Most people think building investment capital requires a steady paycheck and years of saving. At Top Wealth Guide, we’ve found that strategic side hustles can accelerate this timeline dramatically.

The right side hustle doesn’t just generate extra income-it creates genuine capital you can deploy into real investments. We’ll show you which models actually work, how fast they scale, and exactly how to transition from side income to serious wealth building.

In This Guide

Freelancing and Professional Services

The fastest way to convert your expertise into investment capital is through high-income freelance work. Unlike a salaried position, freelancing lets you capture the full economic value of your skills without corporate overhead taking a cut. Rates for specialized freelance services have climbed significantly. Software developers command $250 to $350 per hour depending on language and specialization.

Positioning Yourself in High-Demand Niches

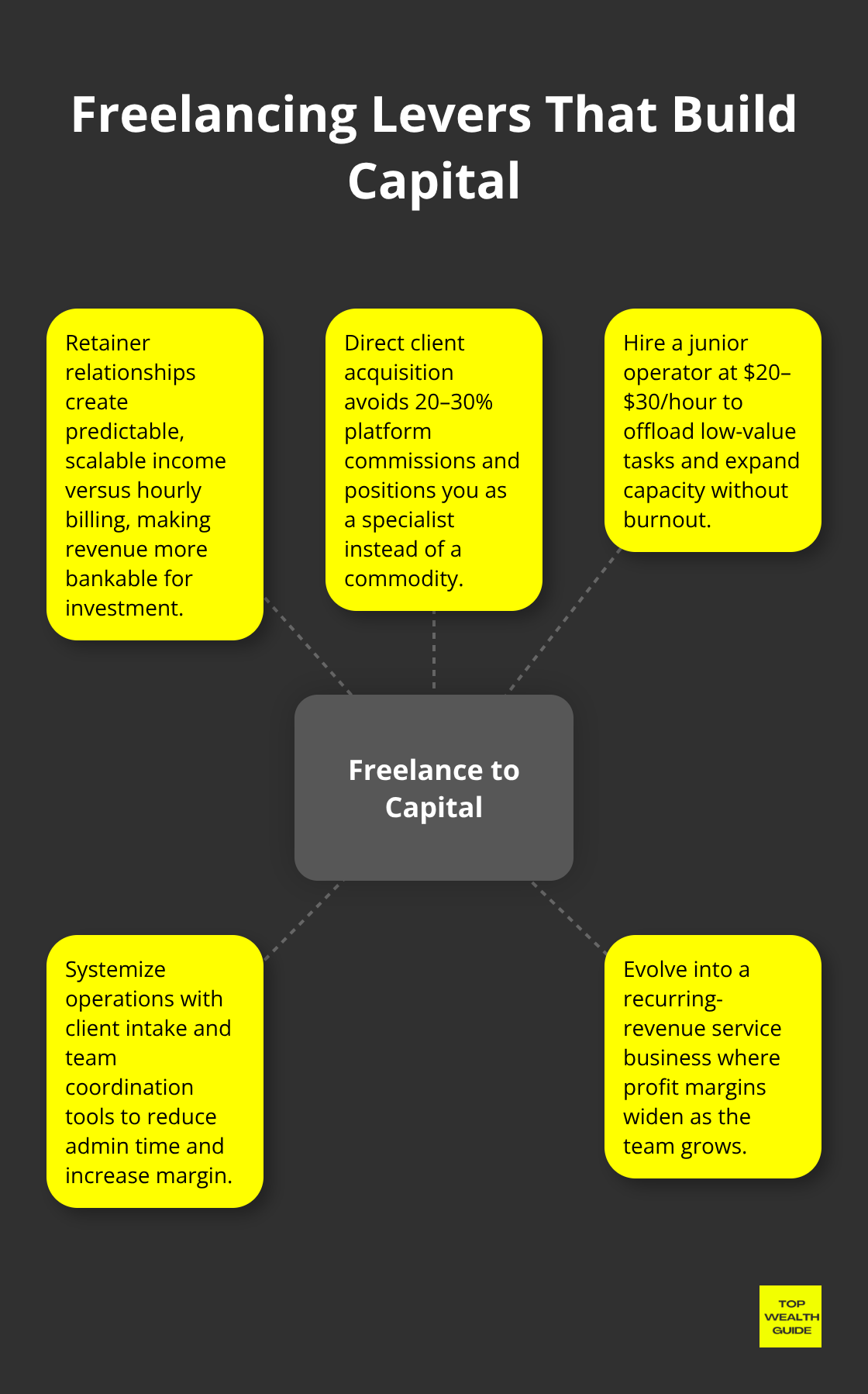

The real capital builders in freelancing aren’t doing general work at commodity rates-they position themselves in niches where demand outpaces supply. Technical writing for SaaS companies, fractional CFO services for startups, and paid advertising management for e-commerce businesses all generate $5,000 to $15,000 per month for a single operator working part-time. The key is moving away from time-for-money transactions into retainer-based relationships. A $3,000 monthly retainer with three clients generates $9,000 in predictable monthly income, far more scalable than hourly billing.

Building Direct Client Relationships

