Here’s a little secret to optimizing your returns — portfolio rebalancing. Vanguard research shows it can boost your investment haul by 0.35% to 2.56% annually. However, most investors … well, they just let their well-crafted asset allocation wander off the beaten path with market swings.

Over here at Top Wealth Guide, we notice this blunder more often than we’d like. The beauty of rebalancing? It keeps your risk on an even keel, and gives you the chance to buy low and sell high. Smart, right?

In This Guide

What Happens When You Don’t Rebalance Your Portfolio

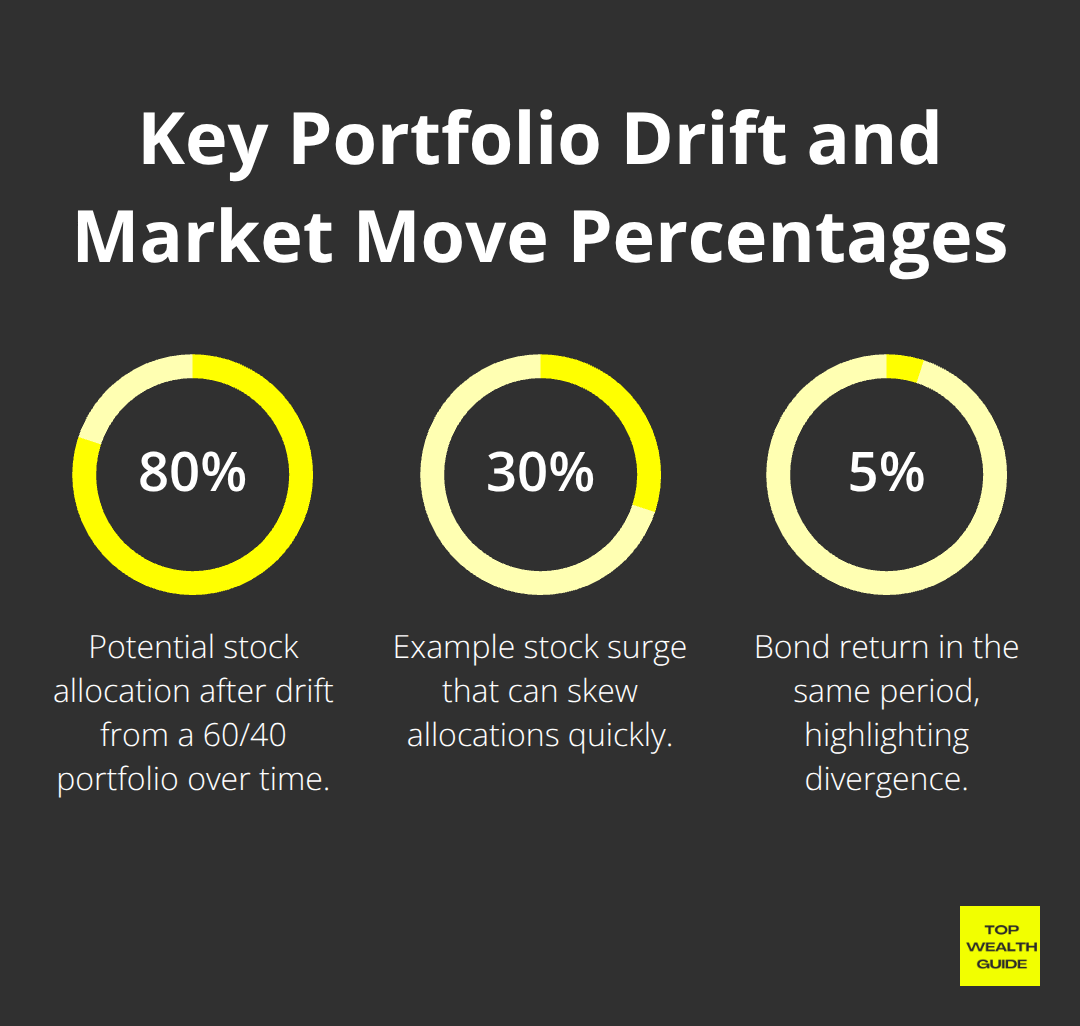

So, let’s chat about portfolio rebalancing. Basically, it’s like tidying up your financial house-systematically buying and selling assets to keep your investment mix just the way you planned it. Picture this: you start with a neat 60% in stocks and 40% in bonds. But, surprise surprise, market waves will definitely stir things up. According to a nifty Vanguard study cruising through portfolios from 1989 to 2021, that dear 60/40 balance could wind up as a whopping 80% in stocks over the years, all on its own. Why? Because stocks generally have a knack for outdoing bonds, nudging your risk profile into a whole new territory.

The Hidden Cost of Market Drift

And here’s the kicker-market volatility, oh, it doesn’t just toss prices around for giggles. Nope, it rewires how risky your investments really are. Remember the 2000-2002 tech nosedive? Investors who didn’t rebalance were left with portfolios chuck-full of tech stocks that were tanking hard. According to Morgan Stanley, rebalancing can be the guidepost to check if your portfolio is still on its quest for returns while keeping risks in check. Notice the math: when stocks leap 30% while bonds just trot at 5%, your meticulously crafted 60/40 split morphs into 65/35 at the speed of light. Do nothing, and bam-you’re toting around 8% more risk in equities.

