Building wealth isn't a complex secret reserved for the lucky few. It boils down to a surprisingly simple, repeatable process: earn more, save a significant portion of it, and invest those savings wisely for the long term. Forget the "get rich quick" schemes. Real financial freedom is built on a foundation of consistent, disciplined habits that turn your income into a portfolio of assets that grow for you.

In This Guide

- 1 Your Realistic Path to Becoming Wealthy Starts Now

- 2 Building Your Financial Bedrock for Lasting Wealth

- 3 Expanding Your Income Beyond a Single Paycheck

- 4 Making Your Money Work Through Smart Investing

- 5 Advanced Strategies to Protect and Optimize Growth

- 6 Frequently Asked Questions (FAQ)

- 6.1 1. How much money do I really need to start investing?

- 6.2 2. Should I pay off all my debt before I start investing?

- 6.3 3. What is the single most important factor for building wealth?

- 6.4 4. How can I increase my income without leaving my current job?

- 6.5 5. Is real estate a better investment than stocks?

- 6.6 6. What's the biggest mistake people make when trying to become wealthy?

- 6.7 7. How do I protect my wealth once I start building it?

- 6.8 8. Do I need a financial advisor to become wealthy?

- 6.9 9. Realistically, how long does it take to become a millionaire?

- 6.10 10. I'm in my 40s/50s, is it too late for me to start building wealth?

- 7 Bringing It All Together: Your Path Forward

Your Realistic Path to Becoming Wealthy Starts Now

It’s a common myth that you need a six-figure salary to build serious wealth. While a high income is a powerful tool, it’s just the starting line. The real magic happens not with what you earn, but with what you keep and what you grow. Internalizing this difference is the single most important step you'll take on your journey.

This guide is your roadmap. We're not going to promise you'll be a millionaire by next month. Instead, we will lay out the sustainable, proven methods that financially successful people use to build lasting prosperity, backed by real-world examples and clear data.

The Core Pillars of Building Wealth

When you strip away the noise, the path to wealth is about mastering four key areas of your financial life.

- Foundation: First, you must build a solid base. This means getting control of your debt and establishing a proper emergency fund.

- Income: Next, you need to actively grow your earning power, both in your primary career and by exploring other ways to bring in cash.

- Investing: This is where you put your money to work, acquiring assets that have the potential to grow in value over time.

- Optimization: Finally, you protect and accelerate that growth with smart tax planning and solid risk management.

A key statistic that perfectly illustrates this is the wealth-to-income ratio. This metric compares your total net worth to your annual income. Historical data reveals that between 1980 and 2025, the global wealth-to-income ratio skyrocketed from around 390% to over 625%. What fueled this incredible jump? Savings and capital gains, primarily from appreciating assets like real estate and stocks.

The takeaway is crystal clear: growing your assets through saving and investing consistently outpaces what you can earn from a job alone. You can dive deeper into the full research about capital and income dynamics to see the numbers for yourself.

This simple progression shows exactly how it works: You earn, you save, and then you invest.

Wealth isn’t a one-and-done event; it's a cycle. Your earnings fuel your savings, and your savings become the capital that fuels your investments. To make these concepts even clearer, let's break them down into a simple table. This gives you a quick snapshot of the fundamental building blocks we're going to cover.

The Four Pillars of Wealth Creation at a Glance

| Pillar | Core Action | Why It Matters |

|---|---|---|

| Foundation | Build an emergency fund and manage debt. | Creates the stability you need to take calculated risks and weather financial storms without derailing your progress. |

| Income | Increase earnings from your job and add side hustles. | Provides the raw material (capital) needed to save and invest. The more you earn, the faster you can build. |

| Investing | Buy assets like stocks, real estate, and bonds. | This is how your money makes more money. It allows your wealth to compound and grow exponentially over time. |

| Optimization | Minimize taxes and manage investment risk. | Protects your hard-earned gains and ensures you keep as much of your growth as legally possible, accelerating your journey. |

Ultimately, this framework is about building a system where your money works for you, not the other way around.

Shifting Your Mindset from Earning to Owning

The biggest change you need to make isn't tactical—it's mental. You have to stop thinking only like an employee who trades time for money and start thinking like an owner who acquires assets that generate money.

