A mutual fund is simply a big pot of money collected from tons of different people. That collective pool is then used to buy a wide variety of investments, like stocks, bonds, or other assets.

It’s a bit like a group of friends wanting to try a huge, expensive pizza with every topping imaginable. Instead of one person buying the whole pie, everyone chips in. That way, you all get to sample a little bit of everything without footing the massive bill alone.

In This Guide

- 1 Unpacking the Core Idea of Mutual Funds

- 2 How Mutual Funds Actually Work Step By Step

- 3 Choosing Your Flavor: Exploring Fund Types

- 4 The Real Pros And Cons Of Mutual Funds

- 5 Decoding The Costs And Fees Of Investing

- 6 Your First Steps To Investing In Mutual Funds

- 7 Common Questions About Mutual Funds

- 7.1 1. What Is The Difference Between A Mutual Fund And An ETF?

- 7.2 2. Can I Lose All My Money In A Mutual Fund?

- 7.3 3. How Much Money Do I Need To Start Investing?

- 7.4 4. How Are Mutual Funds Taxed?

- 7.5 5. What Is A Mutual Fund Prospectus?

- 7.6 6. What Is The Difference Between A Load And A No-Load Fund?

- 7.7 7. How Often Should I Check My Mutual Fund Performance?

- 7.8 8. What Is An Index Fund?

- 7.9 9. Do Mutual Funds Pay Dividends?

- 7.10 10. Can I Sell My Mutual Fund Shares At Any Time?

Unpacking the Core Idea of Mutual Funds

Think about what it would take to build a solid investment portfolio all by yourself. You'd have to spend countless hours researching hundreds of companies, buying individual stocks, figuring out which bonds are a good bet, and keeping a close eye on the market every single day. Honestly, it's a full-time job that’s both expensive and requires a ton of know-how.

This is where the simple genius of a mutual fund really shines.

A mutual fund handles all that heavy lifting for you by offering a ready-made, professionally managed portfolio all in one neat package. When you put your money in, you’re buying shares of the fund itself, not the individual stocks or bonds it contains. This instantly makes you a part-owner of every single investment inside that fund.

The Pizza Analogy Explained

Let's circle back to that pizza analogy, because it perfectly illustrates the concept. If you were investing on your own, you might only have enough cash for a plain cheese pizza (which is like buying one single stock). It's a decent start, but it's not very exciting and carries a bit of risk—what if you suddenly realize you hate cheese?

A mutual fund is the giant, party-sized pizza loaded with everything: pepperoni, mushrooms, olives, even pineapple. Your investment gets you a taste of every single slice.

- Pooled Money: All the friends (that's us, the investors) throw money into the pot to buy the pizza.

- The Chef: A professional fund manager is the chef. They pick the best toppings (the stocks, bonds, etc.) based on a specific recipe (the fund's investment strategy).

- Diversification: You get to enjoy all the different flavors. If the olive slice isn't your thing, no big deal—you can still enjoy the pepperoni one. This is how a fund spreads out your risk.

The Scale of Mutual Funds in Modern Investing

This idea of pooling resources isn't just a neat trick; it's a cornerstone of modern investing. Mutual funds are one of the most popular investment tools on the planet.

In the United States alone, assets managed by mutual funds swelled to an incredible $29.11 trillion as of January 2025. That number is staggering, and it shows just how much everyday people rely on these funds for professional management and easy diversification.

If you’re just starting out, getting a handle on these basics is the perfect first step. For a broader look at the fundamentals, check out our complete guide to investing for beginners.

To really lock in these concepts, here’s a quick-glance table breaking down the key terms you'll hear over and over again.

Mutual Funds at a Glance: Key Concepts

| Concept | Simple Explanation |

|---|---|

| Diversification | Spreading your money across many different investments to lower your overall risk. It's the classic "don't put all your eggs in one basket" strategy brought to life. |

| Fund Manager | A financial pro who makes all the buy and sell decisions for the fund. Their job is to manage the portfolio and try to hit its investment goals. |

| Net Asset Value (NAV) | This is simply the price of one share in a mutual fund. It's calculated just once per day, after the market closes, by taking the fund's total asset value and dividing it by the number of shares. |

Having these terms down will make it much easier to understand how everything fits together as you continue your investment journey.

