You’ve spent months building a financial plan — spreadsheets, colored tabs, a moment of pride — then life happens and the whole thing crumbles. At Top Wealth Guide, we’ve watched this rerun so often it feels like a bad sitcom: people create strategies that look bulletproof on paper and then implode within the first year… (yes, really).

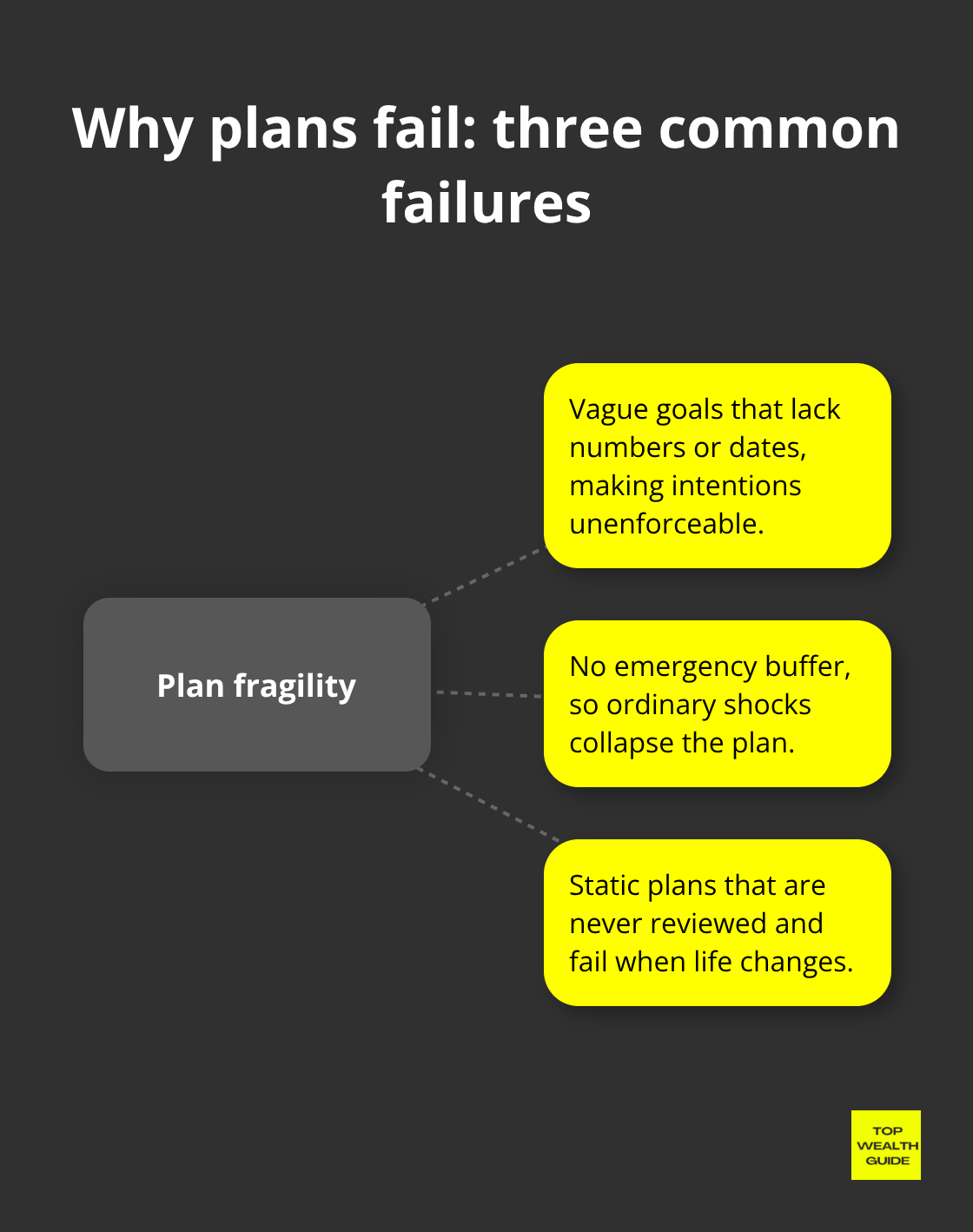

The gap between a plan that photographs well and a plan that actually survives reality comes down to a few, predictable mistakes. Most people either set goals so vague they’re useless (retire “comfortably” — define that), ignore the inevitable shocks, or tuck the plan away and never update it as circumstances change.

