For many, the concept of financial freedom feels like a distant dream. But for a dedicated online community, it's a tangible goal with a surprisingly clear roadmap. This community thrives on Reddit—specifically, in subreddits like r/financialindependence, which serves as a massive, collaborative hub for achieving a life where work is optional.

With over 1.2 million members, r/financialindependence is more than just a forum; it's a public think tank where people from all walks of life openly share their strategies, successes, and setbacks on the journey to retiring early. It's built on the principles of shared knowledge and mutual support, turning the abstract idea of financial independence into a step-by-step process.

In This Guide

- 1 Understanding the Reddit FIRE Community

- 2 The Core Beliefs Driving the FIRE Movement

- 3 Diving into Reddit's Top Financial Discussions

- 4 Learning the Language of Financial Independence

- 5 Inspiring Journeys from Real People on Reddit

- 6 How to Become a Valued Community Member

- 7 Your Questions About Financial Freedom Reddit Answered

- 7.1 1. Is the FIRE movement only for high earners?

- 7.2 2. What is the go-to investment strategy on these subreddits?

- 7.3 3. How do I calculate my "FI Number"?

- 7.4 4. How is r/financialindependence different from r/personalfinance?

- 7.5 5. Do I need to be extremely frugal to achieve FIRE?

- 7.6 6. What if I don't want to retire early? Is this community still for me?

- 7.7 7. Is the advice on Reddit reliable?

- 7.8 8. How do I handle market downturns?

- 7.9 9. What are the biggest mistakes beginners make?

- 7.10 10. Where should I start if I'm a complete beginner?

Understanding the Reddit FIRE Community

The driving force behind the financial freedom Reddit is a concept called FIRE, which stands for Financial Independence, Retire Early. This isn't a get-rich-quick scheme. It's a disciplined, long-term approach to systematically building enough wealth to live off your investments, making a traditional 9-to-5 job completely optional.

At its core, the FIRE movement is built on a few simple but powerful pillars: maintaining a high savings rate, investing intelligently (usually in low-cost index funds), and spending money only on what truly adds value to your life. It’s a place where you'll find members sharing their actual numbers—net worth updates, budget breakdowns, and investment portfolios—all in the spirit of learning from each other's real-world journeys.

