Most investors chase growth stocks, but we at Top Wealth Guide believe REITs investing offers something better: predictable monthly income. Real estate investment trusts distribute 90% of their taxable income to shareholders, making them one of the few assets that pay you consistently every month.

The challenge isn’t finding REITs-it’s building a strategy that actually works. This guide shows you exactly how to select, diversify, and monitor REITs for reliable cash flow.

In This Guide

How REITs Work and Why They Pay Monthly

A REIT is a company that owns, operates, or finances real estate properties and must distribute at least 90% of its taxable income to shareholders. This requirement comes from the IRS-it’s not optional. That’s what makes REITs fundamentally different from regular stock investments. When you buy Apple or Microsoft shares, the company decides whether to pay a dividend. With REITs, the 90% payout is mandatory, which means your income stream is built into the structure itself.

Three main types exist: equity REITs (which own physical properties), mortgage REITs (which own real estate loans), and hybrid REITs (a combination of both). Equity REITs are what most income investors want because they generate cash from rental income and property appreciation. Mortgage REITs are riskier and more interest-rate sensitive, making them less suitable for stable monthly cash flow. More than 225 publicly traded REITs operate in the U.S., giving you substantial choice without forcing you into illiquid nontraded REITs that charge high fees and lock up your capital with minimums of $25,000 or higher.

The Monthly Dividend Reality

Monthly-dividend REITs deliver steadier cash flow than quarterly payers. Realty Income, which trades under the ticker O, pays monthly and has maintained an uninterrupted dividend streak for 56 years-a track record that speaks louder than any marketing claim. It yields 6.0% and owns thousands of properties under long-term triple-net leases, meaning tenants cover most maintenance costs. Agree Realty yields 4.3% with a 13-year dividend streak, while STAG Industrial yields 4.5% with the same longevity. Main Street Capital yields 5.1% and occasionally adds special dividends, boosting total returns.

These aren’t theoretical examples; they’re real REITs paying real dividends every single month. The advantage is clear: instead of waiting three months for a quarterly check, you receive income on a predictable monthly schedule, which helps with budgeting and reinvestment timing.

Sector Performance Matters More Than You Think

Not all REITs perform equally, and sector selection directly impacts your monthly cash flow stability. As of November 2025, Health Care REITs gained 30.53% year-to-date and Advertising REITs jumped 24.67%, driven by strong occupancy and rent growth. Meanwhile, Office REITs fell 18.35% and Data Centers dropped 13.93%, reflecting structural headwinds in those sectors.

For monthly income, avoid chasing high yields in struggling sectors. Office properties face permanent tenant loss from remote work trends, and Data Centers, despite high multiples, face margin compression. Instead, focus on industrial warehouses, healthcare properties, and retail with strong national tenants under long-term leases. Industrial REITs posted same-store NOI growth of 5.2% in Q3 2025, while Health Care achieved 4.1%-these sectors have cash flow that actually grows.

Triple-net lease structures, common in retail and industrial, shift operating costs to tenants, making your income more predictable and less vulnerable to rising maintenance expenses that erode returns. This structural advantage means you collect more stable cash flow regardless of inflation or unexpected property repairs.

Why Large-Cap REITs Offer Stability

Large-cap REITs trade at higher forward FFO multiples (16.2x for 2026 versus 12.8x for small-cap REITs), but this premium reflects their stability and liquidity. Large-cap REITs outperformed small-cap REITs by roughly 60 basis points in the first eleven months of 2025, and Vanguard Real Estate ETF (VNQ) delivered 5.63% year-to-date returns while the average REIT fell 2.55%. When you prioritize monthly cash flow, stability matters more than chasing outsized gains. Large-cap REITs typically have diversified tenant bases, stronger balance sheets, and lower refinancing risk-all factors that protect your dividend stream during economic downturns.

Now that you understand how REITs generate monthly income and which sectors offer the most reliable cash flow, the next step is learning how to build a diversified strategy that actually works.

How to Build a Diversified REIT Portfolio That Pays Monthly

Stop Concentrating Your Income in One Sector

The biggest mistake income investors make is loading up on one or two high-yield REITs and hoping for the best. Concentration kills cash flow reliability. In November 2025, 77.8% of REIT property types averaged negative returns, with Hotels (+3.82%) and Data Centers (+2.53%) outpacing all other property types. If your entire monthly income depends on one sector, you’re one earnings miss away from a dividend cut.

