An index fund is a type of investment that holds all the stocks or bonds within a specific market index. Its goal isn't to beat the market, but to be the market.

Think of it like this: with one single purchase, you're instantly buying a small piece of hundreds of top companies. It's a simple yet incredibly powerful strategy that has become a go-to for millions of investors, from beginners to seasoned pros.

In This Guide

A Simple Explanation of Index Funds

Let's say you wanted to bet on the overall success of the U.S. stock market. How would you do it? You could try to handpick a few companies you think will do well, but that's a tough game to win. There's a much easier way.

An index fund is built to mirror a specific market benchmark, like the famous S&P 500. This index is a basket of the 500 largest public companies in the United States. When you buy a share of an S&P 500 index fund, you're essentially owning a tiny fraction of Apple, Microsoft, Amazon, and all the other economic giants in that list.

Your investment's performance will almost perfectly match the S&P 500's ups and downs. It's a straightforward approach that sidesteps the often-unsuccessful game of trying to find the next big winning stock.

The Power of Passive Investing

This hands-off strategy is called passive investing. The fund manager isn't actively trading stocks or trying to outsmart anyone. Their one and only job is to make sure the fund's holdings perfectly reflect the index it's tracking. This key difference is what makes index funds so appealing. To get started, you'll need to understand what is an investment account and how it works as the home for your investments.

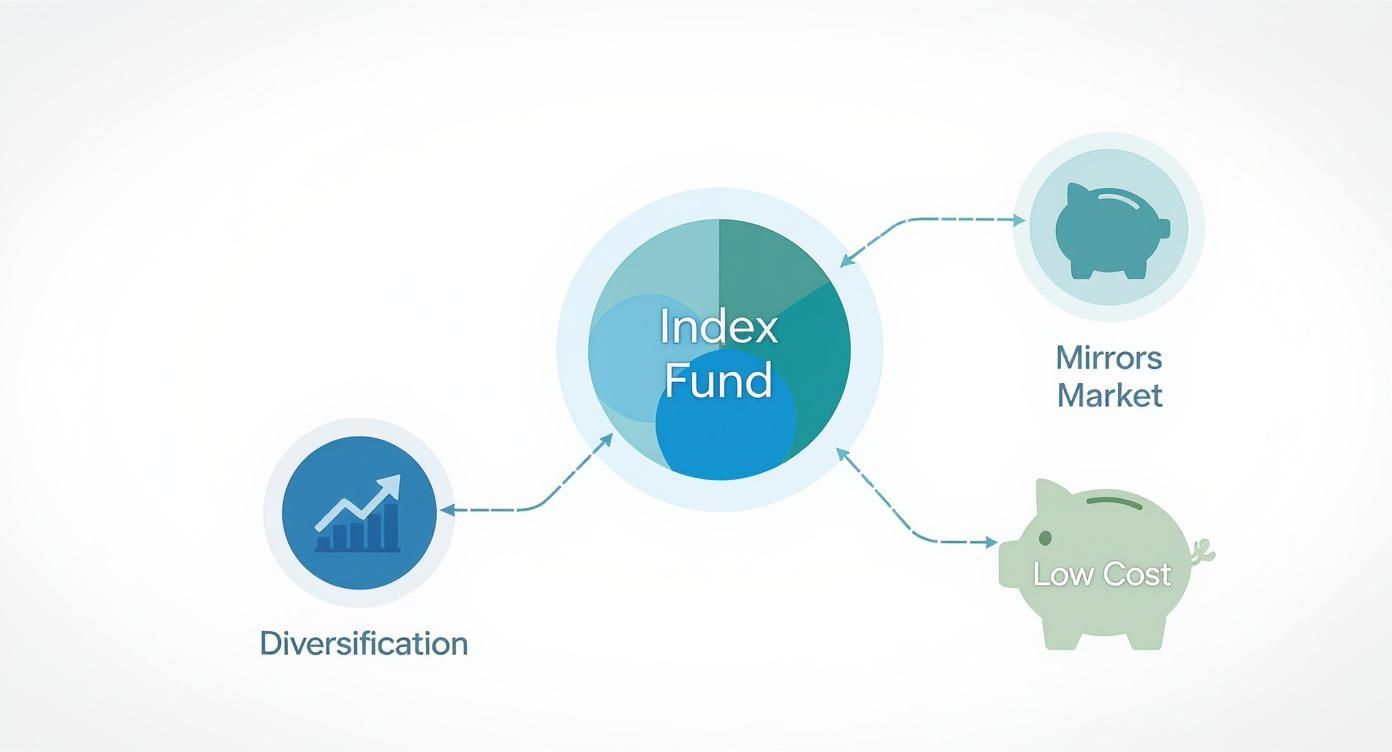

This passive approach delivers a trio of major benefits:

- Instant Diversification: Instead of putting all your eggs in one basket, your money is spread across hundreds of companies. This drastically lowers the risk if any single company hits a rough patch.

