Stepping into 2025… you can almost hear the gears shifting in the investment world. Global markets are throwing out a mishmash of opportunities and hurdles—like a buffet of confused piñatas—for anyone hoping to pick the right stocks and watch their cash go “ka-ching!”

So, what’s cooking at Top Wealth Guide? We’ve got our magnifying glass out, dissecting everyone and their cousin’s strategy (OK, maybe just emerging trends, pesky economic indicators, and those charming company performances) to find you the blue-chip darlings of the year. Grab our guide—it’s your tactical playbook in this whirlwind of a financial carnival, perfect for those who want to surf the chaos with more swagger than bluster.

In This Guide

What’s Shaping Global Markets in 2025?

Market Performance and Economic Indicators

So here we are, looking at the S&P 500 Growth – essentially, it’s a yardstick for those stocks that scream “We’re gonna grow!” But hold on… it’s not just measuring growth on paper. It’s a mix of sales growth, earnings-to-price ratio, and momentum. Fun stuff, right? Gives you a snapshot of how the growth gang is playing in the broader market.

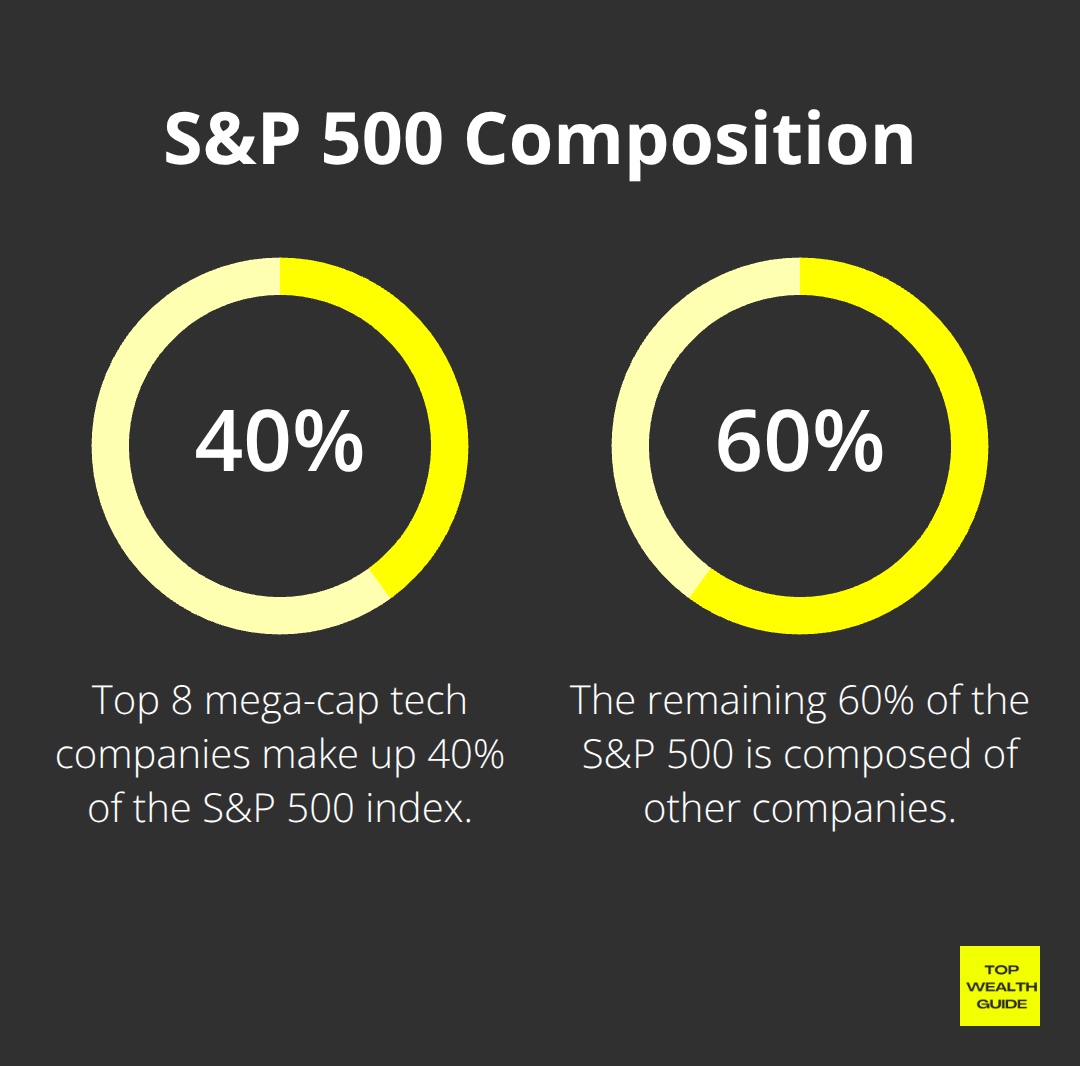

Now, don’t start dancing just yet. There’s this, let’s call it tech baggage… the S&P 500 is lugging around. Those top 8 mega-cap tech darlings you all love? Yup, nearly 40% of the index. Too many eggs, one basket? Maybe. Something to chew on for you folks with a tech-heavy diet.

And then there’s Core CPI. Fed’s best buddy predicts it’s gonna rock a 3.1% annual rate for August. Still way over the Fed’s 2% sweet spot. This little number? Oh, it pulls its weight in stock performance and investment strategies.

Emerging Sectors and Industry Trends

