Real estate investing—yeah, it’s been the darling of wealth-building strategies for what feels like forever. Over at Top Wealth Guide, we’ve watched people stack serious cash through property buys.

But…big question: Is real estate still the golden goose in today’s market? Let’s chew on the benefits, hurdles, and game plans for making it big in real estate. This way, you can decide if it’s worth your time—or if you’re just gonna get stuck with a money pit.

In This Guide

Why Real Estate Shines as an Investment

Let’s chat real estate-the heavyweight champ of wealth building. Investors diving into smart property deals can make some serious dough. Why does real estate often leave other investments in the dust? Let’s break it down…

Appreciation: The Long Game That Pays Off

Property values just love to climb over time. In the good ol’ U.S. of A., homes typically appreciate 3.5-3.8% each year (yeah, really). So, your initial investment can see some nice, hefty growth. But, just remember-local markets, the economy, and that rad open floor plan can tweak those appreciation rates.

Rental Income: Your Monthly Money Maker

Owning rental property… It’s like getting a money tree planted right in your backyard. Imagine snapping up a duplex for $400K. Rent each unit for $1,500 a month, and bingo-$3,000 monthly in your pocket. Subtract expenses, and you’re clearing $1,500 in pure profit each month. That’s $18,000 a year just for having your name on the deed.

Tax Perks That Fatten Your Wallet

The IRS has a soft spot for real estate moguls. Mortgage interest, property taxes, depreciation? All deductible, my friend. These write-offs can give your tax bill a serious trim. Picture this: Earn $50,000 in rental income, deduct $30,000 in expenses and depreciation, and voilà, you’re taxed on just $20,000. Talk about savings, especially when compared to other investment plays.

Inflation-Proof Your Wealth

As prices head north, your real estate’s value rides the wave up. Rents rise with inflation, meaning your income tags along, too. And if you locked in a fixed-rate mortgage? Your biggest expense stays put while your property value and rental income both decide to inch upwards. Real estate, meet inflation hedge. Real assets tend to kick stocks and bonds to the curb during low-growth, high-inflation scenarios.

Real estate’s not just an investment; it’s a turbo-charged wealth engine. But hang tight-it’s not all smooth roads. Gear up for the tricky bits of property ownership. Next, let’s tackle those hurdles and skirt them like a seasoned pro.

The Hidden Costs of Real Estate Investing

So, real estate investing. Not all iced lattes and Instagram posts, right? Let’s yank the curtain back and chat about the gritty side of owning property.

The Cash Crunch

You wanna play in this league? You better have some serious moolah. We’re talking sizeable wads of cash. Down payments of 10% – 24.99% are the norm. And oh, for investment properties, max seller concessions are a measly 2%. Plus, those closing costs – tack on another 2-5%.

But wait – there’s more! Cue the emergency fund for repairs, vacancies, and surprises your wallet won’t love. Pro tip: stow away at least six months’ worth of mortgage and operating expenses. On a $300,000 property, that’s another $10,000 to $15,000 – easy.

The 2 AM Toilet Call

Got a rental property? Well, congrats – you’ve signed up for the 24/7 club. Pipes burst at an ungodly hour, or tenants don’t see eye to eye? You’re the one handling it. A Buildium survey says property managers lose about 20 hours a week to property tasks (hello, side career).

It’s not just time – it’s pure stress. Tenants demand nerves of steel, evictions will make your head spin, and local laws might just be your final boss battle.

Market Volatility

The housing market – a rollercoaster of recessions, recoveries, booms, and busts. Just look at the San Francisco Bay Area over the last 30 years.

Economic slumps? They bring higher vacancies and lower rent checks. During COVID? Landlords watched their incomes nosedive as tenants scraped by.

Illiquidity Woes

Unlike stocks, selling a property ain’t a click-and-done job. You’re looking at 55-70 days on average to close a sale in the U.S. (thanks, Zillow). Slow market? You’re looking at a calendar, not a stopwatch.

Need cash quickly? This lack of liquidity can spell trouble. You might have to sell at a loss or take on those juicy, high-interest loans to stay afloat.

