Hitting the $100,000 savings mark is a huge financial milestone, but it’s not some kind of secret financial magic. It really boils down to a simple framework: set a non-negotiable timeline, budget with purpose, slash your biggest expenses, get creative about boosting your income, and put your money to work through investing.

This whole process is less about being a Wall Street wizard and more about showing up with consistent, deliberate action day after day.

In This Guide

- 1 Your Path To 100k Starts With A Clear Vision

- 2 Master Your Cash Flow with a Purpose-Driven Budget

- 3 Get Serious About Slashing Your Biggest Expenses

- 4 Turn Up the Dial on Your Income to Accelerate Your Savings

- 5 Make Your Money Work for You with Smart Investing

- 6 Frequently Asked Questions About Saving Your First $100k

- 6.1 1. How long should it realistically take to save 100k?

- 6.2 2. Is it better to pay off debt or save money first?

- 6.3 3. What is the best place to keep my savings?

- 6.4 4. Can I still save 100k on a low income?

- 6.5 5. How do I stay motivated when the goal feels far away?

- 6.6 6. Is an emergency fund really that important?

- 6.7 7. What role does automation play in reaching 100k?

- 6.8 8. What are the biggest mistakes to avoid on the way to 100k?

- 6.9 9. Should I contribute to a 401(k) while saving for 100k?

- 6.10 10. How should I adjust my strategy if I have a setback?

Your Path To 100k Starts With A Clear Vision

Let’s be honest, saving $100,000 can feel like an abstract number you just pulled out of thin air. Before you even think about opening a spreadsheet or looking for a side hustle, you need to nail down your ‘why.’ This is the personal reason that will drag you out of bed on a tough day and keep you focused when the initial excitement wears off.

What’s the real, tangible goal here?

- Scraping together a down payment on your first home?

- Building the seed money to finally launch that business idea?

- Creating a “freedom fund” to take a year off or switch careers without financial stress?

- Getting a head start on your kids’ future education costs?

Without a clear destination, you’re just piling up cash. But with a powerful ‘why,’ every dollar you set aside becomes a concrete step toward the life you’re actively trying to build. This simple mindset shift turns saving from a chore into an act of empowerment. It’s about more than just numbers, which is why it’s worth taking the time to define wealth beyond money and possessions.