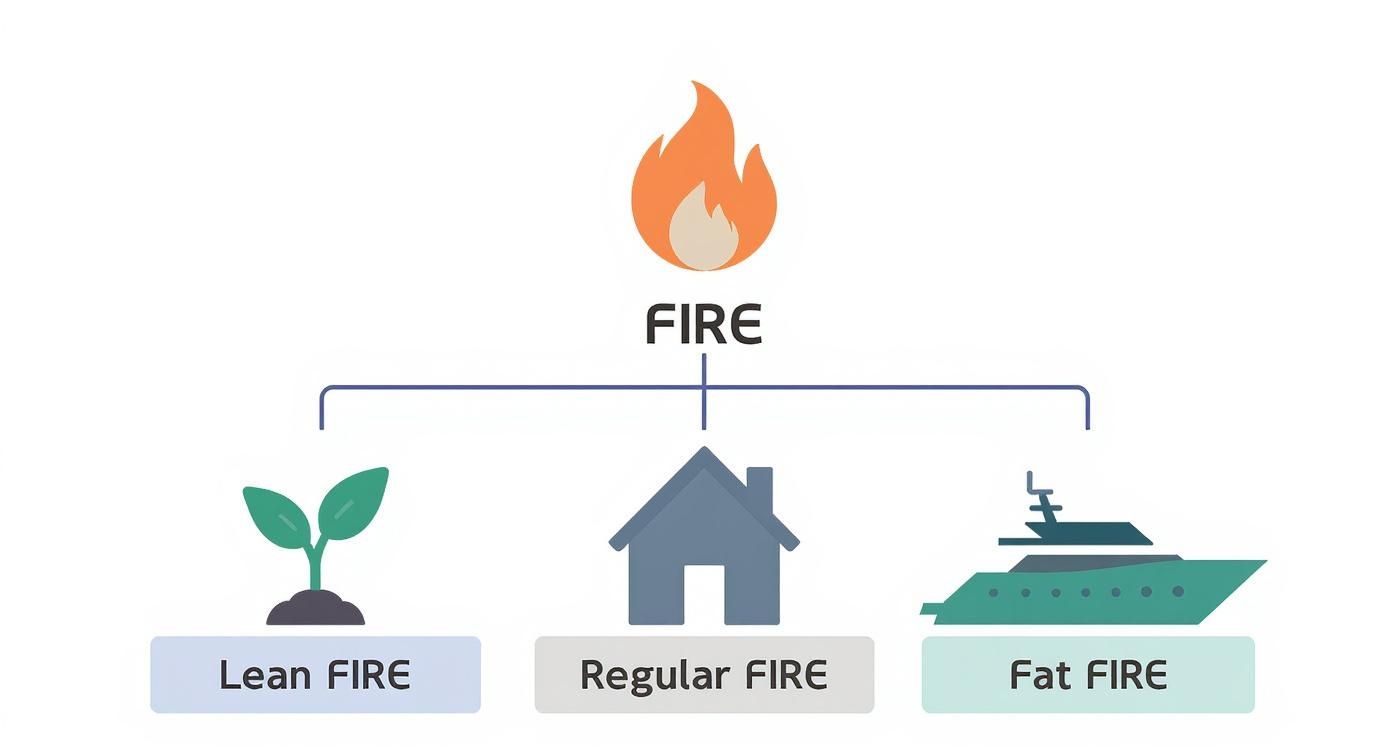

The Different Flavors of FIRE

The path to FIRE isn't one-size-fits-all, and the community has embraced that reality. Over time, several distinct approaches have emerged to match different lifestyles, income levels, and retirement goals.

Understanding the Different Paths to FIRE

Here’s a comparative look at the main FIRE philosophies you'll see discussed.

| FIRE Type | Core Philosophy | Typical Annual Spending in Retirement | Real-Life Example |

|---|---|---|---|

| Lean FIRE | Extreme frugality and minimalism to retire with a smaller nest egg. | Less than $40,000 | A single person living in a low-cost-of-living area who enjoys simple hobbies like hiking and reading, requiring a nest egg of $1M or less. |

| Regular FIRE | A balanced approach with a comfortable, middle-class lifestyle. | $40,000 – $100,000 | A couple with one child who wants to own a modest home, travel once a year, and maintain their current standard of living without lavish spending. |

| Fat FIRE | Amassing significant wealth for a luxurious retirement lifestyle. | More than $100,000 | A high-earning professional who wants to travel extensively in business class, own multiple properties, and enjoy expensive hobbies without financial constraints. |

This simple framework helps you see how different people are aiming for very different finish lines, even though they're all running the same race toward financial independence.

The diagram below gives you a nice visual breakdown of these different paths.

As you can see, each approach grows from the same core principles but branches out to accommodate different ambitions for life after work. By digging into these discussions, you’re not just reading about money; you're tapping into a powerful, supportive ecosystem that's focused on turning financial independence from a dream into a reality.

The Core Beliefs Driving the FIRE Movement

If you're looking for get-rich-quick schemes or risky stock tips, you've come to the wrong place. The r/financialindependence community isn't built on flimsy shortcuts. Instead, its members share a powerful commitment to a few core ideas that, when applied consistently, can turn a regular income into a life of freedom.

The first, and most striking, is a high savings rate. Forget the standard 10-15% advice you hear everywhere else. FIRE followers often shoot for saving 50% or more of their income. This isn't just about squirreling away more money; it's about fundamentally changing the timeline to financial independence.