On to health care – emerging like that band no one’s heard of but will explode with a Grammy next year. At the “maybe this is the floor” level relative to the S&P 500. Warren Buffett and pals dumped $1.6B+ onto UnitedHealth, even after a 40% drop in 2025… talk about gutsy. Betting big on Medicare Advantage, hinting the sector’s got juice.

Oh, and e-commerce? Still pushing boundaries. Newegg Commerce Inc. (NEGG) isn’t just poking its head up – it’s done a full-on leap with a 382.9% hike this year, thanks to niche customer clinginess. Yup, the shift to online retail therapy marches on.

Meanwhile, sustainability is the belle of the ball. Tecogen Inc. (TGEN) with their chic cogeneration systems is up a whopping 403.4% this year. Goes to show, folks are loving the planet-friendly ways.

Shifting Investment Strategies

The global turbulence? Yup, that’s rewriting the investor playbook. Gold and silver hitting peaks – safe-haven assets’ time to shine.

But don’t sleep on the little guys. Smaller, bold stocks are catching eyes. Like Celcuity Inc. (CELC), killing it with innovative cancer therapies and notching a 309.3% rise this year. Showing there’s gold in them risky, niche hills.

So, what’s the takeaway here? We’re in a market cocktail – some sweet opportunities, some bitter risks. Balance is the name of the game. Diversify, mix and match those sectors like you’re a DJ at Burning Man. Do your homework – know your risk tolerance before diving in.

Time to dive into some hot stock picks of 2025. This crazy, dynamic ride has just begun.

Which Stocks Will Dominate 2025

Alright folks, so at Top Wealth Guide, we’ve crunched the numbers, squinted at the charts, and come up with our top stock picks for 2025. These are the companies that are not only weathering the storm but surfing the big waves of economic chaos and tech upheaval.

