Dollar-cost averaging (DCA) is a straightforward investment strategy: you invest a fixed amount of money at regular intervals, no matter what the market is doing. Instead of trying to guess the perfect time to buy, you just keep buying consistently. This simple, disciplined approach smooths out your purchase price over the long haul and takes a lot of the emotion out of investing.

In This Guide

- 1 What Is Dollar-Cost Averaging and Why Does It Matter

- 2 Seeing Dollar-Cost Averaging in Action

- 3 DCA vs. Lump-Sum Investing: The Great Debate

- 4 Weighing the Pros and Cons of DCA

- 5 How to Put Dollar-Cost Averaging into Practice

- 6 Common Questions About Dollar-Cost Averaging

- 6.1 1. What's the Best Frequency for Dollar-Cost Averaging?

- 6.2 2. Does Dollar-Cost Averaging Work for Cryptocurrency?

- 6.3 3. Should I Stop Dollar-Cost Averaging During a Market Crash?

- 6.4 4. When Is Lump-Sum Investing Better Than DCA?

- 6.5 5. Can I Use DCA in My 401(k) or IRA?

- 6.6 6. What Is Cash Drag and How Does It Affect DCA?

- 6.7 7. Is There a Bad Time to Start a DCA Strategy?

- 6.8 8. How Do Transaction Fees Impact a DCA Strategy?

- 6.9 9. Does DCA Guarantee I Won't Lose Money?

- 6.10 10. How Long Should I Use a DCA Strategy?

What Is Dollar-Cost Averaging and Why Does It Matter

Trying to "time the market"—predicting the absolute best moment to buy low and sell high—is like trying to catch a falling knife. It's incredibly difficult, and even the pros get it wrong all the time. Dollar-cost averaging offers a powerful alternative by shifting the focus from perfect timing to consistent action.

At its heart, the strategy is about discipline. When you commit to investing a set amount on a regular schedule—say, $100 every month—you put your investment plan on autopilot. This one simple move has a surprisingly powerful effect on your returns.

To give you a clearer picture, here’s a quick breakdown of what dollar-cost averaging is all about.

Dollar-Cost Averaging at a Glance

| Core Principle | How It Works | Primary Goal |

|---|---|---|

| Consistency Over Timing | You invest a fixed dollar amount into a specific asset on a regular schedule (e.g., weekly, bi-weekly, monthly). | To reduce the impact of market volatility on your portfolio over time. |

| Automatic Buying | When prices are low, your fixed amount buys more shares. When prices are high, it buys fewer shares. | To lower your average cost per share compared to buying a fixed number of shares each time. |

| Emotional Discipline | By automating your investments, you remove the temptation to make panicked decisions based on market swings. | To build wealth steadily and avoid the common pitfalls of fear- and greed-driven investing. |

This table shows how DCA’s simple rules can lead to powerful, long-term outcomes, making it a reliable strategy for many investors.

How DCA Turns Volatility into an Advantage

Here’s where the magic happens. When the market price for an asset drops, your fixed investment amount naturally buys more shares. On the flip side, when the price climbs, that same amount buys fewer shares. This automatic adjustment helps lower your average cost per share over time.

This makes DCA especially powerful for navigating the market's natural ups and downs. Instead of fearing a market downturn, a DCA investor sees it as a chance to scoop up more assets on sale. You can learn more about these market swings in our guide on what is market volatility. This methodical approach turns a common source of anxiety into a potential strength.

The main idea behind dollar-cost averaging is that by investing consistently, you avoid the single biggest risk of lump-sum investing: putting all your money into the market right before a major crash.

A Strategy for Everyone

DCA is a perfect fit for anyone investing a portion of their regular income, like the automatic contributions to a 401(k) that come out of every paycheck. It’s an incredibly accessible way for beginners to start building wealth without needing to be a market wizard.

Ultimately, this strategy helps build solid financial habits. It encourages steady, long-term saving and investing, which is the real foundation for creating lasting wealth.