Real estate investing is not for those who buckle under pressure. It demands big bucks, time commitments, and strong nerves. But hey, if you can navigate the maze, the payoffs can be real sweet. Ready to find out how to stack the odds in your favor? Let’s dig in.

How to Win at Real Estate Investing

Listen up, because real estate investing isn’t just about buying a piece of land and calling it a day-it’s strategy meets smarts with a side of prep work. At Top Wealth Guide, we’ve seen the good, the bad, and the “what were you thinking?” of investors. The secret sauce? A bulletproof strategy. Here’s the playbook to boost your success:

Master Your Market

Know your turf inside and out. Yep, that means doing your homework on local job growth, economic pulses, and those all-important population waves. The U.S. Census Bureau-your best friend for housing stats, with 145,333,462 housing units stretching across the U.S.

Austin, Texas-is lighting up the population charts. A good sign? Definitely. But don’t stop there. Hunt down gentrifying areas and the next Silicon Valley wannabes.

Pro tip-set up alerts. Stay in the loop on zoning shifts, new builds, and infrastructure leaps that could skyrocket property values.

Diversify Your Portfolio

Mix it up. Spread those investments across property types and spots. Dip your toes in with a suburban single-family home. Once you’re rolling in dough and confidence? Go big, expand that portfolio.

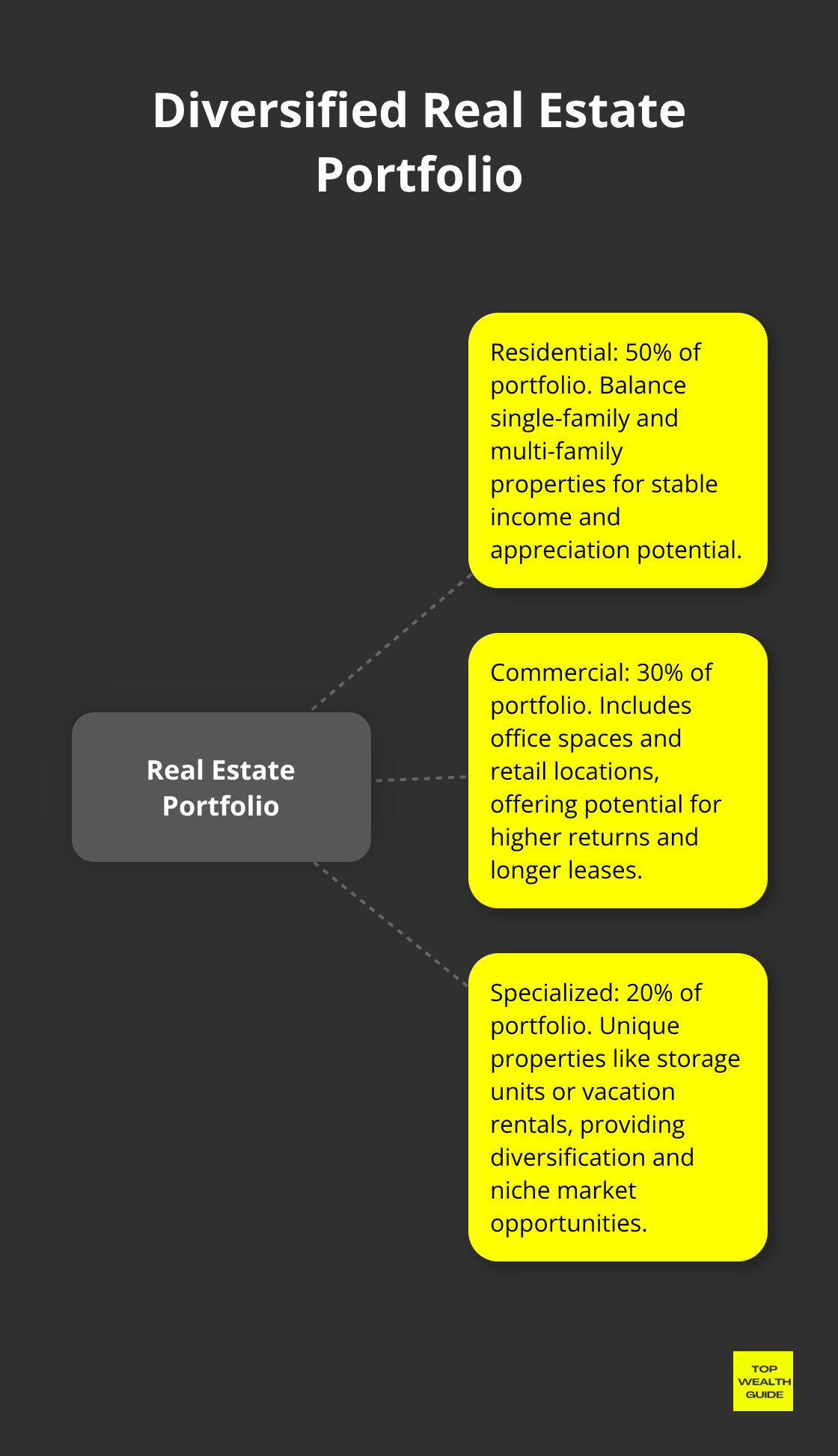

Here’s a smart spread:

- 50% residential (balance single-family and multi-family, like a pro)

- 30% commercial (think office space or retail hot spots)

- 20% specialized (hello, storage units or swanky vacation rentals)

Different types, different market reactions. Keeps your investment ship steady through stormy seas.

Use Professional Services Wisely

Build your Dream Team-the people who’ll have your empire’s back. Pick ’em well.

For property management, look for firms with minimal vacancies and lightning-fast tenant turnover. The National Association of Residential Property Managers (NARPM)-these folks set the bar with their certifications and expertise.

Real estate agents? You want the ones who know investment properties like their backyard. Recent deals, underground property networks-ask them about it all.

They’re there for you. Don’t be shy about negotiating fees or firing underperformers.

Focus on Financial Performance

Numbers first-always. Before taking the plunge, run a cash flow deep-dive.