Amazon: The E-commerce Giant’s Continued Expansion

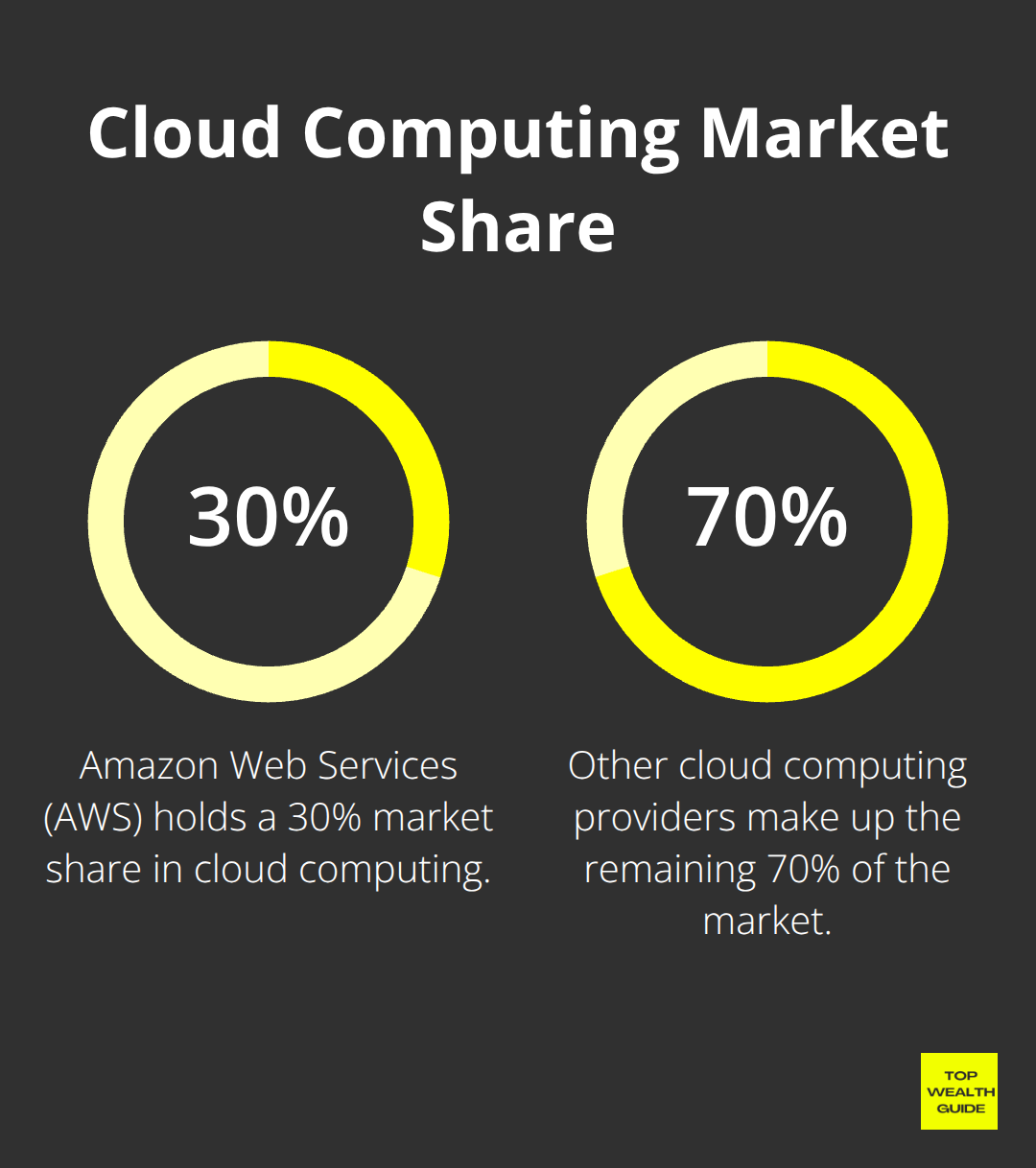

Amazon (AMZN) – still a juggernaut – is holding strong in 2025. Seriously, a market cap of $1.8 trillion? And that P/E ratio of 42? It’s not just hanging in there; it’s flexing. Growth engines? Turbocharged. Amazon Web Services (AWS) isn’t budging from its 30% market share. Cloud computing is like the universe; it keeps expanding.

And North America? A 47% jump in operating income last quarter, with revenue growing by 11%.

Sure, $59 billion in debt sounds like a lot – but when you’ve got $62 billion in cash plus short-term investments, you’re doing more than okay. Their logistics? Powered by AI – and I’m talking DeepFleet here – has shaved costs and sped up deliveries like you wouldn’t believe. But, regulatory whispers are in the wind, eyeing Amazon’s market command. However, the dive into satellite internet services via the Kuiper network? Think fresh revenue steams… err, streams.

Dutch Bros: Brewing Up Expansion Plans

Dutch Bros (BROS) is riding high with a market cap of $6.2 billion and a forward P/E ratio of 55. High? Sure, but check their growth plans and you’ve got your answer. Their blueprint to hit 2,029 shops by 2029 – peek beyond for 7,000 – makes the price tag reasonable.

On the money side, Dutch Bros is not just sipping but chugging along with over $2 million in average sales per store annually. Even with $139 million in debt, cash flows are strong, and the growth trajectory shows no signs of fatigue. Yes, there’s the Starbucks shadow and market saturation worries, but their drive-thru dynamo model plus a devoted customer base offer some serious competition. They’re even experimenting with hot food. Could mean bigger bucks – ask their rivals.