Seeing Dollar-Cost Averaging in Action

Theory is one thing, but seeing dollar-cost averaging in the wild is where the lightbulb really goes on. Let's walk through a simple, real-world scenario with a fictional investor, Sarah, to see how this strategy plays out when the market gets a little bumpy.

Sarah wants to start investing in a popular S&P 500 ETF. Instead of trying to guess the "perfect" time to buy, she commits to a simple plan: invest exactly $100 on the first day of every month for six months. Her only goal is to build her position, not to time the market.

Sarah's Six-Month Investment Journey

Here’s what her investment journey looks like, month by month. The key thing to watch is how her fixed $100 buys a different number of shares each time, depending on the ETF's price.

| Month | Investment Amount | Share Price | Shares Purchased | Total Shares Owned | Total Invested |

|---|---|---|---|---|---|

| January | $100 | $50 | 2.00 | 2.00 | $100 |

| February | $100 | $45 | 2.22 | 4.22 | $200 |

| March | $100 | $40 | 2.50 | 6.72 | $300 |

| April | $100 | $48 | 2.08 | 8.80 | $400 |

| May | $100 | $52 | 1.92 | 10.72 | $500 |

| June | $100 | $55 | 1.82 | 12.54 | $600 |

You can see that in March, when the price hit its lowest point of $40, her $100 bought her the most shares—2.50 to be exact. On the flip side, when the price peaked in June at $55, that same $100 only snagged her 1.82 shares. This is the automatic magic of dollar-cost averaging: you buy more when prices are low and less when they're high, without even thinking about it.

This process highlights the core principles of DCA—investing a set amount on a regular schedule to smooth out the bumps and lower your overall risk.

This discipline turns market volatility from something to fear into an opportunity to scoop up more assets when they’re on sale.

The Mathematical Magic Revealed

So, what’s the final tally? After six months, Sarah has put in $600 and now owns 12.54 shares.

To figure out her average cost for each share, we just do some simple division:

$600 (Total Invested) / 12.54 (Total Shares) = $47.85 per share

Her average cost per share is $47.85. Now, let's see how that stacks up against the average market price over the same period: ($50 + $45 + $40 + $48 + $52 + $55) / 6 = $48.33.

Sarah’s steady approach actually got her a lower average cost than the market's average price. It’s a small difference in this example, but imagine that advantage compounding over 10, 20, or 30 years. To see just how powerful that effect can be, take a look at our guide on what is compound interest.

Thriving in Extreme Volatility: A Real-Life Example

This strategy really shines when the market gets truly chaotic. Think back to the COVID-19 crash in early 2020. The S&P 500 plunged by 34% in just over a month, and panic was everywhere.

Investors who stuck with their DCA plans, however, were quietly buying up shares at a massive discount. In March 2020, someone investing $500 into an S&P 500 ETF was getting 30-40% more shares for their money than they did just a month earlier. When the market came roaring back, rebounding over 70% by the end of the year, those investors saw incredible gains. They turned a frightening downturn into a huge opportunity, simply by sticking to the plan. This is where DCA proves its worth—when it feels the hardest to keep investing.