- Rock-Bottom Costs: Active stock-picking requires big, expensive research teams. Since index funds don't need them, their management fees are incredibly low, which means more of your returns stay in your pocket.

- Set-It-and-Forget-It Simplicity: It offers a reliable way to capture the market's average return over the long haul, without needing to constantly monitor your portfolio.

The core idea is simple but powerful: instead of trying to beat the market, you can achieve your financial goals by simply owning the market itself through a low-cost, diversified fund.

This concept has leveled the playing field, making index funds one of the most effective and accessible tools for building wealth.

To give you a clearer picture, let's break down the essential features of an index fund.

Key Characteristics of Index Funds at a Glance

This table sums up the core traits that define index funds, making them a popular choice for long-term investors.

| Characteristic | Description | Why It Matters for Investors |

|---|---|---|

| Passive Management | The fund automatically tracks a market index without active stock picking. | Leads to significantly lower fees (expense ratios), maximizing your returns. |

| Broad Diversification | A single fund holds hundreds or thousands of securities from the target index. | Reduces your risk by spreading your investment across many assets. |

| Market-Matching Returns | The goal is to replicate the performance of the index, not to outperform it. | Provides predictable, market-average returns over the long term. |

| High Transparency | The fund's holdings are public knowledge and only change when the index changes. | You always know exactly what you own, with no surprises. |

| Low Turnover | The fund only buys or sells securities when the underlying index is updated. | Minimizes trading costs and potential tax liabilities for the investor. |

In short, these characteristics combine to create an investment that is simple, cheap, and effective for achieving long-term growth.

How Index Funds Work Behind the Scenes

An index fund runs on a brilliantly simple idea: its goal is to copy, not to outsmart. Forget about teams of high-paid analysts hunting for the next "big thing." The manager of an index fund has a much more straightforward job—to perfectly mirror the stocks and bonds inside a specific market index.

Think of the S&P 500 as a very specific shopping list containing 500 of America's biggest public companies. The fund manager's task is to go to the stock market and buy every single item on that list. And here’s the crucial part: they have to buy them in the exact proportions.

If Apple makes up 7% of the S&P 500's total value, then 7% of the fund's money goes into Apple stock. If Microsoft is 6%, then the fund holds 6% in Microsoft. This process is called full replication, and it’s the secret sauce that ensures the fund’s performance practically glues itself to the index.

The Mechanics of Tracking an Index

The fund manager isn't paid to have an opinion. They don't get to decide if a company is a good buy or a bad one. Their success isn't measured by beating the market, but by how flawlessly they can track it. This hands-off, mechanical approach is the very soul of passive investing.

Because of this methodical tracking, a single share of an S&P 500 index fund instantly makes you a part-owner in a huge variety of industry titans. You get a slice of NVIDIA's tech genius, Amazon's consumer dominance, and Berkshire Hathaway's financial strength—all rolled into one simple, low-cost package.

This infographic breaks down exactly how these funds work their magic for investors.

As the visual shows, index funds deliver instant diversification and market-level returns with minimal fuss and cost. It’s no wonder they’ve become such a powerhouse in modern investing. In fact, index funds now account for a staggering 62% of all domestic stock assets in the U.S., proving just how many investors have embraced this straightforward strategy.

Two Terms You Absolutely Need to Know

While the concept is simple, a fund's quality boils down to two key numbers. Get these right, and you’re on the path to success.

1. Expense Ratio

This is the annual fee you pay for the fund to operate. Because index funds don't need expensive research teams, their costs are incredibly low—often just a few hundredths of a percent. An expense ratio of 0.03%, for example, means you pay just $3 per year for every $10,000 invested. It might sound tiny, but these fees add up. Our guide explains how investment fees are secretly destroying your wealth and why keeping them low is non-negotiable.