Setting Your Timeline

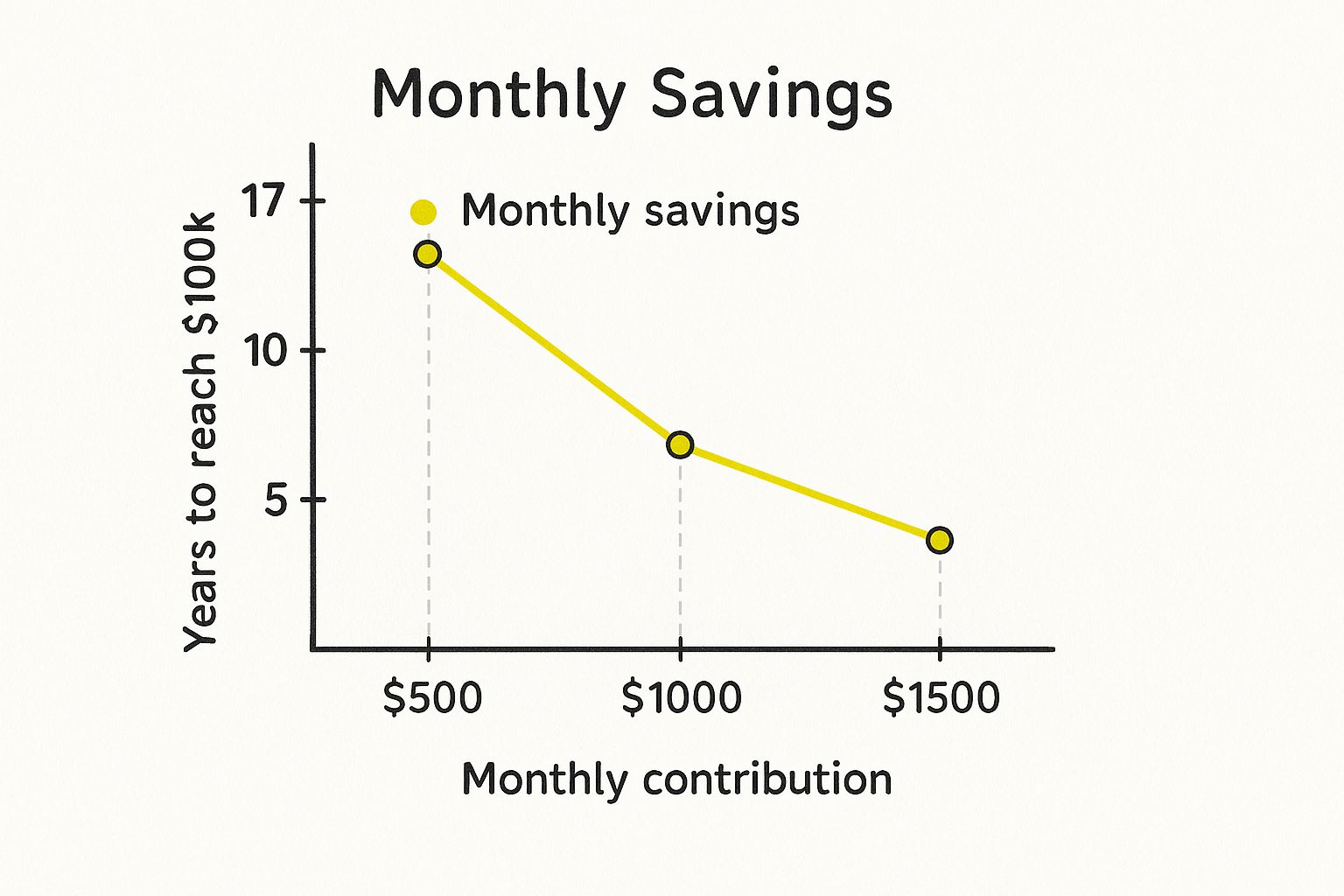

Once you know why you’re saving, the next step is to figure out when. Attaching a timeline makes the goal real. It transforms “$100k someday” into a tangible plan with monthly and yearly targets.

To help you visualize this, here’s a quick breakdown of what it takes to get there on different schedules.

Your 100k Savings Timeline Options

This table illustrates the monthly and yearly savings required to reach $100,000 over different timeframes, helping you choose a realistic target.

| Target Timeline | Required Yearly Savings | Required Monthly Savings |

|---|---|---|

| 10 Years | $10,000 | ~$834 |

| 7 Years | ~$14,286 | ~$1,191 |

| 5 Years | $20,000 | ~$1,667 |

| 3 Years | ~$33,334 | ~$2,778 |

| 2 Years | $50,000 | ~$4,167 |

As you can see, the path to your goal is entirely within your control—it’s all about choosing a pace you can stick with.

The data doesn’t lie. Even small bumps in your monthly savings can shave years off your journey to the $100k mark.

A Real-Life Example Of Getting Started

Need some inspiration? Just look at the story of Obioha Okereke, who managed to save over $100,000 by the time he was 23. His journey didn’t kick off with a six-figure salary; it started with a powerful decision to delay gratification. He consciously skipped the expensive gadgets and nights out, funneling that cash directly into investments instead.

By putting off a lot of the material items I had dreamed of purchasing, and learning to say no to drinks, outings, vacations, I was able to save a ton of money. By investing, I have been able to grow my net worth at a rate that far exceeded my expectations.

His strategy was simple but incredibly effective: he lived at home to avoid rent, cooked his own meals, and invested more than 80% of his income. This aggressive approach let him crush his goal in just two years after graduating. While not everyone can live rent-free, the core principles he used—defining a goal, making intentional sacrifices, and staying disciplined—are universal.

