At its core, rental property cash flow is what's left in your bank account after you've collected all the rent and paid every single bill associated with the property—mortgage included. It's the real, tangible metric of how profitable your investment truly is. This is the money that fuels sustainable wealth in real estate, giving you the stability to handle market downturns, unexpected repairs, and, most importantly, generate a reliable income stream.

In This Guide

- 1 The Foundation of Sustainable Real Estate Wealth

- 2 Getting a Real Handle on Your Gross Rental Income

- 3 Uncovering All Your Operating Expenses

- 4 Calculating Your Net Cash Flow

- 5 Putting Your Cash Flow on Steroids: Actionable Strategies to Boost Your Bottom Line

- 6 Frequently Asked Questions About Rental Property Cash Flow

- 6.1 1. So, what’s a "good" cash flow for a rental property?

- 6.2 2. How does depreciation affect my cash flow vs. my taxes?

- 6.3 3. Should I factor appreciation into my cash flow numbers?

- 6.4 4. What’s the best way to budget for future repairs (CapEx)?

- 6.5 5. Is negative cash flow ever a smart move?

- 6.6 6. What’s the difference between cash flow and NOI?

- 6.7 7. How can I find the real vacancy rate for my area?

- 6.8 8. What’s the best loan type to maximize cash flow?

- 6.9 9. Does self-managing always lead to more cash flow?

- 6.10 10. How does a 15-year mortgage affect cash flow vs. a 30-year?

The Foundation of Sustainable Real Estate Wealth

It’s easy for new investors to get caught up in the excitement of appreciation—the hope that their property’s value will skyrocket over time. While appreciation is a great long-term perk, seasoned investors know that cash flow is the lifeblood of a rental portfolio. It's the predictable, recurring income that keeps the lights on and the business running, month in and month out.

Expert Insight: A sharp focus on positive rental property cash flow builds a resilient and predictable investment portfolio from the very beginning. It shifts your property from a speculative gamble into a dependable, income-producing business.

Put it this way: appreciation is a bet on what the market might do tomorrow. Cash flow pays your bills today. This one number dictates whether you can build momentum, buy more properties, and move toward financial freedom without being at the mercy of unpredictable market swings.

Why Cash Flow Matters More Than Ever

In an era of economic uncertainty, rental property cash flow has proven itself as a remarkably resilient source of income. We've seen markets like Birmingham, Memphis, and Cleveland become hotspots for investors chasing stable returns to get ahead of inflation. You can dig deeper into top markets for rental income over on Rental Income Advisors.

Making cash flow your top priority gives you some serious advantages:

- Financial Stability: It ensures you have the money to cover the mortgage, taxes, insurance, and the inevitable leaky faucet without raiding your personal savings.

- Income Generation: This is the passive income dream in action. Positive cash flow is what puts money in your pocket every month.

- Scalability: The profits you generate can be funneled directly into a down payment for your next property, helping you grow your portfolio exponentially faster.

- Risk Mitigation: When the economy stumbles and property values dip, consistent cash flow is what keeps your investment solvent and self-sufficient.

To get a handle on the numbers, it's helpful to have a quick reference for the key metrics we'll be discussing.

Key Cash Flow Metrics at a Glance

This table breaks down the core formulas you’ll need to understand and analyze any rental property deal. Think of it as your cheat sheet for analyzing investment opportunities.

| Metric | Simple Formula | Primary Purpose |

|---|---|---|

| Gross Operating Income (GOI) | Potential Rental Income – Vacancy/Credit Loss + Other Income | Measures the property's total income potential before expenses. |

| Net Operating Income (NOI) | Gross Operating Income – Total Operating Expenses | Shows the property's profitability from its operations alone, before debt. |

| Cash Flow (Before Tax) | Net Operating Income – Debt Service (Mortgage) | Reveals the actual cash left over for the investor each month. |

| Cash-on-Cash Return | Annual Cash Flow / Total Cash Invested | Calculates the percentage return on the actual money you put into the deal. |

Mastering these calculations is the first step toward true financial control.

Learning to manage this financial lifeline is non-negotiable for success. In fact, solid cash flow management is crucial for wealth building no matter the asset class. Before you can start tweaking and improving your returns, you have to get a firm grasp on every number that goes into the equation. This guide will walk you through it all.