Every dollar you save and invest is like hiring a tiny employee. This employee works for you 24/7, never asks for a day off, and is dedicated to making you more money. This guide will walk you through each of these pillars, giving you the practical tools and strategies you need to build a secure and prosperous future, one smart decision at a time.

Building Your Financial Bedrock for Lasting Wealth

You wouldn’t build a house on a shaky foundation, and the same logic applies to your wealth. Before you even think about picking stocks or diving into real estate, you have to get the basics right. This bedrock is what keeps a minor setback from turning into a full-blown financial disaster.

First, you need a cash cushion: your emergency fund. Think of it as a buffer between you and life’s unpleasant surprises—a job loss, a medical bill, a sudden car repair. The goal is to have three to six months' worth of essential living expenses stashed away in a high-yield savings account. This isn't money you invest; it's your financial first-aid kit.

Real-Life Example: I once worked with a client, a freelance graphic designer named Sarah, who lost a major contract overnight, slashing her income by 40%. Because she had five months of expenses saved up, she didn't panic. She could pay her rent and bills while she focused on finding new work, all without racking up a dime of credit card debt. That emergency fund turned a potential crisis into a manageable inconvenience.

Taming High-Interest Debt

If an emergency fund is your shield, high-interest debt is the dragon you need to slay. Credit card debt, with interest rates often soaring above 20%, actively works against you. It's like trying to climb a hill while dragging a bag of rocks. You’re putting in all the effort, but the debt is constantly pulling you backward.

Getting rid of it must be a top priority. There are two tried-and-true methods:

- The Avalanche Method: You hammer away at the debt with the highest interest rate first while making minimum payments on everything else. Mathematically, this is the smartest move—it saves you the most money in the long run.

- The Snowball Method: You focus on wiping out the smallest debt balance first, regardless of the interest rate. Scoring that quick win provides a huge psychological boost and builds momentum to tackle the next one.

Which one is right for you depends on your personality. Are you driven by pure logic and numbers, or do you need motivational wins to stay in the game?

| Debt Repayment Strategy | Primary Focus | Best For |

|---|---|---|

| Avalanche Method | Highest Interest Rate Debt | People who are disciplined and want to save the most on interest. |

| Snowball Method | Smallest Debt Balance | People who need quick wins to stay motivated and on track. |

Whichever path you take, the destination is the same: freeing up your cash flow so your money can finally start working for you.

Crafting a Budget That Actually Works

Let's be honest, the word "budget" can sound restrictive. I prefer to call it a spending plan. It’s not about telling yourself "no" to everything you enjoy; it’s about consciously telling your money where to go so it aligns with what you really want out of life.

A simple but powerful framework to start with is the 50/30/20 rule:

- 50% of your take-home pay covers your Needs (rent/mortgage, utilities, groceries, transportation).

- 30% is for your Wants (dining out, hobbies, streaming services, travel).

- 20% goes directly to Savings and Debt Repayment.

This is just a starting point, not a rigid law. Feel free to tweak the percentages to fit your life. The real power comes from simply knowing where your money is going. Once you have that clarity, you can start setting SMART financial goals for a prosperous future that feel both exciting and achievable.

Key Takeaway: A budget doesn't steal your freedom; it creates it. It gives you the power to build the life you want instead of just wondering where your paycheck disappeared.

The final piece of the puzzle is automation. Set up automatic transfers to your savings, investments, and any debt payments right after you get paid. This takes willpower completely out of the equation and puts your financial progress on autopilot. With this solid foundation in place, you're truly ready to start growing your income and building lasting wealth.

Expanding Your Income Beyond a Single Paycheck

While getting your financial house in order is great defense, boosting your income is how you go on offense. Saving 20% of what you make is a fantastic start, but if you want to accelerate your wealth-building journey, you have to grow your top line. The faster you can increase your earnings, the more fuel you have for your investment engine.

Think of your earning power not as a fixed number, but as a dynamic asset you can actively develop. This doesn't mean you need to ditch your career or start working 80-hour weeks. It's about wringing every bit of value out of your main job first, then strategically layering on other cash-flowing streams.

Maximizing Your Primary Career

For most of us, our day job is the biggest and most reliable source of income. It just makes sense to start there. Before you start dreaming of side hustles, make sure you're getting everything you can out of your current role. Honestly, landing a 10% raise at work is often easier and more impactful than building a side business that brings in the same amount.