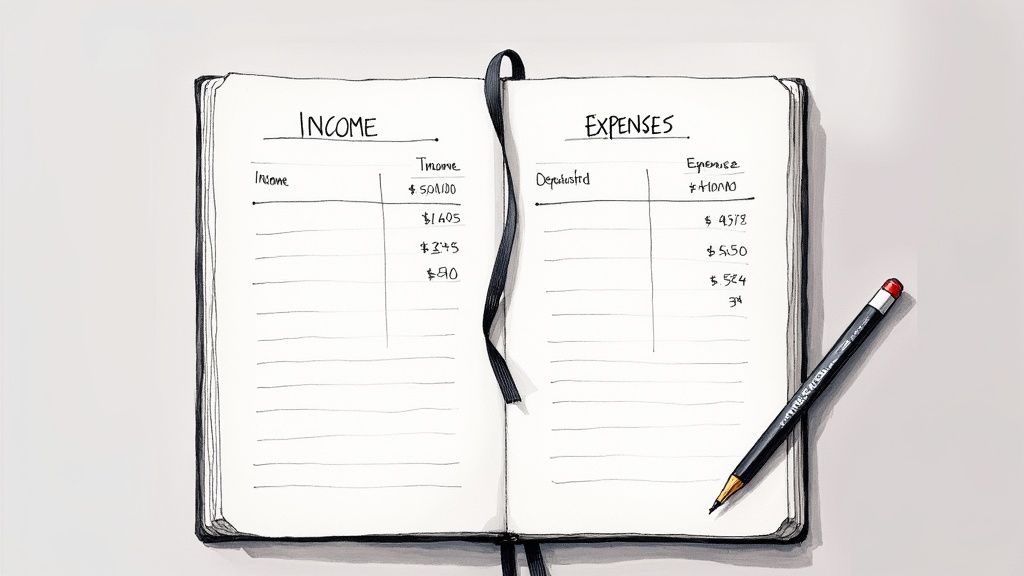

Master Your Cash Flow with a Purpose-Driven Budget

Let’s get one thing straight: a budget isn’t a financial straitjacket designed to make you miserable. Think of it as the steering wheel for your money. It gives you absolute control, and when you’re chasing a goal as big as $100,000, you need more than just a vague spending plan. You need a budget built for one purpose: maximizing every single dollar.

This is about more than just tallying up your bills. It’s about building a system that deliberately channels your money toward that $100,000 finish line. This is the heart of powerful cash flow management, which is non-negotiable for anyone serious about building real wealth.

Find a Budgeting Method That Actually Fits You

There is no single “best” budget. The best one is the one you’ll actually stick with. Each method comes with its own philosophy, so the key is finding an approach that aligns with your personality and financial habits. Let’s look at a few popular options and see how they can be supercharged for aggressive savings.

Different budgeting styles work for different people. The table below breaks down a few popular methods to help you figure out which one might click for you on your journey to saving $100,000.

Choosing Your High-Savings Budgeting Method

| Budgeting Method | Best For | How It Works for Aggressive Savings |

|---|---|---|

| Pay Yourself First | People who love simplicity and automation and want to save without obsessively tracking every single purchase. | Your savings goal becomes your most important “bill.” You set up an automatic transfer for a large chunk of your paycheck—think 20%, 30%, or more—into your savings or investment accounts the moment you get paid. Whatever is left is yours to spend, guilt-free. |

| 50/30/20 Rule (Modified) | Anyone who appreciates a structured but flexible framework with clear spending categories. | The standard rule is 50% for needs, 30% for wants, and 20% for savings. To hit your $100k goal, you flip the script: 50% needs, 20% wants, and 30% (or even 40%) savings. This forces you to get much more intentional with your fun money. |

| Zero-Based Budgeting | Detail-oriented folks who want to give every single dollar a specific job and leave no room for waste. | The formula is simple: Income – Expenses = $0. This method is incredibly effective for aggressive savers because it forces you to account for every cent. There’s no “mystery” spending; you actively decide to funnel any extra cash toward that $100,000 goal. |

No matter which path you choose, consistency is what builds momentum. The goal is to find a system that doesn’t feel like a chore so you can stick with it for the long haul.

Track Everything to Find the Hidden Cash Leaks

You can’t fix what you can’t see. Your first month of diligent tracking will likely be an eye-opener. This is where you finally see exactly where your hard-earned money has been disappearing. Grab an app like Mint or YNAB—or even a simple spreadsheet—and log every single transaction.

The point isn’t to feel bad about past choices; it’s to gather cold, hard data. You’ll probably be shocked at how quickly small, seemingly harmless habits add up over a year.

- That daily coffee: $5/day = $1,825/year

- A few streaming services: $50/month = $600/year

- Ordering takeout a couple of times a week: $100/week = $5,200/year

Once you see those numbers laid out, making changes becomes a whole lot easier. You can consciously decide to redirect that cash flow straight into your savings account. This level of discipline is what separates serious savers from the crowd. The U.S. personal saving rate has recently been around 4.6%, which means the average person is putting away less than a nickel for every dollar they make. To hit $100,000, you have to be far from average, and that starts with a budget you command.