Platforms like Upwork and Fiverr work against you-they commoditize your labor and take 20 to 30 percent commission. Instead, build direct relationships with clients through LinkedIn outreach, warm referrals, or positioning yourself as an expert in a specific industry. One consultant transitioned from hourly web design to retainer-based SEO management ($4,000 monthly per client) by developing case studies showing concrete results for three clients in the local home services industry.

Scaling Beyond Solo Work

The transition from solo freelancer to team operator is where you actually build capital instead of just trading time. Once you’ve established repeatable processes and proven client relationships, hire a junior operator at $20 to $30 per hour to handle lower-value tasks-initial consultations, content edits, basic reporting. This immediately frees you to pursue higher-value work or take on additional clients without burning out.

A freelancer earning $8,000 monthly solo can hire an assistant for $2,000 per month and increase capacity to $12,000 to $15,000 monthly by focusing on sales and strategy. Tools like Dubsado streamline client intake and project management, reducing administrative overhead. Slack keeps your small team coordinated without constant meetings.

As your team scales to three or four people, you shift from being a service provider to running an actual business with recurring revenue. The profit margin widens dramatically-you’re no longer capped by your own available hours.

This inflection point marks where side hustle income actually accelerates wealth building rather than just providing supplemental income. With a functioning team and predictable monthly revenue, you now have genuine capital to deploy into the next wealth-building model: creating products that generate income without your direct involvement.