Getting a Real Handle on Your Gross Rental Income

Before you can even think about cash flow, you have to know exactly what’s coming in the door. It’s a common rookie mistake to just multiply the monthly rent by twelve and call it a day. That simple math can set you up for some nasty surprises down the road.

The truth is, a well-managed property has several income streams. Experienced landlords know that these "ancillary" income sources are where you can really start to juice your returns. They might seem small individually, but they add up fast.

Think about common add-ons like:

- Pet Fees: A monthly charge of $25-$50 per pet is pretty standard these days. It not only boosts your income but also helps offset the extra wear and tear.

- Parking Fees: Got a dedicated or covered spot in a neighborhood where street parking is a nightmare? That’s a revenue source.

- Laundry Facilities: If you own a multi-family, on-site laundry can be a little goldmine, bringing in a surprisingly steady stream of cash.

- Late Fees: You don't want to collect these, but having and enforcing a late fee policy is just part of the business.

Real-Life Example: Duplex in a College Town

Let's break this down with a quick example. From my personal experience managing properties near a university, ancillary income is a game-changer. Imagine you own a duplex where each side rents for $1,500 a month.

| Income Source | Unit 1 (Monthly) | Unit 2 (Monthly) | Total Monthly Income |

|---|---|---|---|

| Base Rent | $1,500 | $1,500 | $3,000 |

| Pet Fee | $50 (1 dog) | $0 | $50 |

| Reserved Parking | $75 (1 spot) | $75 (1 spot) | $150 |

| Laundry (Shared) | $25 (Est.) | $25 (Est.) | $50 |

| Total Monthly | $1,650 | $1,600 | $3,250 |

See that? Those extra fees tack on another $250 every single month. That's an extra $3,000 a year. That’s not just pocket change—it can easily cover your annual property tax bill or a few unexpected repairs. This is a real-world scenario that highlights how overlooking small income streams means leaving money on the table.

Gross Potential vs. Effective Gross Income

Okay, so you've tallied up every possible dollar your property could make. Now it's time for a reality check. This is where we need to talk about two very different numbers: Gross Potential Rent (GPR) and Effective Gross Income (EGI).

Gross Potential Rent (GPR) is the fantasy number. It’s what you'd make if every unit was rented every single day of the year at the full market rate, with no discounts or empty days. For our duplex, the GPR would be $39,000 a year ($3,250 x 12).

But let's be honest, no property ever stays 100% occupied. Life happens. Tenants move, and it takes time to turn a unit over. That’s why the number that actually matters is your Effective Gross Income (EGI).

Effective Gross Income (EGI) is what’s left after you subtract the money you lose to vacancies. It's the realistic, grounded income figure you should be using for all your serious calculations.

To find your EGI, you need to subtract a vacancy loss from your GPR. A good rule of thumb is to use your local market’s average vacancy rate, which is usually somewhere between 5% and 10%.

Let's apply a conservative 8% vacancy rate to our duplex:

- Annual GPR: $39,000

- Vacancy Loss (8%): $3,120

- Effective Gross Income (EGI): $35,880

This $35,880 is the number you can actually count on. Starting with a realistic income figure like EGI, instead of the inflated GPR, is the foundation of a solid cash flow analysis. To build on this, take a look at our guide on how to calculate rental yields—it’s the perfect next step.

Uncovering All Your Operating Expenses

This is where the rubber meets the road. A promising deal can fall apart fast if you don't get a handle on your expenses. Too many new investors get tunnel vision, focusing only on the mortgage payment, and completely miss the real costs of owning a rental.