Here are a few things I've seen work wonders:

- Acquire High-Demand Skills: Look around your company and industry. What skills are most valuable right now? Maybe it's learning new software, getting a project management certification, or mastering data analysis. When you become the go-to expert in something critical, you're not just more valuable—you have serious leverage come negotiation time.

- Document Your Wins: Don't expect your boss to remember every great thing you've done. I keep a "brag file"—a running list of my accomplishments with hard numbers attached. Instead of saying, "I improved a process," you can say, "I implemented a new workflow that cut project delivery time by 15% and saved the department $20,000 this year." See the difference?

- Negotiate with Confidence: When you walk into a salary discussion armed with your documented wins and solid market research on your role's value, you're in a position of power. So many people leave money on the table simply because they're afraid to ask.

Developing Multiple Income Streams

Relying on a single paycheck is like building a house with only one support beam—it’s a huge risk. Adding more income sources not only provides a safety net but also dramatically speeds up how quickly you can build wealth. The real key is finding something that complements your life, not something that just burns you out.

Your goal isn't just to make more money; it's to build a system where income flows from multiple directions, insulating you from the risk of any single source drying up.

Let's break down a few common approaches. They fit different personalities, skill sets, and schedules.

| Income Stream Type | Example | Time Commitment | Startup Cost |

|---|---|---|---|

| Service-Based | A graphic designer freelancing on weekends. | Medium to High | Low |

| Product-Based | An HR professional creating and selling an online course. | High (upfront) | Medium |

| Asset-Based | A software developer building a small SaaS application. | High (upfront) | Medium to High |

Each path has its own trade-offs. A freelance gig gives you cash right away, but it's tied directly to your time. An online course takes a ton of work upfront, but it can generate passive income for years. For a much deeper look, our guide on how to create multiple income streams unpacks these strategies in detail.

Real-Life Example: Take Mark, an accountant who's an Excel wizard. He started offering his financial modeling services to small businesses on the side. This not only brought in an extra $1,000 a month but also made him even better at his day job, which led to a promotion and a raise. That’s the kind of synergy you’re looking for, where one effort feeds another.

The ultimate aim is to create an income engine so powerful that it doesn’t just cover your bills but throws off a significant surplus. That surplus is the raw material for the investment strategies we’ll cover next, turning your hard-earned income into lasting wealth.

Making Your Money Work Through Smart Investing

Saving money is a great first step, but it’s like putting your cash in a safe. It’s protected, but it’s not growing. Investing is where the real magic happens. Think of it as planting a money tree—you put your capital to work, and it starts growing and compounding on its own, even while you sleep. This is the critical shift from just saving money to actually building wealth.

Diving into investing can feel overwhelming. There's jargon and charts seem to move a mile a minute. But the core idea is surprisingly simple: you're owning assets that have the potential to go up in value over time. That’s it. This simple act becomes the engine for your entire financial future.