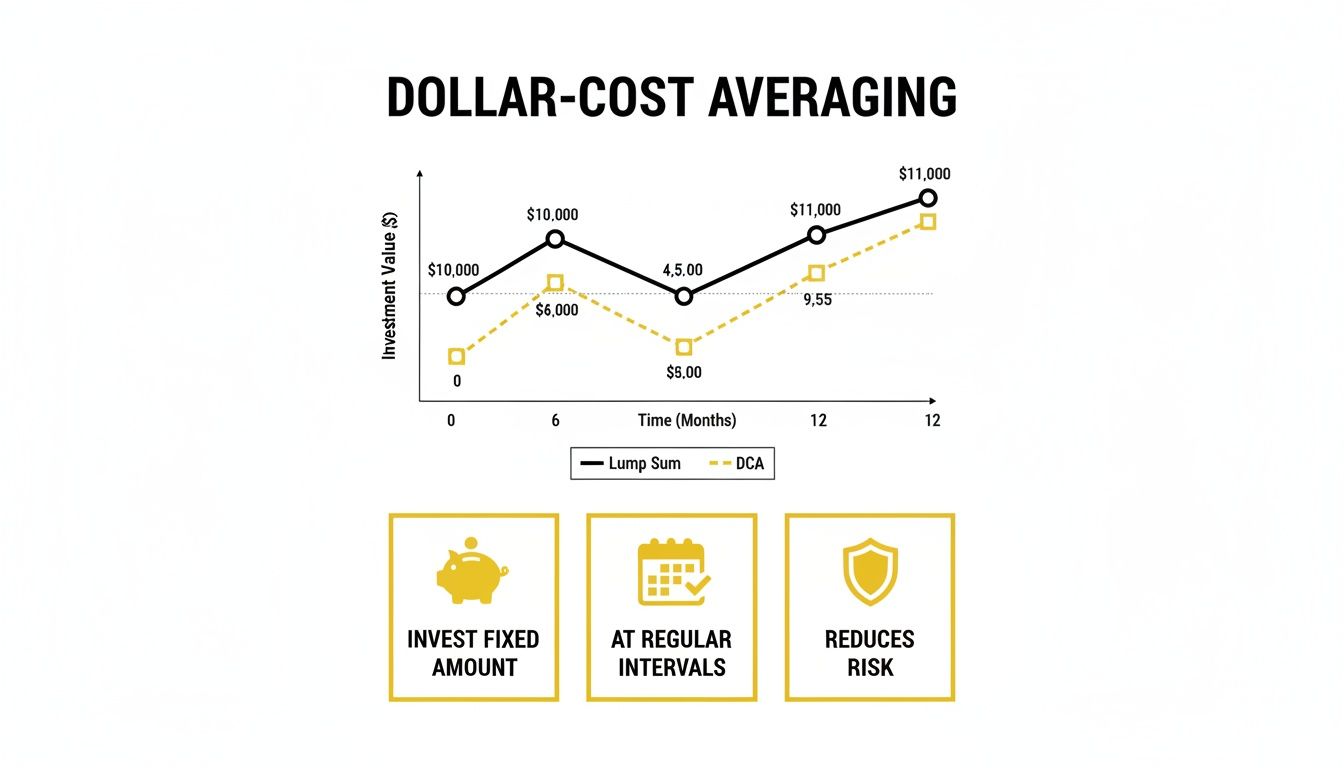

DCA vs. Lump-Sum Investing: The Great Debate

So, you’ve come into a windfall—a bonus, an inheritance, maybe a nice tax refund. Now you’re facing one of the classic investing dilemmas: Do you put it all in the market at once (lump-sum investing, or LSI), or do you feed it in gradually using dollar-cost averaging (DCA)?

This isn't just an academic question; it’s a decision every serious investor faces at some point. On paper, the math often points toward lump-sum investing. Since markets tend to trend up over the long haul, getting your money working for you sooner seems like a no-brainer. But that statistical edge comes with a big string attached: timing risk. What if you invest it all right before a massive market drop?

This is where dollar-cost averaging really shines. Its main job isn't necessarily to squeeze out the absolute highest return. It's about managing risk and—just as importantly—managing your own emotions. DCA acts as a psychological buffer against the gut-wrenching scenario of watching your entire nest egg plummet right after you've committed it.

Understanding the Core Trade-Off

The choice between DCA and LSI really boils down to a simple trade-off: are you chasing maximum potential returns or prioritizing risk management?

LSI is essentially a bet that the market's upward trajectory will continue, making today the best possible day to get in. On the other hand, DCA is a hedge. It’s a way of saying, "I think the market will go up over time, but it might dip in the short term, and I don't want to go all-in at the peak."

By spreading your investments out, you dramatically reduce the odds of buying everything at the absolute worst time. If the market does fall, your next scheduled investment just buys you more shares at a discount. It’s a systematic approach, which is fundamentally different from trying to guess market tops and bottoms. You can read more about why that's a losing game in our guide to market timing vs. buy-and-hold strategies.

