Passing down wealth? Not as easy as handing over a check… and keeping the family fortune intact? It’s more like a chess game than just jotting down a will. Seriously, folks, without a strategy that’s sharper than your average sword, most fortunes? Poof — gone in three generations. It’s a classic case of poor planning meets a shortage of financial smarts.

At Top Wealth Guide, we’ve cracked the code… Wealth transfer done right? It’s the lovechild of savvy tax moves and gearing up your heirs for the big game. Nail the strategy, and you’re not just a financial super-parent; you’re the myth, the legend, who preserved a legacy and turned future progeny into asset-managing ninjas.

In This Guide

What Estate Planning Tools Actually Work for Wealth Transfer

Estate planning-what’s the secret sauce? Just three fundamentals: trusts that cradle your assets, gift strategies that milk those tax benefits, and legal docs that can fight off any legal buzzards. Oh, and here’s a kicker-the estate tax exemption is at a whopping $13.99 million per person as of 2025, but then it dives to about $6.4 million once we hit January 1, 2026. Families in the know, they’re moving now before these numbers head south.

Trusts That Move the Needle

Revocable trusts-do the basics. But if you’re looking for tax ninja moves, you want irrevocable trusts. Grantor retained annuity trusts? Perfect for things that are gonna appreciate, sliding future growth over to the kids while you hang on to those juicy income streams. Spousal lifetime access trusts? That’s your ticket if you’re married-tap both exemptions and still keep a little access to your pot.

Want to bypass your kiddos’ estate taxes and get that moolah to the grandkids? Say hello to generation-skipping trusts. These were cooked up in 1976 to keep the big fish from dodging estate taxes with every generation. Each trust is like a custom suit-pick the one that fits your assets rather than some off-the-rack advice.

Gift Tax Strategy That Maximizes Every Dollar

Here’s the deal-2025 gives you a $19,000 per-person gift exclusion ($38,000 if you’re married). Chip in directly for medical bills and tuition without limits if you pay the provider-no cap there. And how about those upstream gifts to the oldies in the family? They can reset the cost basis with a stepped-up valuation when they kick the bucket, though you give up control over those goodies.

Family limited partnerships-a nifty way to hand over discounted interests in a biz while staying in the driver’s seat. The MVP move? Juggle a cocktail of strategies instead of betting all your chips on one.

Essential Legal Documents That Hold Up

Wills? That’s your bedrock. But it’s powers of attorney that keep you covered when the lights go out upstairs. Financial power of attorney lets your go-to gal or guy manage your stuff when you’re out. Healthcare directives-spell out your medical do’s and don’ts to dodge family drama over the plug-pulling decision.

These doc must-haves need to dance with state laws, signed, sealed, delivered-with witnesses and all that jazz. Keep tweaking them after life’s curveballs so they’re ready to rock when your clan needs them most.

Crafting a tax-savvy wealth transfer system starts here, building up to a giant Jenga tower of advanced strategies.