An index fund's biggest superpower is its low cost. The less you give away in fees, the more of the market's return you keep. It’s that simple.

2. Tracking Error

This number tells you how well the fund is actually doing its job of mirroring the index. In a perfect world, the tracking error would be zero. A tiny tracking error means the fund manager is a master of replication. Small things like trading costs can cause slight differences, but a well-managed fund keeps this gap almost invisible.

Why Smart Investors Choose Index Funds

It’s no accident that some of the world's most successful investors, from Warren Buffett down to your neighbor who retired comfortably, often point to index funds. They've embraced this strategy because it's grounded in a few powerful, commonsense principles that just plain work.

Rather than trying to outsmart the market or chase the latest hot stock, index fund investing offers a disciplined path to building wealth. It cuts through the noise, strips away the high costs and the guesswork, and focuses on what truly matters.

Let's dive into the three core reasons why index funds are such a cornerstone for anyone serious about their financial future.

Built-in Diversification: Your Safety Net

Think about it this way: would you bet your entire sports season on a single star player? Probably not. If they get injured, your team is toast. Investing in an individual stock carries a similar risk—if that one company hits a wall, your money can vanish.

Index funds are the answer to this all-or-nothing problem. They offer built-in diversification. When you buy a share of an S&P 500 index fund, you're not just buying one company; you're instantly spreading your investment across 500 of the largest businesses in the U.S.

This creates a powerful safety net. Your portfolio’s success no longer hinges on the fate of any single company. If one business stumbles, its fall is cushioned by the hundreds of others that are doing just fine.

This automatic diversification is a huge reason why index funds are considered so much less risky than trying to pick individual stocks. It's a proven way to smooth out the inevitable bumps in the road.

Low Costs: Keeping More of Your Money

Fees are the silent killer of investment returns. They slowly but surely eat away at your profits over time. Many actively managed funds charge hefty fees to pay for their teams of analysts and constant trading, and that money comes directly out of your pocket.

Index funds, on the other hand, are designed from the ground up to be incredibly cost-effective.

Since their only job is to mirror a market index, they don’t need expensive research teams or a flurry of trading activity. This beautifully simple, passive approach leads to dramatically lower expense ratios—the annual fee you pay for owning the fund.

Just look at the real-world impact over a decade on a $10,000 investment, assuming a 6% annual return.

| Fund Type | Typical Expense Ratio | Fees Paid Over 10 Years | Your Final Account Value |

|---|---|---|---|

| Index Fund | 0.05% | $70 | $17,823 |

| Active Fund | 0.65% | $838 | $16,840 |

The difference is staggering. The index fund’s tiny fee leaves you with nearly $1,000 more. Let that compound over 20 or 30 years, and it can mean tens of thousands of dollars in extra wealth.

Consistent Performance: The Tortoise Beats the Hare

It's tempting to chase after funds that promise to "beat the market." We all want to find that hidden gem. The reality, however, is that decades of data show very few professional fund managers can consistently pull it off, especially after you account for their higher fees.

Study after study shows the same thing: the vast majority of actively managed funds fail to outperform their benchmark index. Over a 10-year period, a simple S&P 500 index fund has historically beaten over 80% of its actively managed competitors.

This is why simply "matching the market" is such a powerful and winning strategy. Instead of paying more for a slim chance of outperformance, index funds give you the market's return, reliably and cheaply. This steady-as-she-goes approach is precisely why index funds are the key to long-term wealth building for so many savvy investors. It's about embracing the timeless wisdom that slow and steady really does win the race.

Index Funds vs. Actively Managed Funds

When it comes to investing, you’re really choosing between two very different philosophies. One says it's better to simply match the market's performance, while the other believes it can beat it. This is the fundamental clash between passive index funds and their active counterparts.

Think of an actively managed fund like hiring a celebrity chef to cook a groundbreaking meal. You're paying a premium for their expertise, trusting them to hand-pick the perfect ingredients (stocks) to deliver a result that outshines everything else. A fund manager and their team of analysts are constantly researching, buying, and selling in an attempt to outperform a benchmark like the S&P 500.

An index fund, on the other hand, is like using a precise, time-tested recipe. It isn't trying to invent a new dish; its only job is to perfectly replicate a classic—the market index itself. The manager's role is simply to follow the recipe, buying all the stocks in the index to ensure the final product tastes exactly like the benchmark.

