Index funds… the trusty steed of the investment world, have become the go-to for millions of Americans chasing that steady, reliable wealth growth. These aren’t your flashy, high-maintenance portfolios — no, they’re the no-nonsense, straightforward investment vehicles that track entire market segments without burning a hole in your wallet with high fees (unlike some actively managed funds that have all the flair and none of the follow-through).

At Top Wealth Guide, we’ve witnessed firsthand how index funds can transform your average Joe or Jane Saver into a bona fide long-term wealth builder. But let’s pump the brakes for a second… are index funds really the golden ticket to financial independence? Or do they come with some sneaky limitations that could throw a wrench in your returns? That’s the million-dollar question, quite literally.

In This Guide

How Do Index Funds Actually Work?

Let’s peel back the curtain on the marvel of index funds – they’re brilliantly simple. All the magic happens as they mimic specific market indexes like the S&P 500, snapping up every stock in those indexes at their given weights. You toss $1,000 into an S&P 500 index fund (yep, just like that) and your cash splashes across all 500 corporations in there. From behemoths like Apple at about 7% to the tiniest blips at less than 0.01%, it’s a full-on market smorgasbord. And the fund manager’s gig? Simple: mimic, don’t dance to a different tune.

This sit-back-and-chill methodology wipes out the need for stock-picking, market timing, or those spendy brainiacs trying to outbrain the markets. Index funds? They’ve skyrocketed in popularity as wave after wave of investors jumps onboard this no-fuss train.