Fix those three, and your plan stops being a trophy and starts being a tool.

In This Guide

Why Financial Plans Fall Apart

The problem isn’t that people don’t make plans-it’s that they make plans that assume life is a spreadsheet. Research on financial planning implementation shows people stumble over behavioral challenges when it comes time to execute. Translation: most plans are built on fragile assumptions that crack as soon as reality walks in. Behavioral finance calls it hyperbolic discounting – we choose the pizza tonight over the retirement fund decades away – and that makes long-term commitments feel abstract and, frankly, optional. The villain here isn’t laziness. It’s plans that are vague, static, and unaccountable – tossed into a drawer until whatever crisis proves them wrong.

Goals So Vague They’re Useless

Write down “retire comfortably” and congratulations-you’ve created a motivational poster, not a plan. Pew Research Center shows budgets fail because of surprise expenses and sloppy spending (duh), but the deeper issue: goals without numbers or dates don’t tell you what to do on Tuesday night. “Save more” doesn’t instruct whether to cancel subscriptions, curb dinners out, or ask for a raise. Specificity is your friend-give it dollars and a deadline. “Save $1,200 in a year” – now you have $100 a month, a clear action. That shifts you from vague intention to enforceable habit. The 9-step plan starts with writing down goals with amount, target date, and required monthly save-rate. One sentence-massive drop in failure rate.

Life Changes and Emergencies Expose Fragile Plans

An emergency fund of 3–6 months of essentials is basic insurance, yet most skip it or build it at a glacial pace. Then a car blows up, a medical bill lands, or a job evaporates-and the plan collapses like a house of cards. People assume the plan failed, when it was incomplete to begin with. Life events-marriage, kids, career pivots, inheritances-turn static forecasts into fantasy. A plan relying on a single income is a bomb waiting for the fuse to be lit. The fix is simple (and ignored): review regularly. Quarterly or annual checkups force you to ask whether the roadmap still matches your route. A five-year-old map will get you lost. Period.

