Most folks think becoming wealthy means you gotta dive into some crazy investment schemes or land that job with a six-figure salary. Nope. Reality check — it’s simpler, and, oh boy, way more impactful.

Financial discipline — it’s the true MVP — outshines market timing, stock picking, and those tempting get-rich-quick schemes every darn time. Over at Top Wealth Guide, we’ve witnessed regular Joes and Janes stacking up seven-figure portfolios through steady habits and savvy money management.

The rich? No secret voodoo. They’ve got systems — tried and true — that, get this, anyone can learn.

In This Guide

How Financial Discipline Actually Builds Wealth

Let’s talk about the magic trick nobody sees-financial discipline. It’s turning the average Joe into a millionaire through mechanisms that are … not exactly rocket science, but boy, do most miss the memo. Consistency is key. Those folks who save regularly? They’re racking up more dough over time compared to the “I’ll save if I feel like it” crowd. Why? Because when the market crashes, the disciplined aren’t running for the hills. They’re buying discounted assets while everyone else is panic-selling-hello, massive returns later on.

The Compounding Effect of Consistent Actions

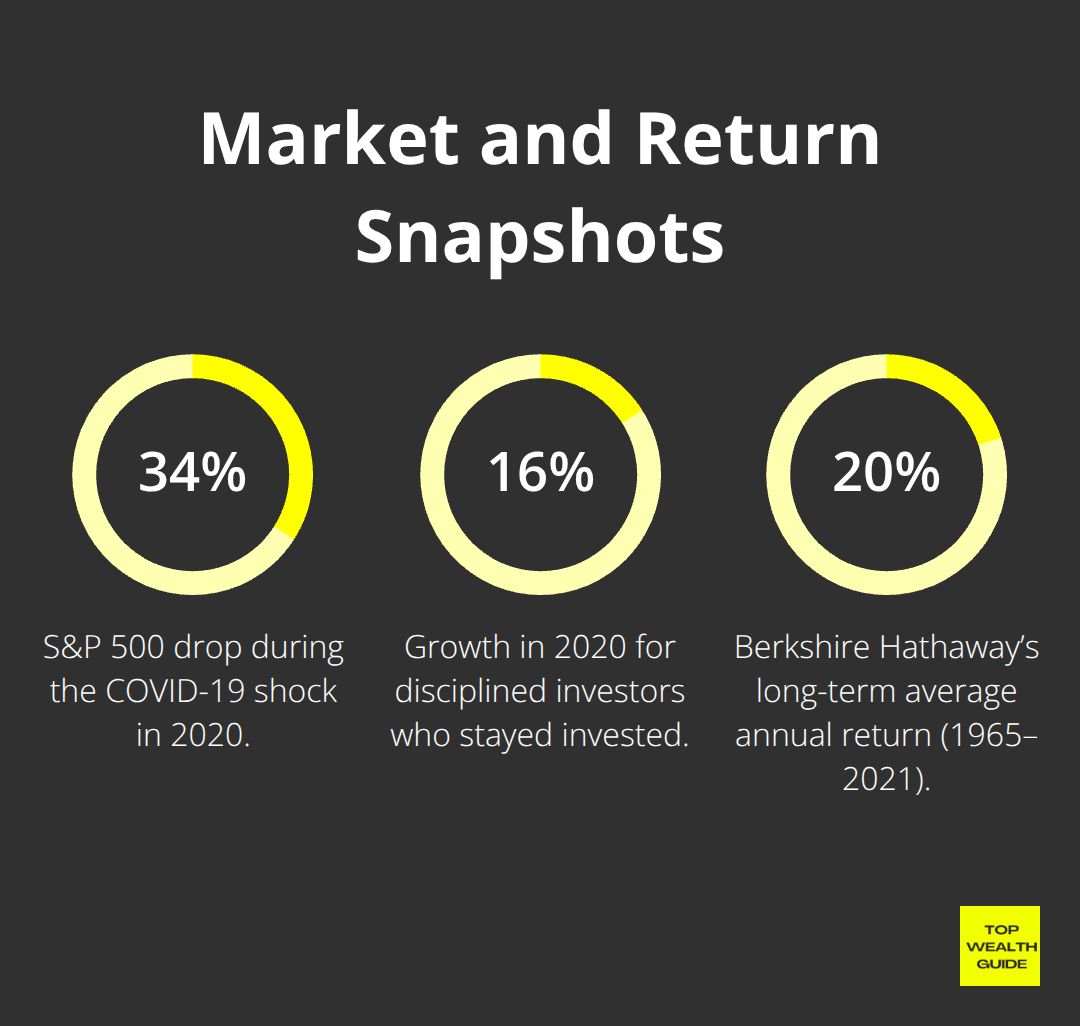

Okay, so Warren Buffett-yeah, everyone’s favorite oracle-his Berkshire Hathaway pulled a 20.1% annual return from ’65 to 2021. But here’s the kicker-it’s all about reinvestment and a truckload of patience. A $10K bid back in ’65? Worth a cool $36.2M by 2022. It wasn’t dazzling stock picks; it was dividend reinvestment (stick with the game plan!) and zero selling during downturns.

Picture this: investors chucking $500 monthly into index funds from ’90 to 2020 ended up with $1.37 million. Even though COVID-19 slammed the S&P 500 by 34%, disciplined folks who stayed in the game saw 16.3% growth in 2020.

The Psychology That Separates Winners from Losers

Wanna know the secret sauce? The big leagues automate everything to dodge emotional landmines. Automated contributions leave manual approaches in the dust-just ask Fidelity’s brainy analysts. The wealth gurus rig systems so their cash jumps straight into investments before they can splurge.

Enter the 50/30/20 rule-a budgeting classic. 50% for necessities, 30% for extras, 20% gets socked away or invested. Charles Schwab’s sleuthing shows 77% of millionaires are budget hawks (who knew wealth wasn’t about endless spending?!). They’re tracking every penny, checking their financial pulse every quarter, and tweaking strategies with hard data. No room for heartstrings here.