Compound Returns Through Disciplined Rebalancing

Here’s a fun fact: rebalancing thrives on good ol’ buying low and selling high-forces you to cash in your winners and pick up some shabby-looking losers. Odd, right? But numbers have no feelings. The secret sauce is in the asset rollercoaster-more bouncing equals more chances to play smart with disciplined rebalancing, so you pocket those compounding returns.

Two Primary Approaches to Portfolio Maintenance

Seasoned investors often pick a side-calendar-based or threshold-based rebalancing, each their unique dance. Calendar-based folks take a peek at their portfolio once a year or quarterly, no matter which way the market winds blow. Meanwhile, threshold-based rebalancers spring into action when asset allocation drifts a certain distance from the plan-typically 5% to 10%. Both approaches come with their bag of tricks that could supercharge your returns for the long haul.

Which Rebalancing Method Works Best

Let’s chat about rebalancing-calendar-based rebalancing, to be precise. It’s like setting your watch to Greenwich Mean Time. Regular, predictable, and emotion-free. Morgan Stanley research confirms that an annual check-in captures those sweet benefits while watching those pesky transaction costs. Pencil it in-January 31st. Why then? Tax docs are in, and you’re staring down your entire financial tapestry.

Switch gears to threshold-based rebalancing-triggers when things drift off course by, say, 5%. Yeah, it can juice your returns, no doubt. But it also demands your eagle-eye attention and brings along surprise costs to the party.

