Asset allocation — the secret sauce of a thriving portfolio or just surviving the market rollercoaster. Investors, here’s the brutal truth: most of us fumble this part. We toss our money around without a real grasp of risk profiles or the art of rebalancing.

But fear not! The folks over at Top Wealth Guide have done their homework. They’ve dissected top-notch portfolio strategies to light the path for you on building and maintaining a killer investment mix. This guide? It’s not just about ideas — it’s your actionable roadmap to juicing returns and keeping risk in check. Enjoy the ride.

In This Guide

What Asset Allocation Actually Does for Your Portfolio

Asset allocation-think of it like a diversified dinner plate-splits your dough across various investment types to keep risk and returns in check. Stocks, bonds, cash, real estate-all play nicely together so you don’t go all in on one pony. Vanguard’s numbers back this up. Conservative portfolios, loaded with bonds, keep things steady over the long haul; aggressive, stock-heavy portfolios might wobble more, but they only hit about a 1.7% loss rate, even with all that volatility.

Real Performance Numbers Behind Each Asset Class

Stocks are the wild child-big returns over time, but they like to party hard year to year. Large-cap stocks from big-name companies? More like a reliable old car. Not gonna break down as much as those flashy small-cap growth stocks that can shoot up or nosedive 30% before breakfast. Bonds? They’re the sensible ones-steady income and the airbag in your portfolio during market car crashes (though they usually roll in with a 3-5% annual return, sitting nicely next to stocks’ historical 10% average). Cash and money market funds? They’re safe and liquid-all good, but inflation munches away at them by 2-3% yearly. Real estate investment trusts (or REITs if you like acronyms) blend growth with income, typically offering 8-12% annually through property appreciation and rental income. Check this out for more: Real estate investment trusts.

