Real estate investors — always on the hunt for that golden formula — are trying to maximize returns while dodging hefty capital hits. The BRRRR method (yep, that’s not a typo) is shaking things up as a go-to strategy for wealth building via rental properties.

Over here at Top Wealth Guide, we’re witnessing this method changing the game when it comes to snagging properties and beefing up those portfolios. This guide? It’s your playbook for what exactly the BRRRR method is, and more importantly, how you can make it work for you.

In This Guide

What Exactly Is the BRRRR Method

BRRRR – Buy, Rehab, Rent, Refinance, Repeat. It’s like a magic trick for real estate, turning rundown properties into cash cows and turbocharging your portfolio. The National Association of Realtors? They say 60% of investors are already riding this leverage-based wave to maximize returns.

So, here’s the play: zero in on properties you can snag at 70% or less of their after-repair value. We’re talking foreclosures, estate sales, or those down-on-their-luck homes that need a little love (or a lot…). You step in with short-term financing-hard money loans at 8-12% interest, mind you-then work your magic with high-impact renovations. Get some quality tenants in there, refinance based on the new-and-improved value, and voilà-your initial capital bounces right back to you.

How BRRRR Beats Traditional Buy-and-Hold Investing

Forget tying up 20-25% down payments in each property-ouch. BRRRR says, “No thanks.” Instead, it lets you claw back up to 100% of your investment with cash-out refinancing. Like winning a game of financial Tetris.

According to BiggerPockets, successful BRRRR folks? They’re seeing annual cash-on-cash returns to write home about-8-12% from traditional rentals, pshh. The secret sauce? Forced appreciation. You don’t sit around waiting for the market to make your property pretty; you roll up your sleeves. Just look at Little Rock, Arkansas: spruced-up properties pulling in $1,100 monthly while their unrenovated neighbors lag behind at $800. Numbers don’t lie.

Prime BRRRR Property Characteristics and Market Conditions

Here’s the sweet spot: single-family homes, duplexes, small multifamily properties in solid, stable rental markets. Look for places with job opportunities, growing populations. And don’t shy away from a little extra work-kitchens, bathrooms, flooring, HVAC systems are all fair game and where the good value hides.

Ideal markets? They see 3-5% yearly appreciation and keep rental vacancy rates below 7%. Steer clear of money pits needing foundation repairs, major electrical overhauls, or properties in declining hoods. This whole deal flourishes where renovation costs are kept under $30k-$40k per unit and nifty investment criteria are met.

So, there you have it: BRRRR – the method that outshines the old-school rental playbook. Ready to dive deep into each step and crack the code on your first BRRRR deal? Let’s do this.

How Do You Execute Each BRRRR Step

Find and Purchase Your Target Property

Alright, let’s talk property hunting. You’re diving into Zillow, Redfin, and BiggerPockets marketplace like a half-starved hawk. Zero in on the distress signals – foreclosures, estate sales, and those “I need out now” situations. Yes, hard money lenders might slap you with 8-12% interest and 6-12 month terms, but they wrap deals in just 7-14 days, compared to the “let’s take a nap” pace of 30-45 days for traditional loans.

When buying, follow the 70% rule like it’s your new religion – don’t shell out more than 70% of a property’s post-fix-up value minus the fix-up costs. Going in with a cash offer? Massive win – even if it’s really hard money; still looks like cash to the seller. This quick-draw approach kicks traditional buyers, still waiting for loan nods, to the curb.

Execute High-Impact Renovations

Now, renovations. Kitchen and bathroom spruces? Gold mines. We’re talking a 70-80% return on what you pour in, per Remodeling Magazine’s report. Stick to the easy wins: paint, flooring, fixtures, and appliances… ditch the heavy-lifting structural stuff.

Price it out: $15-25 per square foot for your basic overhaul and tack on a 20% buffer for the inevitable “Oh no!” moments. General contractors may dazzle you with a 10-20% markup, but go DIY on managing these projects and save a bundle. Aim to wrap it up in 30-60 days to keep those pesky hard money interest meters from spinning like top.

Secure Quality Tenants and Set Competitive Rents

Tenant time. You want folks with credit scores above 650 and incomes at least 3x the rent. Platforms like Zillow Rental Manager or Apartments.com will be your partners in crime for listing and vetting. Make sure your rents are wallet-friendly based on local vibes and those sparkling improvements you just made.

