Thinking about diving into real estate? Yeah, that can be a real game-changer for your financial future… but hold up a sec. Before you jump in headfirst, you gotta figure out if your wallet can handle the hit.

Enter the folks at Top Wealth Guide. They’ve cooked up this killer tool — the “Can I afford an investment property?” calculator. It’s your new best friend in this whole decision-making saga.

So, what’s the magic sauce? This tool sizes up all the vital stuff — from the sticker price to those sneaky ongoing expenses — giving you the lowdown on whether your investment dreams are actually gonna fly.

In This Guide

What Are the Real Costs of Investment Property?

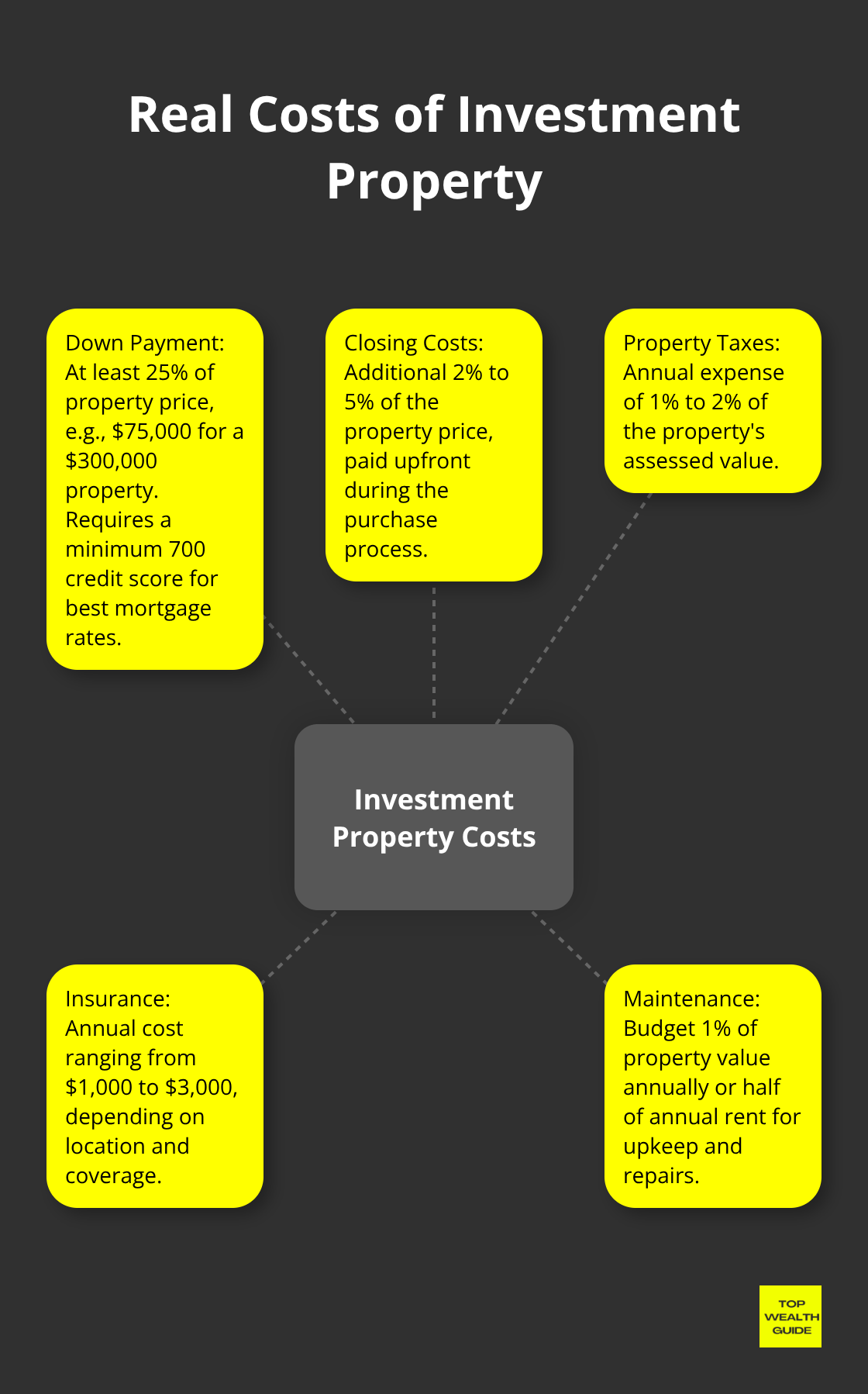

Investing in property? It’s more than just snagging a good deal on a Zillow listing. You’ve got a buffet of costs to chew on, and it’s crucial to digest every morsel before diving headfirst into this venture.

The Upfront Cash Requirements

First up – the down payment. Your initial handshake with the bank. Expect to cough up at least 25% of that property’s price tag, paired with a minimum 700 credit score if you want those sweet mortgage rates. Think a $300,000 deal? That’s $75k to fork over right off the bat. And hold the phone-don’t forget those closing costs, which will nibble away another 2% to 5% from your cash stash.

The Ongoing Expenses

Newbies in real estate often get blindsided by the constant outflow of cash. Here’s the rundown:

