So, what is financial freedom? Simply put, it's the point where your assets generate enough income to cover all your living expenses, freeing you from the necessity of trading your time for money in a traditional job.

It’s less about being "rich" in the conventional sense and more about owning your time and your choices. It's the power to design a life that truly aligns with your values, not just your financial obligations.

In This Guide

- 1 What Financial Freedom Really Means for You

- 2 The Four Pillars of Wealth Creation

- 3 The Environment You Grow In Matters

- 4 How to Master Your Cash Flow Engine

- 5 Making Your Money Work for You Through Investing

- 6 How to Protect Your Financial Foundation

- 7 Frequently Asked Questions About Financial Freedom

- 7.1 1. How much money do I actually need for financial freedom?

- 7.2 2. Is it too late for me to start in my 40s or 50s?

- 7.3 3. What is the single most important first step?

- 7.4 4. What's the difference between being "rich" and being financially free?

- 7.5 5. What are the biggest mistakes people make on this journey?

- 7.6 6. Should I pay off debt or invest first?

- 7.7 7. Is financial freedom possible on a low income?

- 7.8 8. What is the FIRE movement?

- 7.9 9. How does inflation affect my financial freedom number?

- 7.10 10. Do I need a financial advisor to achieve financial freedom?

What Financial Freedom Really Means for You

It's easy to picture financial freedom as a life of flashy cars and massive houses, but that's a narrow, often misleading, view. The real goal is autonomy. It's having the power to make major life decisions—like changing careers, traveling the world, or starting a business—without your bank account having the final say. You achieve this when your money starts working for you, instead of the other way around.