The Passive Management Revolution

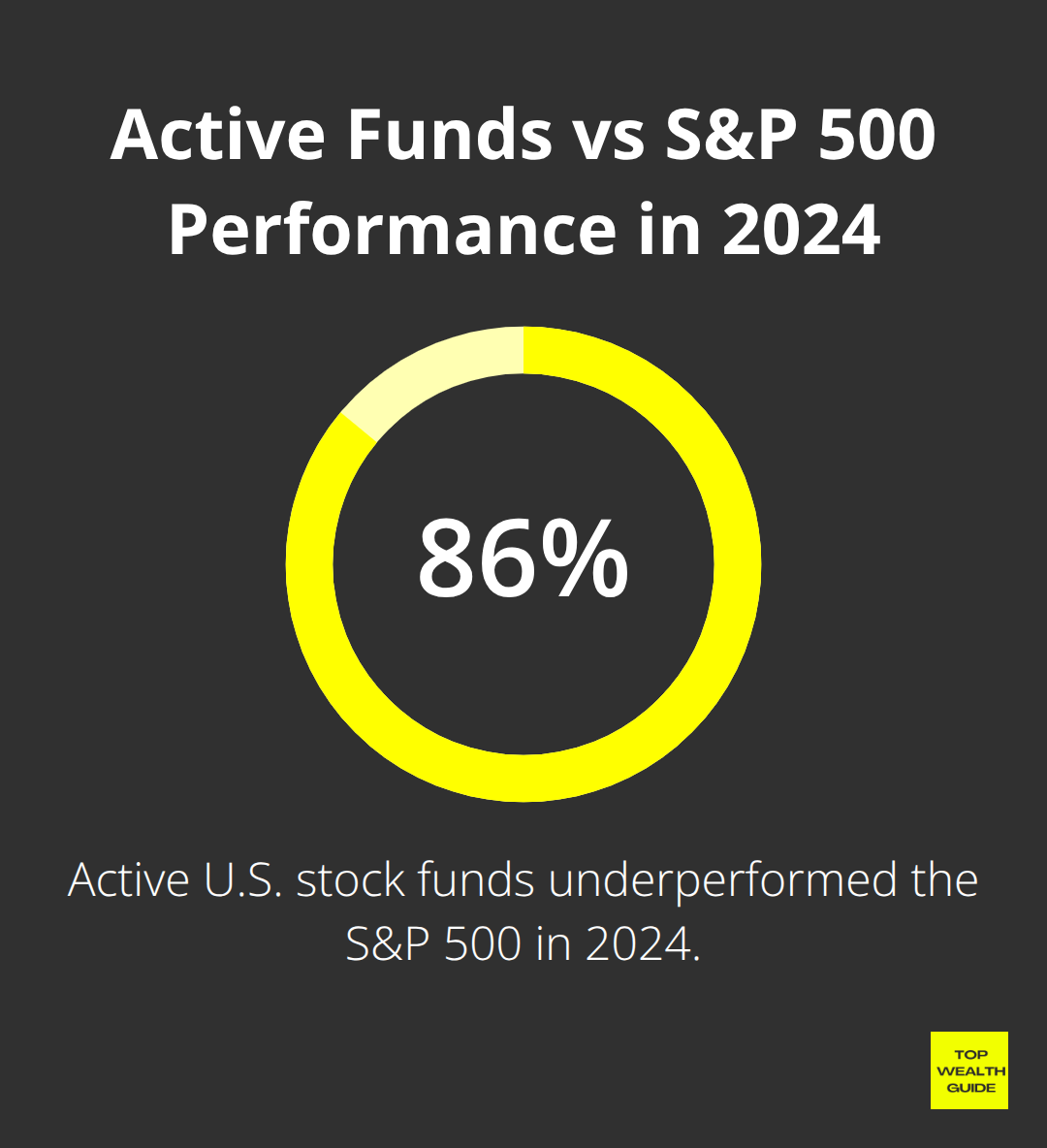

Passive management – totally clobbering the active crew, performance-wise. Data doesn’t lie. Morningstar shows only 13.2% of those active U.S. stock funds pulled a fast one on the S&P 500 in 2024. That means a whopping 86.8% of those funds, even with their pricey research squads and slick strategies, just couldn’t outshine a basic index fund.

And here’s the kicker: it gets even uglier for active funds when you zoom out over time. Actively managed funds tend to lag behind their benchmarks, both in the sprint and the marathon. Active funds sling expense ratios from 0.5% to 2%, but cream-of-the-crop index funds like Fidelity Zero Large Cap Index? Nada. Zip on the expense ratio. And don’t forget – fees compound just like all those nice returns, but fees? They work against ya.

Three Index Fund Categories That Matter

Total market index funds – your gateway to practically owning a slice of every U.S. publicly traded company, from tech mammoths to pint-sized community banks. The Vanguard Total Stock Market Index? Tracks over 4,000 socks and sets you back a minuscule 0.03% annually.

And then, there are international index funds – your ticket to developed and emerging scenes beyond U.S. shores (think 25% to small/mid-cap firms that historically bring higher returns, albeit with more bumps along the road). Bond index funds like the Fidelity U.S. Bond Index Fund? They’re your steady ship in stormy markets, doling out regular income through interest, though returns there hover around 3-5% compared to stocks’ legendary 10%.

These three categories are the bedrock of many a successful long-term investment strategy – real genius shines when you grasp their unique edge in wealth stacking.