- Property Taxes: Think 1% to 2% of your pad’s assessed value each year-bye bye, wallet.

- Insurance: Shell out somewhere between $1,000 to $3,000 annually. It all depends on where you’re parked and how much cushion you want.

- Maintenance: The rule of thumb? Tuck away half your annual rent for those “surprise” expenses, or budget 1% of the property’s worth yearly to keep things from crumbling.

The Potential Income

Ah, rental income-a shiny beacon of hope. But here’s the hitch: vacancies happen. Even in red-hot markets, anticipate your property chilling empty for at least a month annually. That’s about an 8% drop in your yearly rental earnings.

Zillow’s Observed Rent Index (ZORI)-it’s your trusty compass for gauging the typical rent landscape in your area.

The Financial Reality Check

When you do the math, the rosy allure of an “investment” might start looking more like a fiscal leech. This is where investment property calculators (say hello to tools like Top Wealth Guide) come into play. They’ll sketch out the whole financial portrait before you leap.

Can’t let dreams of appreciation and tax breaks eclipse the cold, hard metrics. Zero in on those numbers first-if the property can’t drum up positive cash flow after considering every cost, what you’ve got isn’t an investment-it’s a ball and chain.

As we roll ahead, let’s unwrap how an investment property calculator can steer you toward savvy real estate moves.