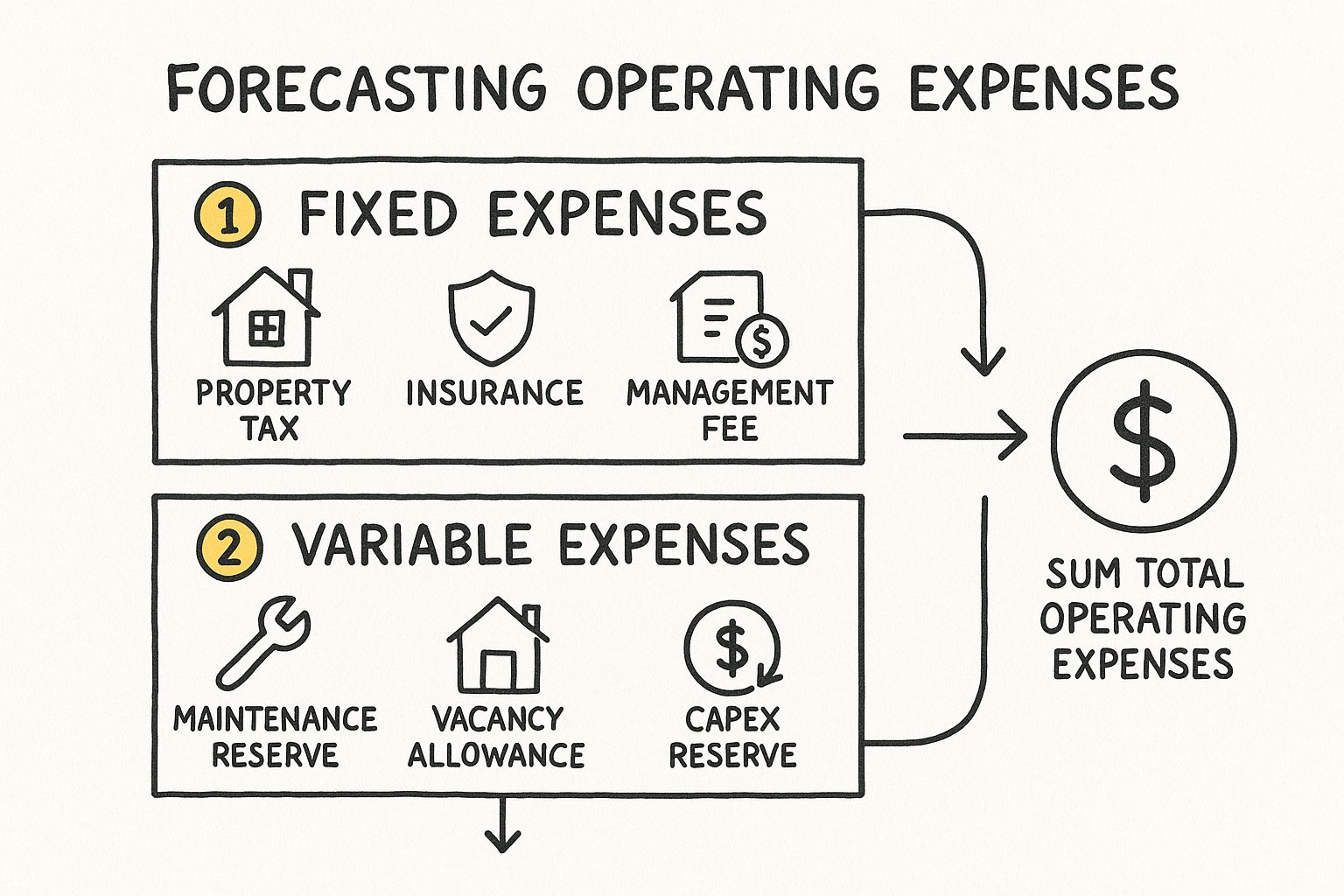

If you want a cash flow forecast you can actually trust, you have to dig in and account for every dollar that will be flying out of your pocket. These costs generally break down into two buckets: fixed expenses (the predictable ones) and variable expenses (the ones that jump up and bite you). Nailing both is the only way to get an accurate picture of your rental property cash flow.

Your Non-Negotiable Fixed Expenses

Think of these as the baseline costs you're on the hook for, month in and month out, whether you have a tenant or not. They're usually pretty easy to pin down.

- Property Taxes: This is a big one, set by the local government. You can usually find the exact amount on the county assessor's website or from the property's previous tax bills.

- Homeowners Insurance: You can't just get a standard policy. You'll need a landlord policy, which typically runs 15-25% higher because it covers the unique risks that come with having tenants.

- Property Management Fees: If you’re not managing the property yourself, expect to pay a pro anywhere from 8-12% of the monthly rent. Even if you plan to self-manage, I always recommend plugging this fee into your calculations. It forces the property's numbers to stand on their own and gives you a realistic plan B.

These are the easy ones. Now for the expenses that really trip people up.

The Variable Expenses That Sink Investors

This is where I see most new investors get into serious trouble. Variable expenses are the costs you can't predict down to the penny, but you absolutely have to plan for. If you don't, you're setting yourself up for negative cash flow.