The Systems That Create Automatic Wealth

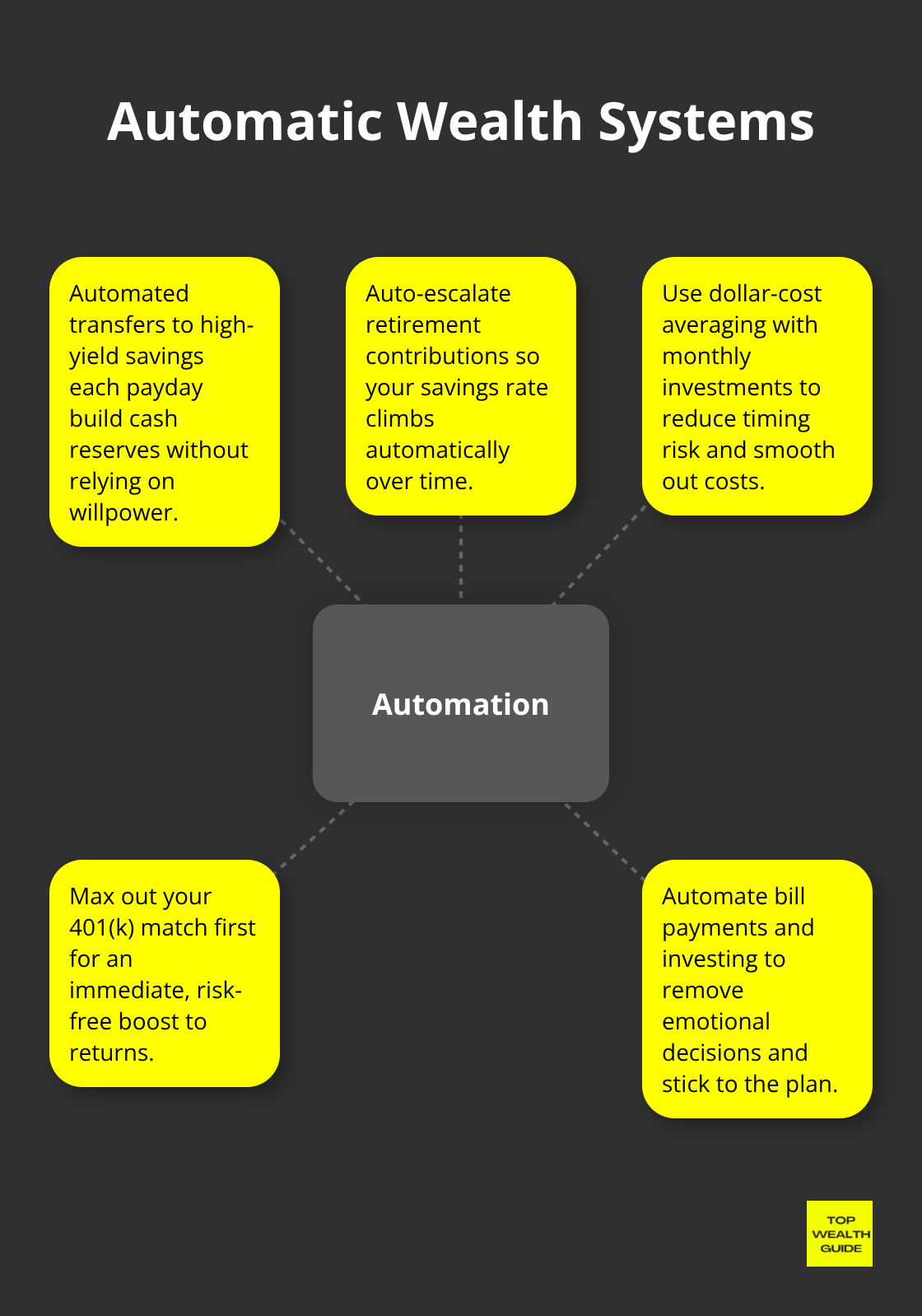

You think millionaires are running on willpower? Nah, they build ironclad systems-automated savings, investments, and bills. This approach nixes the allure of blowing money meant for wealth creation. By scrapping psychological hurdles, they clear the path for the specific wealth-building tactics we’ll dive into next.

What Financial Systems Actually Create Wealth

So, the game of building wealth flips on its head when you stop leaning on sheer willpower and start crafting systems that keep the machine running without you. Here’s the deal-automated investors on their A-game, ramping up their contribution rates automatically, consistently outshine those manually fiddling with adjustments. Automate like a boss-set up those transfers from your checking to a high-yield savings account every payday. Even tossing in $200 a month snowballs into $24,000 over a decade at a 4% interest rate. Those who automate dodge the trap of poor market timing-it’s all about consistency, people.

The Budget Framework That Builds Millionaires