A Tale of Two Investors: A Real-Life Example

Let’s make this real. Imagine two investors, Alex and Ben. They each receive $12,000 on January 1, 2022—a notoriously volatile year for the stock market.

Alex uses LSI, investing the full $12,000 into an S&P 500 index fund on day one. Ben prefers DCA, so he invests $1,000 on the first of every month for the entire year.

- Alex's Experience (LSI): By the end of 2022, the S&P 500 was down roughly 19%. Alex's initial $12,000 investment would have shrunk to about $9,680.

- Ben's Experience (DCA): Ben also invested $12,000, but his regular purchases bought more and more shares as the market fell. His average purchase price was significantly lower than Alex's. By year's end, his portfolio was worth approximately $11,100, a much smaller loss.

This real-world scenario perfectly illustrates the core difference: LSI is built for upside capture in rising markets, while DCA provides a crucial safety net in falling or choppy ones.

When Does Each Strategy Shine?

While long-term historical data often gives LSI the edge, that’s not the full story. The numbers look very different when you zoom in on volatile or declining periods.

Most studies suggest lump-sum investing wins about 66-75% of the time, simply because markets go up more often than they go down. But during downturns, the roles reverse. An insightful analysis from PWL Capital found that in U.S. bear markets, LSI only beat DCA 54.24% of the time. This means DCA was the better strategy in nearly half of the scariest market environments—exactly when investors need protection the most. You can explore more findings from that study here.

DCA vs. Lump-Sum Investing: A Head-to-Head Comparison

This table compares the key features, advantages, and disadvantages of Dollar-Cost Averaging (DCA) and Lump-Sum Investing (LSI) to help investors choose the right strategy for their goals.

| Feature | Dollar-Cost Averaging (DCA) | Lump-Sum Investing (LSI) |

|---|---|---|

| Risk Profile | Lower. Mitigates timing risk by spreading out purchases. | Higher. Fully exposed to market volatility from day one. |

| Psychological Impact | Less stressful. Reduces the anxiety of investing a large sum at once. | Can be highly stressful, especially if the market drops soon after investing. |

| Best For | Risk-averse investors, beginners, or anyone investing in volatile markets. | Investors with a high risk tolerance and a long time horizon. |

| Performance in Bull Markets | May underperform LSI as some cash sits on the sidelines ("cash drag"). | Tends to outperform DCA as all money is invested and benefits from growth. |

| Performance in Bear Markets | Tends to outperform LSI by buying more assets at lower prices. | Can lead to significant initial losses if timed poorly. |

Ultimately, choosing between DCA and LSI is as much a psychological decision as it is a financial one.

The best strategy is the one that lets you sleep at night. If the thought of investing a big chunk of money only to see it drop 10% the next day would cause you to panic and sell, then dollar-cost averaging is absolutely the right choice for you.

The real goal is to get your money in the market and keep it there for the long run. If DCA gives you the confidence to start investing and, more importantly, to stay invested through the ups and downs, then it has already done its job perfectly.

Weighing the Pros and Cons of DCA

Like any investing strategy, dollar-cost averaging isn't a silver bullet. It has some real advantages that make it a go-to for countless investors, but it also comes with trade-offs you need to understand. Let's take an honest look at both sides so you can see if it fits with your own financial goals.

At its heart, DCA is about building discipline. It puts your investing on autopilot, turning what can be a very emotional process into a simple, repeatable habit. For many people, just staying consistent is the biggest challenge of all.

The Advantages of a Disciplined Approach

One of the biggest wins with dollar-cost averaging is psychological. When you commit to a fixed investment schedule, you completely sidestep that nagging fear of investing at the "wrong" time. This systematic approach is fantastic for building a healthy, long-term mindset.

Here's where it really shines:

- Removes Emotional Decisions: Fear and greed are the enemies of good investing. They push you to panic-sell during a dip or chase a hot stock at its peak. DCA’s set-it-and-forget-it nature keeps those impulses at bay.

- Reduces Risk of Buying at a Peak: Nothing stings more than investing a huge chunk of money right before a market downturn. By spreading your buys out, you dramatically lower the odds of that worst-case scenario happening.