Instead, build a portfolio across three to five different property types that move independently. Start with Health Care REITs, which gained 30.53% year-to-date through November 2025 and posted same-store NOI growth of 4.1% in Q3. Add industrial warehouse REITs for their 5.2% same-store NOI growth in Q3, then include one or two retail REITs anchored by national tenants under long-term leases. Farmland REITs like Gladstone Land, yielding 5.3%, provide inflation protection and diversification away from urban real estate cycles.

Avoid overweighting Data Centers despite their tempting yields. Margin compression and technology shifts create structural headwinds that compress payouts. This sector rotation approach means when one property type underperforms, your other holdings stabilize your monthly income stream.

Prioritize Payout Stability Over Yield Chasing

High-yield REITs deserve skepticism, not blind faith. Realty Income yields 6.0% with a 56-year uninterrupted dividend streak and owns thousands of properties, but Main Street Capital yields 5.1% and occasionally adds special dividends that boost total returns beyond the stated yield. The difference lies in payout stability and coverage.

A REIT yielding 8% that barely covers its dividend with cash flow will cut the payout within two years; a 5% yield backed by strong occupancy and growing rents compounds your wealth. As of February 2025, large cap REITs (+4.58%) outperformed small-cap REITs (+2.00%), reflecting market preference for stability. Large-cap REITs demonstrated stronger performance, and Vanguard Real Estate ETF delivered solid year-to-date returns.

This suggests you should prioritize quality over yield chasing. Target REITs with 10-year or longer dividend payment histories, occupancy rates above 94%, and same-store NOI growth above 3%. Agree Realty’s 4.3% yield with a 13-year streak beats a 7% yield from an untested REIT every single time.

Monitor the NAV discount for small-cap and micro-cap REITs. These deeper discounts can signal undervaluation, but they also reflect liquidity risk and lower investor confidence. Build your core income from large-cap and mid-cap REITs, then layer in selective small-cap opportunities only when fundamentals improve and discounts narrow.

The next step involves selecting the specific REITs and vehicles that fit your monthly cash flow goals.

Getting Started with Your First REIT Investment

Choose a Broker That Supports Your Monthly Income Strategy

Opening a brokerage account is straightforward, but selecting the right platform matters for monthly income strategies. You need a broker that offers commission-free REIT trades, low account minimums, and access to REIT ETFs alongside individual stocks. Fidelity, Charles Schwab, and TD Ameritrade all meet these criteria without charging per-trade fees. Skip brokers that impose account minimums above $500 or charge commissions on REIT purchases; those fees compound over years and erode your monthly income.

Start with a Core REIT ETF Position

Once your account opens, resist the temptation to immediately buy individual REITs. Instead, start with a low-cost REIT ETF like Vanguard Real Estate ETF (VNQ), which tracks the broad REIT market with an expense ratio of 0.13%. This single move solves the diversification problem instantly, giving you exposure to hundreds of REITs across multiple property types without requiring you to analyze each individual security.