How Mutual Funds Actually Work Step By Step

Okay, so we know a mutual fund is a big pot of money from lots of different people. But what happens to your money when you actually invest? Let's walk through the process from start to finish. We'll follow a fictional investor, Alex, to make this crystal clear.

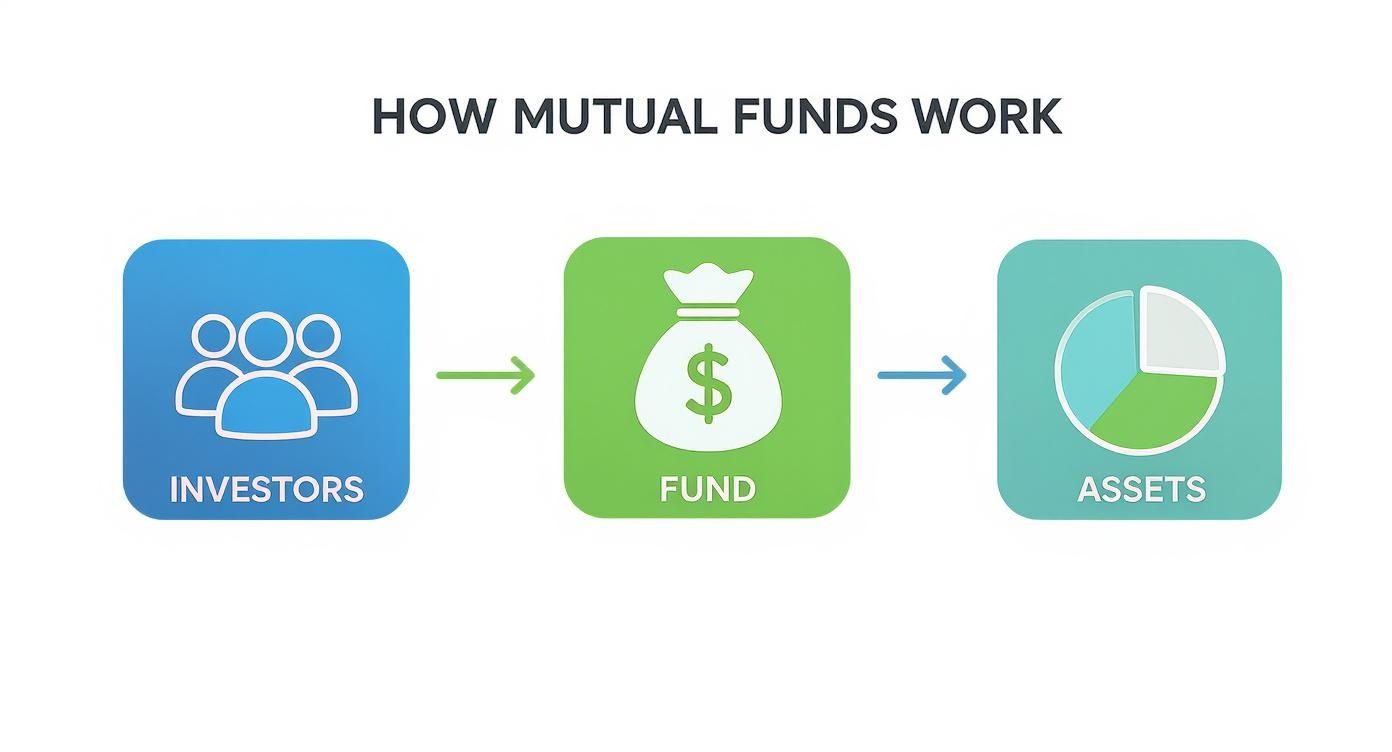

This visual gives you a great bird's-eye view of how money flows from individual investors, like Alex, into a single, diversified fund.