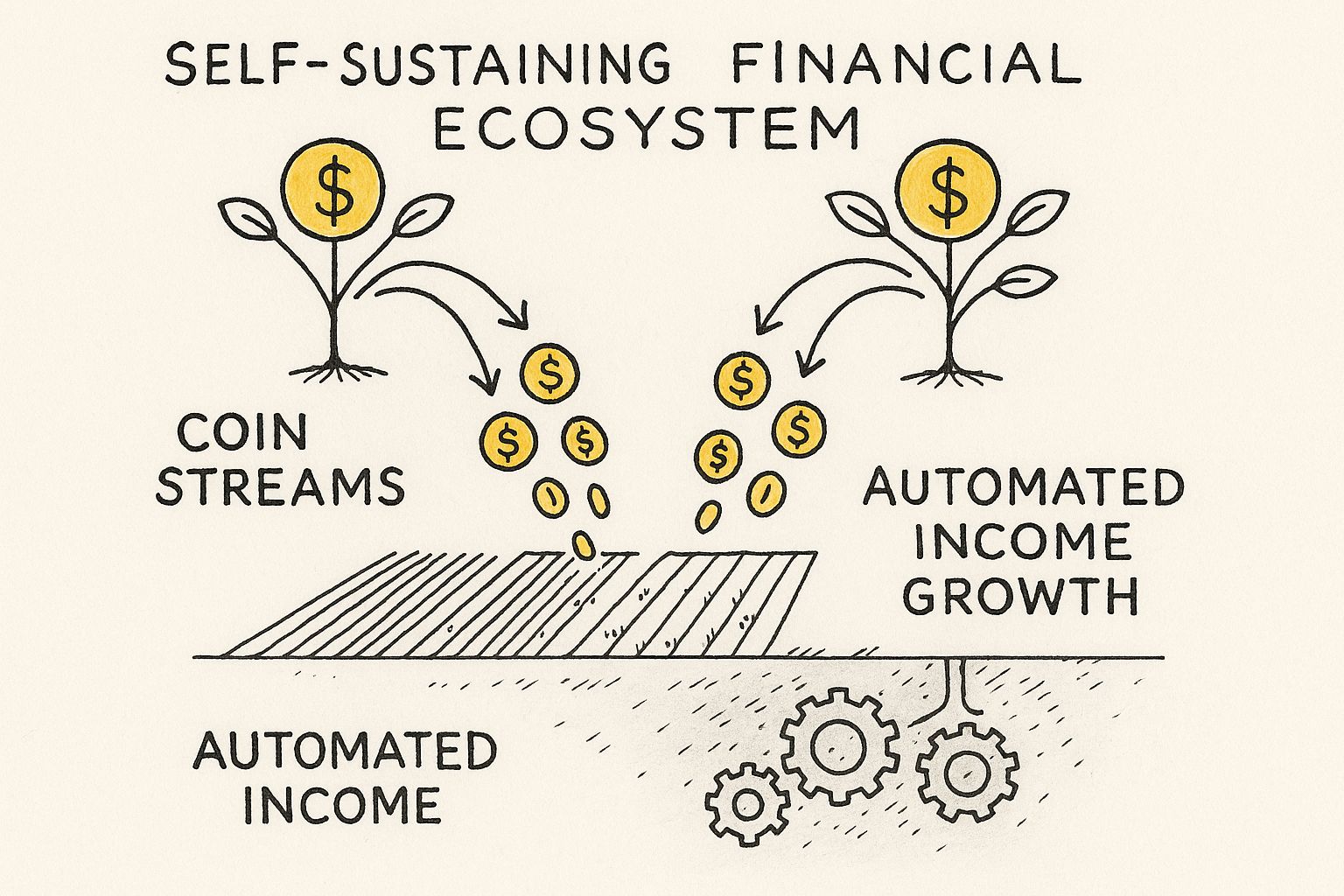

Think of it like building a personal financial engine. At first, you're the one supplying all the fuel by saving and investing. Over time, those investments—whether they're dividend-paying stocks, a rental property, or a profitable side hustle—start generating their own power. Eventually, that engine can run and even grow on its own, freeing you from having to show up every day just to keep things going.

This infographic breaks down how all the different pieces fit together to create that self-powering system.

As you can see, it’s not about just one thing. True financial freedom comes from a network of income streams and growth strategies working in harmony to support the life you want.

The True Benefits of Financial Freedom

The biggest payoff isn't the number in your bank account—it’s the incredible upgrade to your quality of life. This journey is just as much about personal growth as it is about growing your net worth. If this idea resonates with you, we have a whole guide on how to define wealth beyond money and possessions.

Here’s what you’re really working toward:

- Less Stress and Anxiety: Let's be real, money is a huge source of stress. A 2023 study found that a staggering 77% of Americans feel anxious about their finances. Financial freedom acts as a powerful safety net, giving you peace of mind that your bills are paid no matter what.

- More Time for What Matters: This is the big one. You get to reclaim your most precious, non-renewable resource: time. Imagine having the bandwidth to actually be present with your family, dive deep into a hobby you love, travel without a return date, or volunteer for a cause that lights you up.

- Greater Career Flexibility: Once you're not dependent on a paycheck for survival, your career options explode. You can afford to take calculated risks, like starting that business you've been dreaming of, switching to a more fulfilling but lower-paying field, or simply taking a year off to recharge.

Financial freedom is the ultimate expression of personal liberty. It’s not about escaping work; it’s about having the power to choose the work you love, on your own schedule, for reasons that matter to you.

Ultimately, this is about getting to a place where your life is shaped by your values, not your financial obligations.