Age-Based Allocation Rules That Actually Work

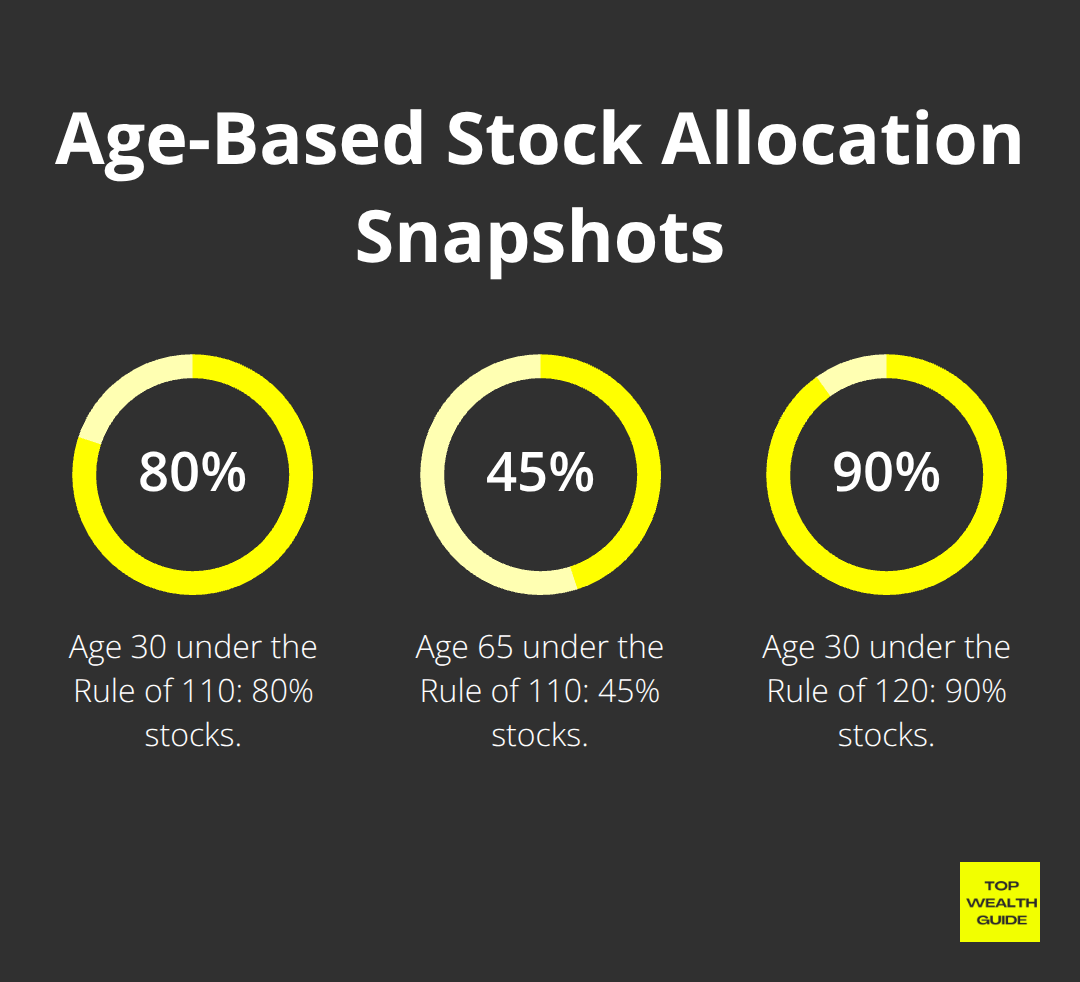

Ever heard of the Rule of 110? It darts you right into the asset allocation thing. Knock your age off 110-there’s your stock percentage. At 30 years old? That’s an 80% stock allocation. Hit 65? Roll back to 45% stocks and pad with bonds for that safety net.

Want to live on the edge? The Rule of 120 gives the same 30-year-old a 90% stock allocation. Monte Carlo simulations reveal these age-based strategies guard and grow wealth over the years. When you’re young, you’ve got the time to bounce back from market nosedives; retirees? They crave dependable income over bold growth moves.

How Risk Tolerance Shapes Your Mix

Your comfort with the up-and-downs-way more crucial than any calculator. If a 10% portfolio dip sends you into a panic, aim for a 30-40% stock allocation, even if you’re barely out of college. But if a 30% crash isn’t shaking you? Ramp up that stock allocation to 90% or higher. Financial advisors pull out all these questionnaires, but you know yourself better than anyone. The secret sauce? Stick with an allocation that won’t have you jumping ship during both good times and bad.

Got a grip on how asset allocation vibes with your goals? Great. Time to dig into strategies that spin this knowledge into action.

Asset Allocation Strategies That Work

Strategic asset allocation – it’s the tortoise winning the race every time. This isn’t about flying by the seat of your pants; it’s setting those target percentages (you know the drill: 70% stocks, 25% bonds, 5% cash) and riding out the rollercoaster of market madness. Schwab loves reminding us that these methodical planners, who rebalance every year, beat the flashy tactical players by 1.2% annually over two decades. Those tactical folks? They try to outsmart the market, cranking stocks up to 90% when the bulls are running and slashing to 40% when panic sets in. It sounds genius in theory, but wait… Vanguard spills the beans – tactical investors underperform because emotions steer their ship straight into rocky waters.

Strategic vs Tactical Approaches

Strategic allocation is your solid rock – a buy-and-hold mantra that tunes out the short-term noise. You set your blend once based on how many gray hairs you’ve got and your risk-flirting level, then let it ride. Tactical allocation? It’s like thinking you can dodge every storm and surf every wave – tempting yet deceiving. Even the fund managers, armed to the teeth with analysts and high-tech gizmos, find market timing elusive. Individual investors? They’re playing against the house with rotten odds (research shows they trail market gains by 2-3% per year thanks to dodgy timing).