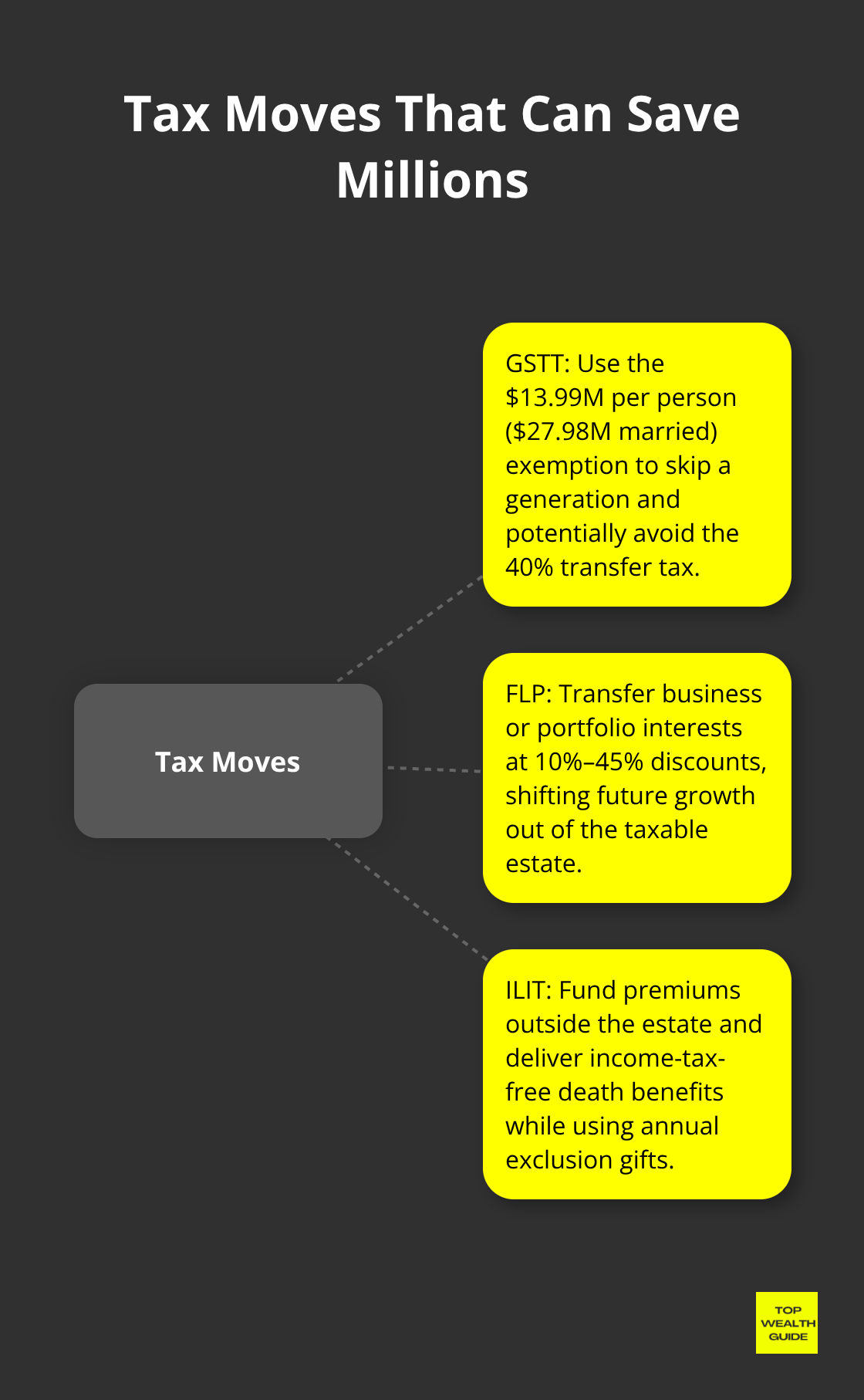

Which Tax Moves Actually Save Millions

Generation-skipping transfer tax exemptions deliver serious ammo for grandparents calling the shots with $13.99 million or more. So here’s the deal – the GSTT lets you leapfrog right over your kids’ estate and make a beeline to the grandkids, minus that draconian 40% tax blow. Each grandparent gets the full exemption, so if you’ve hitched your wagon to someone, that’s $27.98 million you can slide to the next gen without the tax man getting a cut. The savvy players stash this exemption with high-octane growth assets – think startup equity or sizzling real estate markets.

But here’s the kicker: the IRS has its magnifying glass out on every dollar of exemption used, so seal the deal with Form 709 before your assets go ballistic.

