Compound interest is a simple idea that has some pretty incredible effects. At its core, it's the interest you earn on your original investment plus the interest you've already accumulated. In other words, you start earning "interest on your interest," which is the secret sauce that makes your money grow faster and faster over time.

Albert Einstein is often quoted as having called it the "eighth wonder of the world," and for good reason. Understanding this concept is the first major step toward building real, long-term wealth.

In This Guide

- 1 Understanding How Compound Interest Works

- 2 The Formula Behind The Magic

- 3 Seeing Compounding in Real-Life Scenarios

- 4 Where to Find Compound Interest in Action

- 5 Putting Compound Interest to Work for You

- 6 Frequently Asked Questions About Compound Interest

- 6.1 1. How often does interest actually compound?

- 6.2 2. What's the real difference between APR and APY?

- 6.3 3. Can you lose money in an account with compound interest?

- 6.4 4. How does compound interest work with debt?

- 6.5 5. What is the Rule of 72?

- 6.6 6. Is compound interest always better than simple interest?

- 6.7 7. How do taxes affect compound growth?

- 6.8 8. What's the best account for maximizing compound interest?

- 6.9 9. Do I need a lot of money to start?

- 6.10 10. How does inflation impact compound interest?

Understanding How Compound Interest Works

The best way I've heard it explained is to picture a snowball rolling down a hill. That small ball of snow you start with is your initial investment—your principal. As it rolls, it picks up more snow, which is the interest you're earning.

After that first turn, the snowball is a little bigger. Now, on its next rotation, it collects snow not just on its original surface but also on that new layer it just added. This is compounding in action.

Your money builds momentum this way, growing more with each passing year. It's a world away from simple interest, where the snowball never actually gets bigger. With simple interest, it just collects the same amount of snow on every rotation, based only on its original size.

The Key Difference: Simple vs. Compound Interest

Getting a handle on the difference between these two is one of the most important things for any investor. Simple interest is straightforward and static; it's always calculated on the initial amount you put in, and that’s it. Compound interest, on the other hand, is dynamic. The calculation is based on an ever-growing total of your principal plus all the interest you’ve earned so far.

This dynamic growth is precisely why compounding is hailed as a cornerstone of building wealth. In the beginning, the difference might not look like much. But give it a few decades, and the gap between what you’d earn with simple interest versus compound interest becomes absolutely massive.

"At its core, compounding occurs when the returns on an investment generate additional returns over time. This process allows your money to grow at an accelerating rate, as interest or investment earnings begin to earn returns themselves."

To really see the power here, a side-by-side look makes it crystal clear. Knowing the average rate of return for different investments helps put this into a real-world context, showing you just how much of an impact this can have.

Compound Interest vs. Simple Interest At a Glance

The table below breaks down the fundamental differences between simple and compound interest, showing how each one calculates growth and the long-term impact on your money.

| Feature | Simple Interest | Compound Interest |

|---|---|---|

| Growth Calculation | Interest is earned only on the original principal amount. | Interest is earned on the principal and the accumulated interest. |

| Growth Rate | Linear and constant over time. | Exponential and accelerates over time. |

| Long-Term Effect | Slower, predictable growth. | Significantly faster, wealth-building growth. |

| Best Analogy | A fixed salary. | A snowball rolling downhill, growing larger as it rolls. |

The Formula Behind The Magic

The incredible growth we've been talking about isn't magic—it's math. While formulas can look a bit intimidating, the one for compound interest is actually pretty simple once you see what each piece does.

Think of it like a recipe for building wealth. Each ingredient plays a specific role, and when you put them all together, the results can be amazing.

The formula is: A = P(1 + r/n)^(nt)

Let's break down this "recipe" ingredient by ingredient.

P = Principal (Your Starting Snowball)

The Principal (P) is your starting investment. It's the initial chunk of money you put away, like the first small snowball you pack at the top of a snowy hill. This is the foundation for everything that comes next.

A bigger starting principal gives you a nice head start, of course, but the real power of compounding is that even a small amount can grow into something huge. The most important thing is just to get that first snowball rolling.

R = Rate (How Fast Your Snowball Grows)

The interest rate (r) is the percentage your money grows by each year, but you'll write it as a decimal in the formula. So, a 5% annual return becomes 0.05. This is the "stickiness" of the snow—it determines how much more snow your snowball picks up with each turn down the hill.