How a Real Couple Restructured Their Finances for Success

Consider Alex and Maria, a couple bringing home a combined $7,500 a month after taxes. They felt like they were constantly broke, with barely anything left at the end of the month. Their goal was to save aggressively for a down payment on a house.

After tracking their spending for just one month, they were floored. They discovered they were burning through over $1,500 on a combination of dining out, random online shopping, and subscriptions they barely used.

“We had no idea it was that much. Seeing the total was the wake-up call we needed. We weren’t broke; we were just incredibly inefficient with our money.”

They immediately adopted a zero-based budget and made some targeted cuts:

- Food: They slashed their restaurant budget to $300/month and embraced meal prepping, which instantly saved them $600.

- Shopping: They created a 48-hour “cool-off” rule for any non-essential purchase over $50. This simple habit cut their impulse buys by $500 a month.

- Subscriptions: They audited their recurring charges and canceled redundant streaming services and unused gym memberships, freeing up another $120.

By simply reallocating money they were already spending, Alex and Maria went from saving almost nothing to funneling over $2,000 a month toward their goal. They did it all without a single pay raise. Their story is a perfect example of how getting control of your cash flow is often the fastest way to supercharge your savings.

Get Serious About Slashing Your Biggest Expenses

Sure, skipping the daily latte and canceling a streaming service or two feels like progress. But if you’re serious about hitting a $100,000 savings goal, you have to go where the real money is. I’m talking about the “Big Three”: housing, transportation, and food.

These three categories almost always devour the lion’s share of our income. Making meaningful changes here isn’t about tiny sacrifices; it’s about making a few strategic moves that can free up hundreds, if not thousands, of dollars every single month. One smart decision about your living situation can have a bigger impact than a hundred little cutbacks combined.

Taming Your Housing Costs

For most of us, our rent or mortgage payment is by far the biggest check we write each month. Because it’s so large, it also holds the most powerful potential for massive savings. Getting this one cost under control can put your journey to $100k on the fast track.

Here are a few high-impact ideas I’ve seen work wonders:

- House Hacking: This is a fantastic strategy. You buy a home and rent out a spare room, a basement apartment, or even a whole unit in a duplex. The income you generate can slash your mortgage payment or, in some cases, eliminate it entirely. You’re essentially living for free while a tenant helps you build equity.

- Negotiate Your Rent: Never assume the price is final. If you’ve been a great tenant who pays on time, you have more power than you think. Do some research on what similar units in your area are going for. Go to your landlord with that data and offer to sign a longer lease in exchange for a lower monthly rate.

- Refinance Your Mortgage: If you’re a homeowner and interest rates have dropped since you first got your loan, refinancing could be a no-brainer. It can lower your monthly payment significantly, freeing up a ton of cash. Just make sure the savings you’ll get over the life of the loan are worth more than the closing costs.

Each of these requires some upfront effort, but the payoff is enormous. These are the kinds of foundational moves on the road to financial freedom that can permanently change your financial life for the better.

Reimagining Your Transportation Expenses

When you think about your car, don’t just think about the monthly payment. You have to add up the true cost—insurance, gas, regular maintenance, and the silent killer, depreciation. Once you see the full picture, you’ll realize what a huge opportunity for savings this category is.

The trick is to make sure your transportation spending truly serves its purpose, rather than just being a habit or a status symbol.

Real-Life Example: How Sarah Optimized Her Commute

Sarah, who works in an office and lives out in the suburbs, was watching her SUV drain her bank account. She was paying $450 a month for the car itself, $150 for insurance, and another $200 for gas—that’s $800 a month!Realizing this was sabotaging her savings goals, she sold the SUV. She used some cash to buy a reliable, fuel-efficient used sedan. Instantly, her insurance dropped to $80 and her gas bill was cut in half. She even started carpooling with a coworker twice a week to save more.

Total Monthly Savings: $600

That one move freed up an extra $7,200 a year that she could throw directly at her $100,000 goal.

Mastering Your Food Budget

Food is the last of the Big Three, and it’s the one where mindless spending can really sneak up on you. But with a little bit of planning, you can eat incredibly well while cutting your grocery and dining bills in half. This isn’t about eating ramen noodles for a year; it’s about being intentional.

Here are a few next-level techniques that go way beyond just clipping coupons:

- Strategic Meal Planning: Before you even think about going to the store, plan your meals for the week. Base your plan on what’s on sale and what you already have in your pantry. This simple habit all but eliminates those expensive, last-minute takeout orders and impulse buys.