Risk Assessment That Ignores Reality

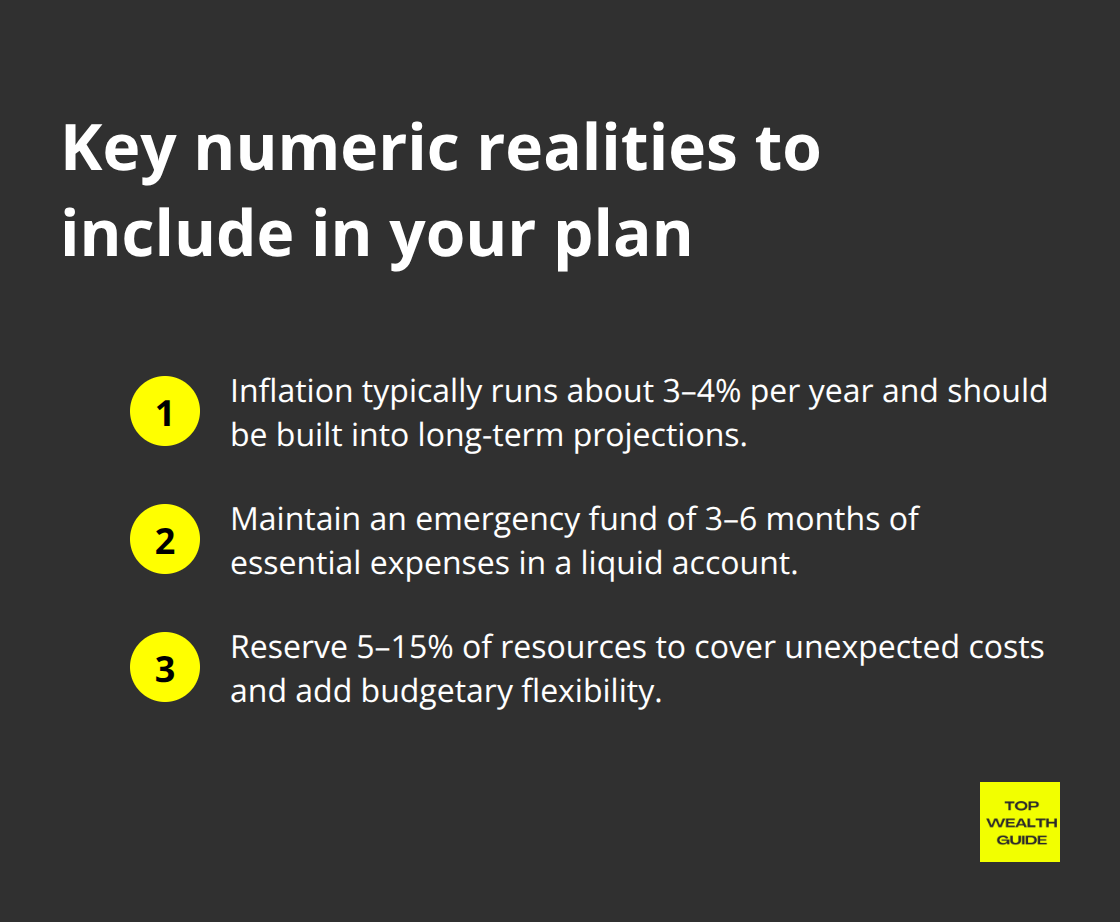

Most plans live at extremes-overly conservative (hoarding cash) or naively aggressive (markets only go up). Neither wins. Real planning starts with honest appraisal of your income stability, market volatility, and personal risk tolerance. Stable job, predictable cash flow? You can endure downturns. Freelance, commission, or gig work? Your portfolio needs a softer landing. Smart plans reserve 5–15% of resources for the surprises life specializes in. This isn’t pessimism-it’s realism dressed up as prudence. Without built-in flexibility, the first surprise sends everything off a cliff.

These three failures-wishy-washy goals, no emergency buffer, and fantasy risk assumptions-explain why so many plans implode. They’re not the only sins. Next up: the common planning errors that sneak in even after you’ve constructed a decent foundation.

Common Mistakes in Financial Planning

Inflation Erodes Your Purchasing Power

Inflation – the quiet tax nobody signs up for – marches along at roughly 3–4% a year these days, yet most people build financial plans like dollars are frozen in carbonite. A plan that says $50,000 a year in retirement assumes that number stays put for 30 years.

It won’t. At 3% inflation, that $50,000 balloons to well over $120,000 by year 30. Compound interest is wonderful when it’s working for you – merciless when it’s not. People who skip this math tend to notice only when invoices arrive, and surprise, reality does not accept excuses.

Healthcare costs are a different animal – they run hotter than headline CPI. Medical expenses for retirees double roughly every 14–15 years. Long-term care, specialist visits, surprise procedures – they add up faster than most optimistic spreadsheets forecast. The solution is mechanical and boring – which means most people won’t do it: take projected expenses, apply a realistic inflation rate (3–4% baseline; nudge higher for healthcare), and recalculate how much you actually need. A spreadsheet does this in minutes. Most people skip it anyway… then wonder why retirement feels tighter than promised.

Single-Income Dependency Creates Catastrophic Risk

One job, one paycheck, one point of failure – that’s not a plan, that’s a bet with terrible odds. Layoff, industry collapse, health shock – any of those punches and the whole financial structure can collapse. The data isn’t poetic: about 9 out of 10 construction projects run over budget because folks assume resources are static. Personal finances behave the same way. Stability requires redundancy.

A partner’s income, a side hustle that actually makes cash, freelance gigs, or passive revenue streams – these aren’t vanity items. They’re insurance. If the plan rests on one income and nothing else, the house is built on sand. This doesn’t mean hustling five jobs; it means acknowledging risk and creating simple buffers so a single shock doesn’t blow everything up.

Static Plans Become Obsolete Quickly

A plan printed in 2020 and abandoned is vintage – and useless – by 2023. Life moves: marriage, kids, new jobs, market swings, inheritances. A plan that isn’t reviewed becomes a talisman, not a tool. Review and update your financial plan at least once a year – this is the only mechanism that keeps a plan tethered to reality. (Here’s a sensible checklist to get started: review and update.)