As you can see, the core idea is simple: many investors pool their cash, and a fund manager uses that collective pot to buy a wide range of assets.

Step 1: Pooling The Capital

Let's say Alex decides to put $1,000 into something called the "Global Growth Fund." His money doesn't just sit in a little account with his name on it. It’s immediately pooled with cash from thousands of other investors. Some might be putting in just $100, while others could be investing $100,000.

This massive, combined pool of capital is what gives a mutual fund its muscle. It creates an economy of scale, allowing the fund manager to buy a huge variety of stocks, bonds, and other assets in a way no single investor could.

Step 2: Purchasing The Assets

Now that the fund has millions of dollars to work with, a professional fund manager takes the reins. Their job is to invest that collective capital according to a specific strategy, which is all laid out in a document called a prospectus.

If the Global Growth Fund's mission is to own shares in large, international tech companies, the manager will start buying stocks that fit that exact profile. Alex's $1,000 is now spread across all those different companies, giving him instant diversification he couldn't possibly achieve on his own.

So, how do you know what Alex's investment is worth from one day to the next? This is where a very important term comes in: Net Asset Value (NAV). The NAV is simply the price of one share in the mutual fund.

It's calculated once every business day after the markets close. Here's how it works:

- The fund tallies up the current market value of everything it owns (all the stocks, bonds, cash, etc.).

- It then subtracts any operational costs or fees.

- That final number is divided by the total number of shares that all investors own.

Think of it like this: if the Global Growth Fund has assets worth $100 million and there are 10 million shares out there, the NAV would be $10.00 per share. If Alex invested his $1,000 when the NAV was $10.00, he would now own 100 shares.

Step 4: How You Make Money

As a shareholder, Alex has two main ways to profit from his mutual fund. Getting a handle on these is key to understanding how these investments can build wealth over time.

How Investors Earn Returns

| Method | Description | Real-Life Example |

|---|---|---|

| Capital Appreciation | The value of the assets inside the fund—the stocks and bonds—goes up. When this happens, the fund's NAV increases. | If the tech stocks in the Global Growth Fund have a good run, the fund's total value might climb to $110 million. The NAV would then jump to $11.00 per share, making Alex’s 100 shares now worth $1,100. |

| Distributions | The fund collects earnings from its investments (like stock dividends or bond interest) and passes them along to its shareholders. | The fund might pay out a dividend of $0.20 per share. With his 100 shares, Alex would receive $20 in cash. He can either take the money or, more commonly, reinvest it to buy more shares. |

This whole process shows how your money is put to work to generate both growth and income. While many funds, like our example, have managers actively picking investments, another popular type of fund simply aims to track a market index. If that passive approach sounds interesting, you can explore our detailed guide on what are index funds right here on Top Wealth Guide.

Ultimately, it’s the combination of professional management, diversification, and the compounding power of both appreciation and distributions that makes mutual funds such a cornerstone for so many long-term investors.

