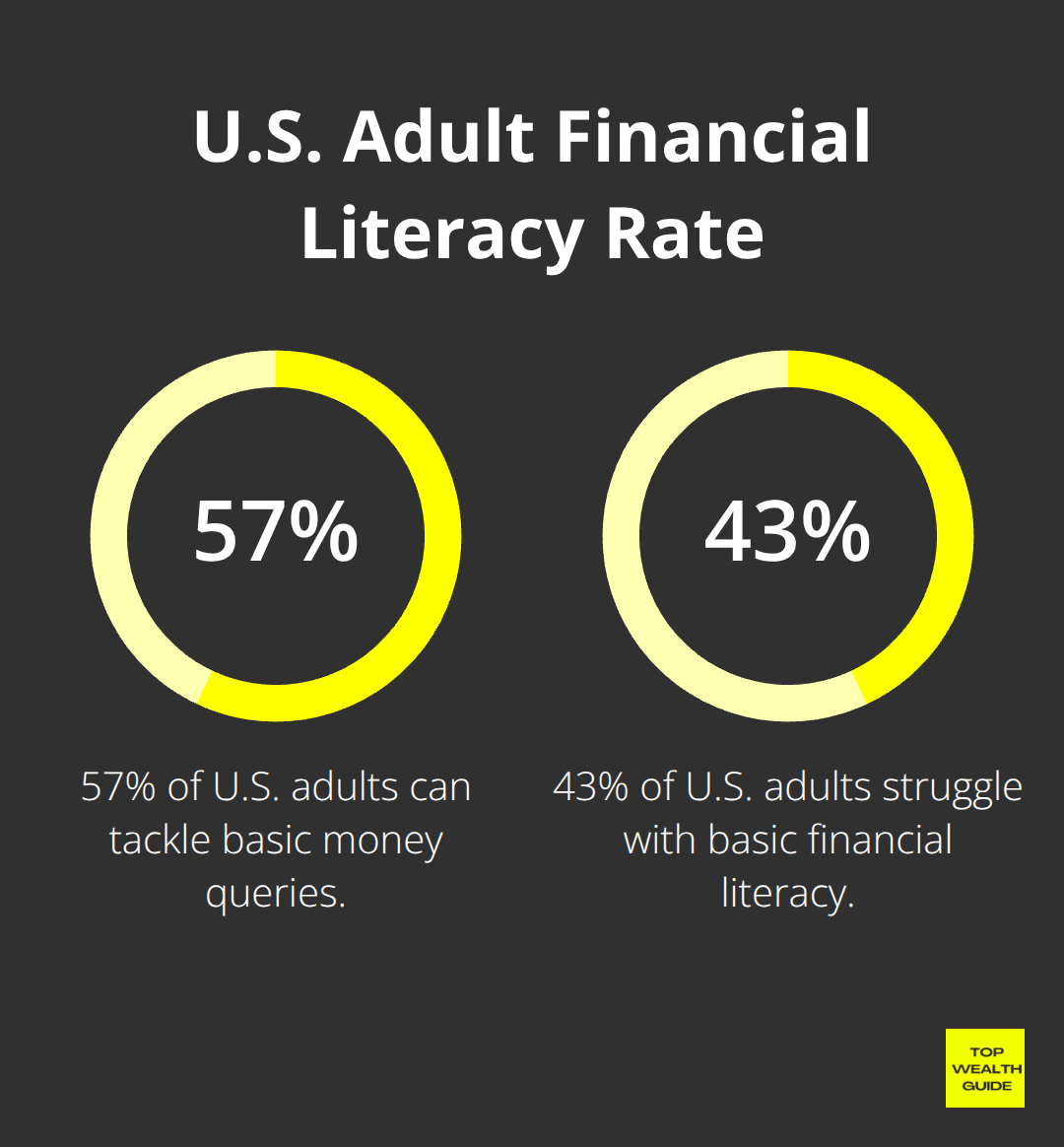

57% of adults in the U.S. can tackle basic money queries — that’s it. Yep, according to the National Financial Educators Council’s 2023 study, just over half qualify as financially literate.

