Your financial success — yep, it’s all about the mindset. Most folks? They’ve got these sneaky, unconscious habits that mess up their wealth-building game… without even knowing it.

We at Top Wealth Guide are all in on this — changing your wealth mindset is key to real, lasting success. This guide? It’s gonna help you spot those limiting beliefs, flip your financial script, and craft strategies that actually do the job.

In This Guide

What Drives Your Money Decisions

Think of your money blueprint like some kind of stealth app running your financial life without you even realizing it. Most of us? We’re wandering through the same spending errors on a loop – because we never pop the hood to check the wiring we inherited as kids. Here’s the kicker: the financial education we soak up from our parents as kiddos is shown to be linked with healthier financial moves later on.

The Hidden Money Scripts That Control You

Parents fighting over dollars and cents leaves a mark – a big ol’ emotional tattoo on your brain. Heard a lot of shouting about cash? You’ve likely built up some serious anxiety about money talks. Kids who see their folks going at it over bills often end up swinging to either extreme: splurging for a hit of feel-good or pinching every penny for that safety cushion.

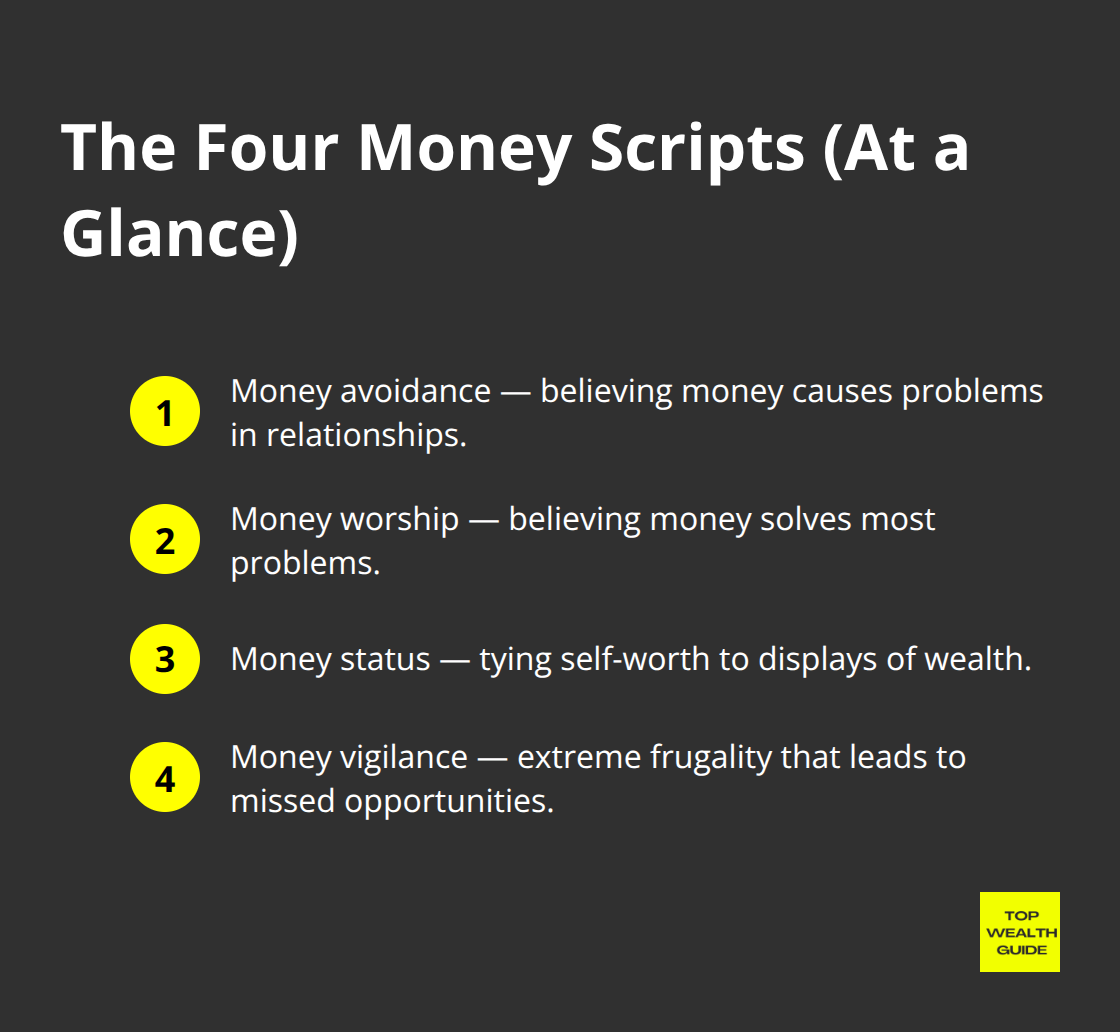

Research highlights four main types of money scripts that derail the wealth train: money avoidance (believing cash ruins relationships), money worship (thinking cash is the ultimate problem-solver), money status (showing off success with purchases), and money vigilance (being super stingy, missing chances because of it).