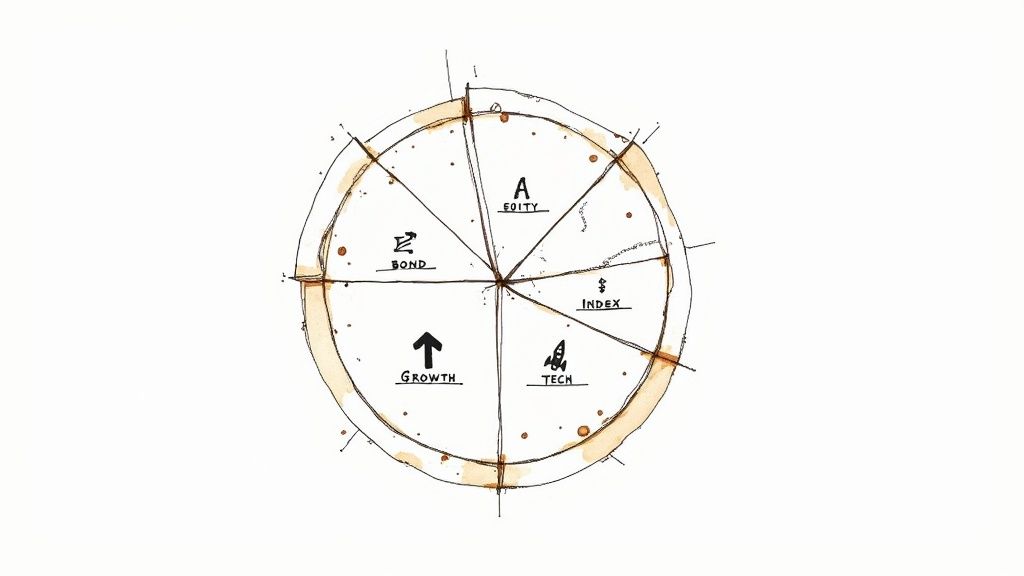

Choosing Your Flavor: Exploring Fund Types

Just as there are endless pizza toppings to suit every taste, the world of mutual funds offers a vast menu of options. Each one is designed for different financial goals and risk appetites. Knowing the difference between them is the key to picking a fund that actually fits your personal strategy.

Think of this section as your guide to the fund menu. It'll help you tell the difference between a spicy, high-growth tech fund and a reliable, plain-cheese government bond fund.

The global appetite for these investments is soaring. Projections show the worldwide mutual fund market expanding from $670.64 billion in 2025 to an estimated $1,217.35 billion by 2034. While North America is currently the biggest player, this growth points to rising investor confidence in professionally managed portfolios across the globe. You can read more about the future of the mutual fund market on Precedence Research.

This boom is really fueled by the sheer variety of funds out there, which are usually grouped by the kinds of assets they hold.

Funds Categorized By Asset Class

The most basic way to classify mutual funds is by what’s inside them. Each asset class brings its own unique risk and return profile to the table, making this the first and most important distinction to grasp.

- Equity Funds (Stock Funds): These are the most common type of mutual fund. They invest mainly in stocks (equities), which represent a slice of ownership in public companies. They're built for long-term growth but come with higher risk because the stock market can be a rollercoaster.

- Bond Funds (Fixed-Income Funds): These funds buy debt from governments or corporations. Think of a bond as a loan that pays you a fixed interest rate. This makes them a more conservative choice, focused on providing a steady stream of income.

- Money Market Funds: Generally considered one of the safest bets, these funds invest in high-quality, short-term debt like U.S. Treasury bills. They aim to keep their share price stable at $1.00 and are often used as a low-risk spot to park cash you might need soon.

- Balanced Funds (Hybrid Funds): Just like the name implies, these funds hold a mix of both stocks and bonds. The goal is to balance growth potential with income generation while smoothing out the ride. They're a popular "all-in-one" solution for many investors.

- Specialty Funds: This is a catch-all category for funds that focus on a specific industry (like technology or healthcare) or a unique asset. For example, some funds invest in physical properties. If that sparks your interest, you can learn more about how Real Estate Investment Trusts work right here on our site.

Funds Categorized By Investment Style

Beyond what they own, funds are also defined by how they invest. This really comes down to the classic debate: active versus passive management.

An actively managed fund has a professional manager, or even a whole team, making the calls. They're constantly researching and trading, trying to pick winners and outperform a market benchmark like the S&P 500.

On the other hand, a passively managed fund—you'll often hear it called an index fund—doesn't try to beat the market at all. Instead, its job is to simply mirror the performance of a specific index by holding the same securities. Since a computer can do most of that work, these funds almost always have much lower fees.

Key Takeaway: Your choice between active and passive funds really boils down to a simple question. Do you believe a manager's expertise is worth paying a higher fee for, or would you rather just match the market's return for a lower cost?

