Most folks craft financial ambitions that sound flashy … but end up as roadkill on the highway to nowhere. Why? They’re missing the architecture to evolve those dreams into tangible outcomes.

At Top Wealth Guide, we champion the SMART framework—it’s a game changer. This tried-and-true approach spins your fuzzy cash dreams into solid, actionable blueprints that … gasp … actually deliver.

Here’s the thing: the chasm between simply wishing for wealth and making it rain lies in how you map out your targets.

In This Guide

What Makes SMART Goals Actually Work

The Fatal Flaw in Traditional Financial Planning

Traditional goal setting-yeah, it’s a train wreck, folks-because it misses the mark on precision. When people say, “Hey, I want to save more money” or “get out of debt,” they’re basically heading straight for disappointment city. According to the Federal Reserve’s Survey of Household Economics and Decisionmaking, 35% of adults said their financial situation actually took a nosedive compared to the previous year. Why? Because all these vague good intentions don’t move the needle. Your brain isn’t signing up for ‘maybe.’ It craves concrete, specific targets-not some wishy-washy stuff that leads nowhere.

Why SMART Framework Delivers Real Results

Enter the SMART goals-a game-changer. They make you get super clear, brutally specific about what you wanna do, and when you wanna do it. Forget the lazy “save more;” instead, you’re laying down the law: save $500 a month for 24 months to stack up a $12,000 emergency fund. The framework pushes you to stick to the five must-haves: Specific targets, Measurable progress markers, Achievable based on your income, Relevant to your situation, and Time-bound with deadlines. It turns those airy-fairy wishes into rock-solid action plans. When you know exactly what success looks like, and can check off your progress every week, you’re way more likely-research from Dominican University backs it up-to actually hit those goals.

The Psychology Behind SMART Success

So, what’s the deal with SMART goals? They tap into good ol’ human psychology using measurement and accountability. Track your debt payoff every month or keep an eye on your investment contributions each week, and you’re lighting up the same mental rewards system that glues people to video games or those digital step-counters. It keeps you motivated even when the initial thrill wears off. Plus, it stops your financial plans from getting swamped; breaking huge goals into bite-sized monthly or weekly steps.

Now that we’ve cracked open why SMART goals leave the traditional methods in the dust, let’s dig into crafting those financial targets that’ll actually make things happen.

How Do You Build SMART Goals That Actually Work

Start With Dollar-Specific Targets

Let’s skip the nonsense and get straight to brass tacks… numbers. None of this “I want to save money” vagueness, but a “save $400 every month” reality check for your emergency fund. Schools teach calculus, but financial literacy? That’s the ticket to long-term success, the gift that keeps on giving. Your brain? It craves specifics, not cloudy ambitions. Pay off $8,000 in credit card debt by December 2026-or stack up $15k for that down payment within 18 months. Write it, see it, do it. Vague goals are like vague recipes-end up with something you didn’t order.

Track Progress With Weekly Check-Ins

Weekly beats monthly-no contest. See, the average American is a bit shaky on the savings front (thanks, Federal Reserve data), because expenses? They sneak up like ninjas. Switching up to $92 weekly transfers keeps it bite-sized and top of mind. Apps like Mint or YNAB? Your new BFFs for tracking debt-payoff heroes. Or, go old school-spreadsheet style. Watching that emergency fund climb from $1,200 to $2,000? That visible progress? It’s caffeine for your goals.

