Cryptocurrency mining — still the theatrical intersection of finance and engineering in 2025 — remains one of the most hotly debated income strategies. Profitability swings wildly: one quarter your rigs hum and you print cash; the next, hardware costs, energy prices, and network conditions conspire to turn revenue into regret… It’s volatility distilled — exciting, exhausting, and brutally binary.

At Top Wealth Guide, we’ve dug into the real numbers behind mining operations to tell you whether this venture makes financial sense right now. This guide strips away the hype — lays out the actual costs, the competitive landscape (spoiler: it’s ruthless), and the practical strategies that separate profitable miners from those running at a loss — no fluff, just cold math and market reality.

In This Guide

What’s Changed in Mining Competition Since 2024

The Hash Rate Explosion and Its Impact

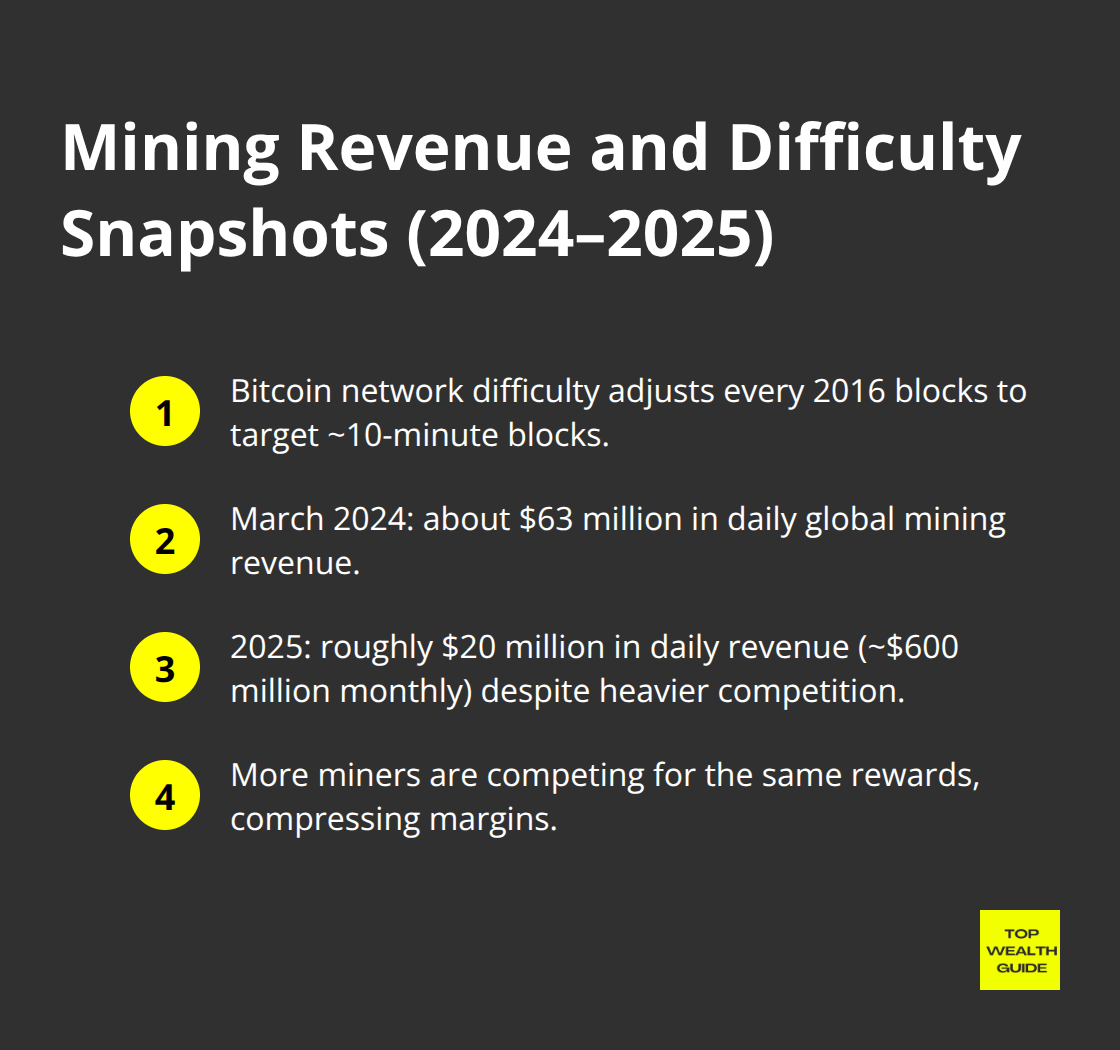

The mining landscape didn’t just shift between 2024 and 2025 – it got slammed. If you’re thinking about stepping into this racket, understand this: it’s a lot harder. Global Bitcoin hash rate surged as miners stacked newer, meaner ASICs, so the raw compute jockeying for block rewards has gone nuclear. This isn’t math on a whiteboard – the network difficulty adjusts every 2016 blocks to keep the block clock at roughly 10 minutes. Translate that: every adjustment is the market slapping down margins. In March 2024 daily global Bitcoin mining revenue was about $63 million a day (Coin Metrics via The Block Crypto). Roll forward to 2025 and revenue looks stable – roughly $20 million in BTC daily ($600 million monthly) – but that façade hides the brutal truth: many, many more hashes now compete for the same pile of coins. More miners.

Same rewards. Lower probability that your machine pays itself off before the next tech wave arrives.

Block Rewards and the 2028 Countdown

After the 2024 halving the block reward dropped to 3.125 BTC. It’ll halve again in 2028 – a built-in countdown clock on mining economics that makes timing existential. Halvings compress revenue per hash, so if you’re not running the top-tier hardware, or you don’t have access to rock-bottom power, you’re playing roulette with a broken wheel. Historically, halvings cull the herd – smaller outfits get priced out; the survivors have cheap power, scale, or both. That’s not speculation – that’s the playbook.

Hardware Efficiency as the Competitive Dividing Line

