Market volatility — it’s the wild ride nobody asked for but everyone’s on. But guess what? It doesn’t have to be a one-way ticket to financial doom. Yep, the right investment strategy can actually safeguard and even boost your moolah — whether the market’s throwing a party or crashing like a frat boy at a kegger.

At Top Wealth Guide, we’ve rolled up our sleeves and sifted through decades (that’s right, decades) of market data to zero in on rock-solid approaches that actually do the job in any economic weather. The secret sauce here? It’s all about those steady returns… rather than obsessively trying to catch the market’s mood swings.

In This Guide

What Makes an Investment Strategy Truly All-Weather?

Dollar-Cost Averaging Transforms Volatility Into Opportunity

Alright, folks… let’s talk about strategies that weather all storms. Start with dollar-cost averaging-a surefire way to make volatility your BFF instead of your stressor. Forget about timing your market entry like a Wall Street pro; instead, invest set amounts every month come rain or shine. Vanguard’s got the data-this method trims average purchase costs by 1.5% annually versus lump-sum efforts in shaky markets. It’s simple math: snag more shares on the cheap when prices dip and buy fewer when they peak. Set up those automatic transfers-$500 to $1000 monthly into broad market index funds-and let compound magic do its thing.

Asset Allocation Models That Deliver Results

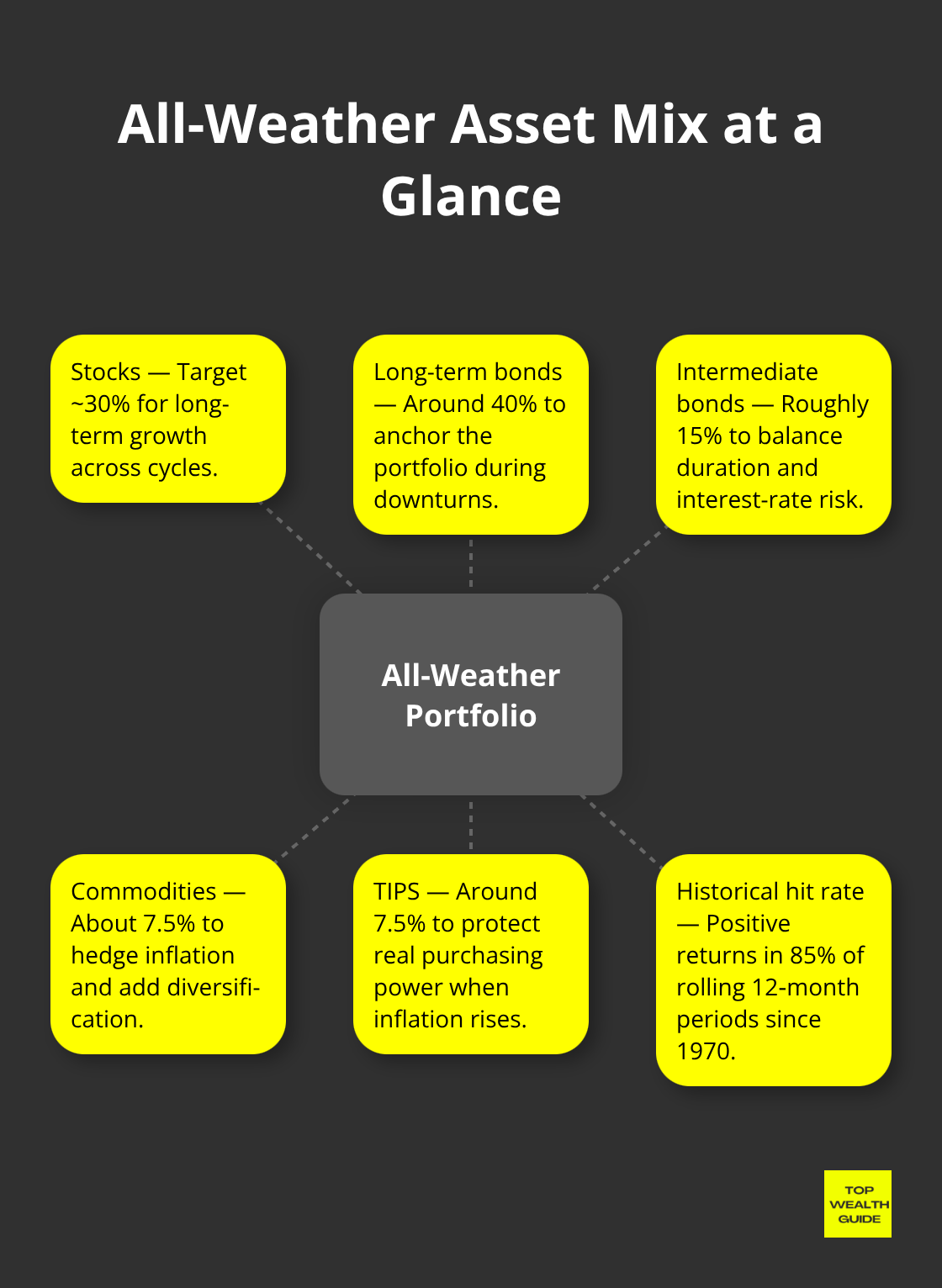

Resilient portfolios? They dance to the tune of risk-based allocation-ancient history’s dusty 60/40 split belongs in a museum. Take a cue from Bridgewater Associates’ All Weather symphony: 30% stocks, 40% long-term bonds, 15% intermediates, plus a spicy mix of 7.5% commodities and 7.5% TIPS. This cocktail served up positives in a whopping 85% of rolling 12-month marathons since 1970. Throw in geographic diversity to supercharge that shield: spread it 50% US, 25% developed international, and 25% emerging markets. Rebalance when allocations play hopscotch more than 5% from targets-think sell high, buy low… on autopilot.