Your Current Financial Behavior Patterns

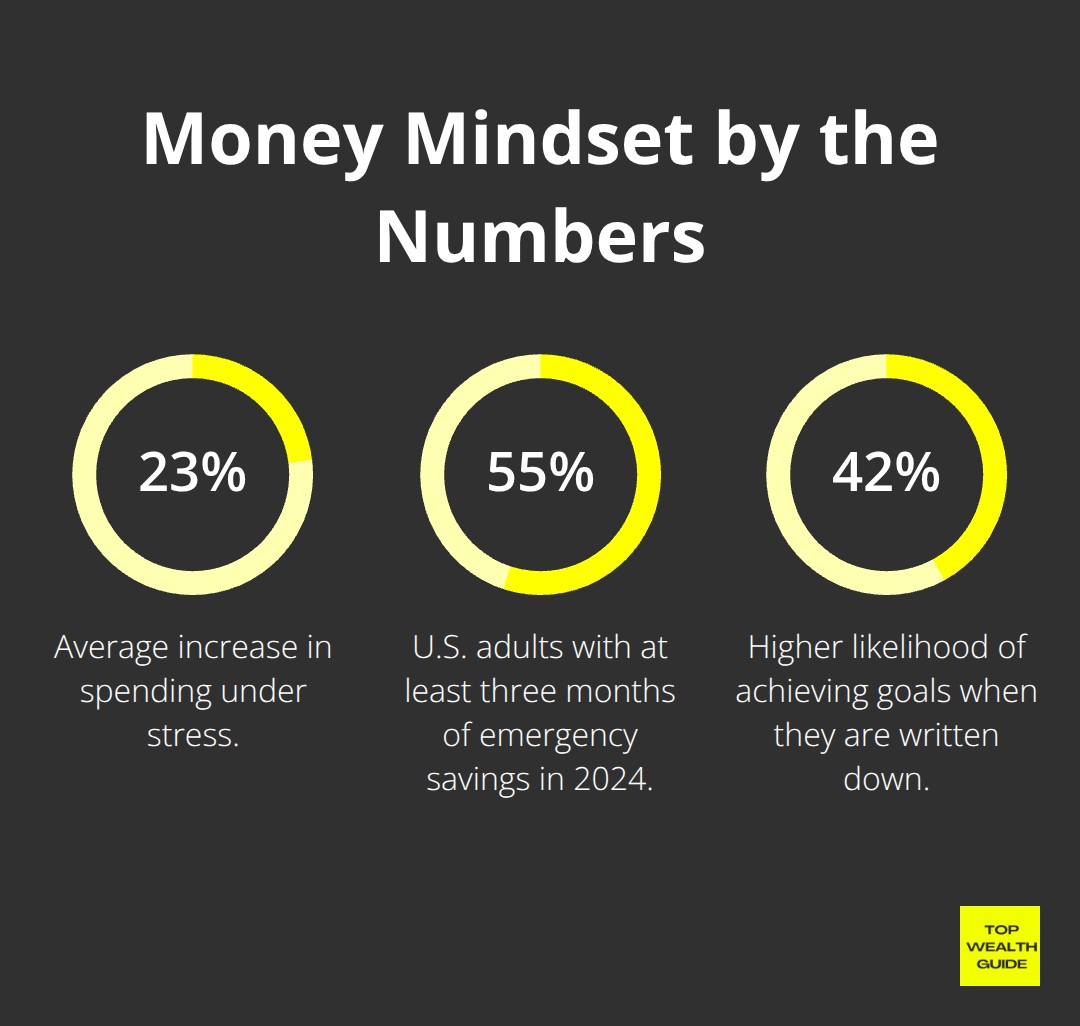

Here’s an idea – track every dime you spend for a month to uncover those sneaky spending triggers. When stress hits? People tend to splash out 23% more, according to the American Psychological Association. Catch yourself reaching for that credit card when emotions spike.

Do you hit the shops after a rough day at work? Buy pricey stuff when feeling a bit meh? Check your credit card bills – they spill the real beans better than your memory ever will. Tuning into how money psychology plays puppet master with your investments can help spot these habits before they dent your wallet.

The Numbers That Tell Your Real Story

Get those calculators out – what’s your debt-to-income ratio? And how about that savings percentage? In 2024, Americans saved just about 4.6% of their spare cash. Scribble down your net worth. Shocked? You bet – many steer clear of this number, and it keeps them in the same financial rut. These figures? They’re your starting blocks for change. But first, you’ve got to square up and face them head-on. Turns out, financial wisdom often outshines a fat paycheck when it comes to building lasting wealth.