The 50/30/20 rule? It’s legit, sure… but if you want to ride with the big dogs, you gotta tweak it. Wealthy folks? They’re not playing by the 20% savings rule-they’re cranking it up to 30-40% into investments and slamming the door shut on lifestyle inflation. Look at this stat-Charles Schwab says millionaires throw just 23% of their dough at housing compared to the national 33%. Take that extra cash and pull the lever on wealth creation. Get down and dirty-track every expense for 30 days with Mint or YNAB. What’s gobbling up your cash? Cut the fat. Housing, transportation, food-those bad boys eat up 70% of your income. Negotiate your rent, roll in a used car, and get your meal prep on-redirect all that cash into your investments.

Debt Elimination That Accelerates Wealth Creation

Debt-it’s a wealth killer faster than a bad investment decision. The avalanche method smashes high-interest rates first while the snowball method knocks out the smallest debts-both are killer strategies to wipe out debt. Credit card debt at an 18% interest clip? It’s chewing through $1,800 a year for each $10,000… when that dough could be a cool $46,000 in 20 years sitting pretty at 8%. Consolidate high-interest debt with a personal loan at 6% to 10%-and automate the hell out of those payments beyond the minimum. Toss in an extra $100 a month on a $20,000 student loan at 5%, and bam, save $3,000 in interest and slash repayment by four years.