A classic mistake is forgetting that things break—and when they do, they're expensive. This is why you need a reserve fund for Capital Expenditures, or CapEx. This is your war chest for the big-ticket items with a finite lifespan, like a roof, an HVAC system, or a water heater. A solid rule of thumb is to sock away 5-10% of your gross rent just for these inevitable replacements.

On top of that, no property stays rented 100% of the time. It's just not realistic. You have to account for vacancy—the empty periods between tenants when no rent is coming in. Look at what's typical for your specific market, but budgeting 5-8% of your gross rent for vacancy is a safe place to start.

And of course, there's the day-to-day stuff: maintenance and repairs. This covers everything from a leaky faucet and a running toilet to repainting walls after a tenant moves out. I'd pencil in another 5-10% of your gross rent to cover these ongoing costs.

This simple flowchart breaks down how all these pieces fit together.

As you can see, your total operating expenses are a sum of both the predictable bills and the unpredictable costs you must prepare for.

Using Rules of Thumb as a Starting Point

When you're sifting through dozens of potential properties, you need a quick way to vet them. That’s where helpful shortcuts like the 50% Rule and the 1% Rule come in. They aren't a replacement for a deep dive, but they're fantastic for a quick gut check.

The 50% Rule: This is a back-of-the-napkin guideline that assumes your total operating expenses (everything except the mortgage) will average out to about 50% of your gross rental income over the long haul. So if a property rents for $2,000 a month, you should plan on $1,000 going toward all the other expenses.

What I love about this rule is that it forces you to be realistic. It bakes in all those easily forgotten costs like vacancy, repairs, and CapEx right from the start.

Comparison of Expense Estimation Rules

The 50% Rule is a great first pass, but it's not the only tool in the shed. Knowing how different rules work helps you build a much more bulletproof analysis.

| Estimation Method | How It Works | Best For | Potential Downside |

|---|---|---|---|

| The 50% Rule | Assumes 50% of gross rent covers non-mortgage operating costs. | Quick, initial screening to see if a deal is worth a closer look. | Can be way off for older properties needing lots of work or in areas with very high or low property taxes. |

| Line-Item Budgeting | Researching and estimating every single expense category individually. | Creating a precise, detailed financial forecast for a specific property you're serious about. | Very time-consuming and requires you to do your homework on local costs. |

| The 1% Rule | Says a property's monthly rent should be at least 1% of the purchase price. | A fast check to see if the rent-to-price ratio makes sense. | Ignores expenses completely; it's only a rough gauge of income potential. |

No single rule is perfect. My process is to use the 50% and 1% Rules for a quick initial screen. If the property passes that test, I'll then invest the time to build a detailed, line-item budget based on real, local numbers.

Also, don't forget the silver lining: many of these operating costs are tax-deductible. To see how you can save, check out our comprehensive guide to property investment tax deductions.

Calculating Your Net Cash Flow

https://www.youtube.com/embed/5lgjnd9d8AY

Alright, you've done the hard work of gathering your income figures and hunting down every last expense. Now it's time to put it all together and see what the property is really doing for your bank account.

The formula itself is refreshingly simple. You just subtract all your costs from all your income to find out what's left over. This is the number that truly matters.

Net Cash Flow = Effective Gross Income – (Total Operating Expenses + Mortgage Payment)

This final figure is your take-home profit. It's the money you can use to pay yourself, save up for the next property, or just build a solid financial cushion. It’s the ultimate report card for your investment.

A Real-World Example: Single-Family Home in Austin, TX vs. Cleveland, OH

Let's walk through two realistic scenarios to see how this plays out. Theory is great, but seeing actual numbers on typical deals in different markets makes it all click.