True Diversification Goes Beyond Stocks and Bonds

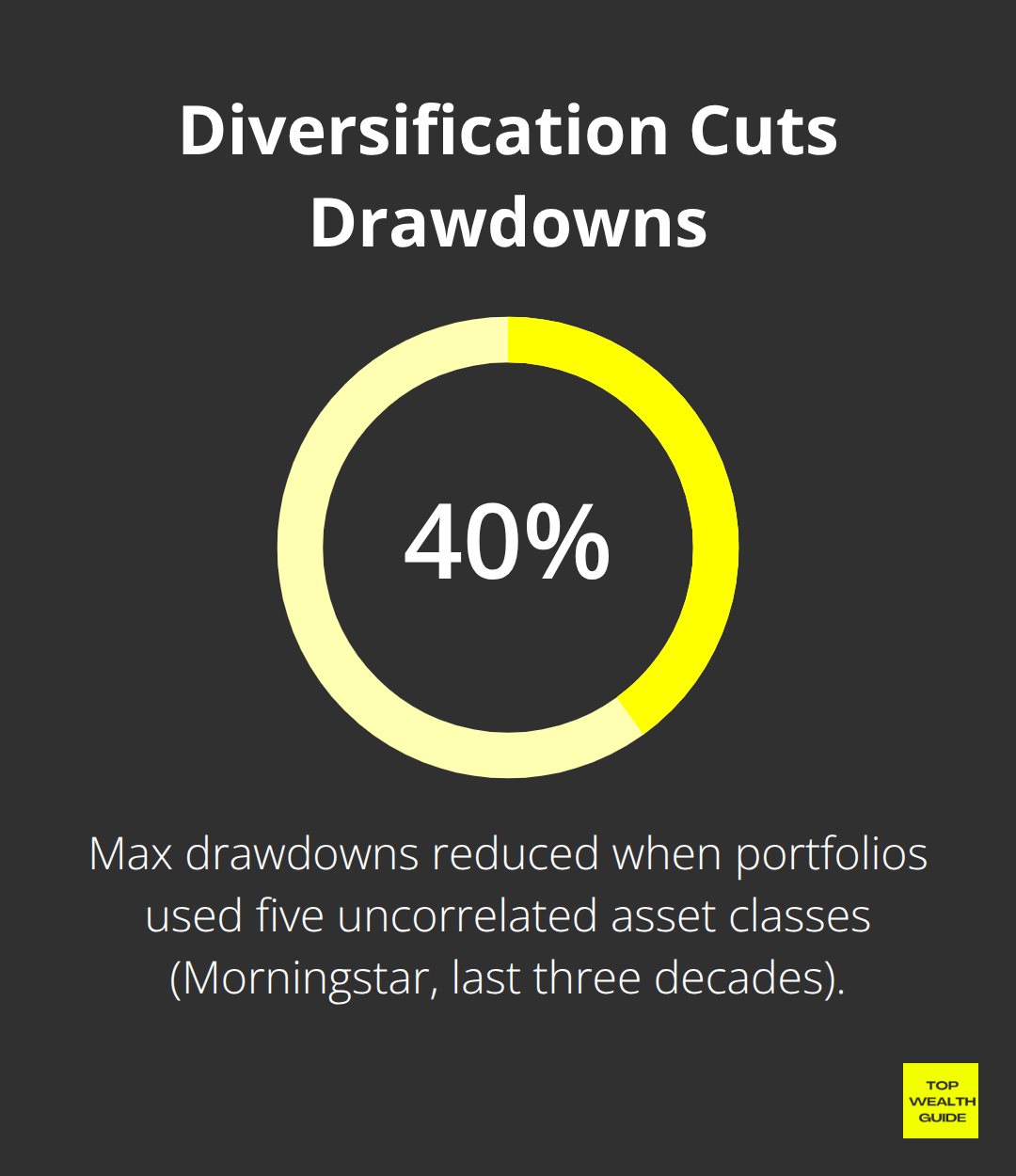

Genuine diversification? It goes way beyond just stocks and bonds, my friend. Real protection comes from owning assets that dance to their own beat when the economic music changes. In crisis? Stocks and bonds might do the tango together… but toss in REITs, commodities, and global exposure and you’re really grooving. Morningstar’s got the receipts: portfolios with five uncorrelated asset classes slashed maximum drawdowns by 40% compared to stock-only outfits over the last three decades.

Think 10-15% in commodity ETFs, 5-10% in precious metals, and another 10% in international REITs to get that all-weather swagger.

These are the building blocks of a market-neutral powerhouse, but real fortress-like protection? It needs some extra armor-smartly chosen defensive assets and recession-resistant gems.

Which Assets Actually Shield Your Portfolio From Recession?

Consumer Staples and Utilities Lead Defensive Stock Performance

Alright, folks-smart defensive moves? It’s all about stuff people need, not want. Consumer staples like Procter & Gamble and Coca-Cola-they’ve got resilience nailed down, even when the market’s doing the cha-cha. 2024? Yeah, they rocked it. High-growth stocks might have been on a bender, but staples held their ground. And utilities? They’re the steady rock stars you want during economic storms.

Why? Because even when times are tight, people still need their toothpaste, lights, and groceries-no question. So, what’s the game plan? Target a cool 20-25% of your equity positions here. Look for companies with rock-solid dividend histories spanning 20 years plus and debt-to-equity ratios south of 0.5.

Those dividend aristocrats-yep, the ones with a consistent 3-4% yield-they keep the cash flowing when the growth stocks are falling like a lead balloon and the market’s on a roller coaster.

Treasury Bonds and TIPS Create Portfolio Stability

Think of fixed-income securities like your portfolio’s airbags during market meltdowns. Treasury bonds? They’ve been the anchor in past financial storms, like when the Treasury cranked up borrowing in 2008 to keep things steady Eddy. You’re looking at a 30-40% allocation here, divvying it up between intermediate Treasuries and Treasury Inflation-Protected Securities.