Now that you’ve cracked the code on the invisible drivers behind your money moves, it’s time to roll up those sleeves and reshape these ingrained patterns.

Steps to Transform Your Money Mindset

Forget the wishful thinking-destructive money patterns need a kick in the assets. Start with the belief audit. Yeah, I said audit. Write down every dollar-and-cents thought for seven days… notice patterns like “I can’t afford that” or “Rich people are greedy.” Spoiler: these thoughts are running the show more than your paycheck. Folks who write down their goals are up to 42% more likely to hit ’em compared to those who don’t. So, how about flipping these negatives? Turn “I’m bad with money” into “I’m learning to manage money better every day.” Boom.

Challenge Your Financial Beliefs Head-On

Here’s the deal-question every money belief. Where’d it come from? Does it serve your financial dreams? Bet you most of those limiting beliefs come from childhood or, yeah, societal programming that’s expired faster than a coupon. Write down three beliefs that put a chokehold on your wallet. Then, jot down evidence that calls their bluff. If your brain says, “I’ll never be wealthy,” find examples of people from similar backgrounds who built wealth. It’s a brain hack… rewiring those neurons for new cash flow possibilities.

Replace Bad Money Habits With Wealth Routines

Your noggin can create new neural highways in just 21 days of consistent action. So, choose three money habits to shake up now. Swap morning social media doom-scrolling for a peek at your investment app. Replace those “add to cart now” urges with a 24-hour cooldown on anything over $50. Automate savings-let 15% of that paycheck slip into investments before you even lay eyes on it. FYI, back in 2024, 55% of adults stashed cash for three months of expenses in an emergency savings fund. Don’t be out of the loop.

Train Your Subconscious for Financial Success

Get this-your subconscious is a beast, processing 11 million bits per second while your conscious mind is chilling with just 40. So feed it the right finance snacks. Engaging in daily visualization? Oh yeah, that’s the ticket. Spend 10 minutes a.m.-dreaming about that hefty bank account, making top investment moves, feeling like a pro in money chats. Record those financial affirmations: “I attract multiple income streams” and “I make profitable investment decisions,” and listen while you’re commuting-hello, super brain! Oh, and regularly showing gratitude can tweak the brain’s wiring and transmitter stuff. Yep.

With all these mindset shifts in the bank, it’s time for those solid strategies that put the grind in measurable wealth growth.

Build Wealth-Focused Financial Strategies

Stop dreaming about wealth and start engineering it – no more empty aspirations, folks. Mindset changes mean diddly-squat without some serious financial scaffolding. What’s the chasm between wishful thinking and actual cash in the bank? A methodical blueprint that treats money as the tool it is. Americans who actually jot down their financial aspirations are 42% more likely to hit those targets, yet, bafflingly, most folks are flying blind with no written strategy.

Set Specific Financial Targets With Deadlines

Pen down three specific dollar goals with ambitious yet realistic deadlines: a short-term savings aim for six months, a medium-term investment objective for three years, and a long-term wealth milestone for that ten-year mark. Keep tabs on your progress every month using spreadsheets or handy apps like Mint or YNAB. The magic? Breaking down that hefty $500,000 net worth ambition into bite-sized $4,167 monthly increments.

Create Multiple Income Streams That Generate Real Money

Living off a single income source? That’s a financial fantasy (not to mention a disaster) in 2024 – trust me. The average millionaire juggles seven streams of income, while most Americans bank on one measly paycheck. Begin with your primary gig, then layer in rental income, dividend-paying stocks, side hustles, or digital products. Automate funneling 20% of every dollar into index funds like VTSAX or VTI (yeah, they’ve averaged 10.5% annual returns over the past decade). And seriously, tap out your 401k match first – that’s a surefire 100% return right there.