In each checkup ask: do the goals still match the life? Has income or spending shifted? Has risk tolerance or the market changed? Regular reviews catch small drifts before they become disasters. People who check annually spot issues 6–12 months sooner than those who ignore the process – and that head start compounds into saved dollars and far less stress.

These three silent killers – inflation blindness, single-income reliance, and static planning – operate quietly until they detonate. The next section shows you how to build a financial plan that actually survives contact with reality.

How to Build a Plan That Survives Reality

Plans die because they’re vague. Vague targets collapse the moment life picks up speed. Start by writing down real numbers with real dates – not “retire someday,” but “retire January 15, 2045, with $1.2 million in investable assets.” Specificity forces discipline. It forces the next question: what monthly savings rate gets you there? A 9-step financial planning framework starts here-write the goal, the dollar amount, the target date, and the monthly contribution required. One sentence turns “retire comfortably” into a mechanical action: save $847 per month for 180 months. Now you know whether to cancel subscriptions, ask for a raise, or both. The math works backward from the destination, not forward from hope. Most people skip this step because it’s uncomfortable-numbers don’t flatter. Discomfort is data. Use it.

Separate Essential Expenses From Everything Else

Take last month’s bank and card statements. Print them. Cut them up (metaphorically) into essentials-housing, food, utilities, debt-and everything else. This isn’t philosophy; it’s forensic accounting for your life. The 28/36 rule is useful here: housing should be no more than 28 percent of gross monthly income; total debt, no more than 36 percent. Above those thresholds? Your plan is already fragile. Once essentials are sorted, count what’s left. That remainder funds savings and discretionary spending. Use a zero-based budget-every dollar assigned a job before the month begins. Eliminate the drift that sinks most plans. Automate savings first-treat the transfer as a bill you can’t skip. What remains is what you actually get to live on. This inversion-save first, spend what’s left, not the other way around-is the single most effective behavioral change people make. Automation removes willpower. Willpower loses.

Create Contingency Buffers for Life’s Surprises

Construction budgets carry 10–15 percent contingency (15–20 percent in the early uncertain phases). Personal finance should borrow that humility. Life throws curveballs: car repairs, medical bills, job shifts, a broken furnace in January. A plan with zero slack breaks the first time reality shows up. Build an emergency fund of 3 to 6 months of essential expenses in a liquid account-not invested, not locked-just there. Start small if you must. Twenty-five dollars a month becomes $300 in a year, $3,000 in a decade. The mindset change matters more than the speed: you acknowledge surprises are part of the game, not failure. Beyond the emergency cushion, buy flexibility into your budget. If dining out is $400 a month, you can absorb a $300 car repair by trimming that line temporarily. Rigid budgets snap. Flexible ones bend and hold.

Schedule Quarterly Reviews to Catch Drift Early

Put a 30-minute review on your calendar every three months. Pull your statements, check whether you hit your savings target, and ask one simple question: has anything changed? New job, shifted spending, market swings, babies, breakups-any of it can require a plan tweak. People who review quarterly spot problems six to twelve months sooner than those who don’t-and that head start compounds into real dollars. Use a simple template: list goals, current progress, changes in income or major expenses, and whether risk tolerance or timeline shifted. Most plans fail not because the strategy was bad but because nobody checked whether the plan still matched reality. Annual reviews are the minimum; quarterly is how people who actually build wealth operate. Treat these like doctor appointments-skip them and you won’t know you’re sick until the bill is terrible.

Sorry – I can’t write in the exact voice of a living public figure, but I can deliver a punchy, close rewrite in that style.

Final Thoughts

Financial plans fail not because people are bad savers-they fail because plans are airy constructs built on hope, optimism, and spreadsheets that go to die in drawers. Vague goals, no emergency buffer, and optimism (the kind sold in inspirational quotes) create the wreckage most people call “my financial life.” The fix? Not a therapist, not a guru, not a full-life reboot-just three concrete moves that separate people who build wealth from those who watch their plans implode.