TIPS-they’re your go-to for fending off those nasty inflation spikes that erode wealth faster than you can say “market volatility.” And if you’re adding some corporate investment-grade bonds, stick to the cream of the crop-AAA and AA ratings. For high-income earners, municipal bonds are your tax-free sweet spot, bumping up yields.

Spread out bond maturities across 2-10 years to juggle interest rate risks and keep cash flowing for when you need to snap up bargains.

Let’s talk alternatives, shall we? Real estate investment trusts and commodities-these are your non-correlated returns masters. REITs have historically not fared as well as private real estate in the lead-up to recessions-six times running. Meanwhile, commodity futures tend to skyrocket when inflation hits the pedal to the metal-especially when supply chains get wonky.

Gold and precious metals? Think of them as your insurance policy when currencies start acting up or geopolitics go haywire. You’d want 5-10% in precious metals ETFs and another 10-15% in diversified REIT funds for solid protection.

These defensive players-they’re your portfolio’s backbone. But if you really want to take it up a notch, active risk management and regular rebalancing turn decent protection into extraordinary long-term gains.

How Do You Protect Gains While Staying Growth-Ready?

Stop-Loss Orders and Position Sizing Rules

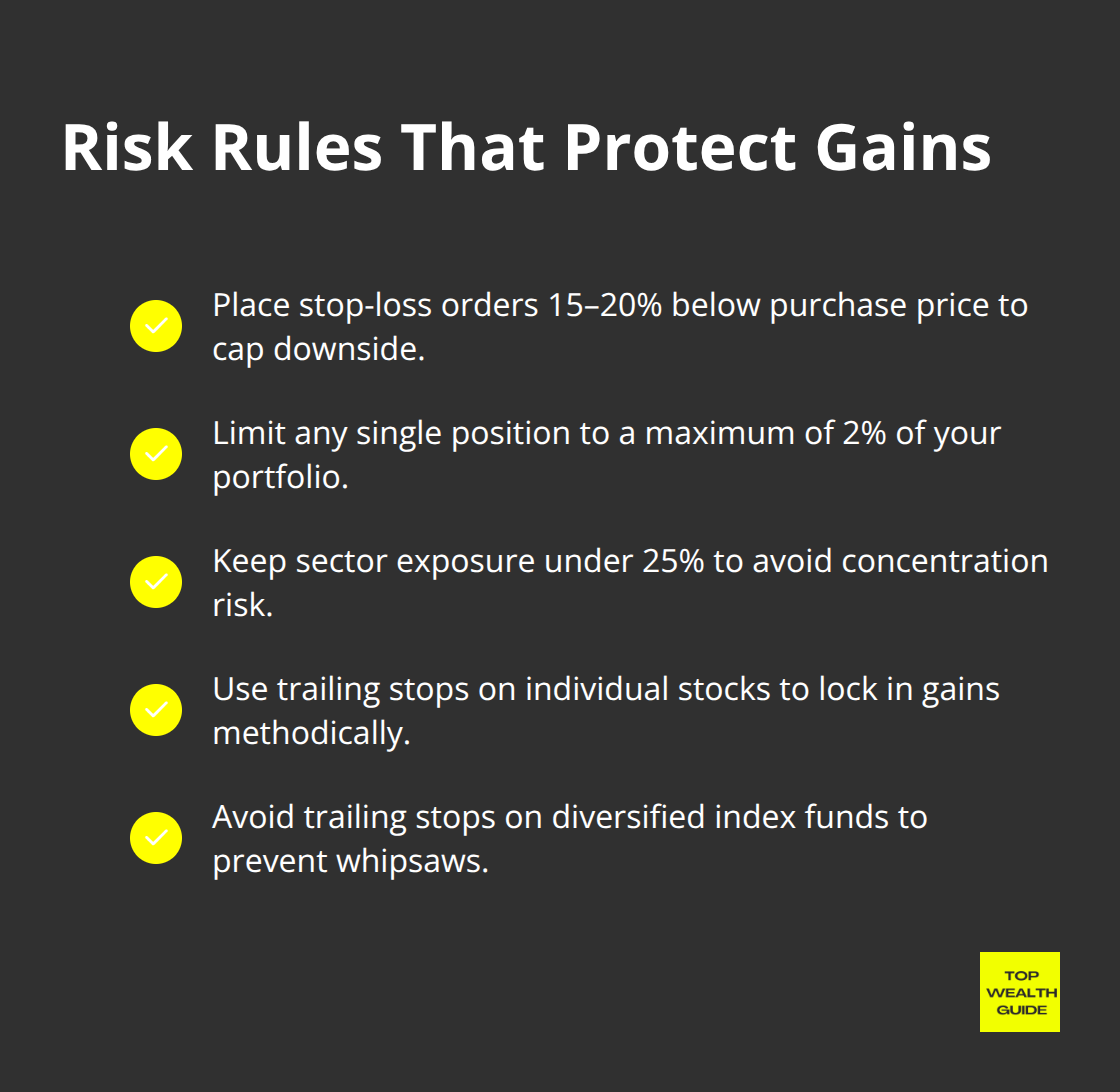

Here’s the deal-active risk management is your ticket out of becoming another tale of woe. Stop-loss orders set 15-20% below your purchase price are like a seatbelt for your investments, keeping you strapped in for the wild ride of recoveries. And remember, position size trumps stock picking any day of the week. Never let more than 2% of your portfolio hitch a ride on a single position-think of it as risk control with an iron fist. Also, keep your sector bets below 25% because nobody likes a one-trick pony.

Stick with systematic position sizing rules-they’ll be your winning formula in the long run, unlike those poor souls who put all their chips on a single hot tip. Set trailing stops on your individual stocks, but leave your diversified index funds alone. Too much twitchiness is a shortcut to bad decisions.

Cash Allocation Strategy Beats Emotional Decisions