Why Index Funds Beat Active Management Every Time

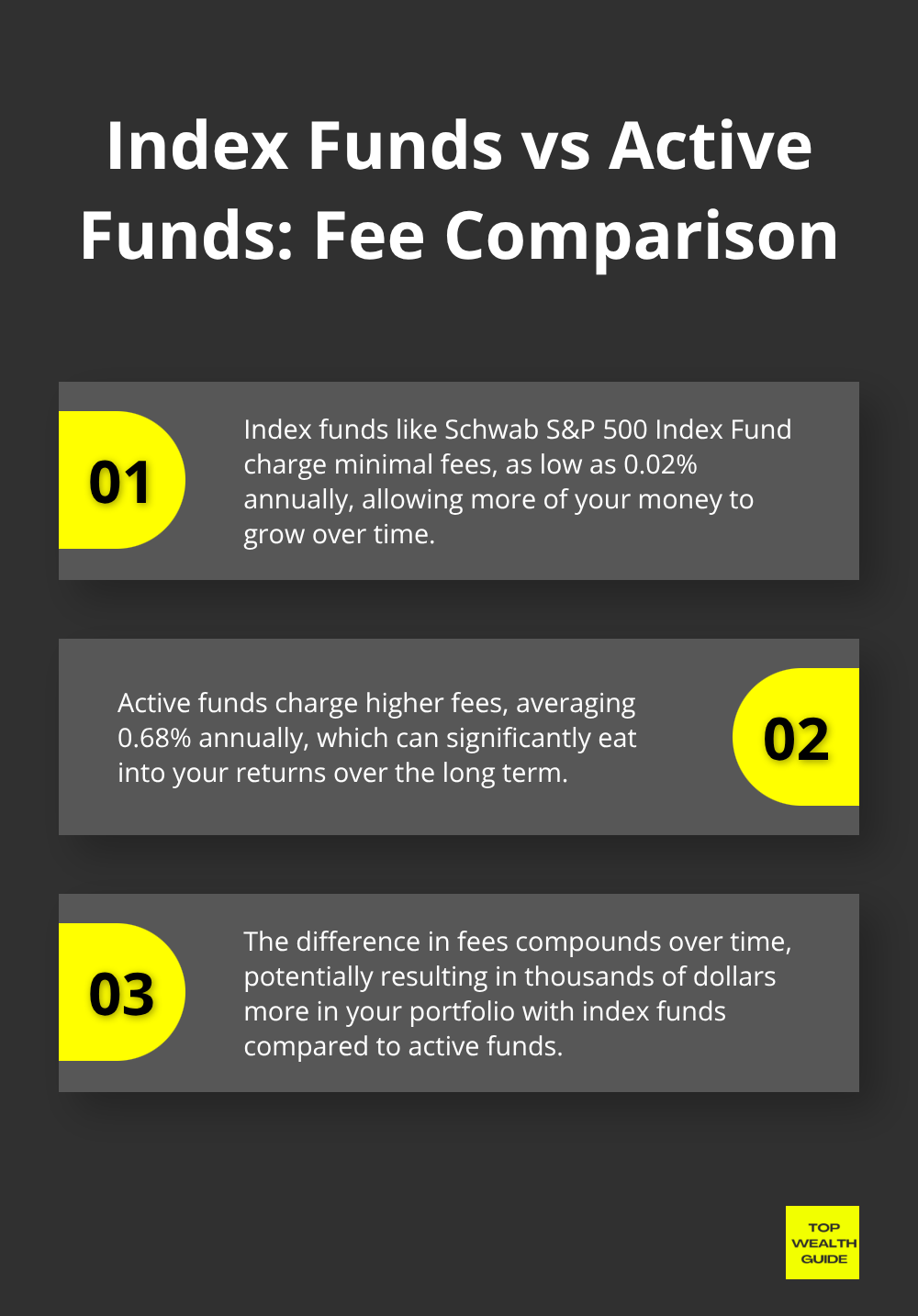

Here’s the deal, folks-active fund managers have been getting crushed, and the numbers don’t lie. Over the past 15 years, roughly 90% of large-cap active funds have failed to outperform the S&P 500, according to the SPIVA report from S&P Global. This isn’t just a fluke-it’s a colossal systematic failure. Meanwhile, index funds, like the Schwab S&P 500 Index Fund-charging a paltry 0.02% annually-leave active funds (averaging 0.68%) in the dust. And here’s where it gets ugly: the fee difference compounds over time, eating away your returns like termites in a wooden house. The arithmetic is ruthless, and the fact is-active managers just can’t win this battle.

The Compound Power of Low Fees

Index funds win big with fee compression that propels wealth generation. The Fidelity Zero Large Cap Index throws down a zero-percent fee gauntlet, while Vanguard’s 500 Index Fund comes in at a meager 0.04%. Compare this to active funds sneaking away with 0.5% to 2% yearly. Those tiny percentages? They turn into financial wrecking balls over time. Throw $500 monthly into a 0.04% index fund instead of a 1% active fund, and watch as your portfolio rockets to impressive heights over 25 years. Investment Company Institute’s data lays it out clearly-index funds have surged precisely because smart investors see the math is on their side.