Naturally, a higher rate means faster growth. This is why you'll often hear about finding investments with good returns. But the rate is just one part of the equation.

N = Compounding Periods (How Often It's Calculated)

The number of compounding periods (n) tells you how many times per year your interest gets calculated and added back into the pot. This is a subtle but powerful part of the formula. Interest might be compounded:

- Annually (n=1)

- Quarterly (n=4)

- Monthly (n=12)

- Daily (n=365)

The more often interest is compounded, the faster your money grows. Why? Because you start earning interest on your new, slightly larger balance sooner. Daily compounding will always beat annual compounding, even if the interest rate is identical.

T = Time (Your Most Powerful Ally)

Finally, we have time (t), which is the number of years you let your money grow. This is, without a doubt, the most powerful ingredient in the entire recipe. Time is what gives the compounding effect the room it needs to really work its magic.

The longer your money is invested, the more cycles of growth it goes through. The growth isn't just steady; it accelerates. This is exactly why every financial expert will tell you to start investing as early as humanly possible.

When you put all these pieces together, you can map out the future growth of your money with surprising accuracy. You can even play with these numbers yourself. Pop over to our free compound interest calculator and see for yourself how changing one little variable can lead to a massively different outcome down the road.

Seeing Compounding in Real-Life Scenarios

Formulas are great for understanding the mechanics, but the real magic of compound interest hits home when you see it work with real dollars and over a real lifetime. It might sound surprising, but the most powerful ingredient in this recipe for wealth isn't the amount you invest or even your rate of return. It's time.

Let’s bring this to life with a quick story about two friends, Alex and Ben. They have the exact same financial goals, but one of them makes a single choice that changes everything.

Real-Life Example: The Power of a Decade

Imagine two friends, Alex and Ben. Both are smart with their money and decide to invest $200 a month into a stock market index fund that earns a solid 8% average annual return.

- Alex gets started right away at age 25. He’s consistent, putting that $200 in every single month.

- Ben puts it off, finally starting at age 35. He invests the same $200 a month into the same type of account.

A ten-year delay doesn't sound like a catastrophe, does it? But when it comes to compounding, those ten years are an absolute game-changer. Ben isn't just missing out on ten years of his own contributions; he's forfeiting the most explosive years of growth, where his money would have had the longest runway to multiply.