Match Goals to Your Real Income

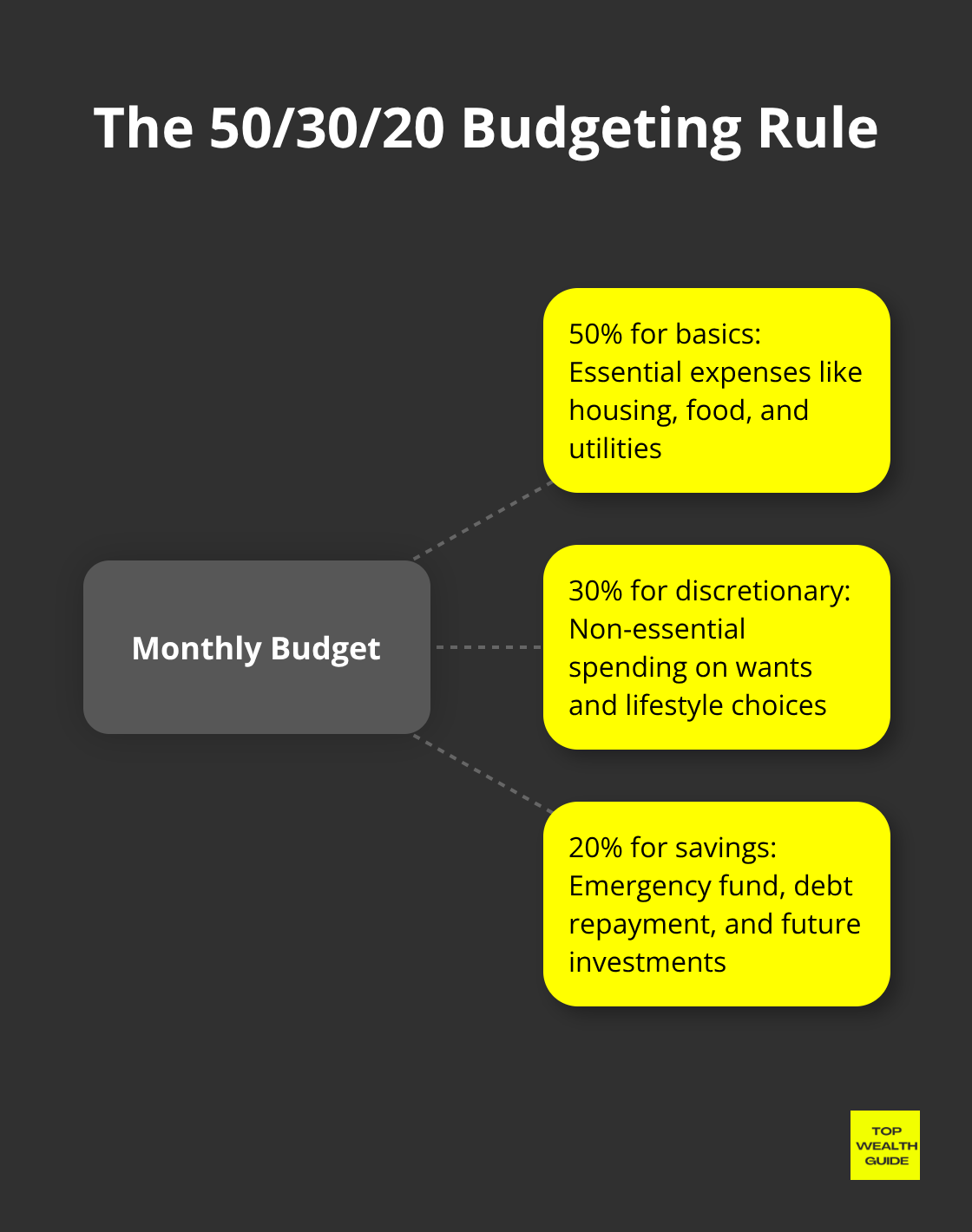

Here’s the thing-plan with the money you actually take home, not the fantasy figures before Uncle Sam’s cut. Making $4k after taxes? Aiming to save $1,500 is like flooring the gas with no engine. The 50/30/20 rule is a nice guide-50% for basics, 30% for fun, 20% savings. But… twist it-go for 25% savings if housing stays below 30% of gross. Know your disposable income (after the must-pays), then funnel 60% of that into your big SMART dreams. It’s all about avoiding that crash-and-burn frustration by month three.