Built-In Risk Protection Through Market Breadth

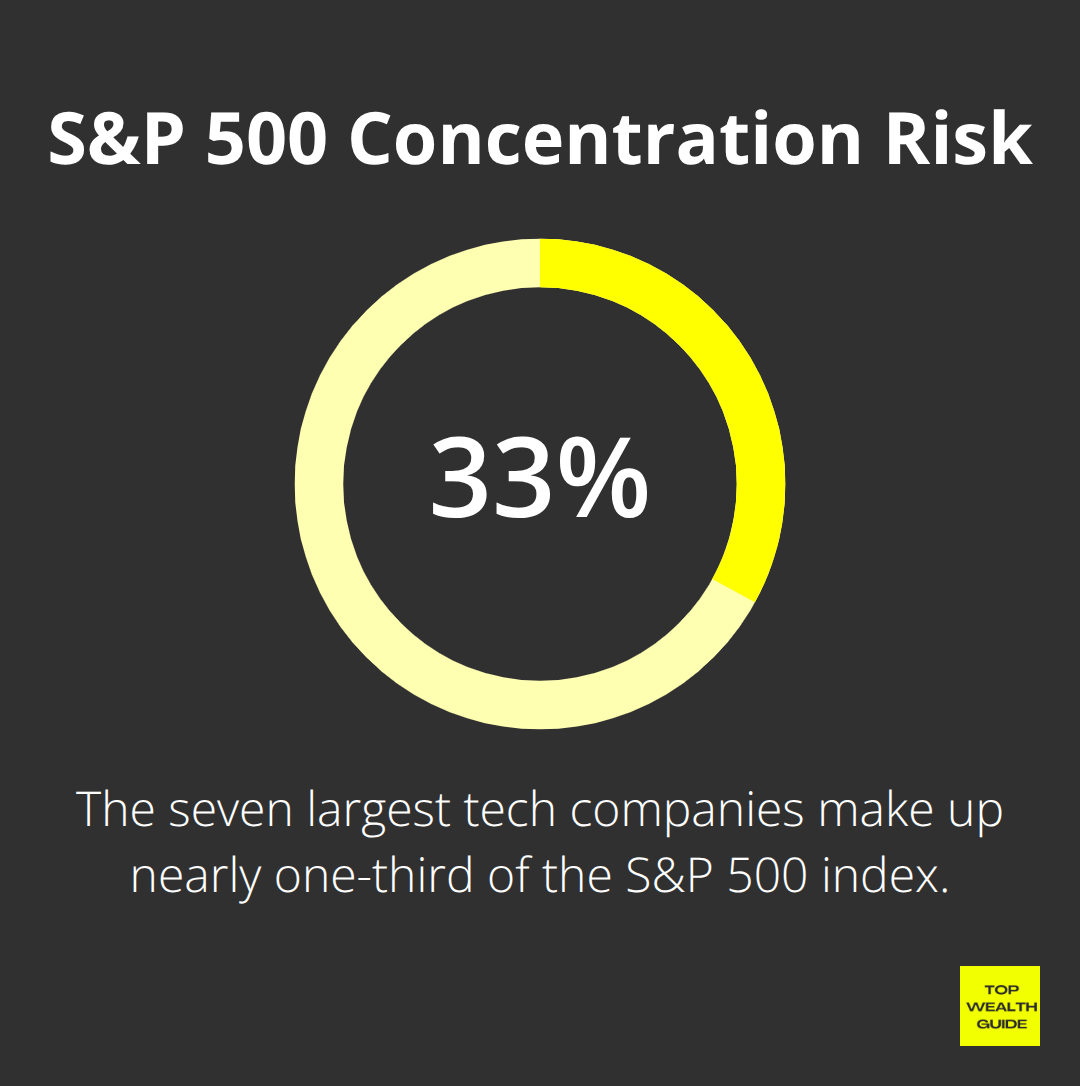

This is where index funds shine-spreading your risk across hundreds, sometimes thousands, of companies effortlessly. You don’t have to become a stock-picking wizard. The S&P 500 index tosses your investment across 500 companies like Oprah giving away cars, while total market funds cover over 4,000 stocks. This vast reach shields you from the next Enron-level fiasco. Remember when Enron tanked or Lehman Brothers went under? Index fund holders barely flinched. And even though the seven tech behemoths now make up nearly a third of the S&P 500, this risk is peanuts compared to betting big on a single, saggy stock.