Active vs. Passive Management: A Head-to-Head Comparison

| Feature | Actively Managed Fund | Passively Managed (Index) Fund |

|---|---|---|

| Goal | To beat a market benchmark (e.g., the S&P 500). | To match the performance of a market benchmark. |

| Management | A professional fund manager or team makes active buy/sell decisions. | Follows a set of rules to replicate an index; computer-driven. |

| Fees | Higher expense ratios to pay for research and management talent. | Very low expense ratios due to the automated approach. |

| Potential Returns | Potential to outperform the market, but also to underperform. | Will perform very closely to the market index, minus a small fee. |

| Best For | Investors who believe a skilled manager can justify higher costs. | Cost-conscious investors who want broad, diversified market returns. |

Getting a handle on these different "flavors" is the first step toward building a portfolio that actually reflects your goals. Whether you’re shooting for aggressive growth or just want some stable income, there’s a mutual fund out there designed to help you get there.

The Real Pros And Cons Of Mutual Funds

Every investment has its trade-offs, and mutual funds are no different. They offer some fantastic advantages, especially if you're just getting started, but it's important to walk in with your eyes wide open. Acknowledging both sides of the coin is the only way to make a smart decision that truly fits your financial goals.

Let's cut through the noise and take an honest look at what makes mutual funds so powerful—and what potential pitfalls you need to watch out for.

The Powerful Advantages Of Mutual Funds

For millions of people, mutual funds are the on-ramp to the investment world. There's a good reason for that. They neatly solve some of the biggest headaches that new investors face.

- Instant Diversification: This is the big one. With one transaction, you can own tiny slivers of hundreds, sometimes thousands, of different companies. This immediately spreads your risk. If one company hits a rough patch, it doesn't sink your entire portfolio.

- Professional Management: You’re not just buying a pre-packaged portfolio; you're hiring a team of pros to run it for you. These fund managers and their analysts do all the heavy lifting—the research, the number-crunching, and the day-to-day trading decisions—saving you an incredible amount of time.

- Affordability and Accessibility: You don't need to be wealthy to start building wealth. Many funds let you get started with as little as $100, and some have no minimum at all. This makes investing accessible to just about anyone, regardless of their starting capital.

- Liquidity: Unlike tying your money up in something like real estate, mutual fund shares are easy to sell. On any day the market is open, you can cash out your shares, giving you the flexibility to access your money when you need it.

The Potential Drawbacks To Consider

As compelling as the benefits are, you have to be just as aware of the downsides. Knowing what they are can help you pick better funds and keep your expectations realistic.

The biggest drawbacks usually boil down to three things: costs, control, and taxes. These factors can be hiding in the fine print, but they have a very real impact on how much money you actually get to keep.

Key Insight: The convenience of a mutual fund always comes at a price. Your job as an investor is to decide if the benefits you receive are worth the fees you pay and the control you give up.

Unpacking The Disadvantages

Let’s get specific about the common cons you'll run into.

- Management Fees: That professional team doesn't work for free. Funds charge an annual fee known as the expense ratio to cover their operating costs. It might look tiny—often between 0.5% to 1.5%—but that fee is skimmed off your investment returns year after year. Over decades, it can seriously eat into your growth.

- Lack of Direct Control: When you buy into a fund, you’re handing the keys to the fund manager. You don't get to choose which stocks are bought or sold. For investors who want a more hands-on role in their portfolio, this lack of control can be a major source of frustration.

- Potential Tax Inefficiency: Actively managed funds are constantly buying and selling securities. When they sell a stock for a profit, it triggers a capital gain. Those gains are passed down to you, the shareholder. This means you could end up with a tax bill, even if you personally never sold a single share of the fund.