Family Limited Partnerships Slash Valuations by 30%

Family limited partnerships – get this – can chop asset values thanks to juicy discounts for lack of control and marketability, and the IRS doesn’t bat an eye. Parents funnel business interests or whopper investment portfolios into the FLP, then dole out limited partnership units to the kiddos at rock-bottom prices – slashed anywhere from 10% to 45% below what you’d see on the open market, depending on a few moving parts. Mom and pop keep the helm of the general partnership while booting future growth out of the taxable estate. A $10 million real estate portfolio sneaked through an FLP could snag those sweet valuation discounts, pumping up your gift tax exemption mojo.

Life Insurance Multiplies Transfer Power

Irrevocable life insurance trusts – yeah, they’re the hacks that pump gift dollars into estate-tax-free jackpots for your heirs. So picture this: a spry 60-year-old plunks down $50,000 a year on premiums for a $2 million policy, zapping those premiums and death benefits out of the taxable estate equation. When the time comes, the death benefit swoops in tax-free for your beneficiaries, and those annual premium gifts? Nicely nestled under the $19,000 exclusion umbrella. Business owners with split-dollar arrangements can let their companies foot the premium bill while keeping a grip on cash values.

These tax strategies sing when paired with some no-nonsense financial smarts for your heirs…because hey, even the slickest tax-efficient transfer slips through the cracks if your progeny isn’t clued up on managing the windfall.