How Our Investment Property Calculator Works

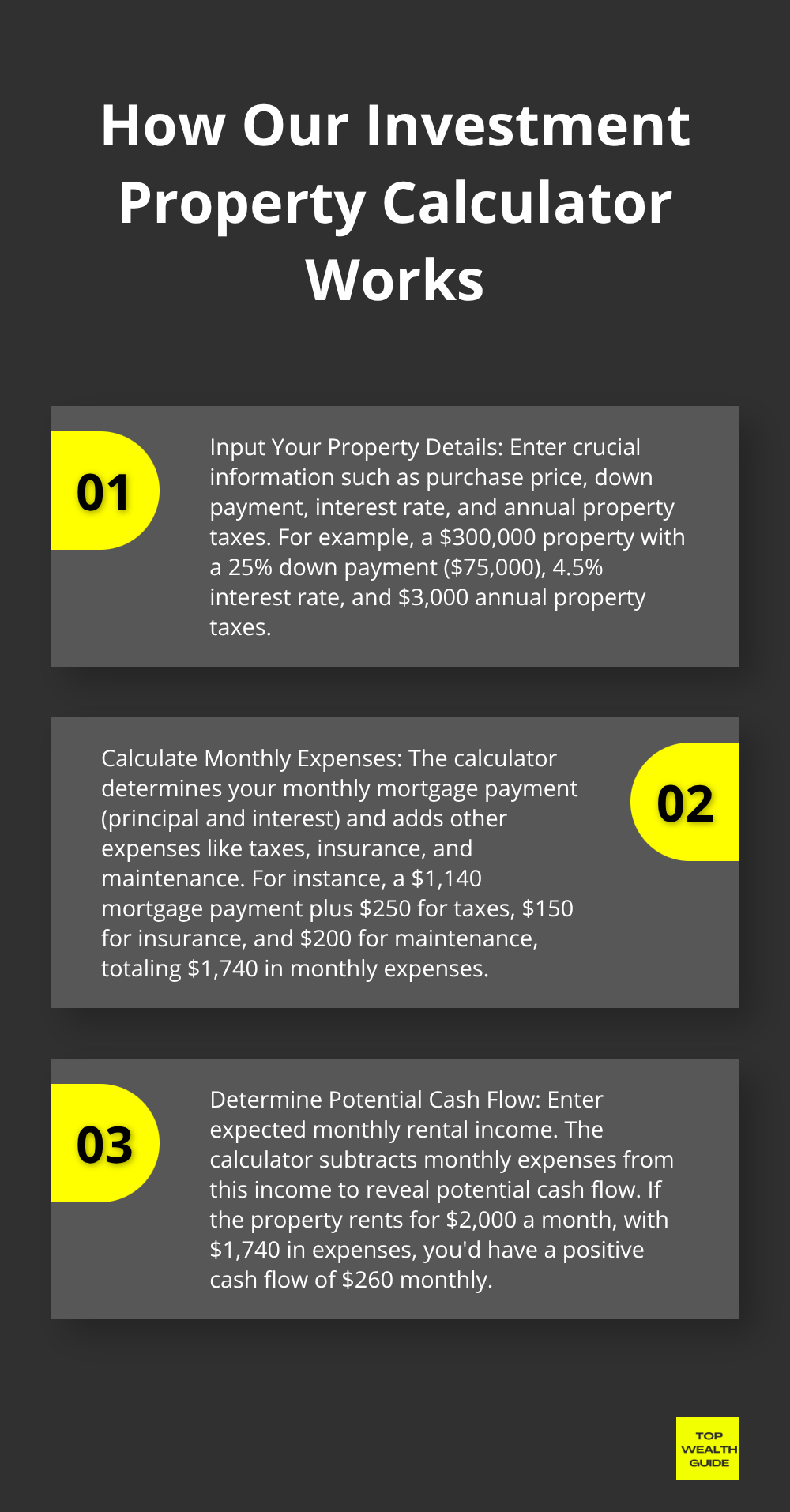

Input Your Property Details

Our calculator needs the nitty-gritty on the property you’re eyeing. We’re talking the purchase price, that down payment you’re planning to fork over, the interest rate of your mortgage, and annual property taxes – all the juicy details that shape your investment’s financial profile.

Picture this: A $300k property, you’re putting down 25% ($75k), with a spicy interest rate of 4.5%, and property taxes cruising at $3k annually. Punch these numbers in, and our calculator starts its magic.

Calculate Monthly Expenses

Once the basics are in, the real show begins. The calculator dishes out your monthly mortgage payment – principal and interest tag-teaming here – and throws in those other less exciting, but crucial expenses like taxes, insurance, and maintenance.

Say you’ve got a monthly mortgage payment of $1,140. Now, toss in $250 for taxes, $150 for insurance, and $200 for sprucing up the joint, and there you have it – total monthly expenses at a cool $1,740.

Determine Potential Cash Flow

Now, let’s talk flow – cash flow, that is. Enter what you expect to rake in each month in rent. Our trusty tool then subtracts those monthly expenses from this income to reveal your cash flow potential.

If your place rents for $2,000 a month, voilà – a positive cash flow of $260 monthly ($2,000 – $1,740). This quick and dirty look tells you if your property is likely riding the cash flow wave or caught in the undertow.

Evaluate Key Investment Metrics

Our calculator isn’t just crunching basic cash flow; it’s diving into the deep end with key investment metrics. ROI and capitalization rate (cap rate) are on the docket.