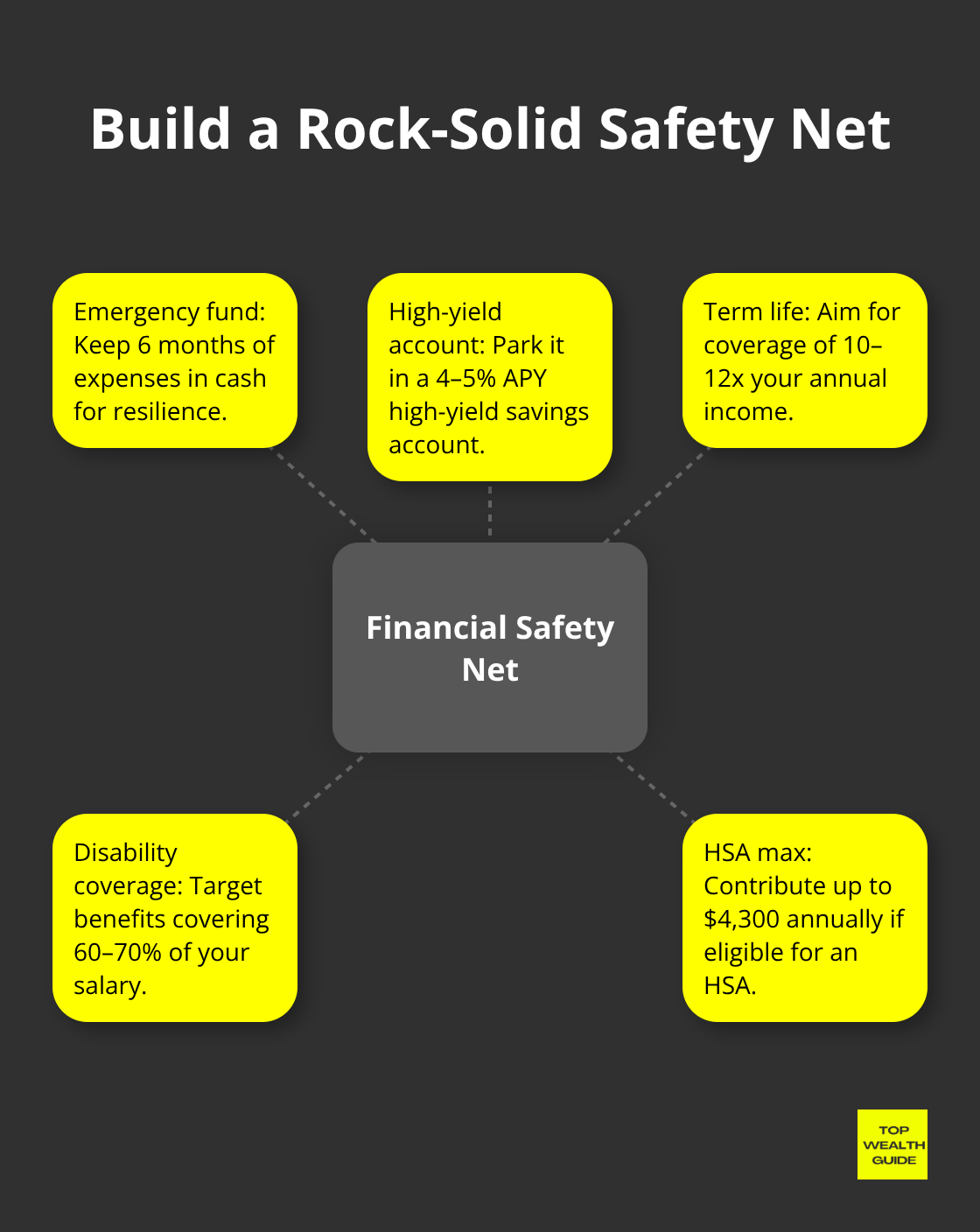

Build Your Financial Safety Net

Craft a cash cushion covering six months of expenses, nestling it in a high-yield savings account earning 4-5% APY. Secure term life insurance worth 10-12 times your yearly earnings and disability insurance that picks up 60-70% of your salary.

Whole life insurance? Skip it – overpriced rubbish that lines agents’ pockets instead of yours. Health Savings Accounts? They multiply-tax your money while taking care of medical expenses – maximize that $4,300 individual cap annually.

Protect Your Wealth From Unexpected Disasters

Risk savvy separates the money-savvy builders from the bankrupt dreamers. One medical mishap or job cutoff can bulldoze years of gains if you’re not shielded right. Odds of disability before retirement? A jaw-dropping one in four, per Social Security Administration stats. Spread your investments across domestic stocks, international platforms, bonds, and REITs with cost-effective index funds boasting expense ratios under 0.1%. Rebalance every quarter to keep your portfolio on point. Consider umbrella insurance policies for an extra layer of liability protection beyond your standard homeowners coverage.

Final Thoughts

Your money blueprint transformation? It kicks off now-this very moment, not later. Research tells us that folks jotting down financial goals nail them 42% more often. That’s right… scribble it, win it. Your childhood money hang-ups, those sneaky spending triggers, and mindset blocks have had the wheel for way too long.

The game plan going forward? Simple: track every penny for 30 days, automate that 20% into investments, and establish a six-month rainy day fund. The shift in your wealth mindset? It happens with action, not fairy dust. Swap out those “I can’t afford it” thoughts with “How can I afford it?” and spend 10 minutes every morning picturing your financial success.

Look, Americans saved a measly 4.6% in 2024, while the average millionaire? They’ve got seven income streams lined up. Which side are you leaning towards? At Top Wealth Guide, we’ve got you covered with real tools and strategies to make this change stick. Hit up Top Wealth Guide for the wealth-building resources that actually work.