Smart Tax Management Strategies

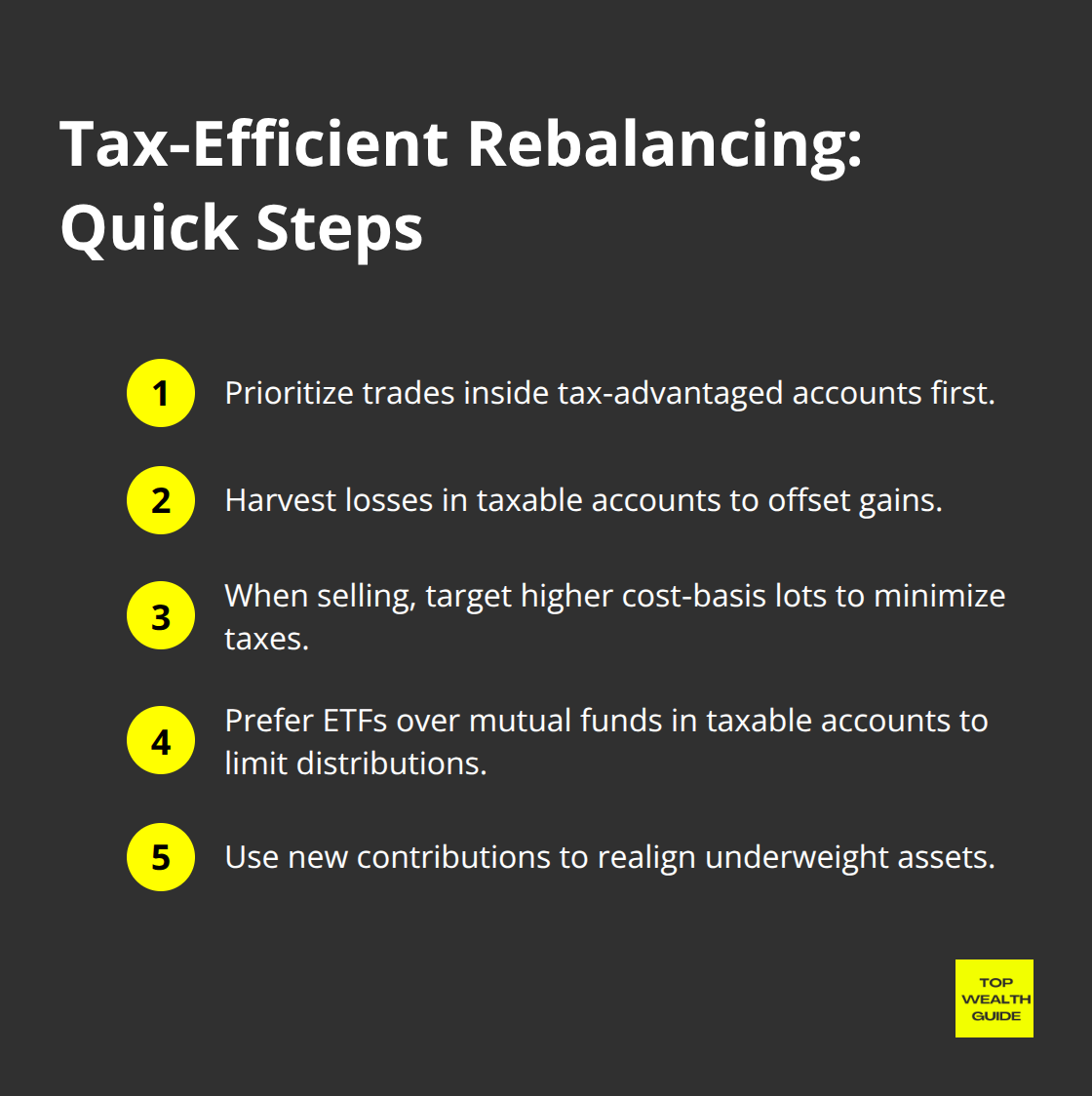

Next up, tax-efficient rebalancing. Begin with tax-advantaged accounts. Sell those bulked-up spots in your 401k or IRA-escapes the capital gains tax trap. For the taxable crew? Harvest those ugly duckling losses before you pop the bubbly on winners.

Hone in on securities with a higher cost basis when selling-less tax sting.

Fidelity steps in to say this can save you a nifty 1.2% annually after tax. Opt for ETFs instead of mutual funds in those taxable zones-ETFs keep taxable distributions in check come rebalance time.

New Money Rebalancing Approach

Now, onto the savvy play-fresh money over rearranging deck chairs on the Titanic. Aim those new 401k contributions, IRA deposits, straight at underweight assets like a heat-seeking missile. Rebalance without the friction of transaction fees or tax headaches.

Charles Schwab spills the beans: this approach saves you $400 a year in fees and taxes versus playing the sell-buy game. Check your target allocation gaps every quarter-funnel that new cash until your portfolio harmonizes back to target levels.