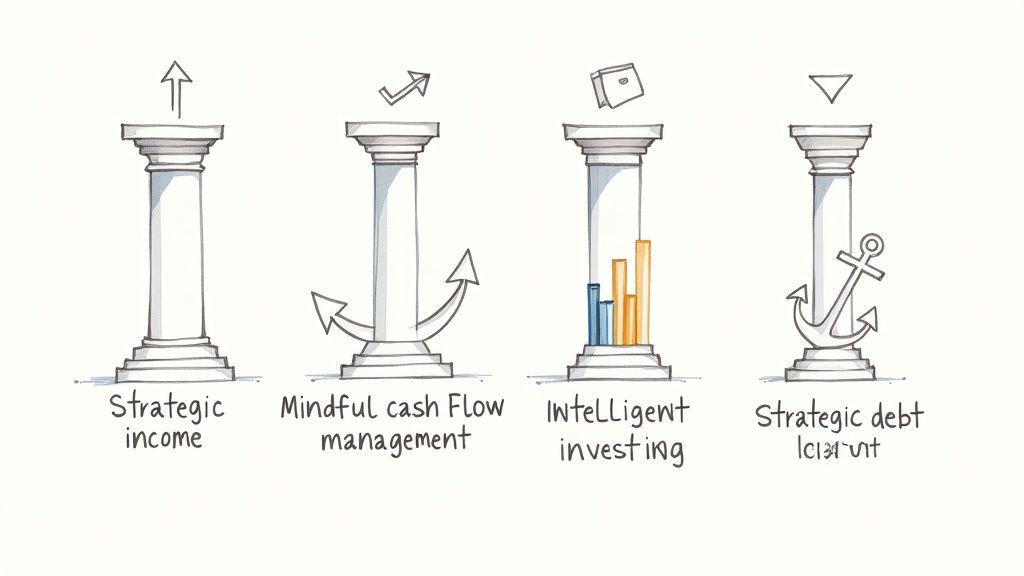

The Four Pillars of Wealth Creation

The path to financial freedom can sometimes feel like you’ve been asked to build a skyscraper without a blueprint. It's overwhelming. But once you realize it's built on just four core pillars, the entire process becomes much clearer and far more achievable.

Think of it like building a sturdy table. If one leg is wobbly or too short, the whole thing is unstable. When all four legs are strong and balanced, you've created a solid foundation that can support your financial goals for a lifetime. Let's break down what those four legs are.

1. Strategic Income Expansion

The first pillar is all about what’s coming in. It’s the engine of your wealth-building machine. For most of us, this starts with our day job, but to really pick up speed, you have to look beyond a single paycheck. This means getting proactive about diversifying how you earn money.

Here's how that looks in practice:

- Active Income: This is about maximizing your primary earner. Think negotiating a raise, learning a new skill that makes you more valuable, or even making a career change into a higher-paying field.

- Side Hustles: Adding a second income stream—like freelance writing, consulting on the weekends, or a small e-commerce shop—gives you an immediate cash injection and a fantastic financial safety net.

- Scalable Income: This is the game-changer. It’s about creating income that isn’t tied directly to the hours you work. Think selling a digital course, earning royalties from a book, or building a business that can run without you.

2. Mindful Cash Flow Management

If income is your engine, then your cash flow is the fuel. It’s simply the money left over after all your expenses are paid each month. Without this surplus, you have nothing to put to work—no money to save, invest, or throw at debt.

It doesn't matter how powerful your engine is; without fuel, you're stuck on the side of the road. The goal here is to consciously and consistently widen the gap between what you earn and what you spend.

3. Intelligent Investing

This is where things get exciting. Investing is the pillar that puts your money to work for you, instead of the other way around. It’s the process of taking your surplus cash and buying assets—like stocks, real estate, or bonds—that can grow in value or generate their own income over time.

The real power of investing comes from compound growth. This is where your investment returns start earning their own returns, creating a snowball effect that can turn small, consistent contributions into serious wealth over the long haul.

Once you’re ready to put this pillar into practice, a great next step is to explore the best ways to build wealth through different investment options.

4. Strategic Debt Elimination

The final pillar is about cutting off the things that are dragging you down. While not all debt is bad, high-interest debt—especially from credit cards and personal loans—is like a heavy anchor holding your financial ship in place.

This kind of debt actively works against your progress. Every dollar you pay in interest is a dollar you can't use to build your future. A laser-focused plan to pay it off is non-negotiable if you want to free up your money and accelerate your journey.

Real-Life Example: The Four Pillars in Action

Meet Sarah, a 30-year-old marketing manager earning $70,000. She felt stuck, living paycheck to paycheck with $15,000 in credit card debt. Here’s how she applied the four pillars over two years:

- Income Expansion: Sarah started a freelance social media consulting business on evenings and weekends, bringing in an extra $1,000 per month.