- Declare War on Food Waste: It’s shocking how much food the average person throws away. Get in the habit of using leftovers for lunch the next day, freezing food before it goes bad, and organizing your fridge so you use the oldest items first.

- Buy in Bulk (the Smart Way): A giant bag of quinoa is only a good deal if you actually eat it all. Focus on buying non-perishable staples you use all the time, like rice, pasta, and canned goods. Be careful with buying fresh produce in bulk unless you have a clear plan to use or freeze it right away.

By turning your attention to these three areas, you can transform your biggest expenses into your greatest savings opportunities and dramatically speed up your journey to $100k.

Turn Up the Dial on Your Income to Accelerate Your Savings

Cutting expenses is a fantastic start, but let’s be honest—it has a ceiling. You can only trim so much from your budget before you’re left with just the essentials. Earning more money, on the other hand, has virtually no limit. This is the accelerator that can shave years off your journey to saving $100,000.

Think of it this way: saving is just one side of the wealth-building equation. The other, far more scalable side, is boosting the amount of money you bring in each month. This isn’t just about grinding harder; it’s about being strategic and creating new channels of cash flow that you can point directly at your savings goal.

Squeeze More Out of Your Main Gig

Before you start hunting for a second job, your first move should be to optimize the income you already have. For most of us, our primary job is our largest and most reliable source of cash flow. This means even a small percentage increase here can make a massive difference over time.

A 5% raise on a $60,000 salary, for example, is an extra $3,000 per year. That’s $250 a month you can funnel straight into savings. Do that consistently, and you’ll see how much faster you can hit that $100k milestone.

I can’t stress this enough: don’t underestimate the power of simply asking for more. So many people leave money on the table because they’re afraid to negotiate. Go into your next performance review prepared. Document your wins, research what your role pays in the current market, and practice making your case.

If a raise isn’t in the cards right now, shift your focus to career advancement. Have a frank conversation with your manager about what it takes to climb to the next rung on the ladder. It might mean picking up a new skill, taking on a challenging project, or getting a professional certification. The idea is to make yourself so valuable that a pay bump becomes the logical next step.

Start a Side Hustle That Doesn’t Suck the Life Out of You

Once you’ve done what you can with your 9-to-5, it’s time to add another layer of income. A side hustle is the perfect tool for generating extra cash that you can earmark specifically for that $100k fund. The secret is picking something that fits your life and skills so you don’t burn out.

From what I’ve seen, the best side hustles usually fall into one of three buckets: using a professional skill you already have, turning a hobby you love into cash, or providing a simple service people need.

Let’s look at what that means in the real world.

Side Hustle Comparison: Finding Your Fit

| Side Hustle Type | What It Looks Like | Realistic Income | The Catch (Time) |

|---|---|---|---|

| Leverage Your Skills | A graphic designer takes on freelance logo projects for small businesses using platforms like Upwork or Fiverr. | $500 – $2,000+ per month, all depending on your rates and how many clients you take on. | It’s flexible, but you have to consistently market yourself and hit deadlines. |

| Monetize a Hobby | An avid baker starts an Instagram page to sell custom cakes for local birthdays and weddings. | $200 – $800+ per month, growing as word-of-mouth spreads. | Mostly nights and weekends. It can get intense during peak seasons. |

| Provide a Service | Someone who loves animals offers pet-sitting in their neighborhood through an app like Rover. | $100 – $500+ per month, depending on how busy your area is and how often you’re available. | Super flexible. You can do it as needed around your main job. |

Seriously, the most critical factor here is choosing something you won’t dread doing after a long day at your main job. If you hate it, it’ll be the first thing to go when life gets hectic.

A Real-World Example From a Teacher

Think about a high school history teacher who was laser-focused on saving for a down payment. She noticed a common pain point: her students were terrible at writing research papers. She knew this stuff inside and out, so she created a simple, self-paced online course called “Master the Research Paper in 5 Steps.”

She promoted it in the local PTA newsletter and on her social media channels. After the initial work of recording the videos and making the worksheets, the course started selling on its own. It became a source of semi-passive income, bringing in an extra $400 per month with very little ongoing effort—all of which went straight into her house fund.

Lay the Groundwork for Passive Income

While a side hustle involves trading your time for money, the holy grail is passive income—money that flows in without you having to actively work for it every day. This is truly one of the best ways to build wealth for the long haul.

You don’t need a fortune to get started, either. You can begin building these income streams with the extra cash you’re already saving and earning.

