Emotions … they’re running the show more than you think when it comes to your investments. And guess what? If you’re letting your feelings ride shotgun, you might be leaving money on the table — to the tune of 2-3% a year. That’s a lot of potential returns whooshing away.

Investment psychology … it’s not just fluff. It’s the puppet master behind every buy-sell decision you make. The folks at Top Wealth Guide? They’ve combed through the nastiest behavioral traps that are sinking your portfolio faster than a stone.

But here’s the upside — yes, there is one! You can actually rewire your brain to make smarter financial moves and, surprise, supercharge those long-term gains.

In This Guide

Why Your Brain Sabotages Your Portfolio

Your brain-yep, that ancient thing in your head-still thinks we’re dodging saber-toothed tigers, but when it comes to your investments, it’s a disaster waiting to happen. Overconfidence bias is what Barber and Odean from UC Berkeley call it, and boy, it’ll have you thinking you’re the Wolf of Wall Street. But instead, you end up spinning those wheels with way too much trading-it’s costing the average investor big bucks every year.

The Disposition Effect Destroys Wealth

Then there’s the disposition effect-basically a fancy way of saying you’re clinging to your losers like a kid with a security blanket, hoping for a comeback that’s probably not gonna happen. Confirmation bias is your brain’s sneaky trick to make you see what you want to see, ignoring all the glaring red flags. Home country bias? That’s when you keep your money local and miss out on those sweet international returns waiting for a dart to a map decision.

Fear Creates Expensive Mistakes

And fear? It’s whispering in your ear to hit the eject button at all the wrong times. Remember March 2020-yep, folks scrambled out of equity funds, missing out on the rocket-speed recovery right after. Miss just the 10 best trading days over a couple of decades and watch your returns take a nosedive. Loss aversion means losing feels twice as bad as winning feels good. So what do you do? You run to cash and bonds, missing out on the golden goose-stocks.

Greed Costs More Than Fear

And greed, oh greed-it’s the devil on your shoulder, nudging you toward the hot, overpriced stocks. Flashback to 2000: investors poured $85 billion into tech funds right before the dot-com bubble burst and the NASDAQ took a 78% plunge. Recency bias tricks you into thinking the party will never end.