- Cash Flow Management: She tracked her spending and realized she was wasting nearly $400/month on unused subscriptions and impulse online shopping. She cut those costs and redirected the money.

- Debt Elimination: She used the "avalanche method," aggressively paying down her highest-interest credit card first with her new freelance income and saved cash. She became debt-free in 18 months.

- Intelligent Investing: Once the debt was gone, she automated a $500 monthly investment into a low-cost S&P 500 index fund, starting her compounding journey.

Sarah didn't become a millionaire overnight, but by strengthening all four pillars, she transformed her financial reality from one of stress to one of control and forward momentum.

The Environment You Grow In Matters

Your journey to financial freedom doesn't happen in a bubble. A master gardener knows you can’t grow thriving plants in bad soil, and the same idea applies to your money. Your financial success is deeply connected to the economic environment you live and work in.

Think of it like this: your savings, investments, and business ventures are the seeds you plant. A stable economy that respects individual rights and has clear, fair rules is the rich soil, consistent sunlight, and steady rain those seeds need to grow. When the conditions are right, your potential for growth isn't just possible—it's amplified.

This isn't some abstract theory. It’s a reality we can see and measure, and it’s what separates prosperous nations from those that struggle. The very same principles that create a healthy national economy are the ones you can mirror to build a healthy personal financial plan.

What Is Economic Freedom, Really?

At its heart, economic freedom is simply the ability to make your own financial choices without the government getting in your way unnecessarily. It’s your right to own property, to work or start a business, to trade freely, and to trust that the money in your pocket will be worth something tomorrow.

When these things are in place, they create a predictable and trustworthy environment. People are more willing to take the risk of starting a new business. Investors feel confident putting their money to work. Everyone can plan for the future with a greater sense of security. This is the stage on which personal financial freedom is built.

The data is impossible to ignore. There's a powerful link between economic freedom and prosperity. According to the Fraser Institute's Economic Freedom of the World 2025 Annual Report, nations in the top quarter for economic freedom had an average per capita GDP of $66,434 in 2023. Meanwhile, those in the bottom quarter averaged a mere $10,751. You can dig into the numbers yourself in the full Fraser Institute report.

The connection here is vital. The systems that allow a country to flourish are the same ones that give you the best odds of building your own wealth. Your financial plan is supercharged when it operates within a system that rewards hard work, smart decisions, and innovation.

How Big-Picture Economics Shapes Your Wallet

Once you grasp this link, you start to see why certain financial strategies are so effective. It’s about more than just balancing your checkbook; it’s about aligning your personal habits with proven principles of growth.

Let's break down how these big economic ideas translate directly into the small, everyday habits that build real wealth.

| Big-Picture Principle (Macro) | Your Personal Habit (Micro) | The Impact on Your Freedom |

|---|---|---|

| Rule of Law & Property Rights | Legally protecting your assets (e.g., wills, trusts). | Your wealth is secure and can be passed on as you intend. |

| Sound Money & Stable Currency | Avoiding high-interest debt; managing your cash flow. | Your spending power is protected and your savings actually grow. |

| Freedom to Trade Internationally | Diversifying your investments across global markets. | Your portfolio can better weather downturns and tap into new growth. |

| Regulation that Fosters Competition | Building multiple income streams and new skills. | You aren't reliant on a single employer, which boosts your security. |

By building these macro principles into your personal financial life, you’re doing more than just managing money. You're cultivating your own fertile ground for sustainable growth, giving yourself the absolute best shot at achieving lasting financial freedom.

How to Master Your Cash Flow Engine

At its core, financial freedom boils down to a pretty simple formula: you need to earn more than you spend. That gap between your income and your expenses? That's the fuel for your wealth-building engine.

Let’s get beyond the usual vague advice. This section is about giving you a practical framework to widen that gap, putting you firmly in control of your financial future. To do this right, you have to tackle the equation from both sides—first by strategically growing your income and then by thoughtfully optimizing your spending.