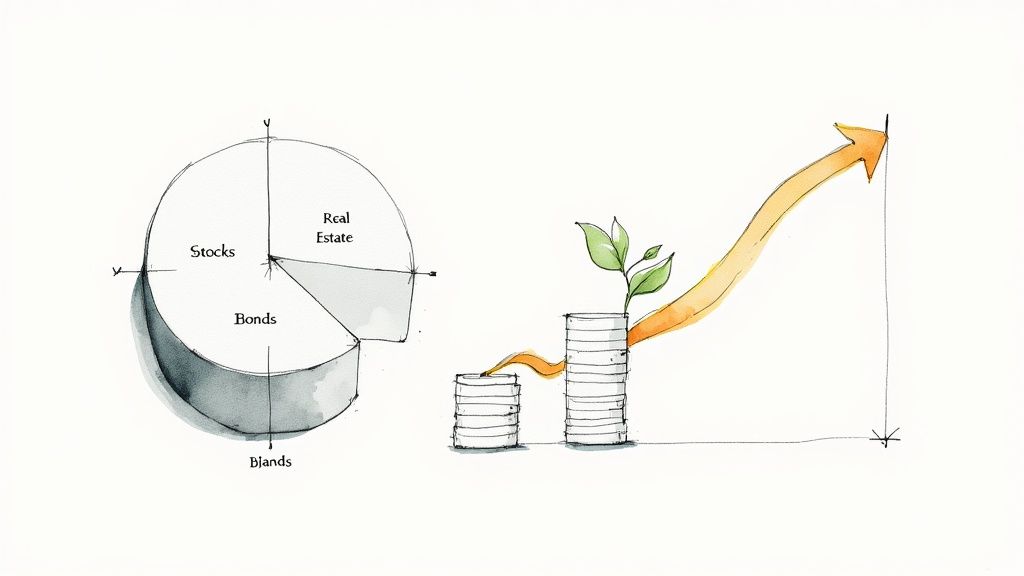

Getting to Know the Core Asset Classes

You don't need a PhD in finance to be a successful investor. You just need a solid grasp of the main building blocks. For most people, a healthy, well-rounded portfolio is built on three key asset classes.

- Stocks (Equities): When you buy a stock, you're buying a tiny piece of a company like Apple or Amazon. If the company does well and grows, the value of your piece goes up. It's that straightforward.

- Bonds (Fixed Income): Buying a bond is like giving a loan to a government or a big corporation. They promise to pay you back in full, with interest, over a set period. They're generally a much steadier, less volatile ride than stocks.

- Real Estate: This is about owning physical property. You can do it directly by buying a rental house, or indirectly by investing in a Real Estate Investment Trust (REIT). The goal is to earn rental income and have the property's value appreciate over time.

Owning these kinds of assets is what separates savers from the truly wealthy. The UBS Global Wealth Report 2025 drove this point home, noting that global wealth grew by 4.6% in 2024. More telling is that securities—like stocks and bonds—made up 45.1% of all global financial assets. That tells you everything you need to know: being in the market is essential.

Comparing Core Investment Asset Classes

Each asset class has a different personality, with its own mix of potential rewards and risks. Understanding them is key to building a strategy that fits you.

| Asset Class | Potential Return | Risk Level | Best For… |

|---|---|---|---|

| Stocks | High | High | Long-term growth; investors who can handle the market's ups and downs without panicking. |

| Bonds | Low to Moderate | Low | Protecting capital and generating a predictable income stream; more conservative investors. |

| Real Estate | Moderate to High | Medium | Generating cash flow through rent and building long-term value; investors who like owning a tangible asset. |

You don’t have to pick just one. In fact, you shouldn’t. The smartest long-term approach is diversification—spreading your money across different assets. That way, when one is having a bad year, another might be soaring, which helps smooth out your returns and lets you sleep better at night.

The Real Power of Compound Interest

The secret weapon of every successful investor is compound interest. Albert Einstein famously called it the "eighth wonder of the world," and for good reason. It’s your earnings generating their own earnings, creating a snowball effect that can turn a small nest egg into a fortune over time.

Let’s make this real. Imagine you invest $10,000 today. Here’s a look at what could happen over 20 years with different approaches (this is an illustration; actual returns are not guaranteed).

| Investment Vehicle | Assumed Annual Return | Value After 20 Years | Total Growth |

|---|---|---|---|

| High-Yield Savings Account | 3% | $18,061 | $8,061 |

| Conservative Bond Fund | 5% | $26,533 | $16,533 |

| S&P 500 Index Fund | 8% | $46,610 | $36,610 |

The difference is staggering. The savings account barely keeps up with inflation, while the stock market investment more than quadruples your initial money. This isn't from genius stock-picking or risky market timing. This is from consistently investing in the broad market and letting time work its magic. This single principle is the foundation of building wealth. It’s about getting in the game, staying consistent, and having the patience to let your money do the heavy lifting for you.

Advanced Strategies to Protect and Optimize Growth

Once your investments start gaining momentum, the focus must expand. It's not just about picking winners anymore; it's about safeguarding what you've built. This is where you shift from pure offense to smart defense, protecting your portfolio from taxes, volatility, and whatever curveballs life throws your way.

Too many people get laser-focused on growth and completely forget about the forces working against them. But seasoned investors know that minimizing tax drag and managing risk are just as critical as your investment returns. This is how you keep your journey smooth and avoid painful, unnecessary setbacks.

Use Tax-Advantaged Accounts to Your Full Advantage

One of the biggest leaks in any wealth-building plan is taxes. Luckily, the government provides tools to plug that leak. Tax-advantaged accounts are like special wrappers for your investments that shield them from taxes, letting your money compound dramatically faster.