Toast: Tech Solutions for the Restaurant Industry

Let’s talk Toast (TOST). They’re top-tier in restaurant tech, sitting with a $10.5 billion market cap. Profitable? Not quite yet, but those growth stats are worth a look. With around 148,000 restaurants on board by mid-2025, well, that’s reach.

Annual recurring revenue (ARR) is clocking in at $1.9 billion. Scalability? Check. Market penetration? Double-check. The debt? A manageable $390 million, and that’s with a growth curve and a $1.2 billion cash cushion to boot. Biggest hurdle? Relying on an industry that’s anything but steady. However, Toast’s menu of services – including AI tools like ToastIQ – offers the breadcrumbs of invaluable insights and operational oomph. Useful? More of a mandatory partner than just an extra.

These stocks span a spectrum of sectors and strategies – each packed with its own brand of promise and peril. The market’s got a heartbeat that shifts gears fast, so the bright stars of today could be the dull ones tomorrow. Investors? Do your homework – deep dive – and make sure those moves align with your personal financial playlist.

So, let’s keep threading through the maze of investment strategies that could help us navigate the unpredictable seas of 2025’s financial world.

So, here we are, 2025. Investing now? It’s like navigating a jungle with a butter knife. But fear not-I’ve got the map, and it’s all about finding that sweet spot between risk and reward. Yep, balance is key, folks. Let’s dive into the killer strategies that could just help you thrive in this ever-spinning roulette wheel we call the market.

Sector Rotation: A Modern Diversification Approach

Out with the old, in with the… slightly newer. Diversification? Pushed aside, 2025-style. Sector rotation is the Beyonce of investment strategies now. Our crystal ball shows that bouncing like a ping pong ball between cyclical and defensive sectors-cue the economic indicators-is how you turn meh returns into fireworks. Materials and energy stocks? They’re the prom kings when inflation’s doing the Cha-Cha. But when life’s uncertain, utilities and consumer staples step up. Keep pivoting, keep winning. Don’t just spread-capitalize.