- Dividend Investing: This is a classic. You buy stocks or ETFs in solid companies that pay out a portion of their profits to shareholders. You get a regular cash deposit that you can automatically reinvest to buy more shares, which then pay you even more dividends. It’s a beautiful, compounding cycle.

- High-Yield Savings Accounts (HYSAs): Okay, it’s not totally passive, but the interest you earn from an HYSA is literally money you get just for parking your cash in the right place. It’s the simplest and safest way to make your money start working for you.

- Real Estate Crowdfunding: Don’t want the hassle of being a landlord? Platforms like Fundrise or RealtyMogul let you invest in a portfolio of real estate projects for just a few hundred bucks. You can earn income from rent payments and property appreciation without ever fixing a leaky faucet.

By combining a maxed-out salary, a smart side hustle, and the early stages of passive income, you create a powerful, three-pronged attack. This strategy doesn’t just put your goal of saving $100k on the fast track; it builds a resilient financial foundation that will serve you for decades to come.

Make Your Money Work for You with Smart Investing

Saving your cash is a crucial first step, but just letting it sit in a regular savings account isn’t going to get you to your goal quickly. In fact, you’re actually losing ground. Inflation is constantly chipping away at the value of your dollars, meaning the cash you have today will buy less tomorrow. To really pick up the pace on your journey to $100,000, you need to put that money to work.

Investing is what turns your savings from a static pile of cash into an active, income-generating machine. It’s how you make your money work for you, even when you’re not working. The key is to get started the right way, without taking on unnecessary risk.

The Magic of Compounding and Why You Need to Start Now

There’s a reason people say compound interest is one of the most powerful forces in finance. It’s a simple idea with incredible results: your investments earn a return, and then that return starts earning its own return. This creates a snowball effect that can dramatically accelerate your wealth over time.

Think about it in real-world terms:

- Sarah starts investing at 25, putting away $500 a month. Assuming an average annual return of 7%, by the time she’s 65, her portfolio could be worth over $1.3 million.

- Tom waits until he’s 35 to start. He invests the same $500 a month at the same 7% return. By age 65, he’ll have just under $600,000.

Tom invested for a solid 30 years, but Sarah’s extra decade of compounding nearly doubled her final amount. This is why you’ll always hear financial experts say the best time to start investing was yesterday. The next best time is right now. If you’re new to all this, I’d suggest reading through a good foundational guide on how to start investing money.

Choosing the Right Tools for Your $100k Goal

You don’t need to be a Wall Street guru to build a solid investment portfolio. To reach a goal like $100k, a few straightforward and effective tools will do most of the heavy lifting for you. It’s all about matching the right tool to the right part of your plan—some are for safety, and others are built for growth.

Different investment vehicles serve different purposes. Here’s a simple breakdown to help you put together a smart, diversified strategy.

Investment Vehicle Comparison for Your $100k Journey

| Investment Vehicle | Primary Purpose | Best For |

|---|---|---|

| High-Yield Savings Account (HYSA) | Safety & Accessibility. This is a secure spot for your cash that earns much more interest than a standard savings account. | Holding your 3-6 month emergency fund and any money you’re saving for short-term goals. You can’t risk losing this money. |

| Low-Cost Index Funds/ETFs | Long-Term Growth. These funds let you own tiny pieces of hundreds of companies (like the S&P 500), giving you instant diversification. | The bulk of your $100k savings fund. These are the workhorses for growing your money over a multi-year timeline. |

| Tax-Advantaged Retirement Accounts | Tax Efficiency. Accounts like a 401(k) or Roth IRA provide huge tax benefits that supercharge your growth. | Maximizing long-term growth by shielding it from taxes. Always try to max these out before investing in a regular account. |

Prioritizing saving isn’t just a personal strategy; it’s a global one. Some countries have incredibly high national savings rates. Qatar, for example, has one of the highest, recently saving over 57% of its GDP. This just goes to show how putting savings ahead of immediate spending can dramatically accelerate financial goals—a powerful lesson for anyone aiming to save $100,000. You can see more about these global savings rate trends for perspective.

Frequently Asked Questions About Saving Your First $100k

Chasing a goal like saving your first $100,000 is a huge step, and it’s natural to have a ton of questions swirling around. Let’s tackle some of the most common ones I hear, so you can move forward with confidence instead of uncertainty.