From Linear Work to Scalable Income

Most of us start out by trading our time directly for money. An hour of work for an hour of pay. This is linear income, and its biggest flaw is that if you stop working, the money stops coming in. To truly build wealth, you need to focus on creating scalable income streams.

Think of these as assets that make money for you, whether you’re actively working or not.

Let’s take a graphic designer as an example. She could spend her entire career designing logos for individual clients, trading hours for dollars. That's the linear path. Or, she could take her expertise and create an online course that teaches others logo design. After the initial work is done, that course can sell thousands of times over, generating income while she sleeps. That’s the magic of scalability.

The mindset shift is moving from being a service provider to an asset creator. It doesn't matter if it's an ebook, a portfolio of dividend stocks, or a piece of software—you're building an engine that works for you.

The goal isn't just to work more; it's to build systems that work for you. Scalable income is the mechanism that separates your earnings from your time, unlocking the potential for true wealth.

This difference is so crucial that it’s worth breaking down side-by-side.

Comparison: Linear vs. Scalable Income

| Characteristic | Linear Income (e.g., Salary, Hourly Wage) | Scalable Income (e.g., Royalties, Dividends, Online Course Sales) |

|---|---|---|

| Effort to Income Link | Directly tied. More hours worked equals more pay. | Delinked. Initial effort creates an asset that earns passively. |

| Growth Potential | Capped by the number of hours you can physically work. | Virtually unlimited. Can grow exponentially without more work. |

| Time Commitment | Constant and ongoing to maintain income. | Heavy upfront, but minimal maintenance once established. |

| Risk Profile | Perceived as low risk, but highly dependent on one employer. | Higher initial risk, but creates diversification and security. |

As you can see, while a salary feels safe, it’s entirely dependent on one source. Scalable income streams create a much more resilient financial foundation over the long term.

Optimizing Spending with Value-Based Budgeting

Now for the other side of the equation: your spending. Traditional budgeting gets a bad rap because it often feels like a chore focused on cutting out every small joy. A much smarter and more sustainable method is value-based spending.

It’s a system designed to align your money with what you actually care about.

Instead of asking, "How can I cut back?" the question becomes, "Does this purchase get me closer to the life I want?" It's a powerful shift in perspective.

This allows you to spend generously—even lavishly—on the things you truly love, like travel or continuing education, while ruthlessly cutting costs on things that just don't matter to you. Think expensive daily coffees or designer labels you don't really care about. It isn't about depriving yourself; it's about being intentional.

Here’s a simple way to get started:

- Identify Your Top 3-5 Values: What’s most important to you? Is it security, adventure, family, or personal growth?

- Review Your Last 3 Months of Spending: Go through your bank statements, categorize everything, and see how well your spending actually lines up with those values.

- Create "Guilt-Free Spending" Categories: Earmark a generous portion of your budget specifically for your top values.

- Automate and Minimize Everything Else: Find ways to systematically reduce or completely eliminate spending on the things that don't make the cut.

This approach turns your budget from a financial straitjacket into a blueprint for building a life you’re excited about. If you want to dive deeper, our guide on why cash flow management is crucial for wealth building explores more advanced strategies.

By pairing scalable income with intentional, value-based spending, you create a powerful and sustainable cash flow engine that will propel you toward financial freedom.

Making Your Money Work for You Through Investing

If managing your cash flow is the engine of your financial life, then investing is the accelerator. It’s the most powerful tool you have to turn your hard-earned savings into genuine, life-changing wealth. The secret sauce here is compound growth—the almost magical process where your money starts making its own money.

Think of it like a small snowball at the top of a very long, snowy hill. As it starts rolling, it picks up more snow, getting bigger and moving faster. Your initial investment is that first little snowball, and the returns it generates are the extra snow it picks up along the way. Given enough time, that snowball can become an unstoppable force.

This is exactly how small, consistent contributions can eventually balloon into a sum large enough to give you financial freedom. It’s not about timing the market perfectly or finding that one lottery-ticket stock. It's about patience, discipline, and letting time do the heavy lifting.