The Great Debate: Philosophy and Cost

This philosophical divide has huge, real-world consequences, especially when it comes to cost. Active management is expensive. You're paying for the celebrity chef's talent, which means higher salaries, bigger research budgets, and more frequent trading. All those costs get passed on to you through a higher expense ratio.

Index funds cut out almost all of those expenses. Since the fund is just following a preset recipe, there's no need for a costly team of analysts. This passive strategy leads to dramatically lower fees, which means more of your money stays invested and working for you. While some investors love the idea of outsmarting the market, learning how to identify top-performing stocks is an incredibly difficult skill to maintain year after year.

A core truth of investing is that costs matter immensely. The higher fees of an actively managed fund create a permanent drag on performance that must be overcome just to break even with a simple, low-cost index fund.

A Head-to-Head Comparison

To make the best choice for your portfolio, it helps to see the key differences laid out side-by-side. This table breaks down exactly how these two fund types stack up against each other.

| Feature | Index Funds (Passive) | Actively Managed Funds (Active) |

|---|---|---|

| Investment Goal | To match the performance of a specific market index (e.g., S&P 500). | To outperform a specific market index through active stock selection. |

| Management Style | Follows a rules-based, automated approach to buy and hold securities. | Relies on a fund manager's expertise to pick individual winners. |

| Typical Expense Ratio | Very low, often ranging from 0.02% to 0.15%. | Significantly higher, typically from 0.50% to 1.50% or more. |

| Portfolio Turnover | Low. Securities are only traded when the underlying index changes. | High. Frequent buying and selling of stocks based on manager decisions. |

| Tax Efficiency | Generally more tax-efficient due to low turnover, resulting in fewer capital gains. | Less tax-efficient due to frequent trading, which can trigger capital gains. |

| Long-Term Performance | Consistently provides market-average returns, reliably beating most active funds. | The vast majority fail to outperform their benchmark index over the long run. |

As you can see, the trade-offs are significant, touching everything from your annual fees to your tax bill.

The Verdict from the Data

The theory is interesting, but what does the real-world evidence say? Study after study confirms just how difficult it is for active managers to consistently win.

A recent SPIVA report, for instance, revealed that over a 15-year period, 92.7% of all domestic equity funds underperformed the S&P Composite 1500. This isn't just a fluke; it's a persistent trend seen across almost every asset class. You can read the full analysis of active vs. passive performance on spglobal.com for a deeper dive.

Sure, a few managers might have a fantastic year here and there. But maintaining that outperformance over a decade or more is exceedingly rare. For the average investor, choosing a low-cost index fund is the most reliable path to capturing the market's growth.

Exploring the Different Flavors of Index Funds

It's a common mistake to think of index funds as a one-size-fits-all product. That's like saying all cars are the same. Just as you'd pick a truck for hauling and a sedan for a daily commute, different index funds are built for different jobs in your portfolio.

Getting to know these types is what separates a novice investor from someone who can strategically build a portfolio that truly fits their goals. Each fund tracks a unique slice of the market, bringing its own set of risks and rewards to the table.

Broad Market Funds

Think of a Broad Market Fund as the ultimate U.S. stock market "sampler." Instead of just focusing on the 500 biggest players, these funds aim to own a piece of the entire U.S. stock market—large, medium, and small companies alike. A fund tracking the CRSP US Total Market Index is a classic example.

- What it tracks: Thousands of U.S. stocks across every size and industry.

- Role in a portfolio: This is the workhorse. For many, it's the core of their U.S. stock holdings, offering maximum diversification in a single package.

- Real-life example: Vanguard Total Stock Market ETF (VTI).

Large-Cap Funds

When you hear newscasters say "the market is up today," they're almost always talking about an index like the S&P 500, which is what Large-Cap Funds track. These funds invest in the titans of the industry—the household names you already know, like Apple, Microsoft, and Amazon.

- What it tracks: The 500 largest public companies in the U.S.

- Role in a portfolio: A foundational holding offering a mix of growth and stability.

- Real-life example: Fidelity 500 Index Fund (FXAIX).

International Funds

A smart portfolio doesn't stop at the border. International Funds open up your investments to the rest of the world, tracking indexes of companies in developed countries like Germany and Japan or in faster-growing emerging markets. They might follow an index like the MSCI EAFE, which covers developed markets outside of North America.