The most common are 401(k)s (through your employer) and Individual Retirement Arrangements (IRAs) that you can open yourself. They each have different rules, but the goal is the same: let your money grow without a constant tax drag slowing it down.

| Account Type | Key Feature | Contribution Limit (2024) | Who It's Generally For |

|---|---|---|---|

| Traditional 401(k)/IRA | Contributions can be tax-deductible now; you pay taxes when you withdraw in retirement. | 401(k) $23,000; IRA $7,000 | People who think they'll be in a lower tax bracket when they retire. |

| Roth 401(k)/IRA | You contribute with after-tax money; qualified withdrawals in retirement are 100% tax-free. | 401(k) $23,000; IRA $7,000 | People who want to pay taxes now to enjoy tax-free growth and withdrawals later. |

The difference is staggering. Imagine a $10,000 investment that grows at 8% for 30 years. In a standard brokerage account, you'd owe a hefty chunk of that growth to the IRS. In a Roth IRA, every single penny of that growth is yours to keep, tax-free. Our guide on how to invest tax-efficiently and keep more money breaks down these strategies in more detail.

Playing Smart Financial Defense

Building wealth is pointless if you don't protect it. Proper insurance is the foundation of that protection, acting as a firewall between your assets and a potential financial catastrophe.

Don't overlook these key areas:

- Health Insurance: Medical debt is a leading cause of bankruptcy. Don't let it derail your plan.

- Disability Insurance: This protects your most valuable asset—your ability to earn an income.

- Umbrella Insurance: As your net worth grows, so does your liability. This adds an extra layer of protection on top of your standard home and auto policies.

A single lawsuit or unexpected medical crisis can wipe out years of hard work. Smart insurance planning transfers that risk away from you, letting you stay focused on your goals.

Basic estate planning is another non-negotiable. At the very least, you need a will. This simple document ensures your wealth goes to the people and causes you actually care about, instead of letting the state make those decisions for you.

The Annual Financial Review

Life doesn’t stand still, and neither should your financial plan. Setting aside time for an annual review is one of the most powerful habits you can build. It’s your chance to check the map, see how far you've come, and adjust your course if needed.

Your Annual Check-In Should Cover:

- Net Worth Update: How much did your assets grow and your debts shrink over the last 12 months?

- Portfolio Performance: How did your investments do compared to their benchmarks?

- Goal Reassessment: Are your goals the same? Have your priorities shifted?

- Insurance Check-Up: Is your current coverage enough for your current net worth?

- Contribution Review: Can you bump up your savings and investment rates for the year ahead?

Treating your financial plan as a living document that evolves with you is the key to staying on the fastest, safest path to building real wealth.

Frequently Asked Questions (FAQ)

1. How much money do I really need to start investing?

You can start investing with far less than you think. Thanks to low-cost index funds and fractional shares (allowing you to buy a piece of a stock), you can open an account and begin with as little as $100. The key isn't the starting amount but the consistency of your contributions over time.

2. Should I pay off all my debt before I start investing?

It depends on the interest rate. A good rule is to aggressively pay off high-interest debt (like credit cards with 20%+ APR) before investing heavily. The guaranteed return from eliminating that debt is hard to beat. For low-interest debt (like a mortgage under 5%), it often makes sense to invest simultaneously, as historical market returns have typically been higher.

3. What is the single most important factor for building wealth?

While high income and smart investments are important, the most critical factor is consistency. The habit of regularly saving and investing a portion of your income, month after month, year after year, is what allows the power of compound interest to work its magic.

4. How can I increase my income without leaving my current job?

Focus on becoming indispensable at work. Take on projects that directly impact the company's bottom line, develop specialized skills that are in high demand, and meticulously document your accomplishments with quantifiable results. This positions you for significant raises and promotions, boosting your primary income stream.

5. Is real estate a better investment than stocks?

Neither is inherently "better"—they serve different purposes in a portfolio. Stocks offer high growth potential and liquidity, making them easy to buy and sell. Real estate can provide steady cash flow from rent, offers unique tax advantages, and is a tangible asset, but it requires more capital and hands-on management. A diversified approach often includes both.

6. What's the biggest mistake people make when trying to become wealthy?

The most common trap is lifestyle inflation—letting your spending increase in lockstep with your income. When you get a raise, instead of saving and investing the difference, you buy a more expensive car or a bigger house. This keeps you on the paycheck-to-paycheck treadmill, regardless of how much you earn.