This goes hand-in-hand with intentional spending. A common misconception is that this means living a life of extreme austerity—eating ramen noodles in a cold apartment. The reality is far more empowering. It’s about consciously directing your money toward what truly matters to you and ruthlessly cutting out the rest. Think of it as skipping the daily $7 latte to bankroll a month-long trip through Southeast Asia.

Making Your Money Work For You

The final piece of the puzzle is putting your savings to work. You can't save your way to true freedom. You have to invest. The community strongly advocates for long-term investing, primarily through low-cost, broad-market index funds. This is a "set it and forget it" approach that lets your money grow on its own.

This is where the real magic happens. By investing, you tap into the power of compounding—your money starts earning its own money. If that idea is new to you, we break down the magic of compound interest in another guide. This strategy is the engine that propels you toward your "FI number"—the nest egg you need to officially call yourself retired.

The core idea is simple: You are financially independent when 4% of your invested assets is enough to cover your annual living expenses. This is the foundation of the entire FIRE movement.

Calculating Your Financial Finish Line

This brings us to two of the most important concepts you'll see on the subreddit: the Safe Withdrawal Rate (SWR) and the 4% Rule. Born from historical market analysis, the 4% Rule is a guideline stating that you can safely withdraw 4% of your portfolio's value in your first year of retirement, adjust for inflation each year after, and have a high probability of never running out of money.

This simple rule gives you a clear target to aim for—your "FI Number."

Real-Life Example: Meet "Alex"

- Goal: Alex, a 30-year-old marketing manager, analyzes their budget and determines they need $60,000 a year to live comfortably in retirement. This covers housing, travel, healthcare, and hobbies.

- FI Number Calculation: Using the 4% Rule, Alex calculates their target: $60,000 / 0.04 = $1,500,000.

- The Finish Line: Alex's clear, actionable goal is to build an investment portfolio worth $1.5 million. Once they hit that number, the 4% Rule suggests they can live off their investments without ever having to work for money again.

Diving into Reddit's Top Financial Discussions

Jumping into the financial freedom community on Reddit feels like uncovering a goldmine of shared wisdom. While the number of posts can be overwhelming, a few key themes consistently pop up, forming the foundation of the subreddit’s most valuable conversations. These aren't just abstract ideas; they're a practical roadmap for anyone serious about financial independence.

One of the community's bedrock principles is an almost religious devotion to low-cost index funds. You’ll see tickers like VTSAX (Vanguard’s Total Stock Market Index Fund) mentioned constantly as the default choice. The thinking behind it is simple but incredibly effective: why try to beat the market when you can just own the market? Members would rather buy a tiny slice of everything and let long-term growth do the real work.

This hands-off investing approach goes hand-in-hand with a laser focus on tax efficiency.

Making Your Path to Wealth as Smooth as Possible

Reddit threads regularly break down the best ways to leverage tax-advantaged accounts to speed up the wealth-building process. We're not talking about boring tax code here. These are detailed, real-world discussions about how to legally shrink your tax bill so more of your money stays invested and compounding.

Here’s a comparative table of the accounts that get the most attention:

| Account Type | Key Advantage | The Go-To Reddit Strategy |

|---|---|---|

| 401(k) / 403(b) | Employer Match & High Contribution Limits | Contribute at least enough to get the full employer match—it's a 100% return on your money. Then, consider maxing it out if other options are exhausted. |

| IRA (Roth/Traditional) | More Investment Choices | Max out a Roth IRA if you are eligible. The tax-free growth and withdrawals in retirement are incredibly powerful, especially if you expect to be in a higher tax bracket later. |

| HSA (Health Savings Account) | The "Triple Tax Advantage" | Use it as a supercharged retirement account. Pay for current medical bills out-of-pocket if possible and let the HSA compound for decades, completely tax-free. |

It's Not Just About Saving and Investing

While a high savings rate is non-negotiable, the community is just as focused on the other side of the equation: earning more. You’ll find countless threads detailing smart career pivots, strategies for negotiating a bigger salary, and ideas for side hustles that actually make money. These discussions show how a bigger shovel can shorten your timeline to financial independence dramatically.