Create Realistic Timelines That Stick

Look, deadlines gotta be doable, accounting for those life curveballs. People set Herculean timelines (like crushing $20k debt in half a year on a $50k salary) and naturally, they flounder. Instead? Add a 20% cushion, make room for reality. Plan for a $12k emergency stash over 30 months instead of 24, stretch that credit card conquest to 18 months instead of 12. It’s about staying the course when life throws its weight around.

So, you’ve got your SMART goals, solid and time-savvy. Next chapter? Crafting systems to keep tabs on progress and sticking to the game plan.

How Do You Track Goals Without Losing Steam

Pick Apps That Actually Move the Needle

Forget the bells and whistles-you want apps that track what counts: numbers. YNAB? It dominates budgeting by making you allocate every single dollar before you can blow it. Mint connects all your accounts, sure, but it’s missing the oomph for real goal tracking. Personal Capital? It’s your go-to for keeping tabs on investments and watching your net worth tick upwards like a stock that just got Elon’s blessing. Tally? It automates your debt payments-showing you precisely when that monkey’s off your back. The magic combo? YNAB for budgeting, Personal Capital for wealth. Let tech do its thing-set up auto data sync, review progress every Sunday morning, and watch that financial picture come into focus week after week.

Build Bulletproof Accountability Systems

Weekly money dates with your better half? Blow monthly check-ins out of the water. Treat them like your annual physical-non-negotiable. Share that debt slaying journey with a friend who’ll ring the alarm when you stray. Dive into online communities like Reddit’s r/personalfinance-where legions track similar goals. Put your monthly progress out there for all to see. The fear of a public fail? That’s rocket fuel, my friends. Set up auto transfers so your goals are sorted before life’s shiny distractions can nab your cash. Hit that $5,000 emergency fund? Toast with a dinner out for $50-not a $500 getaway.

Pivot When Reality Hits Hard

Life likes curveballs-job gone, medical bills, divorcing the wrong person. Your goals? They need give, not cement. Lose a chunk of income? Slash your savings target by the same chunk, but keep your timeline steady. Bonus time? Funnel 80% into your top goal, save 20% for a splurge. Review goals quarterly, not just when the ball drops on Times Square. Americans suck at savings consistency, often because a bump in the road has them bailing. The savvy? They adjust-not bailout. If dropping $500 a month into that emergency fund becomes undoable, trim it to $200, keep the rhythm going.

Monitor Progress With Weekly Reviews

Sunday, 9 AM-be there, do the same thing in the same spot. Pull up those apps, pit this week’s numbers against last week’s, jot down what clicked. Blew the grocery budget? Reign it in next week. Nailed your savings early? Pocket it or throw it at the debt dragon. Track these: saved dollars, debt crushed, net worth nudged. Write ’em in a notebook (yes, paper-a throwback). In 2024, 55 percent managed to tuck away cash for a rainy day. Weekly check-ins catch slip-ups before they steamroll your month.

Final Thoughts

SMART financial goals-what do they do? They take your dreams of wealth and make them reality. This framework? It brings results because it demands precision… while most folks remain all foggy. When you decide to stash away $400 a month rather than just saying “save more,” your brain zeroes in on something solid. Keeping track weekly? It keeps your drive alive, and realistic timelines? They stop burnout before it starts.

And then, the magic of compound interest hits fast. That $12,000 emergency fund? It’s not just some random number. It’s your launchpad for bigger deals. Wiping out debt opens the floodgates for investments-and with each goal met, your confidence? It skyrockets. Americans on the structured-plan-train frequently crush those who prefer to wing it.

What’s your next move? Choose one financial goal. Now. Make it specific, measurable, and slap on a time limit. Automate those transfers and set up a weekly pep talk with yourself. Over at Top Wealth Guide, we’re all about practical financial strategies to speed up your journey. We make complicated stuff simple and break it down into steps you can actually do.