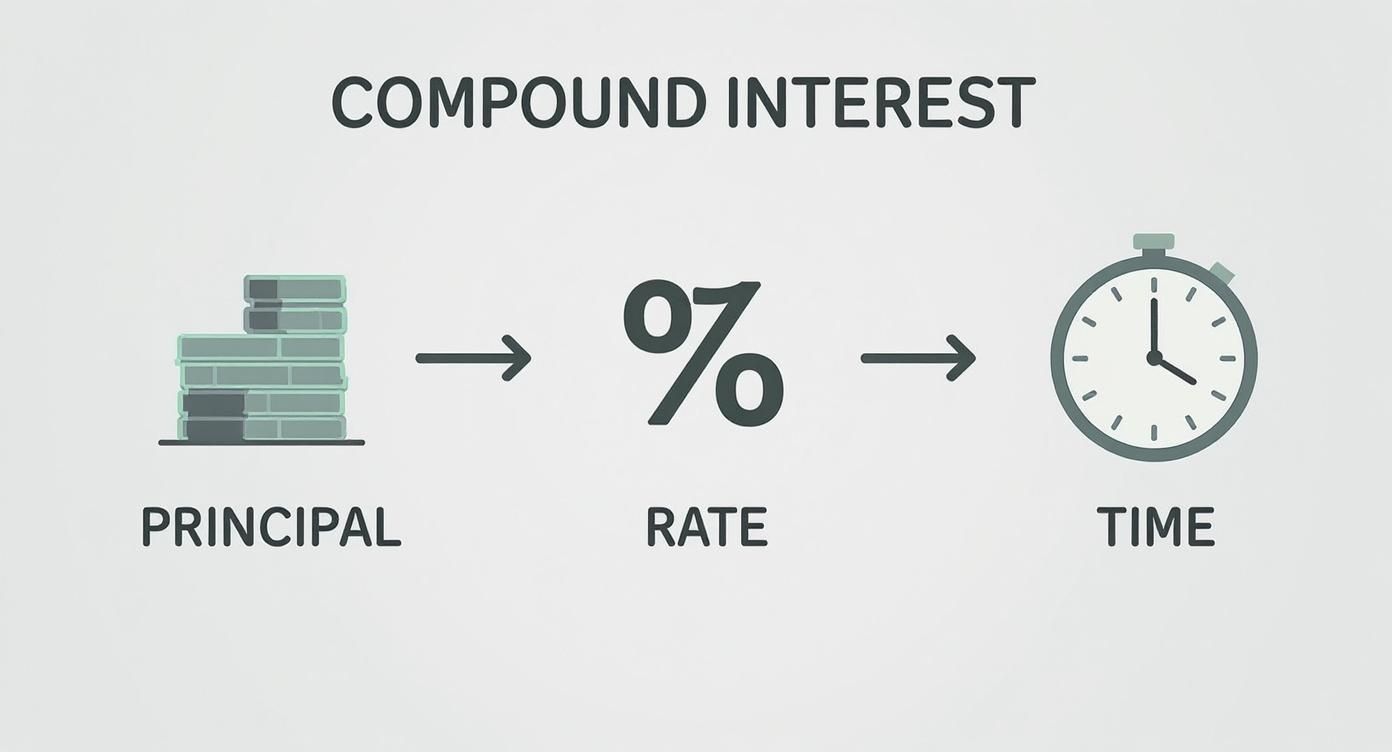

To really see how the different pieces fit together, this visual breaks down the core elements.

As you can see, the Principal, Rate, and Time all drive your results. But it's Time that acts as the ultimate accelerant.

The Staggering Cost of Waiting

Let's fast-forward and check in on Alex and Ben at a few different stages of their lives. The gap created by that one-decade delay is nothing short of shocking.

By the time they both turn 45, Alex has been investing for 20 years, while Ben has only been at it for 10. Alex has only contributed $24,000 more out of his own pocket ($48,000 vs. Ben's $24,000), but his account balance is already worlds apart thanks to that extra decade of growth.

As they get closer to retirement, the difference becomes a chasm. Ben keeps investing diligently, but he’s fighting a losing battle. He can never make up for the head start Alex’s money got. Alex's interest has simply had ten more years to earn its own interest.

The lesson here is crystal clear: Procrastination is the single biggest threat to building wealth. Every single year you wait to start is a year of your most valuable compounding potential lost forever.

The table below lays out the stark reality of this financial race, showing just how dramatic the dollar difference becomes over time.

Starting Early vs. Waiting: A Comparison Table

This table shows the incredible difference in wealth between someone who starts investing at 25 versus someone who starts at 35, even with identical monthly contributions ($200) and returns (8%).

| Age | Alex's Investment (Starts at 25) | Ben's Investment (Starts at 35) | Difference in Wealth |

|---|---|---|---|

| 45 | $118,537 | $36,442 | $82,095 |

| 55 | $354,717 | $118,537 | $236,180 |

| 65 | $821,378 | $354,717 | $466,661 |

Let that sink in. By retirement at age 65, Alex has put in a total of $96,000 over his 40 years of investing. Ben has put in $72,000 over his 30 years.

For just $24,000 more in total contributions, Alex ends up with $466,661 more in his account. That is the almost unbelievable power of time. It proves that the journey to major financial goals, like the one we map out in our guide on how to save 100k, is made infinitely easier by just starting sooner.

Where to Find Compound Interest in Action

Knowing what compound interest is intellectually is one thing. But knowing where to actually put it to work is how you start building real wealth.

The good news is that compounding isn't hiding in some obscure, complex financial product. It's the engine humming quietly behind many of the accounts you probably already know. These are the places designed to let your money grow on its own, and each one offers a unique environment for compounding to work its magic.

Let's look at the most common places you can find it.

High-Yield Savings Accounts

A high-yield savings account is probably the simplest and most direct example of compounding you can find. Sure, the interest rates aren't going to make you rich overnight compared to the stock market, but what they offer is stability and security.

It’s pretty straightforward: the bank pays you interest on your balance, usually calculated daily and paid out monthly. That small bit of interest gets added right back into your principal, making your total balance just a little bit bigger. The next month, the interest is calculated on this new, slightly higher balance. It’s a slow and steady process, which makes these accounts perfect for things like an emergency fund or saving for a down payment.