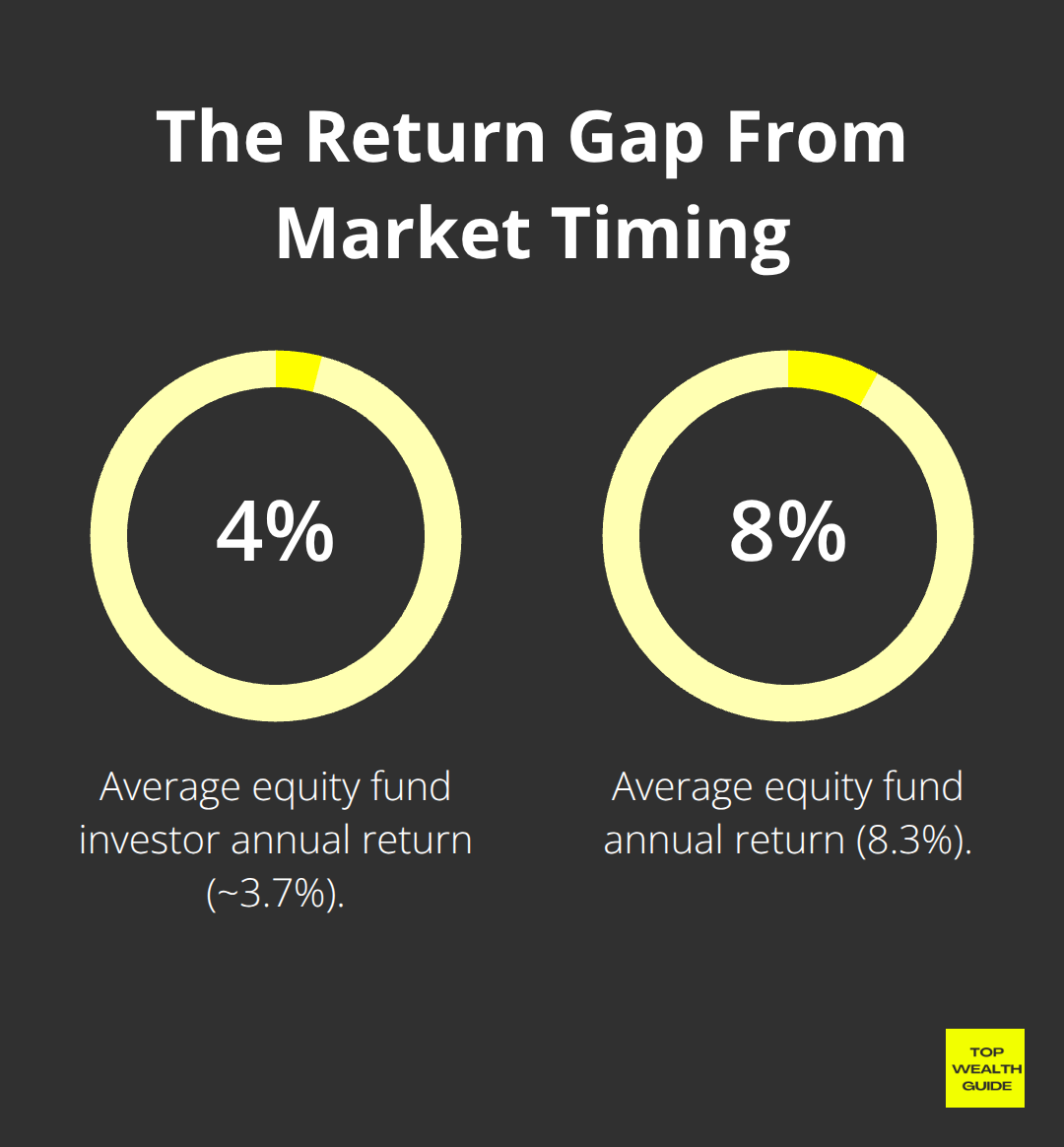

The average equity fund investor walks away with just 3.7% a year while the funds themselves are handing over 8.3%, all because folks are too busy timing jumps and freaking out over dips.

Mental accounting is your brain’s way of playing games with newfound money-like it’s somehow different from the rest in your savings. Next thing you know, you’re gambling like you just inherited Monopoly money. Decades flash by, and those emotional blunders turn your millionaire dreams into little more than a pipe dream. But here’s the silver lining: there’s hope. You can train your brain, adopting the same strategies the smart investors live by every single day.

How Do You Stop Emotions From Hijacking Your Money?