Investing internationally is a core principle of diversification. It means your portfolio's success isn't tied solely to the U.S. economy, spreading your risk across different countries and economic cycles.

- What it tracks: Stocks in developed markets outside of North America.

- Role in a portfolio: Adds global diversification and captures growth wherever it's happening.

- Real-life example: Vanguard FTSE Developed Markets ETF (VEA).

Sector-Specific and Specialized Funds

For those who want to make a more targeted bet on a particular industry, there are Sector-Specific Funds. These funds concentrate on one slice of the economy, like technology, healthcare, or financial services. A tech sector fund, for instance, would be full of names like NVIDIA and Alphabet, but you wouldn't find any banks or oil companies in it.

- What it tracks: Stocks within a single economic sector.

- Role in a portfolio: A tactical "satellite" position to overweight an industry you believe in. High risk, high reward.

- Real-life example: Technology Select Sector SPDR Fund (XLK).

Bond Index Funds

Investing isn't just about stocks. Bond Index Funds track indexes made up of different kinds of bonds, from ultra-safe U.S. Treasury bonds to corporate or municipal bonds. The key thing to know is that bonds often act as a counterbalance to stocks—when the stock market gets rocky, high-quality bonds tend to hold their value or even rise.

- What it tracks: A broad mix of U.S. investment-grade bonds.

- Role in a portfolio: Provides stability, income, and acts as a shock absorber during stock market volatility.

- Real-life example: iShares Core U.S. Aggregate Bond ETF (AGG).

To pull this all together, here’s a quick-reference comparison table.

| Fund Type | Primary Goal | Risk Level | Diversification Level | Example Fund (Ticker) |

|---|---|---|---|---|

| Broad Market | Capture the entire U.S. stock market | Medium-High | Very High (within U.S.) | Vanguard Total Stock Market (VTI) |

| Large-Cap | Invest in the largest U.S. companies | Medium | High (within U.S. large caps) | Fidelity 500 Index (FXAIX) |

| International | Invest in companies outside the U.S. | Medium-High | Very High (globally) | Vanguard Developed Markets (VEA) |

| Sector-Specific | Target a single industry (e.g., tech) | High | Low (concentrated) | Technology Select Sector (XLK) |

| Bond | Provide stability and income | Low | High (within bonds) | iShares Aggregate Bond (AGG) |

By mixing and matching these different types, you can move beyond owning just "an index fund" and start building a truly robust, globally-diversified portfolio that's designed to meet your long-term goals.

How to Start Investing in Index Funds

Ready to move from theory to action? It's one thing to read about index funds, but it's another to actually put your money to work. The good news is, getting started is surprisingly simple.

Let’s walk through the four basic steps to make your first index fund investment.

Step 1: Open a Brokerage Account

First things first, you need a place to buy and hold your funds. This is where a brokerage account comes in. Think of it as a bank account, but specifically for investments like stocks, bonds, and, of course, index funds.

Setting one up is usually a quick online process. You'll find plenty of great, beginner-friendly options out there.

- Vanguard: A crowd favorite, famous for its low-cost philosophy and investor-first structure.

- Fidelity: Widely respected for top-notch customer support and a lineup of zero-fee index funds.

- Charles Schwab: A well-rounded broker known for its powerful tools and solid reputation.

Just pick one, complete the online application, and connect your bank account to fund it.

Step 2: Choose Your Index Fund

With your account ready to go, the fun part begins: picking a fund. Your choice should really come down to your personal goals and how long you plan to stay invested.

For anyone just starting out, you can’t go wrong with a broad-market index fund. An S&P 500 fund (like VOO or FXAIX) or a Total Stock Market fund (like VTI) is a fantastic one-stop shop. With a single purchase, you get a small piece of hundreds—or even thousands—of U.S. companies. It's diversification made easy.

Step 3: Decide How Much to Invest

Now, figure out how much money you want to put in. There are two common ways to approach this.

- Lump-Sum Investing: If you have a chunk of cash saved up, you can invest it all in one go. History shows this often gives your money the best chance to grow since it's in the market longer.

- Dollar-Cost Averaging (DCA): This just means investing a set amount on a regular schedule—say, $200 every month. DCA is a great way to build a habit and reduce the stress of trying to "time the market," as you'll buy shares at various prices over time.