The appetite for these kinds of discussions is massive. According to the FINRA Foundation's National Financial Capability Study, a significant portion of the population is actively seeking ways to improve their financial standing, and forums like Reddit provide that peer-to-peer insight.

But these conversations are so much more than just charts and numbers. They're about real people changing their lives. Members share incredible stories of digging out from under a mountain of debt, celebrating their first $100k net worth, or finally walking away from a job they hated. These personal wins are what make the financial freedom subreddit so powerful, proving that with a good plan and some discipline, you can do it too. For more concrete advice, take a look at our guide on the best ways to build wealth.

Learning the Language of Financial Independence

Jumping into the financial freedom Reddit community for the first time can feel a little like walking into a conversation in a foreign country. You'll see acronyms and odd-sounding terms tossed around that look like a secret code.

But don't worry, you just need to learn the local dialect. Once you get a handle on the lingo, you unlock a much deeper understanding of the strategies being discussed. It’s the key to moving from the sidelines into the heart of the conversation.

Think of it like this: you can't build a house without knowing the difference between a stud and a joist. In the same way, you can’t build a solid financial plan without understanding the core vocabulary. This shared language is what makes the community tick, and it's a huge step in your own journey, which is exactly why financial literacy is the key to building wealth.

A Glossary for the Financial Freedom Reddit Community

To get you up to speed, here is a quick guide to the most common acronyms and terms you'll see on r/financialindependence and other related subreddits. This isn't just a list of definitions; it's your decoder ring for the core concepts that drive almost every discussion.

| Acronym/Term | Full Meaning | Why It's Important |

|---|---|---|

| FI / FIRE | Financial Independence / Financial Independence, Retire Early | This is the ultimate goal. FI means your assets generate enough income to cover your living expenses forever, so work becomes a choice, not a necessity. |

| NW | Net Worth | Your total assets (everything you own) minus your total liabilities (everything you owe). It’s the single most important metric for tracking your progress toward FI. |

| SWR | Safe Withdrawal Rate | The percentage you can safely withdraw from your investments each year in retirement without a high risk of depleting your principal. The community benchmark is 4%. |

| FI Number | Your Financial Independence Number | This is your target portfolio value needed to achieve FI. It's calculated as your annual expenses multiplied by 25 (or divided by your 4% SWR). |

| VTSAX | Vanguard Total Stock Market Index Fund | This specific fund is often used as shorthand for the community's preferred investment strategy: low-cost, broadly diversified index funds that track the entire market. |

| HSA | Health Savings Account | Often called a "secret IRA," this is a powerful retirement tool with a triple tax advantage: contributions are tax-deductible, it grows tax-free, and withdrawals for medical costs are tax-free. |

Getting comfortable with these terms is your first step from being a passive lurker to an active participant in your own financial future. You're now ready to join the conversation.

Inspiring Journeys from Real People on Reddit

Theories and acronyms are great for building a foundation, but let's be honest—the real magic of the financial freedom Reddit community comes from the stories. These are the real-world, anonymous case studies from actual users that prove financial independence isn't some abstract dream. It's a real, achievable goal for people from all walks of life.

These journeys are part motivation, part practical blueprint. They take the numbers and strategies off the page and show you what they look like in action, proving that with the right plan and a healthy dose of discipline, you can actually build a life where work becomes a choice, not a necessity.

Real-Life Example: The Frugal Teacher Couple Who Retired in Their 40s

One of the most powerful and relatable stories you'll find is that of the dual-income, no-kids (DINK) couple living on a totally normal salary. Picture this: a high school teacher and a librarian, with a combined income under $120,000, who managed to hang it all up in their late 40s.