Scenario 1: Austin, Texas (High Appreciation, Lower Cash Flow)

- Purchase Price: $450,000

- Down Payment (20%): $90,000

- Loan Amount: $360,000

- Interest Rate (30-year fixed): 6.5%

- Monthly Mortgage (P&I): $2,275

- Gross Potential Rent: $2,800/month

| Line Item (Austin, TX) | Monthly Amount |

|---|---|

| Gross Potential Rent | $2,800 |

| Less: Vacancy (5%) | -$140 |

| Effective Gross Income (EGI) | $2,660 |

| Operating Expenses | |

| Property Taxes (High Rate) | $656 |

| Landlord Insurance | $150 |

| Repairs & Maintenance (5%) | $140 |

| CapEx Reserve (5%) | $140 |

| Property Management (8%) | $224 |

| Total Operating Expenses | $1,310 |

| Mortgage Payment (P&I) | $2,275 |

| Net Cash Flow | -$925 |

Scenario 2: Cleveland, Ohio (Lower Appreciation, Higher Cash Flow)

- Purchase Price: $150,000

- Down Payment (20%): $30,000

- Loan Amount: $120,000

- Interest Rate (30-year fixed): 6.5%

- Monthly Mortgage (P&I): $758

- Gross Potential Rent: $1,400/month

| Line Item (Cleveland, OH) | Monthly Amount |

|---|---|

| Gross Potential Rent | $1,400 |

| Less: Vacancy (8%) | -$112 |

| Effective Gross Income (EGI) | $1,288 |

| Operating Expenses | |

| Property Taxes (Lower Rate) | $200 |

| Landlord Insurance | $80 |

| Repairs & Maintenance (8%) | $112 |

| CapEx Reserve (8%) | $112 |

| Property Management (10%) | $140 |

| Total Operating Expenses | $644 |

| Mortgage Payment (P&I) | $758 |

| Net Cash Flow | -$114 |

The final verdict from this comparison? In the current interest rate environment, both properties show negative cash flow. This is a crucial, real-world lesson: just because a property is for sale doesn't mean it's a good investment right now. This analysis prevents you from buying a financial drain and forces you to either negotiate a much lower price, find a better deal, or wait for market conditions to improve.

If you want to run these numbers even faster, a good real estate investment calculator can be a huge time-saver.

Going Beyond Basic Cash Flow: Two Critical Metrics

While net cash flow tells you what you’ll pocket each month, seasoned investors always look at two other metrics to judge the true strength of a deal: Net Operating Income (NOI) and Cash-on-Cash Return.

Net Operating Income (NOI)

NOI is a powerful metric because it measures the property's profitability without factoring in your mortgage. It shows how well the asset itself performs, purely based on its income and operational costs.

- NOI = EGI – Total Operating Expenses

Think of NOI as the gold standard for comparing different properties. It levels the playing field by removing the financing variable, so you can see which building is fundamentally a better money-maker. As global real estate markets shift, many investors are zeroing in on rental income and NOI as the most reliable drivers of return. You can dig deeper into why NOI is so important for global investors on UBS.com.

Cash-on-Cash Return

This one is all about efficiency. It answers a simple but crucial question: "For every dollar I put into this deal, how much am I getting back each year?" It’s my favorite way to measure how hard my invested capital is working for me.

Here’s the formula:

- Cash-on-Cash Return = Annual Net Cash Flow / Total Cash Invested

Your "Total Cash Invested" is everything you paid out-of-pocket: the down payment, closing costs, and any upfront repair money. For our example properties, with negative cash flow, the Cash-on-Cash return would also be negative—an immediate red flag. It tells you that not only are you not making money, but your initial investment is actually losing value from a cash flow perspective. By running these numbers, you've essentially performed a financial stress test on the deal, saving yourself from a costly mistake and freeing you up to find an investment that actually moves you forward.

Putting Your Cash Flow on Steroids: Actionable Strategies to Boost Your Bottom Line

Running the numbers is just the starting line. The real magic happens when you actively start improving your cash flow. The good news is that you have direct control over both sides of the equation—you can crank up the income and trim down the expenses.

Getting even one or two of these strategies in motion can make a huge difference, turning a decent investment into an absolute cash cow. Let's dig into some of the most effective ways I've seen investors boost their property's profitability.

Getting More Money in the Door

The fastest way to pump up your cash flow is, of course, to increase your income. This goes way beyond just bumping up the rent every year. It’s about making smart, strategic additions that tenants genuinely want and are happy to pay more for. With the global housing affordability crisis pushing more people toward renting, there's a huge demand for quality rentals, which puts savvy landlords in a great position.

