Most folks trip up with money — not because they’re not smart, but because they’re missing the right habits. Little daily choices…. yeah, they stack up over time into something big.

Over at Top Wealth Guide, we’ve nailed down the habits that set the financially savvy apart from those just scraping by. These aren’t just tips — they’re game-changers that’ll transform your money mojo.

In This Guide

Essential Daily Money Habits for Financial Success

Financial success… it’s like trying to land a quadruple axel on ice-takes practice, precision, and a little bit of flair. But let’s get real. It boils down to three-count ’em, three-non-negotiable habits.

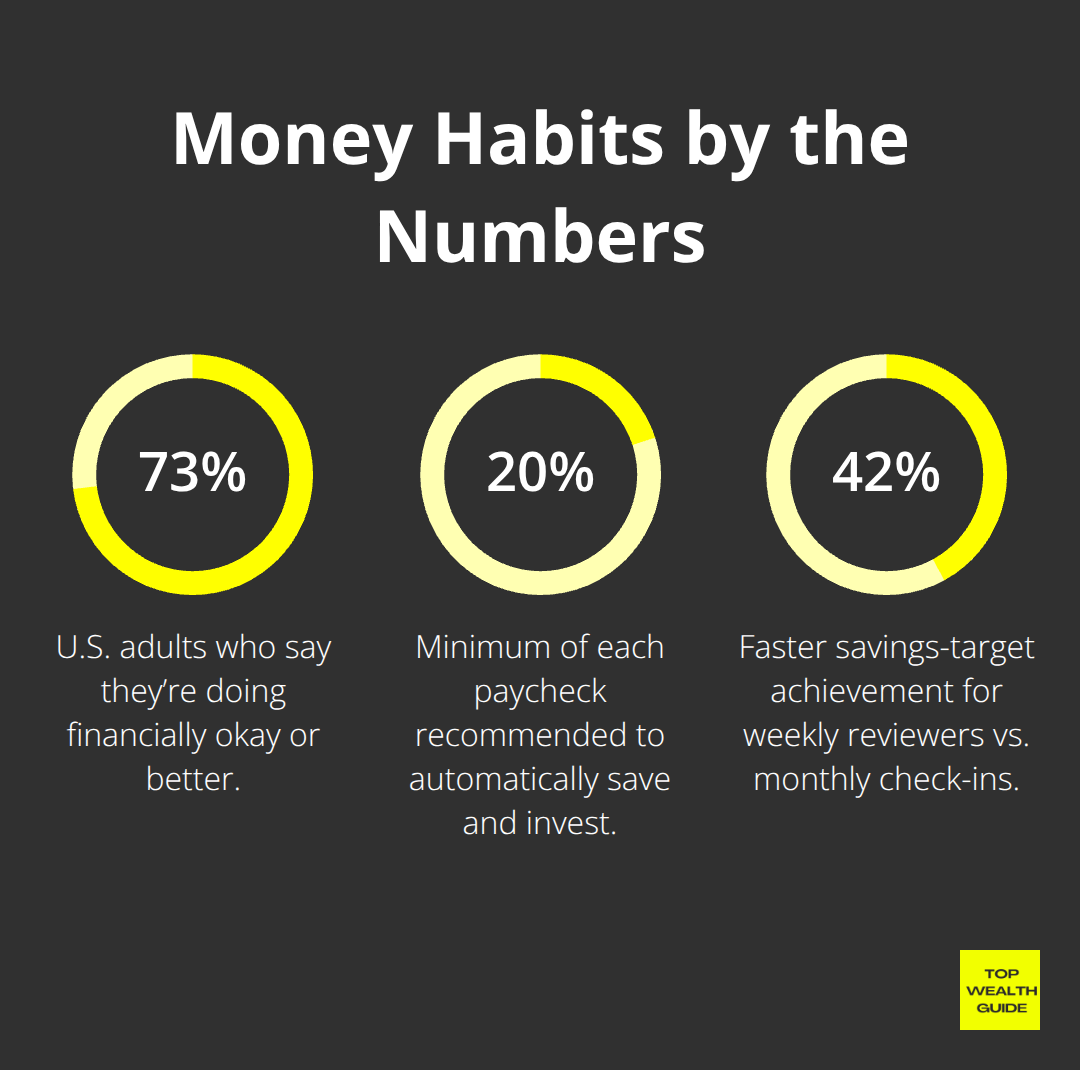

The Fed says 73 percent of adults think they’re doing just fine. But those really living the high life? They’ve got a secret sauce cooked from these exact practices. No exceptions.

Track Every Dollar You Spend

Want to see where your cash disappears to? Successful folks have this uncanny knack for tracking cash flow like it’s a rare species. Apps like Mint or YNAB? Download yesterday. Get down to categorizing within 24 hours. And for the love of your bank balance, peek at your accounts not once, not twice, but thrice a week.

This little habit prevents those pesky overdraft fees from popping up. You’ll think you’re spending $50 on coffee, but surprise! It’s more like $120. Keep an eye on those daily expenses and suddenly, you’re the boss of your money-not the other way around.

Automate Your Savings and Investments

Set those wheels in motion, pronto-automatic transfers to savings accounts the day after payday. We’re talking at least 20% of your hard-earned cash shuffled into high-yield savings accounts like Marcus or Ally Bank (hello, 4.5% interest rates).

Automate bill payments so you’re not tossing $32 at late fees every time you forget a bill. Pump up those 401k contributions by 1% annually, and boom-wealth grows while you catch some Z’s. This is about making willpower irrelevant, folks. Building wealth happens when you’re, quite literally, sleeping on it.

Review Your Financial Goals Weekly

Reserve 30 minutes every Sunday-not for Netflix, but for your financial health check. This is when you dive into account balances, investment performance, spend patterns-the whole shebang. Vanguard says weekly reviewers hit their savings targets 42% faster than those who only check in monthly.

Do the net worth math and tweak next week’s spending based on how you’re doing. These weekly snapshots? They catch issues before they spiral, keeping you laser-focused on hitting those wealth markers. This transforms your spending from random to intentional, like you’ve got a financial game plan that compounds and grows.

Nail these cornerstone habits and you’ve laid the groundwork for amassing wealth, but leveling up means bringing in the heavy artillery-sophisticated strategies designed to rocket your financial growth beyond the stratosphere.