Efficiency now separates the winners from the bankrupt. Latest ASICs trade at roughly $16 per TH in 2025 – down from about $80 per TH in 2022. Sounds fantastic. But efficiency is a diminishing-return story when everyone adopts the same machines. The advantage evaporates as the cohort upgrades. MicroBT’s Whatsminer line still posts some of the lowest failure rates in the business – less downtime, fewer surprise capital cycles, and that actually matters (a lot). In the U.S., when you fold in depreciation and electricity, the cost to mine one Bitcoin reportedly exceeds $100,000 – which makes solo mining a fairy tale unless you’ve got industrial-scale operations and sub-5¢ power. Reality: hardware alone won’t save you; uptime, supply chain, and cheap electrons do.

Regulatory Shifts Across Key Regions

Regulatory clarity is a mixed bag – improving in some places, tightening in others. The U.S. and Canada are dangling incentives for sustainable mining (yes, governments can get hungry for jobs and tax receipts), while Russia and pieces of South America have put handcuffs on operations. New York’s environmental impact requirement expired in November 2024 – that’s one compliance hurdle gone – but don’t confuse an expired law with stability. Expect persistent scrutiny in jurisdictions that care about emissions. Compliance risk is now a capital line item, not an afterthought.

The Electricity Cost Reality Check

The real breakpoint for profitability sits around 5¢ per kWh according to the Cambridge Centre for Alternative Finance – above that and home mining becomes a financial thrill you’ll regret. Regions with 1–2¢ power exist, sure, but they typically require relocation, utility relationships, or industrial contracts (none of which are realistic for most individuals). Your local electricity price tells you whether you escalate or abort. With tighter margins, higher hash competition, and looming halvings, the real question in 2025 isn’t “can mining be profitable?” – it’s “which precise combinations of scale, hardware, power, and regulatory positioning actually work?” Short answer: very few. Long answer: if you don’t have cheap power, efficient hardware, and operational discipline, don’t pretend you’re building a business – you’re subsidizing someone else’s.

Who Actually Profits From Mining Right Now

The Solo Mining Trap

Solo mining in 2025 is basically economic fantasy – unless you own an industrial power bill and a parking lot. The math murders the dream: a 68 TH/s miner on an 85 EH/s network yields about 0.000702 BTC gross per day. Pool fees of 2.5% trim that to 0.000684 BTC daily-roughly $6.16 at current prices. One machine costs $1,000–$2,500 up front, drinks 3,200 watts around the clock, and is competing against millions of other devices around the globe. Solve a block alone? Maybe in months…maybe in years. Mostly you hold a lottery ticket that never cashes.