ROI – it’s all about how efficiently your investment’s working for you by comparing net profits to what you initially put in. Real estate ROI? It’s a rollercoaster – financing, rental income, costs, all this stew impacts the numbers.

Meanwhile, the cap rate checks in on the return rate based on the income your property should drum up. Take a net operating income of $15k and a property valued at $300k, that cap rate hits 5%.

These metrics are like X-ray vision for your investment, giving you the lowdown on how this stacks up against other opportunities or your goals. Our investment property loan calculator arms you with key insights for navigating the real estate arena. But remember, friends – while this tool’s got some serious chops in data dishing, it’s just one piece of the investment puzzle. Next up, we’ll dive into the other factors you need to eyeball when making those big financial moves in real estate.

Beyond the Calculator: Key Factors for Property Investment

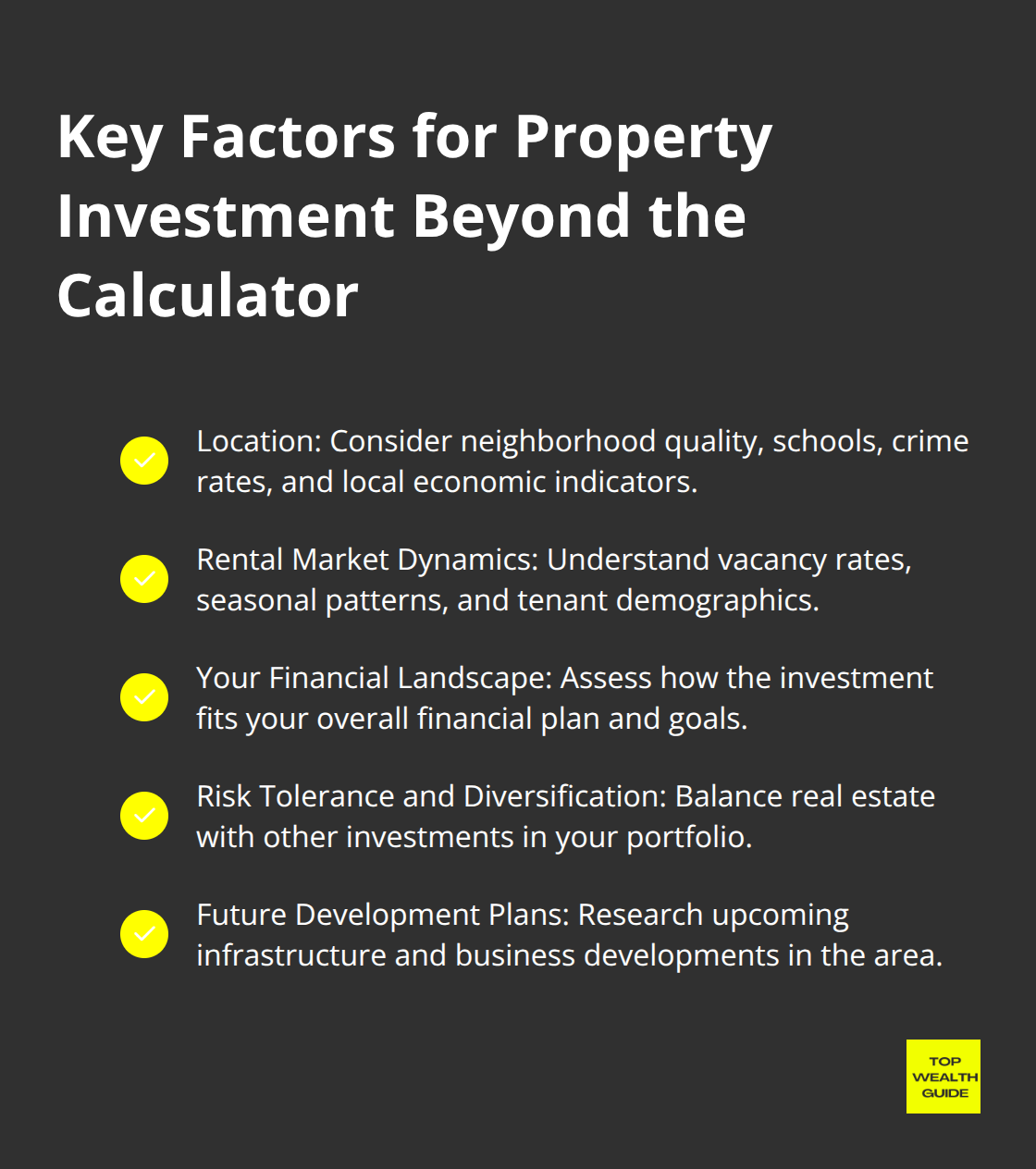

Location: The Unbeatable Element

Location, location, location. Still the undisputed heavyweight champ of real estate investments. Plant your money in a bustling neighborhood with good schools, low crime, and easy access to stuff you need-and voilà, faster appreciation and quality tenants. But hey, don’t just eyeball it: dig into those local economic indicators. Is the job market diverse? Are major companies setting up shop or skipping town? These are the threads that weave the long-term value and rental demand of your property.

Rental Market Dynamics

You’ve gotta get the pulse of the rental market, folks. Sure, Zillow’s Rent Index is a decent starting point, but don’t rest on your laurels there. Go talk to local property managers and agents-they’ve got the lowdown on vacancy rates, seasonal quirks, and who’s actually living there. Picture this: a college town buzzing with renters during the school year but ghosting come summer. Or a tourist magnet flipped on its head. Commit to understanding these patterns and watch your rental income soar while sidestepping those rentless periods.

Your Financial Landscape

Your personal dollars and cents situation-yeah, it’s kind of a thing here. Ponder these questions:

- How does this investment mesh with your whole financial plan?

- Could you handle a vacancy or a surprise repair bill without sweating bullets?