Advanced Money Habits That Build Wealth

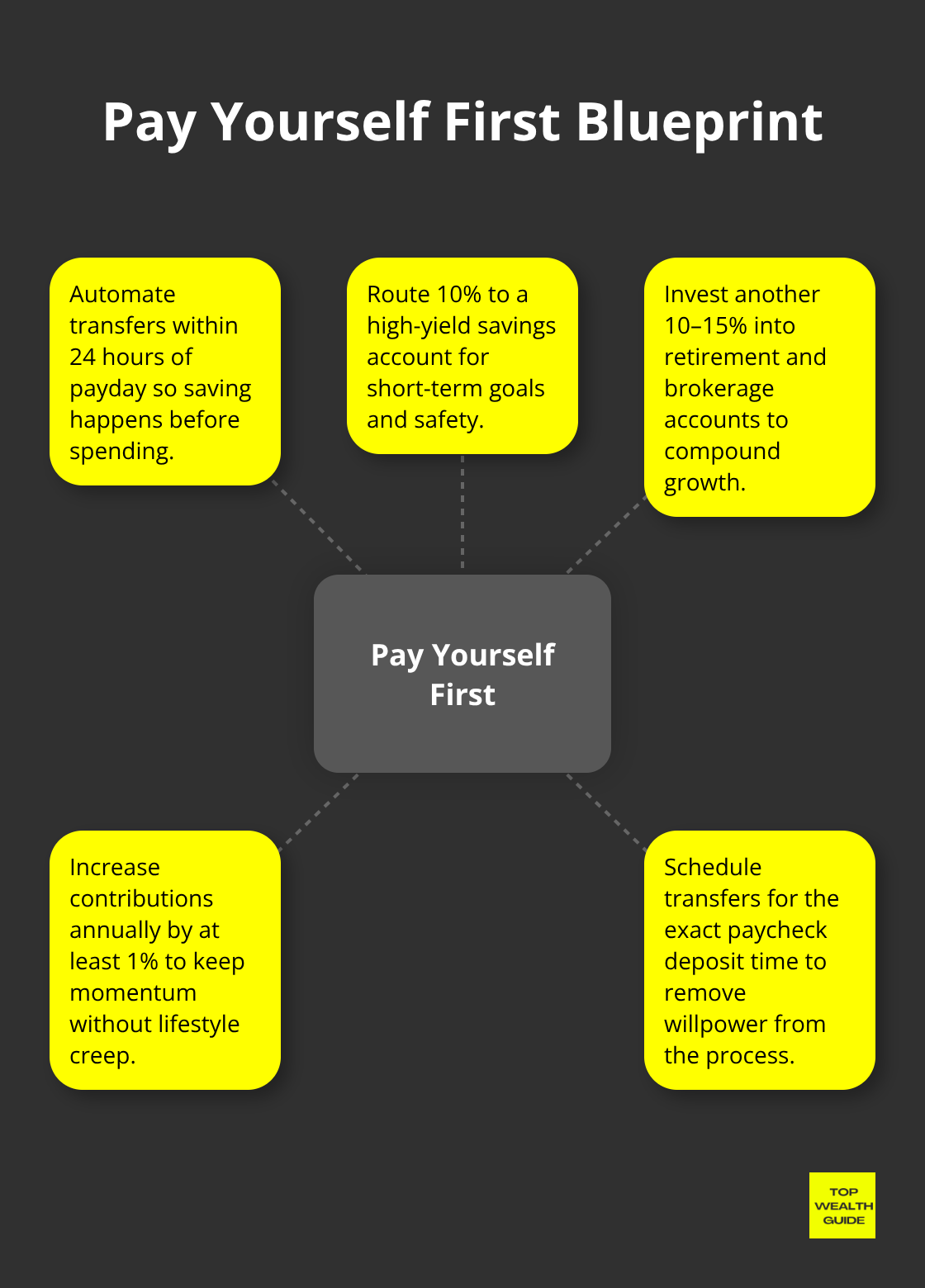

Pay Yourself First Every Single Time

Here’s something the wealthy live by-it’s etched in stone: pay yourself before anyone else sees a nickel. We’re talking 20-25% of every single paycheck funneled directly into wealth-building accounts before tackling rent, groceries, or the lure of the latest Netflix craze. Warren Buffett’s been banging this drum for years, and guess what? The numbers are crystal clear.

Fidelity research swings in with data-folks who automate their savings within 24 hours of that sweet payday turbocharge their wealth 67% faster than the ‘save-what’s-left’ crowd. Set those automatic transfers for the exact second your paycheck lands.

Aim for high-yield savings accounts over at Ally or Marcus taking 10% and investment accounts snagging another 10-15%. It’s non-negotiable-think of it as the bedrock of every millionaire’s secret playbook.

Slash Your Bills Like a Financial Ninja

Most people make the rookie mistake of treating bills as if they’re set in stone. The wealth maestros? They treat every bill like a challenge to conquer. Hit up your internet provider, insurance company, and phone carrier to negotiate bills. Drop a name-check on competitor rates and ask to be redirected to retention departments-they’ve got the power to slash those costs right before your eyes.

Slice through unused subscriptions like a hot knife through butter. Truebill data spills the beans-Americans waste an average of $273 each month on services gathering dust. Negotiate those property taxes (assessment appeals, anyone?), refinance when rates drop, and switch banks to dodge those pesky fees. Voila-a few hundred bucks freed up monthly, compounding into serious wealth down the line.