A high-yield savings account is a fantastic, real-world classroom for compounding. It shows how even a modest interest rate, when compounded frequently, can steadily grow your money with almost zero risk.

Stocks and Index Funds

Now we're getting to the big leagues. This is where the true, explosive power of compounding really gets to shine. When you invest in the stock market, your money grows in two main ways: the price of your shares goes up (appreciation), and the companies pay out a portion of their profits to you (dividends).

Compounding really kicks into high gear when you reinvest those dividends. Instead of pocketing the cash, you use it to automatically buy more shares of the stock or fund. This gives you more shares, which means your next dividend payment will be larger, which then lets you buy even more shares. You can see how this creates a powerful, self-perpetuating growth loop. To dive deeper, check out our guide on how to supercharge your portfolio with dividend reinvestment.

Just for perspective, the U.S. stock market has historically returned an average of around 10% per year (including dividends) since 1928. A single $100 investment back then, with every dividend reinvested along the way, would be worth an absolutely staggering amount today. It's a testament to what time and compounding can achieve. You can see more data on historical market returns on curvo.eu.

Retirement Accounts (401k and IRA)

Retirement accounts like a 401(k) or an Individual Retirement Account (IRA) are another key area. It's important to understand that these aren't investments themselves—they're special "containers" that hold your investments, like stocks and funds. What makes them so special? Tax advantages. And those tax benefits act like rocket fuel for compound growth.

Here’s a quick breakdown of how these different accounts put compounding to work:

| Account Type | Compounding Mechanism | Key Advantage | Best For |

|---|---|---|---|

| High-Yield Savings | Interest paid on principal + interest | Safety and liquidity | Emergency funds, short-term goals |

| Stock Market | Reinvested dividends and capital gains | High growth potential | Long-term wealth building |

| Retirement Accounts | Tax-deferred or tax-free growth | Tax advantages supercharge returns | Long-term retirement savings |

In a traditional 401(k) or IRA, your money grows tax-deferred. This is a huge deal. It means you don't pay any taxes on the dividends or capital gains your investments generate each year. This lets 100% of your earnings get reinvested and continue compounding, without the government taking a slice every year. This "tax drag" in a normal brokerage account can slow things down, but inside a retirement account, your money can grow much faster, completely unbothered by taxes until you withdraw it decades later.

Putting Compound Interest to Work for You

It’s one thing to understand how compound interest works. It’s another thing entirely to put it into practice and actually build wealth. The good news is that you don't need a complex Wall Street strategy or some secret stock-picking formula. It really boils down to a few powerful, consistent habits that give compounding the fuel it needs.

Think of it as a playbook for your financial future. By following these proven strategies, you can stop just saving and start actively growing your money.

Start As Early As You Can

If there's one "secret ingredient" to compounding, it's time. As we saw in the earlier examples, every single year you put off investing is a year of explosive growth you can never get back. Starting early—even if it's with small amounts—gives your money the longest possible runway to multiply.

Don't get caught in the trap of waiting until you have a "large" sum to invest. Thanks to compounding, a small investment today can easily outperform a much bigger one made ten years from now. The best time to plant a tree was 20 years ago. The second-best time is today.

Make Consistency Your Superpower

This is where the magic really happens. Turning your contributions into a regular, automatic habit transforms compounding from a background process into a deliberate wealth-building machine. Whether it's weekly, bi-weekly, or monthly, consistent contributions continuously add fuel to the fire.

This disciplined approach is often called dollar-cost averaging. By investing a fixed amount on a set schedule, you remove emotion from the equation and turn saving into a simple, powerful habit. You can learn more about this in our guide to master dollar-cost-averaging for steady wealth growth.

Reinvest Everything

To let compounding truly work its wonders, your earnings need to start earning money of their own. This means automatically reinvesting every dividend, interest payment, and capital gain right back into your portfolio. It’s like making sure every snowflake that sticks to your snowball stays on for the next roll downhill.

The moment you pull out your earnings, you hit the reset button on that money's compounding potential. Reinvesting ensures your investment base is always getting bigger, which in turn accelerates your future returns.