They didn't do anything flashy. Their strategy was simple and effective. First, they went to war on their non-mortgage debt, wiping out student loans and car payments in just three years. Then, they started socking away over 50% of their take-home pay, plowing it into low-cost index funds in their 403(b) and IRA accounts. By living simply and refusing to let their lifestyle creep up, their net worth hit the $1 million mark in under two decades. It's a fantastic testament to the power of consistency over a huge income.

Real-Life Example: The Tech Worker Who Maxed Out Investments

On the other end of the spectrum, you'll see stories from the high-income tech world. One software engineer, pulling in $180,000 a year, managed to hit her financial independence number in a little over a decade. Her path was all about aggressive optimization.

From her very first paycheck, she maxed out every single retirement account she could get her hands on: her 401(k), her HSA, and a backdoor Roth IRA. That move alone put over $30,000 of her pre-tax income to work for her every year. Every dollar left over, including bonuses and stock grants, went straight into a taxable brokerage account. Her biggest battle wasn't financial, but psychological—fighting the urge to spend like her high-earning peers. By staying laser-focused, she built a $1.5 million portfolio by age 35, showing how a high income, when you handle it right, can put your FI journey on hyperdrive.

Real-Life Example: The Entrepreneur Who Scaled a Side Hustle

Then you have the entrepreneurs, the people who build their own path to freedom. One of my favorite stories is about an office manager who started a small e-commerce business on the side, hoping to make an extra $500 a month. Fast-forward five years, and that little weekend project had blossomed into a real business generating over $100,000 in annual profit.

Here’s the brilliant part: instead of letting that new income inflate his lifestyle, he invested 100% of it. This turbocharged his savings rate and helped him stack his first six figures in what felt like no time. For anyone inspired by this, learning how to save your first $100k is a huge milestone that these stories often revolve around. His journey is a perfect reminder that earning more can be just as potent as spending less.

How to Become a Valued Community Member

If you want to get the most out of the financial freedom Reddit community, you've got to do more than just scroll. The real magic happens when you shift from being a passive reader to an active, helpful participant. This isn't about being a financial guru; it's about engaging in a way that helps everyone—including you.

The absolute first step, and it's non-negotiable, is to read the sidebar and the wiki. Seriously. The moderators and seasoned members have poured thousands of hours into creating a goldmine of information that answers just about every basic question you could think of.

Skipping this step is like walking into a restaurant and asking the chef for a recipe that's already printed right on the menu. It signals you haven't done the bare minimum, and your questions might get ignored.

Asking Questions That Actually Get Answered

Once you've done your homework, you're ready to ask much smarter questions. You'll find that vague posts like "How do I start investing?" tend to get crickets because they're too broad and have been answered a million times.

The trick is to frame your questions with specific details. This simple act respects everyone's time and, more importantly, attracts insightful, personalized advice from people who are happy to help.

Here’s a quick comparison of what works and what doesn't:

| Poor Question Structure | Strong Question Structure |

|---|---|

| "What should I invest in?" | "I'm 28 with a $15k emergency fund and no debt. I can invest $500/month. Should I prioritize maxing my Roth IRA or contributing to my taxable brokerage account first?" |

| "Is my savings rate good?" | "My take-home pay is $4,200/month, and I'm saving $1,800. With my goal of FI in 20 years, is a 43% savings rate aggressive enough to reach a $1.2M goal?" |

Giving Back to the Community

Being a great community member isn't a one-way street. It's just as much about sharing your own story as it is about asking for help. You don't need to be a millionaire to have something valuable to contribute.

A core belief on the financial freedom Reddit is that every person's experience is a valuable data point. Sharing your monthly budget, a small win, or even a mistake you learned from can be incredibly helpful for someone else just starting out.

Jump into the daily or weekly discussion threads. These are the perfect low-pressure spots to share your progress, ask smaller questions, and celebrate milestones. By offering a bit of support and sharing your journey, you'll go from a lurker to a genuinely respected member of the group.