To put it all together, here’s a side-by-side look at the trade-offs.

| Aspect | The Upside (Pro) | The Downside (Con) |

|---|---|---|

| Diversification | Get instant exposure to a wide range of assets, reducing your overall risk. | "Diworsification" can occur if a fund holds too many assets, diluting the impact of its top performers. |

| Management | Benefit from the expertise of professional money managers who do the research for you. | You must pay ongoing management fees (expense ratios) that reduce your net returns. |

| Control | A simple, hands-off investment. You don't have to worry about the day-to-day decisions. | You have no control over which individual securities are held within the portfolio. |

| Taxes | The fund handles all the trading complexity internally. | You can be hit with unexpected capital gains distributions, creating a tax liability. |

Ultimately, understanding these trade-offs is the key to making a good choice. While fees are a clear drawback, you can lessen their bite by consciously choosing low-cost funds. If you really want to see how much of a difference this can make, check out our guide on how investment fees are secretly destroying your wealth for a much deeper analysis.

Decoding The Costs And Fees Of Investing

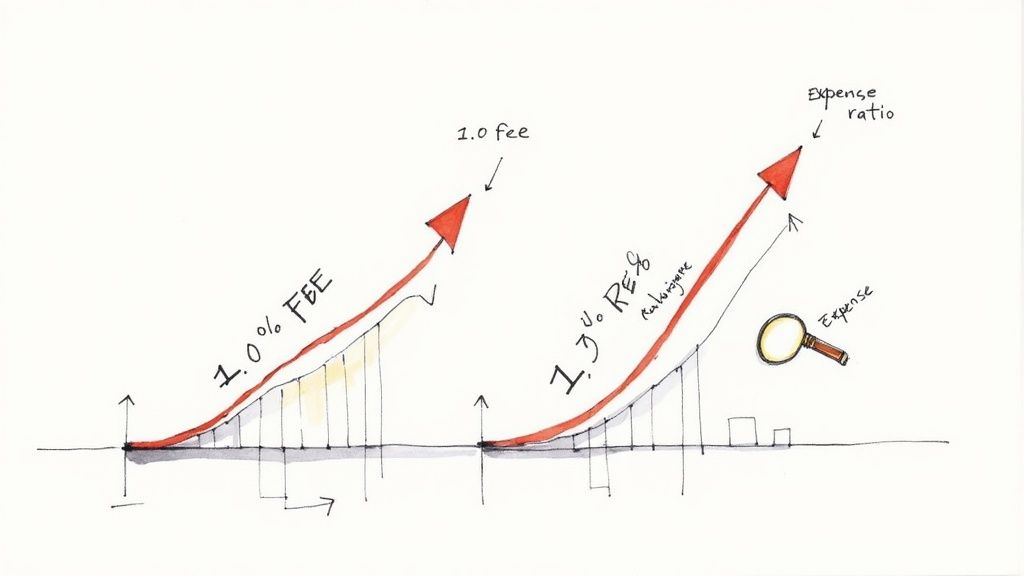

Let's talk about something that isn't flashy but is absolutely critical to your long-term success: fees. Understanding the costs tied to a mutual fund isn't just a minor detail—it's one of the most powerful things you can control as an investor. Even tiny, seemingly insignificant fees can act like a slow leak, quietly draining your returns over time.

This section will pull back the curtain on the common costs you'll run into. My goal is to help you spot the low-cost winners and keep more of your hard-earned money working for you.

The All-Important Expense Ratio

The single most important fee to watch is the expense ratio. Think of it as the fund's annual operating cost, all bundled into one number. It covers everything from the fund manager's salary to administrative overhead and marketing expenses.

This fee is expressed as a percentage of the fund's total assets, and it’s deducted automatically from your returns every year. You never see a bill for it, but trust me, it’s there.

So, if you have $10,000 invested in a fund with a 1.0% expense ratio, you're paying $100 a year for the management. That might not sound like a deal-breaker, but when you zoom out over your entire investing lifetime, the impact is staggering.

Over decades, a small difference in fees can compound into a massive difference in your final portfolio value. A lower expense ratio means more of your money stays invested and working for you.