What does this ignorance cost? A cool $1,882 per year in poor choices. (Ouch.) Here at Top Wealth Guide, we’re convinced financial literacy isn’t just a skill but your ticket to lasting wealth.

Here’s the kicker: You can pick these skills up anytime. Age doesn’t matter. Seriously.

In This Guide

How Bad Is America’s Financial Knowledge Gap

You want a reality check? The numbers are not just bad-they’re downright scary. Not only do we have a 57% literacy rate, the TIAA Institute-GFLEC Personal Finance Index tells us that understanding financial risk among U.S. adults sank to just 35% in 2024. And here’s a kicker-just 30% of Americans can nail the Big Three financial literacy questions crafted by professors Lusardi and Mitchell. Meanwhile, the 2024 SHED survey spills the beans: 55% of folks claim they’ve stashed away enough cash to float them for 3 months in an emergency, yet the average Joe still juggles $6,194 in credit card debt. Millions are ensnared in this relentless fog of financial stress-it just keeps piling up over time.

The Real Cost of Financial Ignorance

Financial ignorance isn’t just a one-off blunder-it’s a constant drain on your wallet, a slow bleed. The National Endowment for Financial Education shows that financially savvy individuals boast nearly double the savings of their peers. Investment know-how can save you buckets of cash just through optimizing fees. Over time, investment fees can contour your strategy, with tiny differences tallying up like crazy over the years. A good grip on credit scores means better loan rates-that’s hundreds or even thousands shaved off interest payments. And don’t get me started on scams-the Consumer Financial Protection Bureau says financial education means getting conned less. Keeps your money safe from those crafty predators.

Why Different Generations Struggle Differently

Millennials? They’re in a league of their own-drowning in a sea of information, yet starving for knowledge. The President’s Advisory Council highlights their need for better financial resources, while surveys find that financial stress is a massive mountain standing in the way of their educational aspirations. The older crowd, though? They’re scrambling to keep up as fintech zooms past traditional banking at thrice the speed (thanks, McKinsey). By 2050, with 22% of humanity over 60, the gaps in retirement planning are like cracks you could trip over. And only 24% of high schoolers take required finance classes, according to the Jump$tart Coalition-it’s a gap that persists into their professional lives.

The Compound Effect of Financial Illiteracy

Financial ignorance-it’s like rolling a snowball downhill. It gathers speed and mass, creating its own avalanche. People without basic money smarts bumble into bad investments, shell out more in fees, and miss out on the magic of compound interest. They’re easy prey for the high-interest debt trap and haven’t built emergency funds, leaving them exposed to life’s financial curveballs. The World Bank suggests that elevating women’s financial literacy can chip away at the gender wealth gap, while the OECD sees a direct line from financial literacy to national economic stability.

These gaping holes in knowledge? They’re practically a blueprint for why sharpening specific financial skills is your golden ticket to wealth creation. Want to get ahead? Start here.