Here’s the magic formula:Monthly Rent – (Mortgage + Taxes + Insurance + Maintenance + Vacancy Allowance) = Your Cash Flow Jackpot

Aim for a cool $200+ per unit in monthly positive cash flow. Anything less might mean feeding your investments during tough times.

ROI basics-the 1% rule is your go-to. It ensures rent will at least match, if not beat, mortgage payments. Check cap rates (Net Operating Income / Purchase Price) and shoot for that golden 8% or more-markets be damned.

Real estate? It’s bravery and brains. With the right playbook, it morphs into your ticket to wealth-building glory. Deep research, smart diversity, team-building, and money metrics. These are your keys to turning properties into profit machines.

Final Thoughts

So, real estate investing-it’s like the golden child of wealth-building, promising all sorts of financial goodies. But… let’s be clear-it ain’t exactly a walk in Central Park. Long-term appreciation, rental income that keeps the lights on, tax perks Uncle Sam surprisingly gives you, and that nice little hedge against inflation-sweet deal, right? Well, buckle up, because it comes with a punch: high upfront costs, the headache of managing properties, market roller-coasters, and-oh joy-illiquidity. Your call on this one… figure out what you’re cool with, financially and risk-wise, to see if real estate should be your next move.

And hey, if you’re diving into the real estate pool, guess what-education is your lifeline. Get into the weeds of local markets, hit up some seminars, and schmooze with the wise folks who’ve been around the block. Ask questions, take notes. Start with a single-family rental-think training wheels-or team up with investors who’ve got the scars to show for it. Once you’ve got some miles under your belt, go big or go home by mixing up your portfolio with different real estate flavors.

Over at Top Wealth Guide, we’ve got your back with insights and resources to untangle the web of real estate investing. We dish out practical advice-no fluff-and offer tools that’ll prime your financial pump. Whether you’re wearing a newbie badge or have already planted a flag in investment land, we’re here to fast-track your journey to long-term wealth.

3 Comments

Pingback: What Is a Good Average Rate of Return on Investments?

Pingback: Property Management Company Services for Rental Income - AIM Properties

Pingback: Commercial Real Estate for Beginners: A Complete Guide