Let's run the numbers to see what this really means. Imagine you start with a $10,000 investment that earns an average of 7% annually over 20 years. Here’s how a small fee difference plays out:

| Expense Ratio | Ending Balance (After 20 Years) | Fees Paid Over 20 Years |

|---|---|---|

| 0.1% (Low-Cost) | $37,842 | $495 |

| 1.0% (High-Cost) | $32,071 | $4,064 |

Look at that. A tiny 0.9% difference in the annual fee leaves you with nearly $5,800 less in your pocket. This is exactly why experienced investors are obsessed with finding funds that have the lowest possible expense ratios.

Other Potential Mutual Fund Costs

While the expense ratio is the main event, a few other fees can pop up depending on the fund you choose. Knowing what they are can help you avoid any nasty surprises down the road.

- Sales Loads: This is simply a commission paid to the broker or advisor who sells you the fund. A "front-end load" is charged when you buy, while a "back-end load" hits you when you sell. The good news? Many of the best funds are "no-load," meaning you don't pay any sales commission at all.

- Redemption Fees: Some funds charge this if you sell your shares too quickly, often within 30 to 90 days. It's not meant to be a penalty but rather a way to discourage short-term, speculative trading that can disrupt the fund's long-term strategy.

- 12b-1 Fees: These are tucked inside the overall expense ratio and are specifically used to cover the fund's marketing and distribution costs. You'll often see these attached to actively managed funds that are trying to attract new investors.

Keeping these costs in check is a cornerstone of smart financial planning. The combination of fees and taxes can significantly impact your net returns, so building a strategy to minimize them is essential. To dive deeper into this, check out our guide on how to invest tax-efficiently and keep more money.

Ultimately, by paying close attention to a fund's prospectus and making low-cost options your priority, you set yourself up for a much more successful and profitable investment journey.

Your First Steps To Investing In Mutual Funds

Alright, theory is great, but now it's time to put your money to work. Getting started with mutual funds isn't nearly as intimidating as it might seem. Think of it as a clear, four-step path to taking control of your financial future.

Step 1: Define Your Financial Goals

Before you even think about looking at specific funds, you need to answer one simple question: "What am I investing for?"

Is this money for a down payment on a house in five years? Or is it for retirement, which might be 30 years away? Your answer is everything. It dictates your timeline and how comfortable you should be with risk. A short-term goal usually calls for a more cautious approach, while a long-term goal gives you the runway to weather market ups and downs for a shot at higher growth.

Step 2: Find The Right Fund

With your goals set, the hunt for the right fund begins. This really boils down to two things: the fund's strategy and its cost. First, make sure its mission matches yours. If you're a young investor focused on growth, a fund that invests in large, innovative tech companies might make sense.

But just as important is the expense ratio. We've touched on this before, but it bears repeating: this small annual fee can take a huge bite out of your returns over time. Always lean toward funds with the lowest possible costs.

This is also where you'll face the classic choice between actively managed funds and passive index funds.

- Active Funds: A real person is at the helm, trying to pick winning investments to outperform the market. This hands-on approach means they usually have higher fees.

- Passive Funds: These funds don't try to be heroes. They simply aim to match the performance of a market index, like the S&P 500. They're typically automated and come with rock-bottom fees.

Step 3: Open An Investment Account

You need a place to actually buy and hold your funds. This means opening a brokerage account. Plenty of well-known, reputable firms offer access to a huge menu of no-load, low-cost mutual funds.

The setup process is almost always done online and takes just a few minutes. You'll need to provide some basic personal information, connect your bank account to transfer money in, and you'll be ready to go.

Step 4: Make Your First Purchase

With your account funded, you're on the home stretch. Now you just have to buy your chosen fund. You can either invest a lump sum all at once or set up a recurring investment schedule. Many smart investors prefer the second option, a strategy called dollar-cost averaging.

Dollar-cost averaging is the practice of investing a fixed amount of money at regular intervals—say, $100 every month—no matter what the market is doing. This strategy helps average out your purchase price over time and takes the emotion out of trying to perfectly "time the market."