E-Commerce and Digital Products

Why One-Time Sales Fail to Build Capital

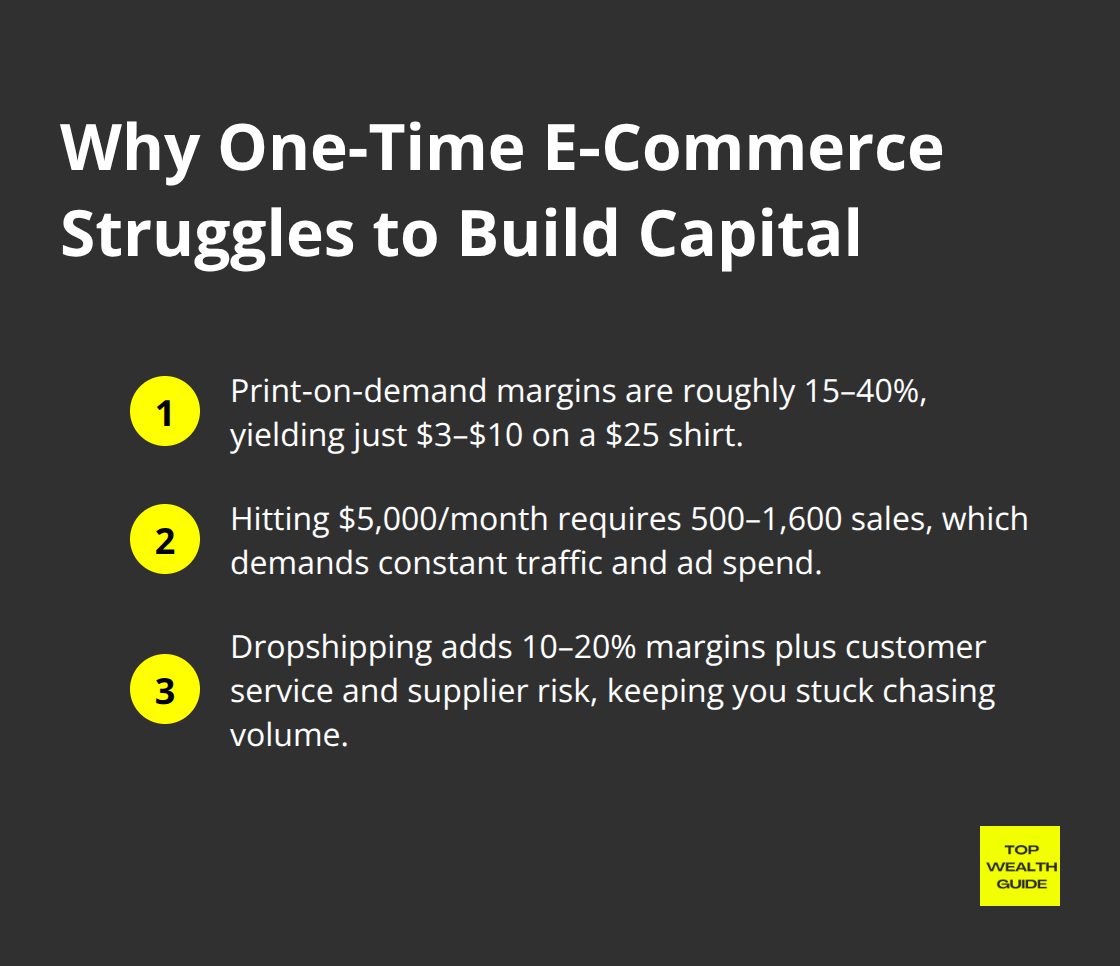

E-commerce models that rely on one-time transactions drain your time without building capital. Print-on-demand and dropshipping sound appealing because startup costs are low, but they’re fundamentally broken for capital accumulation. With print-on-demand through Printful or Merch by Amazon, you design a product, upload it, and earn roughly 15 to 40 percent margin on each sale. A t-shirt selling for $25 nets you $3 to $10 per unit. To generate $5,000 monthly, you need 500 to 1,600 sales depending on margins.

That requires consistent traffic, paid advertising spend, and relentless content creation just to maintain flat income.

Dropshipping carries identical problems: thin margins of 10 to 20 percent, customer service headaches, and supplier dependency. Neither model scales into serious investment capital because you perpetually chase volume instead of building assets. The effort-to-reward ratio makes these approaches unsuitable for anyone serious about wealth acceleration.

Digital Products Create Passive Income Streams

Digital products and subscription models operate differently. Creating a digital course, template library, or software tool requires upfront work but generates income without inventory, shipping, or supplier drama. A course on Udemy or Teachable priced at $47 to $197 with conversion rates of 1 to 3 percent from your audience builds passive income that compounds over time.

More importantly, subscription models create predictable monthly revenue. SaaS tools charging $29 to $99 monthly generate recurring income that funds reinvestment into marketing, product improvements, or additional ventures. A tool with 500 paying subscribers at $49 monthly produces $24,500 in annual recurring revenue. That’s genuine capital you can deploy into real estate down payments, stock portfolios, or scaling other businesses.

Subscriptions vs. One-Time Transactions

The difference between one-time sales and subscriptions is the difference between trading activity for money and building an asset that generates money automatically. One-time transactions require constant effort to replace lost customers and maintain revenue. Subscriptions compound-each new customer adds to your baseline revenue without replacing anyone else.

A subscription model with 100 customers paying $50 monthly generates $60,000 annually with minimal additional effort beyond product maintenance. That same revenue from one-time sales would require hundreds of transactions monthly, each demanding marketing spend and customer acquisition effort. The math heavily favors recurring revenue for capital building.

Scaling Digital Products Into Real Wealth

Focus your e-commerce effort on products people buy repeatedly or services they pay for monthly, not trinkets that sell once then vanish from customer memory. Digital products paired with subscription revenue create the foundation for serious wealth accumulation. Once you establish a subscription base generating $5,000 to $10,000 monthly, you shift from side hustle to genuine business asset. This predictable capital flow opens doors to the next wealth-building frontier: deploying that income into real estate investments that multiply your returns exponentially.