- What’s your exit game? Shooting for that long-term appreciation, or is it quick cash flow you’re after?

Real estate is a marathon, not a sprint, folks. Make sure that marathon jibes with your bank account goals.

Risk Tolerance and Diversification

How’s your stomach for risk? Real estate is like a stable ship, but it can still hit choppy waters (think market swings, property damage, tenant nightmares). Diversify-spread that risk across your investment portfolio with stocks, bonds, and whatnot.

Future Development Plans

Scope out future development blueprints for the area you’ve got your eye on. Infrastructure on the rise, new businesses popping up, or shifts in zoning laws-these are the big levers that move property values. Your local government’s planning department? Yeah, they’re the gatekeepers of this intel. Investing in a place on the cusp of major upgrades could mean serious appreciation down the road.

Final Thoughts

So, you’re thinking about diving into property investment, huh? Sounds like a great plan…if you know what you’re getting into. Let’s be honest, though-it’s not as simple as just plugging numbers into a “Can I afford an investment property?” calculator. That’s just your warm-up. The real game? It’s about juggling ongoing expenses, pulling in potential rental income, and keeping an eye on those pesky vacancy rates. Get the full picture, people, to see if your investment stands a chance.

Location, location, location-can’t stress it enough. Seriously, your property sitting in a hip, up-and-coming neighborhood with solid schools and low crime rates? It’s like holding a golden ticket. That spot is likely going to see its value shoot through the roof, scooping up quality tenants along the way. But slow your roll; take a minute to dig into local economic indicators, check out the job market trends, and get the lowdown on future development plans. Why? Well, these little nuggets tell you a lot about long-term potential.

Don’t just take my word for it. The folks at Top Wealth Guide are there to help you navigate these financial waters without capsizing. Their investment property calculator provides a snapshot of potential costs and returns (think of it as your launching pad). But don’t stop there. Pair those insights with some good old-fashioned research and analysis of the factors we’ve laid out. Only then can you really figure out if you can pull off owning an investment property.

1 Comment

Pingback: Your Practical Real Estate Investment Guide