It’s easy to get swept up in what everyone else is doing. For instance, in Q2 2025, mutual funds saw net inflows of $182.9 billion, a complete reversal from the net withdrawals in the previous quarter. This shows how quickly market sentiment can shift. You can find more details on these trends in this report on global fund flows from ISS Market Intelligence.

But a consistent, disciplined strategy like dollar-cost averaging helps you tune out the noise and stick to your plan. Follow these four steps, and you’ll be well on your way.

Common Questions About Mutual Funds

Let's wrap up by tackling some of the questions that almost always come up when people first start looking into mutual funds. Getting these sorted out can clear up any lingering confusion and help you feel more confident about taking the next step.

1. What Is The Difference Between A Mutual Fund And An ETF?

Think of it this way. A mutual fund is like ordering a prix-fixe dinner at a restaurant. You place your order during the day, but the price is set only once after the market closes. An Exchange-Traded Fund (ETF), on the other hand, is like buying and selling food from a popular street vendor during a busy lunch rush—prices are changing constantly, and you can make a trade anytime the market is open.

Both get you a diversified "meal" of investments, but the way they are bought and sold is fundamentally different.

2. Can I Lose All My Money In A Mutual Fund?

Theoretically, yes, but it's incredibly improbable, especially in a fund that holds hundreds of different stocks or bonds. For you to lose everything, every single company or government entity in that fund would have to simultaneously go bankrupt and become worthless.

The whole point of diversification is to protect against that kind of total catastrophe. Still, all investing comes with risk, and the value of your fund will absolutely go up and down.

3. How Much Money Do I Need To Start Investing?

Gone are the days when you needed a small fortune to get started. Many brokerage firms now let you buy into mutual funds with no minimum investment at all. Others have minimums as low as $100 or even $1. The barrier to entry has never been lower.

4. How Are Mutual Funds Taxed?

Typically, taxes come into play in two main ways. First, when the fund manager sells investments inside the fund for a profit, the fund is required to distribute those capital gains to you. You'll owe taxes on that distribution, even if you didn't sell any of your own shares.

Second, if you decide to sell your shares of the fund for more than you originally paid for them, you'll owe capital gains tax on your own profit.

5. What Is A Mutual Fund Prospectus?

Think of the prospectus as the fund's official instruction manual. It's a legal document that lays out everything you need to know: its investment goals, the strategies it uses, the specific risks involved, all the fees, and its historical performance. Reading it is essential before you put a single dollar in.

6. What Is The Difference Between A Load And A No-Load Fund?

A "load" is just a fancy word for a sales commission.

- A load fund charges you this commission, either when you buy your shares (a "front-end load") or when you sell them (a "back-end load").

- A no-load fund has no sales commissions. All of your money goes straight to work for you in the investment.

7. How Often Should I Check My Mutual Fund Performance?

If you're investing for the long haul, checking in once a quarter is more than enough. Some people only look once or twice a year. Watching the daily ups and downs is a recipe for anxiety and can tempt you into making emotional, short-sighted decisions. Trust the plan you made and give it time to work.

8. What Is An Index Fund?

An index fund is a specific type of mutual fund that is "passively managed." Instead of having a manager who actively picks and chooses investments trying to beat the market, an index fund's goal is much simpler: it just tries to match the performance of a specific market benchmark, like the famous S&P 500.

9. Do Mutual Funds Pay Dividends?

Yes, many of them do. As the fund collects dividends from the stocks and interest payments from the bonds it owns, it bundles these earnings up and passes them along to shareholders. These distributions are usually paid out quarterly or annually.

Absolutely. Mutual funds are considered very liquid, which means you can cash out easily. You can place an order to sell your shares on any day the stock market is open. Your sale will be processed at that day's closing price, known as the Net Asset Value (NAV).

At Top Wealth Guide, our mission is to provide you with the clear, actionable insights needed to build lasting wealth. From decoding investments to mastering financial strategies, we're here to support your journey. Explore more and subscribe for exclusive tips at https://topwealthguide.com.