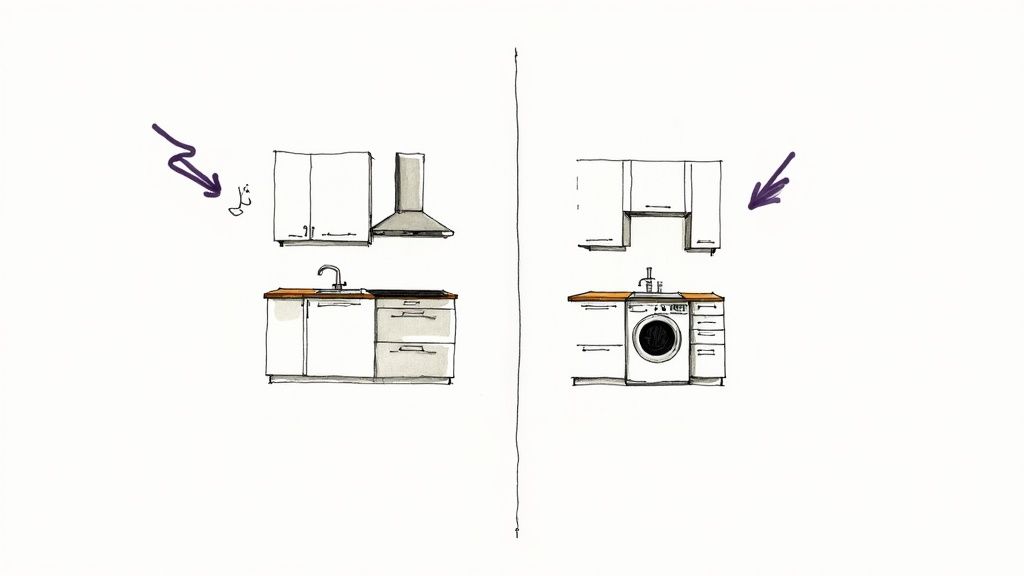

- Make Smart, Value-Add Renovations: Don't just renovate—focus on upgrades with the highest return. A kitchen with new countertops and stainless steel appliances or a modern, clean bathroom can easily justify a higher rent. And one of the biggest game-changers? An in-unit washer and dryer. I've seen that one feature alone add $50-$100 to the monthly rent.

- Bill Back Utilities (RUBS): If you own a multi-family property, look into a Ratio Utility Billing System (RUBS). It’s a system for fairly dividing costs like water, sewer, and trash among tenants. This takes a major variable expense off your plate and directly boosts your Net Operating Income.

- Get Creative with Ancillary Income: Think about what else you can offer. In a neighborhood with tough parking, reserved spots can be a goldmine. You can also charge a small monthly fee for storage lockers in the basement or implement a pet fee for furry friends. These small streams add up fast.

If this approach of buying and upgrading sounds appealing, these income-boosting tactics are the heart and soul of the BRRRR method, which you can learn about in our step-by-step guide.

The Other Side of the Coin: Slashing Your Expenses

While boosting income is exciting, cutting your costs is often the simpler and quicker path to fatter margins. Remember, every single dollar you save on expenses drops straight to your bottom line.

Expert Insight: Systematically challenging every single expense is one of the most powerful habits you can build as an investor. Don't just accept your bills as fixed costs—almost everything is negotiable if you know where to look.

Think of it as a financial treasure hunt. Spending a few hours on the phone and doing a little research can genuinely lead to thousands in annual savings.

Your Cost-Cutting Playbook

This comparison table shows the impact versus effort for common cost-saving strategies I use in my own portfolio.

| Strategy | Potential Savings | Effort Level | What to Do |

|---|---|---|---|

| Refinance Your Mortgage | High | Medium | Constantly shop for a lower interest rate. This is your biggest expense, so even a small drop helps. |

| Fight Your Property Taxes | Medium | Medium | Pull comps and file an appeal if your assessed value is out of line. It's easier than you think. |

| Shop Your Insurance Yearly | Low to Medium | Low | Get fresh quotes from multiple insurance providers every year. Loyalty rarely pays here. |

| Embrace Preventative Maintenance | High | High | Schedule regular HVAC and plumbing check-ups. It prevents those brutal, cash-flow-killing emergency calls. |

Let's see how this works in the real world. A preventative maintenance plan might cost you $300 a year for a professional to service your HVAC. But that small investment can save you from a $5,000 emergency furnace replacement in the dead of winter. That’s a massive win.

Likewise, appealing your property taxes sounds daunting, but many counties get it wrong. If you can show that your property is valued higher than similar homes that just sold, you could easily slash hundreds or thousands off your annual tax bill.