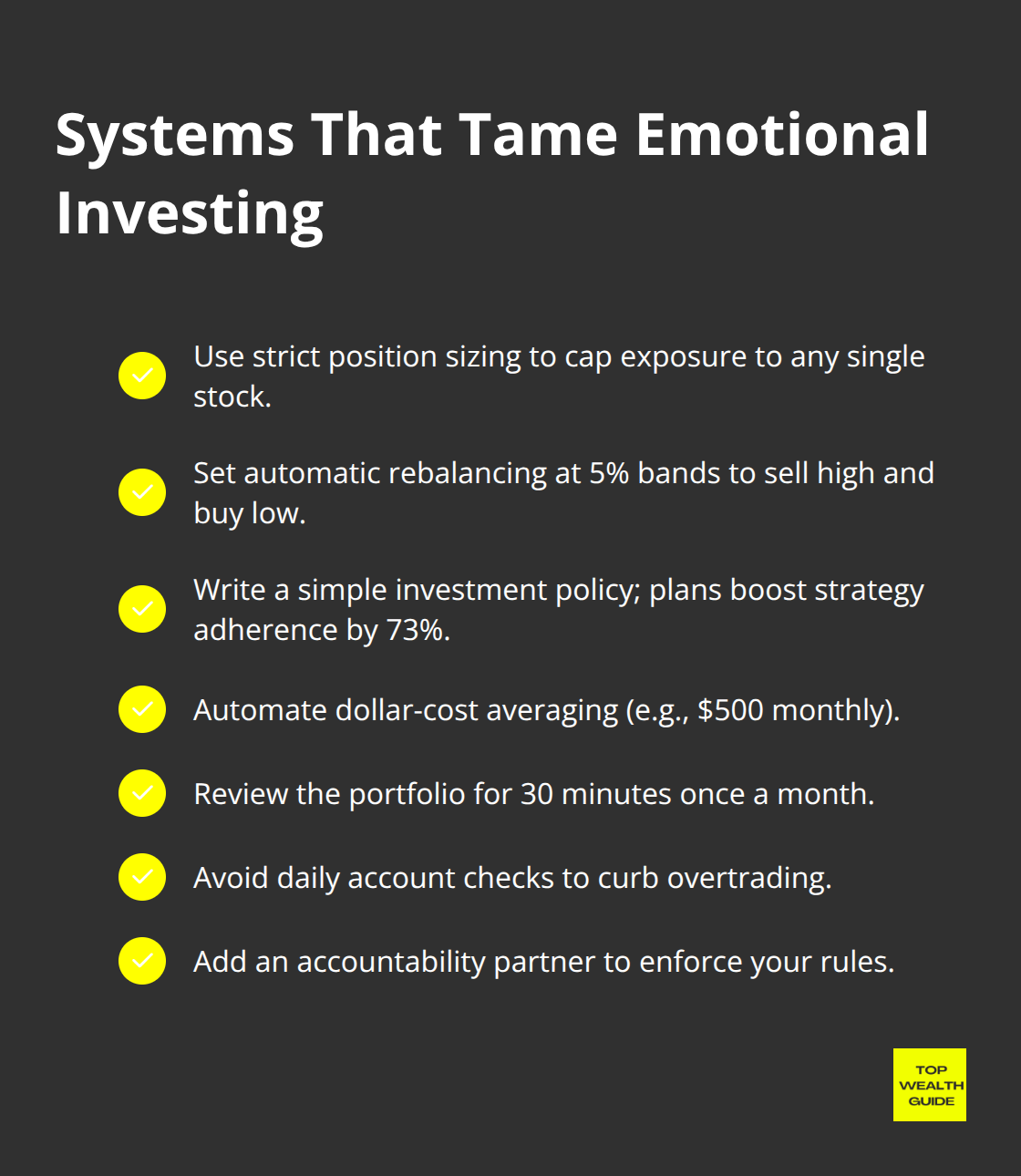

The secret weapon against emotional investing isn’t some magical willpower-it’s systems, folks. Vanguard research shows that investors with systematic approaches make 1.5% more annually-yeah, you heard that right-than those winging it (and praying). Start with systematic position sizing: never drop more than a tiny slice of your portfolio into any single stock, even if you’re convinced it’s the next Amazon. Why? Because humans are terrible at stock-picking fantasies.

Set Automatic Rebalancing Triggers

Set those automatic rebalancing triggers at 5% deviations from your target allocation. Your tech stocks hit 25% instead of the planned 20%? Awesome. The system? It forces you to sell high and buy low-literally the opposite of the emotional rollercoaster most are on. Write down those investment criteria before you buy a thing: minimum market cap, maximum debt-to-equity ratio, required dividend history.

Schwab data says it all-investors with written plans stick to their strategies 73% more often than those who just wing it.

Dollar-Cost Averaging Beats Perfect Timing Every Time

Dollar-cost averaging-a no-brainer for those who freak out over market timing. Numbers don’t lie. Historical analysis? It shows long-term investing in the S&P 500 hands you solid returns-$10,000 invested 20 years ago morphs into over $61,000 today. Set up autopilot investments-like $500 monthly-instead of sweating over dropping $6,000 at the “perfect” time. Here’s the kicker: it reduces your average cost per share and the psychological benefit? Massive-you sleep better knowing your investment isn’t a one-shot deal.