Analyze REITs Using Three Essential Metrics

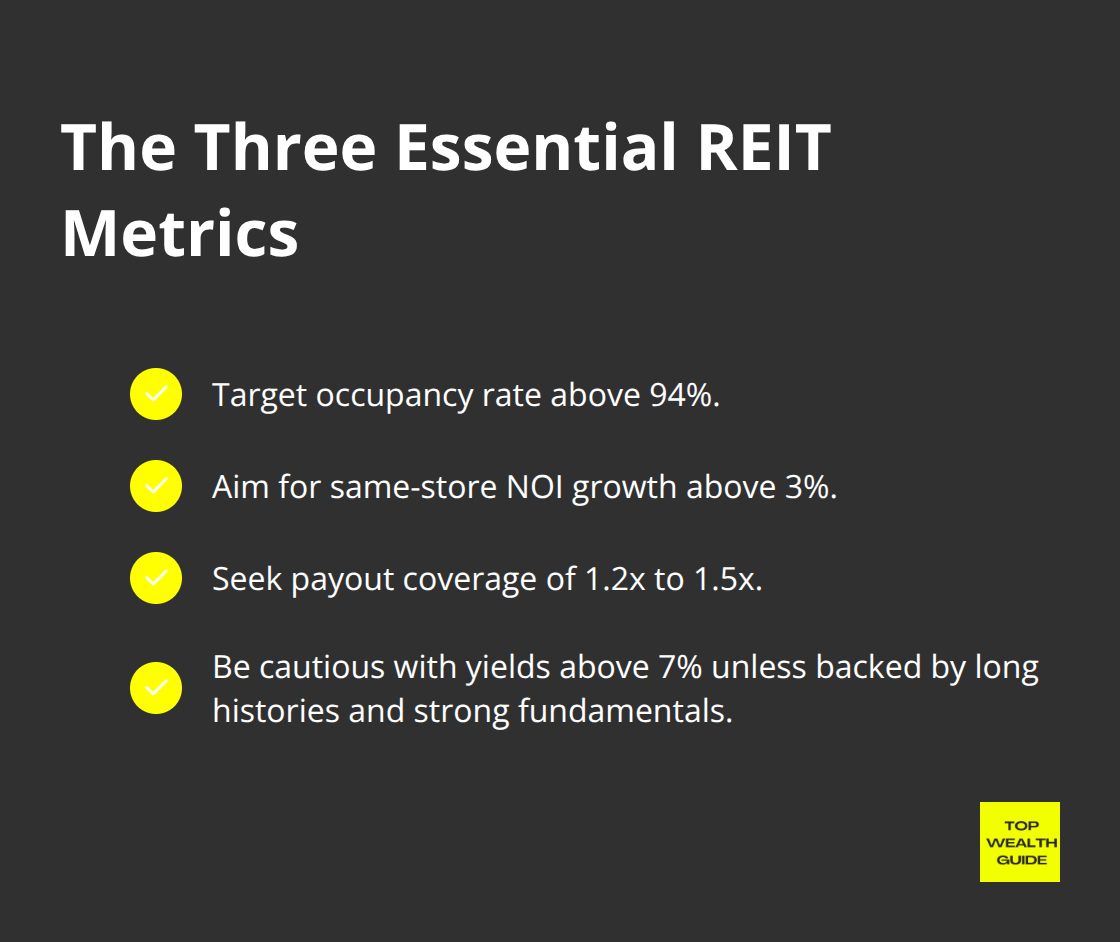

When you’re ready to build beyond a core REIT ETF holding, analyze specific REITs using three non-negotiable metrics: occupancy rate, same-store NOI growth, and payout coverage. Occupancy rate above 94% signals strong tenant demand and pricing power; Realty Income maintains occupancy in this range across its thousands of properties, which explains its 56-year uninterrupted dividend streak. Same-store NOI growth above 3% means the REIT increases cash flow from existing properties rather than relying on acquisitions to boost payouts.

Payout coverage measures whether the REIT generates enough cash to fund its dividend; most quality REITs cover distributions 1.2 to 1.5 times from operating cash flow, providing a safety cushion against dividend cuts. Avoid any REIT yielding above 7% unless it combines a 10-year dividend payment history with occupancy above 95% and same-store NOI growth above 4%.

Structure Your Portfolio for Consistent Monthly Payouts

Your portfolio allocation should follow this structure: 40% to 50% in a core REIT ETF like VNQ, 30% to 40% split between two sector-specific REITs from Health Care and Industrial, and 10% to 20% in one specialty REIT like a farmland trust or retail REIT with national tenants under long-term leases. This approach balances simplicity with diversification and generates monthly income without requiring constant monitoring of individual security valuations.

Final Thoughts

REITs investing delivers what most income strategies promise but rarely achieve: predictable monthly cash flow backed by real assets and mandatory dividend distributions. The 90% payout requirement means your income stream doesn’t depend on management discretion or market sentiment. When you build a diversified portfolio across Health Care, Industrial, and Retail REITs, you collect rent from thousands of properties without the headaches of direct ownership.

Monitor occupancy rates above 94%, same-store NOI growth above 3%, and payout coverage between 1.2 and 1.5 times to determine whether a REIT’s dividend will sustain or face cuts. Large-cap REITs outperformed smaller peers by 60 basis points in 2025, reflecting the market’s preference for stability over speculation. This performance gap widens during economic uncertainty, making quality your best defense against dividend cuts.

Open a brokerage account and start with a core position in Vanguard Real Estate ETF, which costs just 0.13% annually and eliminates single-REIT risk. Layer in two sector-specific REITs from Health Care and Industrial, where same-store NOI growth remains positive and occupancy stays strong, then add one specialty position in farmland or retail with national tenants under long-term leases. For more strategies on building passive income and growing your wealth, explore Top Wealth Guide for practical frameworks and actionable insights tailored to your financial goals.

![REITs Investing Strategies for Monthly Cash Flow [2025] REITs Investing Strategies for Monthly Cash Flow [2025]](https://topwealthguide.com/wp-content/uploads/emplibot/reits-investing-hero-1769966216-1024x585.jpeg)