- Accessible and Simple: DCA is perfect for anyone investing a piece of their regular paycheck. It breaks the whole concept of "investing" down into small, manageable steps.

Ultimately, the best strategy for you lines up with how you handle market swings. If you're not sure where you stand, our guide on how to determine your investment risk tolerance can help you get a clearer picture.

Potential Downsides to Consider

While DCA is a champ at managing risk, it's not always the best way to squeeze every last drop of profit out of the market. This is especially true when markets are consistently climbing, which brings us to its main drawback: cash drag.

Cash drag is the opportunity cost of having cash sitting on the sidelines instead of being invested and working for you. In a strong bull market, that uninvested cash is missing out on all the growth.

This means that while you're steadily dripping your money into the market, the portion still waiting in the wings isn't earning anything. If the market goes on a long tear, a lump-sum investment made right at the start would have performed better.

Another practical thing to watch out for is transaction fees. If your brokerage charges a fee for every single trade, making lots of small investments can get expensive fast. Those fees can seriously eat into your returns over time, so it's vital to use a platform with low or zero commissions for the assets you're buying.

Pros vs Cons: A Clear Comparison

To lay it all out, here’s a straightforward comparison of the good and the bad that comes with a dollar-cost averaging strategy.

| Pros of Dollar-Cost Averaging | Cons of Dollar-Cost Averaging |

|---|---|

| Instills Investing Discipline | Potential for 'Cash Drag' |

| Removes Emotional Decision-Making | Transaction Fees Can Add Up |

| Reduces Timing Risk | May Underperform in Strong Bull Markets |

| Simple to Automate and Execute | Not Ideal for Short-Term Goals |

In the end, choosing DCA is often a conscious decision to favor peace of mind and risk management over chasing the absolute highest possible returns. For many investors, that’s a trade-off they are more than happy to make.

How to Put Dollar-Cost Averaging into Practice

Alright, let's move from theory to action. Getting a dollar-cost averaging strategy up and running is surprisingly simple. It really just comes down to making a few smart decisions at the start, putting a system in place, and then letting it run on its own.

The magic ingredient here is automation. When you set up automatic transfers and investments, you take emotion and guesswork completely out of the equation. No more agonizing over whether it's the "right" day to invest. This “set it and forget it” approach is your best friend for long-term investing success.

Step 1: Choose Your Investment Vehicle

First things first: where are you putting your money? For a DCA strategy to work well, you'll want to invest in things that are easy to buy regularly, even in small pieces, and have solid long-term growth potential. For most people, this means broad-market funds.

- Exchange-Traded Funds (ETFs): Think of these as a basket of stocks you can buy and sell in one go, like a single share. An S&P 500 ETF, for example, gives you a tiny piece of 500 of the largest U.S. companies. They’re a fantastic way to get instant diversification with very low fees.

- Mutual Funds: These operate on a similar principle, pooling money from thousands of people to build a diversified portfolio. Nearly every brokerage platform makes it incredibly easy to set up automated investments into mutual funds.

Honestly, you can't go wrong with either for a DCA plan. If you want to get into the weeds on one of the most popular types of funds, you might find it helpful to see if index funds are the key to long-term wealth building. The goal is to pick something you feel good about holding for the long haul.

Step 2: Determine Your Amount and Schedule

Next up, you need to figure out two things: how much you'll invest and how often. The key here is consistency, not the size of the investment.

Take a hard look at your budget and find an amount you can comfortably part with on a regular basis. Even $50 or $100 a month is a powerful start. Then, pick a schedule that makes sense for your life, probably lining up with when you get paid.

A monthly investment schedule is the most common approach because it lines up with most people's paychecks and provides a good balance for smoothing out market volatility over time.

Of course, weekly or bi-weekly works just as well. The best schedule is simply the one you can stick with, no matter what.

Step 3: Automate the Entire Process

This is the step that makes your DCA strategy truly work for you. Log into your brokerage account and set up two recurring actions:

- Automatic Transfer: Tell your bank to send a specific amount of money to your brokerage account on a regular schedule.