Investment Automation That Compounds Wealth

Sounds simple, but smart investors are all about automation. Everything in their investment strategy-automated-stripping emotions right out of the equation. Dollar-cost averaging, automatic contributions every month, keeps costs low over time. Consistent savers? They’re racking up way more retirement wealth than those who just pop in sporadically. First stop? Max out that 401(k) match-it’s an instant 100% return… on your money… no brainer. Then there’s building wealth through real estate-rental income, appreciation-another automated avenue on the wealth highway.

These systems-they break down the mental roadblocks that trip up most wealth plans. But systems alone? They need the right habits to rock and roll.

What Makes Financial Habits Stick When Willpower Fails

Alright, folks, here’s the scoop-systems rock, but habits? They make those systems invincible. Duke University crunched the numbers, and guess what? A whopping 45% of your daily grind? Habits, not those so-called conscious decisions. Wealthy folks get this-they automate behaviors that build massive wealth over time. Your noggin? It LOVES a good routine, so set up wealth creation as the default option instead of wrestling with willpower every month.

Set Up Accountability That Actually Works

Accountability is where your good intentions morph into actual money. Harvard Business School rang the bell, saying folks who jot down goals hit ’em 42% more often. Want that in your life? Get texts buzzing when you blow the budget-Bank of America and Chase offer these juicy tools for nada. Dive into investment clubs or tag a bud who’ll scope your portfolio every month.

Data from Fidelity backs this up-investors chatting with advisors regularly outperform the solitary wolves by 1.5% every year. Set consequences that sting-drop $100 on a cause you’d rather skip every time you flub your savings goals. Use Personal Capital or Mint to track net worth monthly, and then spill the beans to someone who’ll call you out on the excuses.

Beat Lifestyle Inflation Before It Kills Your Wealth

Lifestyle inflation? That’s the silent killer of millionaire dreams, more so than any market hiccup. Consumer prices ticked up 3.0% over the last year, says the Bureau of Labor Statistics. The fix? Pour raises into investments before lifestyle creep bites.

Snag a $5,000 raise? Pump up those 401k contributions by exactly that amount.

The wealthy live on last year’s cash, shoveling the rest into investments. Match your expenses with inflation-if your costs are zooming past 2-3% annually, you’re off track in this wealth journey. Stick to the one-day rule for splurges over $100 and the one-week rule if it’s over $500. Most impulse buys lose their shine after a day’s mulling.

Build Systems That Override Emotional Decisions

Emotions? They vaporize wealth faster than bad stocks. Set real-world hurdles between you and your cash-different banks for emergencies and daily dough. Automate those transfers straight from the paycheck (way better than doing it manually).

Get apps that slam the door on shopping sites when temptation strikes. Wealthy folks? They ditch temptation instead of banking on sheer will. They know discipline takes a backseat under stress, but systems? They hum along no matter the mood or mayhem. Crafting these automatic systems is key-even if you’re just starting out or gunning for those bigger savings milestones.

Final Thoughts

Let’s get real – financial discipline isn’t about acting like a monk or surviving on ramen. Nope, it’s about building systems that click into place effortlessly… especially when your willpower takes a nosedive. Here’s the deal: wealthy folks get it. Consistent, boring, steady moves always crush those intermittent flashes of effort.

First step: automation. Have your dough shipped off to savings and investments before you even realize it’s left your account. Think 50/30/20 rule as your baseline. Then, as those Benjamins stack up, crank up the savings rate. Take on that high-interest debt like a gladiator while also beefing up your investment game (trust me, once people track their spending for a mere 30 days, it’s like opening Pandora’s Box of financial revelations).

Over at Top Wealth Guide, we’ve witnessed people rewrite their financial scripts using smart systems and habits that stick. Your transformation? It kicks off the moment your next paycheck lands. Automate something today, eyeball one pesky expense category this week, and just keep that momentum rolling.