What Financial Skills Actually Create Wealth

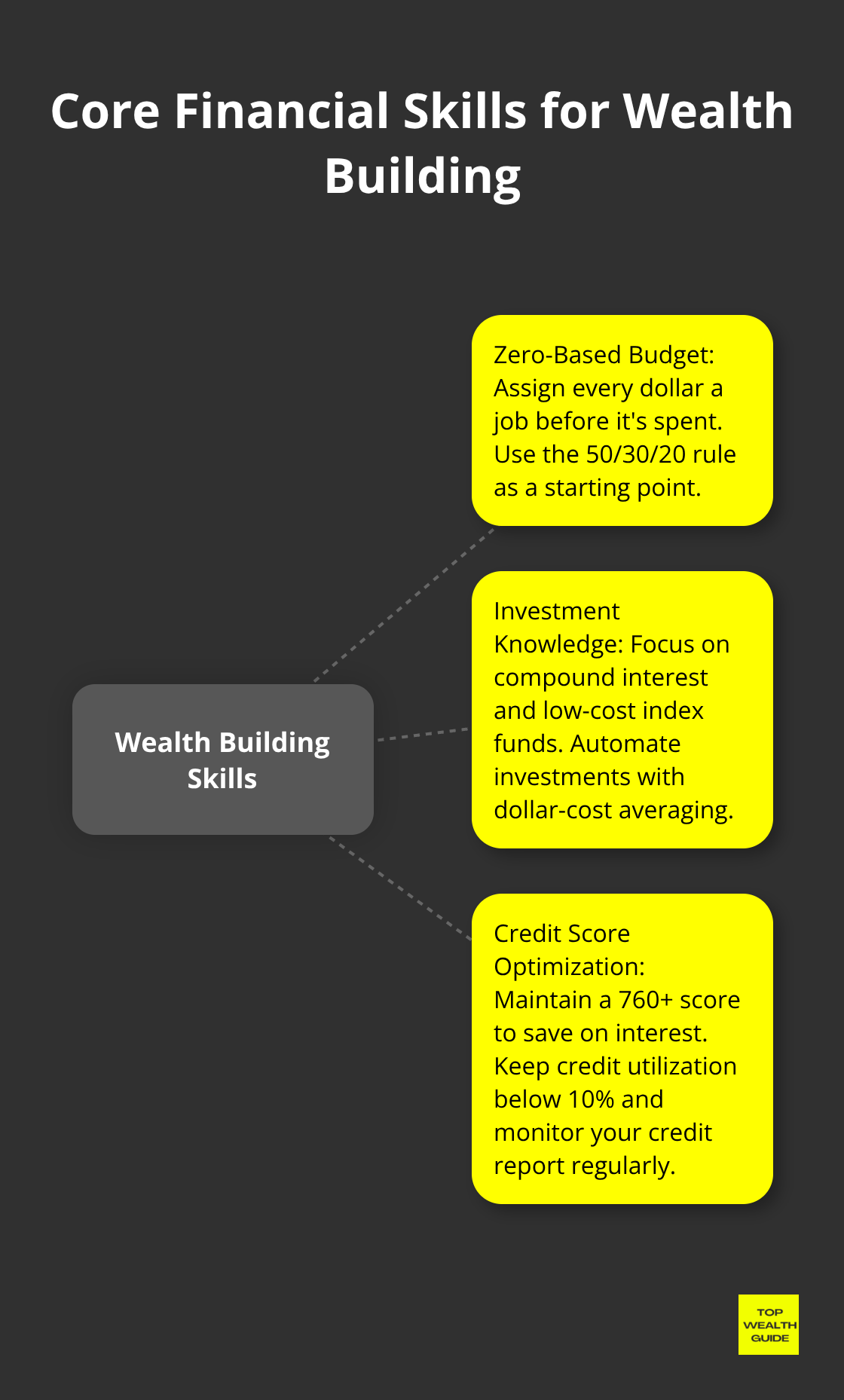

The chasm between basic finance and wealth creation – we’re talking some serious cheddar here – boils down to three overlooked skills. Ever heard of a zero-based budget? Yeah, that’s where you give every dollar a job before it’s out the door. This tactic wrangles your money before it pulls a Houdini. The Federal Reserve found a whopping 73% boost in financial confidence among folks who budget this way. Why? Because they’re putting their money where the wealth is, upfront.

Zero-Based Budget Mastery

Kick things off with the 50/30/20 rule: 50% for needs, 30% for whims, 20% for savings and debt smackdowns. Tweak it for your big money dreams. Apps like YNAB or EveryDollar make you stick to this discipline, but hey, a simple Excel sheet works too if you babysit it weekly. The secret sauce is in assigning each dollar its gig before it hits your bank-it needs a job description.