Target-Date Funds vs Robo-Advisors

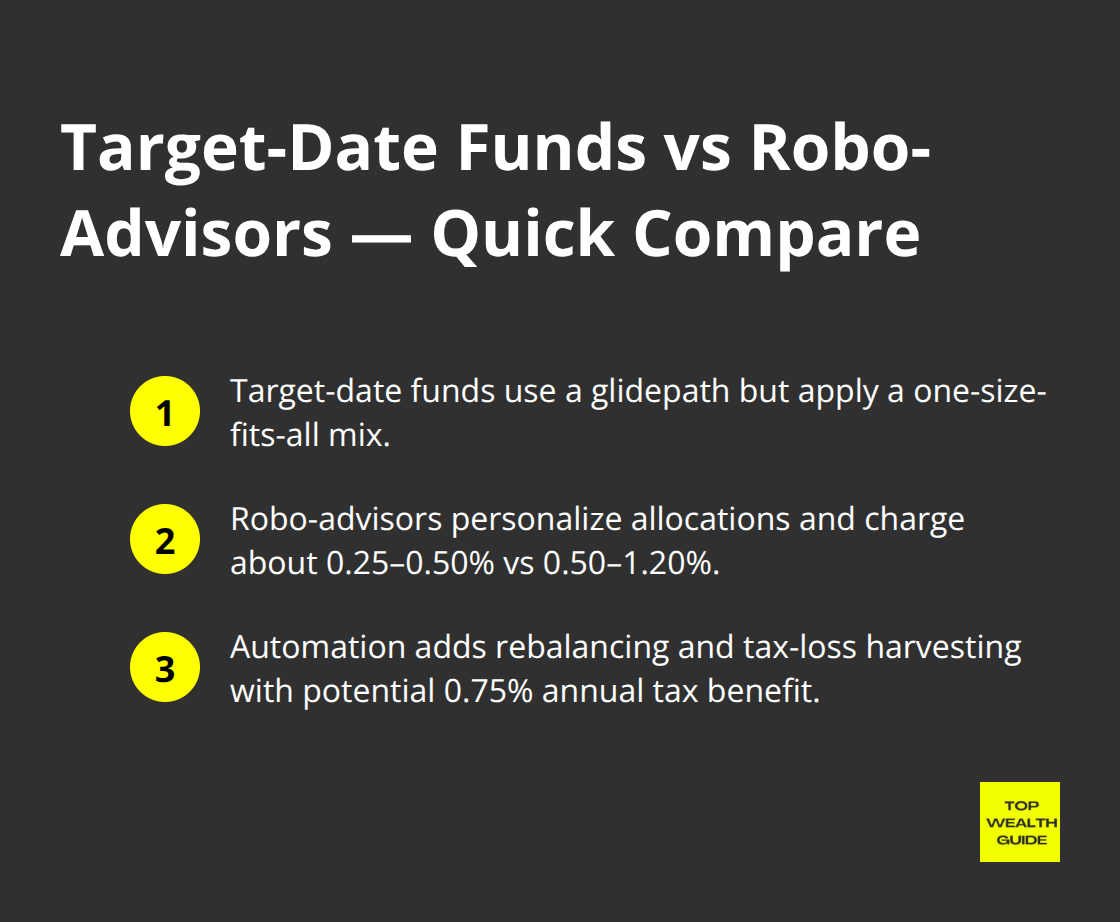

Take target-date funds. As you gray, they slowly shift from thrill-seeking to safe-mode, but let’s face it, they’re painting everyone with the same broad brush. A 2045 fund throws the same weight whether you’re a gung-ho startup wizard or a play-it-safe teacher. Enter robo-advisors like Betterment and Wealthfront – these guys tailor-make portfolios to fit your real risk appetite and dreams. They shave off costs too, at 0.25-0.50% yearly compared to target-date funds’ 0.50-1.20%. The kicker? Robo-advisors juggle rebalancing and snag those tax loss opportunities on autopilot, potentially pocketing you a 0.75% tax saving each year per Wealthfront.