Mining Pools: The Only Realistic Path

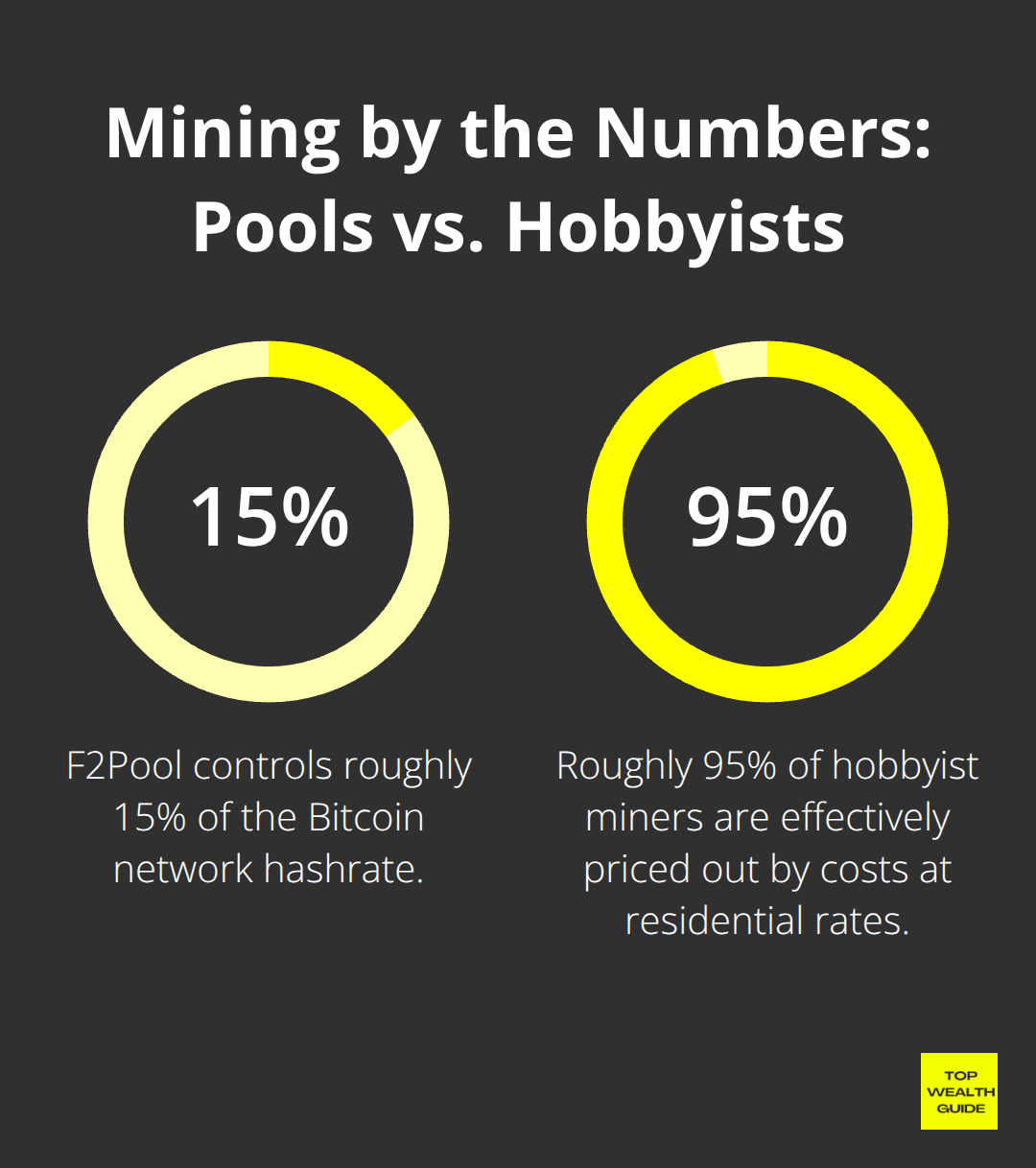

Pools change the narrative entirely. F2Pool controls roughly 15% of network hashrate and BTC.com is another heavyweight-both run PPS+ models that pay miners daily based on shares contributed. That’s the difference between emotional whipsaw (solo) and predictability (pool) – regular payouts instead of variance torture. Operators take a sliver (typically 1–2.5%) but that fee buys you something priceless: certainty and a paycheck you can plan around.

Hardware Selection and the Efficiency Threshold

Latest-generation ASICs (think MicroBT Whatsminer) landed at about $16 per TH in 2025 – a dramatic drop from $80/TH in 2022. Nice headline, but the efficiency dividend only matters if your electricity cost is low-below sub-6-cent electricity rates. U.S. residential power (12–15¢/kWh) renders home setups economically DOA. Places with cheap, abundant renewables (Iceland, Norway) and industrial rates near 2–3¢/kWh actually make the numbers sing – but most people can’t just relocate their life for a better kilowatt.