Investment Knowledge That Builds Wealth

Forget the investment gobbledygook. Focus on compound interest-the real MVP of wealth building. Einstein supposedly dubbed it the eighth wonder of the world, and no wonder: $10,000 at 7% returns morphs into $76,122 in 30 years. The National Bureau of Economic Research says 70% of personal fortunes come from smart investments, not bloated paychecks.

Start with low-cost index funds on platforms like Vanguard or Fidelity. Their expense ratios average 0.03% versus 0.5% for actively managed funds (that difference siphons $47,000 over 30 years on a $100K investment). Automate with dollar-cost averaging to keep emotions out of it and hold tight through market rollercoasters.

Credit Score Optimization Strategy

Your credit score is the fast lane to wealth, thanks to killer interest rate savings over time. A 760+ score shaves $64,000 off a $300K mortgage versus a 620 score, per FICO data. Pay bills early, keep credit use below 10%, and keep old credit cards open to beef up your credit history.

Use credit monitoring tools like Credit Karma to keep tabs monthly, and pounce on any errors. A quarter of credit reports have mistakes that ding scores. The quickest score jump? Pay down balances under 10% utilization and watch your score leap 50-100 points within three months.

These three skills are the bedrock, but knowing where to learn and hone them? That’s the game-changer for your wealth journey.

How Do You Actually Learn Financial Skills That Matter

Forget the finance tomes gathering dust. The real deal? Khan Academy’s Personal Finance course-structured lessons with numbers and exercises that stick (seriously). Coursera’s Financial Markets course from Yale? Dive into investment fundamentals that might actually turn into portfolio gains. Financial education programs-check this-can boost student outcomes with zero added cost. And hey, YouTube’s got the goods too. Ben Felix and The Plain Bagel? They break it down with data, no fluff.