By aggressively managing both sides of the ledger—income and expenses—you seize full control of your investment's financial performance, pushing your cash flow higher month after month.

Frequently Asked Questions About Rental Property Cash Flow

When you’re diving into rental properties, the questions come fast and furious. It’s totally normal. Getting a firm grip on cash flow is what really separates the investors who thrive from those who just get by. Let’s tackle the ten most common questions I hear from both new and seasoned investors.

1. So, what’s a "good" cash flow for a rental property?

This is always the first question, and the honest answer is… it depends. What’s considered “good” can change dramatically depending on your city, the price of the property, and what you’re trying to achieve financially. That said, a solid rule of thumb I’ve always used is to aim for a monthly cash flow of at least $100 to $200 per unit. This gives you a decent buffer for small surprises and makes the investment worth your time.

2. How does depreciation affect my cash flow vs. my taxes?

This is a critical concept. Let's be clear: depreciation has zero effect on your actual cash flow. It’s a “non-cash expense,” meaning you don’t actually write a check for it. However, it has a massive impact on your taxable income. The IRS lets you deduct a portion of your property's value from your rental income each year, creating a "paper loss" that can dramatically lower or even eliminate the taxes you owe.

3. Should I factor appreciation into my cash flow numbers?

Absolutely not. Cash flow and appreciation are two completely different things. Cash flow is the real, predictable profit your property generates for you right now. Appreciation is the potential for the property's value to go up over time—it's just speculation until the day you sell or refinance. Always analyze a deal based on the cash it produces today. Think of appreciation as a fantastic long-term bonus, not a guarantee.

4. What’s the best way to budget for future repairs (CapEx)?

You can’t predict the future, but you can prepare for it. The most reliable method is to build a reserve fund by setting aside a percentage of your gross rent every month. A good, conservative starting point is to set aside 5-10% of gross rent for routine maintenance and another 5-10% for major capital expenditures (CapEx) like a new roof or HVAC. For older properties, lean toward the higher end of that range.

5. Is negative cash flow ever a smart move?

For about 99% of investors, the answer is a hard no. Negative cash flow means you’re losing money every month. The rare exception is for very wealthy investors in high-appreciation markets who are making a strategic bet that asset value growth will far outpace the small monthly operational loss. This is a high-risk strategy best left to experts with very deep pockets.

6. What’s the difference between cash flow and NOI?

This is a simple but important distinction.

- Net Operating Income (NOI) is your property’s total income minus all operating expenses—before you pay the mortgage. It measures the asset's profitability.

- Cash Flow is what’s left in your pocket after you’ve paid the mortgage. It measures your investment's profitability.

7. How can I find the real vacancy rate for my area?

Don’t just guess. The best method is to call a few local property management companies. Ask them what vacancy rate they’re seeing for the exact type of property in the specific neighborhood you’re targeting. They have real-time, on-the-ground data that is infinitely more accurate than a generic online estimate.

8. What’s the best loan type to maximize cash flow?

For most investors focused on monthly income, the 30-year fixed-rate mortgage is the go-to choice. Spreading the loan out over a longer term gives you a lower monthly payment compared to a 15- or 20-year loan. That simple difference leaves more cash in your pocket every single month.

9. Does self-managing always lead to more cash flow?

On paper, it looks like an easy win to avoid an 8-10% property management fee. But a great property manager can often command higher rents, find better-quality tenants who stay longer, and get vendor discounts on maintenance that you can't. These benefits can easily cancel out their fee. A bad self-management experience can cost you far more in vacancies and headaches than the fee ever would.

10. How does a 15-year mortgage affect cash flow vs. a 30-year?

It’s a direct trade-off between monthly income and long-term wealth building.

- A 15-year mortgage will slash your monthly cash flow because the payment is significantly higher. The upside is you build equity faster and pay less total interest.

- A 30-year mortgage maximizes your monthly cash flow but builds equity more slowly. For investors focused on generating passive income now, the 30-year loan is almost always the better path.

At Top Wealth Guide, we're dedicated to giving you the insights and strategies needed to build real wealth through smart investing. Our resources are designed to help you navigate financial markets with confidence.

Ready to take the next step in your financial journey? Visit us at https://topwealthguide.com to access exclusive content and proven tactics to enhance your investment portfolio.

1 Comment

Pingback: How to Find Investment Properties That Actually Work