Monthly Portfolio Reviews Prevent Emotional Disasters

Carve out a monthly half-hour for portfolio reviews-same day each month. Never daily. Why? Because frequent account checking translates to hyper trading and worse performance among individual investors. Use this time to check actual allocation against targets, not as a panic session over short-term blips. Get a financially savvy friend on board-have them keep you accountable to your rules when the market’s a circus and you’re tempted to jump ship.

These systematic approaches-they work by kicking emotions to the curb. But remember, systems alone won’t turn you into a disciplined investor. You’ve gotta develop the mindset that sees market volatility not as a threat, but as a golden opportunity.

How Do You Think Like a Millionaire Investor?

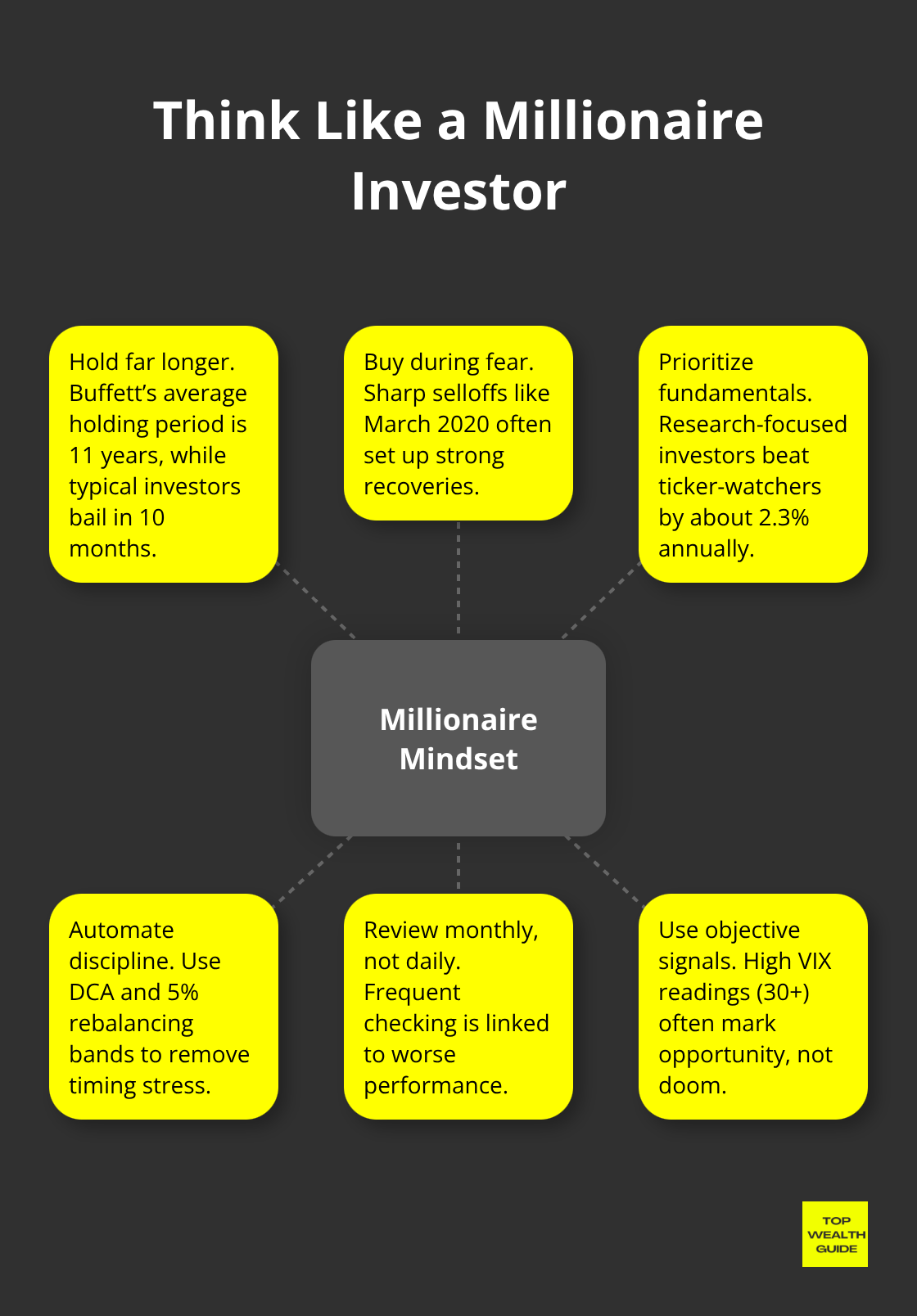

Here’s the kicker: it’s not about having a crystal ball or Einstein-level IQ-it’s about mindset, folks. Look at Warren Buffett. Berkshire Hathaway’s data says it all: his average holding period? 11 years. Meanwhile, the average Joe dumps stocks after just 10 months.

What does this mean…? Simple: Buffett compounds wealth at a cool 19.9% per annum, while most investors can barely outpace inflation. The “aha” moment? Rejig your brain to see market crashes as discount events, not as calamities.

Market Volatility Becomes Your Best Friend

Flip the narrative, my friends. The data’s clear-S&P 500 history shows every big correction (think ’87 crash, dot-com bust, 2008 meltdown) minted millionaires. When COVID-19 sent markets plummeting in March 2020, the smart money? They bought in while the herd ran scared; those who stayed cool saw 60% gains by year’s end.

Ditch the daily ticker obsession. Instead, set Google Alerts for SEC filings relevant to your stocks. Morningstar research out there shows that investors who dig into company fundamentals trounce the returns of those glued to stock price fluctuations by 2.3% annually. Start a ‘volatility diary’-jot down your feelings during market swings and examine the 6-month outcomes. You’ll soon notice: market fears often overblow reality.

Data Beats Gut Feelings Every Time