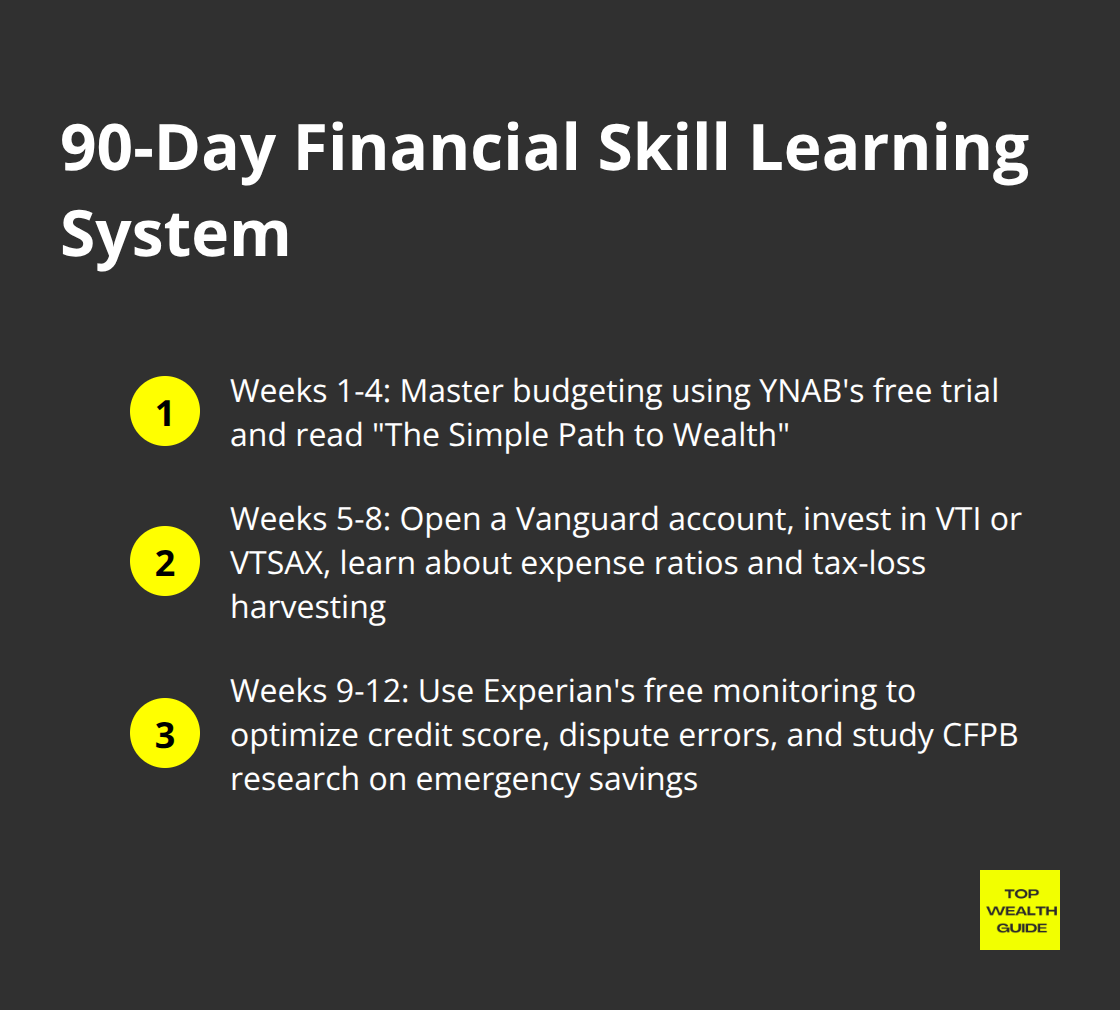

Create Your Learning System in 90 Days

Week 1-4: Master budgets using YNAB’s free trial and soak up The Simple Path to Wealth by JL Collins. Week 5-8: Dive into a Vanguard account and start with VTI or VTSAX-learn all about expense ratios and tax-loss harvesting. Week 9-12: Go full-on credit guru with Experian’s free monitoring-dispute those annoying errors hurting your score. The Consumer Financial Protection Bureau dishes out solid research on emergency savings and financial security. Track everything in a simple spreadsheet-monthly net worth hops included.

Technology That Accelerates Your Progress

Mint links all your accounts for automatic expense categorization. Personal Capital? It’s your guy for tracking investment performance and fees across brokerages. Credit Karma’s there for weekly score checks-Tiller for syncing bank accounts with advanced spreadsheets. Get those alerts rolling for any unusual spending, consistent investment contributions, and score shifts.

Focus on High-Impact Skills First

Nail the basics before veering into the deep end of advanced strategies. Start with expense tracking, shift to investment basics, and then credit optimization. Zero in on one skill for 30 days before layering on another. This method wards off overwhelm and builds habits that, in the long run, compound big time.

Final Thoughts

Financial literacy-it’s not just a buzzword, folks. It’s the pivot that transforms your approach to money from a knee-jerk reaction to a tactical game plan. The takeaway? Data doesn’t lie: people who know their financial onions end up with nearly double the savings of those who don’t, sidestepping pricey blunders that bleed $1,882 from the average Joe’s pocket every year. Want to kickstart your path to rolling in it? Three moves: launch zero-based budgets this week, set up low-cost index fund accounts with auto contributions, and, for heaven’s sake, keep tabs on your credit scores each month.

But here’s the kicker: the magic of financial smarts isn’t just about what’s in your bank account. Fast forward a few decades, and the savvy you pick up now compounds in spades through rock-solid investment choices, savvy credit usage, and shrewd debt management. According to the National Bureau of Economic Research, a whopping 70% of personal wealth isn’t about fat paychecks-it’s about strategic investments (yup, brains over bucks).

At Top Wealth Guide, we’re all about financial education, because it dishes out returns like nothing else. Every minute you invest in budgets, investment tactics, and credit hacks is like planting seeds for a lifetime of returns. So dive into your comprehensive wealth-building education today instead of crossing your fingers for a finance fairy godmother later.