DIY Portfolio Construction Methods

Forget the convoluted stuff – a three-fund portfolio smacks down pricey managed options. Just mix a total stock market index fund (70%), international stock index (20%), and bond index fund (10%) – boom, diversified and dirt cheap. Vanguard’s VTSAX, VTIAX, and VBTLX cost you a mere 0.05-0.08% per year versus the usual managed funds at 0.75-1.50%. Just adjust quarterly if anything drifts more than 5% from your targets. This no-nonsense tactic outpaced 85% of pro-managed portfolios over the last ten years, slashing fees by the thousand.

Your strategy is the game plan, but keeping it on track is what seals the deal. Next, you’ve got to stick to your allocation guns through systematic rebalancing and smart tax management.

When Should You Rebalance Your Portfolio

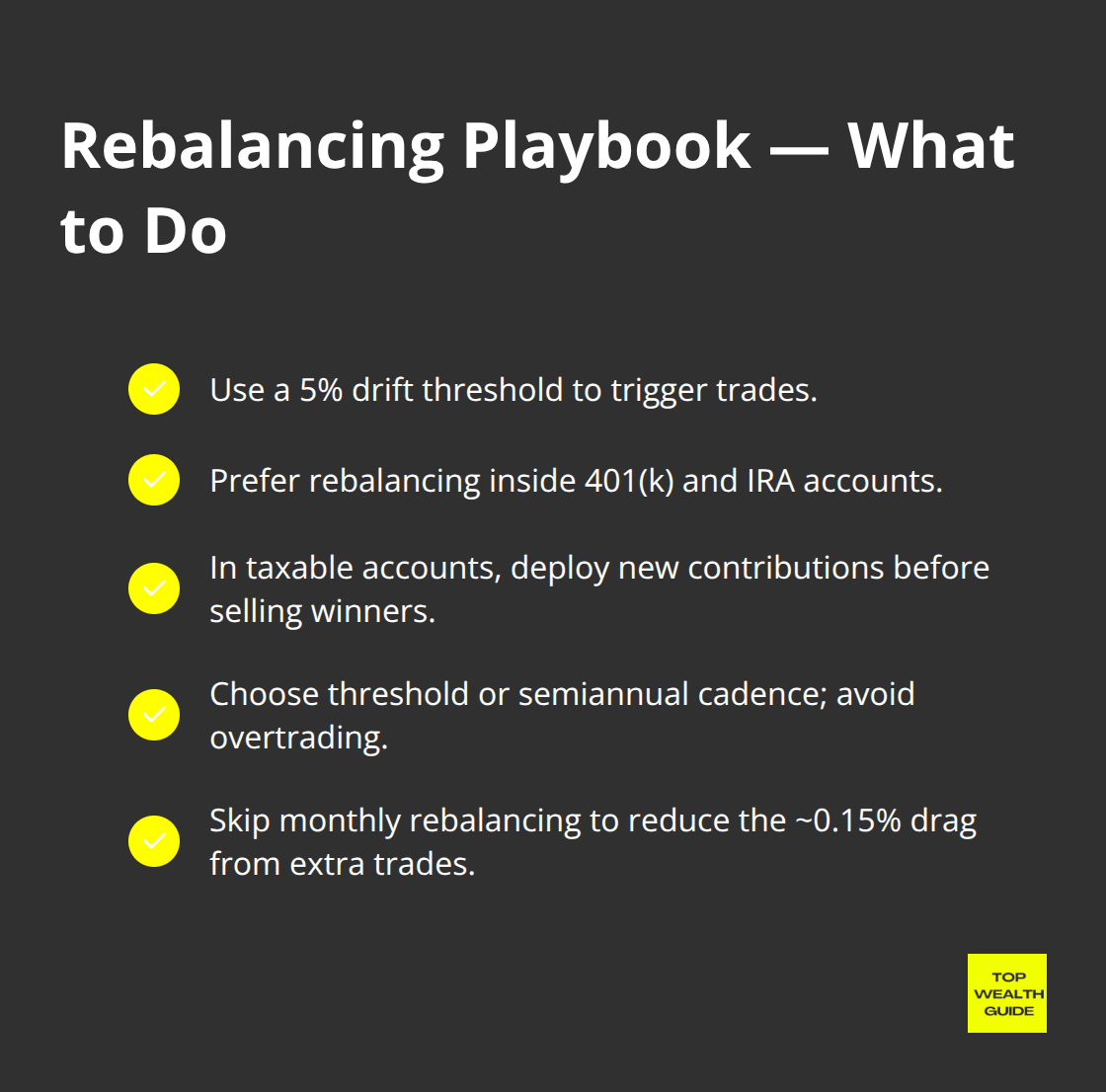

Rebalancing-it’s not wizardry, it’s math with a watch. Investors? They either check their portfolios like they’re watching TikTok videos or forget about them like gym memberships. The golden rule? Rebalance when any asset class drifts 5% or more from your target allocation, or set it and forget it with a quarterly nudge if you dig automation. According to Fidelity’s analysis, a smart rebalancing act can juice up your portfolio, while touchy-feely monthly rebalances end up costing you 0.15% thanks to too many trades and that taxman.

The 5% Drift Rule Works Best

Leave those egghead equations at home. When your 70% stock stake wanders up to 75% or slides to 65%, then it’s a rebalancing dance. This limit-based strategy netted 78% of the rebalancing perks minus the fee sting, according to Vanguard wisdom. Six-month calendar balancing works, sure, but threshold rebalancing handles those market mood swings way better.

Watch the 2020 crash-threshold balancers were snagging stocks at markdowns, while calendar folks sat on their hands.

Tax-Smart Rebalancing Saves Thousands