Demystifying Common Investment Tools

The investing world can seem intimidating, full of jargon designed to keep people out. But the truth is, some of the most effective tools are refreshingly simple. For most of us on this journey, the best options are usually index funds and Exchange-Traded Funds (ETFs).

Imagine building a championship basketball team. You wouldn’t bet your entire budget on one superstar who could get injured tomorrow. You’d build a deep, balanced roster with players who have different skills. That’s what a diversified portfolio does for your money.

| Investment Tool | How It Works | Key Benefit for Financial Freedom |

|---|---|---|

| Index Funds | A type of mutual fund that passively tracks a market index, like the S&P 500. You own a small piece of every company in that index. | Provides instant, broad diversification at a very low cost. It's the ultimate "set it and forget it" strategy. |

| ETFs | Similar to index funds but trade like individual stocks on an exchange. Can track broad markets, specific sectors, or even commodities. | Offers the diversification of an index fund with the flexibility of a stock, allowing for more targeted investment strategies. |

The goal isn’t to become a Wall Street wizard. It’s to build a resilient, well-rounded portfolio that grows steadily and protects you from the rookie mistake of putting all your eggs in one basket.

The Bigger Picture Your Investments Depend On

No matter how brilliant your personal investing strategy is, it still needs a stable economic environment to succeed. Responsible government fiscal policies create the fertile ground where your investments can actually grow. When countries mismanage their finances, it introduces risk that affects everyone.

The Heritage Foundation’s 2025 Index of Economic Freedom flagged a worrying trend: while global economic freedom is up slightly, fiscal soundness has gotten significantly worse worldwide. Growing government deficits and massive public debt can choke off the economic growth that fuels wealth creation. Countries that keep their financial house in order consistently see higher incomes and a healthier environment for investors. You can dive into the complete analysis in the 2025 Index of Economic Freedom report.

How to Overcome the Fear of Starting

For most people, the biggest obstacle isn't a lack of money—it's the fear of making a mistake. But here's the reality: you can start with almost any amount. Modern brokerage apps have made it possible to invest with as little as $5.

The real key is to just start. Every day you put it off is a day you miss out on the power of compounding. If you’re ready to take that first step but feel a little lost, our simple guide on how to start investing money walks you through the entire process. Remember, the path to financial freedom is paved with consistent action, not perfect timing.

How to Protect Your Financial Foundation

It’s one thing to build wealth, but it's another thing entirely to keep it. The journey to financial freedom doesn't stop once you've accumulated assets; you have to build a fortress around them. Real, lasting security comes from having smart systems in place to manage risk and shield what you've built from life’s curveballs.

Many people get so caught up in the excitement of investing and watching their income grow that they forget this crucial step. But this protective layer is the very bedrock of your financial house. Without it, you’re building on sand, and one bad storm could wash away years of hard work.

Building Your Financial Shock Absorbers

Your first line of defense is an emergency fund. Let’s be clear: this isn't an investment designed for growth. It’s your financial shock absorber. This is a dedicated stash of cash, usually 3-6 months' worth of essential living expenses, parked in a high-yield savings account where you can get to it quickly.

When an unexpected job loss, a surprise medical bill, or a busted water heater happens, this fund lets you handle the crisis without derailing your long-term investments or resorting to high-interest credit card debt.

Once your cash cushion is in place, insurance becomes the next critical layer.

- Health Insurance: A major health crisis is one of the quickest ways to wipe out a lifetime of savings. Good health coverage isn't a luxury; it's a necessity.

- Disability Insurance: This protects your single greatest asset—your ability to earn an income. If an injury or illness keeps you from working, it provides a steady paycheck to keep your financial plan on track.

Securing Your Legacy with Legal Protections

Think about how a country's stability relies on a strong legal system. The 2025 Freedom and Prosperity Index from the Atlantic Council found that a nation's legal framework is the single best predictor of its prosperity. Countries with a reliable rule of law simply have stronger economies and better property rights. You can dive deeper into how these systems foster stability in the full Atlantic Council report.