When it comes to squashing emotional noise, numbers are your best ally. Keep a straightforward spreadsheet recording your buy rationale against actual results-this makes you accountable and keeps hindsight bias at bay. And the next time panic-sell thoughts creep in, check out the VIX fear index (a reading over 30? Historically, it says “opportunity,” not “armageddon”).

Go beyond headlines. Dive into company debt-to-equity ratios, revenue growth, and market standing before any investment dive. Study after study shows investors who dig into the digits fare better than those riding the news cycle.

Train Your Brain to Love Market Chaos

When markets tumble, your emotions may go haywire… but your spreadsheet? It’ll keep you grounded in reality-and that usually means holding steady. Market corrections hit roughly once a year, but each one? A golden ticket for the prepared. So, gear up for the storm, don’t try to predict it.

Final Thoughts

Investment psychology-it’s what separates the winners from the folks just scraping by in the market. The numbers don’t lie: emotional decisions? They shave off 2-3% of your returns annually. Meanwhile, being systematic tacks on a cool 1.5%. Fear? It nudges you to sell at rock-bottom prices. Greed? It whispers sweet nothings to buy when everything’s sky-high. Oh, and let’s not forget those biases that clutter your head when what you really need is clarity.

So, what’s the game plan? Get started now. Jot down your investment rules before you even think about buying anything. And hey, set up automatic rebalancing for every 5% drift-that’s the magic number. Dollar-cost averaging? Your best friend. It takes timing out of the equation. Oh, and don’t skip those monthly portfolio reviews (but steer clear of daily checks). And, for a touch of accountability? Find that financially savvy friend who’s going to call you out when market madness ensues.

The millionaire mindset? It sees volatility as an opportunity, not a threat. When the markets take a nosedive, the smart money swoops in while everyone else is panicking. At Top Wealth Guide, we’ve got strategies to transform your financial smarts into lasting wealth. Curious about more tried-and-true methods? Dive deeper at Top Wealth Guide.