This is where DIY investors drop the ball-rebalancing in taxable accounts equals tax nightmares. Your ace in the hole: rebalance inside 401k and IRA accounts first-no taxes knocking. In taxable accounts, use fresh money to grab undervalued assets rather than offloading your hot shots. Tax-loss harvesting while you rebalance could shave your tax bill by 0.75% a year (Betterment showed tax-savvy investors kept an extra $7,500 per $100,000 invested over 20 years compared to those who snub tax strategies).

Performance Monitoring That Actually Matters

Daily price peeping? Recipe for disaster. Keep an eye on your allocation percentages monthly and total returns quarterly against your benchmarks. A basic three-fund mix should echo about 85% of the total stock market returns, minus the bond downsides. If you keep lagging behind by more than 0.50% after fees, check for high fees or dubious fund picks. Jot down your rebalancing moves and review yearly to figure out what’s tripping you up emotionally.

Final Thoughts

Asset allocation – it’s about discipline, not Mensa-level IQ. Numbers don’t lie; strategic investors sticking to their target percentages and rebalancing mechanically have a habit of outperforming market timers by, wait for it… 1.2% a year. That “age minus 110” rule? A strong starting point for stock allocation – but let’s be honest, your actual risk tolerance is the boss in the room (not a formula).

Get moving with a straightforward three-fund portfolio if you’re the DIY kind, or go ahead, let the robo-advisors earn their keep at a measly 0.25-0.50% fee. Set that golden 5% drift rule, and when your assets start to wander like a lost child, you rebalance. Use tax-advantaged accounts first – it’s like dodging unnecessary punches from the taxman (and trust me, this saves you big bucks over the long haul).

The grand faux pas? Overthinking it. Choose your allocation, automate the heck out of it, and keep your hands out of the cookie jar every time the market decides to throw a tantrum. Check out practical investment strategies we dish out at Top Wealth Guide, crafted for those ready to put their money where their mouth is for long-term wealth through shrewd financial judgment.

2 Comments

Pingback: Understanding the Difference Between Stocks and Bonds

Pingback: 10 Proven Wealth Management Strategies for 2025