That exact same principle applies to your personal finances. Your estate plan—which includes your will, trusts, and power of attorney—is your personal rule of law. It dictates exactly how your assets are managed and passed on, protecting your family’s future.

Without these documents, you're leaving your life's work in the hands of the courts, which can cause incredible stress and financial pain for your loved ones. Being proactive here is key, and it often involves savvy tax planning. For anyone thinking long-term, understanding capital gains tax strategies is a non-negotiable part of preserving the value you've created. After all, protecting your foundation means being ready for anything.

Frequently Asked Questions About Financial Freedom

1. How much money do I actually need for financial freedom?

The most common guideline is the 4% Rule, which suggests your target number is 25 times your desired annual expenses. For example, if you want to live on $80,000 per year, you would aim for an investment portfolio of $2 million ($80,000 x 25). This allows you to withdraw 4% annually with a high probability of never running out of money.

2. Is it too late for me to start in my 40s or 50s?

Absolutely not. While starting earlier gives you more time for compounding, your 40s and 50s are often your peak earning years. This allows you to save and invest more aggressively than you could in your 20s. The best time to start was yesterday; the second-best time is today.

3. What is the single most important first step?

Gain clarity. Before anything else, you must understand your starting point. Calculate your net worth (assets minus liabilities) and track your income and expenses for at least one month to see where your money is truly going. This financial snapshot is the foundation for all future decisions.

4. What's the difference between being "rich" and being financially free?

"Rich" is often tied to a high income or a large net worth, but it doesn't guarantee freedom. A high-earning doctor with an expensive lifestyle and massive debt is rich, but not free. Financial freedom is when your passive income from assets covers your living expenses, giving you the choice to work or not, regardless of your income level.

5. What are the biggest mistakes people make on this journey?

The three most common traps are: 1) Lifestyle Inflation: Increasing your spending every time you get a raise, keeping you on the financial treadmill. 2) Trying to Time the Market: Attempting to buy low and sell high often leads to missing the best market days. Consistent, automated investing is far more effective. 3) Ignoring High-Interest Debt: Credit card debt is an emergency that actively works against your wealth-building efforts.

6. Should I pay off debt or invest first?

Compare the interest rates. If your debt has an interest rate higher than the expected return on your investments (historically 7-10% for the stock market), prioritize paying off the debt. Paying off a 20% interest credit card is like getting a guaranteed 20% return on your money.

7. Is financial freedom possible on a low income?

Yes, but it requires more discipline and creativity. Your savings rate (the percentage of income you save) is more important than your income level. On a lower income, you must become an expert at optimizing expenses and relentlessly seek ways to increase your earning potential through side hustles or new skills.

8. What is the FIRE movement?

FIRE stands for "Financial Independence, Retire Early." It's a lifestyle movement of people dedicated to extreme savings and investing (often 50%+ of their income) with the goal of achieving financial freedom at a much younger age than the traditional retirement age of 65.

9. How does inflation affect my financial freedom number?

Inflation erodes the purchasing power of your money, so it's a critical factor. The 4% rule already has a high probability of success built-in that accounts for historical inflation. However, during periods of high inflation, you may need to be more conservative with withdrawals or ensure your portfolio includes assets that perform well in an inflationary environment, like real estate or Treasury Inflation-Protected Securities (TIPS).

10. Do I need a financial advisor to achieve financial freedom?

Not necessarily, but they can be incredibly helpful. You can achieve financial freedom on your own through self-education and simple, low-cost investment strategies (like index fund investing). However, a good fee-only financial advisor can provide a personalized roadmap, help with complex situations (like tax planning or estate law), and act as a behavioral coach to keep you on track during market volatility.

Ready to build a solid foundation for your financial future? At Top Wealth Guide, we provide the insights and strategies you need to navigate the world of investing and wealth creation. Explore our resources and start your journey today at https://topwealthguide.com.