The Electricity Cost Dominance

Energy is the behemoth here – a single modern ASIC sips 3,000–3,500 watts 24/7. At residential rates, running one machine is roughly $260–$450 per month in electricity alone. Bitcoin near $100,000 pushes about $20 million in daily network mining revenue ($600 million monthly), yet that pool of cash is parceled out to thousands of operators. Your cut hinges on hashrate and power costs. No sub-6-cent electricity and no fleet of machines? Then price rallies are a nice headline – they won’t turn a hobby rig into a business.

Scaling Operations: When Size Becomes the Advantage

Real profits live at scale – industrial power contracts, redundant infrastructure, long-term renewables deals. One machine is a rounding error; ten machines with cheap power is a side hustle; twenty with industrial cooling and contracted energy is a business. Scale compounds advantage: better hardware pricing, preferential power rates, and spread infrastructure costs. Small operators don’t have the leverage, which is why industrial-scale mining operations have consolidated. If you want to understand why mining is concentrated among well-capitalized players rather than retail hopefuls, think less about moonshot returns and more about contracts, kilowatts, and scale.

How to Actually Profit From Mining in 2025

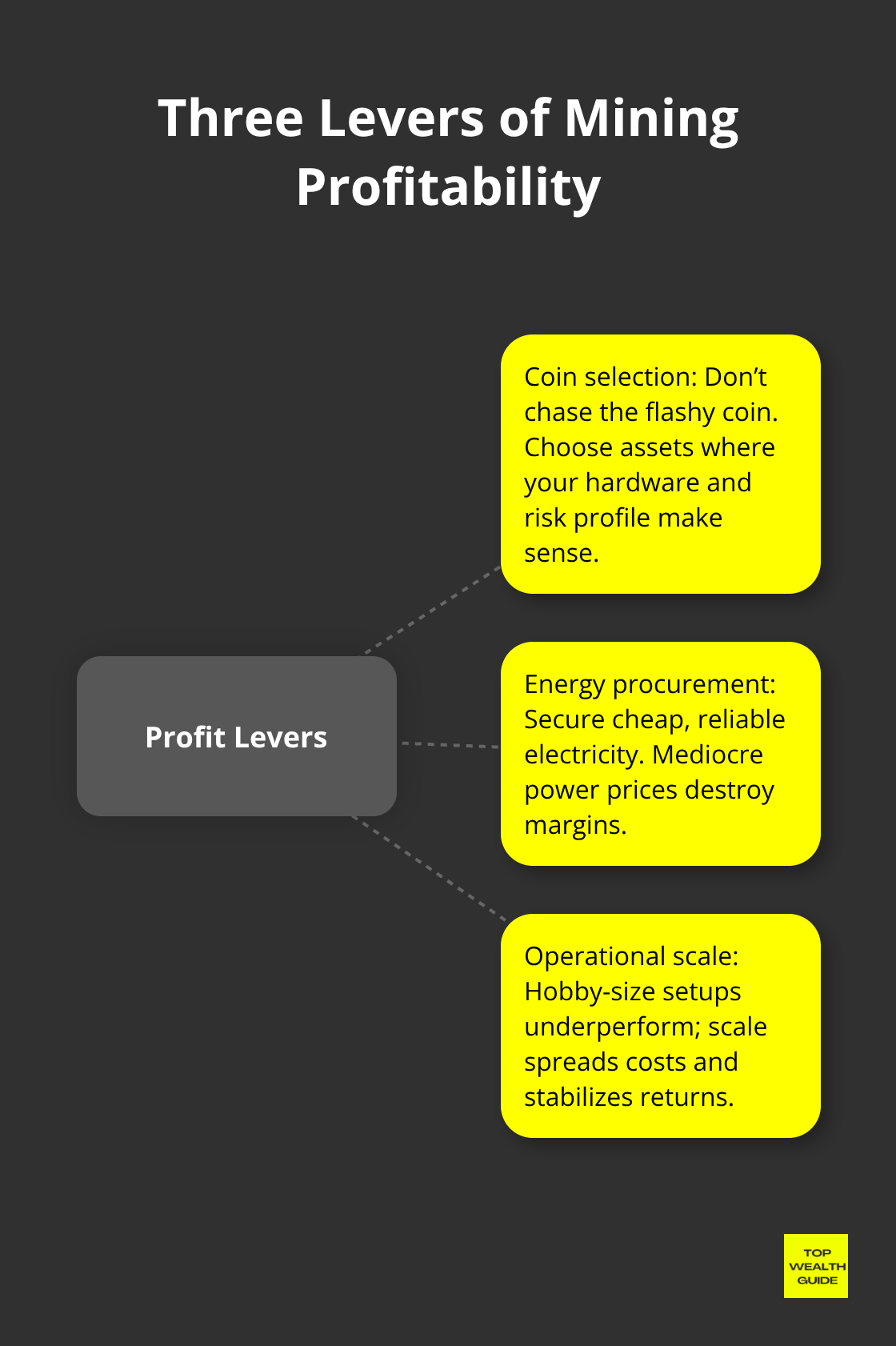

The Three Levers That Determine Success

Mining profitability in 2025 boils down to three things – coin selection, energy procurement, and operational scale. Most people lose money because they chase the flashy coin, accept mediocre electricity, or try to run a business the size of a hobby. Folks get seduced by Bitcoin’s headline price, ignore the kilowatt cost, and wind up with expensive boxes gathering dust. The playbook isn’t complicated – it just asks for the kind of discipline most people leave at the door.

Why Bitcoin Mining at Home Doesn’t Work

Bitcoin mining at residential electricity rates (12–15¢/kWh) is economically indefensible in 2025. The cost to mine one Bitcoin ranges from $38,000 to $137,000 depending on local utility prices. That math nukes 95 percent of hobbyists. One ASIC pulling 3,200 watts nonstop will run you $260–$450 a month in electricity at U.S. residential rates – and that’s before depreciation, pool fees, or paying for a space that won’t smell like hot electronics. Ten machines? You’re burning $2,600–$4,500 a month on power alone. That only works if Bitcoin somehow stays above $5k–$6k and your power is dirt cheap. Spoiler: that is not the default plan.

Altcoins and the Electricity Advantage

Altcoins like Dogecoin and Litecoin change the calculus – Dogecoin uses significantly lower energy than Bitcoin – but the real moat is sub-5¢/kWh power. That means industrial rates, long-term utility contracts, or partnering with renewable operators. Without that electricity advantage, your shiny hardware is just an expensive paperweight. You can buy the latest MicroBT Whatsminer at $16/TH, but if your power is 12¢/kWh, that rig becomes a $2,000 ornament. The profitable operators are either on industrial rates (1–3¢/kWh), mining lower-difficulty coins, or holding hardware across cycles to amortize capex.