Your Questions About Financial Freedom Reddit Answered

Diving into the world of financial freedom on Reddit can feel like learning a new language. Let's break down some of the most common questions people have when they first discover the community, so you can get your bearings and start your journey with confidence.

1. Is the FIRE movement only for high earners?

Absolutely not. It's easy to assume that the FIRE movement is a club for six-figure software engineers and doctors, but that’s a huge misconception. The core philosophy isn't about how much you make—it’s about your savings rate. The subreddit is packed with success stories from people in all sorts of professions, like teachers, nurses, and government employees. It’s proof that discipline and consistency can easily outperform a massive salary that isn't managed well.

2. What is the go-to investment strategy on these subreddits?

If you spend any time on r/financialindependence, you'll see a clear winner for investment strategy: low-cost, broad-market index funds and ETFs. Think funds like VTSAX or VTI that track the entire market. This passive approach is loved for its simplicity, built-in diversification, and historically reliable long-term growth. The community consensus is to avoid market timing or stock picking and instead embrace a "set it and forget it" mindset.

3. How do I calculate my "FI Number"?

Your "FI Number" is the amount you need in your investment portfolio to become financially independent. The community relies on a straightforward rule of thumb based on the 4% Safe Withdrawal Rate (SWR). To calculate your FI Number, multiply your expected annual expenses in retirement by 25. For example, if you need $50,000 a year, your target FI Number would be $1,250,000 ($50,000 x 25).

4. How is r/financialindependence different from r/personalfinance?

Both subreddits are fantastic resources, but they have different focuses. Think of r/personalfinance as the all-purpose hub for money management—it covers everything from building a budget and improving your credit score to getting out of debt. In contrast, r/financialindependence is laser-focused on the specific strategies, mindset shifts, and calculations needed to reach financial independence and have the option to retire early. It's the advanced course for those ready to accelerate their wealth-building.

5. Do I need to be extremely frugal to achieve FIRE?

No. While frugality is a tool many use, especially for "Lean FIRE," it's not a requirement for everyone. The key is intentional spending—directing money toward things that bring you value and cutting waste elsewhere. For someone on a high income, reaching "Fat FIRE" might involve very little frugality at all. The goal is to optimize your savings rate in a way that is sustainable for you.

6. What if I don't want to retire early? Is this community still for me?

Yes! Many members aren't aiming to stop working entirely. For them, Financial Independence (FI) is about having the freedom to choose their work. It could mean switching to a lower-paying but more fulfilling career, starting a passion business without financial pressure, or working part-time. FI gives you options beyond the traditional retirement path.

7. Is the advice on Reddit reliable?

The financial freedom subreddits have strong moderation and a community that self-corrects misinformation. However, it is still an anonymous public forum. Always treat the advice as a starting point for your own research. Use the community's wisdom to learn concepts, but verify specific financial advice with trusted sources or a qualified professional.

8. How do I handle market downturns?

The overwhelming advice from the community is to stay the course. The FIRE strategy is built on long-term investing, which assumes market volatility. Members often share historical data and personal anecdotes to encourage others to avoid panic-selling during a downturn, viewing it instead as an opportunity to buy assets at a discount.

9. What are the biggest mistakes beginners make?

Common mistakes discussed on Reddit include: lifestyle inflation (increasing spending as income rises), trying to time the market, paying high fees for actively managed funds instead of low-cost index funds, and neglecting to build an emergency fund before investing aggressively.

10. Where should I start if I'm a complete beginner?

The best place to start is the sidebar/wiki on the r/financialindependence subreddit. It contains a curated list of foundational posts, flowcharts, and recommended reading. Absorb that information first, then lurk in the daily discussion threads to see how the principles are applied in real life before you post your own questions.

At Top Wealth Guide, we provide the tools and knowledge you need to turn these concepts into a concrete plan. From in-depth investment guides to practical wealth-building strategies, we're here to support every step of your journey. Explore our resources and start building your financial future today.