The 60/30/10 Portfolio Strategy

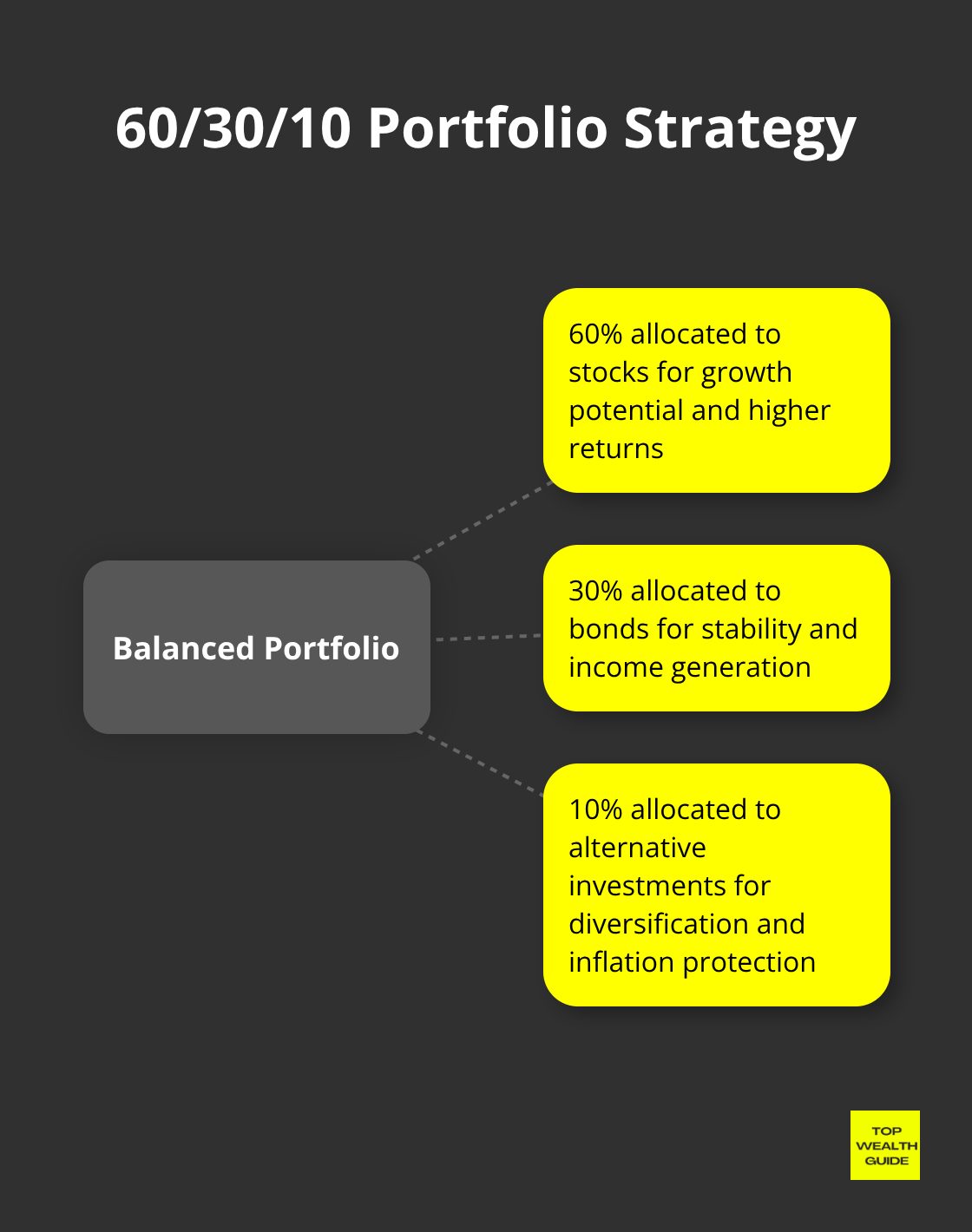

The age-old 60/40 stock-bond split? Toss it in the recycling bin. Let’s talk 60/30/10 for a hot second: 60% stocks, 30% bonds, and 10% in the wildcard bin-alternatives (think real estate trusts or commodities). It’s the cocktail that balances risk and reward with just the right kick. That 10%? Your personal bodyguard against the mean streets of inflation and volatility.

AI-Powered Market Timing

Behold, the AI overlords have graced us-now, even retail investors get a peek behind the Wall Street curtain. Welcome to trading in the age of AI. With AI-powered platforms that can sense market hiccups with increasing accuracy, you’re armed to the teeth. But remember, these AI tools? They’re the sidekicks, not the superheroes. Flying solo on AI signals? You risk turning trading into a 3 a.m. infomercial disaster.

Risk Management in a Volatile Market

Welcome to the roller coaster, folks… keep your hands and legs inside at all times. Risk management in 2025? It’s all about the toolkit: stop-loss orders, protective puts, and tail risk hedging are your friends. Risk parity? That’s the buzzword-allocate based on risk, not assets. It’s the bread and butter for those looking to keep things steady across this whirling dervish of a market.

Embracing Global Opportunities

Think global or stay local. In 2025, wearing blinders ain’t gonna cut it. Emerging markets offer more spice than your typical show, while developed markets are your sturdy oaks. Throw in some currency diversification, and you’ve got yourself a party. Consider spreading the love to international stocks-not just to hedge your bets, but to hop on the global shift train and ride those demographic waves.

Final Thoughts

The cream-of-the-crop stocks of 2025…they’re the shiny new toys for investors to ogle. Welcome Amazon, Dutch Bros, and Toast to the spotlight-each a juggernaut in its own playground. They’re not just playing the game; they’re rewriting the rules with innovation and savvy growth maneuvers, snapping onto the winning side of this chaotic marketplace.

Now, navigating the stock market in 2025? That’s a whole circus. Investors have to play chess, not checkers. Think sector rotation, think the 60/30/10 portfolio shuffle-strategies built to weather the storm of market turbulence. And let’s not forget our trusty sidekicks: stop-loss orders and protective puts (can’t wander into battle without these, folks). They’re like airbags-there when you need ’em most.

Check out Top Wealth Guide for the roadmap to fortune in 2025 and the steps beyond. Dive into our market insights and financial planning gadgets-because every well-made plan starts with good intel. 2025’s stock market serves up opportunities for those ready to wrestle with its hurdles and synchronize their dreams with a future-proof investment trajectory.