Tax Efficiency That Boosts Returns

Let’s not forget about taxes-index funds are tax ninjas compared to active funds, which spark constant buying and selling (often exceeding 100% turnover annually). These trades trigger capital gains taxes that chew through your returns like a Pac-Man. Index funds dodge this with less than 5% turnover, letting you reinvest more and grow your wealth faster. This tax efficiency is massive, especially in taxable accounts where every saved buck compounds like rabbits and the benefits stack over time.

Still, even with all these golden advantages, it’s key to remember index funds have limitations that might-just might-impact your wealth trajectory.

What Are Index Funds Missing?

So, let’s talk index funds. They’re essentially the chicken soup of investing-plain, reliable, but ultimately kinda bland. They lock you into average returns, no questions asked. Remember 2021 when the S&P 500 gained 28.7%? Your index fund? Ditto. No extra sprinkles on top. Meanwhile, superstar active funds like ARK Innovation ETF were off to the races. This… ceiling, yeah, it’ll hit you hard during those market fireworks, when high-flying sectors or stocks are doing the cha-cha and your index fund is… waltzing along, out of step.

The Crash Reality Check

Market meltdowns? Oh boy. They tear away the curtain and reveal the grandiose shortfall of index funds-zero protection when the proverbial hits the fan. March 2020? The S&P 500 nose-dived 34%, and index funds decided to tag along for the full nosedive experience. Active fund managers, though? They’ve got options. They could have swerved into cash, hedged a bit, or cozied up with bonds. But your index fund? Nope. Just… ding, first floor, all the way down.

Remember 2008, the financial horror show? The S&P 500 dropped, dragging every index investor through the chaos, without a parachute in sight. They can’t tweak their holdings when the market looks like a bad action movie with too many explosions.

Missing the Smart Money Moves

Index funds are like the last kid picked for dodgeball-can’t quite catch the action of opportunistic market plays or fresh opportunities. Picture this: ChatGPT bursts onto the scene in late 2022, and quick-thinking active managers scoop up those AI stocks before the crowd even knows what’s happening. Index fund investors? Left waiting around for eternity, until these companies grow large enough to nudge their broad exposure… maybe.

Wash and repeat with every revolutionary tech, regulatory shift, or sprouting economic trend-active folks seize the day while index funds play it safe and sound. It’s like watching the initial profit waves from the beach… with no surfboard. Missing out on true wealth acceleration.

The Concentration Risk Problem

And then we’ve got today’s S&P 500. It’s carrying a ticking time bomb called concentration risk. The seven largest tech companies are now almost one-third of the index, which is… a recipe for disaster if those tech titans trip up. Late 2022, anyone? When these titans catch a cold, your “diversified” fund sneezes. Apple by itself-some 7% of the S&P 500 juggernaut-takes a mere 10% dip, and your returns feel the punch more than you’d care to know.

Final Thoughts

Let’s talk index funds, folks. They’re the quiet, boring heroes of the investment world – low fees, broad diversification, and consistent market returns. Simple, right? The math tells the story: with expense ratios scraping the floor at 0.02% and outperforming a whopping 86.8% of active funds. Sure, during bull runs, they cap your upside, and crashes? No downside protection. But hey, when you’re playing the long game, these “limitations” become background noise – they’re just small hurdles on the road to long-term wealth.

Index funds are the answer if you’re looking for a hands-off strategy, despise those pesky high fees, and are in it for the long haul. Ideal for retirement accounts, emergency funds, and as the backbone of your portfolio. Skip them only if you’re a thrill-seeker who loves juggling higher-risk and picking stocks like a pro (spoiler: most aren’t).

Ready to dive in? Open up a brokerage account with the big names: Fidelity, Schwab, or Vanguard. Go for a total market index fund like FZROX or SWTSX to pop your investing cherry. Set up those automatic monthly contributions – $500 or whatever fits your budget. Keep those costs low, and let compound growth do its magic. We over at Top Wealth Guide are convinced this is how ordinary savers turn into millionaires – just a smidge of patience and a dash of consistency, baby.