The historical data paints a clear picture. Over the last 124 years, the U.S. stock market has produced a real return of roughly 6.9% per year. Because of the incredible power of reinvested returns, a single dollar invested in 1900 would be worth about $3,703 today. For more on this, check out the data on historical market returns on monevator.com.

Nudge Your Savings Rate Up Over Time

Finally, don't underestimate the power of small, gradual increases. You don't have to double what you're saving overnight. Instead, challenge yourself to increase your savings rate by just 1% each year.

This tiny step is often so small you won't even feel it in your budget, but it can add tens, or even hundreds, of thousands of dollars to your nest egg over a few decades. A great way to do this is to time the increase with a pay raise or bonus. It’s a simple, painless way to supercharge your financial journey without feeling the pinch.

Frequently Asked Questions About Compound Interest

1. How often does interest actually compound?

The compounding frequency—how often interest is calculated and added to your balance—depends on the financial product. Common frequencies include:

- Daily: Used by high-yield savings accounts and credit cards. This is the most powerful for growth (or debt).

- Monthly: Common for dividend stocks and some savings accounts.

- Quarterly: Some bonds and older investments compound four times a year.

- Annually: The slowest frequency, often used for simple examples.

The more frequent the compounding, the faster your money grows.

2. What's the real difference between APR and APY?

This is a critical distinction for savers and borrowers.

- APR (Annual Percentage Rate) is the simple annual interest rate without factoring in compounding within the year.

- APY (Annual Percentage Yield) is the effective annual rate you earn because it includes the effects of compounding.

For saving, APY is the more important number as it reflects your actual earnings.

3. Can you lose money in an account with compound interest?

Yes, depending on the account type.

- In a Savings Account or CD: Your principal is safe in a federally insured bank (up to $250,000). The only "loss" is if your interest rate doesn't outpace inflation.

- In the Stock Market: The value of your investment can go down. However, compounding still works by reinvesting dividends to buy more shares, which can accelerate recovery when the market turns around.

4. How does compound interest work with debt?

It works against you with devastating effect. Credit card debt, for example, often compounds daily. Interest is added to your balance, and the next day, you're charged interest on that new, larger balance. This "interest on interest" is how a manageable debt can quickly spiral into a major financial burden.

5. What is the Rule of 72?

The Rule of 72 is a simple mental math trick to estimate how long it will take for an investment to double in value. The formula is:

72 ÷ Interest Rate = Approximate Years to Double

For example, at an 8% annual return, your money would double in approximately 9 years (72 ÷ 8 = 9). It's a quick way to grasp the power of different growth rates.

6. Is compound interest always better than simple interest?

For growing wealth over time, the answer is a resounding yes. Simple interest provides linear, straight-line growth. Compound interest provides exponential growth that accelerates. Over any significant period, the "interest on interest" from compounding will always result in far greater returns.

7. How do taxes affect compound growth?

Taxes act as a brake on compounding. In a standard taxable brokerage account, you owe taxes on dividends and capital gains each year. This removes money from your account that could have been compounding. This is why tax-advantaged accounts like 401(k)s and IRAs are so powerful—they allow your money to compound for decades without being slowed down by annual taxes.

8. What's the best account for maximizing compound interest?

While it depends on your goals, a Roth IRA is a fantastic tool for long-term growth. It combines the high-growth potential of stock market investments with the benefit of tax-free growth and withdrawals in retirement. For short-term goals where safety is paramount, a high-yield savings account is an excellent choice for steady, risk-free compounding.

9. Do I need a lot of money to start?

Absolutely not. This is one of the biggest myths in investing. The most critical factor for successful compounding is time, not the initial amount. With modern brokerage accounts offering zero minimums and fractional shares, you can start with as little as $5 or $10. Starting small and early will almost always outperform waiting to start with a large sum later.

10. How does inflation impact compound interest?

Inflation erodes the purchasing power of money. To truly build wealth, your investment return must be higher than the inflation rate. This is called your "real return."

- Real Return = Investment Return – Inflation Rate

If your investments grow by 8% while inflation is 3%, your real return is 5%. This means your wealth and purchasing power have actually increased. This is why investing is crucial; holding cash over the long term guarantees a loss of purchasing power to inflation.

Ready to put the power of compounding to work for your future? At Top Wealth Guide, we provide the strategies and insights you need to build lasting wealth. Explore our articles and tools to take the next step on your financial journey. Find out more at https://topwealthguide.com.