When it comes to cash, strategy smokes emotion every single time. Keep 6-12 months of living expenses in high-yield savings accounts pulling in a sweet 4-5% APY. This emergency fund is your lifeline against the chaos of downturns, giving you the swagger to buy when everyone else is freaking out and markets are practically giving stuff away.

Resist the siren call to dip into this cash pile-investment opportunities will whisper sweet nothings, but remember, market crashes don’t send a memo, they just crash. You need liquidity like a lifeboat, not liquidation penalties or timing headaches.

Quarterly Rebalancing Schedule Maximizes Returns

Rebalance on a quarterly basis-not every time the market hiccups. Quarterly schedules do wonders for your portfolio’s zen, capturing more of that elusive target return than yearly rebalancing or emotional knee-jerks.

Use those nifty tax-advantaged accounts to keep Uncle Sam’s hands off your gains. Stick to a predictable schedule-the third Friday of March, June, September, and December is your new best friend. This methodical strategy shuns emotional meddling and keeps your portfolio marching in lockstep with your wealth management strategies.

Final Thoughts

Market cycles – they’re like the weather, unpredictable and often a mess. What you need is discipline, not some crystal ball for predictions. The real pros stick to the rules: diversify across lots of assets, keep putting in money regularly (that dollar-cost averaging magic), and rebalance like clockwork. Your investment game plan – it’s gotta hold up no matter what, focusing on those risk-adjusted returns, not chasing after the latest shiny object.

Your starting lineup? Easy – 30% in the safety net of defensive assets, 40% in bonds with all sorts of maturities, and 30% in a global spread of diversified equities. Want to go a step further? Toss in some alternative investments like REITs and commodities – that’s genuine diversification. Automate your game – monthly contributions, quarterly rebalancing – and bingo, you’re removing the emotion from the equation (this set-it-and-forget-it style kills the guesswork).

And the numbers? They’re loud and clear: stick to these principles and your portfolio saw positive returns in 85% of rolling 12-month chunks since 1970. Trying to time the market? A fool’s errand. Systematic approaches – those are the winners. Over at Top Wealth Guide, we’re all about equipping you with the tools and the know-how to nail it. Building wealth over the long haul? It’s about steady execution, not throwing darts at market predictions.