7. How do I protect my wealth once I start building it?

Protecting wealth involves smart defense. This includes having adequate insurance (health, disability, and umbrella policies), establishing a basic estate plan (like a will or trust), and maintaining a diversified investment portfolio to avoid being over-exposed to any single asset's decline.

8. Do I need a financial advisor to become wealthy?

Not necessarily, especially in the beginning. The fundamentals of budgeting, saving, and investing in low-cost index funds can be managed on your own. However, as your financial life becomes more complex (e.g., high income, business ownership, estate planning), a fee-only fiduciary advisor can provide invaluable expertise.

9. Realistically, how long does it take to become a millionaire?

It's a math problem based on your savings rate and investment returns. Someone saving $500/month with an 8% average annual return could reach $1 million in about 35 years. If they increase that to $2,000/month, the timeline shrinks to just 20 years. The more you save and invest, the faster you'll get there. Globally, while only 1.1% of adults are millionaires, a much larger group of 583 million people have a net worth between $100,000 and $1 million, showing that significant wealth is attainable. You can discover more insights about the global distribution of wealth.

10. I'm in my 40s/50s, is it too late for me to start building wealth?

Absolutely not. While starting in your 20s is ideal, your 40s and 50s are typically your peak earning years. This gives you the powerful advantage of being able to save and invest significantly larger sums of money than you could when you were younger. By aggressively maxing out retirement and investment accounts during these years, you can still build a very substantial nest egg.

This article is for educational purposes only and is not financial or investment advice. Consult a professional before making financial decisions.

Bringing It All Together: Your Path Forward

Building wealth isn't about getting lucky. It’s a deliberate process built on solid financial habits and patience. You now have the roadmap. The principles are straightforward, but it's consistent application that makes all the difference.

This isn't about chasing the latest crypto craze or hoping for a stock to pop overnight. It’s about taking real, tangible control over your money, one decision at a time, and making choices that your future self will thank you for.

Turning Knowledge into Action

We've covered a lot of ground, but it all boils down to a few core ideas:

- First, build a strong foundation by getting a handle on debt and creating an emergency fund.

- Next, actively grow your income, as a single paycheck is rarely enough.

- Then, you must put your money to work through consistent investing, letting compounding do its heavy lifting.

- Finally, protect and optimize everything you've built with smart tax planning and risk management.

The gap between wanting to be wealthy and actually becoming wealthy is closed by one thing: action. It starts with the simple decision to begin.

A Quick Word on Mindset: Andrew Carnegie famously said, "The man who dies thus rich dies disgraced." This isn't just a quote; it's a fundamental shift in thinking. Wealth is a tool. It's meant to be managed, used, and directed with purpose—not just hoarded for its own sake.

Your next move doesn't need to be a giant leap. Start with something simple, like setting up an automatic transfer to your savings account or spending an hour researching a low-cost index fund. Just start.

Your Wealth-Building Kickstart Checklist

To get you moving right now, here's a simple checklist. Don't try to do it all at once. Just pick one thing to knock out this week.

- Calculate Your Net Worth: Get an honest look at where you stand today.

- Analyze Last Month's Spending: Find just one area where you can realistically cut back by 10%.

- Automate Your Savings: Set up a recurring transfer—even just $50—to a high-yield savings account.

- Brainstorm a Side Hustle: List three skills you have that people would genuinely pay for.

- Boost Your 401(k): Log into your account. Can you bump your contribution by just 1%? You'll barely notice it now, but it makes a huge difference later.

These small, repeatable actions are what build unstoppable momentum. It’s how real, lasting wealth is created.

It's a Marathon, Not a Sprint

The world of finance is always evolving, and your own life will change in ways you can't predict. Think of this guide as a reference point. Come back to it whenever you feel stuck or are ready to tackle the next phase of your financial journey. Wealth isn't a final destination you suddenly arrive at. It’s a continuous process of learning, adapting, and staying disciplined. Every dollar you save and invest today is a concrete step toward the future you want.

Here at Top Wealth Guide, our mission is to give you the clear, actionable strategies you need to build and manage your wealth. From breaking down stock market fundamentals to exploring real estate investing, we're here to help you make smarter financial moves. Keep learning with our other articles and tools at https://topwealthguide.com.

This article is for educational purposes only and is not financial or investment advice. Consult a professional before making financial decisions.