- Automatic Investment: Inside your brokerage account, set up a rule to automatically purchase your chosen ETF or mutual fund as soon as that money arrives.

Modern brokerage apps make this ridiculously easy—you can usually get it done in a few minutes. Once it’s set, your contributions happen like clockwork. You'll be buying shares whether the market is up or down, all without lifting a finger. That built-in discipline is how you turn market ups and downs into a long-term advantage.

Common Questions About Dollar-Cost Averaging

Even after you've got the basics down, a few questions about the finer points of dollar-cost averaging are bound to pop up. This section provides clear, straightforward answers to the questions investors ask most often.

1. What's the Best Frequency for Dollar-Cost Averaging?

The perfect schedule—weekly, bi-weekly, or monthly—really comes down to your own cash flow. The specific interval isn't nearly as important as one simple thing: your commitment to consistency. For most people, a monthly schedule works best because it aligns with paychecks and is easy to automate.

2. Does Dollar-Cost Averaging Work for Cryptocurrency?

Yes, and it can be a game-changer for volatile assets like crypto. The very thing that makes crypto feel so risky—those dramatic price swings—is what can make DCA so effective. By investing a fixed amount regularly, you avoid the nightmare of dropping a huge sum in right before a crash and naturally buy more coins when prices are low.

3. Should I Stop Dollar-Cost Averaging During a Market Crash?

Absolutely not. In fact, a market crash is when dollar-cost averaging really shows its worth. It feels counterintuitive to keep buying when everyone else is panicking, but sticking to your plan is crucial. A downturn means your fixed investment is now buying more shares at a steep discount, setting you up for a much stronger recovery when things turn around.

4. When Is Lump-Sum Investing Better Than DCA?

Statistically, lump-sum investing (LSI) tends to come out ahead in markets that are on a steady, strong climb. That’s because all your money gets in the game sooner, giving it more time to grow. However, this comes with higher upfront risk. If you have a high risk tolerance and a very long time horizon, LSI might win out. For most, DCA offers a much smoother—and less stressful—ride.

5. Can I Use DCA in My 401(k) or IRA?

Yes, and if you have a 401(k) through your job, you're probably already doing it. A workplace retirement plan is the perfect example of DCA in action. You can set up the exact same system for an Individual Retirement Account (IRA) by scheduling automatic, recurring transfers from your bank account.

6. What Is Cash Drag and How Does It Affect DCA?

Cash drag is the main trade-off with dollar-cost averaging. It’s the opportunity cost of having cash sitting on the sidelines, waiting for the next scheduled investment date. In a roaring bull market, that uninvested cash is missing out on gains. You're essentially swapping some potential upside for powerful protection against a downturn.

7. Is There a Bad Time to Start a DCA Strategy?

One of the best things about dollar-cost averaging is that there’s really no bad time to start. The whole point is to avoid trying to time the market, so you don’t have to stress about finding the "perfect" entry point. The best time to start is simply when you're financially ready.

8. How Do Transaction Fees Impact a DCA Strategy?

This is a critical consideration. If your brokerage charges a fee for every trade, making lots of small investments can get expensive fast. To get around this, you absolutely want to use a platform that offers commission-free trading for the assets you’re buying. Many modern brokers now offer zero-commission trades for stocks, ETFs, and index funds.

9. Does DCA Guarantee I Won't Lose Money?

No. It’s crucial to remember that no investment strategy can guarantee a profit or prevent losses entirely. Dollar-cost averaging is a risk-management tool, not a magic wand. If the asset you’re buying goes down in value and never recovers, your investment will still lose money. Its success is tied to the long-term performance of the assets you choose.

10. How Long Should I Use a DCA Strategy?

Dollar-cost averaging is designed for the long game. Think years, even decades. It’s not a strategy for short-term trading. The longer you stick with it, the more market cycles you'll invest through, which gives the "averaging" effect more time to work its magic and lets you fully benefit from the power of compounding.

This article is for educational purposes only and is not financial or investment advice. Consult a professional before making financial decisions.