Solid tenants? They’re like gold-leaf insurance – they keep your investment’s engine purring and the cash flowing. Rigorous screening wards off the nightmare of evictions and property meltdowns that could knock your BRRRR game plan right off track.

Extract Capital Through Cash-Out Refinance

You’ve gotta hang tight for the seasoning period – at least six months before you can woo conventional lenders into a cash-out refi dance at 75-80% loan-to-value. Expect a 30-45 day shuffle and appraisals that reflect your lipstick-on-a-pig improvements. Banks want a good look at your rental income records and reno kudos before they hand over fresh funds.

As soon as the capital’s in your clutches, launch it right into the next deal, like, yesterday. This step? It’s the secret sauce that flips the BRRRR script from a one-hit wonder to a relentless wealth-harnessing juggernaut, swelling your portfolio faster than a tech stock in a bull market.

What Are The Real Rewards and Dangers of BRRRR

Capital Multiplication That Actually Works

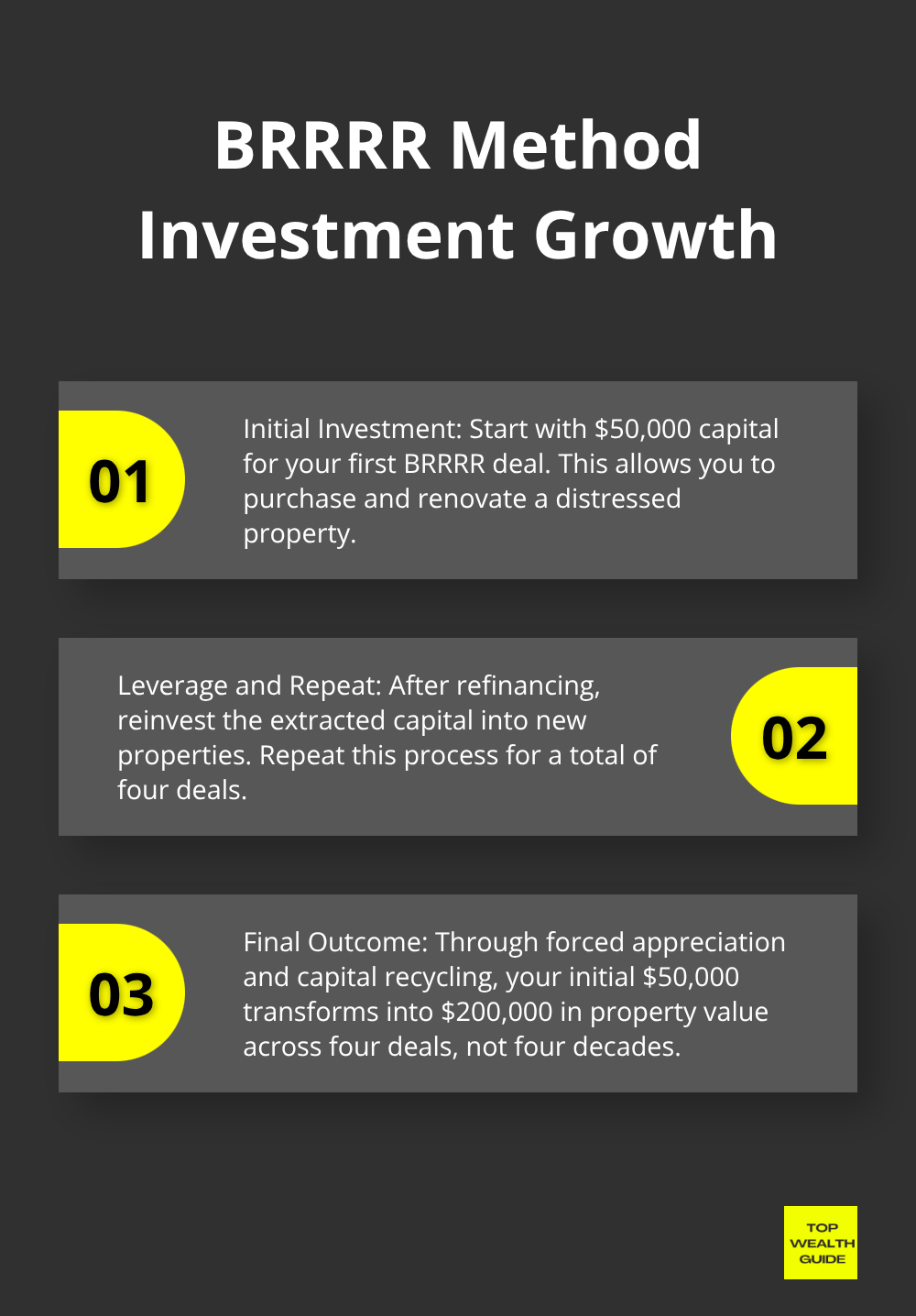

BRRRR-it’s like your money hitting the gym and coming out absolutely jacked. We’re talking forced appreciation and capital recycling on steroids. Instead of letting $50,000 gather dust in a single property, you pull that cash out in, oh, 6-12 months and throw it back into the game. The bottom line: BiggerPockets tells us folks are raking in 20-25% cash-on-cash annually. So, watch that $50,000 morph into $200,000 in property value over four deals-not four decades. Yeah, you read that right.

Now, sprinkle in some rental income that wipes out your mortgage payments while your equity is busy beefing up. A $200,000 property pulling $1,800 in rent with a $1,200 mortgage leaves you with a sweet $600 a month in cash flow. Ramp this up across multiple properties, and boom-serious passive income becomes the name of the game, all while your tenants chip away at your mortgages.

Hard Money Loans Will Crush Your Profits

Hard money loans-the silent killers of BRRRR dreams. These guys love to feast on your profits, especially if your reno drags on past the magical 12-month mark. Those interest rates? Nasty. A $150,000 loan comes with beastly monthly interest. Construction delays, permits playing hard-to-get, or vanishing contractors can flip your golden deals into financial horror shows real quick. And if the market pulls the rug out, you’ll feel it-hard.