Converting Side Hustle Profits Into Real Estate

Leverage Transforms Side Hustle Income Into Asset Control

The inflection point where side hustles become genuine wealth accelerators arrives when you stop spending profits and start deploying them into real assets. Real estate offers the clearest path because it uses leverage transforms income into asset control-you borrow money to control assets worth far more than your cash down payment. A down payment allows you to finance the rest of the property, controlling a much larger asset that generates rental income while the property appreciates. That’s capital multiplication that no subscription model or freelance retainer can match. Your side hustle income becomes the fuel for real estate acquisitions that generate true wealth.

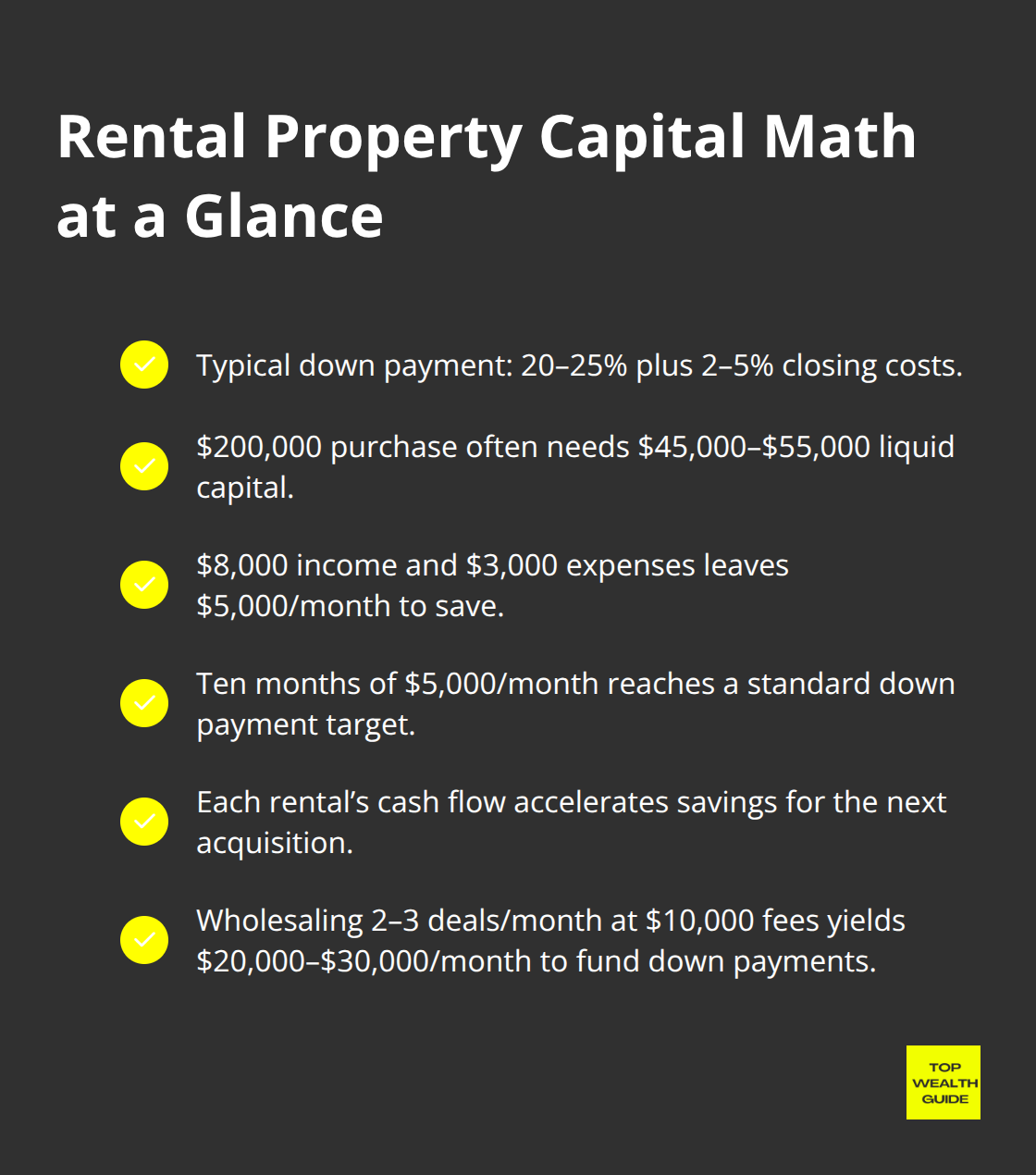

Wholesaling Converts Capital Into Down Payments Fast

Wholesaling real estate is the fastest way to convert side hustle capital into down payment funds without requiring significant upfront cash. A wholesaler identifies undervalued properties, contracts them at below-market rates, then assigns the contract to an actual buyer or end investor for a fee ranging from $5,000 to $25,000 per deal. Unlike flipping properties (which requires renovation capital and carries execution risk), wholesaling requires only knowledge and negotiation skills. You don’t buy the property-you capture the spread between what a seller will accept and what a buyer will pay. An operator closing two to three deals monthly at $10,000 average assignment fees generates $20,000 to $30,000 monthly with zero inventory risk. This income flows directly into down payment accounts for rental properties. The challenge is finding deals before they hit the MLS, which requires direct mail campaigns to distressed property owners, networking with local agents, and building a cash buyer list. Expect $1,500 to $3,000 monthly in marketing costs to source consistent deal flow, but the returns justify the expense if you execute properly.

Rental Properties Compound Capital Through Cash Flow

Rental properties compound capital through cash flow once your side hustle generates consistent monthly surplus. Most lenders require 20 to 25 percent down on investment properties plus closing costs of 2 to 5 percent-so a $200,000 property needs $45,000 to $55,000 in liquid capital. A freelancer earning $8,000 monthly with $3,000 in expenses has $5,000 monthly available for down payment accumulation. Within ten months, you’ve accumulated the capital for a down payment. The rental income from that property then accelerates down payment savings for the next acquisition.

This compounding effect is where real wealth builds. You’re no longer just saving money; you’re acquiring income-producing assets that appreciate while generating cash flow. A real estate wholesaler closing three deals monthly at $15,000 average fees can accumulate down payment capital for a $300,000 rental property within six months. That property then generates $18,000 annually in net cash flow after mortgage, taxes, insurance, and maintenance-capital that funds the next property or scales the wholesaling operation itself.