Build Income Streams That Work While You Sleep

Here’s the brutal truth-relying on just one income stream? That’s financial suicide. The savvy ones? They’re busy creating multiple revenue streams that run on autopilot. Start with dividend stocks-folks like Johnson & Johnson have been dishing out dividends for 61 straight years (talk about trustworthiness).

Real estate investment trusts are there to churn out monthly cash flow, minus the headache of property management. Got skills in writing, design, or consulting? You could see $500-2000 month-to-month returns in just 90 days. Dive into online courses, affiliate marketing, and rental properties for passive income that tickles your bank account while you zero in on your primary gig. Hit $1000 monthly from these side hustles in your first year-that’s a cool $12,000 annually, rocketing your wealth growth into the stratosphere.

These advanced strategies are the fine line separating hardcore wealth hustlers from the ‘meh’ savers, but even the best-laid plans can go up in smoke if you stumble into the gaping financial pitfalls that lie in wait.

Common Money Mistakes to Avoid

Folks are experts at wrecking their financial future with a trio of blunders that snowball into disaster over time. These wealth-eating culprits turn would-be millionaires into lifelong slaves to their paychecks.

Lifestyle Inflation Kills Your Future Self

Guess what happens the second your paycheck swells? Your spending jumps right along with it. This lifestyle inflation is a silent killer – more lethal to your wealth than a market meltdown. Step into the shoes of a software engineer going from $75K to $95K, and watch them blow $18K more each year, instead of stuffing it into savings.

Bottom line? Higher earnings don’t budge your net worth. The fix? Channel 80% of any pay bump straight into your investment accounts, pronto. Keep living like you’re earning your old salary for at least a year after any raise. This simple trick turns salary hikes into money-making machines, not lifestyle snares.

Emotional Spending Bleeds Money Fast

When emotions run high, cash flies out the window. Shopping under the influence of stress, anger, or celebration is a money pit. Did you know people have less willpower and productivity when swamped with choices? Retailers love it – they whip up flash sales, limited-time deals, and tempting ads on social media just to push those buttons.

Want to outsmart them? Set a 72-hour cooling-off period for any non-urgent buy over $100. Ditch the shopping apps and delete those promo emails, like, yesterday. Swap emotional spending with free go-tos – take a walk, chat with a buddy, or read something. Track these emotional buys for a month, and you’ll spot habits that drain thousands every year.

High-Interest Debt Compounds Against You

High-interest debt is a monster, gobbling up your cash at 24% a year while your emergency fund drags at 4% (funding savings while barely touching your debt? That’s a financial death wish). Tackle debt like a pro using the debt snowball method – knock out the smallest balances first. Pour every spare dime into your debt until it’s history.

Credit card companies thrive on your unpaid balances. They’ve mastered the art of minimum payments just to trap you in debt hell for years on end. Break the shackles by going beyond minimums and swearing off new debt while you clear the old.

Final Thoughts

Let’s talk about separating the wealth builders from the paycheck prisoners. It’s all about tracking every dollar (yep, every single one), automating those transfers, and giving your goals a once-over every week. Here’s the deal: Pay yourself first – stash away 20-25% of that income. And yeah, don’t forget to negotiate those bills like your life depends on it – annually. Oh, and multiple income streams? Essential. Lifestyle inflation and high-interest debt? Avoid like the plague.

Start today, folks. Pick a habit, any habit. The compound effect? It’ll do its magic. Download a spending tracker app, set up those automatic savings transfers, and mark your calendar for a weekly 30-minute money date every Sunday (trust me, this stuff becomes as natural as breathing in about 90 days).

People who jump on this train see 67% faster growth in their wealth compared to the aimless savers. Future you? They’re counting on the choices present you makes today. We here at Top Wealth Guide are all about turbo-charging your financial transformation with strategies that actually deliver – just stick with it.