Time? Not your friend here. When your contractor vanishes or inspectors go, “Nuh-uh,” every extra month on a hard money loan balloons your costs (and your stress levels). Pro tip: smarties budget for 20% cost overruns and map out worst-case scenarios before signing on that dotted line.

Appraisal Gaps Destroy Deals Regularly

Drop $50,000 on a reno, and bam-only $30,000 in appraised value. Ouch. That shortfall can force you to cough up cash at closing or say goodbye to the refinance. Appraisers might not catch the glow-up you gave your property, particularly in sleepy markets dragging behind your upgrades. This throws a wrench in your refinancing plans.

The BRRRR strategy: Buy, Rehab, Rent, Refinance, Repeat. It’s all about leveraging equity as the new down payment once you refi. But, yeah, vacancy periods? Costly when you’re lugging around hard money debt. And oh, scaling fast means property management bloopers get magnified-one nightmare tenant can send your cash flow crashing-fast. Treat tenant screening like your financial life depends on it (because it totally does).

Final Thoughts

BRRRR success – it’s like this secret formula cooked up in a backroom somewhere. It hinges on three biggies: nabbing properties at 70% of after-repair value, keeping those renovation costs under a cool $40K, and locking down reliable tenants before you can say “cash flow.” The ideal hunting ground? Well, look for markets boasting a nice 3-5% annual appreciation and those nifty sub-7% vacancy rates. Think of the BRRRR sweet spot as those metro areas where $150,000-$300,000 homes only need a little makeup, not major surgery.

Want something different? Traditional buy-and-hold is your jam when you’re all about that passive income life – minus the reno drama. House hacking? Perfect for the newbie investors with less cash to sling around. But BRRRR? It’s the game-changer for those chasing the aggressive portfolio dragon, armed with $75,000 to $100,000 in liquid capital (and the nerves to handle those hard money loans).

Start with hard money – yeah, it sounds intimidating, but it’s the ticket. Then hit up Zillow and BiggerPockets like you’re on a treasure hunt for distressed gems. Befriend contractors, property managers, and local real estate agents – they’re your new besties who get your investment dreams. At Top Wealth Guide, we’re here to help you crack the code on wealth-building strategies that deliver real results through smart, systematic plays.