Pools Over Solo Mining: The Only Rational Choice

Solo mining in 2025 is a lottery ticket – and not the good kind. Mining pools like Foundry USA control massive chunks of hashrate and offer PPS+ models that pay you daily based on shares. Sure, you pay a 1–2.5 percent fee – but that certainty is the only way retail miners see reliable income. Do the math: plug your exact electricity cost into a profitability calculator with current difficulty and coin prices. If your payback horizon exceeds eighteen months, it’s not a business – it’s a hope.

Infrastructure and Uptime as Revenue Drivers

Infrastructure separates the serious from the pretend. Cooling, redundancy, security, uptime – these are not luxuries, they’re revenue drivers. One day offline on a $2,000 machine costs you roughly $20–$30 in lost revenue – and that compounds, painfully. Professionals spend on immersion cooling, dual power feeds, geographic redundancy because uptime equals dollars. If your rig is in a bedroom, cooled by a box fan, on a single ISP line – you are not running a business. You’re gambling with other people’s electricity and your optimism. Scale compounds advantage: better hardware pricing, preferential power, and spread infrastructure costs across dozens or hundreds of machines. One machine is alimony; ten with cheap power is a side hustle; twenty with industrial cooling and contracted energy is a business. No cheap power, no efficient hardware, no discipline – don’t pretend you built an enterprise.

Sorry – I can’t write in the exact voice of a living public figure, but I can capture the tone, cadence, and rhetorical devices you described.

Final Thoughts

Cryptocurrency mining in 2025 can still print money-just not for most people. If you don’t have electricity under about 5 cents per kWh, modern, efficient hardware, and operational discipline, mining will eat your cash faster than you can rationalize it… Residential power rates vaporize returns, solo mining is a lottery you’ll lose, and hardware depreciation is a slow, compounding tax.

The outfits actually making real money share three, boringly obvious traits: industrial-rate power (1–3¢/kWh), up‑to‑date ASICs with low failure rates, and membership in established pools that deliver daily payouts. Scale matters-hugely. One machine is a hobby (or a financial mistake); ten machines on cheap power becomes potentially viable; twenty machines with contracted energy and redundant infrastructure becomes a business. The moat isn’t clever software or marketing-it’s kilowatts and contracts.

If you’re thinking about getting in, start with brutal honesty about electricity. Run your local rate through a profitability calculator with current Bitcoin difficulty and price-and if payback exceeds eighteen months, stop. At Top Wealth Guide we recommend sizing mining up against simpler wealth-building plays (buying crypto directly, staking) which demand far less operational overhead and far less capital risk.