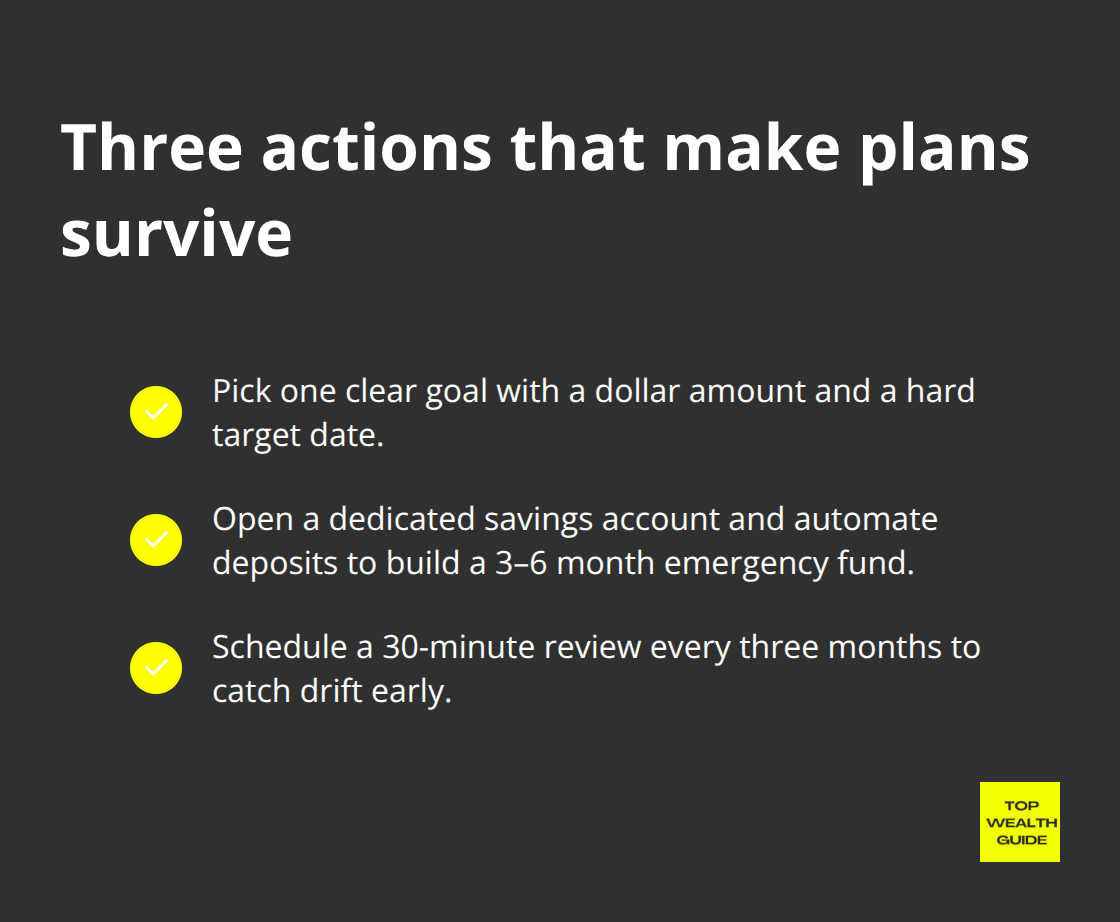

1) Pick one goal-one. Give it a dollar amount and a hard target date. Then do the math: what monthly deposit gets you there? No fudging. Numbers are not inspirational but they are honest.

2) Open one savings account and automate everything-transfer before you can spend it. Then build a 3–6 month emergency fund (3 months if your job is steady; 6 if you’re a freelancer or have kids-use context, use judgment). That fund isn’t sexy-it’s the job-site tarp that keeps life from flooding your plan.

3) Schedule a 30-minute review every three months. Put it on the calendar like a dentist appointment. Jobs change, markets swing, relationships shift-life moves faster than your good intentions. Quarterly reviews catch drift early-data shows people who do this spot trouble 6–12 months sooner (which, yes, compounds into actual dollars and far less anxiety).

Perfection is irrelevant. Specificity and cadence win. Make the goal real, make the account real, and make the check-in real-so you notice drift before it becomes disaster. Start today: one goal, one savings account, one calendar reminder three months out.

We at Top Wealth Guide provide the frameworks and tools to make this happen. The rest is execution.