How Do You Prepare Heirs to Handle Inherited Wealth

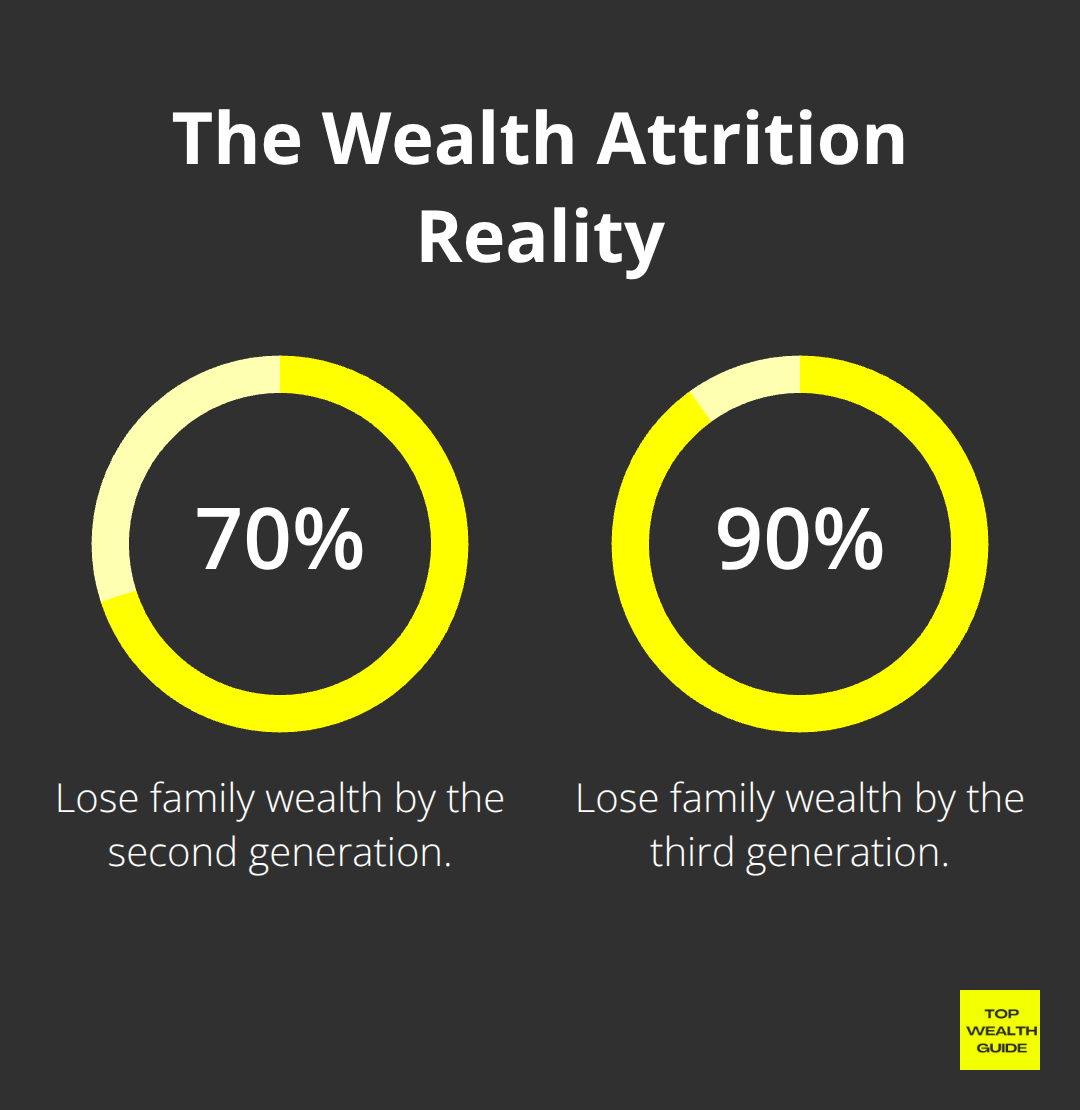

Here’s a sobering truth bomb: 70% of wealthy families lose their fortunes by the second generation; 90% by the third. Why? Heirs who have no clue how to handle the cash. It’s all about starting financial education early – like age 10 early. Families that chat about money sooner rather than later? They’re the ones keeping the assets in check.

Start With Real Money at Age 12

Forget the piggy bank charade. Hand those kids an actual investment account – yep, $1,000 at age 12. Let them dive into researching companies and pick three stocks they feel good about. Real-world portfolio management trumps fiddling with apps or simulations when it comes to financial literacy. Host monthly family investment pow-wows – each kid pitches their stock pick with some solid rationale behind it. Track how they’re doing, celebrate the wins, and, yep, the losses – it’s all education.

Create Investment Clubs Within Your Family

Monthly family investment clubs? They blow classroom lessons out of the water. Families who do internal investment challenges? Engagement goes through the roof compared to the snooze-fests of traditional talks. Start with a $10,000 family pot – each heir gets a slice and shows quarterly results. Loop in grandparents as coaches, switch up leadership every year. The winner? More capital to play with (everyone loves a little friendly competition and skill-building before the big bucks roll in).

Make Wealth Responsibilities Crystal Clear

Heirs need a playbook, not hazy aspirations. Draft up clear agreements on wealth responsibilities – who does what, minimum education goals, career paths, charity commitments. Families with these roadmaps reduce the chances of wealth going poof. Plan annual heir reviews – where performance gets the same scrutiny as any major family investment. Teach budgeting, investing, and responsible management during these reviews to keep everyone on track and committed to long-term goals.

Final Thoughts

So, here’s the deal: nailing wealth transfer isn’t rocket science, but it does rest on three biggies-smart tax moves, airtight legal setups, and educating the heirs on money stuff. Families who dodge the 70% wealth-transfer crash-and-burn? They nail all three, at once. We’re talking irrevocable trusts, generation-skipping voodoo, and fancy family limited partnerships while making sure their kids know the money ropes by age 12.

Here’s where the plot thickens: professional help is essential when those $13.99 million exemptions (ouch) shrink to $6.4 million in 2026. Estate gurus, tax whizzes, and wealth sherpas-they’re the ones stopping costly blunders that could unravel decades of clever planning. These folks are in the know about rule changes that families snooze through. Also, let’s not forget about keeping the family talk alive-heirs who get their roles and keep learning money smarts are the real wealth keepers.

Get cracking on your wealth transfer game, like, yesterday. Get your asset ducks in a row, set up basic trusts, and kick off those annual gifting plans. We’re at Top Wealth Guide, dishing out the practical insights and strategies to forge family wealth that laughs in the face of that third-generation jinx.