1. How long should it realistically take to save 100k?

Honestly, this timeline is completely unique to you. It all boils down to your income, your expenses, and how aggressively you can save. Let’s run some simple math. If you can consistently sock away $1,000 a month, you’re looking at a little over 8 years, and that’s before you even factor in any potential investment returns. Double that to $2,000 a month, and you could hit the $100k mark in about 4 years. The real trick is building a plan that fits your numbers, not someone else’s.

2. Is it better to pay off debt or save money first?

This is the classic financial dilemma, and the answer almost always comes down to interest rates. If you’re carrying high-interest debt—think credit card balances with 15-25% APR—that debt is costing you far more than you could reliably earn by investing. Tackling that debt aggressively should be your top priority. On the flip side, for lower-interest debt like mortgages or some student loans under 5-6%, the math can change. It often makes sense to make your minimum payments while investing the rest, since your potential returns from the market could easily outpace the interest you’re paying.

3. What is the best place to keep my savings?

You don’t want to put all your eggs in one basket. The smartest approach is a mix of strategies. Your emergency fund, which should cover 3-6 months of essential living expenses, needs to be safe and easy to access. A high-yield savings account (HYSA) is perfect for this. For all the money you’re saving for long-term growth, you’ll want to put it to work. Think about investing in a diversified portfolio of low-cost index funds or ETFs inside a brokerage account or a tax-advantaged retirement account like a Roth IRA.

4. Can I still save 100k on a low income?

Absolutely. It might take longer, and you’ll have to be more disciplined, but it is entirely possible. When your income is lower, your focus needs to shift to maximizing your savings rate—the percentage of your income you save. This means getting surgical with your budget, especially on the “big three” expenses: housing, transportation, and food. At the same time, you should always be looking for ways to boost your income, whether through a side hustle, learning a new skill for a promotion, or eventually changing careers.

5. How do I stay motivated when the goal feels far away?

That $100k figure can feel like a mountain. The key is to turn it into a series of smaller, more manageable hills. Set mini-goals along the way. Celebrate hitting $10,000, then $25,000, and again at $50,000. These milestones make the process feel real. Better yet, automate everything. Set up recurring transfers to your savings and investment accounts for the day you get paid. This puts your progress on autopilot so you’re not constantly fighting temptation or losing motivation.

6. Is an emergency fund really that important?

Yes. It’s not just important; it’s the foundation of your entire financial plan. Without a safety net, one unexpected event—a sudden car repair, an urgent medical bill—can completely derail your progress. You’d be forced to rack up credit card debt or, even worse, sell your investments at the worst possible time. Build up that 3-6 months of expenses in a separate account before you start investing heavily. Don’t skip this step.

7. What role does automation play in reaching 100k?

Think of automation as your most reliable savings partner. It’s the single best tool for consistency. By setting up automatic transfers from your checking account to your savings and investment accounts, you adopt the “pay yourself first” mindset. The money is whisked away before you even have a chance to spend it. This strategy removes willpower and emotion from the equation, ensuring you’re always making progress toward your goal.

8. What are the biggest mistakes to avoid on the way to 100k?

The biggest mistakes I see people make are ‘lifestyle inflation’—where spending automatically rises with every pay increase—and waiting too long to invest. They miss out on years of compound growth. Another common trap is not having a clear “why” for your savings goal, which makes it easy to lose motivation. Remember, this journey is never a straight line. You’ll have setbacks, but staying focused is what gets you there.

9. Should I contribute to a 401(k) while saving for 100k?

Yes, especially if your employer offers a match. An employer match is free money and an instant 100% return on your contribution, which you won’t find anywhere else. Prioritize contributing enough to get the full match. After that, you can decide whether to increase your 401(k) contributions or direct extra funds to other savings goals based on your specific timeline and financial plan.

10. How should I adjust my strategy if I have a setback?

Setbacks are a normal part of any long-term goal. The key is not to panic. First, pause and assess the situation. Did you have an unexpected expense? Use your emergency fund if you need to, as that’s what it’s for. If your income drops, rework your budget to a new baseline and adjust your savings goal temporarily. The most important thing is to avoid abandoning your plan altogether. Once you’re back on your feet, replenish your emergency fund first, then get back to your regular savings and investing schedule.

At Top Wealth Guide, we’re focused on giving you the strategies and knowledge to build real, lasting wealth. Whether you’re trying to understand stocks, real estate, or other investments, our mission is to empower you on your financial journey. You can find more proven tactics to grow your portfolio on our website.