide crucial support and accountability.

8. What is "sequence of returns risk" and how do I manage it?

This is the risk of experiencing poor market returns in the first few years of retirement. Withdrawing from a declining portfolio can permanently damage its ability to recover. You can mitigate this risk by:

- Using a more conservative withdrawal rate.

- Holding 1-3 years of living expenses in cash or bonds as a buffer.

- Being flexible with your spending and cutting back during down years.

9. Does my FI number need to account for inflation?

Absolutely. Your FI number is calculated based on today's expenses, but those expenses will rise over time. The 4% Rule has inflation built into its model (you adjust your withdrawal amount annually for inflation). When building your plan, always invest in assets like stocks and real estate that are expected to grow faster than inflation over the long term.

10. What is the single most important first step to take?

Track your spending to calculate your savings rate. You cannot optimize what you do not measure. Understanding exactly where your money is going is the foundational step that makes everything else—budgeting, cutting costs, and investing more—possible. This single metric, your savings rate, is the most powerful predictor of how quickly you will reach financial independence.

Ready to take control of your financial future? At Top Wealth Guide, we provide the insights and strategies you need to build lasting wealth. Explore our articles and tools today. https://topwealthguide.com

This article is for educational purposes only and is not financial or investment advice. Consult a professional before making financial decisions.