Common Frequency Mistakes

The timing trap-either too much or too little. Monthly? It burns through your returns like wildfire-endless transaction fees. But wait two years? You’re adrift in dangerous waters. Academic heads nod along-annual hits the sweet spot for most.

But here’s the kicker-volatile markets might flip the script. Remember 2020? Sticking to the annual plan missed out while the world seesawed around them.

All the plans can crumble if you let emotions drive the wheel in market chaos, leading us to the sneaky psychological traps that topple otherwise solid investment frameworks.

Why Most Investors Sabotage Their Own Rebalancing

Most investors… shoot themselves in the foot with three fatal rebalancing boo-boos that bleed them dry annually. Number one on that list? Over-rebalancing. Yep, Morningstar data throws it right in our face-monthly rebalancers are kissing goodbye to 1.2% in annual returns, thanks to transaction costs and Uncle Sam.

The Cost of Excessive Trading

Crunch some numbers, and it stings: a $500k portfolio, rebalanced monthly, forks over about $6,000 every year in unnecessary fees-ouch! Stick to quarterly rebalancing, and you’re cutting costs with substantial benefits. The sweet spot? Annual or semi-annual checks, that is, unless your portfolio’s gone rogue and drifted more than 10% from your target.

Frequent trading? It’s a transaction cost rollercoaster. Each buy/sell comes with bid-ask spreads, commissions, and market impact costs, gobbling up your returns. The smart crowd knows this-perfect timing is a myth; consistent discipline (over decades) is what matters.

The Emotional Rebalancing Trap

Then there’s mistake numero dos: letting emotions run the show. When markets take a nosedive, like in March 2020, investors bailed-selling stocks at 23% losses when they should’ve been buying. Lesson from the pros: sticking to a mechanical schedule trumps emotional juggling, hands down, over the long haul.

Fear and greed have investors making the wrong moves… at the worst moments. Market tanking? Panic takes over rational moves. Markets on a joyride? FOMO stops you from taking profits off the table in those chubby positions.

Tax Rebalancing Disasters

And rounding out the trio of screw-ups-taxes. In taxable accounts, it’s a massacre. Schwab analysis shows a 1.5% annual burnout from ignoring tax angles-no tax-loss harvesting, neglecting the cost basis, nada.

Sharp investors play it cool-start rebalancing in tax-advantaged accounts, then tweak taxable ones with fresh contributions. If you gotta sell in taxable waters, aim for high-cost basis targets to dodge the capital gains whammy. This no-nonsense strategy saves the average investor $2,400 annually in taxes on a $300k portfolio.

Automation Beats Human Psychology

The fix? Slick and simple-let automation do its thing. Use your brokerage’s tools or calendar dates set in stone to rebalance without giving market noise a second thought. Most top brokerages offer automatic rebalancing that keeps you on track-no emotions, no expensive trading, just consistent balance.

Final Thoughts

Portfolio rebalancing-turning the storm of market swings into a smooth sailing for wealth creation. The digits back it up: disciplined rebalancers snag an extra 0.35% to 2.56% each year while keeping risk levels exactly where they want them. It’s math working for you, not some pie-in-the-sky idea.

Here’s how you start-automate through your brokerage platform, then pick those annual dates or set those 5% drift lines. Tax-advantaged accounts? Tackle those first. Slap new contributions into taxable accounts for realignment. This trick saves you thousands on fees and taxes plus keeps that sneaky little devil called emotion out of your investment game (protecting your long-term moolah).

Over the years, watch the compound effect do its magic. Imagine a $100,000 portfolio with regular rebalancing climbing to $1.2 million more than if you’d just let it sit there for 30 years-Vanguard says it’s true. At Top Wealth Guide, we see savvy investors sticking to these golden rules: follow your set schedule, tune out the market buzz, and focus on tax smarts. Pop over to Top Wealth Guide for more practical financial hacks and wealth-building wisdom.