Separate Accounts Protect Capital From Lifestyle Inflation

The critical tactical point that most side hustlers miss is the separation between side hustle income and real estate operations. Your freelance retainers or subscription revenue should flow into a dedicated investment account, not back into personal spending. Jocelyn Elizabeth’s case demonstrates this precisely-she reinvested NikNax marketplace profits into Pennsylvania rental properties rather than increasing personal lifestyle. Those properties now generate significant Airbnb income alongside traditional rental cash flow. This discipline converts side hustle earnings into genuine wealth instead of temporary income bumps. The math becomes undeniable once you run it: a $5,000 monthly side hustle surplus deployed into down payments and wholesaling fees creates a real estate portfolio generating $30,000 to $50,000 annually in passive income within two to three years. That passive income then funds lifestyle while the original side hustle capital continues compounding into additional properties and equity appreciation. Separate accounts protect capital from lifestyle inflation by creating a psychological barrier between earned income and discretionary spending.

Final Thoughts

Freelancing and professional services produce the fastest initial capital because you convert existing expertise into income immediately. A consultant earning $8,000 monthly from retainers accumulates $5,000 in investable surplus within weeks, and reaching $10,000 monthly profit takes twelve to eighteen months once you hire your first team member. E-commerce and digital products move slower initially but require less active time once established, with subscription models reaching $5,000 monthly recurring revenue within six to twelve months. Real estate wholesaling and rental properties represent the highest capital multiplication, allowing you to own three to five rental properties generating $30,000 to $50,000 annually in passive income within two to three years.

The most effective approach combines multiple models simultaneously. A freelancer earning $8,000 monthly can deploy $3,000 into a subscription product while maintaining client work, and within eighteen months that subscription generates $2,000 monthly passive income alongside the original $8,000 from freelancing. This layered strategy compounds faster than any single model alone because each income stream funds the next wealth-building layer. The side hustles that actually generate real investment capital share one critical trait: they prioritize reinvestment over lifestyle spending, which means tracking every dollar and deploying it into the next opportunity rather than increasing personal expenses.

Start with what you can execute immediately-if you have expertise, launch freelance retainers this month; if you have an audience, build a subscription product; if you have capital, start wholesaling deals. We at Top Wealth Guide recommend visiting our detailed frameworks on scaling each model and protecting your capital as it grows. The side hustles that transform your financial future are the ones you actually start today.