Most people find that setting up an automatic, recurring investment with DCA is the easiest way to stay consistent. For a deeper dive, check out our guide on how to start investing for beginners.

Step 4: Place Your First Trade

You're on the home stretch! All that's left is to actually buy the fund.

Log into your new brokerage account, find the search bar, and type in the fund’s ticker symbol (for example, VOO is the ticker for Vanguard's S&P 500 ETF). From there, you just tell it how much you want to invest and hit the "buy" button.

That's it. You're officially an index fund investor.

Frequently Asked Questions About Index Funds (FAQ)

Here are answers to the top 10 questions new investors have about index funds.

1. Are index funds a safe investment for a beginner?

Yes, they are widely considered one of the best and safest starting points for new investors. Instead of the high risk of picking individual stocks, index funds provide instant diversification across hundreds of companies. This significantly reduces the risk of a single company's poor performance hurting your overall portfolio. While no stock market investment is risk-free, index funds offer a balanced and prudent approach.

2. How much money do I need to start investing in index funds?

You can start with very little. Many brokerage firms have no account minimums. If you buy an index ETF (Exchange-Traded Fund), you only need enough to cover one share, which can be anywhere from $50 to a few hundred dollars. Even better, some brokers offer fractional shares, allowing you to invest with as little as $1.

3. Is it possible to lose all my money in an index fund?

For a broad market index fund (like an S&P 500 or Total Stock Market fund), this is practically impossible. It would require all 500 of the largest U.S. companies to go bankrupt simultaneously, which would mean a complete collapse of the global economy. While markets go up and down, a diversified index has historically always recovered and grown over the long term.

4. What is the difference between an index fund and an ETF?

This is a common point of confusion. "Index fund" refers to the passive investment strategy of tracking an index. An "ETF" (Exchange-Traded Fund) is a type of security that can be bought and sold on a stock exchange like a stock. Most modern index funds are structured as ETFs. You can also buy index funds structured as traditional mutual funds. For most investors, ETFs are more flexible and often more tax-efficient.

5. How often should I buy or sell my index funds?

The best strategy for index funds is to "buy and hold." The goal is long-term growth, not short-term trading. Set up a regular, automatic investment plan (e.g., monthly) and stick with it through market ups and downs. Trying to time the market by buying and selling frequently is a proven way to underperform.

6. Do index funds pay dividends?

Yes. The index fund collects dividends from all the companies it holds and distributes them to you, usually quarterly. Most investors choose to automatically reinvest these dividends back into the fund, which buys more shares and accelerates growth through the power of compounding.

7. Which is the "best" index fund to buy?

There is no single "best" fund for everyone, but a fantastic starting point for most U.S. investors is a low-cost, broad-market fund like an S&P 500 fund (e.g., Vanguard's VOO or Fidelity's FXAIX) or a Total Stock Market fund (e.g., Vanguard's VTI). These provide maximum diversification within the U.S. market in a single purchase.

8. How are index funds taxed?

Tax treatment depends on the account type. In a tax-advantaged retirement account like a 401(k) or IRA, your growth is tax-deferred or tax-free. In a standard brokerage account, you will owe taxes on dividends received annually. When you sell shares for a profit, you'll pay capital gains tax. Holding for over a year qualifies you for a lower long-term capital gains tax rate.

9. Can I invest in index funds myself, or do I need a financial advisor?

You can absolutely do it yourself. The simplicity of index funds makes them ideal for DIY investors. Opening a brokerage account and buying an index ETF is a straightforward process that takes minutes online. An advisor can still be helpful for comprehensive financial planning, but they are not necessary to simply start investing in index funds.

10. If two funds track the S&P 500, how do I choose between them?

If two funds track the exact same index, their holdings and performance will be nearly identical. The deciding factor should be the expense ratio. Always choose the fund with the lower fee. A difference of even 0.05% can save you thousands of dollars over your investing lifetime.

At Top Wealth Guide, our mission is to give you the clear, actionable knowledge you need to make smart decisions with your money. From stocks to real estate, we break down proven strategies for building and managing wealth. Explore more insights and start securing your financial future today by visiting https://topwealthguide.com.

1 Comment

Pingback: Are Mutual Funds Still Worth It in Today's Market? - Top Wealth Guide - TWG